0001899287FALSEfalse000189928700018992872024-01-162024-01-160001899287us-gaap:CommonStockMember2024-01-162024-01-160001899287ampx:RedeemableWarrantsMember2024-01-162024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 8-K

_________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 16, 2024

_________________________

Amprius Technologies, Inc.

(Exact name of Registrant as Specified in Its Charter)

_________________________

| | | | | | | | |

| Delaware | 001-41314 | 98-1591811 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

1180 Page Ave Fremont, California | 94538 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (800) 425-8803

N/A

(Former Name or Former Address, if Changed Since Last Report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common stock, par value $0.0001 per share | | AMPX | | The New York Stock Exchange |

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 | | AMPX.W | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01 Other Events.

On January 16, 2024, Amprius Technologies, Inc., a Delaware corporation (“Amprius”), announced its plans to broaden its product portfolio with new silicon anode battery platform – SiCoreTM. In addition to this SiCore product platform, Amprius has also branded its existing silicon nanowire platform SiMaxxTM. The SiCore batteries are based on the innovative, proprietary material system developed by Berzelius (Nanjing) Co. Ltd., a Chinese corporation (“Berzelius”), which prior to February 2022 was a subsidiary of Amprius, Inc., a significant stockholder of Amprius, and are currently manufactured by toll manufacturing partners. Amprius expects to produce both SiCore and SiMaxx batteries at its large-scale factory in Colorado.

To facilitate this product expansion, Amprius entered into an Exclusive Supply Agreement (the “Exclusivity Agreement”) with Berzelius, pursuant to which Berzelius agreed, among other things, (i) to manufacture for, and sell exclusively to, Amprius its proprietary silicon anode materials in the United States, Canada or Mexico and (ii) to use best efforts to prioritize fulfillment of Amprius’ forecasted orders, if any. The Exclusivity Agreement does not include any commercial terms, and the purchase of the materials under the Exclusivity Agreement by Amprius, if any, will be specified in written purchase orders mutually agreeable to the parties. The Exclusivity Agreement will remain in effect until it is mutually terminated by the parties.

The foregoing description of the Exclusivity Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement, which is attached hereto as Exhibit 99.1 to this report and incorporated herein by reference.

Forward-Looking Statements

This report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the batteries to be produced at Amprius’ large-scale manufacturing facility and Amprius’ ability to successfully expand its product offerings. These statements are based on various assumptions, whether or not identified in this report, and on the current expectations of Amprius’ management and are not predictions of actual performance. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties. These forward-looking statements are subject to a number of risks and uncertainties, including market demands for SiCore batteries; the ability of Amprius to deliver high performance products to customers at acceptable prices and meet their demands via the toll manufacturing arrangements; Amprius’ ability to reduce costs as it scales production; delays in permitting, construction and operation of production facilities; the ability of Amprius to establish manufacturing lines suitable for SiCore batteries at its Colorado facility; the ability of Amprius to meet costs targets when manufacturing SiCore batteries at its Colorado facility; third-party producers of Amprius batteries continuing to produce such batteries in the expected quantities and caliber and at the expected prices; Amprius’ customers continuing to purchase batteries directly from Amprius; Amprius’ liquidity position; risks related to the rollout of Amprius’ business and the timing of expected business milestones; Amprius’ ability to commercially produce high performing batteries; the effects of competition on Amprius’ business; supply shortages in the materials necessary for the production of SiCore or SiMaxx batteries; and changes in domestic and foreign business, market, financial, political and legal conditions. For more information on these risks and uncertainties that may impact the operations and projections discussed herein can be found in the documents we filed from time to time with the Securities and Exchange Commission (the “SEC”), all of which are available on the SEC’s website at www.sec.gov. There may be additional risks that Amprius does not presently know or that Amprius currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Amprius’ expectations, plans or forecasts of future events and views as of the date of this report. These forward-looking statements should not be relied upon as representing Amprius’ assessments as of any date subsequent to the date of this report. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, Amprius specifically disclaims any obligation to update any forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 10.1* | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | *Certain schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule will be finished to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AMPRIUS TECHNOLOGIES, INC. |

| | |

| Date: January 16, 2024 | By: | /s/ Sandra Wallach |

| | Name: Sandra Wallach |

| | Title: Chief Financial Officer |

AMPRIUS TECHNOLOGIES, INC.

