0001762322

false

0001762322

2023-10-06

2023-10-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

October 10, 2023 (October 6, 2023)

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(855) 575-6739

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

SFT |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.03. Bankruptcy or Receivership. Voluntary Petition for Bankruptcy

On October 9, 2023 (the “Petition Date”),

Shift Technologies, Inc. (the “Company”) and certain of its direct and indirect subsidiaries (collectively, the “Company

Parties”) commenced bankruptcy cases (the “Chapter 11 Cases”) by filing voluntary petitions under Chapter 11 of the

U.S. Bankruptcy Code (the “Bankruptcy Code”) in the U.S. Bankruptcy Court for the Northern District of California (the “Bankruptcy

Court”). On the Petition Date, the Company Parties filed a motion with the Bankruptcy Court seeking to jointly administer the Chapter

11 Cases under the caption “In re: Shift Technologies, Inc., et al.” The Company will continue to manage its business and

properties as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable

provisions of the Bankruptcy Code and orders of the Bankruptcy Court. On the Petition Date, the Company Parties filed certain motions

with the Court generally designed to facilitate the Company Parties’ transition into Chapter 11. These motions seek authority from

the Court for the Company Parties to make payments upon, or otherwise honor, certain obligations that arose prior to the Petition Date,

including obligations related to employee wages, salaries and benefits, taxes, and utilities, as well as to take actions in furtherance

of the Company Parties’ liquidation. The Company Parties expect that the Court will approve the relief sought in these motions on

an interim basis.

Item 2.04. Triggering Events that Accelerate or Increase a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The filing of the Chapter 11 Cases constitutes an event of default

that accelerated the obligations of the Company Parties under the following debt instruments and agreements (collectively, the “Debt

Instruments”):

| ● | The Company’s 4.75% Convertible Senior Notes due 2026 (the “Convertible

Notes”) issued under that certain Indenture, dated as of May 27, 2021, by and between the Company, as issuer, and U.S. Bank National

Association, as trustee (the “Indenture”); |

| ● | 6.00% Senior Unsecured Notes due 2025 (the “SoftBank Notes”) issued under that certain Note

Purchase Agreement, dated as of May 11, 2022, by and between the Company, as issuer, certain of the Company’s subsidiaries party

thereto, as guarantors, and SoftBank, as purchaser; and |

| ● | The Inventory Financing and Security Agreement, dated as of December 9, 2021, as amended, by and among

the Company, certain of the Company’s subsidiaries party thereto, Ally Bank and Ally Financial Inc. |

Item 7.01 Regulation FD Disclosure

Press Release

In connection with the expected filing of the Chapter

11 Cases, the Company issued a press release on August 6, 2023, a copy of which is attached to this Current Report on Form 8-K as Exhibit

99.1.

Nasdaq Delisting Notice

The Company expects to receive

a notice from The Nasdaq Stock Market (“Nasdaq”) that the Common Stock, $0.0001 par value per share, of the Company (the “Common

Stock”) no longer meets the eligibility requirements necessary for listing pursuant to Nasdaq Listing Rule 5110(b) as a result of

the Chapter 11 Cases. If the Company receives such notice, the Company does not intend to appeal Nasdaq’s determination and, therefore,

it is expected that its Common Stock will be delisted. The delisting of the Common Stock would not affect the Company’s post-petition

status and does not presently change its reporting requirements under the rules of the Securities and Exchange Commission (the “SEC”).

Additional Information

on the Chapter 11 Cases

Additional information is available at https://omniagentsolutions.com/Shift.

Stakeholders with questions will be able to contact the Company’s Claims Agent, Omni Agent Solutions, Inc., at ShiftInquiries@omniagnt.com,

888-505-9433 if calling from the U.S. and Canada, or 747-204-5943 if calling from outside the U.S. The documents and other information

available via website or elsewhere are not part of this Current Report and shall not be deemed incorporated therein. The information disclosed

in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any general incorporation language in such a filing

Discussions with Convertible

Debtholders

Following the previous discussions

that concluded in July 2023, on September 26, 2023, the Company entered into new confidentiality agreements (the “Convertible Notes

NDAs”) and commenced discussions with legal advisors for a group of holders (the “Holders”) of the Convertible Notes,

regarding potential debtor-in-possession financing as well as potential restructuring or refinancing of the Convertible Notes and/or the

Softbank Notes (as defined below), and related transactions (collectively, the “Transaction”).

