As filed with the Securities and Exchange Commission on March 15, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SUPER LEAGUE ENTERPRISE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

47-1990734

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

2912 Colorado Ave., Suite #203

Santa Monica, California 90404

(213) 421-1920

(Address, including zip code, and telephone number, including

area code of registrant’s principal executive offices)

Ann Hand

Chief Executive Officer

Super League Enterprise, Inc.

2912 Colorado Ave., Suite #203

Santa Monica, California 90404

(213) 421-1920

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

|

Ann Hand

Chief Executive Officer

Super League Enterprise, Inc.

2912 Colorado Ave., Suite #203

Santa Monica, California 90404

(213) 421-1920

|

Daniel W. Rumsey, Esq.

Jack Kennedy, Esq.

Disclosure Law Group, a Professional Corporation

655 West Broadway, Suite 870

San Diego, CA 92101

(619) 272-7050

|

As soon as practicable after this registration statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

| |

Emerging growth company

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

|

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

|

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

|

DATED March 15, 2024

|

16,003,844 SHARES OF COMMON STOCK

This prospectus relates to the resale from time to time of up to 16,003,844 shares of our common stock, par value $0.001 per share (“Common Stock”), by the selling stockholders identified herein (collectively, with any of such stockholders’ transferees, pledgees, assignees, distributees, donees or successors-in-interest, the “Selling Stockholders”). The shares of Common Stock being registered hereunder include (A) shares of Common Stock issuable upon conversion of (i) 8,438 shares of Series AAA Convertible Preferred Stock, par value $0.001 per share and (ii) 4,656 shares of Series AAA-2 Convertible Preferred Stock, par value $0.001 per share (collectively, the “Conversion Shares”); (B) shares of Common Stock issuable as dividends on shares of the Series AAA Preferred Stock and AAA-2 Preferred Stock (the “Dividend Shares”); and (C) shares of Common Stock issued to three institutional investors in connection with certain piggyback registration rights (the “Piggyback Shares” and, collectively with the Conversion Shares and the Dividend Shares, the “Securities”). For additional information on the Securities, see the sections titled “The Private Placement and Exchange” and “The Piggyback Shares.”

We will not receive any proceeds from the resale of the Securities by the Selling Stockholders in this offering. All selling and other expenses incurred by the Selling Stockholders will be paid by such stockholders, except for certain legal fees and expenses, which will be paid by us. The Selling Stockholders may sell, transfer or otherwise dispose of any or all of the Securities offered by this prospectus from time to time on The Nasdaq Capital Market or any other stock exchange, market, or trading facility on which the shares are traded, or in private transactions. The Securities may be offered and sold or otherwise disposed of by the Selling Stockholders at fixed prices, market prices prevailing at the time of sale, prices related to prevailing market prices, or privately negotiated prices. Refer to the section entitled “Plan of Distribution” for more information regarding how the Selling Stockholders may offer, sell, or dispose of their Securities.

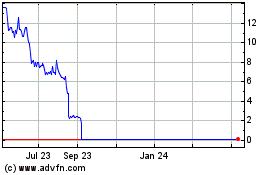

Our Common Stock is listed on The Nasdaq Capital Market, which we sometimes refer to herein as “Nasdaq,” under the symbol “SLE.” The last reported sale price of our Common Stock on March 14, 2024 was $1.77 per share.

Investing in these securities involves a high degree of risk. Refer to the section entitled “Risk Factors” on page 6 of this prospectus and in the documents incorporated by reference herein for a discussion of the factors you should carefully consider before deciding to invest in our securities.

Neither the Securities and Exchange Commission (the “Commission”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

1 |

|

THE OFFERING

|

4 |

|

RISK FACTORS

|

6 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

7 |

|

USE OF PROCEEDS

|

9 |

|

SELLING STOCKHOLDERS

|

10 |

|

PLAN OF DISTRIBUTION

|

15 |

|

DESCRIPTION OF OUR CAPITAL STOCK

|

16 |

|

DIVIDEND POLICY

|

32 |

|

EXECUTIVE OFFICERS, DIRECTORS AND CORPORATE GOVERNANCE

|

33 |

|

EXECUTIVE COMPENSATION

|

41 |

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

51 |

|

LEGAL MATTERS

|

52 |

|

EXPERTS

|

52 |

|

WHERE YOU CAN FIND MORE INFORMATION

|

52 |

PROSPECTUS SUMMARY

This summary highlights information contained in this prospectus, or incorporated by reference into this prospectus, and does not contain all of the information that you should consider in making your investment decision. Before investing in our Common Stock, you should carefully read this entire prospectus, including the information set forth under the section entitled “Risk Factors,” as well as our financial statements, the related notes thereto, and other information incorporated by reference into this prospectus. Some of the statements in this prospectus and the information incorporated by reference into this prospectus constitute forward-looking statements. For additional information, refer to the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Unless the context requires otherwise, the words “we,” “us,” “our,” the “Company,” “Super League,” and “Super League Enterprise” refer to Super League Enterprise, Inc., a Delaware corporation, and its wholly owned subsidiaries, Mobcrush Streaming, Inc., a Delaware corporation, and Super League Gaming, UK Ltd., a company organized under the laws of England and Wales.

Overview

Super League Enterprise, Inc. (Nasdaq: SLE), is a leading strategically-integrated publisher and creator of games and experiences across the world’s largest immersive digital platforms. From metaverse gaming powerhouses such as Roblox, Minecraft and Fortnite, to the most popular Web3 environments such as Sandbox and Decentraland, to bespoke worlds built using the most advanced 3D creation tools, Super League’s innovative solutions provide incomparable access to massive audiences who gather in immersive digital spaces to socialize, play, explore, collaborate, shop, learn and create. As a true end-to-end activation partner for dozens of global brands, Super League offers a complete range of development, distribution, monetization and optimization capabilities designed to engage users through dynamic, energized programs. As an originator of new experiences fueled by a network of top developers, a comprehensive set of proprietary creator tools and a future-forward team of creative professionals, Super League accelerates IP and audience success within the fastest growing sector of the media industry.

