0001834045false00018340452024-02-282024-02-280001834045vwe:WarrantsToPurchaseCommonStockMember2024-02-282024-02-280001834045us-gaap:CommonStockMember2024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 28, 2024 |

Vintage Wine Estates, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

001-40016 |

87-1005902 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

205 Concourse Boulevard |

|

Santa Rosa, California |

|

95403 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (877) 289-9463 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, no par value per share |

|

VWE |

|

The Nasdaq Stock Market LLC |

Warrants to purchase common stock |

|

VWEWW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 28, 2024, Vintage Wine Estates, Inc., a Nevada corporation (the “Company”), its wholly owned subsidiary Vintage Wine Estates, Inc., a California corporation ("Borrower Agent"), certain other subsidiaries of the Borrower Agent (together with the Borrower Agent, collectively, the “Borrowers”), the lenders party thereto (the “Lenders”), and BMO Bank N.A., as administrative agent and collateral agent (the “Agent”), entered into a Forbearance Agreement (the “Forbearance Agreement”) with respect to the Second Amended and Restated Loan and Security Agreement, dated of December 13, 2022 (as amended from time to time, the “Loan Agreement”), by and among the Company, the Borrowers, the Lenders and the Agent.

Under the Forbearance Agreement, the Agent and the Lenders have agreed to forbear from enforcing their respective rights and remedies in respect of certain events of default under the Loan Agreement (the “Designated Defaults”), subject to the terms and conditions set forth in the Forbearance Agreement, through March 31, 2024 (the "Forbearance Period"), so long as no event of default (other than the Designated Defaults) shall occur, and the Company and the Borrowers (collectively, the “Obligors”) comply with the terms of the Forbearance Agreement and otherwise do not assert a defense to their obligations under the Loan Agreement or any other loan document or make a claim against the Agent or any Lender.

The Forbearance Agreement, among other things, (a) reduces the revolving commitments under the Loan Agreement from $200 million to $180 million, (b) permits the Borrowers to continue to borrow under the Loan Agreement, subject to the terms and conditions set forth therein, during the Forbearance Period, notwithstanding the existence of the Designated Defaults, (c) increases, during the Forbearance Period, the interest rate for revolving loans outstanding or incurred under the Loan Agreement by 100 basis points, (d) provides that, during the Forbearance Period, the Borrowers will not maintain cash in excess of their projected cash needs (with any excess to be used to pay outstanding revolving loans), (e) requires the Obligors to comply with certain specified milestones with respect to business planning during the Forbearance Period and (f) requires the payment of certain fees to the Agent and the Lenders including a one-time payment to the Agent for the benefit of the Consenting Lenders, as defined in the Forbearance Agreement, equal to 7.5 basis points on the Consenting Lenders' outstanding Loans and Commitments (as modified by the Forbearance Agreement and to the extent such Commitments are not funded).

The description of the Forbearance Agreement in this Current Report on Form 8-K (this “Current Report”) is a summary and is qualified in its entirety by reference to the complete terms of the Forbearance Agreement included therein. The Forbearance Agreement is filed hereto as Exhibit 10.1 and is incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is incorporated into this Item 2.03 by reference.

Item 7.01 Regulation FD Disclosure.

On March 5, 2024, the Company issued a press release announcing the forbearance agreement and providing an update on asset sales. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information set forth, or referred to, in this Item 7.01, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing by the Company under the Exchange Act or the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Vintage Wine Estates, Inc. |

|

|

|

|

Date: |

March 5, 2024 |

By: |

/s/ Kristina Johnston |

|

|

|

Chief Financial Officer |

FORBEARANCE AGREEMENT

This FORBEARANCE AGREEMENT, dated as of February 28, 2024 (as amended, restated, supplemented or otherwise modified from time to time, this "Agreement") is by and among VINTAGE WINE ESTATES, INC., a Nevada corporation ("Holdings"), VINTAGE WINE ESTATES, INC., a California corporation ("Borrower Agent"), each Subsidiary of Borrower Agent party to this Agreement (together with Borrower Agent, each a "Borrower" and, collectively, the "Borrowers"), the Lenders party to this Agreement (constituting "Required Lenders" under the Loan Agreement, the "Consenting Lenders"), and BMO BANK N.A., as successor in interest to BANK OF THE WEST ("BMO"), as administrative agent and collateral agent (in such capacity, together with its successors and assigns in such capacity, the "Agent"), to that Second Amended and Restated Loan and Security Agreement and Waiver, dated of December 13, 2022 (as amended by Amendment No. 1, dated as of February 13, 2023, Amendment No. 2, dated as of March 31, 2023, Amendment No. 3, dated as of May 9, 2023, and Amendment No. 4, dated as of October 12, 2023, and as further amended, restated, amended and restated, supplemented, or otherwise modified from time to time prior to the date hereof, the "Loan Agreement").