On September 26, 2023, the Holders

held a telephone conference with the Company’s management team, during which management and the Company’s advisors presented

the Holders with information regarding the Company’s financial situation and the potential need for debtor-in-possession financing,

and a refinancing or restructuring (the “September Company Proposal”).

On September 28, 2023, the Company

entered into a confidentiality agreement (the “Softbank NDA”, and together with the Convertible Notes NDAs, as they may be

amended or modified, the “NDAs”) with SB LL Holdco, Inc. (“SoftBank”), the beneficial holder or investment advisor,

sub-advisor, or manager of funds and/or accounts that are beneficial holders of the SoftBank Notes.

On September 28, 2023, the Company

provided SoftBank with the September Company Proposal materials that were provided to the Holders on September 26, 2023.

During the following days, the

Company and its advisors responded to numerous follow-up questions from the Holders and the advisors to the Holders.

On October 3, 2023, following

a request of the Holders, the Company provided the Holders with a liquidation analysis for the Company (the “Liquidation Analysis”).

On October 6, 2023, the advisors

to the Holders confirmed that the Holders declined the September Company Proposal.

Pursuant to the NDAs, a public

disclosure of all material non-public information provided to the Holders and Softbank as well as certain other information (the “Cleansing

Materials”) is required prior to 7:30 a.m. (Eastern Time) on October 11, 2023.

The NDAs have terminated without

the Company and the Holders or Softbank reaching an agreement on the material terms of the proposed Transaction.

The foregoing descriptions of

the Transaction, the September Company Proposal and the Liquidation Analysis do not purport to be complete and are qualified in their

entirety by reference to the complete presentation of the September Company Proposal and the Liquidation Analysis, which constitute the

Cleansing Materials, copies of which are attached to this Current Report on Form 8-K as Exhibits 99.2, and 99.3, respectively.

The information furnished in

this Item 7.01 (including Exhibits 99.1, 99.2, and 99.3 hereto) shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that Section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 8.01. Other Events.

Cautionary Note Regarding the Company’s

Securities

The Company cautions that trading in its securities,

including the Common Stock, during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices

for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s

securities in the Chapter 11 Cases. In particular, the Company expects that its stockholders could experience a significant or complete

loss on their investment, depending on the outcome of the Chapter 11 Cases.

Forward-Looking Statements

Certain statements in

this Current Report on Form 8-K constitute “forward-looking statements” within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Words contained in this Current Report on Form 8-K such as “believe,” “anticipate,”

“expect,” “estimate,” “plan,” “intend,” “should,” “would,” “could,”

“may,” “might,” “will” and variations of such words and similar future or conditional expressions,

are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements related

to the Company’s business operations, financial position, financial performance, liquidity, strategic alternatives, market outlook,

future capital needs, capital allocation plans, the impact and timing of any cost-savings measures; business strategies, the ability

to negotiate suitable restructuring or refinancing options and other such matters. These forward-looking statements are not guarantees

of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond our control.

Important assumptions and other important factors that may cause actual results to differ materially from those in the forward-looking

statements include, but are not limited to: the Company’s ability to negotiate, finalize and enter into suitable restructuring or

refinancing options on satisfactory terms, if at all; the effects of the Company’s ongoing review of strategic alternatives, and

any other cost-savings measures, including increased legal and other professional costs necessary to execute the Company’s strategy;

general economic conditions, including inflation, recession, unemployment levels, consumer confidence and spending patterns, credit availability

and debt levels; the Company’s ability to attract, motivate and retain key executives and other employees; potential adverse reactions

or changes to business relationships resulting from the announcement of the Company’s restructuring plan and associated workforce

reduction; unexpected costs, charges or expenses resulting from the Company’s restructuring plan and associated workforce reduction

or other cost-saving measures; the Company’s ability to generate or maintain liquidity; legal and regulatory proceedings; and those

additional risks, uncertainties and factors described in more detail in the Company’s filings with the Securities and Exchange Commission

(“SEC”) from time to time, including under the caption “Risk Factors” in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2022 (including any amendments thereto), and in the Company’s other filings with

the SEC (including any amendments thereto). The Company disclaims any obligation or undertaking to update, supplement or revise any forward-looking

statements contained in this Current Report on Form 8-K except as required by applicable law or regulation. Given these risks and uncertainties,

readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date hereof.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: October 10, 2023 |

