|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

|

| FORM

6-K |

|

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

|

|

For the month of August 2023

Commission File Number: 001-36363

|

| TARENA INTERNATIONAL, INC. |

|

6/F, No. 1 Andingmenwai Street,

Litchi Tower, Chaoyang District,

Beijing 100011, People’s Republic of China

Tel: +86 10 6213-5687

1/F, Block A, Training Building,

65 Kejiyuan Road, Baiyang Jie Dao,

Economic Development District,

Hangzhou 310000, People’s Republic of

China

|

|

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

TARENA INTERNATIONAL, INC. |

| |

|

| |

|

| |

By: |

/s/ Xiaobo Shao |

| |

Name: |

Xiaobo Shao |

| |

Title: |

Chief Financial Officer |

| |

|

| Date: August 29, 2023 |

|

EXHIBIT INDEX

Exhibit 99.1 – Press Release

Exhibit 99.1

Tarena Announces the Results for the Second

Quarter of 2023

BEIJING,

August 28, 2023 /PRNewswire/ -- Tarena International, Inc. (NASDAQ: TEDU) ("Tarena" or the "Company"), a

leading provider of IT professional education and IT-focused supplementary STEAM education services in China, today announced its unaudited

financial results for the second quarter ended June 30, 2023.

Highlights for the Second Quarter of 2023

| · | Total student enrollment in IT-focused supplementary STEAM education increased

by 0.6% to 177,500 in the second quarter of 2023, compared to student enrollment of 176,500 in the same period of 2022. |

| · | Net revenues decreased by 16.0% year-over-year to RMB545.0 million (US$75.2

million) from RMB648.8 million in the same period of 2022. |

| · | Gross profit decreased by 26.0% year-over-year to RMB278.7 million (US$38.4

million) from RMB376.5 million in the same period of 2022. |

| · | Gross profit margin decreased by 6.9% year-over-year to 51.1% from 58.0%

in the same period of 2022. |

| · | Operating loss was RMB6.8 million (US$0.9 million), compared to operating

income of RMB48.0 million in the same period of 2022. |

| · | Non-GAAP operating loss, which excluded share-based compensation expenses,

was RMB5.9 million (US$0.8 million), compared to non-GAAP operating income of RMB49.2 million in the same period of 2022. |

| · | Net income was RMB8.3 million (US$1.2 million), compared to RMB47.9 million

in the same period of 2022. |

| · | Non-GAAP net income, which excluded share-based compensation expenses, was

RMB9.2 million (US$1.3 million), compared to non-GAAP net income of RMB49.1 million in the same period of 2022. |

| · | Basic income per American Depositary Share ("ADS"), each representing

five Class A ordinary shares with an effective date of December 23, 2021, was RMB0.70 (US$0.10) in the second quarter of 2023.

Diluted income per ADS was RMB0.67 (US$0.09) in the second quarter of 2023. Non-GAAP basic income per ADS, which excluded share-based

compensation expenses, was RMB0.78 (US$0.11) in the second quarter of 2023. Non-GAAP diluted income per ADS, which excluded share-based

compensation expenses, was RMB0.75 (US$0.10) in the second quarter of 2023. |

Highlights for the Six Months Ended June 30,

2023

| · | Total student enrollment in our IT-focused supplementary STEAM education

decreased by 0.7% to 185,400 in the first half of 2023, compared to student enrollment of 186,700 in the same period in 2022. |

| · | Net revenues decreased by 26.9% year-over-year to RMB930.1 million (US$128.3

million), from RMB1,272.3 million in the same period in 2022. |

| · | Gross profit decreased by 34.8% year-over-year to RMB479.7 million (US$66.2

million), from RMB735.4 million in the same period in 2022. |

| · | Gross profit margin decreased by 6.2% year-over-year to 51.6%, from 57.8%

in the same period in 2022. |

| · | Operating loss was RMB65.6 million (US$9.1 million), compared to an operating

income of RMB76.6 million in the same period in 2022. |

| · | Non-GAAP operating loss, which excluded share-based compensation expenses,

was RMB63.7 million (US$8.8 million), compared to a non-GAAP operating income of RMB79.1 million in the same period in 2022. |

| · | Net loss was RMB41.6 million (US$5.7 million), compared to a net income

of RMB75.0 million in the same period in 2022. |

| · | Non-GAAP net loss, which excluded share-based compensation expenses, was

RMB39.6 million (US$5.5 million), compared to a non-GAAP net income of RMB77.5 million in the same period in 2022. |

| · | Basic and diluted loss per ADS was RMB3.97 (US$0.55) in the first half of

2023. Non-GAAP basic and diluted loss per ADS, which excluded share-based compensation expenses, was RMB3.79 (US$0.52) in the first half

