UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission

File Number: 001-36363

TARENA INTERNATIONAL, INC.

6/F, No. 1 Andingmenwai Street,

Litchi

Tower, Chaoyang District,

Beijing 100011, People’s Republic of China

Tel: +86 10 6213-5687

1/F, Block A, Training Building,

65 Kejiyuan Road, Baiyang Jie Dao,

Economic Development District,

Hangzhou 310000, People’s Republic of China

(Address of principal

executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

TARENA INTERNATIONAL, INC. |

| |

By: |

/s/ Xiaobo Shao |

| |

Name: |

Xiaobo Shao |

| |

Title: |

Chief Financial Officer |

| |

|

| Date: December 26, 2023 |

|

EXHIBIT INDEX

Exhibit 99.1 – Press Release

Exhibit

99.2 – Equity Transfer Agreement between Tarena Software Technology (Hangzhou) Co., Ltd. and Tarena Technologies Inc. dated on

December 24, 2023

Exhibit 99.1

Tarena Signs Equity Transfer Agreement to Dispose

of Professional Education Business

BEIJING, December 26, 2023 /PRNewswire/ —

Tarena International, Inc. (NASDAQ: TEDU) (“Tarena” or the “Company”), a leading provider of IT professional

education and IT-focused supplementary STEAM education services in China, today announced that it has signed an equity transfer agreement

(the “Equity Transfer Agreement”) to dispose of all equity interests in the professional education business to a buyer consortium

led by Tarena Weishang Technology (Hainan) Co., Ltd (the “Disposal Transaction”). Ms. Lijuan Han, affiliate of the Company’s

founder and chairman Mr. Shaoyun Han, is a member of the buyer consortium and has an interest in the Disposal Transaction. Kroll, LLC

was retained as the independent financial advisor in connection with the Disposal Transaction. The Disposal Transaction is expected to

close around the end of March 2024.

About Tarena International, Inc.

Tarena is a leading provider of IT professional

education and IT-focused supplementary STEAM education services in China. Through its innovative education platform combining live distance

instruction, classroom-based tutoring and online learning modules, Tarena offers professional education courses in IT and non-IT subjects.

Its professional education courses provide students with practical skills to prepare them for jobs in industries with significant growth

potential and strong hiring demand. Tarena also offers IT-focused supplementary STEAM education programs, including computer coding and

robotics programming courses, etc., targeting students between three and eighteen years of age. Aiming to encourage “code to learn,”

Tarena embraces the latest trends in STEAM education and technology to develop children's logical thinking and learning abilities while

allowing them to discover their interests and potential.

Safe Harbor Statement

This press release contains forward-looking

statements made under the “safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as amended,

and the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology

such as “will,” “expects,” “anticipates,” “future,” “intends,”

“plans,” “believes,” “estimates,” “confident” and similar statements. Tarena may

also make written or oral forward-looking statements in its reports filed with or furnished to the U.S. Securities and Exchange

Commission, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its

officers, directors or employees to third parties. Any statements that are not historical facts, including any business outlook and

statements about Tarena’s beliefs and expectations, are forward-looking statements. Many factors, risks and uncertainties

could cause actual results to differ materially from those in the forward-looking statements. Such factors and risks include, but

not limited to the following: Tarena’s goals and strategies; its future business development, financial condition and results

of operations; its ability to continue to attract students to enroll in its courses; its ability to continue to recruit, train and

retain qualified instructors and teaching assistants; its ability to continually tailor its curriculum to market demand and enhance

its courses to adequately and promptly respond to developments in the professional job market; its ability to maintain or enhance

its brand recognition, its ability to maintain high job placement rate for its students, and its ability to maintain cooperative

relationships with financing service providers for student loans.

Further information regarding these and other

risks, uncertainties or factors is included in Tarena’s filings with the U.S. Securities and Exchange Commission. All information

provided in this press release is current as of the date of the press release, and Tarena does not undertake any obligation to update

such information, except as required under applicable law.

For further information, please contact:

Investor Relations Contact

Tarena International, Inc.

Email: ir@tedu.cn

Exhibit 99.2

Equity Transfer Agreement

between

Tarena Software Technology (Hangzhou) Co., Ltd.

and

Tarena Technologies Inc.

December 24, 2023

Table of Contents

| Article 1 |

Definitions |

2 |

| Article 2 |

Equity Transfer |

5 |

| Article 3 |

Closing |

6 |

| Article 4 |

Transition Period |

10 |

| Article 5 |

Representations and Warranties |

11 |

| Article 6 |

Commitments |

11 |

| Article 7 |

Confidentiality |

13 |

| Article 8 |

Taxes and Dues |

13 |

| Article 9 |

Compensation |

13 |

| Article 10 |

Effectiveness and Termination |

15 |

| Article 11 |

Notice |

15 |

| Article 12 |

Applicable Law and Dispute Resolution |

16 |

| Article 13 |

Miscellaneous |

17 |

| Appendices |

|

|

Equity Transfer Agreement

This Equity Transfer Agreement ("this Agreement")

is made by and between the following parties on December 24, 2023 ("Signing Date"):

(1)

Tarena Weishang Technology (Hainan) Co., Ltd., a limited liability company established in accordance with Chinese law, with

a unified social credit code of 91460000MAD7NKUX8G and its registered address at Building C09, Phase I, Hainan Eco-software Park, Laocheng

Town, Chengmai County, Hainan Province (the "Transferee");

(2)

Tarena International, Inc., a limited liability company established and existing under the laws of the Cayman Islands, with

its registered address at offices of Conyers Trust Company (Cayman) Limited, Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman

KY1-1111, Cayman Islands ("Tarena Cayman" or "Transferor I");

(3)

Tarena Hong Kong Limited, a limited liability company established under the laws of Hong Kong, with its registered address

at RMS 05-15, 13A/F, SOUTH TOWER WORLD FINANCE Centre, HARBOR CITY 17 CANTON Road, TST, KLN, HONG KONG ("Tarena Hong Kong"

or "Transferor II", together with the Transferor I, individually or collectively referred to as the "Transferor");

(4)

Tarena Technologies Inc., a limited liability company established in accordance with Chinese law, with its registered address

at Room 3709, No.18 West Road of North Third Ring, Haidian District, Beijing ("Tarena Technologies Inc." or "Target

Company I"); and

(5)

Tarena Software Technology (Hangzhou) Co., Ltd. is a limited liability company established under Chinese law, with its registered

address at Building A, Floor 1, Training Building, No. 65 Kejiyuan Road, Baiyang Subdistrict, Hangzhou Economic and Technological Development

Zone, Zhejiang Province ("Tarena Hangzhou" or "Target Company II", together with Target Company I, individually

or collectively referred to as the "Target Company").

The Transferee, Transferor,

and Target Company are hereinafter referred to as a "Party" and collectively as "Parties".

Whereas:

(1)

The Transferor and other entities of the Tarena Group intend to no longer engage in adult-focused training business (as defined

below), while the Transferee and the divested entity (as defined below) plan to undertake adult-focused training business. Therefore,

the Transferee wishes to purchase all equity of the Target Company held by the Transferor in accordance with the terms and conditions

hereof ("Target Equity"), and the Transferor wishes to sell the Target Equity to the Transferee in accordance with the

terms and conditions hereof ("Equity Transfer Transaction" or "Equity Transfer");

(2)

On the signing date, the registered capital of Target Company I is RMB 100 million, all of which are held by Tarena Cayman; and

(3)

On the signing date, the registered capital of Target Company II is USD 50 million, all of which are held by Tarena Hong Kong.