/s/ Jason Curtis |

| |

Name: |

Jason Curtis |

| |

Title: |

Chief Financial Officer |

4

Exhibit 99.1

Shift Technologies, Inc. to File Voluntary Chapter

11 Petition

Shift Stores and Website are Closed as Wind Down

Commences

SAN FRANCISCO, October 6, 2023 (GLOBE NEWSWIRE) -- Shift Technologies,

Inc. (Nasdaq: SFT), a consumer-centric omnichannel retailer for buying and selling used cars, today announced that it and its subsidiaries

(collectively, “the Company”) intend to file a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code

(“Chapter 11”) in the United States Bankruptcy Court (“the Court”) to implement an orderly wind down of its business.

To facilitate the process, the Company will utilize cash on hand and

cash generated by the liquidation of inventory through wholesale channels to provide the necessary liquidity to support the wind down

and closure of operations during the Chapter 11 process.

The Company’s two locations in Oakland, CA, and Pomona, CA, and

the Company’s website have ceased operations as of the time of this press release.

Ayman Moussa, Shift’s Chief Executive Officer, said, “We

deeply value our employees, customers, partners, and the communities in which we have operated. This was not the outcome we had expected

or hoped to achieve. This decision follows months of trying to raise capital and restructure the balance sheet to allow the Company to

operate unencumbered in this challenging environment. Ultimately, the extensive efforts of our senior leadership team and advisors were

not successful. We want to thank all our dedicated employees, customers, and vendors who have supported us over the years.”

Additional information will be available at https://omniagentsolutions.com/Shift

once the case is filed. Stakeholders with questions will be able to contact the Company’s Claims Agent, Omni Agent Solutions, Inc., at

ShiftInquiries@omniagnt.com, 888-505-9433 if calling

from the U.S. and Canada, or 747-204-5943 if calling from outside the U.S.

Keller Benvenutti Kim is serving as legal counsel and AlixPartners

is serving as financial advisor.

About Shift

Shift is a consumer-centric omnichannel used car retailer. The Company

operates the website www.shift.com and two locations in Oakland, CA, and Pomona, CA.

Investor Relations:

IR@shift.com

Media Contact:

press@shift.com

Source: Shift Technologies, Inc.

Exhibit

99.2

STRICTLY PRIVATE AND CONFIDENTIAL Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Shift – Business Plan Update & Proposed In - Court Restructuring – Presentation to Lenders September 2023 DRAFT

2 2 Table of Contents 1. Introduction 2. Business Plan Update 3. DIP Loan Assumptions 4. Proposed Restructuring Terms Appendix: Supplemental Materials Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision

Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision 1. Introduction

4 4 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Business Model Transition ▪ In October 2020, Shift Technologies, Inc., (“Shift” or “the Company”) completed its de - spac transaction, positioning itself as an end - to - end auto ecommerce platform with a goal of transforming the used car industry through a technology - driven experience ▪ The Company aimed to provide digital solutions on a national basis throughout the car ownership lifecycle by operating platfo rms that allowed customers to: – Find the right car and test drive the vehicle before purchasing the vehicle – Access a seamless digitally - driven purchase transaction including financing and vehicle products – Utilize the Company’s efficient, digital trade - in/sale transaction, and be provided with high - value support services during ownership ▪ The Company significantly invested in its preexisting technology platforms, as well as centralized focus on finding new ways to expand via technology investment in an attempt to drive growth through volume and presence ▪ In December 2022, Shift merged with CarLotz in order to leverage the Company’s presence and dealer marketplace platform on the East Coast through a new omnichannel experience rather than the previous sole technology platform ▪ As Shift’s continued use of cash progressed, along with the capital markets no longer providing capital to fund unprofitable gro wth, it became apparent that the Company was no longer in a position to continue to invest in its ecommerce platform as it would t ake years to build its infrastructure to effectively compete at scale with the likes of Carvana and Vroom, whom were and are havi ng their own liquidity and operational challenges not dissimilar from Shift – To optimize its operations, the Company hired a successful dealership industry veteran, Ayman Moussa, as CEO on June 9, 2023 – With his expertise, the Company decided to pivot entirely to a dealership model focused on profitable growth, additionally th e dealership model has the benefit of being less capital intensive compared to the investment necessary to scale the ecommerce business model ▪ Ayman has implemented a number of measures to enhance revenue and operating efficiencies

