Current Report Filing (8-k)

June 07 2022 - 4:02PM

Edgar (US Regulatory)

false 0001701108 0001701108 2022-06-07 2022-06-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 7, 2022

SPERO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38266 |

|

46-4590683 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 675 Massachusetts Avenue, 14th Floor Cambridge, Massachusetts |

|

02139 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (857) 242-1600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

SPRO |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| Item 1.02. |

Termination of a Material Definitive Agreement. |

As previously disclosed, on September 29, 2021, Spero Therapeutics, Inc. (the “Company”) entered into a Revenue Interest Financing Agreement (the “Revenue Interest Agreement”) with certain entities managed by Healthcare Royalty Management, LLC (“HCR”), pursuant to which the Company sold to HCR the right to receive certain royalty payments from the Company for a purchase price of up to $125 million. Also as previously disclosed, on September 29, 2021, the Company entered into a Security Agreement (the “Security Agreement,” and together with the Revenue Interest Agreement, the “HCR Agreements”) with HCR Collateral Management, LLC, as collateral agent for HCR under the Revenue Interest Agreement (the “Secured Party”). Pursuant to the Security Agreement, the Company, among other things, granted HCR a first-priority blanket lien on tebipenem HBr (“Tebi”) assets, including Tebi patent rights, Tebi regulatory approvals and Tebi material contracts, as well as future cash receipts relating to product sales.

On June 7, 2022, the Company entered into a Revenue Interest Termination Agreement (the “Termination Agreement”) with HCR and the Secured Party, pursuant to which the parties mutually terminated the HCR Agreements and certain other related ancillary agreements, arrangements or understandings under or contemplated by the HCR Agreements. Pursuant to the Termination Agreement, the Company will make a one-time cash payment of $54 million in consideration for, among certain other things, the termination of the HCR Agreements, the reversion of all rights transferred thereunder and the termination and release of all liens and security interests granted thereunder.

The foregoing summaries of the HCR Agreements and the Termination Agreement, and the transactions contemplated thereby, do not purport to be complete and are subject to, and qualified in their entirety by, the full text of the HCR Agreements and the Termination Agreement. Copies of the HCR Agreements were filed as Exhibits 10.1 and 10.2, respectively, in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on September 30, 2021, each of which is incorporated herein by reference. A copy of the Termination Agreement is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

| * |

Portions of exhibit have been omitted for confidentiality purposes. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SPERO THERAPEUTICS, INC. |

|

|

|

|

| Date: June 7, 2022 |

|

|

|

By: |

|

/s/ Tamara Joseph |

|

|

|

|

|

|

Tamara Joseph |

|

|

|

|

|

|

Chief Legal Officer |

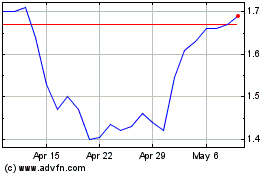

Spero Therapeutics (NASDAQ:SPRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spero Therapeutics (NASDAQ:SPRO)

Historical Stock Chart

From Apr 2023 to Apr 2024