UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 29, 2015

WYNN RESORTS, LIMITED

(Exact name of registrant as specified in its charter)

|

| | |

Nevada | 000-50028 | 46-0484987 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

WYNN LAS VEGAS, LLC

(Exact name of registrant as specified in its charter)

|

| | |

Nevada | 333-100768 | 88-0494875 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

3131 Las Vegas Boulevard South Las Vegas, Nevada | | 89109 |

(Address of principal executive offices of each registrant) | | (Zip Code) |

(702) 770-7555

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On July 29, 2015 Wynn Resorts, Limited issued a press release announcing its results of operations for the second quarter ended June 30, 2015. The press release is furnished herewith as Exhibit 99.1. The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

|

| |

Item 7.01 | Regulation FD Disclosure. |

The information set forth under Item 2.02 of this report is incorporated herein by reference.

On July 29, 2015, Wynn Resorts, Limited, announced a cash dividend of $0.50 per share of its outstanding common stock. This cash dividend will be payable on August 20, 2015 to stockholders of record on August 11, 2015.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

|

| |

Exhibit No. | Description |

| |

99.1 | Press release, dated July 29, 2015, of Wynn Resorts, Limited. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | WYNN RESORTS, LIMITED |

| | |

Dated: July 29, 2015 | | By: | | /s/ Stephen Cootey |

| | Stephen Cootey |

| | Chief Financial Officer and Treasurer |

| | (Principal Financial and Accounting Officer) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | WYNN LAS VEGAS, LLC |

| | |

Dated: July 29, 2015 | | By: | | Wynn Resorts Holdings, LLC |

| | | | its sole member |

| | | | |

| | By: | | Wynn Resorts, Limited |

| | | | its sole member |

| | | | |

| | | | |

| | By: | | /s/ Stephen Cootey |

| | Stephen Cootey |

| | Chief Financial Officer and Treasurer |

| | (Principal Financial and Accounting Officer) |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

| |

99.1 | Press release, dated July 29, 2015, of Wynn Resorts, Limited. |

Exhibit 99.1

Wynn Resorts, Limited Reports Second Quarter 2015 Results

LAS VEGAS, July 29, 2015 — Wynn Resorts, Limited (Nasdaq: WYNN) today reported financial results for the second quarter ended June 30, 2015.

Net revenues for the second quarter of 2015 were $1,040.5 million, compared to $1,412.1 million in the second quarter of 2014. The decline was the result of a 35.8% net revenue decrease from our Macau Operations and a 6.2% decrease in net revenues from our Las Vegas Operations. Adjusted property EBITDA (1) was $295.4 million for the second quarter of 2015, a 36.8% decrease from $467.4 million in the second quarter of 2014.

On a US GAAP basis, net income attributable to Wynn Resorts, Limited for the second quarter of 2015 was $56.5 million, or $0.56 per diluted share, compared to net income attributable to Wynn Resorts, Limited of $203.9 million, or $2.00 per diluted share, in the second quarter of 2014.

Adjusted net income attributable to Wynn Resorts, Limited (2) in the second quarter of 2015 was $75.0 million, or $0.74 per diluted share (adjusted EPS), compared to an adjusted net income attributable to Wynn Resorts, Limited of $215.1 million, or $2.11 per diluted share, in the second quarter of 2014.

Wynn Resorts, Limited also announced today that the Company has approved a cash dividend of $0.50 per common share. This dividend will be payable on August 20, 2015, to stockholders of record on August 11, 2015.

Macau Operations

In the second quarter of 2015, net revenues were $617.0 million, a 35.8% decrease from the $960.6 million generated in the second quarter of 2014. Adjusted property EBITDA in the second quarter of 2015 was $173.4 million, down 43.5% from $307.0 million in the second quarter of 2014, due primarily to weakness in the gaming segment.