5 5 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Business Model Transition (Cont.) 1) Defined as older than 8 years or greater than 80,000 miles. New Shift Old Shift – An omnichannel retailer with a primary focus on its core retail used car dealership business while utilizing economical off - the - shelf technology solutions to drive revenue and operating efficiencies – An omnichannel retailer utilizing an end - to - end ecommerce platform and small retail presence to provide a technology - driven experience with a complimentary brick and mortar alternative Business Model – Automotive dealership / profitability focused – Technology / Volume focused Management Background – Profitability focused; focus on lower mileage, higher margin vehicles – Reduced headcount for the appropriate number of FTEs needed to operate two dealerships – Volume over profitability; focus on higher mileage, less profitable vehicles (1) – Elevated headcount in place to meet growth expectations Growth Strategy – Two retail dealership locations – Primary focus on ecommerce with a secondary focus on Shift’s three retail dealership locations Sale Channels / Locations – Low – Very high Capital Intensity

Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision 2. Business Plan Update

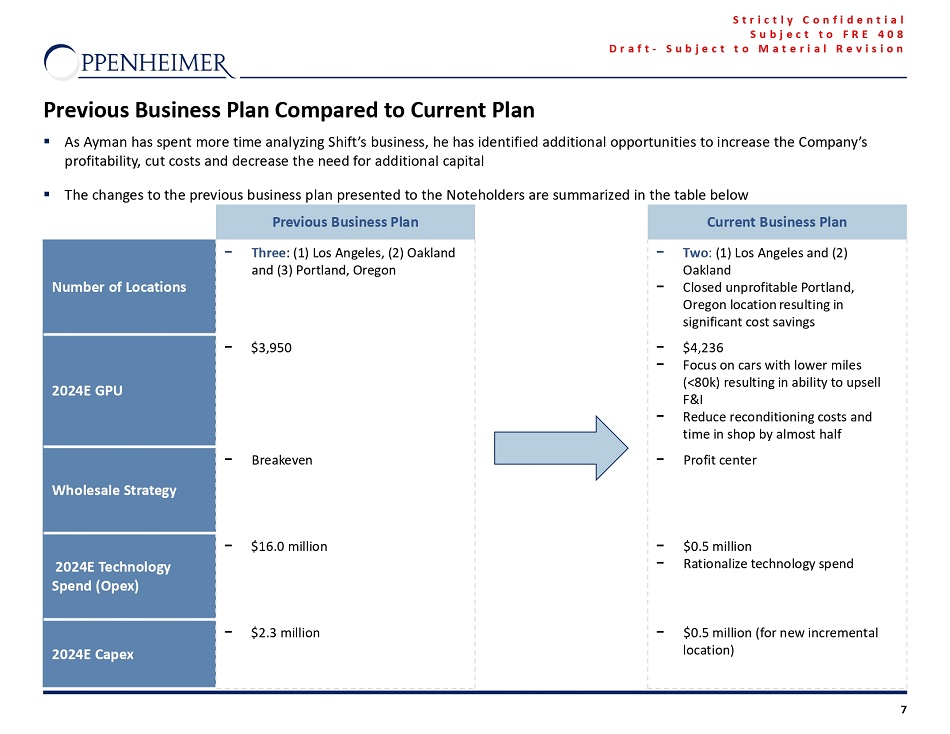

7 7 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Previous Business Plan Compared to Current Plan Current Business Plan Previous Business Plan – Two : (1) Los Angeles and (2) Oakland – Closed unprofitable Portland, Oregon location resulting in significant cost savings – Three : (1) Los Angeles, (2) Oakland and (3) Portland, Oregon Number of Locations – $4,236 – Focus on cars with lower miles (<80k) resulting in ability to upsell F&I – Reduce reconditioning costs and time in shop by almost half – $3,950 2024E GPU – Profit center – Breakeven Wholesale Strategy – $0.5 million – Rationalize technology spend – $16.0 million 2024E Technology Spend ( Opex ) – $0.5 million (for new incremental location) – $2.3 million 2024E Capex ▪ As Ayman has spent more time analyzing Shift’s business, he has identified additional opportunities to increase the Company’s profitability, cut costs and decrease the need for additional capital ▪ The changes to the previous business plan presented to the Noteholders are summarized in the table below