Therefore, all parties hereby

agree as follows:

Article 1 Definitions

1.1 Definitions

Unless otherwise defined

herein, the following words have the following meanings:

"Divested business"

or "adult-focused training business" refers to the business of providing professional education courses in IT and non-IT

subjects to students through innovative education platforms, real-time remote teaching, classroom tutoring, and online learning modules

to build practical skills and preparing students for work in industries with increasing recruitment demand and growth potential (for the

avoidance of doubt, such business includes employment recommendation).

"Divested assets"

refer to the assets required or related to the divested business of the Tarena Group (as defined below).

"The divested entity"

refers to the target company and the entities controlled by the target company, including but not limited to the entities listed in Appendix

I List of Related Entities Schedule 1 Divested Entity List, but does not include children-focused business related entities (as defined

below).

"Divested personnel"

refer to personnel who have already established or intend to establish labor relations or labor relations with the divested entity before

or after the closing date (as defined below) necessary for carrying out the divested business.

"Retained business"

or "children-focused training business" refers to providing IT literacy education courses for teenagers aged 3-18, including

computer coding and robot programming courses. By encouraging "code learning", such business cultivates children's logical thinking

and learning abilities, and stimulates their interest and potential.

"Retained assets"

refer to the assets required or related to the divested entity for carrying out retained business or related to retained business.

"Retained personnel"

refer to personnel who have already established or intend to establish labor relations or labor relations with Tarena Group before or

after the closing date, as required for carrying out retained business.

"Tarena Group"

refers to Tarena Cayman and the entities controlled by Tarena Cayman, but does not include the divested entity (for the avoidance of doubt,

children-focused business related entities belong to the scope of Tarena Group).

"Long-term investment

entities" refer to the entities, partial shares of which are held by the divested entity, listed in list of related entities

in Appendix I List of Related Entities Schedule 3 List of Long-term Investment Entities hereof.

"Law" refers

to all regulations, rules, and orders of any government agency, including any decrees, written laws, or other legislative measures, as

well as any regulations, rules, treaties, orders, or judgments.

"Liability"

refers to, with respect to any entity, all obligations of that entity to make payments of, including but not limited to: (i) borrowed

or raised repayments, (ii) acceptance credit, documentary credit or commercial paper loans, (iii) any bonds, notes, loans, bills of exchange

or similar documents, (iv) delayed payments for purchased assets or services, amounts payable for fulfilling contractual obligations,

and any liquidated damages, (v) rent under leases (whether related to land, machinery, equipment, or other projects) primarily for the

purpose of raising funds or financing the purchase of leased assets, (vi) guarantees, standby letters of credit or other documents issued

for the performance of contracts, (vii) mortgages, guarantees or other guarantees for financial losses related to the obligations of any

entity, (viii) payable employee salaries, insurance, provident fund, benefits, expenses, (ix) payable distributions, dividends, bonuses,

taxes, compensation, litigation costs.

"Working days"

refer to normal business days of commercial banks in China, excluding statutory holidays.

"Related

party" refers to (1) with respect to any entity, (a) any other entity/natural person who directly or indirectly controls, is

controlled by, or is jointly controlled by another entity/natural person; (b) The directors, supervisors, senior management personnel

of the entity, as well as the related party of the aforementioned personnel. (2) With respect to any natural person, the close relatives

of such natural person (including spouse, parents, paternal grandparents, maternal grandparents, siblings and their spouses, parents of

spouse, siblings of spouse and their spouses, children and their spouses, grandchildren and their spouses) and the entity in which such

close relatives serve as directors, supervisors or senior management personnel, or the entity controlled, directly or indirectly, by such

close relatives (including but not limited to, through the designated persons). However, for the purpose of this Agreement, neither the

Transferee nor its related party shall be deemed as a related party of the Transferor; After the closing date, the Transferor and

its related party shall not be considered as a related party of the divested entity.

"Closing

date" has the meaning set forth in Article 3.1.

"Transaction documents"

refer to this Agreement, any other agreements signed regarding equity transfer, and the Target Company's articles of association modified

based on equity transfer.

"Control"

refers to the power, directly or indirectly or as a trustee or executor, in relation to the relationship between two or more entities,

to give instructions or cause others to give instructions regarding the business, affairs, management, or decision-making of an entity,

whether through the ownership of equity, voting rights, or voting securities, whether as a trustee or executor, whether under a contract,

agreement, trust arrangement, or other arrangements including (i) directly or indirectly owning fifty percent (50%) or more of the issued

shares or equity of the entity, (ii) directly or indirectly owning fifty percent (50%) or more of the voting rights of the entity, or

(iii) directly or indirectly having the power to appoint a majority of the members of the board of directors or similar management organization

of the entity. "Controlled" and "jointly controlled" have meanings related to the above interpretation.

"Approval"

refers to the rights, licenses, permits, approvals, exemptions, approvals, authorizations granted by any government agency, as well as

all registrations and filings processed by any government agency.

"Encumbrance"

refers to (1) priority or other interests with security purposes set up on specific property through mortgage, pledge, retention, or other

means; and (2) claims related to the ownership, possession, or use of specific property attached to it (including nominee shareholding

arrangements).

"Person"

refers to an individual, company, enterprise, partnership, trust, unincorporated organization, government, any government department or

agency, or any other entity.

"RMB" refers

to the legal currency of China, the Chinese yuan.

"Representations and

warranties of the Transferee" refers to the representations and warranties of the Transferee as described in Appendix II (B).

"Children-focused

business related entities" refer to the entities engaged in children-focused training business among the divested entities,

namely the entities listed in Appendix I List of Related Entities Schedule 2 List of Children-focused Business Related Entities hereof.

"Taxes and dues"

or "Taxation" refer to all forms of taxes and similar charges levied, collected, withheld or assessed by local, city,

regional, urban, government, state, federal authorities or other authorities in China or any other jurisdictional region, as well as any

interest, additional taxes, fines, surcharges or penalties related to the above.

"Cash" refers

to cash, cash equivalents, tradable securities, or other items that can be defined as current assets pursuant to applicable accounting

standards.

"Government agency"

refers to any government or its affiliated institutions with jurisdiction, any department or organization of any government or its affiliated

institutions, any court or arbitration tribunal, and any regulatory agency of any securities exchange.

"Intellectual property"

refers to all patents, trademarks, service marks, registered designs, domain names, utility models, copyrights, inventions, confidential

information, trade secrets, proprietary production processes and equipment, brand names, database rights, trade names, all similar rights

and the benefits of any of the aforementioned in any country (in each case, whether registered or not, and including all applications

for the aforementioned and the right to apply for any of the aforementioned in any place in the world).

"Material adverse

effect" refers to any situation, change or impact involving the applicable Target Company and its controlled entities that (a)

affects the existence, business, assets, intellectual property, liabilities (including but not limited to contingent liabilities), financial

condition, operating performance, business prospects or financial condition of the Target Company and/or its controlled entities or there

is sufficient evidence to suggest that it may cause serious adverse effects; (b) has a serious adverse impact on the qualification, license,

or ability of the Target Company and/or its controlled entities to operate their current business, or sufficient evidence suggesting that

it may be; (c) has serious impact on the ability of the applicable Transferor to fulfill its obligations and responsibilities under the

transaction documents; or (d) any event or legal action that seriously affects the validity or enforceability of any transaction document.

