Filed Pursuant to Rule 424(b)(5)

Registration No. 333-237982

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 15, 2020)

Liquid Media Group Ltd.

2,666,668 Common Shares

________________________

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering an aggregate of 2,666,668 of our common shares, without par value, to institutional accredited investors. In a concurrent private placement, we are also selling to such investors warrants to purchase an aggregate of up to 1,333,334 of our common shares (the "Warrants"), which represent 50% of the number of our common shares being issued in this offering, The exercise price of each Warrant is $1.88 per share, and each Warrant will be exercisable immediately upon issuance and will expire five years from the date of issuance. The Warrants and the common shares issuable upon the exercise of the Warrants (the "Warrant Shares") are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the "Securities Act"), and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established trading market for the Warrants, and we do not intend to list the Warrants on any national securities exchange or nationally recognized trading system.

Our common shares are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol "YVR." On June 3, 2020, the closing price of our common shares on Nasdaq was $1.88 per share.

The aggregate market value of our outstanding common shares held by non-affiliates is $19.7 million based on 7,326,842 common shares outstanding as of June 3, 2020, of which 6,457,848 common shares were held by non-affiliates, at a price per common share of $3.05 based on the closing sale price of our common shares on the Nasdaq Capital Market on April 23, 2020. In addition, as of the date hereof, we have not offered any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus supplement (but excluding the securities in this offering).

We have retained H.C. Wainwright & Co., LLC (the "placement agent") to act as our exclusive placement agent in connection with this offering. The placement agent has no obligation to buy any of the securities from us in this offering or to arrange for the purchase or sale of any specific number or dollar amount of securities but will assist us in this offering on a reasonable best efforts basis. We have also agreed to pay the placement agent the fees set forth in the table below in connection with this offering.

|

|

|

Per Share

|

|

Total

|

|

|

Offering Price

|

|

$

|

1.50

|

|

$4,000,002

|

|

|

Placement Agent Fees (1)

|

|

$

|

0.12

|

|

$320,000

|

|

|

Proceeds, before expenses, to us (2)

|

|

$

|

1.38

|

|

$3,680,002

|

|

(1) In addition, we have agreed to pay the placement agent certain expenses and to issue to the placement agent, or its designees, warrants to purchase up to 213,333 of our common shares (the "Placement Agent Warrants"), which represent 8.0% of the common shares sold in this offering. See "Plan of Distribution" beginning on page S-26 of this prospectus supplement for additional information with respect to the compensation we will pay the placement agent.

(2) The amount of offering proceeds to us presented in this table does not give effect to the sale or exercise, if any, of the Warrants being issued in the concurrent private placement or the warrant being issued to the placement agent.

Delivery of the common shares is expected to be made on or about June 8, 2020, subject to the satisfaction of certain conditions.

Investing in our securities involves a high degree of risk. Before investing in our securities, you should carefully consider the risks described under the caption "Risk Factors" beginning on page S-12 of this prospectus supplement, and in the accompanying prospectus and in the documents incorporated by reference in this prospectus supplement and refer to the risk factors that may be included in our reports and other information that we file with the U.S. Securities and Exchange Commission.

Neither the U.S. Securities and Exchange Commission nor any state or Canadian securities commission or regulator has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

_______________________

Placement Agent

H.C. Wainwright & Co.

The date of this prospectus supplement is June 4, 2020.

Table of Contents

i

About This Prospectus Supplement

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission ("SEC") using a "shelf" registration process. This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to and updates the information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides you with a general description of the securities we may offer from time to time, some of which does not apply to this offering. Generally, when we refer only to the prospectus, we are referring to the combined document consisting of this prospectus supplement and the accompanying prospectus, and, when we refer to the accompanying prospectus, we are referring to the base prospectus. If there is any inconsistency between the information in this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement. You should read the information in this prospectus supplement and the accompanying prospectus together with the additional information incorporated by reference herein and therein as provided for under the heading "Incorporation of Certain Information by Reference."

Investing in our securities may subject you to tax consequences in the U.S. and/or Canada. This prospectus supplement and the accompanying prospectus may not describe these tax consequences fully. You should read the tax discussion in this prospectus supplement and the accompanying prospectus and consult your own tax adviser with respect to your own particular circumstances.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus. We have not authorized, and the placement agent has not authorized, anyone to provide you with different information. We are not making an offer to sell or soliciting an offer to buy these securities in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make the offer or solicitation. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering, is accurate only as of the date of those respective documents.

The registration statement of which this prospectus supplement and the accompanying prospectus form a part, including the exhibits to the registration statement, contains additional information about us and the securities offered under this prospectus supplement. You can find the registration statement at the SEC's website or at the SEC office mentioned under the heading "Where You Can Find More Information."

Our consolidated financial statements that are incorporated by reference into this prospectus supplement and the accompanying prospectus have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, which we refer to as IFRS.

Unless the context otherwise indicates, the terms "us," "we," "our," "Liquid" and the "Company" refer to Liquid Media Group Ltd. and our subsidiaries.

All trademarks, trade names and service marks appearing in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein are the property of their respective owners. Use or display by us of other parties' trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner. Solely for convenience, trademarks and tradenames referred to in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein or therein appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

Unless stated otherwise or as the context otherwise requires, all references to dollar amounts in this prospectus supplement are references to U.S. dollars. References to "$", "US$" or "USD$" are to U.S. dollars and references to "CS" or "CAD$" are to Canadian dollars.

Prospectus Supplement Summary

This summary highlights selected information contained elsewhere in this prospectus supplement, in the accompanying prospectus or in documents incorporated by reference. This summary does not contain all of the information that you should consider before making an investment decision. This prospectus supplement and the accompanying prospectus include or incorporate by reference information about this offering, our business and our financial and operating data. You should carefully read the entire prospectus supplement, the accompanying prospectus, including under the sections titled "Risk Factors" included herein and therein, and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus, before making an investment decision.

Overview

Our primary business is in aggregating gaming and film production service studios and creating a vertically integrated studio system for producing film, television and animation, and gaming content from inspiration to distribution. With the goal of becoming a global competitor in gaming and film content creation, we are forging relationships with an extensive network of industry partners to integrate cutting-edge technology into our portfolio of gaming and film products.