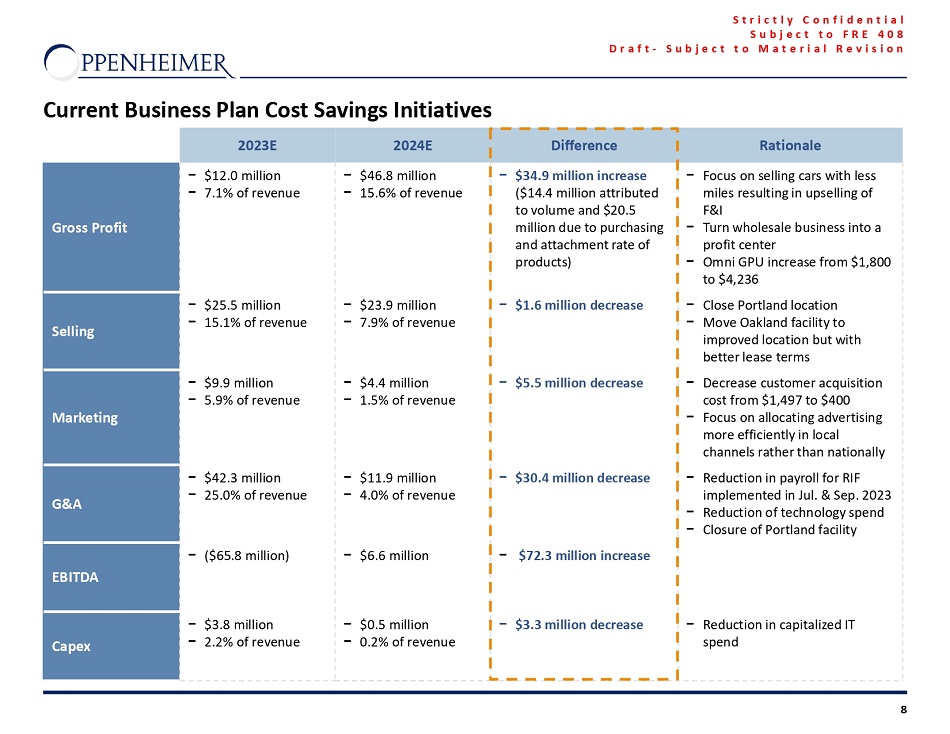

8 8 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Current Business Plan Cost Savings Initiatives Rationale Difference 2024E 2023E – Focus on selling cars with less miles resulting in upselling of F&I – Turn wholesale business into a profit center – Omni GPU increase from $1,800 to $4,236 – $34.9 million increase ($14.4 million attributed to volume and $20.5 million due to purchasing and attachment rate of products) – $46.8 million – 15.6% of revenue – $12.0 million – 7.1% of revenue Gross Profit – Close Portland location – Move Oakland facility to improved location but with better lease terms – $1.6 million decrease – $23.9 million – 7.9% of revenue – $25.5 million – 15.1% of revenue Selling – Decrease customer acquisition cost from $1,497 to $400 – Focus on allocating advertising more efficiently in local channels rather than nationally – $5.5 million decrease – $4.4 million – 1.5% of revenue – $9.9 million – 5.9% of revenue Marketing – Reduction in payroll for RIF implemented in Jul. & Sep. 2023 – Reduction of technology spend – Closure of Portland facility – $30.4 million decrease – $11.9 million – 4.0% of revenue – $42.3 million – 25.0% of revenue G&A – $72.3 million increase – $6.6 million – ($65.8 million) EBITDA – Reduction in capitalized IT spend – $3.3 million decrease – $0.5 million – 0.2% of revenue – $3.8 million – 2.2% of revenue Capex