"China" refers

to the People's Republic of China, and for the purpose of this Agreement only, does not include the Hong Kong Special Administrative Region,

Macao Special Administrative Region, and Taiwan region.

"Representations and

warranties of the Transferor" refers to the representations and warranties of the Transferor as described in Appendix II (A).

"Assets"

refer to tangible or intangible assets, rights, and privileges of any nature, including but not limited to all rights related to intellectual

property.

Article 2 Equity Transfer

2.1 Target equity

| (1) | As of the signing date of this Agreement, the equity structure of Target Company I is as follows: |

| Shareholder | |

Subscribed

Registered Capital

(RMB 10,000) | | |

Paid-in Registered

Capital (RMB

10,000) | | |

Shareholding

Ratio | |

| Tarena Cayman | |

| 10,000 | | |

| 10,000 | | |

| 100 | % |

| Total | |

| 10,000 | | |

| 10,000 | | |

| 100 | % |

Pursuant to the terms hereof

and subject to meeting the conditions stipulated herein, the Transferee agrees to purchase from Transferor I and Transferor I agrees to

sell 100% equity of the Target Company I (corresponding to a registered capital of RMB 100 million of the Target Company I) to Transferor

I ("Tarena Technologies Inc. Equity Transfer").

| (2) | As of the signing date of this Agreement, the equity structure of Target Company II is as follows: |

| Shareholder | |

Subscribed

Registered Capital

(USD 10,000) | | |

Paid-in Registered

Capital (USD

10,000) | | |

Shareholding

Ratio | |

| Tarena Hong Kong | |

| 5,000 | | |

| 5,000 | | |

| 100 | % |

| Total | |

| 5,000 | | |

| 5,000 | | |

| 100 | % |

Pursuant to the terms hereof

and subject to meeting the conditions stipulated herein, the Transferee agrees to purchase from Transferor II and Transferor II agrees

to sell 100% equity of the Target Company II (corresponding to a registered capital of USD 50 million of the Target Company II) to Transferor

II ("Tarena Hangzhou Equity Transfer").

2.2 Equity transfer price

All

parties agree that, in accordance with the terms hereof and subject to the satisfaction of the conditions stipulated herein, the Transferee

shall pay the equity transfer price of RMB 1 to Transferor I for the Tarena Technologies Inc. Equity Transfer (the "Tarena

Technologies Inc. Equity Transfer Amount"); For the Tarena Hangzhou Equity Transfer, the Transferee shall pay the equity transfer

price of RMB 1 to Transferor II (the "Tarena Hangzhou Equity Transfer Amount", together with the transfer amount of Tarena Technologies

Inc.'s equity, referred to as the "Equity Transfer Amount").

2.3 Payment of equity transfer

price

All parties agree that, with

regard to the Tarena Technologies Inc. Equity Transfer, the Transferee shall pay the Tarena Technologies Inc. Equity Transfer Amount to

the bank account designated by the Transferor within five (5) working days after all the closing prerequisites stipulated in Article 3.1

hereof are met or waived in writing by Transferor I; With regard to the Tarena Hangzhou Equity Transfer, the Transferee shall pay the

Tarena Hangzhou Equity Transfer Amount to the bank account designated by the Transferor within five (5) working days after all the closing

prerequisites stipulated in Article 3.1 hereof are met or waived in writing by Transferor II.

Article

3 Closing

3.1 Closing prerequisites

Provided that the Transferee

confirms that all the closing prerequisites listed in this clause ("Closing prerequisites") have been met or waived in

writing by the Transferee ("Closing", the date on which the Transferee confirms that all the closing prerequisites have

been met or waived in writing by the Transferee is the "Closing Date"), the Transferee shall pay the transfer amount

to Transferor I in accordance with the provisions of Article 2.3 regarding the Tarena Technologies Inc. Equity Transfer, and pay the transfer

amount to Transferor II for the Tarena Hangzhou Equity Transfer:

| (1) | This Agreement and other transaction documents (including but

not limited to the Target Company's articles of association modified based on equity transfer) have been appropriately signed by all

signatories; |

| (2) | The representations and warranties made by the Transferor herein

shall be true, accurate, complete, and not misleading on the signing date and closing date of this Agreement; All commitments and agreements

that shall be fulfilled by the Transferor on or before the closing date in all applicable transaction documents have been fulfilled; |

| (3) | Unless otherwise agreed in Article 6.1 hereof, both the Transferor

and the Target Company have obtained all internal and external authorizations, approvals, and filings, as well as all relevant third-party

consent, regarding the equity transfer transaction, the signing and performance of this Agreement and other related transaction documents; |

| (4) | No event has occurred that, individually or jointly, would have

a material adverse effect on the divested entity, and it is reasonably expected that such event would not have a material adverse effect

on the divested entity, either individually or jointly; |

| (5) | No government department has formulated, issued, promulgated,

implemented or enacted any law that would result in illegal equity transfer transactions, or restrict or prohibit equity transfer transactions; |

| (6) | The Transferor and/or other entities of the Tarena Group shall

have reached an agreement with the Transferee and/or the designated entity of the Transferee on the list of divested and retained personnel,

and the Transferor and/or other entities of the Tarena Group shall have provided the Transferee or the designated entity of the Transferee

with a list of divested and retained personnel recognized by them; |

| (7) | The Transferor and/or other entities of the Tarena Group shall

have reached an agreement with the Transferee and/or the designated entity of the Transferee regarding the settlement plan for historical

expenses, fund transactions, and/or loans between the Transferor and/or other entities of the Tarena Group and the divested entity, and

the Transferor and/or other entities of the Tarena Group shall have provided the Transferee or the designated entity of the Transferee

with an approved settlement plan ("Settlement Plan"). The settlement plan shall specify the following content: (a) As of December

31, 2023, pursuant to the net amount mutual transactions between the book records of the divested entity and the book records of Tarena

Group, if the divested entity is receivable from Tarena Group (i.e. the divested entity is a creditor, and Tarena Group is a debtor),

except for foreign currency debts of Tarena Group to the divested entity that have been filed with the State Administration of Foreign

Exchange, all other transactions will be exempted pursuant to the net book transaction amount; (b) As of December 31, 2023, pursuant

to net amount the mutual transactions between the book records of the divested entity and the book records of Tarena Group, if Tarena