Table games turnover in the VIP segment was $15.5 billion for the second quarter of 2015, a 41.1% decrease from $26.4 billion in the second quarter of 2014. VIP table games win as a percentage of turnover (calculated before commissions) for the quarter was 2.92%, within the expected range of 2.7% to 3.0% and flat compared to the 2.93% experienced in the second quarter of 2014. The average number of VIP tables decreased to 247 units in the second quarter of 2015 from 263 units in the prior year's second quarter.

The Company has determined that it will now include the amount of cash that is deposited in a gaming table's drop box plus cash chips purchased at the casino cage in the calculation of table drop in accordance with standard Macau industry practice. Table drop in the mass market segment was $1.2 billion in the second quarter of 2015, down 16.5% from the 2014 second quarter. Table games win in the mass market segment decreased by 32.9% to $208.6 million in the second quarter of 2015. The mass market win percentage of 17.5% in the second quarter of 2015 was below the 21.8% in the second quarter of 2014 and below the 20.5% over the trailing twelve months ended June 30, 2015.

Slot machine handle for the second quarter of 2015 declined 29.5% from the 2014 period to $1,027.6 million, and slot win decreased by 22.5%.

For the second quarter of 2015, total non-casino revenues, before promotional allowances, decreased 22.3% during the quarter to $78.1 million. We achieved an average daily rate (ADR) of $321, down 3.9% compared to the $334 reported in the 2014 second quarter. Occupancy at Wynn Macau of 96.4% compares to 98.4% in the prior-year period. Revenue per available room (REVPAR) decreased 5.8% to $310 in the 2015 quarter from $329 in last year’s second quarter.

Las Vegas Operations

For the quarter ended June 30, 2015, net revenues were $423.5 million, a 6.2% decrease from $451.4 million in the second quarter of 2014. Adjusted property EBITDA was $122.0 million, down 23.9% compared to the prior year.

Net casino revenues in the second quarter of 2015 were $134.7 million, a 26.2% decrease from the second quarter of 2014. Table games drop of $509.3 million was down 19.0% from $629.0 million in the 2014 quarter. Table games win percentage was 19.5%, outside the property’s expected range of 21% to 24% and below the 27.4% reported in the 2014 quarter. Slot machine handle of $712.1 million was 0.7% above the $706.9 million in the comparable period of 2014, and net slot win was up 10.6%.

For the second quarter of 2015, total non-casino revenues, before promotional allowances, increased 5.3% from the second quarter of 2014 to $330.3 million.

Room revenues increased 0.9% to $108.8 million during the quarter, versus $107.9 million in the second quarter of 2014. Occupancy was flat at 88.4% and ADR increased 2.1% to $289 from $283. REVPAR was $255 in the 2015 second quarter, 1.6% above the $251 reported in the prior-year quarter.

Food and beverage revenues in the second quarter of 2015 were $162.0 million, up 8.7% compared to the 2014 second quarter. Entertainment, retail and other revenues improved 4.8% from last year’s quarter to $59.4 million.

Wynn Palace Project in Macau

The Company is currently constructing Wynn Palace, an integrated resort containing a 1,700-room hotel, a performance lake, meeting space, a casino, a spa, retail offerings, and food-and-beverage outlets in the Cotai area of Macau. In July 2013, we signed a $2.6 billion guaranteed maximum price (GMP) contract for the project’s construction costs. The total project budget, including construction costs, capitalized interest, pre-opening expenses, land costs and financing fees, is approximately $4.1 billion. We expect to open our resort on Cotai in the first half of 2016.

During the second quarter of 2015, we invested approximately $431.4 million in our Cotai project, taking the total investment to $2.7 billion through June 30, 2015.

Wynn Project in Massachusetts

In November 2014, we were awarded a gaming license to develop and construct an integrated resort in Everett, Massachusetts, outside of Boston. On January 2, 2015, we purchased 33 acres of land in Everett, along the Mystic River. On this land, we intend to develop and construct an integrated resort containing a hotel, a waterfront boardwalk, meeting space, a casino, a spa, retail offerings, and food-and-beverage outlets.