Our strategy involves partnering with or obtaining substantial interests in companies that have demonstrated success in the industries. We believe that imaginative video product is essential to success. As a result, we have obtained a 49% interest in Waterproof Studios Inc. ("Waterproof"), an animation studio based in Vancouver, BC, which has demonstrated success in providing content and animation to large studios. In providing content to or creating animation requested by the studio, we and Waterproof avoid the substantial costs of wholly creating intellectual property, providing advertising and production and absorbing the substantial costs of doing so. Instead, we provide segments of films for studios that instead incur those costs. We believe that entering the film industry in this manner allows us to build out our infrastructure while obtaining capital and profits and developing the skills necessary to develop films.

Additionally, Liquid develops games for various platforms, including console and desktop downloadable games as well as mobile games for multiple platforms, including Apple's iOS and the Android operating systems. Our strategy mainly involves partnering with or obtaining substantial interests in companies that have demonstrated that they have successfully created games with a substantial audience. In leveraging these partnerships and acquisitions, we believe that we can more quickly and successfully enter the market and develop profitability. In doing so, we believe we will be able to finance other acquisitions and develop the skills to develop successful games in-house and thereby capture more of the profits generated from the games developed. For example, through our subsidiary Liquid Canada, we own a 51% interest in Majesco Entertainment Company ("Majesco"), a video game developer offering such games as Ancient Aliens: The Game™ and Romans From Mars. Majesco primarily uses third-party development studios to develop its games. However, Majesco may employ game-production and quality-assurance personnel to manage the creation of the game and its ultimate approval by the first-party hardware manufacturer. Majesco carefully selects third parties to develop video games based on their capabilities, suitability, availability and cost. Majesco typically has broad rights to commercially utilize products created by the third-party developers it works with. Development contracts are structured to provide developers with incentives to provide timely and satisfactory performance by associating payments with the achievement of substantive development milestones and by providing for the payment of royalties to them based on sales of the developed product, only after Majesco recoups development costs. The process for producing video games also involves working with platform manufacturers from the initial game concept phase through approval of the final product. During this process, Majesco works closely with the developers and manufacturers to ensure that the title undergoes careful quality assurance testing. Each platform manufacturer requires that the software and a prototype of each title, together with all related artwork and documentation, be submitted for its pre-publication approval. This approval is generally discretionary. We intend to acquire additional companies engaged in the film and gaming industries, and obtain the rights to films and games directly as we deem appropriate.

We also intend to develop and launch an online direct-to-consumer distribution platform that would both allow us to bring our portfolio of content to market independently and serve as a platform for other content creators (whether filmmakers, makers of video games or otherwise) to self-distribute their content directly to consumers. Through this platform, filmmakers would be able to access the latest monetization, social and showcasing features, which would in turn engage viewers in online viewing experiences.

We have a goal of becoming a global competitor in gaming and film content creation. We are forging relationships with an extensive network of industry partners to integrate cutting edge technology into our portfolio of gaming and film products. Initial growth efforts in this regard are intended to take steps to begin consolidating the city of Vancouver's fragmented film and entertainment market, where more than $3.4 billion is spent annually on film and television production services. We have signed a licensing agreement to enable us to move digital content production into the cloud.

Company Background and Information

Liquid Media Group Ltd. is a corporation incorporated under the laws of the province of British Columbia, Canada, and is governed by the Business Corporations Act (British Columbia). The Company was incorporated under the Company Act (British Columbia) on February 4, 1986, under the name "2060 Investments Ltd." On May 21, 1986, Liquid changed its name to "Camfrey Resources Ltd." On March 16, 1993, Liquid changed its name to "Brio Industries Inc.," and on October 25, 1999, Liquid changed its name to Leading Brands, Inc. ("LBI"). On August 10, 2018, the Company changed its name to "Liquid Media Group Ltd." in connection with the consummation of the business combination between LBI and Liquid Canada by way of a plan of arrangement under the Business Corporations Act (British Columbia) (the "Business Combination").

The head office of the Company is located at 202, 5626 Larch Street Vancouver, BC, Canada V6M 4E1, and our telephone number is (604) 602-0001.

The Offering

|

Common Shares Offered by Us

|

|

2,666,668 common shares

|

|

|

|

|

|

Offering Price

|

|

$1.50 per common share

|

|

|

|

|

|

Common Shares to be Outstanding Immediately After this Offering

|

|

9,993,510 common shares (assuming the sale of all of the common shares offered in this offering and excluding common shares issuable upon the exercise of the Warrants to be issued in the concurrent private placement and the Placement Agent Warrants to be issued to the placement agent).

|

|

Concurrent Private Placement

|

|

In a concurrent private placement, we are also selling to investors in this offering Warrants to purchase up to an additional 1,333,334 common shares, representing 50% of the common shares being issued in this offering. The exercise price of each Warrant is $1.88 per share, and each Warrant will be exercisable immediately upon issuance and will have a term of five years from the date of issuance. The Warrants and the Warrant Shares are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established trading market for the Warrants, and we do not intend to list the Warrants on any national securities exchange or nationally recognized trading system.

|

|

Use of Proceeds

|

|

We expect to use CAD$250,000 of the net proceeds from this offering to satisfy obligations to RDL Realisation PLC (formerly Ranger Direct Lending Fund, PLC) (“Ranger”) under the terms of a forbearance agreement between Ranger and us (the “Forbearance Agreement”). We intend to use the remaining net proceeds from this offering for working capital purposes, expanding existing businesses or acquiring or investing in businesses, debt reduction or debt refinancing, capital expenditures and other general corporate purposes. See “Use of Proceeds” on page S-18 of this prospectus supplement.

|

|

Risk Factors

|

|

You should read the "Risk Factors" sections beginning on page S-12 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of factors that you should read and consider before investing in our securities.

|

|

|

|

|

|

Tax Considerations

|

|

You are urged to consult your own tax advisers with respect to the U.S. and Canadian federal, state, provincial, territorial, local and foreign tax consequences of purchasing, owning and disposing of our common shares. See "U.S. Federal Income Tax Considerations" and "Canadian Federal Income Tax Considerations" on pages S-20 and S-24 of this prospectus supplement.

|

|

Listing

|

|

Our common shares are listed on the Nasdaq Capital Market under the symbol "YVR." The Warrants and the Placement Agent Warrants will not be listed for trading on any national securities exchange or nationally recognized trading system.

|

The number of common shares that will be outstanding after this offering as shown above is based on 7,326,842 common shares outstanding as of June 3, 2020 and excludes the following:

|

|

•

|

507,995 common shares issuable upon the exercise of stock options outstanding as of June 3, 2020, at a weighted-average exercise price of $2.55 per share;

|

|

|

•

|

2,075,459 common shares issuable upon the exercise of warrants outstanding as of June 3, 2020, at a weighted-average exercise price of $1.44 per share;

|

|

|

•

|

270,000 common shares issuable upon the conversion of convertible debentures outstanding as of June 3, 2020, at a weighted-average exercise price of $1.50 per share;

|

|

|

|

|

|

|

•

|

1,333,334 common shares issuable upon the exercise of the Warrants to be issued to investors in a private placement concurrent with this offering, at an exercise price of $1.88 per share; and

|

|

|

|

|

|

|

•

|

213,333 common shares issuable upon the exercise of the Placement Agent Warrants to be issued as compensation to the placement agent in connection with this offering, at an exercise price of $1.88 per share.

|

Unless otherwise indicated, all information in this prospectus supplement assumes:

• no exercise of the outstanding options or warrants described above; and

• no exercise of the Warrants or the Placement Agent Warrants.