Group is receivable from the divested entity (i.e. Tarena Group is the creditor, and the divested entity is the debtor), including the

foreign currency debts ("Foreign Currency Debts of the Divested Entity") and other net book transaction amount of the divested

entity to Tarena Group filed with the State Administration of Foreign Exchange, such net amount shall not be exempted; and (c) for the

foreign currency debts of Tarena Group and the foreign currency debts of the divested entity, Tarena Group shall repay the foreign currency

debts of Tarena Group to the divested entity in two payments. The first repayment amount shall be the portion of the total foreign currency

debts of Tarena Group that exceeds the total amount of foreign currency debts of the divested entity. After the first repayment, the

remaining amount of foreign currency debts of Tarena Group to be repaid shall be equal to the total amount of foreign currency debts

of the divested entity; and the second payment is the outstanding balance of foreign currency debts of Tarena Group to be repaid after

the divested entity repays all foreign currency debts of the divested entity (for the avoidance of doubt, such outstanding balance is

the total amount of foreign currency debts of Tarena Group minus the aforementioned first repayment amount of the Tarena Group). |

| (8) | The Transferor and/or other entities of the Tarena Group shall

have already reached consensus on the deliverables to be submitted to the Transferee and/or the designated entity of the Transferee on

the closing date, including but not limited to accounting original vouchers, financial statements, bank account opening permits, bank

signature cards, U-shields, invoices, tax control disks, tax calculation tables, tax declaration forms, settlement and payment materials,

audit reports, official seals, financial seals, personal name seals, invoice seals, contract seals, business licenses, multiple-purpose

certificate, business contracts, labor contracts, other contracts, intellectual property documents, etc. The Transferor and/or other

entities of the Tarena Group shall have provided the Transferee and/or the designated entity of the Transferee with a list of recognized

deliverables ("List of Deliverables"); For the avoidance of doubt, the list of deliverables shall not include the aforementioned

materials of any children-focused business related entities and long-term investment entities; |

| (9) | The Transferor and/or other entities of the Tarena Group shall

have reached a consistent plan with the Transferee and/or the designated entity of the Transferee on the relevant matters that need to

be handled or completed before closing (including but not limited to matters related to long-term investment entities, children-focused

business related entities, systems, qualification certificates, assets, contracts, personnel). The Transferor and/or other entities of

the Tarena Group shall have provided the Transferee and/or the designated entity of the Transferee with the approved plan, and shall

have completed the matters that need to be completed or processed before closing in accordance with the plan; |

| (10) | The Transferor and/or other entities of the Tarena Group shall

have reached a consistent plan (hereinafter referred to as "Retention Matters Plan") with the Transferee and/or the

designated entity of the Transferee on the relevant matters that need to be handled or completed after closing (including but not limited

to matters related to long-term investment entities, children-focused business related entities, systems, qualification certificates,

assets, contracts, personnel) (hereinafter referred to as "Retention Matters"). The Transferor and/or other entities

of the Tarena Group shall have provided the Transferee and/or the designated entity of the Transferee with their approved retention plan. |

3.2 Equity structure of the

Target Company after the closing date

Subject to compliance with

the terms and conditions hereof, the equity structure of Target Company I will be changed since the closing date to:

| Shareholder | |

Subscribed

Registered Capital

(RMB 10,000) | | |

Paid-in Registered

Capital (RMB

10,000) | | |

Shareholding

Ratio | |

| Tarena Weishang Technology (Hainan) Co., Ltd. | |

| 10,000 | | |

| 10,000 | | |

| 100 | % |

| Total | |

| 10,000 | | |

| 10,000 | | |

| 100 | % |

The equity structure of Target

Company II will be changed since the closing date to:

| Shareholder | |

Subscribed

Registered Capital

(USD 10,000) | | |

Paid-in Registered

Capital (USD

10,000) | | |

Shareholding

Ratio | |

| Tarena Weishang Technology (Hainan) Co., Ltd. | |

| 5,000 | | |

| 5,000 | | |

| 100 | % |

| Total | |

| 5,000 | | |

| 5,000 | | |

| 100 | % |

From the closing date, all

rights and obligations attached to the target equity shall be transferred with the transfer of equity. The Transferee shall enjoy shareholder

rights and assume shareholder obligations in accordance with applicable laws, regulations, and the newly signed articles of association

of the Target Company.

3.3 Deliverables on the closing

date

(1)

On the closing date, the Transferor or the designated entity of the Transferor shall provide the Transferee or the designated entity

of the Transferee with all the materials shown in the list of deliverables.

(2)

On the closing date, each Transferor shall provide the Transferee with the latest register of shareholders and capital contribution

certificate of the Target Company, indicating that the Transferee has been registered as a shareholder of the company by the Target Company

and its capital contribution and shareholding ratio are consistent with the provisions of Article 3.2 hereof and stamped with the official

seal. The issuance date shall be the closing date.

3.4 Facilitating closing

All parties shall make every

effort to ensure that the closing prerequisites stipulated in Article 3.1 hereof are met as soon as possible after the signing of this

Agreement.

3.5 Transfer of rights and

obligations

(1)

Unless otherwise expressly agreed in the transaction documents, agreed upon in writing by all parties, or otherwise provided by

law, the Target Company or its designated divested entity shall have all rights and interests in the divested assets from the closing

date (except for divested assets that are only used by the Target Company through licensing or leasing, and shall have rights and assume

obligations in accordance with relevant agreements on licensing or leasing), and bear all risks related to the divested assets (except

for the risks related to the divested assets that are only be used through licensing or leasing, and shall have rights and assume obligations

in accordance with relevant agreements on licensing or leasing).

(2)

Unless otherwise expressly agreed in the transaction documents, agreed upon in writing by all parties, or otherwise provided by

law, the Transferor or its designated entity shall have all rights and interests in the retained assets from the closing date (except

for retained assets that are only used by the Target Company through licensing or leasing, and shall have rights and assume obligations

in accordance with relevant agreements on licensing or leasing), and bear all risks related to the retained assets (except for the risks

related to the retained assets that are only be used through licensing or leasing, and shall have rights and assume obligations in accordance

with relevant agreements on licensing or leasing).

(3)

Unless otherwise expressly agreed upon in the transaction documents, agreed upon in writing by all parties, or otherwise provided

by law, from the closing date, the Transferor and/or other entities of the Tarena Group shall still have all rights and interests over

long-term investment entities and children-focused business related entities, and shall bear all risks related to long-term investment

entities and children-focused business related entities.

3.6 Independent operation

All parties confirm that from

the closing date, (1) Tarena Group shall no longer own and/or operate any adult-focused training business, and the divested entity shall

own and independently operate all adult-focused training businesses; (2) The divested entity shall no longer own and/or operate any children-focused

training business, and the Tarena Group shall own and independently operate all children-focused training businesses.

Article 4 Transition

Period

4.1 Business operations before

closing

From the signing date this

Agreement until the closing date (the "Transition Period"), the Target Company shall cause other divested entities, and

the Transferor shall cause the Target Company and other divested entities, to:

| (1) | Carry out the business operations of the divested entity in the general and customary business processes

in the same manner as those before the signing of this Agreement; |

| (2) | Maintain the original relationships between the Target Company and its customers, employees, creditors,

as well as other parties in contact with it, in accordance with the principle of integrity; and |

| (3) | Comply with applicable laws in significant respects. |

4.2 Action restrictions during

the transition period

During

the transition period, without the prior written consent of the Transferee, unless otherwise specified in the actions or transaction

documents related to meeting the closing prerequisites listed in Article 3.1 hereof, the Target Company shall not, and the Target Company

shall cause other divested entities not to, and the Transferor shall cause the Target Company and other divested entities not to take

any of the following actions:

| (1) | Change the registered capital and equity structure of the divested entity; |

| (2) | Sign new contracts outside of the daily business operations of the divested entity, including equity investments

or disposal of equity investments, acquisitions, mergers, bank loans, or other non-daily debts, leases, fixed asset purchases, entrusted

operations, etc., and do not engage in securities or financial derivative investments; or |

| (3) | Set new debt burden on any substantial business or assets of the divested entity, or any divested assets,

including but not limited to mortgage, pledge, retention, lending, leasing, transfer on the assets and business. |

4.3 Right to know

Prior

to closing, the Transferor shall promptly notify the Transferee in writing of (a) all events, circumstances, or facts to its knowledge

that may result in a breach of any of its representations, warranties, or commitments under the corresponding transaction documents, or

that may make any of its representations or warranties under the transaction documents untrue or inaccurate in any material respect, (b)

any fact, change, condition or circumstance that it is aware of, which may reasonably be expected to cause any of the conditions specified

in Article 3.1 hereof to become unfulfilled, and (c) all other significant developments that affect the assets, liabilities, business,

financial condition, operations, operating results, customer or supplier relationships, employee relationships, forecasts or prospects

of the divested business.