Our Strategy

We believe that virtual world platforms are where the next generation lives and are a launchpad of unlimited new interactive worlds and content. In a world of blended physical-to-digital lives and smarter, more immersive screens, consumer expectations are increasing for more customized and personalized digital experiences, changing the way consumers will socialize, play, create, collaborate, shop, learn and work.

While our roots are in open gaming platforms where interactive worlds were first spawned, we believe our success is in the creation, growth, and monetization of digital experiences across the wider immersive web landscape. Super League’s vision is to build the most comprehensive immersive web publishing engine and be the driver of the next generation of digital platform businesses and experiences.

Built on a powerful foundation of unmatched capabilities, solutions and software platforms that have driven consistent success for innovative brand experiences, creator growth and monetization, and significant consumer engagement, our scalable, vertically-integrated engine offers:

| |

●

|

Successful owned and third-party publishing worlds, experiences and destinations;

|

| |

●

|

Innovative marketing solutions for brands and developers; and

|

| |

●

|

Valued tools and services for creators and developers.

|

Our Business

As an early mover creating engaging experiences inside of metaverse, or “open world,” game platforms since 2015, Super League has converted our deep understanding of young gamers into significant audience reach in virtual world gaming platforms. We believe we have successfully iterated our business model through these market insights, and our organic and inorganic growth to establish scale and ultimately drive our monetization strategies. Our strong and growing product-market fit currently reaches over 100 million monthly unique players in Roblox, Minecraft and Fortnite and generates over one billion monthly impressions. Our software supports the creation and operation of our owned and third-party metaverse gaming worlds and experiences, along with creator tools and analytics underpinned by a creator economy. These tools enable Super League to access these extended audiences with our innovative in-game and in-stream ad products, and allow our game designers and content creators to participate in our advertising economy. Our analytics suite provides Super League, brands and advertisers, and game developers data that informs campaign measurement and insights, along with enhanced game design. Beyond our primary advertising revenue stream, we have the opportunity to extend further downstream in the metaverse gaming worlds we operate and generate direct to consumer revenues. In addition, our platform, and our capability to produce compelling gaming-centric video and livestream broadcasts drives viewership to our own and our brand partner’s digital channels and generates content production and syndication revenues from third party partners.

Specifically, Super League’s digital experience and media products provide a wide range of solutions for brands and advertisers. From branded in-game experiences, through to custom content and media, Super League can provide end-to-end solutions for brands to acquire customers, deepen brand affinity and deliver campaign performance with innovative advertising inventory. As Super League has scaled in both metaverse player and viewing audience reach, we have experienced growth in both the average revenue size of advertiser programs, along with a strong percentage of repeat buyers, while upholding our premium cost per impressions (“CPM”) advertising rates and margins, further validating a new premium social marketing channel for advertisers to reach elusive Generation Z and Alpha gamers. Additionally, our capability and proprietary technology is now being applied to new virtual world platforms beyond our core offering and is proving to be an enterprise solution for our owned and branded digital experiences that are less temporal and campaign-centric, generating revenue opportunities that are more diversified, annual in nature and less impacted by traditional advertising seasonality.

The Private Placement and Exchange

On November 6, 2023, the Company entered into a Placement Agency Agreement (the “Placement Agency Agreement”) with a registered broker dealer, which acted as the Company’s exclusive placement agent (the “Placement Agent”), pursuant to which the Company entered into subscription agreements between November 30, 2023 and December 22, 2023 (each, a “Subscription Agreement” and collectively, the “Subscription Agreements”) with accredited investors relating to an offering (the “Offering” or “Private Placement”) with respect to the sale of an aggregate of (i) 5,377 shares of newly designated Series AAA Convertible Preferred Stock, par value $0.001 per share (the “Series AAA Preferred”) and (ii) 2,978 shares of newly designated Series AAA-2 Convertible Preferred Stock, par value $0.001 per share (the “Series AAA-2 Preferred” and collectively with the Series AAA Preferred, the “Series AAA Stock”), at a purchase price of $1,000 per share, for aggregate gross proceeds to the Company of approximately $8,355 million.

Pursuant to the terms of the Placement Agency Agreement, the Company paid the Placement Agent an aggregate cash fee of $835,500, a non-accountable expense allowance of $167,100 , and will issue to the Placement Agent or its designees warrants to purchase an aggregate of 718,270 shares of Common Stock in connection with the Offering (the “Placement Agent Warrants”), including 465,750 warrants with an exercise price of $1.674 per share and 252,520 warrants with an exercise price of $1.71 per share.

Also pursuant to the Placement Agency Agreement on November 30, 2023 and December 22, 2023, the Company entered into certain Series A Exchange Agreements (the “Series A Agreement”) and Series AA Exchange Agreements (the “Series AA Agreement”, and collectively with the Series A Agreement, the “Exchange Agreements”), with certain holders (the “Holders”) of the Company’s Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred”), and Series AA Convertible Preferred Stock, par value $0.001 per share (“Series AA Preferred”), pursuant to which the Holders exchanged an aggregate of 6,367 shares of Series A Preferred and/or Series AA Preferred, for an aggregate of 6,367 shares of Series AAA Preferred (the “Exchange”). Additional Investment Rights shall also be granted with respect to shares of Series AAA Preferred issued in the Exchange. The Exchange closed concurrently with the closing of the Subscription Agreements.

