Current Report Filing (8-k)

July 08 2020 - 7:53AM

Edgar (US Regulatory)

false 0001675149 0001675149 2020-07-08 2020-07-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 8, 2020

ALCOA CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-37816

|

|

81-1789115

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

201 Isabella Street, Suite 500

Pittsburgh, Pennsylvania

|

|

15212-5858

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 412-315-2900

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

AA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On July 8, 2020, Alcoa Corporation (the “Company”) issued a press release announcing certain preliminary financial information with respect to its second quarter of 2020. A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated by reference into this Item 2.02.

The second and third sentences of the second paragraph under the heading “Coronavirus” set forth under “Item 7.01 Regulation FD Disclosure” of this Current Report on Form 8-K are hereby incorporated by reference into this Item 2.02.

The information contained in this Item 2.02, including Exhibit 99.1 attached hereto, shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

Item 7.01

|

Regulation FD Disclosure.

|

The press release of the Company dated July 8, 2020, identified in, and incorporated by reference into, Item 2.02 above is also incorporated by reference into this Item 7.01.

On July 8, 2020, the Company issued a press release announcing a proposed offering (the “Offering”) of senior notes by Alcoa Nederland Holding B.V., a wholly-owned subsidiary of the Company. A copy of the press release is attached hereto as Exhibit 99.2, and is incorporated by reference into this Item 7.01. In connection with the proposed Offering, the Company disclosed certain information to prospective investors in a preliminary offering memorandum, dated July 8, 2020. The preliminary offering memorandum included information that supplements or updates certain prior disclosures of the Company. Such information is included below.

Coronavirus

In response to the coronavirus (COVID-19) pandemic, the Company continues to protect the health of the Company’s workforce, prevent infection in the Company’s locations, and mitigate impacts. As a result of these measures and the aluminum industry being classified as an essential business, all of the Company’s bauxite mines, alumina refineries, and aluminum manufacturing facilities remain in operation with comprehensive measures in place for health and business continuity. Most of the Company’s locations have had minimal disruptions. Company-wide there have been approximately 425 confirmed employee and contractor cases; however, most of the employees and contractors have received medical treatment, have returned to work, and are contributing to the Company’s operations.

The Company has experienced a sequential decline in demand for aluminum value-added products in the second quarter 2020 as its customers have reduced production levels in response to the economic impacts from the pandemic. However, for the second quarter of 2020, the Company’s overall third party aluminum shipment volume is expected to increase approximately 9 percent sequentially as volume has shifted into lower priced commodity-grade ingot and higher volume from the resumed Bécancour (Canada) smelter restart. Third party alumina shipments in the second quarter 2020 are expected to increase approximately 2 percent compared with first quarter 2020 shipment volume. The Company has not experienced any significant interruption from its supply sources.

To comply with health and safety restrictions in the Canadian province of Québec related to the COVID-19 pandemic, the previously announced restart at the Bécancour (Canada) smelter had been slowed; the operating capacity was at approximately 85 percent of total nameplate capacity at March 31, 2020. The restart process has since resumed, and the operating capacity is at approximately 90 percent of total nameplate capacity as of June 30, 2020. The restart is expected to be fully completed during August 2020.

The Company is taking advantage of various government programs, primarily the U.S. Coronavirus Aid, Relief, and Economic Security (CARES) Act, that provide for both payment deferrals and credits. For example, programs are being utilized in the U.S. to defer cash payments for Company pension contributions (approximately $220 million) into 2021 and defer employer payroll taxes (approximately $14 million) into 2021 and 2022. The Company is still evaluating the applicability of payroll tax reductions and wage subsidies in several countries where the Company operates.

The information contained in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2 attached hereto, shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning. All statements by Alcoa Corporation that reflect expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa Corporation believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Additional information concerning factors that could cause actual results to differ materially from those projected in the forward-looking statements is contained in Alcoa Corporation’s filings with the Securities and Exchange Commission. Expected second quarter 2020 results are subject to change and finalization based on completion of all quarter end close processes. Alcoa Corporation disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALCOA CORPORATION

|

|

|

|

|

|

By:

|

|

/s/ Marissa P. Earnest

|

|

|

|

Marissa P. Earnest

|

|

|

|

Senior Vice President, Chief

|

|

|

|

Governance Counsel and Secretary

|

Date: July 8, 2020

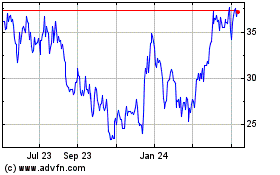

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

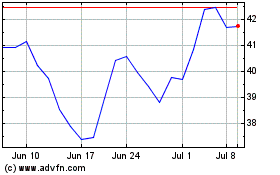

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024