Balance Sheet and Other

Our cash and cash equivalents, restricted cash and investment securities at June 30, 2015 was $1.8 billion. Total debt outstanding at the end of the quarter was $8.1 billion, including $3.3 billion of Wynn Las Vegas debt, $2.9 billion of Wynn Macau debt and $1.9 billion at the parent company.

Conference Call Information

The Company will hold a conference call to discuss its results on July 29, 2015 at 1:30 p.m. PT (4:30 p.m. ET). Interested parties are invited to join the call by accessing a live audio webcast at http://www.wynnresorts.com.

Forward-looking Statements

This release contains forward-looking statements regarding operating trends and future results of operations. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those we express in these forward-looking statements, including, but not limited to, our dependence on existing management, results of regulatory or enforcement actions and probity investigations, pending or future legal proceedings, uncertainties over the development and success of new gaming and resort properties, adverse tourism trends, general global macroeconomic conditions, changes in gaming laws or regulations, volatility and weakness in world-wide credit and financial markets, and our substantial indebtedness and leverage. Additional information concerning potential factors that could affect the Company’s financial results is included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 and the Company’s other periodic reports filed with the Securities and Exchange Commission. The Company is under no obligation to (and expressly disclaims any such obligation to) update or revise its forward-looking statements as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

(1) “Adjusted property EBITDA” is net income before interest, taxes, depreciation, amortization, pre-opening costs, property charges and other, management and license fees, corporate expenses and other, intercompany golf course and water rights leases, stock-based compensation, loss on extinguishment of debt, change in interest rate swap fair value, and other non-operating income and expenses, and includes equity in income from unconsolidated affiliates. Adjusted property EBITDA is presented exclusively as a supplemental disclosure because management believes that it is widely used to measure the performance, and as a basis for valuation, of gaming companies. Management uses adjusted property EBITDA as a measure of the operating performance of its segments and to compare the operating performance of its properties with those of its competitors. The Company also presents adjusted property EBITDA because it is used by some investors as a way to measure a company’s ability to incur and service debt, make capital expenditures and meet working capital requirements. Gaming companies have historically reported EBITDA as a supplement to financial measures in accordance with U.S. generally accepted accounting principles (“GAAP”). In order to view the operations of their casinos on a more stand-alone basis, gaming companies, including Wynn Resorts, Limited, have historically excluded from their EBITDA calculations pre-opening expenses, property charges, corporate expenses and stock-based compensation, that do not relate to the management of specific casino properties. However, adjusted property EBITDA should not be considered as an alternative to operating income as an indicator of the Company’s performance, as an alternative to cash flows from operating activities as a measure of liquidity, or as an alternative to any other measure determined in accordance with GAAP. Unlike net income, adjusted property EBITDA does not include depreciation or interest expense and therefore does not reflect current or future capital expenditures or the cost of capital. The Company has significant uses of cash flows, including capital expenditures, interest payments, debt principal repayments, taxes and other non-recurring charges, which are not reflected in adjusted property EBITDA. Also, Wynn Resorts’ calculation of adjusted property EBITDA may be different from the calculation methods used by other companies and, therefore, comparability may be limited.

(2) "Adjusted net income attributable to Wynn Resorts, Limited" is net income before pre-opening costs, loss on extinguishment of debt, change in interest rate swap fair value, property charges and other, net of noncontrolling interest and taxes in respective jurisdictions. Adjusted net income attributable to Wynn Resorts, Limited and adjusted net income attributable to Wynn Resorts, Limited per diluted share (“adjusted EPS”) are presented as supplemental disclosures because management believes that these non-GAAP financial measures are widely used to measure the performance, and as a principal basis for valuation, of gaming companies. These measures are used by management and/or evaluated by some investors, in addition to income and EPS computed in accordance with GAAP, as an additional basis for assessing period-to-period results of our business. Adjusted net income attributable to Wynn Resorts, Limited and adjusted net income attributable to Wynn Resorts, Limited per diluted share may be different from the calculation methods used by other companies and, therefore, comparability may be limited. Adjusted net income attributable to Wynn Resorts, Limited for the six months ended June 30, 2015 reflects a revision to the effective tax rate previously applied to the loss on extinguishment of debt, net for the three months ended March 31, 2015 to reflect the same assumed effective U.S. tax rate applied to other adjustments to net income.