of 2023. |

Key Financial Results

| | |

For the Three Months Ended

June 30, | | |

Variance | | |

%

of

change | | |

For the Six Months Ended

June 30, | | |

Variance | | |

%

of

change | |

| | |

2022 | | |

2023 | | |

| | |

| | |

2022 | | |

2023 | | |

| | |

| |

| | |

RMB | | |

RMB | | |

RMB | | |

| | |

RMB | | |

RMB | | |

RMB | | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

(in

thousands, except for percentages) | |

| Net

revenues | |

648,817 | | |

545,012 | | |

(103,805 | ) | |

-16.0 | % | |

1,272,323 | | |

930,116 | | |

(342,207 | ) | |

-26.9 | % |

| Cost

of revenues(a) | |

(272,306 | ) | |

(266,301 | ) | |

6,005 | | |

-2.2 | % | |

(536,894 | ) | |

(450,402 | ) | |

86,492 | | |

-16.1 | % |

| Gross

profit | |

376,511 | | |

278,711 | | |

(97,800 | ) | |

-26.0 | % | |

735,429 | | |

479,714 | | |

(255,715 | ) | |

-34.8 | % |

| Gross

margin | |

58.0 | % | |

51.1 | % | |

-6.9 | % | |

| | |

57.8 | % | |

51.6 | % | |

-6.2 | % | |

| |

| Selling

and marketing expenses(a) | |

(156,874 | ) | |

(150,999 | ) | |

5,875 | | |

-3.7 | % | |

(329,274 | ) | |

(264,150 | ) | |

65,124 | | |

-19.8 | % |

| General

and administrative expenses(a) | |

(158,742 | ) | |

(118,819 | ) | |

39,923 | | |

-25.1 | % | |

(300,327 | ) | |

(250,366 | ) | |

49,961 | | |

-16.6 | % |

| Research

and development expenses(a) | |

(12,878 | ) | |

(15,696 | ) | |

(2,818 | ) | |

21.9 | % | |

(29,220 | ) | |

(30,824 | ) | |

(1,604 | ) | |

5.5 | % |

| Total

operating expenses | |

(328,494 | ) | |

(285,514 | ) | |

42,980 | | |

-13.1 | % | |

(658,821 | ) | |

(545,340 | ) | |

113,481 | | |

-17.2 | % |

| Operating

income/(loss) | |

48,017 | | |

(6,803 | ) | |

(54,820 | ) | |

-114.2 | % | |

76,608 | | |

(65,626 | ) | |

(142,234 | ) | |

-185.7 | % |

Notes:

| (a) | Includes share-based compensation expenses. |

“In the second quarter of 2023, as the external

business environment improved, our net revenues gradually rebounded,” remarked Ms. Ying Sun, Tarena's Chief Executive Officer.

“Driven by relatively stable market demand for STEAM education, our STEAM education services recovered from the pandemic’s

impact over the past quarters, with net revenues growing at 39% quarter over quarter and returning to its level in the same period of

2022 thanks to cash receipt growth, demonstrating our business resilience. Benefiting from the improving external business environment,

the net revenues of our IT professional education business also recovered from the impact of the suspension of courses and services in

the first quarter, with its net revenues increasing by 47% quarter over quarter. On a year-over-year basis, the net revenues of our IT

professional education business decreased due to its relatively longer recovery cycle amid the uncertainties associated with the post-pandemic

economic recovery, which affected the supply of and demand for talents in the job market.”

“Furthermore, we continued to enhance our

profitability during the second quarter,” Ms. Sun continued. “We carved out the college-collaboration related business

and focused on STEAM education and To-C professional education services, which will allow us to narrow losses in subsequent quarters.

Meanwhile, we continued to optimize our staff structure and learning centers to enhance operational efficiency, achieving a comprehensive

refined management upgrade across our organization. Benefiting from our focused strategic plan and effective cost reduction and efficiency

enhancement measures, we achieved a significant reduction in our group’s operating loss of 88% quarter over quarter.”

“Looking ahead, we believe enterprises’

digital transformation and the rapid development of artificial intelligence will drive continuous growth of market demand for IT talents,

while professional education-related policies will also benefit industry development. In this context, our long-term efforts to enhance

operational efficiency and optimize our business model will help us effectively strengthen our operations and improve profitability under

a light, highly efficient and highly focused operating model, positioning our two businesses to achieve sustainable and healthy growth,”

concluded Ms. Sun.

Financial Results for the Second Quarter of

2023

Net Revenues

Total

net revenues decreased by 16.0% to RMB545.0 million (US$75.2 million) in the second quarter of 2023, from RMB648.8 million in the

same period of 2022. The decrease in revenue was primarily due to a lower student enrollment for our IT professional education business,

which resulted from the closure of some teaching centers with relatively low profitability, as well as the impact of the divestiture of

the college-collaboration related business with revenues of only two months recognized in the second quarter of 2023.

Cost of Revenues

Cost

of revenues decreased by 2.2% to RMB266.3 million (US$36.7 million) in the second quarter of 2023, from RMB272.3 million in the

same period of 2022. The decrease was mainly due to a decrease in personnel cost attributable to headcount reduction and a decrease in

rental fees and deprecation cost attributable to the closure of some teaching centers during this period. The decrease was partially offset

by the increase in costs of camps and competition activities in this quarter.

Gross Profit and Gross Margin

Gross

profit decreased by 26.0% to RMB278.7 million (US$38.4 million) in the second quarter of 2023, from RMB376.5 million in the same

period of 2022. Gross margin narrowed to 51.1% in the second quarter of 2023, compared to 58.0% in the same period of 2022, as the decline

in net revenues is greater than the reduction in the cost of revenues in this quarter.