In connection with this offering, Ranger agreed to waive its previously disclosed right under the Forbearance Agreement to participate in any offering by us of equity securities or securities convertible into equity securities, and we agreed to pay to Ranger, on the earlier of the closing of this offering and June 30, 2020, the first payment of CAD$250,000 under the Forbearance Agreement, originally scheduled for June 30, 2020. See “Use of Proceeds” on page S-18 of this prospectus supplement for additional information.

Where You Can Find More Information

Statements included or incorporated by reference in this prospectus supplement and the accompanying prospectus about the contents of any contract, agreement or other documents referred to are not necessarily complete, and in each instance an investor should refer to any such contracts, agreements or other documents incorporated by reference for a more complete description of the matter involved. Each such statement is qualified in its entirety by such reference.

We are subject to the information requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and in accordance therewith file and furnish reports and other information with the SEC. As a foreign private issuer, certain documents and other information that we file and furnish with the SEC may be prepared in accordance with the disclosure requirements of Canada, which are different from those of the U.S. In addition, as a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required to publish financial statements as promptly as U.S. companies.

An investor may read and download the documents we have filed with the SEC under our corporate profile at www.sec.gov. An investor may read and download any public document that we have filed with the Canadian securities regulatory authorities under our corporate profile on the SEDAR website at www.sedar.com. An investor may also access our public filings through our website at www.liquidmediagroup.co.

This prospectus supplement and the accompanying prospectus are a part of a registration statement on Form F-3. This prospectus supplement and the accompanying prospectus do not contain all of the information you can find in the registration statement or the exhibits to the registration statement. For further information about us and the securities offered under this prospectus supplement and the accompanying prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement.

Incorporation of Certain Information by Reference

The SEC allows us to "incorporate by reference" information we have filed with the SEC into this prospectus supplement and the accompanying prospectus. This means that we can disclose important information to you by referring to another document filed separately with the SEC. The information incorporated by reference is an important part of this prospectus supplement and the accompanying prospectus, and the information we file subsequently with the SEC will automatically update and supersede the information in this prospectus supplement and the accompanying prospectus. The information that we incorporate by reference in this prospectus supplement and the accompanying prospectus is deemed to be a part of this prospectus supplement and the accompanying prospectus. This prospectus supplement and the accompanying prospectus incorporate by reference the documents listed below that we have previously filed with the SEC:

-

Our Annual Report on Form 20-F for the year ended November 30, 2019, filed with the SEC on March 2, 2020 ("2019 Annual Report"), as amended by Amendment No. 1 thereto, filed with the SEC on May 14, 2020;

-

Our Report on Form 6-K, furnished to the SEC on May 14, 2020, with respect to our condensed consolidated interim financial statements for the three months ended February 29, 2020, and related Management's Discussion and Analysis of Financial Condition and Results of Operations; and

-

The description of our common shares contained in Exhibit 2(d) to Amendment No. 1 to our Annual Report on Form 20-F for the year ended November 30, 2019, as filed with the SEC on May 14, 2020, and any amendments and reports updating such description.

In addition, this prospectus supplement and the accompanying prospectus shall also be deemed to incorporate by reference all subsequent annual reports filed on Form 20-F, Form 40-F or Form 10-K, and all subsequent filings on Forms 10-Q and 8-K (if any) filed by us pursuant to the Exchange Act prior to the termination of the offering made by this prospectus supplement. We may also incorporate by reference into this prospectus supplement and the accompanying prospectus any Form 6-K that is submitted to the SEC after the date of the filing of the registration statement of which this prospectus supplement and the accompanying prospectus form a part and before the date of termination of this offering. Any such Form 6-K that we intend to so incorporate shall state in such form that it is being incorporated by reference into this prospectus supplement and the accompanying prospectus. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information relating to us, and you should review all information contained in this prospectus supplement and the accompanying prospectus and the documents incorporated or deemed to be incorporated herein by reference.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this prospectus, to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not constitute a part of this prospectus, except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Documents which we incorporate by reference are available from us without charge, excluding all exhibits, unless we have specifically incorporated by reference an exhibit in this prospectus supplement and the accompanying prospectus. You may obtain documents incorporated by reference in this prospectus supplement and the accompanying prospectus by requesting them in writing or by telephone from us at:

Liquid Media Group Ltd.

Attention: Corporate Secretary

#202, 5626 Larch Street

Vancouver, BC V6M 4E1

Canada

(604) 602-0001

Forward-Looking Statements

This prospectus supplement, the accompanying prospectus and the documents that are incorporated by reference herein and therein contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act") and Section 21E of the Exchange Act, and "forward-looking information" within the meaning of applicable Canadian securities legislation. We have tried to identify these forward-looking statements and information by using words such as "may," "might," "hope," "will," "should," "expect," "plan," "forecast," "project," "anticipate," "intend," "believe," "estimate," "predict," "potential," "contemplate," "could," "future" or the negative of those terms or other words of similar meaning. These forward-looking statements include statements with respect to the Company's beliefs, expectations, estimates, and intentions and are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond the Company's control. These risks, uncertainties and other factors relate to, without limitation:

-

Our limited operating history and our evolving business make it difficult to evaluate our results of operations and prospects.

-

We are in the initial phase of executing our business plan, and we cannot guarantee that our intended business will be successful.

-

We may not be successful in developing or launching our online direct-to-consumer distribution platform following our acquisition in February 2020.

-

Our business is intensely competitive and "hit" driven. If we do not deliver "hit" products and services, or if consumers prefer our competitors' products or services over our own, our operating results could suffer.

-

We have a history of operating losses and negative cash flow, and we may never achieve profitability.

-

We lack adequate financing and may not be able to obtain financing on acceptable terms, or at all, which would have a material adverse effect on our business, results of operations, financial condition and prospects.

