Current Report Filing (8-k)

March 08 2021 - 7:36AM

Edgar (US Regulatory)

false 0001675149 0001675149 2021-03-08 2021-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 8, 2021

ALCOA CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-37816

|

|

81-1789115

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

201 Isabella Street, Suite 500

Pittsburgh, Pennsylvania

|

|

15212-5858

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 412-315-2900

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

AA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Offering of Senior Notes

On March 8, 2021, Alcoa Corporation (the “Company”) issued a press release announcing a proposed offering (the “Offering”) of senior notes (the “New Notes”) by Alcoa Nederland Holding B.V. (the “Issuer”), a wholly-owned subsidiary of the Company. The Issuer intends to use the net proceeds of the issuance of the New Notes, together with cash on hand, to contribute approximately $500 million to affiliate U.S. defined benefit pension plans applicable to salaried and hourly employees and to redeem in full the outstanding 6.75% Senior Notes due 2024 (the “2024 Notes”), and pay transaction-related fees and expenses. A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated by reference into this Item 8.01.

The Issuer intends to issue a conditional notice of redemption to redeem all $750 million aggregate principal amount outstanding of its 2024 Notes. The 2024 Notes would be redeemed on the 30th day following the date of the conditional notice of redemption (the “Redemption Date”) at a redemption price equal to 103.375% of the principal amount of the 2024 Notes, plus accrued and unpaid interest to but not including the Redemption Date. The Issuer’s obligation to redeem the 2024 Notes would be conditioned upon the consummation, on or prior to the Redemption Date, of the Offering on terms and conditions that are satisfactory to the Issuer (the “Condition”). In the Issuer’s discretion, the Redemption Date may be delayed until such time as the Condition has been satisfied (or waived by the Issuer in its sole discretion).

Sale of the Warrick Rolling Mill

As previously announced, on November 30, 2020, the Company entered into an agreement to sell its rolling mill (the “Warrick Rolling Mill”), held by Alcoa Warrick LLC, to Kaiser Aluminum Corporation for total consideration of approximately $670 million, which includes $587 million in cash and the assumption of $83 million in other postretirement benefit liabilities. The sale is expected to close by the end of the first quarter of 2021 and is subject to customary closing conditions. There can be no guarantee that the sale will be completed. Filed herewith as Exhibit 99.2 are unaudited pro forma condensed consolidated financial information based on the Company’s historical consolidated financial statements, as adjusted to give effect to the Company’s sale of the Warrick Rolling Mill. The Company is not yet required to file the pro forma financial statements giving effect to the sale of the Warrick Rolling Mill on a Current Report on Form 8-K as the sale has not yet been completed. However, the Company is filing the unaudited pro forma condensed consolidated financial information with this Current Report on Form 8-K at this time in connection with the proposed Offering.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALCOA CORPORATION

|

|

|

|

|

By:

|

|

/s/ Marissa P. Earnest

|

|

|

|

Marissa P. Earnest

|

|

|

|

Senior Vice President, Chief

|

|

|

|

Governance Counsel and Secretary

|

Date: March 8, 2021

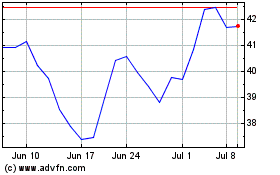

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

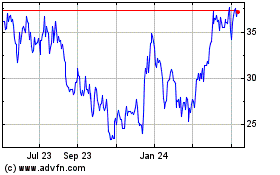

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024