Operating Expenses

Total

operating expenses decreased by 13.1% to RMB285.5 million (US$39.4 million) in the second quarter of 2023 from RMB328.5 million

in the same period of 2022. Total non-GAAP operating expenses, which excluded share-based compensation expenses, decreased by 13.0% to

RMB284.6 million (US$39.3 million) in the second quarter of 2023, from RMB327.4 million in the same period of 2022. Total share-based

compensation expenses allocated to the related operating expenses decreased by 23.5% to RMB0.9 million (US$0.1 million) in the second

quarter of 2023, from RMB1.1 million in the same period of 2022.

Selling and marketing expenses decreased by 3.7%

to RMB151.0 million (US$20.8 million) in the second quarter of 2023 from RMB156.9 million in the same period of 2022. The decrease was

mainly due to a decrease in personnel-related costs resulting from a decrease in the number of sales staff in the second quarter of 2023.

General

and administrative expenses decreased by 25.1% to RMB118.8 million (US$16.4 million) in the second quarter of 2023, from RMB158.7

million in the same period of 2022. The decrease was mainly due to a decrease in personnel-related costs associated with headcount reduction.

Furthermore, a one-time provision for the amount of the anticipated settlement of a class action lawsuit was recognized in the previous

period, while no such expenditure was incurred in this period.

Research

and development expenses increased by 21.9% to RMB15.7 million (US$2.2 million) in the second quarter of 2023, from RMB12.9 million

in the same period of 2022. The increase was mainly due to an increase in spending on operating systems improvement to enhance operating

efficiency.

Operating Income/(Loss)

Operating

loss was RMB6.8 million (US$0.9 million) in the second quarter of 2023, compared to operating income of RMB48.0 million in the

same period of 2022. Non-GAAP operating loss, which excluded share-based compensation expenses, was RMB5.9 million (US$0.8 million) in

the second quarter of 2023, compared to non-GAAP operating income of RMB49.2 million in the same period of 2022.

Income Tax Expense

The

Company recorded an income tax expense of RMB10.4 million (US$1.4 million) in the second quarter of 2023, compared to RMB0.6 million

in the same period of 2022.

Net Income

As

a result of the foregoing, net income was RMB8.3 million (US$1.2 million) in the second quarter of 2023, compared to RMB47.9 million

in the same period of 2022. Non-GAAP net income, which excluded share-based compensation expenses, was RMB9.2 million (US$1.3 million)

in the second quarter of 2023, compared to RMB49.1 million in the same period of 2022. The impact on the net income due to the gain on

disposal of college business was RMB26.8 million (US$3.7 million) for this period.

Basic and Diluted Income per ADS

Basic income per ADS was RMB0.70 (US$0.10) in

the second quarter of 2023. Diluted income per ADS was RMB0.67 (US$0.09) in the second quarter of 2023. Non-GAAP basic income per ADS,

which excluded share-based compensation expenses, was RMB0.78 (US$0.11) in the second quarter of 2023. Non-GAAP diluted income per ADS,

which excluded share-based compensation expenses, was RMB0.75 (US$0.10) in the second quarter of 2023.

Cash Flow

The total balance of cash, cash equivalents and

restricted cash decreased RMB2.9 million from RMB371.0 million as of March 31, 2023 to RMB368.1 million (US$50.8 million) as of June 30,

2023. Net cash outflow from operating activities in the second quarter of 2023 was RMB20.0 million (US$2.8 million). Net cash inflow from

investing activities in the second quarter of 2023 was RMB68.2 million (US$9.4 million), as we received a deposit of RMB76.6 million (US$10.6

million) on the sale of office buildings in this period. Capital expenditures in the second quarter of 2023 were RMB11.6 million (US$1.6

million). Net cash outflow from financing activities in the second quarter of 2023 was RMB51.4 million (US$7.1 million), as we repaid

the bank borrowing of RMB50.0 million (US$6.9 million).

Financial Results for the Six Months Ended

June 30, 2023

Net Revenues

Total

net revenues decreased by 26.9% to RMB930.1 million (US$128.3 million) in the first half of 2023, from RMB1,272.3 million in the

same period of 2022. The decrease in revenue was primarily due to a lower student enrollment for our IT professional education business,

which resulted from the closure of some teaching centers with relatively low profitability. Additionally, we suspended courses and services

for almost the entire month of January, resulting in a decrease in net revenues.

Cost of Revenues

Cost of revenues decreased by 16.1% to RMB450.4

million (US$62.1 million) in the first half of 2023, from RMB536.9 million in the same period of 2022. The decrease was mainly due to

a decrease in personnel cost attributable to headcount reduction and a decrease in rental fees and deprecation cost attributable to the

closure of some teaching centers during this period.

Gross Profit and Gross Margin

Gross profit decreased by 34.8% to RMB479.7 million

(US$66.2 million) in the first half of 2023, from RMB735.4 million in the same period of 2022. Gross margin was 51.6% in the first half

of 2023, compared with 57.8% in the same period of 2022. The decrease in gross profit was due to the revenues decline in the quarter being

greater than the reduction in the cost of revenues.