With respect to shares of Series AAA Preferred Stock issued in the Exchange, the Placement Agent exchanged previously issued placement agent warrants to purchase an 88,403 shares of Common Stock of the Company that were issued in connection with the Series A and Series AA Preferred Stock financings of the Company, at exercise prices ranging from $7.60 to $13.41 per share, for new Placement Agent Warrants to purchase (i) a total of 347,428 shares of Common Stock at an exercise price of $1.674 per share and (ii) a total of 199,778 shares of Common Stock at an exercise price of $1.71 per share.

The Company and the investors in the Offering executed a registration rights agreement (the “Registration Rights Agreement”), pursuant to which the Company agreed to file a registration statement, of which this prospectus forms a part, covering the resale of: (A) 150% of the shares of Common Stock issuable upon the conversion of the Series AAA Stock at the initial exercise price set forth in the applicable Certificate of Designation of Preferences, Powers and Rights (“Certificate of Designations”) of each series (the “Conversion Shares”); (B) the shares of Common Stock issuable as payment of dividends on the Series AAA Stock (the "Dividend Shares”, and collectively with the Conversion Shares, the “Securities”), within sixty days following the final closing of the Offering and to use its best efforts to cause such registration statement to become effective within 90 days of the filing date.

The foregoing description of the Form of Subscription Agreement, Form of Registration Rights Agreement, Form of Series A Exchange Agreement, Form of Series AA Exchange Agreement and Form of Placement Agent Warrants are qualified in their entirety by reference to the full text of such documents, copies of which are filed as Exhibit 10.1, Exhibit 10.2, Exhibit 10.3, Exhibit 10.4 and Exhibit 10.5, respectively, to the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”) on December 6, 2023. The foregoing description of the Placement Agency Agreement is qualified in its entirety by reference to the full text of such document, a copy of which is filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on December 22, 2023.

A copy of the Certificate of Designation of Preferences, Rights and Limitations of Series AAA Preferred Stock is filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the Commission on December 6, 2023. A copy of the Certificate of Designation of Preferences, Rights and Limitations of Series AA-2 Preferred Stock is filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the Commission on December 22, 2023.

The Piggyback Shares

On May 16, 2022, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with three institutional investors (collectively, the “Note Holders”) providing for the sale and issuance of a new series of senior secured convertible notes in the aggregate original principal amount of $4,320,000, of which 8% is an original issue discount (each, a “Note,” and, collectively, the “Notes,” and such financing, the “Note Offering”). All principal outstanding on the Note was repaid in full on January 3,2023, and all outstanding interest was paid in full on February 22, 2023.

On March 12, 2024, the Company and the Note Holders entered into that certain Mutual General Release and Settlement Agreement (the “Mutual Release”) with the Note Holders, whereby the Company, among other things, issued the Piggyback Shares to the Note Holders in consideration of the mutual release of all claims between the Company and the Note Holders related to the Purchase Agreement. Pursuant to the terms of the Mutual Release, the Company is registering the Piggyback Shares for resale in this Registration Statement on Form S-3.

The foregoing description of the Mutual Release is qualified in its entirety by reference to the full text of such document, a copy of which is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the SEC on March 15, 2024. The foregoing descriptions of the Securities Purchase Agreement and Note are qualified in their entirety by reference to the full text of such documents, copies of which are filed as Exhibit 10.1, Exhibit 10.2 and Exhibit 10.3, respectively, to the Company’s Current Report on Form 8-K, filed with the Commission on May 16, 2022.

Risk Factors

Our business is subject to substantial risk. Please carefully review the section entitled “Risk Factors” beginning on page 6 of this prospectus for a discussion of the factors you should carefully consider before deciding to purchase the securities offered by this prospectus.

Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. You should be able to bear a complete loss of your investment.

Impact of COVID-19 Pandemic

The novel coronavirus and actions taken to mitigate the spread of it have had and may continue to have an adverse impact on the economies and financial markets of many countries, including the geographical areas in which the Company operates. It is unknown how long the adverse conditions associated with the coronavirus will last and what the complete financial effect will be to the Company. Although we were impacted by the general deferral in advertising spending by brands and sponsors resulting from the COVID-19 pandemic for a significant portion of the year ended December 31, 2020 (“Fiscal Year 2020”), we reported significant quarter over quarter growth in revenue in the second half of Fiscal Year 2020, the year ended December 31, 2021, and the year ended December 31, 2022, and we expect to continue to expand our advertising revenue in future periods, as we continue to expand our advertising inventory, viewership and related sales activities. Notwithstanding the growth in revenues and in user engagement metrics discussed herein, the broader impact of the ongoing COVID-19 pandemic on our results of operations and overall financial performance remains uncertain. The pandemic may continue to impact our revenue and revenue growth in future periods and is likely to continue to adversely impact certain aspects of our business and our partners, including advertising demand, retail expansion plans and our in-person electronic video game sports (“esports”) experiences.

Corporate Information

Super League Enterprise, Inc. was incorporated under the laws of the State of Delaware on October 1, 2014 as Nth Games, Inc. On June 15, 2015, we changed our corporate name from Nth Games, Inc. to Super League Gaming, Inc., and on September 11, 2023, we change our corporate name from Super League Gaming, Inc. to Super League Enterprise, Inc. Our principal executive offices are located at 2912 Colorado Avenue, Suite #203, Santa Monica, California 90404. Our Company telephone number is (213) 421-1920 and our investor relations contact number is (949) 574-3860.