9 9 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Source: Company provided forecast. 2023 - 2024 Updated Operating Assumptions ▪ The revised operating assumptions include: – Shift files a pre - arranged plan under Chapter 11 of the U.S. Bankruptcy Code – Significant ramp in units sold beginning in 2024, with increased inventory acquisition and improved sales conversion – Closure of the Portland, Oregon location which never achieved profitability; having this location open was inefficient with respect to marketing dollars – Move Oakland operations to new, improved location with favorable lease terms – Higher GPU due to new leadership; major initiatives including transforming wholesale operation into a profit center and significant growth in F&I from improved training, revised compensation structures and addition of new products – Repositioning retail to focus on cars with fewer than 80k miles • Company was incurring reconditioning costs of over $1,500 per vehicle and 14 day time frame to complete the work, which is nearly double the standard industry cost; resulted in a longer time in inventory and lower margin per vehicle sold • Lower mileage vehicles present greater opportunities for ancillary revenue streams attached to sales (F&I, etc ) • Higher mileage cars can still generate margin for the Company, but will be confined to the wholesale channel • Salespeople were incentivized to sell at high volumes, at the expense of margin, with little customer - facing time that limited sales of ancillary products – Rationalization of technology spend from over $16 million per year to ~$0.5 million per year using an off - the - shelf solution managed by a smaller in - house tech team more in line with the focus of the operation – Reduction in annual capital expenditures of ~$3 million per year

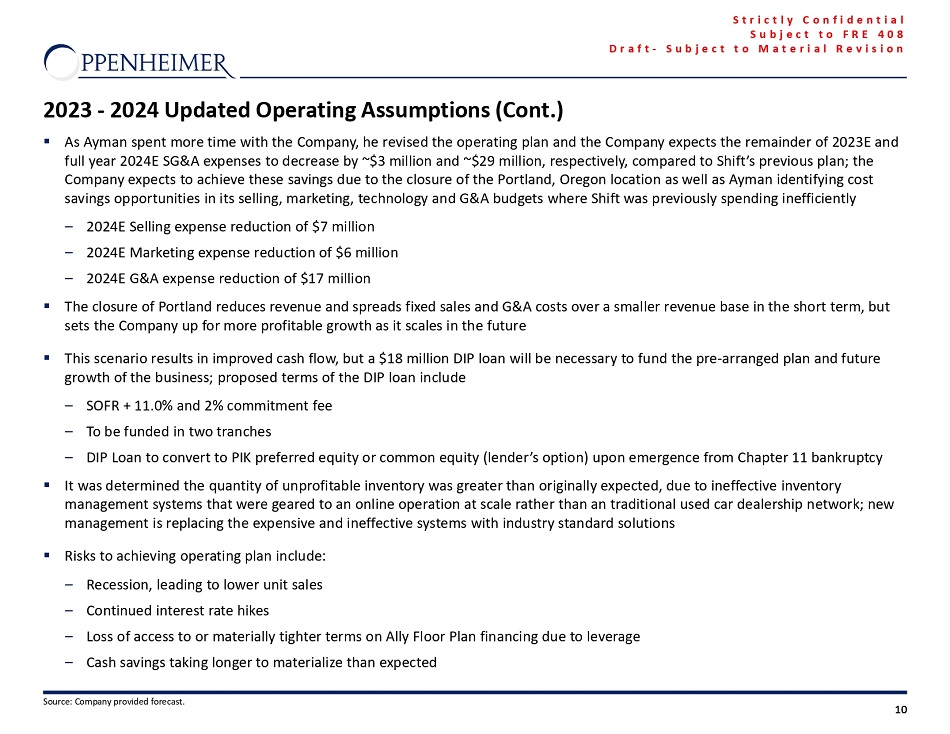

10 10 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Source: Company provided forecast. 2023 - 2024 Updated Operating Assumptions (Cont.) ▪ As Ayman spent more time with the Company, he revised the operating plan and the Company expects the remainder of 2023E and full year 2024E SG&A expenses to decrease by ~$3 million and ~$29 million, respectively, compared to Shift’s previous plan; t he Company expects to achieve these savings due to the closure of the Portland, Oregon location as well as Ayman identifying cos t savings opportunities in its selling, marketing, technology and G&A budgets where Shift was previously spending inefficiently – 2024E Selling expense reduction of $7 million – 2024E Marketing expense reduction of $6 million – 2024E G&A expense reduction of $17 million ▪ The closure of Portland reduces revenue and spreads fixed sales and G&A costs over a smaller revenue base in the short term, but sets the Company up for more profitable growth as it scales in the future ▪ This scenario results in improved cash flow, but a $18 million DIP loan will be necessary to fund the pre - arranged plan and futu re growth of the business; proposed terms of the DIP loan include – SOFR + 11.0% and 2% commitment fee – To be funded in two tranches – DIP Loan to convert to PIK preferred equity or common equity (lender’s option) upon emergence from Chapter 11 bankruptcy ▪ It was determined the quantity of unprofitable inventory was greater than originally expected, due to ineffective inventory management systems that were geared to an online operation at scale rather than an traditional used car dealership network; n ew management is replacing the expensive and ineffective systems with industry standard solutions ▪ Risks to achieving operating plan include: – Recession, leading to lower unit sales – Continued interest rate hikes – Loss of access to floor plan financing – Cash savings taking longer to materialize than expected

