UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-39436

KE Holdings Inc.

(Registrant’s Name)

Oriental Electronic Technology Building,

No. 2 Chuangye Road, Haidian District,

Beijing 100086

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KE Holdings Inc. |

| |

|

|

|

| |

By |

: |

/s/ XU Tao |

| |

Name |

: |

XU Tao |

| |

Title |

: |

Chief Financial Officer |

Date: February 22,

2024

Exhibit 99.1

Hong Kong Exchanges and Clearing

Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation

as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance

upon the whole or any part of the contents of this announcement.

KE

Holdings Inc.

貝殼控股有限公司

(A company controlled through

weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock Code: 2423)

ANNOUNCEMENT

DISCLOSEABLE

TRANSACTIONS

SUBSCRIPTION

OF WEALTH MANAGEMENT PRODUCTS

SUBSCRIPTION

OF EVERBRIGHT PRODUCTS

We

refer to the Company’s Announcement on September 13, 2023 in relation to, among other things, the subscription of Everbright

Product No.3 in the principal amount of RMB2 billion with Everbright Wealth Management by Tianjin Lianjia, a wholly-owned subsidiary

of the Company.

The Company, through its wholly-owned subsidiary, Tianjin Lianjia, further subscribed for (i) Everbright Product No.4 in the principal amount of RMB1 billion with Everbright Wealth Management on October 18, 2023; (ii) Everbright Product No.5 in the principal amount of RMB0.45 billion with Everbright Wealth Management on November 28, 2023; and (iii) Everbright Product No.6 in the principal amount of RMB1.2 billion with Everbright Wealth Management on February 20, 2024. The subscription of Everbright Product No.4 and Everbright Product No.5, on a standalone or aggregation basis, did not constitute discloseable transactions of the Company.

HONG KONG LISTING RULES IMPLICATIONS

As (i) Everbright Product No.3, Everbright Product No.4, Everbright Product No.5 and Everbright Product No.6 were issued by Everbright Wealth Management and (ii) at the time of the subscription of Everbright Product No.6, Everbright Product No.3, Everbright Product No.4 and Everbright Product No.5 remain outstanding, pursuant to Rule 14.22 of the Hong Kong Listing Rules, those transactions shall be aggregated. |

| Pursuant to the Hong Kong Listing Rules, as (i) the highest applicable percentage ratio (as

defined under Rule 14.07 of the Hong Kong Listing Rules) in respect of the aggregated transaction amounts of the subscription

of Everbright Product No. 4, Everbright Product No. 5 and Everbright Product No. 6 exceeds 5% but is below 25%, and

(ii) all applicable percentage ratios in respect of the aggregated transaction amounts of the subscription of Everbright

Product No. 3, Everbright Product No. 4, Everbright Product No. 5 and Everbright Product No. 6 are below 25%,

the subscription of Everbright Product No. 6 constitutes a discloseable transaction of the Company and is subject to the

notification and announcement requirements under the Hong Kong Listing Rules. |

BACKGROUND

We refer to the Company’s

Announcement on September 13, 2023 in relation to, among other things, the subscription of Everbright Product No.3 in the principal

amount of RMB2 billion with Everbright Wealth Management by Tianjin Lianjia, a wholly-owned subsidiary of the Company.

The Company, through its

wholly-owned subsidiary, Tianjin Lianjia, further subscribed for (i) Everbright Product No.4 in the principal amount of RMB1

billion with Everbright Wealth Management on October 18, 2023; (ii) Everbright Product No.5 in the principal amount of

RMB0.45 billion with Everbright Wealth Management on November 28, 2023; and (iii) Everbright Product No.6 in the principal

amount of RMB1.2 billion with Everbright Wealth Management on February 20, 2024. The subscription of Everbright Product No.4

and Everbright Product No.5, on a standalone or aggregation basis, did not constitute discloseable transactions of the Company.