Our corporate website address is www.superleague.com. Information contained in, or accessible through, our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

|

THE OFFERING

|

| |

|

|

|

Shares of Common Stock offered by the Selling Stockholders

|

|

Up to 16,003,844 shares of Common Stock.

|

| |

|

|

|

Shares of Common Stock outstanding prior to this offering

|

|

5,358,708 shares.

|

| |

|

|

|

Shares of Common Stock to be outstanding after this offering

|

|

21,362,592 shares of Common Stock, taking into consideration the conversion of the Securities.

|

| |

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the resale of the Securities by the Selling Stockholders in this offering. For additional information, refer to the section entitled “Use of Proceeds.”

|

| |

|

|

|

Terms of this offering

|

|

The Selling Stockholders may sell, transfer or otherwise dispose of any or all of the Securities offered by this prospectus from time to time on Nasdaq or any other stock exchange, market or trading facility on which the shares are traded, or in private transactions. The Securities may be offered and sold or otherwise disposed of by the Selling Stockholders at fixed prices, market prices prevailing at the time of sale, prices related to prevailing market prices, or privately negotiated prices.

|

| |

|

|

|

Nasdaq symbol

|

|

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “SLE.”

|

| |

|

|

|

Risk factors

|

|

Investing in our Common Stock involves a high degree of risk. You should carefully review the risks and uncertainties described in or incorporated by reference under the section entitled “Risk Factors” in this prospectus, the documents we have incorporated by reference herein, and under similar headings in other documents filed after the date hereof and incorporated by reference into this prospectus. For additional information, refer to the sections entitled “Incorporation of Certain Information by Reference” and “Where You Can Find More Information.”

|

Unless otherwise noted, the number of shares of our Common Stock outstanding prior to and after this offering is based on 5,358,708 shares of Common Stock outstanding as of February 20, 2024, and excludes:

| |

●

|

750,684 shares of Common Stock issuable upon the exercise of outstanding warrants to purchase our Common Stock, with a weighted average exercise price of $4.03 per share;

|

| |

|

|

| |

●

|

395,364 shares of Common Stock issuable upon exercise of outstanding stock options under our Amended and Restated 2014 Stock Option and Incentive Plan (the “2014 Plan”), with a weighted average exercise price of $15.71 per share;

|

| |

|

|

| |

●

|

87,919 shares of Common Stock reserved for future issuance pursuant to the 2014 Plan;

|

| |

|

|

| |

●

|

280,941 shares of Common Stock issuable upon vesting of outstanding restricted stock units;

|

| |

|

|

| |

●

|

788,484 shares of Common Stock issuable upon the exercise of certain placement agent warrants to purchase our Common Stock, with a weighted average exercise price of $4.34;

|

| |

|

|

| |

●

|

11,584,417 shares of Common Stock issuable upon the conversion of the Company’s Series A Preferred Stock, Series A-2 Preferred Stock, Series A-3 Preferred Stock, Series A-4 Preferred Stock, Series A-5 Preferred Stock, Series AA Preferred Stock, Series AA-2 Preferred Stock, Series AA-3 Preferred Stock, Series AA-4 Preferred Stock, Series AA-5 Preferred Stock, Series AAA Preferred Stock, and Series AAA-2 Preferred Stock; and

|

| |

|

|

| |

●

|

500,000 shares of Common Stock issued as the Piggyback Shares to the Note Holders on March 12, 2024.

|

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to purchase any of our securities, you should carefully consider the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and our other filings with the SEC, all of which are incorporated by reference herein. If any of these risks actually occur, our business, financial condition and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks occur, the trading price of our Common Stock could decline materially and you could lose all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections of this prospectus entitled “Prospectus Summary” and “Risk Factors,” as well as in those sections of our Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Annual Report”) entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere in this prospectus. In some cases, you can identify forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” or “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for making each forward-looking statement contained in this prospectus, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. Forward-looking statements are subject to considerable risks and uncertainties, as well as other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements, including:

| |

●

|

the overall strength and stability of general economic conditions and of the esports industry in the United States and globally;

|

| |

●

|

changes in consumer demand for, and acceptance of, our services and the games that we license for our tournaments and other experiences, as well as online gaming in general;

|

| |

●

|

changes in the competitive environment, including adoption of technologies, services and products that compete with our own;

|

| |

●

|

our ability to generate consistent revenue;

|

| |

●

|

our ability to effectively execute our business plan;

|

| |

●

|

changes in the price of streaming services, licensing fees, and network infrastructure, hosting and maintenance;

|

| |

●

|

changes in laws or regulations governing our business and operations;

|

| |

●

|

our ability to maintain adequate liquidity and financing sources and an appropriate level of debt on terms favorable to us;

|

| |

●

|

our ability to effectively market our services;

|

| |

●

|

costs and risks associated with litigation;

|

| |

●

|

our ability to obtain and protect our existing intellectual property protections, including patents, trademarks and copyrights;

|

| |

●

|

our ability to obtain and enter into new licensing agreements with game publishers and owners;

|

| |

●

|

changes in accounting principles, or their application or interpretation, and our ability to make estimates and the assumptions underlying the estimates, which could have an effect on earnings;

|

| |

●

|

interest rates and the credit markets; and

|

| |

●

|

other risks and uncertainties, including those described within the section entitled “Risk Factors” in our 2022 Annual Report, and subsequent Quarterly Reports on Form 10-Q, which risk factors are incorporated herein by reference.

|

This list of factors that may affect future performance and the accuracy of forward-looking statements is illustrative, but not exhaustive. New risk factors and uncertainties not described here or elsewhere in this prospectus, including in the section entitled “Risk Factors,” may emerge from time to time. Moreover, because we operate in a competitive and rapidly changing environment, it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. The forward-looking statements are also subject to the risks and uncertainties specific to our Company, including but not limited to the fact that we have only a limited operating history as a public company. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

You should read this prospectus, any prospectus supplement and the documents incorporated herein and those documents filed as exhibits to the registration statement, of which this prospectus is a part, with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect.