W I T N E S S E T H

WHEREAS, Holdings and the Borrowers (collectively, the "Obligors" and each an "Obligor") have requested that the Consenting Lenders and the other Secured Parties forbear from accelerating the Obligations or otherwise exercising any rights or remedies under the Loan Documents, in accordance with and subject to Section 3 of this Agreement, as a result of any Defaults or Events of Default (i) under Section 11.1(c) of the Loan Agreement resulting from the Obligors' failure to maintain Adjusted EBITDA of $17,000,000 for the two Fiscal Quarter period ended December 31, 2023, as required by Section 10.3.3 of the Loan Agreement (the "EBITDA Event of Default"); (ii) under Section 11.1(c) of the Loan Agreement resulting from the Obligors' failure to deliver the Agent and Lenders unaudited balance sheets and the related statements of income and cash flow for the Fiscal Quarter ended December 31, 2023, and for the portion of the Fiscal Year then elapsed within forty-five (45) days after the end of such Fiscal Quarter, as required by Section 10.1.2(c) of the Loan Agreement (the "Reporting Event of Default"); (iii) under Section 11.1(c) of the Loan Agreement resulting from the Obligors' failure to provide an executed Compliance Certificate for the Fiscal Quarter ended December 31, 2023, as required by Section 10.1.2(d) of the Loan Agreement (the "Compliance Certificate Event of Default"); and (iv) resulting from the EBITDA Event of Default, the Reporting Event of Default or the Compliance Certificate Event of Default, including with respect to any representation or warranty given or deemed given as if such EBITDA Event of Default, Reporting Event of Default and Compliance Certificate Event of Default were not in existence or to any notice requirement relating to EBITDA Event of Default, the Reporting Event of Default, the Compliance Certificate Event of Default or any of the foregoing (clauses (i) through (iv), collectively, the "Designated Defaults"); and

WHEREAS, the Obligors have requested that the Consenting Lenders grant a period of forbearance with respect to the Designated Defaults, and the Consenting Lenders party hereto, which constitute the Required Lenders under the Loan Agreement, agree to accommodate such request of Holdings and the Borrowers on the terms and subject to the conditions set forth herein;

NOW, THEREFORE, the parties hereto agree as follows:

SECTION 1. Incorporation of Recitals. Each of the Obligors acknowledges that the recitals set forth above are true and correct in all respects.

SECTION 2. Defined Terms and Other Definitional Provisions. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Loan Agreement.

SECTION 3. Forbearance.

a.The "Forbearance Period" shall commence on the Forbearance Effective Date (as defined below) and shall terminate immediately and automatically upon the earliest to occur of: (i) March 31, 2024, at 11:59 p.m. Pacific time; (ii) the occurrence of any Event of Default under the Loan Agreement (other than the Designated Defaults); (iii) the failure of any Obligor to comply with any term, condition or covenant set forth in this Agreement; (iv) any Obligor repudiates or asserts a defense to any Obligations under the Loan Agreement or any other Loan Document or to any obligation or liability owing to the Agent or any Lender in respect thereof or with respect to this Agreement; or (v) any Obligor makes or pursues a claim against the Agent or any Lender.

b.Subject to the satisfaction of the covenants and conditions precedent set forth in Sections 7 and 8 hereof, during the Forbearance Period, the Agent and each of the Consenting Lenders agree not to enforce any of their respective rights and remedies under the Loan Documents and any agreement contemplated thereby or executed in connection therewith, in each case solely in respect of any of the Designated Defaults, other than rights and remedies explicitly arising under Sections 5.4.4, 7.2.2 (as modified hereby), 8.3.1, or 10.1.1(b) of the Loan Agreement solely as a result of the continuance of any Trigger Period (the "Forbearance"). For the avoidance of doubt, during the Forbearance Period, so long as no Default or Event of Default shall occur and be continuing, other than the Designated Defaults, Loans may continue to be made, converted or continued as SOFR Loans.

c.The Forbearance is limited in nature, and nothing contained herein is intended, or shall be deemed or construed to: (i) constitute a forbearance of or from any other existing or future Defaults or Events of Default or non-compliance with any term or provision of the Loan Documents or (ii) constitute a waiver of any of the Designated

Defaults or any other existing or future Defaults or Events of Default. The Obligors acknowledge and agree that the agreement of the Lenders hereunder to forbear from exercising their default-related remedies with respect to the Designated Defaults shall not constitute a waiver of any of the Designated Defaults and that, except as expressly set forth in this Agreement, the Consenting Lenders expressly reserve all rights and remedies that the Lenders now or may in the future have under any or all of the Loan Documents and applicable law in connection with all Defaults or Events of Default (including, without limitation, the Designated Defaults). For the avoidance of doubt, except to the extent expressly provided otherwise in this Agreement, all references in the Loan Agreement to a Default or Event of Default shall be deemed to include each and all of the Designated Defaults.