The Company has included schedules in the tables that accompany this release that reconcile (i) net income attributable to Wynn Resorts, Limited to adjusted net income attributable to Wynn Resorts, Limited, (ii) operating income to adjusted property EBITDA, and (iii) adjusted property EBITDA to net income attributable to Wynn Resorts, Limited.

WYNN RESORTS, LIMITED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(unaudited) |

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Operating revenues: | | | | | | | |

Casino | $ | 714,208 |

| | $ | 1,091,595 |

| | $ | 1,540,307 |

| | $ | 2,317,728 |

|

Rooms | 139,912 |

| | 141,355 |

| | 271,967 |

| | 277,831 |

|

Food and beverage | 181,016 |

| | 174,308 |

| | 317,029 |

| | 316,145 |

|

Entertainment, retail and other | 87,459 |

| | 98,635 |

| | 177,835 |

| | 205,495 |

|

Gross revenues | 1,122,595 |

| | 1,505,893 |

| | 2,307,138 |

| | 3,117,199 |

|

Less: promotional allowances | (82,137 | ) | | (93,830 | ) | | (174,442 | ) | | (191,523 | ) |

Net revenues | 1,040,458 |

| | 1,412,063 |

| | 2,132,696 |

| | 2,925,676 |

|

Operating costs and expenses: | | | | | | | |

Casino | 466,535 |

| | 681,236 |

| | 990,588 |

| | 1,464,970 |

|

Rooms | 37,584 |

| | 37,659 |

| | 74,270 |

| | 73,004 |

|

Food and beverage | 110,952 |

| | 100,686 |

| | 187,358 |

| | 175,639 |

|

Entertainment, retail and other | 38,997 |

| | 39,878 |

| | 79,291 |

| | 84,413 |

|

General and administrative | 113,707 |

| | 128,520 |

| | 235,907 |

| | 239,797 |

|

Provision (benefit) for doubtful accounts | 4,302 |

| | (2,710 | ) | | 10,381 |

| | (5,438 | ) |

Pre-opening costs | 16,875 |

| | 5,001 |

| | 32,966 |

| | 8,074 |

|

Depreciation and amortization | 81,913 |

| | 78,351 |

| | 164,779 |

| | 155,010 |

|

Property charges and other | 472 |

| | 2,100 |

| | 2,976 |

| | 12,034 |

|

Total operating costs and expenses | 871,337 |

| | 1,070,721 |

| | 1,778,516 |

| | 2,207,503 |

|

Operating income | 169,121 |

| | 341,342 |

| | 354,180 |

| | 718,173 |

|

Other income (expense): | | | | | | | |

Interest income | 1,498 |

| | 5,505 |

| | 3,190 |

| | 10,258 |

|

Interest expense, net of amounts capitalized | (75,236 | ) | | (81,765 | ) | | (153,219 | ) | | (157,021 | ) |

Decrease in swap fair value | (1,114 | ) | | (4,653 | ) | | (5,723 | ) | | (3,811 | ) |

Loss on extinguishment of debt | (3,839 | ) | | (2,254 | ) | | (120,033 | ) | | (3,783 | ) |

Equity in income (loss) from unconsolidated affiliates | (127 | ) | | 298 |

| | 70 |

| | 606 |

|

Other | 198 |

| | 693 |

| | 1,331 |

| | 396 |

|

Other income (expense), net | (78,620 | ) | | (82,176 | ) | | (274,384 | ) | | (153,355 | ) |