USE OF PROCEEDS

The Securities registered under this prospectus may be resold from time to time by the Selling Stockholders. Accordingly, we will not receive proceeds from any resale of the Securities in this offering. We will pay all of the fees and expenses incurred by us in connection with this registration. All selling and other expenses incurred by the Selling Stockholders will be paid by such stockholders, except for certain legal fees and expenses, which will be paid by us.

SELLING STOCKHOLDERS

This prospectus relates to the resale by the Selling Stockholders identified in the table below, or by the future transferees, pledgees, assignees, distributees, donees or successors-in-interest of or from any such stockholders, of the Securities. The Selling Stockholders may, from time to time, offer and sell pursuant to this prospectus any or all of the Securities, or they may sell none of the Securities. We currently have no agreements, arrangements or understandings with the Selling Stockholders regarding the resale of any of the Securities.

Between November 30, 2023 and December 22, 2023, we entered into subscription agreements and exchange agreements with accredited investors relating to an offering and the sale of:

| |

●

|

8,438 shares of Series AAA Preferred (for which we are registering 10,330,529 shares of Common Stock as conversion shares), with an initial conversion price of $1.674 per share; and

|

| |

●

|

4,656 shares of Series AAA-2 Preferred (for which we are registering 5,173,355 shares of Common Stock as conversion shares), with an initial conversion price of $1.71 per share.

|

In connection with the Private Placement, we have agreed to file this registration statement covering the resale of 150% of the shares of Common Stock initially underlying the Series AAA Preferred and Series AAA-2 Preferred sold in the offering, as determined based upon the initial exercise price in each respective Certificate of Designations, together with the Dividend Shares issuable thereon.

The Series AAA Preferred and Series AAA-2 Preferred contain limitations that prevent the holder thereof from acquiring shares upon conversion that would result in the number of shares beneficially owned by it and its affiliates exceeding 4.99% of all of the Common Stock outstanding at such time (or, at the written election of any holder of Series AAA Stock delivered to the Company pursuant to the terms of the applicable Certificate of Designations prior to the issuance of any shares of Series AAA Stock, 9.99%). The number of shares in the third column reflects this limitation.

On March 12, 2024, we issued the Piggyback Shares to the Note Holders pursuant to the Mutual Release. Pursuant to the Mutual Release Agreement, we agreed to file this registration statement covering the resale of the Piggyback Shares, as reflected in the column in the table below titled “Piggyback Shares.”

The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

The following table is prepared based on information supplied to us by the Selling Stockholders. Unless otherwise indicated below, none of the Selling Stockholders nor any of their affiliates has held a position or office, or had any other material relationship, with us or any of our predecessors or affiliates.

| |

|

|

|

Conversion Shares

Offered for Resale

Pursuant to this Prospectus

|

|

Dividend Shares

Offered

for Resale Pursuant

to this Prospectus (5)

|

|

Piggyback Shares Offered for Resale Pursuant to this Prospectus

|

|

Shares Beneficially

Owned After the

Offering (6)(7)

|

|

Name of Selling Stockholder (1)

|

|

Shares

Beneficially

Owned Prior

to Offering

(2)

|

|

Series AAA Conversion Shares (3)

|

|

Series AAA-2 Conversion Shares (4)

|

|

Dividend Shares

(Year 1)

|

|

Dividend Shares

(Year 2)

|

|

|

Number

|

|

Percent

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3i, LP (8)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

250,000

|

|

-

|

|

-

|

|

|

Ashok & Harshida Patel

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Adam Pollack

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Albemarle Shoals Fund, LLC (9)

|

|

221,111

|

|

-

|

|

174,561

|

|

23,275

|

|

23,275

|

|

|

|

-

|

|

-

|

|

|

Albert Gentile and Hiedi Gentile

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Anthony Intenzo

|

|

111,112

|

|

-

|

|

87,720

|

|

11,696

|

|

11,696

|

|

|

|

-

|

|

-

|

|

|

Antonio Piraino

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Barry Shemaria

|

|

17,026

|

|

13,442

|

|

-

|

|

1,792

|

|

1,792

|

|

|

|

-

|

|

-

|

|

|

Bary W. Pollack

|

|

28,890

|

|

-

|

|

22,808

|

|

3,041

|

|

3,041

|

|

|

|

-

|

|

-

|

|

|

BN Leis Consultant Inc (10)

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

BPY Limited (11)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

100,000

|

|

-

|

|

-

|

|

|

Brad Clayton & Jennifer Clayton

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Bradley Karp and Belinda Karp

|

|

227,001

|

|

179,211

|

|

-

|

|

23,895

|

|

23,895

|

|

|

|

-

|

|

-

|

|

|

Brett Newman

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Brian Kent Langham

|

|

43,130

|

|

34,050

|

|

-

|

|

4,540

|

|

4,540

|

|

|

|

-

|

|

-

|

|

|

Bruce P Inglis and Nancy M Inglis Jtwros

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Bruce Rogers

|

|

22,222

|

|

-

|

|

17,544

|

|

2,339

|

|

2,339

|

|

|

|

-

|

|

-

|

|

|

Burt Stangarone

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Cage S. Johnson 2016 Trust (12)

|

|

28,890

|

|

-

|

|

22,808

|

|

3,041

|

|

3,041

|

|

|

|

-

|

|

-

|

|

|

Carlyle C Eubank II

|

|

33,334

|

|

-

|

|

26,316

|

|

3,509

|

|

3,509

|

|

|

|

-

|

|

-

|

|

|

Cheryl Hintzen

|

|

27,778

|

|

-

|

|

21,930

|

|

2,924

|

|

2,924

|

|

|

|

-

|

|

-

|

|

|

Christoper P. Wood

|

|

22,699

|

|

17,921

|

|

-

|

|

2,389

|

|

2,389

|

|

|

|

-

|

|

-

|

|

|

Christopher and Denise Blum JTWROS

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Christopher Hayes

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Christopher Reynolds and Linda Seyfert