d.As consideration for the Forbearance, the Obligors will pay fees (the "Forbearance Fees") to the Agent pursuant to that certain Fee Letter, of even date herewith, between Borrower Agent and Agent (the "Forbearance Fee Letter") which shall include a one-time payment to the Agent for the benefit of the Consenting Lenders equal to 7.5 basis points on the Consenting Lenders' outstanding Loans and Commitments (as modified by this Agreement and to the extent such Commitments are not funded) as of the date of this Agreement.

e.The Agent and Consenting Lenders will not elect for Obligations to bear interest at the Default Rate pursuant to Section 3.1.1(b) of the Loan Agreement on account of any Designated Defaults during the Forbearance Period and agree not to retroactively apply the Default Rate following the expiration of the Forbearance Period. For the avoidance of doubt the Agent and Consenting Lenders may elect for the Obligations to bear interest at the Default Rate pursuant to Section 3.1.1(b) of the Loan Agreement upon the occurrence an Event of Default or discovery of an Event of Default during the Forbearance Period.

f.Except as provided in Section 4 herein, upon the termination or expiration of the Forbearance Period: (i) the Forbearance and all agreements set forth in this Agreement shall terminate automatically and be of no further force or effect, and (ii) the Agent and each Consenting Lender shall be free to proceed to enforce any or all of its rights and remedies set forth in the Loan Agreement, the other Loan Documents or applicable law. In furtherance of the foregoing, and notwithstanding the occurrence of the Forbearance Effective Date, each Obligor acknowledges and confirms that, subject to the terms of this Agreement, all rights and remedies of the Agent or the Lenders under the Loan Agreement, the Loan Documents and applicable law with respect to the Borrowers or any other Obligor shall continue to be available to the Agent and the Lenders.

g.Execution of this Agreement constitutes a direction by the Consenting Lenders that the Agent act or forbear from acting in accordance with the express terms of this Agreement. Each Consenting Lender agrees that the Agent shall not be required to act against the Obligors if such action is contrary to the express terms of this Agreement.

h.The Obligors understand and accept the temporary nature of the Forbearance and that the Consenting Lenders have given no assurances that they will extend such Forbearance or provide waivers or amendments to the Loan Agreement or any other Loan Document.

SECTION 4. Amendment.

a.As of the date hereof, the Form of Borrowing Base Certificate attached as Exhibit C to the Loan Agreement is hereby amended by reducing Line 10 Total Commitments from $200,000,000 to $180,000,000.

b.During the Forbearance Period, the Form of Borrowing Base Certificate attached as Exhibit C to the Loan Agreement is hereby amended by (a) deleting "." at the end of Certification No. 3 and (b) inserting the immediately following the end of Certification No. 3: ", other than the Designated Defaults, as defined in that certain Forbearance Agreement, dated as of February 28, 2024."

c.During the Forbearance Period, the definition of Applicable Margin is hereby amended to read, in its entirety, as follows:

"Applicable Margin: the per annum margin set forth below:

|

|

|

|

|

|

|

Time Period |

Revolver Loans |

Unused Line Fee Rate for Revolver Loans |

Term Loan, Equipment Loan, Capital Expenditure Loans and Delayed Draw Term Loans |

Unused Line Fee Rate for Term Loans and Delayed Draw Term Loans |

SOFR |

Adjusted Base Rate |

|

SOFR |

Adjusted Base Rate |

|

Forbearance Period |

4.00% |

3.00% |

0.20% |

3.00% |

2.00% |

0.25% |

d.During the Forbearance Period, the Designated Defaults shall be excluded from the last sentence of Section 3.1.2(a) of the Loan Agreement.

e.During the Forbearance Period, the Designated Defaults shall be excluded from Section 6.2(a) of the Loan Agreement.

f.During the Forbearance Period, a new Section 7.2.2(e) shall be added to the Loan Agreement as follows:

"Notwithstanding the occurrence or continuance of any Trigger Period and anything to the contrary contained herein or in any other Loan Document, the Agent and the other Secured Parties will take no action to sweep any amounts held in the Borrowers' operating bank accounts or any bank account maintained by VWE Captive, LLC. Borrowers agree not to maintain in their operating accounts cash balances in excess of their projected cash needs during the Forbearance Period and any excess cash shall be paid to Agent for application against the outstanding Revolver Loans."

g.During the Forbearance Period, the Designated Defaults shall be excluded from Section 9.1.17 of the Loan Agreement.

h.As of the date hereof, the Revolver Commitments are reduced to the aggregate principal amounts shown on Schedule 1.1 attached hereto. The Schedule 1.1 attached to the Loan Agreement is replaced with the Schedule 1.1 attached hereto.