Income before income taxes | 90,501 |

| | 259,166 |

| | 79,796 |

| | 564,818 |

|

Provision for income taxes | (13,298 | ) | | (764 | ) | | (16,495 | ) | | (3,373 | ) |

Net income | 77,203 |

| | 258,402 |

| | 63,301 |

| | 561,445 |

|

Less: net income attributable to noncontrolling interest | (20,743 | ) | | (54,496 | ) | | (51,442 | ) | | (130,643 | ) |

Net income attributable to Wynn Resorts, Limited | $ | 56,460 |

| | $ | 203,906 |

| | $ | 11,859 |

| | $ | 430,802 |

|

Basic and diluted income per common share: | | | | | | | |

Net income attributable to Wynn Resorts, Limited: | | | | | | | |

Basic | $ | 0.56 |

| | $ | 2.02 |

| | $ | 0.12 |

| | $ | 4.27 |

|

Diluted | $ | 0.56 |

| | $ | 2.00 |

| | $ | 0.12 |

| | $ | 4.22 |

|

Weighted average common shares outstanding: | | | | | | | |

Basic | 101,157 |

| | 100,915 |

| | 101,146 |

| | 100,869 |

|

Diluted | 101,710 |

| | 102,018 |

| | 101,795 |

| | 101,979 |

|

Dividends declared per common share: | $ | 0.50 |

| | $ | 1.25 |

| | $ | 2.00 |

| | $ | 2.50 |

|

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED

TO ADJUSTED NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands, except per share data)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Net income attributable to Wynn Resorts, Limited | $ | 56,460 |

| | $ | 203,906 |

| | $ | 11,859 |

| | $ | 430,802 |

|

Pre-opening costs, net | 13,804 |

| | 3,615 |

| | 27,251 |

| | 5,837 |

|

Loss on extinguishment of debt, net | 3,839 |

| | 2,254 |

| | 120,033 |

| | 3,783 |

|

Decrease in swap fair value, net | 804 |

| | 3,831 |

| | 4,131 |

| | 2,754 |

|

Property charges and other, net | 65 |

| | 1,536 |

| | 2,505 |

| | 8,650 |

|

Adjusted net income attributable to Wynn Resorts, Limited (2) | $ | 74,972 |

| | $ | 215,142 |

| | $ | 165,779 |

| | $ | 451,826 |

|

Adjusted net income attributable to Wynn Resorts, Limited per diluted share | $ | 0.74 |

| | $ | 2.11 |

| | $ | 1.63 |

| | $ | 4.43 |

|

| | | | | | | |

Weighted average common shares outstanding - diluted | 101,710 |

| | 102,018 |

| | 101,795 |

| | 101,979 |

|

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME TO ADJUSTED PROPERTY EBITDA AND ADJUSTED PROPERTY EBITDA TO NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2015 |