-

We are subject to product development risks which could result in delays and additional costs, and we must adapt to changes in software technologies.

-

Programming errors or flaws in our games could harm our reputation or decrease market acceptance of our games, which would harm our operating results.

-

Competition within, and to, the media and entertainment industries is intense, and our competitors may be able to draw upon a greater depth and breadth of resources than those available to us.

-

Our growth relies on market acceptance.

-

We process, store and use personal information and other data, which subjects us to governmental regulation and other legal obligations related to privacy, and our actual or perceived failure to comply with such obligations could harm our business.

-

In operating our media and entertainment business, we may fail to launch new products according to our timetable, and our new products may not be commercially successful.

-

Our industry is subject to rapid technological change, and if we do not adapt to, and appropriately allocate our new resources among emerging technologies and business models, our business may be negatively impacted.

-

Our business is subject to our ability to develop commercially successful products for the current video game platforms.

-

Companies and governmental agencies may restrict access to our website, other websites that carry our products, mobile applications or the internet, generally, which could lead to losses or slower growth due to the effects such restrictions may have on our player base.

-

The video game hardware manufacturers set the royalty rates and other fees that we must pay to provide games for their platforms, and therefore have significant influence on our costs. If one or more of these manufacturers change their fee structure, our profitability will be materially impacted.

-

Acquisitions we pursue could result in operating difficulties, dilution to our shareholders and other consequences harmful to our business.

-

The potential growth of our business may depend upon our ability to consummate strategic acquisitions, which will depend on the availability of, and our ability to identify, suitable candidates; our business may suffer if we are unable to successfully integrate acquired companies into our business or otherwise manage the growth associated with multiple acquisitions.

-

The global COVID-19 pandemic may negatively affect our business, financial condition and results of operations, and these impacts may persist for an extended period of time or become more pronounced.

-

Changes in tax laws or tax rulings could materially affect our effective tax rates, financial position and results of operations.

-

Our results of operations may fluctuate significantly as to our film operations depending upon the timing of television shows and films delivered or made available to various media.

-

Our entertainment programming may not be accepted by the public, which would result in a portion of our costs not being recouped or anticipated profits not being realized.

-

Our film and television productions may not receive favorable reviews or ratings or perform well in ancillary markets, broadcasters may not license the rights to our film and television programs and distributors may not distribute or promote our films and television programs, any of which could have a material adverse effect on our results of operations or financial condition.

-

As a company in the early stages of our development, we rely upon our management team; our future success depends significantly on their continued service and performance.

-

Our success depends in part on our ability to hire and retain competent and skilled management and technical, sales and other personnel.

-

We may be involved in legal proceedings that may result in adverse outcomes.

-

Declines in consumer spending and other adverse changes in the economy could have a material adverse effect on our business, financial condition and operating results.

-

Our business is subject to a variety of other U.S. and foreign laws, many of which are unsettled and still developing, and which could subject us to claims or otherwise harm our business.

-

Our management team has limited experience managing a public company, and we need to expand our management team to support our potential growth

-

We may not be able to manage our potential growth.

-

We use a limited number of suppliers.

-

We depend on protection afforded by trademarks and copyrights to protect our intellectual property.

-

Intellectual property claims may increase our costs or require us to cease selling affected products, which could adversely affect our financial condition and results of operations.

-

Security breaches involving the source code for our products or other sensitive and proprietary information could adversely affect our business.

-

Failure to protect or enforce our intellectual property rights or the costs involved in such enforcement could harm our business and operating results.

-

The proliferation of "cheating" programs and scam offers that seek to exploit our games affects the game-playing experience and may lead players to stop playing our games.

-

We may not be able to maintain our listing on the Nasdaq Capital Market.

-

This offering and future capital raising efforts may be dilutive to our shareholders, result in increased interest expense in future periods or depress our share price.

-

The right of RDL Realisation PLC to participate in future offerings by us could impair our ability to raise capital.

-

The price of our common shares may be volatile or may decline regardless of our operating performance.

-

We incur significant costs and demands upon management and accounting and finance resources as a result of complying with the laws and regulations affecting public companies; any failure to establish and maintain adequate internal controls and/or disclosure controls or to recruit, train and retain necessary accounting and finance personnel could have an adverse effect on our ability to accurately and timely prepare our financial statements and otherwise make timely and accurate public disclosure.

-

We are a "foreign private issuer" under U.S. securities laws and, as a result, are subject to disclosure obligations different from requirements applicable to U.S. domestic registrants listed on Nasdaq.

-

We could lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us.

-

If we were to be a passive foreign investment company for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended, U.S. holders of our common shares (or securities exercisable for or convertible into our common shares) may suffer adverse tax consequences.

-

We have never paid cash dividends on our common shares, and we do not anticipate paying cash dividends in the foreseeable future.

-

Our shareholder rights plan and provisions in our articles may prevent efforts by our shareholders to effect a change of control of our company or a change in our management.

-

We are incorporated in British Columbia, Canada, and all but one of our directors and officers live in Canada, and all of the Company's assets, with the exception of our interest in Majesco, are in Canada; therefore, investors may have difficulty initiating legal claims and enforcing judgments against us and our directors and officers.

-

We have broad discretion in the use of the net proceeds of this offering and may not use them effectively.

-

Other risks and uncertainties discussed under the caption "Risk Factors" in this prospectus supplement and in documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

The foregoing list of factors is not exclusive. For further information about these and other risks, uncertainties and factors affecting the Company's business and prospects, please review the disclosure contained in the Company's filings made with the SEC. You should not place undue reliance on any forward-looking statements. Any forward looking statement or information speaks only as of the date on which it is made. The Company expressly disclaims any intent or obligation to update any forward-looking statements or risk factors, whether written or oral, that may be made from time to time by or on behalf of the Company or its subsidiaries, whether as a result of new information, future events or changed circumstances or for any other reason after the date of such forward-looking statements or risk factors.

Risk Factors

Investing in our securities involves a high degree of risk, including those described below. Before making an investment decision, you should carefully consider the risks described below, the risks described under the heading "Risk Factors" in our Annual Report on Form 20-F for the year ended November 30, 2019, as amended, which is incorporated by reference in this prospectus supplement and the accompanying prospectus, and the risks and other information included in any document that we file from time to time with the SEC after the date of this prospectus supplement that is incorporated by reference herein, as well as all other information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. If any of the events described below or in any such other document occur or the risks described herein or therein materialize, our business, financial condition, results of operations, cash flow and prospects could be materially adversely affected. In addition, risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations, our financial results and the value of our securities.