SECTION 5. Confirmation of Loan Documents. Each of the Obligors hereby confirms and ratifies all of its Obligations under the Loan Documents to which it is a party. Each of the Obligors hereby confirms and ratifies that its Obligations under the Loan Agreement are and shall remain secured by the Collateral, pursuant to the terms of the Loan Agreement and the other Loan Documents. By its execution on the respective signature lines provided below, each of the Obligors hereby confirms and ratifies all of its respective Obligations and the Liens granted by it under the Security Documents to which it is a party and confirms that all references in such Security Documents to the "Loan Agreement" (or words of similar import) refer to the Loan Agreement as amended hereby without impairing any such Obligations or Liens in any respect.

SECTION 6. Representations and Warranties.

a.The Obligors hereby represent and warrant to the Agent and the Required Lenders that:

i.the execution, delivery, and performance of this Agreement and the Obligors' obligations hereunder have been duly authorized by all necessary corporate, partnership or limited liability company action;

ii.this Agreement has been duly executed and delivered by the Obligors and constitutes the legal, valid, and binding obligation of the Obligors enforceable against Obligors in accordance with its terms;

iii.no approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority or any other Person is necessary or required in connection with (a) the execution, delivery or performance by, or enforcement against, the Obligors of this Agreement, except for the approvals, consents, exemptions, authorizations, actions, notices, and filings which have been duly obtained, taken, given, or made and are in full force and effect or (b) the exercise by the Agent or any Consenting Lender of its rights under this Agreement; and

iv.other than the Designated Defaults, no Default or Event of Default has occurred or is continuing.

b.Each of the parties hereto hereby represents and warrants that each of the following statements is true, accurate, and complete as to such party as of the date hereof:

i.such party has carefully read and fully understands all of the terms and conditions of this Agreement;

ii.such party has consulted with, or had a full and fair opportunity to consult with, an attorney regarding the terms and conditions of this Agreement;

iii.such party has had a full and fair opportunity to participate in the drafting of this Agreement;

iv.such party is freely, voluntarily, and knowingly entering into this Agreement; and

v.in entering into this Agreement, such party has not relied upon any representation, warranty, covenant, or agreement not expressly set forth herein or in the other Loan Documents.

SECTION 7. Covenants.

a.Each of the Obligors shall provide the Agent and its counsel with reasonable access to the management and advisors of the Obligors, including (but not limited to) Deloitte, and the books and records and financials of the Obligors, in each case of the foregoing, during normal business hours and upon reasonable advance notice from the Agent.

b.Throughout the Forbearance Period, the Obligors shall satisfy the diligence requests of the Agent within a reasonable period of receipt of each request.

c.In accordance with, and as limited by, Section 3.4 of the Loan Agreement, the Borrowers shall reimburse Agent for all reasonable and documented fees and expenses previously incurred or incurred in the future by the Agent and professionals retained by the Agent.

d.On or before 11:59 p.m., Pacific time, on February 29, 2024, the Obligors shall deliver to the Agent a comprehensive proposal regarding the Obligors' go-forward business plan and corporate structure (the "NewCo Model").

e.On or before 11:59 p.m., Pacific time, on March 4, 2024, the Obligors shall deliver the NewCo Model to the Lenders.

f.Borrowers agree to make themselves available for a Lender group meeting on or before March 5, 2024.

g.On or before the 45th day following the date of this Agreement, Borrowers shall cause to be delivered to Agent a fully executed deposit account control agreement ("DACA"), in form and substance satisfactory to Agent, for any deposit account of a Borrower for which a DACA has not yet been entered into with the Agent, except for any account held by VWE Captive, LLC.

For the avoidance of doubt, failure of any Obligor to comply with the foregoing covenants shall be an immediate Event of Default under the Loan Agreement and an immediate termination of the Forbearance Period.

SECTION 8. Conditions to Effectiveness of this Agreement. This Agreement shall be effective as of the date (the "Forbearance Effective Date") when (i) counsel for the Agent has received a counterpart of this Agreement, executed and delivered by the Obligors and Lenders constituting Required Lenders; and (ii) the Agent has received payment of the Forbearance Fee.

SECTION 9. Effects on Loan Documents.

a.All Loan Documents shall continue to be in full force and effect and are hereby in all respects ratified and confirmed.

b.Except as set forth herein, the execution, delivery, and effectiveness of this Agreement shall not operate as a waiver of any right, power, or remedy of the Agent or any Lender under any of the Loan Documents, nor constitute a waiver of any provision of the Loan Documents.

c.The Obligors and the other parties hereto acknowledge and agree that this Agreement shall constitute a Loan Document on and after the Forbearance Effective Date.