Article

5 Representations and Warranties

5.1 Representations and warranties

of the Transferor

In order to facilitate the

signing of this Agreement by the Transferee, and as part of its consideration for signing this Agreement, the Transferor hereby jointly

and severally makes the representations and warranties listed in Appendix II (A) to the Transferee.

5.2 Representations and warranties

of the Transferee

The Transferee hereby makes

the representations and warranties listed in Appendix II (B) to the Transferor.

Article 6 Commitments

6.1 Procedures for industrial

and commercial change registration, etc.

(1)

After the closing date, the Target Company shall complete the industrial and commercial registration, filing, and registration

of change for foreign exchange basic information for the equity transfer transaction as soon as possible. If the Transferor and/or Transferee

is required to cooperate in submitting relevant materials or conducting relevant system identification and authentication to handle the

procedures for industrial and commercial change registration, filing, and/or registration procedures for change of foreign exchange basic

information, the Transferor and/or Transferee shall cooperate.

(2)

After the closing date, the Target Company and/or other divested entities shall complete the procedures for industrial and commercial

registration of transferring the children-focused business related entities to the Tarena Group entity as soon as possible. If the Transferor

and/or other entities of the Tarena Group are required to submit relevant materials or undergo relevant system identification and authentication

to handle the aforementioned procedures for industrial and commercial change registration, the Transferor shall and shall cause other

entities of the Tarena Group to cooperate.

(3)

After the closing date, the Target Company and/or other divested entities shall complete the procedures for industrial and commercial

registration of transferring the long-term investment entities to the Tarena Group entity as soon as possible. If the Transferor and/or

other entities of the Tarena Group are required to submit relevant materials or undergo relevant system identification and authentication

to handle the aforementioned procedures for industrial and commercial change registration, the Transferor shall and shall cause other

entities of the Tarena Group to cooperate.

6.2 Qualification change

After the closing date, the

Target Company and other divested entities shall promptly update, change or reapply for their qualification certificates in accordance

with applicable laws and regulations (if necessary). After the closing date, the children-focused business related entities shall promptly

update, change or reapply for the qualification certificates they hold in accordance with applicable laws and regulations (if necessary).

If the application for qualification change requires the cooperation of the Transferor and/or Transferee in submitting relevant documents,

the Transferor and/or Transferee shall cooperate.

6.3

Retention matters

All parties acknowledge and

agree that the Transferee and the Target Company agree to cooperate with the Transferor or other entities of the Tarena Group to complete

the relevant retention matters as soon as possible after the closing date in accordance with the retention matters plan or the plan determined

by the related parties through separate negotiations; The Transferor agrees to cooperate with the divested entity or Transferee to complete

the relevant retention matters as soon as possible after the closing date in accordance with the retention matter plan or the plan determined

by the related parties through separate negotiations.

6.4 Non-competition

In order to avoid competition

with the adult-focused training business of the divested entity, the Transferor agrees and shall ensure that other entities of the Tarena

Group agree that within 5 years from the closing date, except with the written consent of the Transferee or otherwise agreed by the parties,

the Tarena Group shall not directly and/or indirectly (including but not limited to establishing other entities) engage in any business

that is the same as, similar to, or competitive with the adult-focused training business.

In order to avoid competition

with the children-focused training business of Tarena Group, the Target Company and the Transferee agree, and shall ensure that all other

divested entities agree, within 5 years from the closing date, that, except with the written consent of Tarena Group or other agreements

between the parties, the spin off entity shall not directly and/or indirectly (including but not limited to establishing other entities)

engage in any business that is the same, similar, or competitive with the children-focused training business.

6.5 Obligation to cooperate

All parties acknowledge and

agree that after the closing date, the Transferor and/or its related parties shall no longer hold any divested assets. If, after the closing

date, it is found that the Transferor and/or its related parties hold any divested assets, the Transferor and/or its related parties shall

cooperate to transfer, deliver or license the divested assets to the Transferee, the Target Company or its related parties, or otherwise

enable the Target Company or its related parties to use such divested assets reasonably, and provide reasonable assistance to the Target

Company or its related parties to acquire and/or use such divested assets.

All parties acknowledge and

agree that after the closing date, the Transferee, the Target Company, and/or their related parties shall no longer hold any retained

assets. If, after the closing date, it is found that the Transferee, the Target Company, and/or their related parties hold any retained

assets, the Transferee, the Target Company, and/or their related parties shall cooperate to transfer, deliver or license the retained

assets to the Transferor or its related parties, or otherwise enable the Transferor or its related parties to reasonably use such retained

assets and provide reasonable assistance to the Transferor or its related parties to acquire and/or use such retained assets.

Article 7 Confidentiality

7.1 Confidentiality

All parties agree to keep

confidential the following information: the existence, content, and signing of this Agreement, any trade secrets of the other party obtained

by each party during the validity period of this Agreement, and any oral or written materials exchanged with each other in preparation

or performance of this Agreement, which require confidentiality by all parties, shall not be disclosed or made public to third parties

without the written consent of the other party. All parties shall ensure that their employees, consultants, and agents fulfill their confidentiality

obligations hereunder. However, any disclosure of the following confidential information by either party shall not be deemed a violation

of this Agreement: (1) the information was already known to the public at the time of disclosure; (2) Such information is disclosed with

the prior written consent of the parties hereto; (3) For the purpose of evaluating this equity transfer transaction, one party shall disclose

to its shareholders, directors, management members who agree to fulfill confidentiality obligations, or the accounting firm or law firm

it employs, provided that the aforementioned personnel comply with confidentiality obligations consistent with this clause; (4) If, in

accordance with any applicable mandatory laws and regulations, instructions from any judicial or administrative authority, or requirements

from any applicable securities exchange, regulatory or government agency, one party is required to disclose any confidential information,

to the extent permitted by law, that party shall (i) give written notice to the other party as soon as possible before disclosure; (ii)

consult with other parties on the form, content, and method of disclosure; and (iii) shall make every effort to assist other parties in

seeking protective relief measures. The party shall only provide the portion of confidential information that is legally required to be

disclosed, and shall make every effort to ensure that such confidential information is protected by confidentiality.

Article

8 Taxes and Dues

Each party shall pay and bear

the taxes and dues related to the equity transfer transaction in accordance with applicable laws and regulations.