Operating Expenses

Total operating expenses decreased by 17.2% to

RMB545.3 million (US$75.2 million) in the first six months of 2023, from RMB 658.8 million in the same period of 2022. Total non-GAAP

operating expenses, which excluded share-based compensation expenses, decreased by 17.2% to RMB543.4 million (US$74.9 million) in the

first six months of 2023, from RMB656.3 million in the same period of 2022. Total share-based compensation expenses allocated to the related

operating expenses decreased by 22.7% to RMB1.9 million (US$0.3 million) in the first six months of 2023, from RMB2.5 million in the same

period of 2022.

Selling and marketing expenses decreased by 19.8%

to RMB264.2 million (US$36.4 million) in the first six months of 2023 from RMB329.3 million in the same period of 2022. The decrease was

mainly due to a decrease in personnel-related costs resulting from a decrease in the number of sales staff in the first six months of

2023, compared to the same period of 2022. In addition, the efforts to control marketing spending and the reduction in advertisement expenditure

resulted in a decrease in advertising expenses.

General and administrative expenses decreased

by 16.6% to RMB250.4 million (US$34.5 million) in the first six months of 2023, from RMB300.3 million in the same period of 2022. The

decrease was mainly due to a decrease in personnel expenses associated with headcount reduction. Furthermore, a one-time provision for

the amount of the anticipated settlement of a class action lawsuit was recognized in the previous period, while no such expenditure was

incurred in this period.

Research and development expenses increased by

5.5% to RMB30.8 million (US$4.3 million) in the first six months of 2023, from RMB29.2 million in the same period of 2022. The increase

was mainly due to an increase in spending on operating systems improvement to enhance operating efficiency.

Operating Income/(Loss)

Operating loss was RMB65.6 million (US$9.1 million)

in the first six months of 2023, compared to operating income of RMB76.6 million in the same period of 2022. Non-GAAP operating loss,

which excluded share-based compensation expenses, was RMB63.7 million (US$8.8 million) in the first six months of 2023, compared to non-GAAP

operating income of RMB79.1 million in the same period of 2022.

Income Tax Expense

The Company recorded an income tax expense of

RMB2.3 million (US$0.3 million) in the first six months of 2023, compared to RMB6.0 million in the same period of 2022.

Net Income/(Loss)

As a result of the foregoing, net loss was RMB41.6

million (US$5.7 million) in the first six months of 2023, compared to net income of RMB75.0 million in the same period of 2022. Non-GAAP

net loss, which excluded share-based compensation expenses, was RMB39.6 million (US$5.5 million) in the first six months of 2023, compared

to non-GAAP net income of RMB77.5 million in the same period of 2022. The impact on the net income due to the gain on disposal of college

business was RMB26.8 million (US$3.7 million) for this period.

Basic and Diluted Loss per ADS

Basic and diluted loss per ADS was RMB3.97 (US$0.55)

in the first half of 2023. Non-GAAP basic and diluted loss per ADS, which excluded share-based compensation expenses, was RMB3.79 (US$0.52)

in the first half of 2023.

Cash Flow

The total balance of cash, cash equivalents, and

restricted cash decreased RMB5.9 million from RMB374.0 million as of December 31, 2022 to RMB368.1 million (US$50.8 million) as of

June 30, 2023. Net cash outflow from operating activities in the first half of 2023 was RMB37.7 million (US$5.2 million). Net cash

inflow from investing activities in the first half of 2023 was RMB85.6 million (US$11.8 million), as we received a deposit of 95.6 million

(US$13.2 million) on the sale of office buildings in this period. Capital expenditures in the first half of 2023 were RMB17.4 million

(US$2.4 million). Net cash outflow from financing activities in the first half of 2023 was RMB53.9 million (US$7.4 million), as we repaid

the bank borrowing of RMB52.0 million (US$7.2 million).

Update on Investment from KKR

The Company entered into a registration rights

agreement with Talent Fortune Investment Limited, or KKR, an affiliate of KKR & Co. L.P., on July 17, 2015, pursuant to

which certain registration rights were granted to KKR. The Company's obligations under such agreement have been terminated.

Exchange Rate Information

All translations made in the financial statements

or elsewhere in this press release made from RMB into United States dollars (“US$”) are solely for convenience and calculated

at the rate of US$1.00=RMB 7.2513, representing the exchange rate as of June 30, 2023, set forth in the H.10 statistical release

of the U.S. Federal Reserve Board. No representation is made that the RMB amounts could have been, or could be, converted, realized or

settled into US$ at that rate, or at any other rate, on June 30, 2023.

Conference Call

Company management will hold an earnings conference

call and live webcast to discuss the Company's results at 8:00 AM on Aug 29, 2023, U.S. Eastern Time (8:00 PM on Aug 29, 2023, Beijing

Time).

Please register in advance of the conference,

using the link provided below. Upon registering, you will be provided with participant dial-in numbers, a passcode, and a unique registrant

ID.

Conference

call registration link: https://dpregister.com/sreg/10181809/fa32717b04. It will automatically direct you to the registration

page for " Tarena's Second Quarter 2023 Earnings Conference Call," where you may fill in your details to RSVP.

In the 10 minutes prior to the call start time,

you may use the conference access information (including dial in number(s), direct event passcode, and registrant ID) provided in the

confirmation email received at the point of registration.

A replay of the conference call may be accessed

by phone at the following number until September 5, 2023:

United States: 1-877-344-7529

International: 1-412-317-0088

Replay Access Code: 5885022

Additionally, a live and archived webcast of this

call will be available on the Investor Relations section of Tarena's website at http://ir.tedu.cn.