|

|

11,112

|

|

-

|

|

8,772

|

|

1,170

|

|

1,170

|

|

|

|

-

|

|

-

|

|

|

Clayton Struve

|

|

567,503

|

|

448,029

|

|

-

|

|

59,737

|

|

59,737

|

|

|

|

-

|

|

-

|

|

|

Clifford Augspurger

|

|

55,556

|

|

-

|

|

43,860

|

|

5,848

|

|

5,848

|

|

|

|

-

|

|

-

|

|

|

Dale Myer

|

|

66,668

|

|

-

|

|

52,632

|

|

7,018

|

|

7,018

|

|

|

|

-

|

|

-

|

|

|

Daniel B. Salvas

|

|

27,778

|

|

-

|

|

21,930

|

|

2,924

|

|

2,924

|

|

|

|

-

|

|

-

|

|

|

David & Janet Snazuk Jtwros

|

|

111,112

|

|

-

|

|

87,720

|

|

11,696

|

|

11,696

|

|

|

|

-

|

|

-

|

|

|

David Goldhagen

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Debra Reuben Trust (13)

|

|

66,668

|

|

-

|

|

52,632

|

|

7,018

|

|

7,018

|

|

|

|

-

|

|

-

|

|

|

Dennis and Jane Jones

|

|

111,112

|

|

-

|

|

87,720

|

|

11,696

|

|

11,696

|

|

|

|

-

|

|

-

|

|

|

Don Quinn

|

|

277,779

|

|

-

|

|

219,299

|

|

29,240

|

|

29,240

|

|

|

|

-

|

|

-

|

|

|

Donald P. Sesterhenn

|

|

51,075

|

|

40,323

|

|

-

|

|

5,376

|

|

5,376

|

|

|

|

-

|

|

-

|

|

|

Douglas S. Gannett Gift Trust No. 1 (14)

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Dr. Erich Weidenbener

|

|

170,251

|

|

134,409

|

|

-

|

|

17,921

|

|

17,921

|

|

|

|

-

|

|

-

|

|

|

Dr. Peggy Garjian

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

E. Michael Pompizzi

|

|

29,510

|

|

23,298

|

|

-

|

|

3,106

|

|

3,106

|

|

|

|

-

|

|

-

|

|

|

Edward W. Golebiewski III

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Edward Wavak

|

|

166,667

|

|

-

|

|

131,579

|

|

17,544

|

|

17,544

|

|

|

|

-

|

|

-

|

|

|

Equity Trust Company FBO Brien Wloch IRA

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Frank Redey

|

|

22,699

|

|

17,921

|

|

-

|

|

2,389

|

|

2,389

|

|

|

|

-

|

|

-

|

|

|

Gary Douglas Enterprises LLC (15)

|

|

55,556

|

|

-

|

|

43,860

|

|

5,848

|

|

5,848

|

|

|

|

-

|

|

-

|

|

|

Gary Gettelfinger

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Grant Macquilkan

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Harold S. Reisenfeld Trust (16)

|

|

283,753

|

|

224,015

|

|

-

|

|

29,869

|

|

29,869

|

|

|

|

-

|

|

-

|

|

|

Herman and Esther Friedman

|

|

55,556

|

|

-

|

|

43,860

|

|

5,848

|

|

5,848

|

|

|

|

-

|

|

-

|

|

|

Jacob David Wiznitzer

|

|

59,021

|

|

46,595

|

|

-

|

|

6,213

|

|

6,213

|

|

|

|

-

|

|

-

|

|

|

James Moore

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

James Papania

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Jan Arnett

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Joan L. BonAnno Trust U/A dtd 12.05.2002 (17)

|

|

851,256

|

|

672,044

|

|

-

|

|

89,606

|

|

89,606

|

|

|

|

-

|

|

-

|

|

|

Joel F. Henning

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Joel Yanowitz and Amy Metzenbaum 2003 Revocable Trust (18)

|

|

79,450

|

|

62,724

|

|

-

|

|

8,363

|

|

8,363

|

|

|

|

-

|

|

-

|

|

|

John C Boyer, Marilyn L Boyer

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

John V. Boulger

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Jon Vogler

|

|

22,222

|

|

-

|

|

17,544

|

|

2,339

|

|

2,339

|

|

|

|

-

|

|

-

|

|

|

Joseph Santoro

|

|

11,112

|

|

-

|

|

8,772

|

|

1,170

|

|

1,170

|

|

|

|

-

|

|

-

|

|

|

Kelly Joe Gaskins

|

|

88,890

|

|

-

|

|

70,176

|

|

9,357

|

|

9,357

|

|

|

|

-

|

|

-

|

|

|

Kenneth E. Chyten

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Krigsman Family Trust UDT April 13, 2015 (19)

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Kurtis D. Hughes

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Leonard Lewis

|

|

227,001

|

|

179,211

|

|

-

|

|

23,895

|

|

23,895

|

|

|

|

-

|

|

-

|

|

|

Lewis Kanter

|

|

28,890

|

|

-

|

|

22,808

|

|

3,041

|

|

3,041

|

|

|

|

-

|

|

-

|

|

|

Ligi Investments LLLP (20)