EXCLUSIVE SUPPLY AGREEMENT

This Exclusive Supply Agreement (this “Agreement”) is entered into as of November 28, 2023 (the “Effective Date”) by and between Amprius Technologies, Inc., a Delaware corporation, with its office at 1180 Page Ave., Fremont, CA 94538 (“Amprius”) and Berzelius (Nanjing) Co. Ltd., a Chinese corporation having offices at Feng Zhan Road 30, Building 3, 1st Floor, Suites 101-104, Nanjing City, China 210000 (“Berzelius”). Amprius and Berzelius may be referred to individually as a “Party,” and collectively as the “Parties.”

WHEREAS, Berzelius is the manufacturer of certain silicon anode materials (as further described in Exhibit A, the “Materials”) which are used by Amprius in its battery design and manufacturing business; and

WHEREAS, Berzelius desires to supply the Materials manufactured by Berzelius exclusively to Amprius on the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the premises and the mutual promises and covenants set forth below, Amprius and Berzelius mutually agree as follows:

1.Supply of Materials.

a.Exclusivity. Berzelius hereby agrees to manufacture for, and sell exclusively in the United States, Canada, or Mexico to Amprius such quantities of the Materials to meet Amprius’ requirements. The purchase of the Materials (including pricing, quantities, and shipping terms) will be specified in written purchase orders mutually executed by the Parties separately. For clarity, without Amprius’ prior written consent (which consent may be withheld by Amprius at its sole and absolute discretion), Berzelius may not, directly or indirectly, manufacture for, deliver, or sell any Materials to any other third party in the United States, Canada, or Mexico.

b.Failure to Supply.

i.Berzelius will promptly notify Amprius in writing in the event that Berzelius is unable or anticipates that it will be unable to supply the Materials in the quantities, quality, or delivery timeframe requested by Amprius.

ii.Before the beginning of each calendar quarter, Amprius shall present a forecast for such quarter to Berzelius. Berzelius will use best efforts to procure and allocate adequate raw materials and manufacturing capacity for Amprius with respect to such Materials requirements in priority compared to the manufacture, supply, or delivery of any Materials for any of its affiliates or other customers.

2.Intellectual Property.

a.Background IP and Foreground IP. Each Party shall retain ownership of all its background intellectual property. All foreground intellectual property generated from or arising as a result of the work undertaken by the Parties under this Agreement related to battery cells and battery cell designs shall be the exclusive property of Amprius. All foreground intellectual property generated from or arising as a result of the work undertaken by the Parties under this Agreement related to raw silicon anode materials shall be the exclusive property of Berzelius.

b.IP Indemnification. Berzelius shall indemnify and hold harmless Amprius, its officers, directors, representatives and employees from and against any third-party claim alleging that any Materials delivered hereunder infringe such third party’s intellectual property rights.

3.Term. This Agreement becomes effective as of the Effective Date and will remain in effect until it is mutually terminated by the Parties.

4.Limitation of Liability. Except with respect to any breach of Section 1.a, the indemnification obligation as set forth in Section 2.b. and any confidentiality obligations under the Mutual Non-Disclosure Agreement between the Parties dated as of January 30, 2023 (“NDA”), neither Party will be liable to the other Party for any indirect, incidental, consequential, special or punitive damages, loss of profits, business reputation, anticipated savings and goodwill, whether liability is asserted in contract, tort (including negligence), strict liability, or any other theory or form of action, even if such Party has been advised of the possibility thereof or for any amounts to the extent attributable to a failure to mitigate liabilities after the indemnified party becomes aware of the event or omission which caused such liabilities. Notwithstanding the foregoing, nothing in this Agreement will operate to exclude or restrict either party’s liability for fraud or willful misconduct.