SECTION 10. Amendments; Execution in Counterparts.

a.Other than the amendments in Section 4 of this Agreement, this Agreement shall not constitute a modification or waiver of any provision of the Loan Agreement and, except as expressly stated herein, shall not be construed as a forbearance or consent to any further or future action on the part of the Obligors that would require a forbearance or consent of the Lenders. The provisions of the Loan Agreement are and shall remain in full force and effect.

b.The provisions of this Agreement, including the provisions of this sentence, may not be amended, modified, or supplemented, and waivers or consents to departures from the provisions hereof may not be given, unless amended, modified, supplemented, waived or consented to, in accordance with Section 14.1 of the Loan Agreement. This Agreement may be executed by one or more of the parties hereto on any number of separate counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument.

SECTION 11. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of each party hereto and their respective successors and assigns.

SECTION 12. No Third-Party Beneficiaries. No Person other than the Obligors, the Agent, and the Consenting Lenders shall have any rights hereunder or be entitled to rely on this Agreement, and all third-party beneficiary rights are hereby expressly disclaimed.

SECTION 13. Severability. If any provision of this Agreement is held to be illegal, invalid, or unenforceable, the legality, validity, and enforceability of the remaining provisions of this Agreement and the other Loan Documents shall not be affected or impaired thereby. The invalidity of a provision in a particular jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

SECTION 14. Time of Essence. Time is of the essence in the performance of each of the obligations of the Obligors hereunder and with respect to all conditions to be satisfied by such parties.

SECTION 15. Prior Negotiations; Entire Agreement. This Agreement, the Loan Agreement, and the other Loan Documents constitute the entire agreement of the parties hereto with respect to the subject matter hereof, and supersede all other prior negotiations, understandings, or agreements with respect to the subject matter hereof, whether oral or written.

SECTION 16. Interpretation. This Agreement is the product of negotiations of the parties and in the enforcement or interpretation hereof, is to be interpreted in a neutral manner, and any presumption with regard to interpretation for or against any party by reason of that party having drafted or caused to be drafted this Agreement, or any portion hereof, shall not be effective in regard to the interpretation hereof.

SECTION 17. RELEASE BY BORROWERS AND GUARANTOR. The Obligors, for themselves, and for their respective agents, servants, officers, directors, shareholders, members, employees, heirs, executors, administrators, agents, successors and assigns forever release and discharge Agent and Lenders and their agents, servants, employees, accountants, attorneys, shareholders, subsidiaries, officers, directors, heirs, executors, administrators, successors and assigns from any and all claims, demands, liabilities, accounts, obligations, costs, expenses, liens, actions, causes of action, rights to indemnity (legal or equitable), rights to subrogation, rights to contribution and remedies of any nature whatsoever, known or unknown, which Obligors have, now have, or have acquired, individually or jointly, at any time prior to the date of the execution of this Amendment, including specifically, but not exclusively, and without limiting the generality of the foregoing, any and all of the claims, damages, demands and causes of action, known or unknown, suspected or unsuspected by Obligors which:

a.Arise out of the Loan Documents;

b.Arise by reason of any matter or thing alleged or referred to in, directly or indirectly, or in any way connected with, the Loan Documents; or

c.Arise out of or in any way are connected with any loss, damage, or injury, whatsoever, known or unknown, suspected or unsuspected, resulting from any act or omission by or on the part of Agent or any Lender or any party acting on behalf of Agent or any Lender committed or omitted prior to the date of this Amendment.

As further consideration for the above release, each Obligor specifically agrees, represents, and warrants that the matters released herein are not limited to matters which are known or disclosed, and such Obligor hereby waives any and all rights and benefits which it now has, or in the future may have, by virtue of the provisions of Section 1542 of the Civil Code of the State of California which provides as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE LENDER OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.

Each Obligor is aware that it may later discover facts in addition to or different from those which it now knows or believes to be true with respect to the releases given herein, and that it is nevertheless such Obligor's intention to settle, release, and discharge fully, finally, and forever all of these matters, known or unknown, suspected or unsuspected, which previously existed, now exist, or may exist. In furtherance of such intention, each Obligor specifically acknowledges and agrees that the releases given in this Amendment shall be and shall remain in effect as full and complete releases of the matters being released, notwithstanding the discovery or existence of any such additional or different facts and that such releases shall not be subject to termination or rescission by reason of any such additional or different facts.

SECTION 18. GOVERNING LAW; JURISDICTION; WAIVER OF JURY TRIAL. THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF CALIFORNIA. EACH PARTY HERETO HEREBY AGREES AS SET FORTH FURTHER IN SECTIONS 14.13, 14.14, and 14.15 OF THE CREDIT AGREEMENT AS IF SUCH SECTIONS WERE SET FORTH IN FULL HEREIN, Mutatis mutandis.

