false

0001400118

0001400118

2024-01-25

2024-01-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 25, 2024

SAGIMET BIOSCIENCES INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-41742 |

20-5991472 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

Sagimet Biosciences Inc.

155 Bovet Road, Suite 303,

San Mateo, California 94402

(Address of principal executive offices, including

zip code)

(650) 561-8600

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trade

Symbol(s) |

Name of each exchange on which registered |

| Series A Common Stock, $0.0001 par value per share |

SGMT |

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

On January

30, 2024, Sagimet Biosciences Inc. (the “Company”) closed an underwritten public offering (the “Offering”)

of 9,000,000 shares of the Company’s Series A common stock, par value $0.0001 per share (the “Common Stock”)

at the public offering price of $12.50 per share. All of the shares in the Offering were sold by the Company, resulting in approximately

$112.5 million of gross proceeds, before deducting the underwriters’ discounts and commissions and other estimated offering expenses

payable by the Company. In addition, the Company has granted the underwriters a 30-day option to purchase up to 1,350,000 additional shares

of Common Stock in the Offering. Goldman Sachs & Co. LLC, TD Cowen and Leerink Partners acted as joint book-running managers for the

offering. JMP Securities, A Citizens Company, acted as the lead manager for the offering.

The Company currently intends to use the net proceeds

from the Offering, together with its existing cash, cash equivalents and short-term investments, (i) to advance the development of denifanstat

and begin startup activities related to the pivotal Phase 3 program in non-alcoholic steatohepatitis, including manufacturing of additional

drug supply, (ii) to advance the development of TVB-3567 and submit an investigational new drug application for a Phase 1 clinical trial

for the treatment of acne and (iii) for other general corporate purposes, including additional clinical development, working capital and

operating expenses.

The Offering was made pursuant to the Company’s effective registration

statement on Form S-1, as amended (Registration No. 333-276664) filed with the Securities and Exchange Commission (the “SEC”)

on January 23, 2024 and declared effective by the SEC on January 25, 2024, and a final prospectus filed with the SEC on June 29, 2024.

On January 25, 2024, the Company issued a press release announcing

the pricing of the Offering, a copy of which is filed as Exhibit 99.1 to this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Sagimet Biosciences Inc. |

| |

|

|

| Date: January 30, 2024 |

By: |

/s/ David Happel |

| |

|

David Happel |

| |

|

Chief Executive Officer |

Exhibit 99.1

Sagimet Biosciences Announces Pricing

of Public Offering of Series A Common Stock

01/25/2024 at 8:58 PM EST

SAN MATEO, Calif., Jan. 25, 2024 (GLOBE NEWSWIRE)

– Sagimet Biosciences Inc. (“Sagimet”) (Nasdaq: SGMT), a clinical-stage biopharmaceutical company developing novel fatty

acid synthase (FASN) inhibitors designed to target dysfunctional metabolic and fibrotic pathways, today announced the pricing of its underwritten

public offering of 9,000,000 shares of its Series A common stock at a public offering price of $12.50 per share. The gross proceeds from

the offering, before deducting underwriting discounts and commissions and other offering expenses, are expected to be $112.5 million.

In addition, Sagimet has granted the underwriters a 30-day option to purchase up to an additional 1,350,000 shares of its Series A common

stock at the public offering price, less underwriting discounts and commissions. All of the shares in the offering are to be sold by Sagimet.

The offering is expected to close on January 30, 2024, subject to the satisfaction of customary closing conditions.

Goldman Sachs & Co. LLC, TD Cowen and Leerink

Partners are acting as joint book-running managers for the offering. JMP Securities, A Citizens Company, is acting as the lead manager

for the offering.

A registration statement relating to the shares

being sold in this offering has been filed with, and declared effective by, the Securities and Exchange Commission (the “SEC”),

and is available on the SEC’s website located at www.sec.gov. This offering is being made only by means of a written prospectus.

Copies of the final prospectus relating to the offering, once available, may be obtained from: Goldman Sachs & Co. LLC, Attention:

Prospectus Department, 200 West Street, New York, NY 10282, by telephone at (866) 471-2526, or by email at prospectus-ny@ny.email.gs.com;

Cowen and Company, LLC, 599 Lexington Avenue, New York, NY 10022, by email at Prospectus_ECM@cowen.com, or by telephone at (833)

297-2926; or Leerink Partners LLC, Attention: Syndicate Department, 53 State Street, 40th Floor, Boston, MA 02109, by telephone

at (800) 808-7525, ext. 6105, or by email at syndicate@leerink.com.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities, nor will there be any sale of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any

such state, province, territory or other jurisdiction.

About Sagimet Biosciences

Sagimet is a clinical-stage

biopharmaceutical company developing novel fatty acid synthase (FASN) inhibitors that are designed to target dysfunctional metabolic

pathways in diseases resulting from the overproduction of the fatty acid, palmitate. Sagimet’s lead drug candidate,

denifanstat, is an oral, once-daily pill and selective FASN inhibitor in development for the treatment of NASH, for which there are

no treatments currently approved in the United States or Europe. FASCINATE-2, a Phase 2b clinical trial of denifanstat in NASH with

liver biopsy-based primary endpoints, was successfully completed with positive results.

Forward-Looking Statements

This press release contains forward-looking statements.

Investors are cautioned not to place undue reliance on these forward-looking statements, including, without limitation, statements about

the expected completion of the public offering. Each forward-looking statement is subject to risks and uncertainties that could cause

actual results to differ materially from those expressed or implied in such statement. Applicable risks and uncertainties include those

related to market conditions and satisfaction of customary closing conditions related to the offering. There can be no assurance as to

whether the offering may be completed. Applicable risks also include those identified under the heading “Risk Factors” in

the prospectus that forms a part of the effective registration statement filed with the SEC. These forward-looking statements speak only

as of the date of this press release. Factors or events that could cause Sagimet’s actual results to differ may emerge from time

to time, and it is not possible for Sagimet to predict all of them. Sagimet undertakes no obligation to update any forward-looking statement,

whether as a result of new information, future developments or otherwise, except as may be required by applicable law.

Contact:

Maria Yonkoski

ICR Westwicke

203-682-7167

maria.yonkoski@westwicke.com

Source: Sagimet Biosciences Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

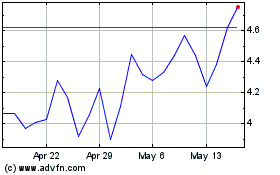

Sagiment Biosciences (NASDAQ:SGMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sagiment Biosciences (NASDAQ:SGMT)

Historical Stock Chart

From Apr 2023 to Apr 2024