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Mainstar Trust ,Custodian FBO Daniel Kinzie, IRA #TW004826 (21)

|

|

22,699

|

|

17,921

|

|

-

|

|

2,389

|

|

2,389

|

|

|

|

-

|

|

-

|

|

|

Manny Family Revocable Trust (22)

|

|

55,556

|

|

-

|

|

43,860

|

|

5,848

|

|

5,848

|

|

|

|

-

|

|

-

|

|

|

Mara Roth

|

|

111,112

|

|

-

|

|

87,720

|

|

11,696

|

|

11,696

|

|

|

|

-

|

|

-

|

|

|

Mark and Joann Maurer

|

|

68,099

|

|

53,763

|

|

-

|

|

7,168

|

|

7,168

|

|

|

|

-

|

|

-

|

|

|

Martin Brunner

|

|

33,334

|

|

-

|

|

26,316

|

|

3,509

|

|

3,509

|

|

|

|

-

|

|

-

|

|

|

Matthew Mohebbi

|

|

45,401

|

|

35,843

|

|

-

|

|

4,779

|

|

4,779

|

|

|

|

-

|

|

-

|

|

|

Maurer Partnership LP (23)

|

|

215,652

|

|

170,252

|

|

-

|

|

22,700

|

|

22,700

|

|

|

|

-

|

|

-

|

|

|

Menachem Deutsch

|

|

222,223

|

|

-

|

|

175,439

|

|

23,392

|

|

23,392

|

|

|

|

-

|

|

-

|

|

|

Michael Delaney

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Michael Kearns

|

|

55,556

|

|

-

|

|

43,860

|

|

5,848

|

|

5,848

|

|

|

|

-

|

|

-

|

|

|

Mitchell Burger

|

|

55,556

|

|

-

|

|

43,860

|

|

5,848

|

|

5,848

|

|

|

|

-

|

|

-

|

|

|

MKF Holdings LLC (24)

|

|

510,752

|

|

403,226

|

|

-

|

|

53,763

|

|

53,763

|

|

|

|

-

|

|

-

|

|

|

N. Michael Wolsonovich Jr.

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Nomis Bay Ltd. (25)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

150,000

|

|

-

|

|

-

|

|

|

Northlea Partners LLLP (26)

|

|

22,699

|

|

17,921

|

|

-

|

|

2,389

|

|

2,389

|

|

|

|

-

|

|

-

|

|

|

P. David Adelson

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Pamlico Shoals Capital, LLC (27)

|

|

483,333

|

|

-

|

|

381,579

|

|

50,877

|

|

50,877

|

|

|

|

-

|

|

-

|

|

|

Pamlico Shoals Targeted Opportunities Fund, LP (28)

|

|

704,444

|

|

-

|

|

556,140

|

|

74,152

|

|

74,152

|

|

|

|

-

|

|

-

|

|

|

Patrick DeCavaignac

|

|

133,333

|

|

-

|

|

105,263

|

|

14,035

|

|

14,035

|

|

|

|

-

|

|

-

|

|

|

Paul C and Elizabeth Belden Living Trust DTD 09/08/2020 (29)

|

|

90,801

|

|

71,685

|

|

-

|

|

9,558

|

|

9,558

|

|

|

|

-

|

|

-

|

|

|

Philip Serbin

|

|

22,699

|

|

17,921

|

|

-

|

|

2,389

|

|

2,389

|

|

|

|

-

|

|

-

|

|

|

Ralph Hagedorn

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Raymond Barbush III

|

|

10,214

|

|

8,064

|

|

-

|

|

1,075

|

|

1,075

|

|

|

|

-

|

|

-

|

|

|

Raymond J. BonAnno Trust U/A dtd 12.05.2002 (30)

|

|

851,256

|

|

672,044

|

|

-

|

|

89,606

|

|

89,606

|

|

|

|

-

|

|

-

|

|

|

RBC Capital Markets LLC Cstdn FBO James Balsbaugh Roth IRA (31)

|

|

27,778

|

|

-

|

|

21,930

|

|

2,924

|

|

2,924

|

|

|

|

-

|

|

-

|

|

|

RBC Capital Markets LLC Custodian FBO Andrew and Kristie Sherrill JTWROS (32)

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

RBC Capital Markets LLC Custodian fbo Anthony Barr (33)

|

|

227,001

|

|

179,211

|

|

-

|

|

23,895

|

|

23,895

|

|

|

|

-

|

|

-

|

|

|

RBC Capital Markets LLC Custodian fbo Souheil Haddad IRA (34)

|

|

277,779

|

|

-

|

|

219,299

|

|

29,240

|

|

29,240

|

|

|

|

-

|

|

-

|

|

|

RBC Capital Markets LLC Custodian fbo Steven M Chester IRA (35)

|

|

22,222

|

|

-

|

|

17,544

|

|

2,339

|

|

2,339

|

|

|

|

-

|

|

-

|

|

|

RBC Capital Markets LLC Custodian fbo Sunil and Sudha Narkar Trust (36)

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Richard Holbrook

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Richard Molinsky

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Richard Santiamo

|

|

55,556

|

|

-

|

|

43,860

|

|

5,848

|

|

5,848

|

|

|

|

-

|

|

-

|

|

|

Robert Lavinsky

|

|

227,001

|

|

179,211

|

|

-

|

|

23,895

|

|

23,895

|

|

|

|

-

|

|

-

|

|

|

Salomon A. Mishaan

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Sean Janzer

|

|

17,026

|

|

13,442

|

|

-

|

|

1,792

|

|

1,792

|

|

|

|

-

|

|

-

|

|

|

Seth Goldberg

|

|

27,778

|

|

-

|

|

21,930

|

|

2,924

|

|

2,924

|

|

|

|

-

|

|

-

|

|

|

Souheil Haddad

|

|

166,667

|

|

-

|

|

131,579

|

|

17,544

|

|

17,544

|

|

|

|

-

|

|

-

|

|

|

Stephen F. Matthews & Martha L. Ballard

|

|

111,112

|

|

-

|

|

87,720

|

|

11,696

|

|

11,696

|

|

|

|

-

|

|

-

|

|

|

Steve Franklin

|

|

33,334

|

|

-

|

|

26,316

|

|

3,509

|

|

3,509

|

|

|

|

-

|

|

-

|

|

|

Sunil Ravi

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

Taihe Wang

|

|

22,222

|

|

-

|

|

17,544

|

|

2,339

|

|

2,339

|

|

|

|

-

|

|

-

|

|

|

Tammron Jay Kleeman

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

Tasso Partners, LLC (37)