SECTION 19. Notice of Designated Defaults. This Agreement and the matters set forth herein shall constitute written notice of the Designated Defaults for purposes of satisfaction of any disclosure requirement in the Loan Agreement or any other Loan Document requiring that the Obligors give notice of, certify as to the absence of, or otherwise disclose in writing the occurrence and/or continuance of any Default or Event of Default and the failure of any Obligor prior to, on, or after the date hereof to deliver any such notice, certification, or other disclosure of the Designated Defaults shall not constitute a Default or Event of Default under the Loan Agreement.

[Remainder of page intentionally left blank; signatures follow.]

IN WITNESS WHEREOF, the parties have caused this Agreement to be duly executed and delivered as of the day and year first above written.

HOLDINGS:

VINTAGE WINE ESTATES, INC.,

a Nevada corporation

By:/s/ Kristina Johnston

Name: Kristina Johnston

Title: Chief Financial Officer

BORROWERS:

VINTAGE WINE ESTATES, INC.,

a California corporation

By:/s/ Kristina Johnston

Name: Kristina Johnston

Title: Chief Financial Officer

GROVE ACQUISITION, LLC,

a California limited liability company

By:/s/ Kristina Johnston

Name: Kristina Johnston

Title: Chief Financial Officer

GIRARD WINERY LLC,

a California limited liability company

By:/s/ Kristina Johnston

Name: Kristina Johnston

Title: Chief Financial Officer

MILDARA BLASS INC.,

a California corporation

By: /s/ Kristina Johnston

Name: Kristina Johnston

Title: Chief Financial Officer

SPLINTER GROUP NAPA, LLC,

a California limited liability company

By: /s/ Patrick Roney

Name: Patrick Roney

Title: Manager

SABOTAGE WINE COMPANY, LLC,

a California limited liability company

By: /s/ Patrick Roney

Name: Patrick Roney

Title: Manager

VWE CAPTIVE, LLC,

a Nevada limited liability company

By: /s/ Kristina Johnston

Name: Kristina Johnston

Title: Manager

CALIFORNIA CIDER CO., INC.,

a California corporation

By: /s/ Kristina Johnston

Name: Kristina Johnston

Title: Vice President, Secretary and Treasurer

THAMES AMERICA TRADING COMPANY LTD.,

a California corporation

By: /s/ Kristina Johnston

Name: Kristina Johnston

Title: Vice President, Secretary and Treasurer

VINESSE, LLC,

a California limited liability company

By: /s/ Kristina Johnston

Name: Kristina Johnston

Title: Vice President, Secretary and Treasurer

MEIER'S WINE CELLARS, INC.,

an Ohio corporation

By: /s/ Kristina Johnston

Name: Kristina Johnston

Title: Chief Financial Officer

MEIER'S WINE CELLARS ACQUISITION,

LLC,

a Delaware limited liability company

By: /s/ Kristina Johnston

Name: Kristina Johnston

Title: Secretary and Treasurer

AGENT AND LENDERS:

BMO BANK N.A., as successor in interest to BANK OF THE WEST,

as Agent and Lender

By:/s/ Ron Freed

Name: Ron Freed

Title: Director

AgCountry Farm Credit Services, PCA,

as Lender

By: /s/ Lisa Caswell

Name: Lisa Caswell

Title: Vice President Capital Markets

Greenstone Farm Credit Services, ACA,

as Lender

By: /s/ Curtis Flammini

Name: Curtis Flammini

Title: VP of Capital Markets Lending

Greenstone Farm Credit Services, FLCA,

as Lender

By: /s/ Curtis Flammini

Name: Curtis Flammini

Title: VP of Capital Markets Lending

RABO AGRIFINANCE LLC,

as Lender

By: /s/ Jeff Hanson

Name: Jeff Hanson

Title: VP-LFR

Compeer Financial, PCA,

as Lender

By: /s/ Jeff Pavlik

Name: Jeff Pavlik

Title: Principal Credit Officer Risk

FARM CREDIT MID-AMERICA, PCA,

as Lender

By: /s/ Jessie Thatcher

Name: Jessie Thatcher

Title: Credit Officer Food & Agribusiness

HTLF Bank,

as Lender

By: /s/ Travis Moncada

Name: Travis Moncada

Title: SVP/Director

FARM CREDIT BANK OF TEXAS,

as Lender

By: /s/ Roger Leesman

Name: Roger Leesman

Title: Managing Director – Capital Markets

COMERICA BANK,

as Lender

By: /s/ Bill Stefani

Name: Bill Stefani

Title: Vice President

EXHIBIT 99.1

News Release

News Release

205 Concourse Boulevard | Santa Rosa, CA 95403

For Immediate Release

Vintage Wine Estates Provides Update on Asset Sales as Company Progresses Towards Streamlined Business Model and Announces Forbearance Agreement with Lenders

•Leadership accelerating efforts to streamline business model with focus on branded

Super Premium+ wine and cider across wholesale and direct-to-consumer (“DTC”) channels

•Measurable progress on monetization of non-core production services and stand-alone DTC platforms to support debt reduction

•Lenders aligned on turnaround and restructuring plan; forbearance agreement provides time for amendment discussions

•Planning to report second quarter fiscal 2024 results on March 12, 2024

SANTA ROSA, CA, March 5, 2024 – Vintage Wine Estates, Inc. (Nasdaq: VWE and VWEWW) (“VWE” or the “Company”), one of the top wine producers in the U.S., today provided an update on the business to include its progress with restructuring and asset sales, discussions with its lenders and financial reporting timing expectations.