Article 9 Compensation

9.1 General principles

If

either party hereto violates any warranties and/or representations, commitments or agreements herein and/or any other transaction documents,

and/or any warranties or representations of either party in any other transaction documents are unfounded, untrue, inaccurate or incomplete,

resulting in or causing the Target Company and/or the counterparty to this Agreement and/or its related parties, directors, shareholders,

employees, agents and representatives (hereinafter referred to as the "Compensated Person") to incur any losses,

such losses shall be jointly and severally compensated by the defaulting party to the compensated person.

9.2 Specific agreements

(1)

Except with the prior written consent of the Transferee or as otherwise expressly agreed in the transaction documents, the Transferee

and its related parties shall not be liable for any liabilities or responsibilities related to the divested entity, divested business,

and/or divested assets that existed or occurred before the closing date, or caused by reasons existing before the closing date, including

but not limited to any liabilities or responsibilities, dispute, or payable taxes, litigation, arbitration, enforcement, claims, administrative

penalties or other legal proceedings, third-party claims, liabilities, obligations, damages, losses, judgments, legal actions, litigation,

proceedings, arbitration related to the divested entity, divested business, and/or divested assets that existed or occurred before the

closing date. If any lawsuit, arbitration, administrative penalty or other legal proceedings arises to the Target Company, Transferee

or their related parties or they suffer any losses due to any third party's request, the Transferor (or its designated related parties)

shall be responsible for responding to or handling the relevant penalties and legal proceedings, and shall make remedy for and/or compensate

the Target Company, Transferee or their related parties for all losses suffered as a result.

(2)

Except with the prior written consent of the Transferor or as otherwise expressly agreed in the transaction documents, the Transferor

and its related parties shall not be liable for any liabilities or responsibilities related to the divested entity, divested business,

and/or divested assets that occurred after the closing date, including but not limited to any liabilities or responsibilities, dispute,

or payable taxes, litigation, arbitration, enforcement, claims, administrative penalties or other legal proceedings, third-party claims,

liabilities, obligations, damages, losses, judgments, legal actions, litigation, proceedings, arbitration related to the divested entity,

divested business, and/or divested assets that occurred after the closing date. If any lawsuit, arbitration, administrative penalty or

other legal proceedings arises to the Transferor or its related parties or they suffer any losses due to any third party's request, the

Transferee, Target Company or their designated related parties shall be responsible for responding to or handling the relevant penalties

and legal proceedings, and shall make remedy for and/or compensate the Transferee or its related parties for all losses suffered as a

result.

(3)

Except with the prior written consent of the Transferee, the Target Company, or as otherwise expressly agreed in the transaction

documents, the Transferee, the Target Company, and their related parties shall not be liable for any liabilities or responsibilities related

to the retained business and/or retained assets that occur after the closing date, including but not limited to any liabilities, liabilities,

disputes, or taxes payable, litigation, arbitration, enforcement, claims, administrative penalties or other legal proceedings, third-party

claims, liabilities, obligations, damages, losses, judgments, legal actions, litigation, proceedings, arbitration related to the retained

business and/or retained assets that occur after the closing date. If any lawsuit, arbitration, administrative penalty or other legal

proceedings arises to the Target Company, Transferee or their related parties or they suffer any losses due to any third party's request,

the Transferor (or its designated related parties) shall be responsible for responding to or handling the relevant penalties and legal

proceedings, and shall make remedy for and/or compensate the Target Company, Transferee or their related parties for all losses suffered

as a result.

Article 10 Effectiveness

and Termination

10.1

Effective date

This Agreement has been duly

signed by all parties and shall come into effect from the signing date.

10.2

Termination events

This Agreement may

be terminated by any related party before the closing date through the following means:

(1)

If the Transferor violates any material representations, warranties, commitments or agreements contained herein, the Transferee

shall have the right to terminate this Agreement by written notice to the Transferor;

(2)

If the Transferee violates any material representations, warranties, commitments or agreements to the Transferor contained herein,

the Transferor has the right to terminate this Agreement by written notice to the Transferee;

(3)

If the equity transfer transaction cannot be completed due to force majeure, changes in laws and regulations, or government reasons,

the Transferee has the right to notify the Transferor in writing to terminate this Agreement;

(4)

At any time on or before the closing date, this Agreement may be terminated with the mutual written consent of all parties.

10.3

Consequences of termination

All parties shall continue

to be bound by Article 10.3, Article 7 (Confidentiality), Article 8 (Taxes and Dues), Article 9 (Compensation), Article 11 (Notice), and

Article 12 (Applicable Law and Dispute Resolution) hereof. Any provision of Article 10.3 shall not be deemed to exempt either party from

any liability for breach of this Agreement prior to its termination.

Article 11 Notice

11.1 Notice

All notices, requests, or

other communications issued hereunder shall be in writing and shall be delivered or sent to the following addresses or email addresses

or communication numbers of the related parties (or other addresses specified by the recipient's written notice to the other parties at

least 5 days in advance).

| Transferor I: |

Mailing Address: 6/F, No.1 Andingmenwai Street, Litchi Tower, Chaoyang District, Beijing |

| Contact person: Han Shaoyun |

| Email: hansy@tedu.cn |

| Transferor II: |

Mailing Address: 6/F, No.1 Andingmenwai Street, Litchi Tower, Chaoyang District, Beijing |

| Contact person: Han Shaoyun |

| Email: hansy@tedu.cn |

| Target Company I: |

Mailing Address: 6/F, No.1 Andingmenwai Street, Litchi Tower, Chaoyang District, Beijing |

| Contact person: Han Shaoyun |

| Email: hansy@tedu.cn |

| Target Company II: |

Mailing Address: 6/F, No.1 Andingmenwai Street, Litchi Tower, Chaoyang District, Beijing |

| Contact person: Han Shaoyun |

| Email: hansy@tedu.cn |

| Transferee: |

Mailing address: Yard No. A10, Meishikou Road, Fengtai District, Beijing |

| Contact person: Li Jin |

| Email: *** |

All notices, requests, or other

communications issued or served in accordance with the provisions of Article 11.1 shall be deemed to have been issued or served: (1) if

sent by registered mail, on the third working day after the relevant notice, request, or communication indicating the above address is

sent to the post office and a receipt is issued by the post office, it shall be deemed to have been served; (2) If delivered by a courier

company or by a dedicated person, it shall be deemed served when the relevant notice, request, or communication is delivered to the abovementioned

address (if rejected or returned without signature, it shall be deemed served from the date of rejection or return); (3) Notification

made by email shall be deemed served when the email system shows that the recipient has actually received it or has not received any return

notification within 24 hours after sending it.

Article 12 Applicable

Law and Dispute Resolution

12.1 Applicable Law

The formation, validity, interpretation,

performance, revision, termination, and dispute resolution of this Agreement shall be governed by Chinese law.

12.2 Dispute resolution

Any disputes, controversies

or demands arising out of or in connection with this Agreement or its breach, termination or invalidity (hereinafter referred to as "Disputes")

shall be resolved through friendly consultation between the parties. If the dispute cannot be resolved through negotiation, either party

may submit the relevant dispute to the Beijing Arbitration Commission for arbitration in accordance with its arbitration rules. The arbitration

shall be conducted in Beijing and the language used shall be Chinese. The arbitration award shall be final and binding on all parties.