| Macau

Operations | | Las Vegas

Operations | | Corporate

and Other | | Total |

Operating income | $ | 93,347 |

| | $ | 58,502 |

| | $ | 17,272 |

| | $ | 169,121 |

|

Pre-opening costs | 11,041 |

| | — |

| | 5,834 |

| | 16,875 |

|

Depreciation and amortization | 34,357 |

| | 45,249 |

| | 2,307 |

| | 81,913 |

|

Property charges and other | 1,461 |

| | (922 | ) | | (67 | ) | | 472 |

|

Management and license fees | 23,876 |

| | 13,323 |

| | (37,199 | ) | | — |

|

Corporate expense and other | 5,291 |

| | 5,135 |

| | 6,412 |

| | 16,838 |

|

Stock-based compensation | 4,018 |

| | 808 |

| | 5,510 |

| | 10,336 |

|

Equity in loss from unconsolidated affiliates | — |

| | (58 | ) | | (69 | ) | | (127 | ) |

Adjusted Property EBITDA(1) | $ | 173,391 |

| | $ | 122,037 |

| | $ | — |

| | $ | 295,428 |

|

| | | | | | | |

| Three Months Ended June 30, 2014 |

| Macau

Operations | | Las Vegas

Operations | | Corporate

and Other | | Total |

Operating income | $ | 217,710 |

| | $ | 97,424 |

| | $ | 26,208 |

| | $ | 341,342 |

|

Pre-opening costs | 5,001 |

| | — |

| | — |

| | 5,001 |

|

Depreciation and amortization | 32,107 |

| | 44,726 |

| | 1,518 |

| | 78,351 |

|

Property charges and other | 2,033 |

| | 67 |

| | — |

| | 2,100 |

|

Management and license fees | 37,620 |

| | 6,777 |

| | (44,397 | ) | | — |

|

Corporate expense and other | 10,946 |

| | 10,379 |

| | 10,584 |

| | 31,909 |

|

Stock-based compensation | 1,584 |

| | 909 |

| | 5,931 |

| | 8,424 |

|

Equity in income from unconsolidated affiliates | — |

| | 142 |

| | 156 |

| | 298 |

|

Adjusted Property EBITDA(1) | $ | 307,001 |

| | $ | 160,424 |

| | $ | — |

| | $ | 467,425 |

|

| | | | | | | |

| | | | | Three Months Ended June 30, |

| | | | | 2015 | | 2014 |

Adjusted Property EBITDA(1) | | | | | $ | 295,428 |

| | $ | 467,425 |

|

Pre-opening costs | | | | | (16,875 | ) | | (5,001 | ) |

Depreciation and amortization | | | | | (81,913 | ) | | (78,351 | ) |

Property charges and other | | | | | (472 | ) | | (2,100 | ) |

Corporate expenses and other | | | | | (16,838 | ) | | (31,909 | ) |

Stock-based compensation | | | | | (10,336 | ) | | (8,424 | ) |

Interest income | | | | | 1,498 |

| | 5,505 |

|

Interest expense, net of amounts capitalized | | | | | (75,236 | ) | | (81,765 | ) |

Decrease in swap fair value | | | | | (1,114 | ) | | (4,653 | ) |

Loss on extinguishment of debt | | | | | (3,839 | ) | | (2,254 | ) |

Other | | | | | 198 |

| | 693 |

|

Provision for income taxes | | | | | (13,298 | ) | | (764 | ) |

Net income | | | | | 77,203 |

| | 258,402 |

|

Less: net income attributable to noncontrolling interests | | | | (20,743 | ) | | (54,496 | ) |

Net income attributable to Wynn Resorts, Limited | | | | | $ | 56,460 |

| | $ | 203,906 |

|

WYNN RESORTS, LIMITED AND SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME TO ADJUSTED PROPERTY EBITDA AND ADJUSTED PROPERTY EBITDA TO NET INCOME ATTRIBUTABLE TO WYNN RESORTS, LIMITED

(in thousands)

