Current Report Filing (8-k)

March 07 2022 - 5:01PM

Edgar (US Regulatory)

American Well Corp false 0001393584 0001393584 2022-03-01 2022-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 1, 2022

AMERICAN WELL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-39515 |

|

20-5009396 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 75 State Street, 26th Floor Boston, MA |

|

02109 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 204-3500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, $0.01 Par Value |

|

AMWL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Long-Term Equity Incentive Compensation Program

On March 1, 2022, the Compensation Committee of the Board of Directors (the “Committee”) of American Well Corporation (the “Company”) approved grants of performance stock units (“PSUs”) to certain of the Company’s named executive officers, reflecting the implementation of changes to the award mix under the Company’s long-term equity incentive (“LTI”) compensation program which the Committee believes will enhance the alignment of executive compensation and long-term shareholder value creation. Commencing with awards granted in 2022, the Company’s named executive officers (other than Messrs. Ido and Roy Schoenberg) will receive 70% of their annual award in the form of PSUs that vest and become earned based on the Company’s achievement of specified market capitalization milestone thresholds, as further described below. The remaining 30% of such named executive officers’ LTI award will continue to be granted in the form of time-vesting restricted stock units, on terms consistent with the Company’s current equity grant practices.

The PSUs will be eligible to be earned between 0% and 300% of target levels based on the Company’s sustained market capitalization growth over a rolling 30 trading-day period during the performance period beginning March 1, 2022 and ending February 28, 2025 (the “Performance Period”) as measured against the Company’s market capitalization on the grant date (the “Market Capitalization Milestones”). The PSUs may be earned at any time during the Performance Period, and will vest and be settled in shares of the Company’s Class A common stock at such time as the Committee approves and certifies that an applicable Market Capitalization Milestone has been achieved, subject to the participant’s continued employment through such certification date; provided that, if an applicable Market Capitalization Milestone is achieved during the first year of the Performance Period, then the PSUs will not vest and be settled until the 180-day anniversary of the achievement of the Market Capitalization Milestone (subject to the participant’s continued employment through such date). Any PSUs that remain unearned at the end of the Performance Period will be cancelled and forfeited. Upon a participant’s termination of employment with the Company and its affiliates for any reason, any unvested PSUs will be immediately forfeited.

The aggregate values of the PSUs granted on March 1, 2022 to each of the Company’s named executive officers and the Company’s principal financial officer are as follows: (i) Phyllis Gotlib, $2,100,000; (ii) Kurt Knight, $2,100,000; and (iii) Robert Shepardson, $2,100,000. The Company’s co-Chief Executive Officers, Ido and Roy Schoenberg, may receive PSU grants under the LTI program at a later time in 2022.

The foregoing description of the PSUs is qualified in its entirety by reference to the full text of the form of PSU award agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 7, 2022

|

|

|

| AMERICAN WELL CORPORATION |

|

|

| By: |

|

/s/ Bradford Gay |

|

|

Bradford Gay |

|

|

Senior Vice President, General Counsel |

American Well (NYSE:AMWL)

Historical Stock Chart

From Mar 2024 to Apr 2024

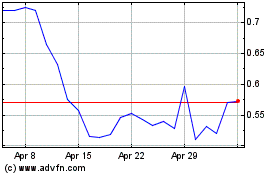

American Well (NYSE:AMWL)

Historical Stock Chart

From Apr 2023 to Apr 2024