About Tarena International, Inc.

Tarena is a leading provider of IT professional

education and IT-focused supplementary STEAM education services in China. Through its innovative education platform combining live distance

instruction, classroom-based tutoring and online learning modules, Tarena offers professional education courses in IT and non-IT subjects.

Its professional education courses provide students with practical skills to prepare them for jobs in industries with significant growth

potential and strong hiring demand. Tarena also offers IT-focused supplementary STEAM education programs, including computer coding and

robotics programming courses, etc., targeting students between three and eighteen years of age. Aiming to encourage "code to

learn," Tarena embraces the latest trends in STEAM education and technology to develop children's logical thinking and learning abilities

while allowing them to discover their interests and potential.

Safe Harbor Statement

This press release contains forward-looking statements

made under the "safe harbor" provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and the U.S.

Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will,"

"expects," "anticipates," "future," "intends," "plans," "believes," "estimates,"

"confident" and similar statements. Among other things, the business outlook, the quotations from management in this announcement,

as well as the Company’s strategic and operational plans contain forward-looking statements. Tarena may also make written or oral

forward-looking statements in its reports filed with or furnished to the U.S. Securities and Exchange Commission, in its annual report

to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to

third parties. Any statements that are not historical facts, including any business outlook and statements about Tarena's beliefs and

expectations, are forward-looking statements. Many factors, risks and uncertainties could cause actual results to differ materially from

those in the forward-looking statements. Such factors and risks include, but not limited to the following: the impact of the COVID-19

outbreak; Tarena's goals and strategies; its future business development, financial condition and results of operations; its ability to

continue to attract students to enroll in its courses; its ability to continue to recruit, train and retain qualified instructors and

teaching assistants; its ability to continually tailor its curriculum to market demand and enhance its courses to adequately and promptly

respond to developments in the professional job market; its ability to maintain or enhance its brand recognition, its ability to maintain

high job placement rate for its students, and its ability to maintain cooperative relationships with financing service providers for student

loans.

Further information regarding these and other

risks, uncertainties or factors is included in Tarena’s filings with the U.S. Securities and Exchange Commission. All information

provided in this press release is current as of the date of the press release, and Tarena does not undertake any obligation to update

such information, except as required under applicable law.

About Non-GAAP Financial Measures

To supplement Tarena’s consolidated financial

results presented in accordance with United States Generally Accepted Accounting Principles ("GAAP"), Tarena's management uses

non-GAAP measures of cost of revenues, operating expenses, operating income, net income, and basic and diluted net income per ADS, which

are adjusted from results based on GAAP to exclude the share-based compensation expenses. These non-GAAP financial measures should be

considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP

results. In addition, calculation of the non-GAAP financial measures may be different from the calculation used by other companies, and

therefore comparability may be limited.

Tarena’s management believes that excluding

the share-based compensation expenses provides meaningful supplemental information regarding our performance and liquidity by excluding

certain items identified as non-recurring and infrequent in nature, and non-cash charges. The amount of share-based compensation expenses

is not built into the Company’s annual budgets and quarterly forecasts, which generally will be the basis for information Tarena

provides to analysts and investors as guidance for future operating performance.

The non-GAAP financial measures are provided to

enhance investors’ overall understanding of Tarena’s current financial performance and prospects for the future. A limitation

of using non-GAAP cost of revenues, operating expenses, operating income (loss) and net income (loss), excluding the share-based compensation

expenses is that the share-based compensation charge has been and will continue to be a recurring expense in the Company’s business

for the foreseeable future. In order to mitigate the limitation, the Company has provided specific information regarding the GAAP amounts

excluded from each non-GAAP measure. The accompanying tables include details on the reconciliation between GAAP financial measures that

are most directly comparable to the non-GAAP financial measures the Company has presented.

For further information, please contact:

Investor Relations Contact:

Tarena International, Inc.

Investor Relations

E-mail: ir@tedu.cn

The Piacente Group, Inc.

In China

Yang Song

Tel: +86-10-6508-0677

E-mail: tedu@tpg-ir.com

In the U.S.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: tedu@tpg-ir.com

TARENA INTERNATIONAL, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data and per ADS

data)