Streamlined business offers commercial/operational focus and improved financial profile, supported by divestment of high-cost operations

Seth Kaufman, President and CEO of Vintage Wine Estates, commented, “To reposition VWE as an omnichannel wine and cider company that offers the highest quality Super Premium+ products in the U.S., we are aggressively advancing on our top priorities to:

•improve profitability and build a strong go-to-market capability that supports differentiated brands,

•sell non-core assets to measurably reduce debt, and

•optimize operations to improve cash generation.

We are actively executing against our planned roadmap to engage potential acquirers for our stand-alone DTC and certain production services businesses, in addition to other assets. This will generate needed focus and allow us to strategically deploy our resources to support a unique branded wine and cider business which we believe can offer accelerated top-line growth, gains in market share, expanded margins, and improved cash generation. We anticipate that selling these non-core assets with unfavorable cost structures will materially reduce operating expenses and help transform VWE into a much smaller, but more profitable business, that can consistently generate cash. And, perhaps most importantly, these actions can allow us to return our focus to developing and scaling unique brands that delight consumers with highly-rated wines and ciders.”

Sale of assets update

The Company retained Oppenheimer & Co. in January 2024 to aggressively pursue the sale of several assets and to date has received numerous attractive bids as well as a non-binding letter of intent. The Company believes it is well positioned to close certain of these transactions over the next few months. There is also an ongoing evaluation of interest in other assets, which could be opportunistically sold if offers exceed valuation and return hurdles.

Mr. Kaufmann noted, “The level of interest in our non-core businesses and other assets has exceeded our expectations in terms of the quantity and quality of discussions. We remain optimistic in our ability to monetize these assets, which will allow us to pay down debt and increase liquidity.”

Vintage Wine Estates Provides Update on Asset Sales as Company Progresses Towards Streamlined Business Model and

Announces Forbearance Agreement with Lenders

March 5, 2024

Page 2 of 2

Forbearance agreement with lenders

The Company also announced that its plans to reorganize and dispose of certain assets through sales were accepted by its lender group. The lender group subsequently provided an agreement to forbear exercising their rights and remedies under the Second Amended and Restated Loan and Security Agreement as amended on October 12, 2023 (the “Second A&R Loan and Security Agreement”), in respect of, or arising out of, certain defaults under the Second A&R Loan and Security Agreement until the earlier of March 31, 2024 or in the event of any other event of default other than those designated in the agreement. The Second A&R Loan and Security Agreement currently has principal amounts outstanding of $324.3 million as of February 29, 2024. The forbearance agreement provides flexibility for the Company to continue executing the previously announced restructuring and transformation while working with its lenders on an amended credit agreement.

Kristina L. Johnston, Chief Financial Officer of VWE, commented, “Our lenders remain fully engaged with us and we appreciate the progress we are making with discussions to further amend our credit agreement to reflect our current business operations as we execute our restructuring roadmap and advance asset sales.”

The Company will provide an update when further disclosure is required or otherwise appropriate.

Second quarter fiscal 2024 financial results timing

As previously announced, the Company has not yet filed its financial results for the period ended December 31, 2023. It expects to report these results and file its Form 10-Q on March 12, 2024.

About Vintage Wine Estates, Inc.

Vintage Wine Estates (Nasdaq: VWE and VWEWW) is reimagining itself to become a leading wine and cider company that makes the highest quality, Super Premium+ wines and ciders that are accessible and approachable for consumers. Its vision is to be a growing, highly profitable omnichannel business with a consumer-centric culture. VWE has a family of estate wineries in Napa, Sonoma, California’s Central Coast, Oregon, and Washington State with valuable heritage and offerings. Through its Five-Point Plan and its strategy to reimagine the future of VWE, the Company is simplifying its offering to ACE Cider, three leading lifestyle brands (Bar Dog, Cherry Pie and Layer Cake) and key estate wines including B.R. Cohn, Firesteed, Girard, Kunde and Laetitia as well as several other heritage estate brands. Its primary focus is on the Super Premium+ segment of the U.S. wine industry defined as $15+ per bottle. The Company regularly posts updates and additional information at ir.vintagewineestates.com.