Article 13 Miscellaneous

13.1

Assignment

The heirs and permitted assignees

of all parties shall enjoy the benefits and be bound by this Agreement. Without the prior written consent of all parties, neither party

shall assign its rights or obligations hereunder. However, the Transferee may transfer the rights and/or obligations hereunder to its

related parties by giving written notice to the Transferor before closing.

13.2 Amendment

Any amendment hereto must

be signed in writing by all parties before taking effect.

13.3 Entire agreement

The

Appendices hereto are an integral part and have the same legal effect as this Agreement. This Agreement constitutes the entire

agreement reached by the parties regarding the subject matter hereof, and supersedes any previous agreements and understandings reached

by the parties regarding the subject matter.

13.4 Severability

All obligations hereunder

shall be deemed independent and enforceable, and the enforceability of other obligations shall not be affected when one or more obligations

hereunder become invalid or unenforceable. When one or some provisions hereunder are not enforceable, they shall be deemed to be removed

from this Agreement, and such removal shall not affect the enforceability of any other provisions hereof. This Agreement being not enforceable

against one party shall not affect its enforceability against other parties.

13.5 Effectiveness

This

Agreement shall be binding on all parties from the signing date. This Agreement is made in quintuplicate, with each party holding

one copy and each copy having equal legal effect. This Agreement may be jointly or separately signed and delivered by all parties. The

electronic version of the signed text hereof exchanged by all parties via email and stored in PDF format shall be deemed as the original

and may serve as separate evidence of the establishment and effectiveness of this Agreement.

13.6 Template agreement for

reporting to government agencies

All parties agree and acknowledge

that a brief template agreement that does not conflict with this Agreement may be signed separately for the purpose of applying for approval/filing

of equity transfer with relevant government agencies. However, equity transfer shall still be subject to the provisions hereof, and neither

party shall invoke such template agreement in any dispute resolution related to equity transfer to counter any provisions hereof.

[The following is the signature page]

In view of this, all parties have caused their authorized

representatives to sign this Agreement on the date stated on the front page hereof.

| Tarena Weishang Technology (Hainan)

Co., Ltd. |

|

| |

|

| Signature: |

/s/ Jin Li |

(Company seal affixed) |

| Name: Jin Li |

|

Signing Page of Equity

Transfer Agreement

In view of this, all parties have caused their authorized

representatives to sign this Agreement on the date stated on the front page hereof.

| Tarena International, Inc. |

|

| |

|

| Signature: |

/s/ Shaoyun Han |

(Company seal affixed) |

| Name: Shaoyun Han |

|

Signing Page of Equity

Transfer Agreement

In view of this, all parties have caused their authorized

representatives to sign this Agreement on the date stated on the front page hereof.

| Tarena Technologies Inc. (Official Seal) |

|

| |

|

| Signature: |

/s/ Shaoyun Han |

(Company seal affixed) |

| Name: Shaoyun Han |

|

Signing Page of Equity

Transfer Agreement

In view of this, all parties have caused their authorized

representatives to sign this Agreement on the date stated on the front page hereof.

| Tarena Hong Kong Limited |

|

| |

|

| Signature: |

/s/ Shaoyun Han |

(Company seal affixed) |

| Name: Shaoyun Han |

|

Signing Page of Equity

Transfer Agreement

In view of this, all parties have caused their

authorized representatives to sign this Agreement on the date stated on the front page hereof.

| Tarena Software Technology (Hangzhou) Co., Ltd. (Official Seal) |

|

| |

|

| Signature: |

/s/ Shaoyun Han |

(Company seal affixed) |

| Name: Shaoyun Han |

|

Signing Page of Equity

Transfer Agreement

Appendix I List of Related Entities

(See a separate Appendix)

***

Appendix II Representations

and Warranties

Appendix II (A) Representations and Warranties

of the Transferor

Each Transferor jointly and

severally makes the following representations and warranties to the Transferee regarding the divested entity and divested assets. The

following representations and warranties are true, complete, and accurate on the signing date and closing date of this Agreement (unless

a particular statement or warranty expressly states that it is only related to a specific date).

| 1. | Disposing Capacity and Authorization |

Each

Transferor and the Target Company are officially established and validly existing in accordance with the laws of their place of registration.

Each Transferor and the Target Company have obtained sufficient and necessary authorization to sign the transaction documents,

fulfill all obligations under the transaction documents, and complete the transactions under the transaction documents. The transaction

documents signed by them as one party are legally binding on each Transferor and the Target Company.

The signing and performance of the

transaction document agreement shall not violate or conflict with any provisions of the articles of association and other organizational

rules of the Target Company and/or the Transferor; shall not result in any breach or non-performance of obligations under any contract

or legal document binding on the Target Company and/or the Transferor; shall not violate any order, judgment or decree of any court or

government agency that is binding on them, nor shall violate any mandatory laws and regulations in China; and shall not result in any

violation of any license, approval or permit issued to the Target Company or other divested entities, and/or any condition for the continued

validity of such license, approval or permit, or cause any approval issued to the Target Company or other divested entities to be terminated,

revoked or subject to additional conditions.

| 3. | Establishment and Existing of the Divested Entity |

Each

divested entity is legally established and validly existing in accordance with Chinese laws and has independent civil rights and disposing

capacity. There is no circumstance where termination is required by laws, regulations, normative documents or their articles of association.

The payment of registered capital by each divested entity complies with the provisions of Chinese law, its articles of association,

and other organizational rules. There are no instances of false reporting and/or withdrawal of registered capital among the divested entities.

The business scope of each divested entity complies with the requirements of Chinese law. Each divested entity shall carry out business

activities in accordance with the registered business scope and legal provisions.

The equity structure recorded in Article

2.1 hereof is consistent with the registered capital equity structure of each Target Company registered and filed with the administration

for industry and commerce, as well as the registered capital equity structure stated in the articles of association of each Target Company,

and accurately and completely reflects the capital structure and paid in capital of each Target Company before closing. Each Target Company

has not promised or actually issued any equity, shares, bonds, warrants, options, or similar interests of the same or similar nature in

any form, to anyone other than the aforementioned shareholder equity.

The Transferor is the sole legal and

beneficial owner of all equity held by it in the Target Company. The registered capital corresponding to the target equity has been fully

paid in cash, and there is no circumstance of false investment, false reporting of registered capital, withdrawal of registered capital,

or other violations of applicable laws and regulations; The Transferor shall have undisputed, legal and undivided ownership of the target

equity held by the Transferor and all related interests, and shall have legal rights and powers over the target equity it holds, and shall

have the right to make any dispositions with respect to the equity of the Target Company it holds.

There are no mortgages, pledges, liens,

security interests, privileges, charges, claims, freezes, lock up period restrictions or other encumbrances on the target equity stipulated

by the laws of China or any other country or region; The target equity also does not have any nominee shareholding, trust, or other third-party

rights of any nature (including but not limited to any circumstance that may affect the rights and interests of any shareholder directly

or indirectly enjoyed by that party over any target equity, or may cause any third party to directly or indirectly acquire any shareholder

rights and interests over the target equity).

There are no ongoing, potential, threatened

lawsuits, administrative penalties, administrative reviews, appeals, investigations, or other legal proceedings filed by the Transferor,

or to which the Transferor is a counterparty or in connection with which the Transferor is a party and which relate to its holding of

the target equity.

| 5. | Qualification Certificate |

Each

divested entity has obtained all necessary approvals, consents, authorizations, and licenses for its establishment and business operations.