5.Assignment. Neither Party will at any time, without obtaining the prior written consent of the other Party, assign or transfer this Agreement or subcontract its obligations hereunder to any third party. Notwithstanding the foregoing, Amprius will be permitted without the consent of Berzelius to assign this Agreement to its affiliates, and each Party may also assign this Agreement without the consent of the other Party, to any successor or third party that acquires all or substantially all of the assets or business to which this Agreement relates by sale, transfer, merger, reorganization, operation of law or otherwise; provided that the assignee agrees in writing to be bound to the terms and conditions of this Agreement. In the event of an assignment permitted under this Section 5, the assigning Party will notify the other Party in writing of such assignment. This Agreement will be binding upon and will inure to the benefit of the Parties and their successors and permitted assigns. Any assignment not in accordance with this Section 5 will be null and void.

6.Entire Agreement. This Agreement, together with the NDA, is the final and complete expression of all agreements between the Parties and supersedes all previous oral and written agreements regarding these matters. It may be changed only by a written agreement signed by the Party against whom enforcement is sought.

7.Governing Law and Resolution of Disputes. This Agreement will be governed and construed in accordance with the laws of Singapore, including all matters of construction, validity, and performance, in each case without reference to its choice of law rules and not including the provisions of the 1980 U.N. Convention on Contracts for the International Sale of Goods and any dispute, controversy, or claim arising in any way out of or in connection with this Agreement, including the existence, validity, interpretation, performance, breach or termination of this Agreement, or any dispute regarding pre-contractual or non-contractual rights or obligations arising out of or relating to it will be referred to and finally resolved by binding arbitration administered by the Singapore International Arbitration Centre under the Administered Arbitration Rules of the Singapore International Arbitration Centre in force when the notice of arbitration is submitted (“Rules”) in Singapore. The arbitration tribunal will consist of three arbitrators to be appointed in accordance with the Rules, which Rules are deemed to be incorporated by reference into this section and as may be amended by the rest of this section. The seat of arbitration will be Singapore or any other place on which the parties mutually agree. Judgment upon the award rendered by the arbitration tribunal may be entered in any court of competent jurisdiction. The prevailing Party will be entitled to receive from the other Party its attorneys’ fees and costs incurred in connection with any arbitration or litigation instituted in connection with this Agreement.

8.Severability. Should one or more of the provisions of this Agreement become void or unenforceable as a matter of law, then such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of this Agreement, and the Parties agree to negotiate in good faith a valid and enforceable provision therefor which, as nearly as possible, achieves the desired effect and mutual understanding of the Parties under this Agreement.

9.Counterparts. The Agreement may be executed in counterparts, each of which will be deemed an original, but all of which taken together will constitute but one and the same instrument. The Agreement may be executed and delivered electronically in PDF format and the Parties agree that such PDF execution and delivery will have the same force and effect as delivery of an original document with original signatures, and that each Party may use the signatures contained in such PDF document as evidence of the execution and delivery of this Agreement by all parties to the same

extent that an original signature could be used. Signed PDF versions, digital certificate signatures, and other electronic signatures on the Agreement will be deemed originals for all purposes.

[Signature Page Follows]

Authorized representatives of each Party hereby execute this Agreement on the Effective Date.

| | | | | |

| AMPRIUS TECHNOLOGIES, INC. | BERZELIUS (NANJING) CO. LTD. |

| By: /s/Kang Sun | By: /s/ Cen Wang |

| Name: Kang Sun | Name: Cen Wang |

| Title: Chief Executive Officer | Title: President |

| Date: November 28, 2023 | Date: November 28, 2023 |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ampx_RedeemableWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

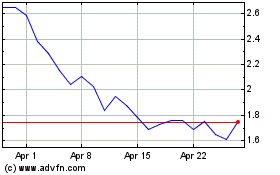

Amprius Technologies (NYSE:AMPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

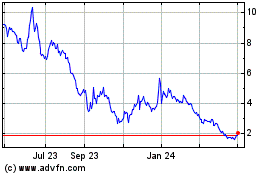

Amprius Technologies (NYSE:AMPX)

Historical Stock Chart

From Apr 2023 to Apr 2024