Forward-Looking Statements

Some of the statements contained in this press release are forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”). Forward-looking statements are all statements other than those of historical fact, and generally may be identified by the use of words such as “anticipate,” “believe,” “expect,” “future,” “plan,” “will,” or other similar expressions that indicate future events or trends. These forward-looking statements include, but are not limited to statements regarding VWE’s business strategies; the ability of VWE’s business strategies to offer accelerated top-line growth, gains in market share, expanded margins, and improved cash generation; the ability of the efforts to divest non-core assets, and for such efforts to measurably reduce debt; the ability of Oppenheimer & Co. to accelerate the VWE’s monetization efforts through the divestment of non-core assets; the ability of selling non-core assets to help transform VWE into a smaller, but more profitable business that can consistently generate cash; any interest or opportunities related to other assets of the Company; the benefits and timing of the forbearance agreement with VWE’s lenders; the discussions with VWE’s lenders and the possibility for a future amendment to the Second A&R Loan and Security Agreement; and the anticipated timing of the filing of VWE’s results for the second quarter ended December 31, 2023. These statements are based on various assumptions, whether or not identified in this news release, and on the current expectations of VWE’s management. These forward-looking statements are not intended to serve as, and should not be relied on by any investor as, a guarantee of actual performance or an assurance or definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ materially from those contained in or implied by such forward-looking statements. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the control of VWE. Factors that could cause actual results to differ materially from the results expressed or implied by such forward-looking statements include, among others: the Company’s limited experience operating as a public company; the Company’s ability to complete its closing procedures for the quarter ended December 31, 2023 within the anticipated timeframe; the ability of the Company to regain compliance with Nasdaq continued listing requirements; the time and expense associated with any necessary remediation of

Vintage Wine Estates Provides Update on Asset Sales as Company Progresses Towards Streamlined Business Model and

Announces Forbearance Agreement with Lenders

March 5, 2024

Page 2 of 2

control deficiencies; the ability of the Company to effectively execute its strategic plans to reimagine the Company; the Company’s ability to deleverage within the anticipated time frame or at all and its ability to regain compliance with the covenants in its credit agreement, or satisfy its other contractual arrangements, including the forbearance agreement with its lenders; the ability of the Company to retain key personnel; the effect of economic conditions on the industries and markets in which VWE operates, including financial market conditions, rising inflation, fluctuations in prices, interest rates and market demand; the effects of competition on VWE’s future business; the potential adverse effects of health pandemics, epidemics or contagious diseases on VWE’s business and the U.S. and world economy; declines or unanticipated changes in consumer demand for VWE’s products; disruption of supply or shortage of energy; VWE’s ability to adequately source grapes and other raw materials and any increase in the cost of such materials; the impact of environmental catastrophe, natural disasters, disease, pests, weather conditions and inadequate water supply on VWE’s business; VWE’s level of insurance against catastrophic events and losses; impacts from climate change and related government regulations; VWE’s significant reliance on its distribution channels, including independent distributors, particularly in its wholesale operations; a loss or significant decline of sales to important distributors, marketing companies, or retailers; risks associated with new lines of business or products; potential reputational harm to VWE’s brands from internal and external sources; decline in consumer sentiment to purchase wine through VWE’s direct-to-consumer channels; possible decreases in VWE’s wine quality ratings; integration risks associated with recent or future acquisitions; possible litigation relating to misuse or abuse of alcohol; changes in applicable laws and regulations and the significant expense to VWE of operating in a highly regulated industry; VWE’s ability to maintain necessary licenses; VWE’s ability to protect its trademarks and other intellectual property rights; risks associated with the Company’s information technology and ability to maintain and protect personal information; VWE’s ability to make payments on its indebtedness; risks that the Company is unable to meet the additional restrictions and obligations imposed by its amended credit agreement; and those factors discussed in the Company’s most recent Annual Report on Form 10-K and in subsequent Quarterly Reports on Form 10-Q or other reports filed with the Securities and Exchange Commission. There may be additional risks including other adjustments that VWE does not presently know or that VWE currently believes are immaterial that could also cause actual results to differ from those expressed in or implied by these forward-looking statements. In addition, forward-looking statements reflect VWE’s expectations, plans or forecasts of future events and views as of the date and time of this news release. VWE undertakes no obligation to update or revise any forward-looking statements contained herein, except as may be required by law. Accordingly, undue reliance should not be placed upon these forward-looking statements.

###

Contacts:

|

Investors

Deborah K. Pawlowski

Kei Advisors LLC

dpawlowski@keiadvisors.com

Phone: 716.843.3908 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vwe_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

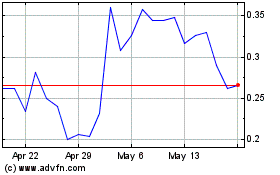

Vintage Wine Estates (NASDAQ:VWE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vintage Wine Estates (NASDAQ:VWE)

Historical Stock Chart

From Apr 2023 to Apr 2024