The aforementioned approvals, consents, authorizations, and licenses are fully valid and there is no circumstance of change, revocation,

or non-renewal. The signing or performance of this Agreement or any documents to be signed prior to the closing date shall not

result in any such approval, consent, authorization or permit being revoked, suspended, altered or not renewed.

Each divested entity engages in business

activities within its approved scope of business and has never engaged in business activities beyond its scope of business. Each divested

entity operates and manages business activities in accordance with all applicable laws, and there are no significant violations of laws,

administrative regulations, or relevant regulatory provisions.

All audit accounts, management accounts,

and other financial information and reports (hereinafter referred to as "Financial Information") of each divested entity

have been prepared in accordance with applicable laws and accounting standards, on the basis of appropriateness and consistency, and truthfully,

fairly, and accurately reflect the assets, liabilities, financial condition, and related matters of each divested entity as of the relevant

balance sheet date, as well as the profits and losses of the reporting period, and the true financial condition of each divested entity

on such date and within the scope of applicable laws and regulations.

For the assets (including intellectual

property) being used by each divested entity, the divested entity has ownership or has obtained valid authorization to use them in its

existing and/or proposed business operations. The ownership and/or use rights of each divested entity over the assets will not be adversely

affected by the transactions proposed under the transaction documents.

The assets

(including intellectual property) being used by each divested entity and the divested assets are free from any mortgage, pledge, retention

or other encumbrances, or are subject to compulsory measures such as sealing, freezing, or seizure by courts, arbitration institutions,

or other authorized institutions; There are no third-party claims or restrictions on the exercise of rights, nor are there any

lawsuits or arbitrations against the aforementioned assets. All necessary approval documents, registration, and other procedures for the

abovementioned assets have been obtained or completed and remain valid.

For the properties used by each divested

entity through leasing (hereinafter referred to as "Leased Properties"), each divested entity enjoys legal and complete

leasing rights and has the right to use such leased properties in accordance with the provisions of the leasing contract, and such leased

properties have no defects in terms of property ownership, leasing rights, etc. that may cause material adverse effects on the business

operations of the divested entity.

To the best of the Transferor's knowledge,

each divested entity has not infringed upon the rights of third parties with respect to the assets it owns or is authorized to use, and

has not received any claims from third parties that it constitutes infringement. There are no pending disputes or judicial proceedings

related to the aforementioned assets.

The Transferor

or its related parties have the necessary power and authorization to transfer and divest assets. After the divested assets are

transferred or licensed to the Target Company or its designated divested entity in accordance with the provisions of the transaction documents,

the Target Company or its designated divested entity will have full and unrestricted ownership or use rights over the divested assets

(except as otherwise agreed in writing in the transaction documents or by all parties).

Each divested entity has obtained or

been licensed to obtain all intellectual property rights that it needs to use in its business process. The divested entity's rights to

such intellectual property are legal and valid, and it has taken legal or appropriate measures (such as filing registration, renewing

annual fees) to maintain its rights.

To the best of the Transferor's knowledge,

each divested entity has not engaged in any infringement of the intellectual property rights of others, has not received any claims from

third parties claiming infringement of intellectual property rights, and there are no pending intellectual property disputes or judicial

proceedings; To the best of the Transferor's knowledge, there is no circumstance where anyone else is infringing, abusing, or misappropriating

the intellectual property rights of each divested entity.

Each divested entity shall perform

the contract in accordance with normal commercial practices and contract terms, and there shall be no significant breach of contract.

To the best of the Transferor's knowledge, there shall be no circumstance that may cause the divested entity to bear significant breach

of contract liability and/or compensation liability to the counterparty. To the best of the Transferor's knowledge, the signing and performance

of transaction documents by each divested entity will not result in the divested entity bearing significant breach of contract and/or

compensation liability to the counterparty, nor will any counterparty claim to cancel or terminate such contracts as a result.

Except for the debts already reflected

herein and financial information, as well as the debts arising from the daily business activities of the divested entity between the financial

statement date corresponding to the latest financial information (i.e. November 30, 2023) and the closing date, there are no other significant

debts of the divested entity.

Except for fulfilling the closing conditions

stipulated in Article 3.1, each divested entity and its employees have signed labor contracts and entered into legal labor relationships

in accordance with the law. The labor employment and labor dispatch of each divested entity comply with applicable laws in significant

aspects. Each divested entity has timely and fully paid employee salaries and remuneration, and has fully withdrawn or paid personal income

tax, social insurance premiums, and other welfare expenses as required by law. There are no unresolved labor disputes between each divested

entity and its employees.

Each divested entity has complied with

various tax regulations, accurately, completely, and timely declared all taxable income in accordance with the regulations of the Chinese

national and local tax authorities, and has paid all due taxes and fees accordingly. There is no need to add or supplement any taxes and

fees (including corporate income tax, employee personal income tax withheld and paid on behalf of employees). Each divested entity has

not received any outstanding collection or supplementary payment documents issued by the tax authority or any other competent department,

or any notice requesting inspection or audit of any tax declaration form. There are no unresolved audits, measures, procedures, investigations,

disputes or claims, and there are no circumstances where the tax authority or other competent department may claim tax compensation from

the divested entity.

| 14. | Punishments, Litigation, and Claims |

There are no unresolved or foreseeable

litigation, arbitration, or administrative penalty cases among the divested entities, and there are no disputes or illegal acts that may

cause litigation, arbitration, or administrative penalty procedures. Additionally, no judicial preservation or enforcement measures have

been taken against the divested entities.

Appendix II (B) Representations and warranties

of the Transferee

The Transferee hereby represents

and warrants to each Transferor that the following representations and warranties are true, complete, and accurate on the signing date

and closing date of this Agreement.

| 1. | Disposing Capacity and Authorization |

The Transferee

is officially established and validly existing in accordance with the laws of its place of registration. The Transferee has obtained

sufficient and necessary authorization to sign the transaction documents, fulfill all obligations under the transaction documents, and

complete the transactions under the transaction documents. The transaction documents signed by it as one party are legally binding on

the Transferee.

The signing and performance of the

transaction document agreement shall not violate or conflict with any provisions of the articles of association and other organizational

rules of the Transferee; shall not result in any breach or non-performance of obligations under any contract or legal document binding

on the Transferee; shall not violate any order, judgment or decree of any court or government agency that is binding on them, nor shall

violate any mandatory laws and regulations in China; and shall not result in any violation of any license, approval or permit issued to

the Transferee, and/or any condition for the continued validity of such license, approval or permit, or cause any approval issued to the

Transferee to be terminated, revoked or subject to additional conditions.

| 3. | Establishment and Existing |

The Transferee is legally established

and validly existing in accordance with Chinese laws and has independent civil rights and disposing capacity. There is no circumstance

where termination is required by laws, regulations, normative documents or its articles of association.

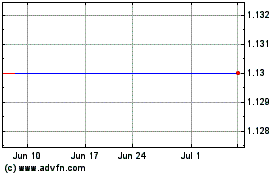

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

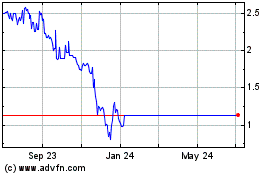

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Apr 2023 to Apr 2024