EVERBRIGHT PRODUCT NO.4, EVERBRIGHT PRODUCT NO.5

AND EVERBRIGHT PRODUCT NO.6

The principal terms of the subscription

of Everbright Product No.4, Everbright Product No.5 and Everbright Product No.6 are set out as follows:

| Product Name: |

Sunshine Jinfengli Zhenxiang

No. C034 (陽光金豐利臻享C034 期) |

Sunshine Jinfengli Zhenxiang

No. C036 (陽光金豐利臻享C036 期) |

Sunshine Jinfengli Zhenxiang

No. C040 (陽光金豐利臻享C040 期) |

| |

|

|

|

| Date of Subscription: |

October 18, 2023 |

November 28, 2023 |

February 20, 2024 |

| |

|

|

|

| Issuer: |

Everbright Wealth

Management |

| |

|

| Subscriber: |

Tianjin Lianjia |

| |

|

|

|

| Subscription Amount: |

RMB1 billion |

RMB0.45 billion |

RMB1.2 billion |

| |

|

|

|

| Term of Product: |

180 days (October 19, 2023 to

April 16,2024) |

181 days (November 29,

2023 to May 28,2024) |

180 days (February 22, 2024 to August 20,2024) |

| |

|

|

|

| Type of Investment Return: |

Non-principal

guaranteed with floating return |

| |

|

|

|

| Risk Level of Product (Internal Risk

Assessment by the Issuer): |

Relatively

low risk |

| |

|

|

|

| Annualized Rate of Return of Product

Expected by the Company: |

2.90% |

2.90% |

3.10% |

|

|

|

|

| Right of Early Termination or Redemption: |

The Group has no right of early termination

or redemption as long as the major terms remain unchanged |

The subscription for the Everbright

Products is financed with the self-owned funds of the Group.

REASONS FOR SUBSCRIPTION OF

EVERBRIGHT PRODUCTS AND THEIR BENEFITS TO THE COMPANY

The Board believes that using

temporary idle funds reasonably and effectively will enhance the capital gain of the Company, which is consistent with the core objectives

of the Company to ensure capital safety and liquidity and meet the capital needs of the Group’s daily operations. The risk associated

with subscription of Everbright Products is relatively low, while the Company can enjoy a relatively higher return from investments in

Everbright Products after comparing quotes from different issuers.

The Directors consider that the

terms of subscription of Everbright Products are fair and reasonable, on normal commercial terms or better, and are in the interests of

the Company and its shareholders as a whole.

INFORMATION OF THE PARTIES

INVOLVED

The Company is an exempted company

with limited liability incorporated in the Cayman Islands on July 6, 2018. The Company is a leading integrated online and offline

platform for housing transactions and services, and a pioneer in building infrastructure and standards to reinvent how service providers

and customers efficiently navigate and complete housing transactions and services in China, ranging from existing and new home sales,

home rentals, to home renovation and furnishing, and other services.

Tianjin Lianjia is a company incorporated

in the PRC. It is a wholly-owned subsidiary of the Company and is mainly engaged in investment holding.

Everbright Wealth Management is

a bank financial subsidiary wholly-owned by China Everbright Bank Company Limited, a licensed bank incorporated under the laws of the

PRC listed on the Stock Exchange (stock code: 6818) and the Shanghai Stock Exchange (stock code: 601818). The business scope of Everbright

Wealth Management mainly covers issuing wealth management products to the public and investing and managing the investors’ assets

as trustee, issuing wealth management products to qualified investors and investing and managing the investors’ assets as trustee,

and financial advisory and consulting services, etc.

To the best of Directors’

knowledge, information and belief after making all reasonable enquiries, Everbright Wealth Management and its ultimate beneficial owner

are third parties independent of the Group and its connected persons.

HONG KONG LISTING RULES IMPLICATIONS

As (i) Everbright Product

No.3, Everbright Product No.4, Everbright Product No.5 and Everbright Product No.6 were issued by Everbright Wealth Management and (ii) at

the time of the subscription of Everbright Product No.6, Everbright Product No.3, Everbright Product No.4 and Everbright Product No.5

remain outstanding, pursuant to Rule 14.22 of the Hong Kong Listing Rules, those transactions shall be aggregated.