Risks Related to this Offering and Our Common Shares

We may not be able to maintain our listing on the Nasdaq Capital Market.

Our common shares trade on the Nasdaq Capital Market. Following the Business Combination in August 2018, we were required to establish compliance with the Nasdaq initial listing requirements, which we did in October 2018. Nasdaq has continued listing requirements that we must meet to avoid delisting. The standards include, among others, a minimum bid price requirement of $1.00 per share and any of: (1) a minimum stockholders' equity of $2.5 million; (2) a market value of listed securities of $35 million; or (3) net income from continuing operations of $500,000 in the most recently completed fiscal year or in two of the last three fiscal years. Our results of operations and our fluctuating share price directly impact our ability to satisfy these listing standards. In the past, we have received written notices from Nasdaq for failing to meet its continued listing requirements, including our failure to hold an annual meeting of shareholders within twelve months of the end of our fiscal year ended November 30, 2018. Although we have regained compliance with Nasdaq's continued listing standards, there can be no assurance that we will remain in compliance in the future. If we are unable to maintain these listing standards, we may be subject to delisting.

A delisting from Nasdaq would result in our common shares being eligible for quotation on the over-the-counter market, which is generally considered to be a less efficient trading system than listing on markets such as Nasdaq or other national exchanges because of lower trading volumes, transaction delays, and reduced security analyst and news media coverage. A delisting from Nasdaq could also result in a determination that our common shares are "penny stock," which would require brokers trading in our common shares to adhere to more stringent rules. These factors could reduce the level of trading activity in the trading market for our common shares and contribute to lower prices and larger spreads in the bid and ask prices for our common shares.

This offering and future capital raising efforts may be dilutive to our shareholders, result in increased interest expense in future periods or depress our share price.

In order to finance our operations, we have raised funds through the issuance of common shares and securities convertible into common shares, we intend to do so pursuant to the offering contemplated by this prospectus supplement and may do so again in the future. This offering may have a dilutive effect on our earnings per share and/or book value per share for the fiscal year ending November 30, 2020. The actual amount of dilution, if any, cannot be determined at this time and will be based on numerous factors. In the future, we may issue common shares in connection with investments or acquisitions. The number of common shares issued in future offerings, including those issued in connection with an investment or acquisition, could be material. We cannot predict the size of future issuances of common shares or the size or terms of future issuances of debt instruments or other securities convertible into or exercisable or exchangeable for common shares, or the effect, if any, that future issuances and sales of our securities will have on the market price of our common shares. Sales or issuances of substantial numbers of common shares, or the perception that such sales could occur, whether in this offering or any future offering, may adversely affect the market price of our common shares. With any additional sale or issuance of common shares, or securities convertible into common shares, our investors may suffer dilution of their investment.

The right of RDL Realisation PLC to participate in future offerings by us could impair our ability to raise capital.

As previously disclosed in our filings with the SEC, in the event we issue any equity securities or securities convertible into equity securities, subject to limited exceptions, RDL Realisation PLC (formerly Ranger Direct Lending Fund, PLC) (“Ranger”) has the right, pursuant to the terms of the Forbearance Agreement, to participate in the offering of such securities such that Ranger may maintain its proportional ownership interest in us immediately prior to the completion of such offering. Although we obtained a waiver from Ranger of its right to participate in this offering pursuant to the Forbearance Agreement, the existence of Ranger’s right of participation, or the exercise of such right in connection with future issuances, may require us to issue securities to Ranger in connection with any such future issuance of equity securities or securities convertible into equity securities and may deter potential investors from providing us needed financing, or may deter investment banks from working with us, which may have a material adverse effect on our ability to obtain financing.

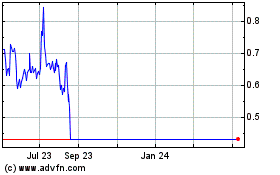

The price of our common shares may be volatile or may decline regardless of our operating performance.

The market price for our common shares may be highly volatile. In addition, the market price of our common shares may fluctuate significantly in response to a number of factors, most of which we cannot control, including:

-

variations in our financial results or those of companies that are perceived to be similar to us;

-

actions by us or our competitors, such as sales initiatives, acquisitions or restructurings;

-

additions or departures of key management personnel;

-

legal proceedings involving us, our industry, or both;

-

changes in our capitalization, including future issuances of our common shares or the incurrence of additional indebtedness;

-

changes in market valuations of companies similar to ours;

-

the prospects of the industry in which we operate;

-

actions by our shareholders;

-

speculation or reports by the press or investment community with respect to us or our industry in general;

-

general economic, market and political conditions; and

-

other risks, uncertainties and factors described under the caption "Risk Factors" in this prospectus supplement, and elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated herein by reference.

The stock markets in general have often experienced volatility, including, most recently, in the wake of COVID-19, that has sometimes been unrelated or disproportionate to the operating performance of particular companies. These broad market fluctuations have caused, and may continue to cause, the trading price of our common shares to decline. A continuation or worsening of the levels of market disruption and volatility seen in the recent past could have an adverse effect on our ability to access capital, on our business, financial condition, results of operations, cash flow and prospects, and on the market price of our common shares. In the past, following periods of volatility in the market price of a company's securities, securities class-action litigation has often been brought against that company. We may become involved in this type of litigation in the future. Litigation of this type may be expensive to defend and may divert our management's attention and resources from the operation of our business.

We incur significant costs and demands upon management and accounting and finance resources as a result of complying with the laws and regulations affecting public companies; any failure to establish and maintain adequate internal controls and/or disclosure controls or to recruit, train and retain necessary accounting and finance personnel could have an adverse effect on our ability to accurately and timely prepare our financial statements and otherwise make timely and accurate public disclosure.

As a public operating company, we incur significant administrative, legal, accounting and other burdens and expenses beyond those of a private company, including public company reporting obligations, both in the U.S. and under applicable Canadian national and provincial securities laws and regulations, and Nasdaq listing requirements. In particular, we have needed, and continue to need, to enhance and supplement our internal accounting resources with additional accounting and finance personnel with the requisite technical and public company experience and expertise to enable us to satisfy such reporting obligations. Currently, we rely upon the services of third parties for our accounting and financial reporting functions, which third-party arrangements create additional monitoring obligations and have the potential to increase risk in the system of internal control. Any failure to maintain an effective system of internal controls (including internal control over financial reporting) could limit our ability to report our financial results accurately and on a timely basis, or to detect and prevent fraud and could expose us to regulatory enforcement action and shareholder claims.