|

|

1,034,815.00

|

|

222,222

|

|

-

|

|

29,630

|

|

29,630

|

|

|

|

27,250

|

|

-

|

|

|

Teddy Kwong

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

The Gault Living Trust (38)

|

|

28,375

|

|

22,401

|

|

-

|

|

2,987

|

|

2,987

|

|

|

|

-

|

|

-

|

|

|

The MG 1996 Irrevocable Trust (39)

|

|

1,135,006

|

|

896,058

|

|

-

|

|

119,474

|

|

119,474

|

|

|

|

-

|

|

-

|

|

|

The Robert L Bahr Revocable Trust (40)

|

|

56,752

|

|

44,804

|

|

-

|

|

5,974

|

|

5,974

|

|

|

|

-

|

|

-

|

|

|

Thomas A Masci Jr

|

|

666,666

|

|

-

|

|

526,316

|

|

70,175

|

|

70,175

|

|

|

|

-

|

|

-

|

|

|

Vasu and Sai Rao

|

|

33,334

|

|

-

|

|

26,316

|

|

3,509

|

|

3,509

|

|

|

|

-

|

|

-

|

|

|

Vishanta Revocable Trust (41)

|

|

113,500

|

|

89,606

|

|

-

|

|

11,947

|

|

11,947

|

|

|

|

-

|

|

-

|

|

|

William Dress

|

|

244,445

|

|

-

|

|

192,983

|

|

25,731

|

|

25,731

|

|

|

|

-

|

|

-

|

|

|

Yandle Family Revocable Trust September 5, 2001 (42)

|

|

227,001

|

|

179,211

|

|

-

|

|

23,895

|

|

23,895

|

|

|

|

-

|

|

-

|

|

* Less than 1.0%.

| |

(1)

|

Information concerning named Selling Stockholders or future transferees, pledgees, assignees, distributees, donees or successors-in-interest of or from any such stockholder or others who later hold any Selling Stockholder’s interests will be set forth in supplements to this prospectus, absent circumstances indicating that the change is material. In addition, post-effective amendments to the registration statement of which this prospectus forms a part will be filed to disclose any material changes to the plan of distribution from the description in the final prospectus.

|

| |

(2)

|

Includes (i) shares of Common Stock held by the Selling Stockholder, (ii) shares of Common Stock issuable upon conversion of securities convertible into Common Stock held by the Selling Stockholder, and (iii) the Dividend Shares, which shares are being registered by the registration statement of which this prospectus forms a part.

|

| |

(3)

|

Represents 150% of the shares of Common Stock issuable upon conversion of Shares of Series AAA Preferred, which is convertible into such number of shares of Common Stock equal to the number of Series AAA Preferred multiplied by the stated value of $1,000, divided by the conversion price. The initial conversion price of the Series AAA Preferred is $1.674.

|

| |

(4)

|

Represents 150% of the shares of Common Stock issuable upon conversion of Shares of Series AAA-2 Preferred, which is convertible into such number of shares of Common Stock equal to the number of Series AAA-2 Preferred multiplied by the stated value of $1,000, divided by the conversion price. The initial conversion price of the Series AAA-2 Preferred is $1.71.

|

| |

(5)

|

Represents Dividend Shares issuable to the Selling Stockholder. Pursuant to their respective Certificates of Designation, the number of Dividend Shares are calculated as that number of shares of Common Stock equal to 20% of the shares of Common Stock underlying each of the Series AAA Preferred and Series AAA-2 Preferred, as determined by the initial conversion price of each respective series, then held by such holder on the 12 and 24 month anniversaries of the respective filing date.

|

| |

(6)

|

Beneficial ownership is determined in accordance with the rules and regulations of the Commission. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, securities that are currently convertible or exercisable into shares of our Common Stock, or convertible or exercisable into shares of our Common Stock within 60 days of February 20, 2024, are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Amounts reported in this column assumes that each Selling Stockholder will sell all of the Securities offered pursuant to this prospectus that may be issued upon conversion of the shares of Series AAA Preferred and Series AAA-2 Preferred held thereby and identified herein. In accordance with the Purchase Agreement, in no event are we permitted to issue shares of Common Stock in excess of the Beneficial Ownership Limitation. Beneficial ownership included in this Selling Stockholder table reflects the total number of shares potentially issuable upon conversion of the Series AAA Preferred and Series AAA-2 Preferred, and does not give effect to the Beneficial Ownership Limitation. Accordingly, actual beneficial ownership, as calculated in accordance with Section 13(d) of the Exchange Act and Rule 13d-3 thereunder, may be lower than as reflected in this table.

|

| |

(7)

|

Percentage ownership is based on 5,358,708 shares of Common Stock outstanding as of February 20, 2024.

|

| |

(8)

|

As Manager of the General Partner of 3i, LP, Maier J. Tarlow may be deemed to be the beneficial owner of the securities reported herein.

|

| |

(9)

|

As President of Albermarle Shoals Fund, LLC, Michael Layman may be deemed to be the beneficial owner of the securities reported herein.

|

| |

(10)

|

As Principal of BN Leis Consultant Inc., Brian Leis may be deemed to be the beneficial owner of the securities reported herein.

|

| |

(11)

|

As Director of BPY Limited, James Keyes may be deemed to be the beneficial owner of the securities reported herein.

|

| |

(12)

|