Pursuant to the Hong Kong Listing

Rules, as (i) the highest applicable percentage ratio (as defined under Rule 14.07 of the Hong Kong Listing Rules) in respect

of the aggregated transaction amounts of the subscription of Everbright Product No. 4, Everbright Product No. 5 and Everbright

Product No. 6 exceeds 5% but is below 25%, and (ii) all applicable percentage ratios in respect of the aggregated transaction

amounts of the subscription of Everbright Product No. 3, Everbright Product No. 4, Everbright Product No. 5 and Everbright

Product No. 6 are below 25%, the subscription of Everbright Product No. 6 constitutes a discloseable transaction of the Company

and is subject to the notification and announcement requirements under the Hong Kong Listing Rules.

DEFINITIONS

In

this announcement, unless the context requires otherwise, the following terms shall have the meanings set out below:

| “Announcement” |

the

announcement of the Company dated September 13, 2023 in relation to, among other things, the subscription of Everbright Product

No.3 by Tianjin Lianjia |

| |

|

| “Board” |

the board

of Directors |

| |

|

| “Company” |

KE Holdings

Inc. |

| |

|

| “Director(s)” |

the director(s) of

the Company |

| |

|

| “Everbright

Product No.3” |

Sunshine Jinfengli Zhenxiang

No. C031 (陽光金豐利臻享 C031 期) |

| |

|

| “Everbright Product

No.4” |

Sunshine Jinfengli Zhenxiang

No. C034 (陽光金豐利臻享 C034 期) |

| |

|

| “Everbright Product

No.5” |

Sunshine Jinfengli Zhenxiang

No. C036 (陽光金豐利臻享 C036 期) |

| |

|

| “Everbright Product

No.6” |

Sunshine Jinfengli Zhenxiang

No. C040 (陽光金豐利臻享 C040 期) |

| |

|

| “Everbright Products” |

Everbright

Product No.3, Everbright Product No.4, Everbright Product No.5 and Everbright Product No.6, collectively |

| “Everbright

Wealth Management” |

Everbright Wealth Management Co., Ltd.

(光大理財有限責任公司), a company incorporated in the PRC and a wholly-owned

subsidiary of China Everbright Bank Company Limited |

| |

|

| “Group” |

the Company and its subsidiaries and

consolidated affiliated entities from time to time |

| |

|

| “Hong Kong Listing Rules” |

the Rules Governing the Listing

of Securities on The Stock Exchange of Hong Kong Limited (as amended from time to time) |

| |

|

| “PRC” |

the People’s Republic of China |

| |

|

| “RMB” |

Renminbi, the lawful currency of the

PRC |

| |

|

| “Stock Exchange” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “subsidiary(ies)” |

has the meaning ascribed thereto in

the Hong Kong Listing Rules |

| |

|

| “Tianjin Lianjia” |

Lianjia (Tianjin) Enterprise Management

Co., Ltd. (鏈家(天津)企業管理有限公司), a wholly-owned

subsidiary of the Company as of the date of this announcement |

| |

|

| “%” |

per cent |

| KE

Holdings Inc.

Yongdong Peng |

| Chairman

and Chief Executive Officer |

Hong Kong, February 20, 2024

As at the date of this announcement,

the board of directors of the Company comprises Mr. Yongdong Peng, Mr. Yigang Shan, Mr. Wangang Xu and Mr. Tao Xu

as the executive directors, Mr. Jeffrey Zhaohui Li as the non-executive director, and Ms. Xiaohong Chen, Mr. Hansong Zhu

and Mr. Jun Wu as the independent non-executive directors.

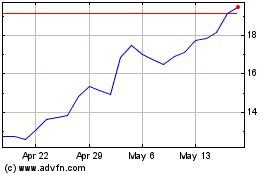

KE (NYSE:BEKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

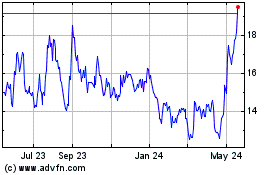

KE (NYSE:BEKE)

Historical Stock Chart

From Apr 2023 to Apr 2024