| |

|

As of | |

| |

|

December 31, | | |

June 30, | | |

June 30, | |

| |

|

2022 | | |

2023 | | |

2023 | |

| |

|

Audited | | |

Unaudited | | |

Unaudited | |

| |

|

RMB | | |

RMB | | |

USD | |

| ASSETS |

|

| | |

| | |

| |

| Current assets: |

|

| | | |

| | | |

| | |

| Cash and cash equivalents |

|

| 356,237 | | |

| 280,077 | | |

| 38,624 | |

| Time deposits |

|

| 6,277 | | |

| 2,119 | | |

| 292 | |

| Restricted cash |

|

| 17,730 | | |

| 88,017 | | |

| 12,138 | |

| Accounts receivable, net of allowance for doubtful accounts |

|

| 68,733 | | |

| 20,598 | | |

| 2,841 | |

| Amounts due from related parties |

|

| 698 | | |

| 5,975 | | |

| 824 | |

| Assets held for sale |

|

| 106,539 | | |

| 106,539 | | |

| 14,692 | |

| Prepaid expenses and other current assets |

|

| 111,339 | | |

| 129,380 | | |

| 17,842 | |

| Total current assets |

|

| 667,553 | | |

| 632,705 | | |

| 87,253 | |

| Time deposits-non current |

|

| 228 | | |

| 228 | | |

| 31 | |

| Accounts receivable, net of allowance for doubtful accounts-non current |

|

| 182 | | |

| 41 | | |

| 6 | |

| Amount due from related parties-non current |

|

| 701 | | |

| 746 | | |

| 103 | |

| Property and equipment, net |

|

| 122,834 | | |

| 102,464 | | |

| 14,130 | |

| Intangible assets, net |

|

| 7,542 | | |

| 6,422 | | |

| 886 | |

| Goodwill |

|

| 52,782 | | |

| 52,782 | | |

| 7,279 | |

| Right-of-use assets |

|

| 350,501 | | |

| 273,399 | | |

| 37,703 | |

| Long-term investments, net |

|

| 46,183 | | |

| 57,878 | | |

| 7,982 | |

| Deferred income tax assets |

|

| 40,127 | | |

| 41,323 | | |

| 5,699 | |

| Other non-current assets, net |

|

| 48,867 | | |

| 58,401 | | |

| 8,055 | |

| Total assets |

|

| 1,337,500 | | |

| 1,226,389 | | |

| 169,127 | |

| |

|

| | | |

| | | |

| | |

| LIABILITIES AND EQUITY |

|

| | | |

| | | |

| | |

| Current liabilities: |

|

| | | |

| | | |

| | |

| Short-term bank loans |

|

| 52,000 | | |

| - | | |

| - | |

| Accounts payable |

|

| 6,330 | | |

| 5,815 | | |

| 802 | |

| Amounts due to related parties |

|

| 87 | | |

| 1,245 | | |

| 172 | |

| Operating lease liabilities-current |

|

| 197,969 | | |

| 128,513 | | |

| 17,723 | |

| Income taxes payable |

|

| 108,434 | | |

| 110,746 | | |

| 15,273 | |

| Deferred revenue-current |

|

| 1,688,610 | | |

| 1,635,321 | | |

| 225,521 | |

| Advance received for disposal of property |

|

| - | | |

| 93,165 | | |

| 12,848 | |

| Accrued expenses and other current liabilities |

|

| 603,516 | | |

| 644,507 | | |

| 88,882 | |

| Total current liabilities |

|

| 2,656,946 | | |

| 2,619,312 | | |

| 361,221 | |

| Deferred revenue-non current |

|

| 14,051 | | |

| 7,222 | | |

| 996 | |

| Operating lease liabilities-non current |

|

| 168,736 | | |

| 145,663 | | |

| 20,088 | |

| Other non-current liabilities |

|

| 4,448 | | |

| 4,101 | | |

| 566 | |

| Total liabilities |

|

| 2,844,181 | | |

| 2,776,298 | | |

| 382,871 | |

| Commitments and contingencies |

|

| - | | |

| - | | |

| - | |

| Deficit: |

|

| | | |

| | | |

| | |

| Class A ordinary shares |

|

| 359 | | |

| 362 | | |

| 50 | |

| Class B ordinary shares |

|

| 74 | | |

| 74 | | |

| 10 | |

| Treasury stock |

|

| (476,918 | ) | |

| (478,993 | ) | |

| (66,056 | ) |

| Additional paid-in capital |

|

| 1,363,845 | | |

| 1,365,965 | | |

| 188,375 | |

| Accumulated other comprehensive income |

|

| 49,664 | | |

| 47,964 | | |

| 6,613 | |

| Accumulated deficit |

|

| (2,436,918 | ) | |

| (2,479,624 | ) | |

| (341,956 | ) |

| Total deficit attributable to the shareholders of Tarena International, Inc. |

|

| (1,499,894 | ) | |

| (1,544,252 | ) | |

| (212,964 | ) |

| Non-controlling interest |

|

| (6,787 | ) | |

| (5,657 | ) | |

| (780 | ) |

| Total liabilities and deficit |

|

| 1,337,500 | | |

| 1,226,389 | | |

| 169,127 | |

TARENA

INTERNATIONAL, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/(LOSS)

(in thousands, except share data and per ADS data)