Furthermore, we are required to comply with Section 404 of the Sarbanes-Oxley Act of 2002. As a non-accelerated filer under the Exchange Act, we are not required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, but we are required to document and test our internal control procedures and prepare annual management assessments of the effectiveness of our internal control over financial reporting. Therefore, our internal controls over financial reporting will not receive the level of review provided by the process relating to the auditor attestation included in annual reports of issuers that are subject to the auditor attestation requirements, which may adversely impact market perception of our business and our common shares. Our assessments must include disclosure of identified material weaknesses in our internal control over financial reporting. The existence of one or more material weaknesses could affect the accuracy and timing of our financial reporting. Testing and maintaining internal control over financial reporting involves significant costs and could divert management's attention from other matters that are important to our business. Additionally, we may not be successful in remediating any deficiencies that may be identified. If we are unable to remediate any such deficiencies or otherwise fail to establish and maintain adequate accounting systems and internal control over financial reporting, or we are unable to continue to recruit, train and retain necessary accounting and finance personnel, we may not be able to accurately and timely prepare our financial statements and otherwise satisfy our public reporting obligations.

In 2019, we identified a material weakness in our internal controls, and such weakness may continue or additional material weaknesses may occur in the future. Specifically, our management conducted an assessment of the effectiveness of our internal control over financial reporting as of November 30, 2019. Based on this assessment, our management concluded that, as of November 30, 2019, our internal control over financial reporting was not effective. Specifically, based on management's assessment, we lack adequate oversight related to the development and performance of internal controls, and, due to the limited number of personnel in the Company, there are inherent limitations to segregation of duties amongst personnel to perform adequate oversight. Furthermore, our management concluded that, as of November 30, 2019, our disclosure controls were not effective because of the material weakness in our internal control over financial reporting. Additionally, we face difficulties in obtaining information, including on a timely basis, with respect to LBI prior to the Business Combination, as well as Majesco and Waterproof, for purposes of making financial and other public disclosure. These difficulties have also adversely affected our ability to timely file tax returns. We have not yet satisfactorily addressed these difficulties and have not yet remediated the weaknesses in our internal controls over financial reporting. Any inaccuracies in our financial statements or other public disclosures (in particular, if resulting in the need to restate previously filed financial statements), or delays in our making required SEC filings, whether as a result of the lack of effectiveness of our internal control over financial reporting or disclosure controls and procedures or otherwise, could have a material adverse effect on the confidence in our financial reporting, our credibility in the marketplace and the trading price of our common shares.

Our management team must continue to adapt to other requirements of being a public company. We need to devote significant resources to address these public company-associated requirements, including compliance programs and investor relations, as well as our financial reporting obligations. We incur substantial legal and financial compliance costs as a result of complying with these rules and regulations promulgated by the SEC. We are also required to simultaneously comply with applicable Canadian national and provincial securities laws and regulations, which result in legal, accounting and other related costs and make some activities more time-consuming and costly.

We are a "foreign private issuer" under U.S. securities laws and, as a result, are subject to disclosure obligations different from requirements applicable to U.S. domestic registrants listed on Nasdaq.

Although we are subject to the periodic reporting requirements under the Exchange Act, the periodic disclosure required of "foreign private issuers" (as defined in Rule 405 under the Securities Act) is different from periodic disclosure required of U.S. domestic registrants. Therefore, there may be less publicly available information about us than is regularly published by or about other public companies in the U.S., and we are exempt from certain other sections of the Exchange Act to which U.S. domestic registrants would otherwise be subject. See "We could lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us" below. In addition, our executive officers, directors and large shareholders are not obligated to file reports under Section 16 of the Exchange Act, and certain of the governance rules and shareholder approval rules imposed by the Nasdaq are inapplicable to us.

We could lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us.

In order to maintain our current status as a foreign private issuer, if more than 50% of our outstanding voting securities are directly or indirectly owned by residents of the U.S., we must not have any of the following: (1) a majority of our executive officers or directors being U.S. citizens or residents, (2) more than 50% of our assets being located in the U.S., or (3) our business being principally administered in the U.S. If we were to lose our foreign private issuer status:

-

we would no longer be exempt from certain of the provisions of U.S. securities laws, such as Regulation FD, the Section 16 disclosure and short swing-profit rules and the requirement to file proxy solicitation materials on Schedule 14A or 14C in connection with meetings of our shareholders;

-

we would be required to commence reporting on forms required of U.S. companies, such as Forms 10-K, 10-Q and 8-K, rather than the forms currently available to us, such as Forms 20-F and 6-K;

-

we would be subject to additional restrictions on offers and sales of securities outside the U.S., including in Canada; and

-

we would lose the ability to rely upon certain exemptions from the Nasdaq corporate governance requirements that are available to foreign private issuers.

If we cease to qualify as a foreign private issuer, our regulatory and compliance costs may increase significantly in order to comply with the requirements discussed above.

If we were to be a passive foreign investment company for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended, U.S. holders of our common shares (or securities exercisable for or convertible into our common shares) may suffer adverse tax consequences.

If 75% or more of our gross income in a taxable year, including our pro-rata share of the gross income of any company, U.S. or foreign, in which we are considered to own, directly or indirectly, 25% or more of the shares by value, is passive income, then we will be a "passive foreign investment company," or "PFIC," for U.S. federal income tax purposes. Alternatively, we will be considered to be a PFIC if at least 50% of our assets in a taxable year, averaged over the year and ordinarily determined based on fair market value and including our pro-rata share of the assets of any company in which we are considered to own, directly or indirectly, 25% or more of the shares by value, are held for the production of, or produce, passive income. Once treated as a PFIC for any taxable year, a foreign corporation will generally continue to be treated as a PFIC for all subsequent taxable years for any U.S. shareholder who owned shares of the foreign corporation when it was treated as a PFIC. If we were to be a PFIC, and a U.S. shareholder does not make an election to treat us as a "qualified electing fund," or "QEF," or a "mark-to-market" election, "excess distributions" to such U.S. shareholder, and any gain recognized by such U.S. shareholder on a disposition of our common shares, would be taxed in an unfavorable way. Among other consequences, our dividends, to the extent that they constituted excess distributions, would be taxed at the regular rates applicable to ordinary income, rather than the 20% maximum rate applicable to certain dividends received by an individual from a qualified foreign corporation, and certain "interest" charges may apply. In addition, gains on the sale of our common shares would be treated in the same way as excess distributions.