(unaudited) |

| | | | | | | | | | | | | | | |

| Six Months Ended June 30, 2015 |

| Macau

Operations | | Las Vegas

Operations | | Corporate

and Other | | Total |

Operating income | $ | 224,293 |

| | $ | 106,102 |

| | $ | 23,785 |

| | $ | 354,180 |

|

Pre-opening costs | 20,540 |

| | — |

| | 12,426 |

| | 32,966 |

|

Depreciation and amortization | 68,558 |

| | 91,489 |

| | 4,732 |

| | 164,779 |

|

Property charges and other | 1,695 |

| | 1,109 |

| | 172 |

| | 2,976 |

|

Management and license fees | 50,933 |

| | 21,454 |

| | (72,387 | ) | | — |

|

Corporate expense and other | 11,279 |

| | 11,098 |

| | 20,103 |

| | 42,480 |

|

Stock-based compensation | 8,435 |

| | 1,472 |

| | 11,089 |

| | 20,996 |

|

Equity in income (loss) from unconsolidated affiliates | — |

| | (10 | ) | | 80 |

| | 70 |

|

Adjusted Property EBITDA(1) | $ | 385,733 |

| | $ | 232,714 |

| | $ | — |

| | $ | 618,447 |

|

| | | | | | | |

| Six Months Ended June 30, 2014 |

| Macau

Operations | | Las Vegas

Operations | | Corporate

and Other | | Total |

Operating income | $ | 502,640 |

| | $ | 148,938 |

| | $ | 66,595 |

| | $ | 718,173 |

|

Pre-opening costs | 8,074 |

| | — |

| | — |

| | 8,074 |

|

Depreciation and amortization | 63,266 |

| | 88,716 |

| | 3,028 |

| | 155,010 |

|

Property charges and other | 12,213 |

| | (179 | ) | | — |

| | 12,034 |

|

Management and license fees | 82,375 |

| | 12,496 |

| | (94,871 | ) | | — |

|

Corporate expense and other | 19,867 |

| | 18,570 |

| | 17,362 |

| | 55,799 |

|

Stock-based compensation | 2,894 |

| | 1,935 |

| | 7,516 |

| | 12,345 |

|

Equity in income from unconsolidated affiliates | — |

| | 236 |

| | 370 |

| | 606 |

|

Adjusted Property EBITDA(1) | $ | 691,329 |

| | $ | 270,712 |

| | $ | — |

| | $ | 962,041 |

|

| | | | | | | |

| | | | | Six Months Ended June 30, |

| | | | | 2015 | | 2014 |

Adjusted Property EBITDA(1) | | | | | $ | 618,447 |

| | $ | 962,041 |

|

Pre-opening costs | | | | | (32,966 | ) | | (8,074 | ) |

Depreciation and amortization | | | | | (164,779 | ) | | (155,010 | ) |

Property charges and other | | | | | (2,976 | ) | | (12,034 | ) |

Corporate expenses and other | | | | | (42,480 | ) | | (55,799 | ) |

Stock-based compensation | | | | | (20,996 | ) | | (12,345 | ) |

Interest income | | | | | 3,190 |

| | 10,258 |

|

Interest expense, net of amounts capitalized | | | | | (153,219 | ) | | (157,021 | ) |

Decrease in swap fair value | | | | | (5,723 | ) | | (3,811 | ) |

Loss on extinguishment of debt | | | | | (120,033 | ) | | (3,783 | ) |

Other | | | | | 1,331 |

| | 396 |

|

Provision for income taxes | | | | | (16,495 | ) | | (3,373 | ) |

Net income | | | | | 63,301 |

| | 561,445 |

|

Less: net income attributable to noncontrolling interests | | | | (51,442 | ) | | (130,643 | ) |

Net income attributable to Wynn Resorts, Limited | | | | | $ | 11,859 |

| | $ | 430,802 |

|

WYNN RESORTS, LIMITED AND SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Macau Operations: | | | | | | | |