| | |

For the Three Months Ended

June 30 | | |

| | |

For the Six Months Ended

June 30 | | |

| |

| | |

2022 (Unaudited) | | |

2023 (Unaudited) | | |

2023 (Unaudited) | | |

2022 (Unaudited) | | |

2023 (Unaudited) | | |

2023 (Unaudited) | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| Net

revenues | |

648,817 | | |

545,012 | | |

75,161 | | |

1,272,323 | | |

930,116 | | |

128,269 | |

| Cost

of revenues(a) | |

(272,306 | ) | |

(266,301 | ) | |

(36,725 | ) | |

(536,894 | ) | |

(450,402 | ) | |

(62,113 | ) |

| Gross

profit | |

376,511 | | |

278,711 | | |

38,436 | | |

735,429 | | |

479,714 | | |

66,156 | |

| Selling

and marketing expenses(a) | |

(156,874 | ) | |

(150,999 | ) | |

(20,824 | ) | |

(329,274 | ) | |

(264,150 | ) | |

(36,428 | ) |

| General

and administrative expenses(a) | |

(158,742 | ) | |

(118,819 | ) | |

(16,386 | ) | |

(300,327 | ) | |

(250,366 | ) | |

(34,527 | ) |

| Research

and development expenses(a) | |

(12,878 | ) | |

(15,696 | ) | |

(2,165 | ) | |

(29,220 | ) | |

(30,824 | ) | |

(4,251 | ) |

| Operating

income/(loss) | |

48,017 | | |

(6,803 | ) | |

(939 | ) | |

76,608 | | |

(65,626 | ) | |

(9,050 | ) |

| Gain

on disposal of college business | |

- | | |

26,797 | | |

3,695 | | |

- | | |

26,797 | | |

3,695 | |

| Interest

income/(expense) | |

445 | | |

(153 | ) | |

(21 | ) | |

743 | | |

240 | | |

33 | |

| Other

income/(loss) | |

198 | | |

(466 | ) | |

(64 | ) | |

3,861 | | |

42 | | |

6 | |

| Foreign

exchange loss | |

(157 | ) | |

(638 | ) | |

(88 | ) | |

(242 | ) | |

(752 | ) | |

(104 | ) |

| Income/(loss)

before income taxes | |

48,503 | | |

18,737 | | |

2,583 | | |

80,970 | | |

(39,299 | ) | |

(5,420 | ) |

| Income

tax expense | |

(583 | ) | |

(10,393 | ) | |

(1,433 | ) | |

(5,981 | ) | |

(2,275 | ) | |

(314 | ) |

| Net

income/(loss) | |

47,920 | | |

8,344 | | |

1,150 | | |

74,989 | | |

(41,574 | ) | |

(5,734 | ) |

| Less:

Net income attributable to non-controlling interests | |

191 | | |

817 | | |

113 | | |

699 | | |

1,132 | | |

156 | |

| Net income/(loss) attributable

to Class A and Class B ordinary shareholders | |

47,729 | | |

7,527 | | |

1,037 | | |

74,290 | | |

(42,706 | ) | |

(5,890 | ) |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net

income/(loss) per ADS(b) | |

| | |

| | |

| | |

| | |

| | |

| |

| Basic(b) | |

4.36 | | |

0.70 | | |

0.10 | | |

6.73 | | |

(3.97 | ) | |

(0.55 | ) |

| Diluted(b) | |

4.29 | | |

0.67 | | |

0.09 | | |

6.63 | | |

(3.97 | ) | |

(0.55 | ) |

| Weighted average number of Class A and Class B

ordinary shares outstanding: | |

| | |

| | |

| | |

| | |

| | |

| |

| Basic | |

54,745,188 | | |

53,856,259 | | |

53,856,259 | | |

55,211,122 | | |

53,828,590 | | |

53,828,590 | |

| Diluted | |

55,606,533 | | |

56,198,770 | | |

56,198,770 | | |

56,011,622 | | |

53,828,590 | | |

53,828,590 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net

income/(loss) | |

47,920 | | |

8,344 | | |

1,150 | | |

74,989 | | |

(41,574 | ) | |

(5,734 | ) |

| Other

comprehensive income | |

| | |

| | |

| | |

| | |

| | |

| |

| Foreign

currency translation adjustment, net of nil income taxes | |

440 | | |

(2,109 | ) | |

(291 | ) | |

389 | | |

(1,702 | ) | |

(235 | ) |

| Comprehensive

income/(loss) | |

48,360 | | |

6,235 | | |

859 | | |

75,378 | | |

(43,276 | ) | |

(5,969 | ) |

Notes:

| (a) | Includes share-based compensation expenses as follows: |

| |

|

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| |

|

2022 | | |

2023 | | |

2023 | | |

2022 | | |

2023 | | |

2023 | |

| |

|

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| Cost of revenues |

|

| 12 | | |

| 7 | | |

| 1 | | |

| 23 | | |

| 13 | | |

| 2 | |

| Selling and marketing expenses |

|

| 152 | | |

| 68 | | |

| 9 | | |

| 296 | | |

| 136 | | |

| 19 | |

| General and administrative expenses |

|

| 689 | | |

| 638 | | |

| 88 | | |

| 1,647 | | |

| 1,489 | | |

| 205 | |

| Research and development expenses |

|

| 287 | | |

| 157 | | |

| 22 | | |

| 562 | | |

| 311 | | |

| 43 | |

TARENA INTERNATIONAL, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP MEASURES TO NON-GAAP

MEASURES

(in thousands, except share data and per ADS

data)

| | |

For the Three Months Ended June 30, | | |

For the Six Months Ended June 30, | |

| | |

2022 (Unaudited) | | |

2023 (Unaudited) | | |

2023 (Unaudited) | | |

2022 (Unaudited) | | |

2023 (Unaudited) | | |

2023 (Unaudited) | |

| | |

RMB | | |

RMB | | |

USD | | |

RMB | | |

RMB | | |

USD | |

| GAAP Cost of revenues | |

| 272,306 | | |

| 266,301 | | |

| 36,725 | | |

| 536,894 | | |

| 450,402 | | |

| 62,113 | |

| Share-based compensation expense in cost of revenues | |

| 12 | | |

| 7 | | |

| 1 | | |

| 23 | | |

| 13 | | |

| 2 | |

| Non-GAAP Cost of revenues | |

| 272,294 | | |

| 266,294 | | |

| 36,724 | | |

| 536,871 | | |

| 450,389 | | |

| 62,111 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP Selling and marketing expenses | |