The tests for determining PFIC status are applied annually. We currently do not expect to be a PFIC for our current and future taxable years. However, because we will hold a substantial amount of cash (which is a passive asset) following this offering and because our PFIC status for any taxable year will depend on the composition of our income and assets and the value of our assets from time to time, we may become a PFIC for our current taxable year or any future taxable year. If we do become a PFIC in the future, U.S. shareholders who hold common shares during any period when we are a PFIC will be subject to the foregoing rules, even if we cease to be a PFIC, subject to exceptions for U.S. holders who made timely QEF or mark-to-market elections or certain other elections. We do not currently intend to prepare or provide the information that would enable our common shareholders to make a QEF election.

If we do become a PFIC for our current taxable year or any future taxable year, in addition to U.S. holders of our common shares, a U.S. holder of our securities exercisable for or convertible into our common shares during any year in which we are a PFIC would be adversely affected under the foregoing rules even if we cease to be a PFIC. Such U.S. holders should consult their own tax advisers concerning the potential application of the PFIC rules to their investment.

We have never paid cash dividends on our common shares, and we do not anticipate paying cash dividends in the foreseeable future.

We have never declared or paid any cash dividends on our common shares and do not intend to pay any cash dividends in the foreseeable future. We currently intend to retain any future earnings to fund the growth of our business. Any determination to pay dividends in the future will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, general business conditions and other factors that our board of directors may deem relevant. As a result, capital appreciation, if any, of our common shares will be the sole source of gain for the foreseeable future. There is no guarantee that our common shares will appreciate in value or even maintain the price at which a shareholder purchased such shareholder's shares.

Our shareholder rights plan and provisions in our articles may prevent efforts by our shareholders to effect a change of control of our company or a change in our management.

We adopted a shareholder rights plan, pursuant to which we issued one right for each outstanding common share to shareholders on August 31, 2006. In the event that a person acquires beneficial ownership of 20% or more of our then-outstanding common shares, subject to certain exceptions, each right would entitle its holder (other than such person or members of such group) to purchase that number of common shares having an aggregate market price (as defined in the shareholder rights plan) equal to forty Canadian dollars for twenty Canadian dollars. The shareholder rights plan could make it more difficult for a third party to acquire the Company or a large block of our common shares without the approval of our board of directors.

Our articles also provide for our board of directors to be divided into three classes of directors. Directors of each class are chosen for three-year terms upon the expiration of their current terms, and each year one class of directors is elected by our shareholders. Because we have a staggered board, our shareholders may be prevented from replacing a majority of our board of directors at any annual meeting, which may entrench management and discourage unsolicited shareholder proposals that may be in the best interests of our shareholders. In addition, the staggered terms of our directors may reduce the possibility of a tender offer or an attempt at a change in control, even though a tender offer or change in control might be in the best interest of our shareholders.

We are incorporated in British Columbia, Canada, and all but one of our directors and officers live in Canada, and all of the Company's assets, with the exception of our interest in Majesco, are in Canada; therefore, investors may have difficulty initiating legal claims and enforcing judgments against us and our directors and officers.

We are a company incorporated under the laws of British Columbia. Currently, all but one of our directors and officers are residents of Canada and all our assets and operations, with the exception of our 51% held subsidiary Majesco Entertainment Company, are located outside of the U.S. It may not be possible for shareholders to enforce in Canada judgments against the Company obtained in the U.S., including actions predicated upon the civil liability provisions of the U.S. federal securities laws. While reciprocal enforcement of judgment legislation exists between Canada and the U.S., we and our insiders may have defenses available to avoid in Canada the effect of U.S. judgments under Canadian law, making enforcement difficult or impossible. There is uncertainty as to whether Canadian courts would enforce (a) judgments of U.S. courts obtained against us or our insiders predicated upon the civil liability provisions of the U.S. federal and state securities laws or (b) in original actions brought in Canada, liabilities against us or our insiders predicated upon the U.S. federal and state securities laws. Therefore, our shareholders in the U.S. may have to avail themselves of remedies under Canadian corporate and securities laws for any perceived oppression, breach of fiduciary duty and other similar legal complaints.

We have broad discretion in the use of the net proceeds of this offering and may not use them effectively.

We expect to use CAD$250,000 of the net proceeds from this offering to satisfy obligations to Ranger under the terms of the Forbearance Agreement. See " Use of Proceeds" on page S-18 of this prospectus supplement. We intend to use the remaining net proceeds from this offering for working capital purposes, expanding existing businesses, acquiring businesses or investing in other business opportunities; debt reduction or debt refinancing; capital expenditures; and/or general corporate purposes. Accordingly, our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common shares. Our shareholders may not agree with the manner in which our management chooses to allocate and spend these funds. The failure by our management to apply these funds effectively could have a material adverse effect on our business. Pending their use, we may invest these funds in a manner that does not produce income for us and does not yield a favorable return to our shareholders.

Capitalization and Indebtedness

The following table sets forth our cash and capitalization (including indebtedness and shareholders’ equity):

-

on an actual basis as of February 29, 2020; and

-

on an adjusted basis to give effect to (1) the sale of 2,666,668 common shares by us in this offering, at the offering price of US$1.50 per common share (CAD$2.02 per common share, translated using the rate of US$1 to CAD$1.3470, based on the exchange rate reported by the Bank of Canada on June 3, 2020), for aggregate net proceeds of US$3,486,755 (CAD$4,696,599), after deducting placement agent fees and estimated offering expenses payable by us, and (2) the application of estimated proceeds to us from this offering as described under "Use of Proceeds."

The amounts shown below are unaudited. The information in this table should be read in conjunction with and is qualified by reference to our consolidated financial statements and notes thereto and other financial information incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

|

|

As of February 29, 2020

|

|

|

|

|

(CAD$ in thousands)

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

|

|

|

|

|

|

|

|

Cash

|

$

|

53

|

|

$

|

4,500

|

|

|

|

|

|

|

|

|

|

|

Non-Current Indebtedness:

|

|

|

|

|

|

|

|

Convertible notes (unsecured)

|

$

|

1,473

|

|

$

|

1,473

|

|

|

Derivative liability (unsecured)

|

$

|

547

|

|

$

|

547

|

|

|

|

|

|

|

|

|

|

|

Current Indebtedness:

|

|

|

|

|

|

|

|

Loan payable (secured)

|

$

|

750

|

|

$

|

500

|

|

|

Loan payable (unsecured)

|

$

|

696

|

|

$

|

696

|

|

|

Accounts payable and other liabilities (unsecured)

|

$

|

4,742

|

|

$

|

4,876

|

|

|

|

|

|

|

|

|

|

|

Total Indebtedness

|

$

|

8,208

|

|

$

|

8,092

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

Share capital (common shares)

|

$

|

21,525

|

|

$

|

25,682

|

|

|

Commitment to issue shares

|

$

|

902

|

|

$

|

902

|

|

|

Reserves

|

$

|

2,246

|

|

$

|

2,652

|

|

|

Accumulated other comprehensive loss

|

$

|

345

|

|

$

|

345

|

|

|

Deficit

|

$

|

(20,094

|

)

|

$

|

(20,094

|

)

|

|

Shareholders' equity attributable to our shareholders

|

$

|

4,924

|

|

$

|

9,487

|

|

|

Total Capitalization

|

$

|

13,132

|

|

$

|

17,579

|

|

|

Cash and Capitalization

|

|

13,185

|

|

|

22,079

|

|

The above table does not include any potential proceeds from the exercise of the Warrants or the Placement Agent Warrants.