VIP | | | | | | | |

Average number of table games | 247 |

| | 263 |

| | 250 |

| | 271 |

|

VIP turnover | $ | 15,537,003 |

| | $ | 26,361,791 |

| | $ | 32,664,669 |

| | $ | 62,359,507 |

|

Table games win | $ | 453,203 |

| | $ | 771,152 |

| | $ | 933,568 |

| | $ | 1,774,388 |

|

VIP win as a % of turnover | 2.92 | % | | 2.93 | % | | 2.86 | % | | 2.85 | % |

Table games win per unit per day (a) | $ | 20,177 |

| | $ | 32,176 |

| | $ | 20,665 |

| | $ | 36,157 |

|

Mass market | | | | | | | |

Average number of table games | 223 |

| | 192 |

| | 218 |

| | 202 |

|

Table drop (b) | $ | 1,193,916 |

| | $ | 1,429,987 |

| | $ | 2,474,260 |

| | $ | 2,799,783 |

|

Table games win | $ | 208,620 |

| | $ | 311,049 |

| | $ | 488,180 |

| | $ | 611,758 |

|

Table games win % | 17.5 | % | | 21.8 | % | | 19.7 | % | | 21.9 | % |

Table games win per unit per day (a) | $ | 10,274 |

| | $ | 17,852 |

| | $ | 12,339 |

| | $ | 16,722 |

|

| | | | | | | |

Average number of slot machines | 707 |

| | 624 |

| | 678 |

| | 732 |

|

Slot machine handle | $ | 1,027,557 |

| | $ | 1,457,653 |

| | $ | 2,067,172 |

| | $ | 2,856,543 |

|

Slot machine win | $ | 51,138 |

| | $ | 65,983 |

| | $ | 98,916 |

| | $ | 135,420 |

|

Slot machine win per unit per day (c) | $ | 795 |

| | $ | 1,163 |

| | $ | 806 |

| | $ | 1,022 |

|

| | | | | | | |

Room statistics | | | | | | | |

Occupancy | 96.4 | % | | 98.4 | % | | 96.9 | % | | 98.3 | % |

ADR (d) | $ | 321 |

| | $ | 334 |

| | $ | 326 |

| | $ | 336 |

|

REVPAR (e) | $ | 310 |

| | $ | 329 |

| | $ | 316 |

| | $ | 330 |

|

| | | | | | | |

Las Vegas Operations: | | | | | | | |

Average number of table games | 235 |

| | 233 |

| | 236 |

| | 232 |

|

Table drop (b) | $ | 509,309 |

| | $ | 629,047 |

| | $ | 1,082,921 |

| | $ | 1,276,483 |

|

Table games win | $ | 99,313 |

| | $ | 172,054 |

| | $ | 234,992 |

| | $ | 305,788 |

|

Table games win % | 19.5 | % | | 27.4 | % | | 21.7 | % | | 24.0 | % |

Table games win per unit per day (a) | $ | 4,650 |

| | $ | 8,130 |

| | $ | 5,501 |

| | $ | 7,281 |

|

| | | | | | | |

Average number of slot machines | 1,868 |

| | 1,837 |

| | 1,861 |

| | 1,851 |

|

Slot machine handle | $ | 712,147 |

| | $ | 706,870 |

| | $ | 1,474,331 |

| | $ | 1,450,668 |

|

Slot machine win | $ | 51,010 |

| | $ | 46,131 |

| | $ | 99,427 |

| | $ | 91,632 |

|

Slot machine win per unit per day (c) | $ | 300 |

| | $ | 276 |

| | $ | 295 |

| | $ | 274 |

|

| | | | | | | |

Room statistics | | | | | | | |

Occupancy | 88.4 | % | | 88.4 | % | | 85.7 | % | | 88.1 | % |

ADR (d) | $ | 289 |

| | $ | 283 |

| | $ | 286 |

| | $ | 279 |

|

REVPAR (e) | $ | 255 |

| | $ | 251 |

| | $ | 245 |

| | $ | 246 |

|

| |

(a) | Table games win per unit per day is shown before discounts and commissions, as applicable. |

| |

(b) | In Macau, table drop is the amount of cash that is deposited in a gaming table’s drop box plus cash chips purchased at the casino cage. In Las Vegas, table drop is the amount of cash and net markers issued that are deposited in a gaming table’s drop box. |

| |

(c) | Slot machine win per unit per day is calculated as gross slot win minus progressive accruals and free play. |

| |

(d) | ADR is average daily rate and is calculated by dividing total room revenue including the retail value of promotional allowances (less service charges, if any) by total rooms occupied including complimentary rooms. |

| |

(e) | REVPAR is revenue per available room and is calculated by dividing total room revenue including the retail value of promotional allowances (less service charges, if any) by total rooms available. |

SOURCE:

Wynn Resorts, Limited

CONTACT:

Mark Strawn

702-770-7555

investorrelations@wynnresorts.com

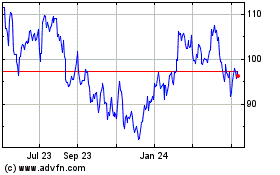

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024