Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 04 2021 - 11:24AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUERPURSUANT TO

RULES 13A-16 OR 15D-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Dated June 4, 2021

Commission File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

VODAFONE HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE,

RG14 2FN, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED

BY REFERENCE IN EACH OF THE REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-240163), THE REGISTRATION STATEMENT ON FORM S-8

(FILE NO. 333-81825) AND THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-149634) OF VODAFONE GROUP PUBLIC LIMITED COMPANY AND

TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY

FILED OR FURNISHED.

This Report on Form 6-K contains a Regulatory News Service Announcement

dated June 4, 2021 entitled “VODAFONE CLOSES US$2.45 BILLION HYBRID SECURITIES OFFERING”.

Released: June 4, 2021

RNS Number: 9313A

Vodafone Group Plc

4 June 2021

VODAFONE CLOSES US$2.45 BILLION HYBRID SECURITIES

OFFERING

On 4 June 2021, Vodafone Group Plc (“Vodafone”) closed

a US$2.45 billion hybrid securities offering. The securities are due on 4 June 2081. Vodafone has applied to list the securities

on the Nasdaq Global Market.

Vodafone has generated net proceeds of U.S.$2,432,850,000 from the

sale of the hybrid securities. Vodafone intends to use these net proceeds for general corporate purposes, which may include funding repurchases

of ordinary shares issued in connection with the £1,720,000,000 1.50% Subordinated Mandatory Convertible Bonds due 2022.

This announcement contains “forward-looking statements”

within the meaning of the US Private Securities Litigation Reform Act of 1995 with respect to the use of proceeds from Vodafone’s

SEC-registered capital securities offering. By their nature, forward-looking statements are inherently predictive, speculative and involve

risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors

that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements.

A review of the reasons why actual results and developments may differ materially from the expectations disclosed or implied within forward-looking

statements can be found by referring to the information contained under the heading “Principal risk factors and uncertainties”

beginning on page 62 of Vodafone’s Annual Report on Form 20-F for the financial year ended 31 March 2020, ‘‘Risk

Factors’’ beginning on page 42 of Vodafone’s Half-Year Report for the six months ended 30 September 2020 and

“Risk Factors” beginning on page 39 of Vodafone’s Preliminary Results for the financial year ended 31 March 2021.

The Half-Year Report and the Annual Report on Form 20-F can be found on Vodafone’s website (www.vodafone.com/investor). Except

as otherwise stated herein and as may be required to comply with applicable law and regulations, Vodafone does not intend to update these

forward-looking statements and does not undertake any obligation to do so.

Disclaimer

The distribution of this announcement in certain jurisdictions may

be restricted and accordingly it is the responsibility of any person into whose possession the announcement comes to inform themselves

about and observe such restrictions.

This announcement does not constitute, or form part of, an offer or

any solicitation of an offer for securities in any jurisdiction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

|

|

VODAFONE GROUP

|

|

|

PUBLIC LIMITED COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Dated:

|

June 4, 2021

|

By:

|

/s/ Jamie Stead

|

|

|

|

Name:

|

Jamie Stead

|

|

|

|

Title:

|

Group Treasury Director

|

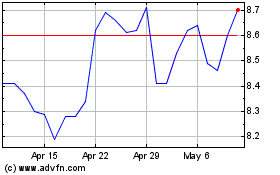

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

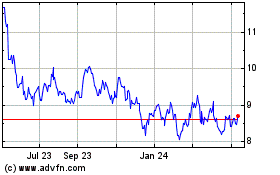

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024