Use of Proceeds

We estimate that the net proceeds from this offering, after deducting placement agent fees and estimated offering expenses payable by us, will be approximately US$3,486,755 (CAD$ 4,696,599), excluding the proceeds, if any, from the exercise of the Warrants and the Placement Agent Warrants.

We expect to use CAD$250,000 of the net proceeds from this offering to satisfy obligations to Ranger under the terms of the Forbearance Agreement. The outstanding principal amount under the loan with Ranger bears interest at a rate of 14.4% per annum and is scheduled to mature on November 30, 2020.

We intend to use the remaining net proceeds from this offering for:

-

working capital purposes;

-

expanding existing businesses or acquiring or investing in businesses;

-

debt reduction or debt refinancing;

-

capital expenditures; and

-

other general corporate purposes.

Until the net proceeds have been used, we may invest the net proceeds in short-term, investment grade, interest bearing instruments.

Dilution

If you invest in our common shares, you will experience dilution to the extent of the difference between the offering price per share and the as adjusted net tangible book value per share after giving effect to this offering.

Our historical net tangible book value on February 29, 2020 was CAD$643,238, or CAD$0.11 per common share. "Net tangible book value" represents our total assets minus the sum of liabilities and intangible assets. "Net tangible book value per share" is net tangible book value divided by the total number of common shares outstanding.

After giving effect to the sale of 2,666,668 common shares in this offering, and after deducting the placement agent fees and our estimated offering expenses payable by us, our net tangible book value as of February 29, 2020, as adjusted, would have been CAD$5,205,139, or CAD$0.62 per common share. This represents an immediate increase in the pro forma as adjusted net tangible book value of CAD$0.51 per share to our existing shareholders and immediate dilution in net tangible book value of CAD$1.40 per share to the investors in this offering. The following table illustrates this calculation on a per share basis in Canadian dollars.

|

Offering price per common share offered (1)

|

|

|

|

|

$2.02

|

|

|

Historical net tangible book value per common share as of February 29, 2020

|

$

|

0.11

|

|

|

|

|

|

Increase in as adjusted net tangible book value per share attributable to this offering

|

$

|

0.51

|

|

|

|

|

|

Pro forma as adjusted net tangible book value per share after giving effect to this offering

|

|

|

|

$

|

0.62

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

$

|

1.40

|

|

(1) Translated using the rate of US$1 to CAD$1.3470, based on the exchange rate reported by the Bank of Canada on June 3, 2020.

The above discussion and table are based on 5,727,554 common shares outstanding as of February 29, 2020, and does not include:

|

•

|

511,500 common shares issuable upon the exercise of stock options outstanding as of February 29, 2020, at a weighted-average exercise price of $2.55 per share;

|

|

•

|

1,894,470 common shares issuable upon the exercise of warrants outstanding as of February 29, 2020, at a weighted-average exercise price of $1.45 per share;

|

|

•

|

785,000 common shares issuable upon the exercise of convertible debentures outstanding as of February 29, 2020, at a weighted-average exercise price of $1.50 per share;

|

|

|

|

|

•

|

1,333,334 common shares issuable upon the exercise of the Warrants to be issued to investors in the private placement concurrent with this offering, at an exercise price of $1.88 per share; and

|

|

|

|

|

•

|

213,333 common shares issuable upon the exercise of the Placement Agent Warrant to be issued as compensation to the placement agent in connection with this offering, at an exercise price of $1.88 per share.

|

The above illustration of dilution per common share to investors participating in this offering assumes no further exercise of outstanding options, warrants or debentures to purchase our common shares, and no exercise of the Warrants or the Placement Agent Warrants. To the extent that any of our outstanding options, warrants or debentures are exercised, or we issue additional common shares, equity securities or convertible debt securities in the future, there may be further dilution to the new investors.

Private Placement of Warrants

In a concurrent private placement, we are selling to investors in this offering Warrants to purchase up to an aggregate of 1,333,334 common shares at an initial exercise price of $1.88 per share. Each Warrant will be exercisable immediately upon issuance and will have a term of five years from the date of issuance. The exercise price and the number of common shares issuable upon exercise of the Warrants are subject to adjustment upon the occurrence of specified events, including stock dividends, stock splits, combinations and reclassifications of our common shares, as described in the Warrants.

Holders of the Warrants may exercise their Warrants to purchase our common shares at any time prior to the expiration date. Subject to limited exceptions, a holder of Warrants will not have the right to exercise any portion of its Warrants if the holder, together with its affiliates and any other persons acting as a group together with the holder and any of the holder's affiliates, would beneficially own in excess of 4.99% (or 9.99% at the election of the holder prior to issuance) of the number of our common shares outstanding immediately after giving effect to such exercise, provided that the holder may increase or decrease the beneficial ownership limitation (but in no event shall such limitation exceed 9.99%). Any increase in the beneficial ownership limitation will not be effective until 61 days following notice of such change to us. If at the time of the exercise of a Warrant a registration statement and current prospectus covering the resale by the holder of the common shares issuable upon exercise of the Warrant is not available, the holder may exercise its Warrant in whole or in part on a cashless basis.

Except as otherwise provided in the Warrants or by virtue of such holder's ownership of our common shares, the holders of Warrants do not have the rights or privileges of holders of our common shares, including any voting rights, until they exercise their Warrants.

The Warrants and the Warrant Shares are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder, and they are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

There is no established trading market for the Warrants, and we do not expect a market to develop. We do not intend to apply for a listing for any of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited.

U.S. Federal Income Tax Considerations

The following is a summary of the anticipated U.S. federal income tax consequences generally applicable to U.S. Holders (as defined below) of the ownership and disposition of our common shares. This summary addresses only holders who acquire pursuant to this offering and hold common shares as "capital assets" (generally, assets held for investment purposes).