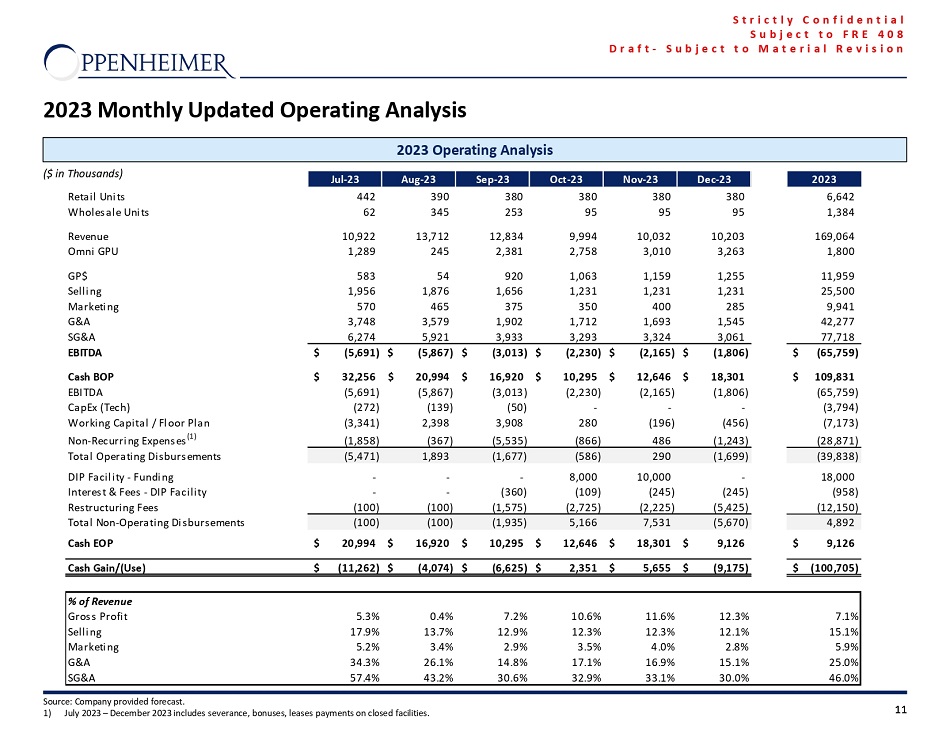

11 11 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 2023 Retail Units 442 390 380 380 380 380 6,642 Wholesale Units 62 345 253 95 95 95 1,384 Revenue 10,922 13,712 12,834 9,994 10,032 10,203 169,064 Omni GPU 1,289 245 2,381 2,758 3,010 3,263 1,800 GP$ 583 54 920 1,063 1,159 1,255 11,959 Selling 1,956 1,876 1,656 1,231 1,231 1,231 25,500 Marketing 570 465 375 350 400 285 9,941 G&A 3,748 3,579 1,902 1,712 1,693 1,545 42,277 SG&A 6,274 5,921 3,933 3,293 3,324 3,061 77,718 EBITDA (5,691)$ (5,867)$ (3,013)$ (2,230)$ (2,165)$ (1,806)$ (65,759)$ Cash BOP 32,256$ 20,994$ 16,920$ 10,295$ 12,646$ 18,301$ 109,831$ EBITDA (5,691) (5,867) (3,013) (2,230) (2,165) (1,806) (65,759) CapEx (Tech) (272) (139) (50) - - - (3,794) Working Capital / Floor Plan (3,341) 2,398 3,908 280 (196) (456) (7,173) Non-Recurring Expenses (1) (1,858) (367) (5,535) (866) 486 (1,243) (28,871) Total Operating Disbursements (5,471) 1,893 (1,677) (586) 290 (1,699) (39,838) DIP Facility - Funding - - - 8,000 10,000 - 18,000 Interest & Fees - DIP Facility - - (360) (109) (245) (245) (958) Restructuring Fees (100) (100) (1,575) (2,725) (2,225) (5,425) (12,150) Total Non-Operating Disbursements (100) (100) (1,935) 5,166 7,531 (5,670) 4,892 Cash EOP 20,994$ 16,920$ 10,295$ 12,646$ 18,301$ 9,126$ 9,126$ Cash Gain/(Use) (11,262)$ (4,074)$ (6,625)$ 2,351$ 5,655$ (9,175)$ (100,705)$ % of Revenue Gross Profit 5.3% 0.4% 7.2% 10.6% 11.6% 12.3% 7.1% Selling 17.9% 13.7% 12.9% 12.3% 12.3% 12.1% 15.1% Marketing 5.2% 3.4% 2.9% 3.5% 4.0% 2.8% 5.9% G&A 34.3% 26.1% 14.8% 17.1% 16.9% 15.1% 25.0% SG&A 57.4% 43.2% 30.6% 32.9% 33.1% 30.0% 46.0% 2023 Operating Analysis Source: Company provided forecast. 1) July 2023 – December 2023 includes severance, bonuses, leases payments on closed facilities. 2023 Monthly Updated Operating Analysis ($ in Thousands)