| 156,874 | | |

| 150,999 | | |

| 20,824 | | |

| 329,274 | | |

| 264,150 | | |

| 36,428 | |

| Share-based compensation expense in selling and marketing expenses | |

| 152 | | |

| 68 | | |

| 9 | | |

| 296 | | |

| 136 | | |

| 19 | |

| Non-GAAP Selling and marketing expenses | |

| 156,722 | | |

| 150,931 | | |

| 20,815 | | |

| 328,978 | | |

| 264,014 | | |

| 36,409 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP General and administrative expenses | |

| 158,742 | | |

| 118,819 | | |

| 16,386 | | |

| 300,327 | | |

| 250,366 | | |

| 34,527 | |

| Share-based compensation expense in general and administrative expenses | |

| 689 | | |

| 638 | | |

| 88 | | |

| 1,647 | | |

| 1,489 | | |

| 205 | |

| Non-GAAP General and administrative expenses | |

| 158,053 | | |

| 118,181 | | |

| 16,298 | | |

| 298,680 | | |

| 248,877 | | |

| 34,322 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| GAAP Research and development expenses | |

| 12,878 | | |

| 15,696 | | |

| 2,165 | | |

| 29,220 | | |

| 30,824 | | |

| 4,251 | |

| Share-based compensation expense in research and development expenses | |

| 287 | | |

| 157 | | |

| 22 | | |

| 562 | | |

| 311 | | |

| 43 | |

| Non-GAAP Research and development expenses | |

| 12,591 | | |

| 15,539 | | |

| 2,143 | | |

| 28,658 | | |

| 30,513 | | |

| 4,208 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating income/(loss) | |

| 48,017 | | |

| (6,803 | ) | |

| (939 | ) | |

| 76,608 | | |

| (65,626 | ) | |

| (9,050 | ) |

| Share-based compensation expenses | |

| 1,140 | | |

| 870 | | |

| 120 | | |

| 2,528 | | |

| 1,949 | | |

| 269 | |

| Non-GAAP Operating income/(loss) | |

| 49,157 | | |

| (5,933 | ) | |

| (819 | ) | |

| 79,136 | | |

| (63,677 | ) | |

| (8,781 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income/(loss) | |

| 47,920 | | |

| 8,344 | | |

| 1,150 | | |

| 74,989 | | |

| (41,574 | ) | |

| (5,734 | ) |

| Share-based compensation expenses | |

| 1,140 | | |

| 870 | | |

| 120 | | |

| 2,528 | | |

| 1,949 | | |

| 269 | |

| Non-GAAP Net income/(loss) | |

| 49,060 | | |

| 9,214 | | |

| 1,270 | | |

| 77,517 | | |

| (39,625 | ) | |

| (5,465 | ) |

| Less: Net income attributable to non-controlling interests | |

| 191 | | |

| 817 | | |

| 113 | | |

| 699 | | |

| 1,132 | | |

| 156 | |

| Non-GAAP net income/(loss) attributable to Class A and

Class B ordinary shareholders | |

| 48,869 | | |

| 8,397 | | |

| 1,157 | | |

| 76,818 | | |

| (40,757 | ) | |

| (5,621 | ) |

| Non-GAAP net income/(loss) per ADS(b) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic(b) | |

| 4.46 | | |

| 0.78 | | |

| 0.11 | | |

| 6.96 | | |

| (3.79 | ) | |

| (0.52 | ) |

| Diluted(b) | |

| 4.39 | | |

| 0.75 | | |

| 0.10 | | |

| 6.86 | | |

| (3.79 | ) | |

| (0.52 | ) |

| Weighted average number of ordinary shares outstanding used in calculating Non-GAAP net loss per ADS(c) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 54,745,188 | | |

| 53,856,259 | | |

| 53,856,259 | | |

| 55,211,122 | | |

| 53,828,590 | | |

| 53,828,590 | |

| Diluted | |

| 55,606,533 | | |

| 56,198,770 | | |

| 56,198,770 | | |

| 56,011,622 | | |

| 53,828,590 | | |

| 53,828,590 | |

Notes:

| (a) | There was no tax impact of share-based compensation expenses for the second quarter of 2023 and 2022,

respectively. |

| (b) | The Non-GAAP net income/(loss) per ADS is computed using Non-GAAP net income/(loss) attributable to ordinary

shareholders and the same number of ordinary shares are used in GAAP basic and diluted net income/(loss) per ADS calculation. |

| (c) | Each ADS represents five Class A ordinary shares. |

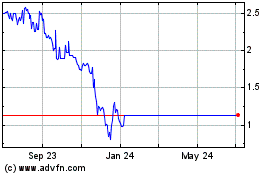

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From Apr 2024 to May 2024

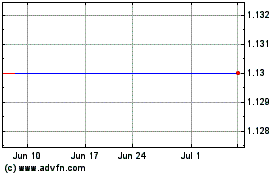

Tarena (NASDAQ:TEDU)

Historical Stock Chart

From May 2023 to May 2024