12 12 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Q1'24 Q2'24 Q3'24 Q4'24 2024 2025 2026 Retail Units 1,900 2,400 3,000 3,750 11,050 13,260 15,249 Wholesale Units 475 600 750 938 2,763 3,315 3,812 Revenue 51,675 65,400 81,750 102,188 301,013 361,215 415,397 Omni GPU 3,923 4,266 4,309 4,319 4,236 4,236 4,236 GP$ 7,454 10,238 12,926 16,195 46,813 56,176 64,602 Selling 4,816 5,666 6,236 7,211 23,929 23,205 25,161 Marketing 760 960 1,200 1,500 4,420 5,304 6,100 G&A 2,945 3,033 3,046 2,871 11,896 12,371 12,743 SG&A 8,521 9,659 10,482 11,582 40,245 40,880 44,003 EBITDA (1,067)$ 578$ 2,444$ 4,613$ 6,568$ 15,295$ 20,599$ Cash BOP 9,126$ 2,223$ (341)$ 318$ 9,126$ 1,722$ 12,486$ EBITDA (1,067) 578 2,444 4,613 6,568 15,295 20,599 CapEx (Tech) (500) - - - (500) (125) (125) Working Capital / Floor Plan (5,336) (3,143) (1,785) (3,208) (13,472) (4,407) (6,804) Cash EOP 2,223$ (341)$ 318$ 1,722$ 1,722$ 12,486$ 26,156$ Cash Gain/(Use) (6,903)$ (2,564)$ 659$ 1,404$ (7,404)$ 10,763$ 13,670$ % of Revenue Gross Profit 14.4% 15.7% 15.8% 15.8% 15.6% 15.6% 15.6% Selling 9.3% 8.7% 7.6% 7.1% 7.9% 6.4% 6.1% Marketing 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% G&A 5.7% 4.6% 3.7% 2.8% 4.0% 3.4% 3.1% SG&A 16.5% 14.8% 12.8% 11.3% 13.4% 11.3% 10.6% 2024 – 2026 Updated Operating Analysis ($ in Thousands) 2024 – 2026 Operating Analysis Source: Company provided forecast. ▪ The revised operating plan assumes the DIP loan is converted to PIK preferred equity or common equity (Consenting Noteholders option) upon emergence from Chapter 11 bankruptcy in December 2023; assumes access to floor plan for pendency of Chapter 11 case ▪ Sale price per unit held approximately flat with volume increases driving revenue growth ▪ Kept GPU constant from 2024 – 2026 ▪ Marketing costs held constant at $400 / unit ▪ Operating leverage in selling and G&A costs result in a decrease in these costs as percentage of revenue ▪ By 2026, the Company is expected to generate $415 million in revenue and $21 million in EBITDA

Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision 3. DIP Loan Assumptions

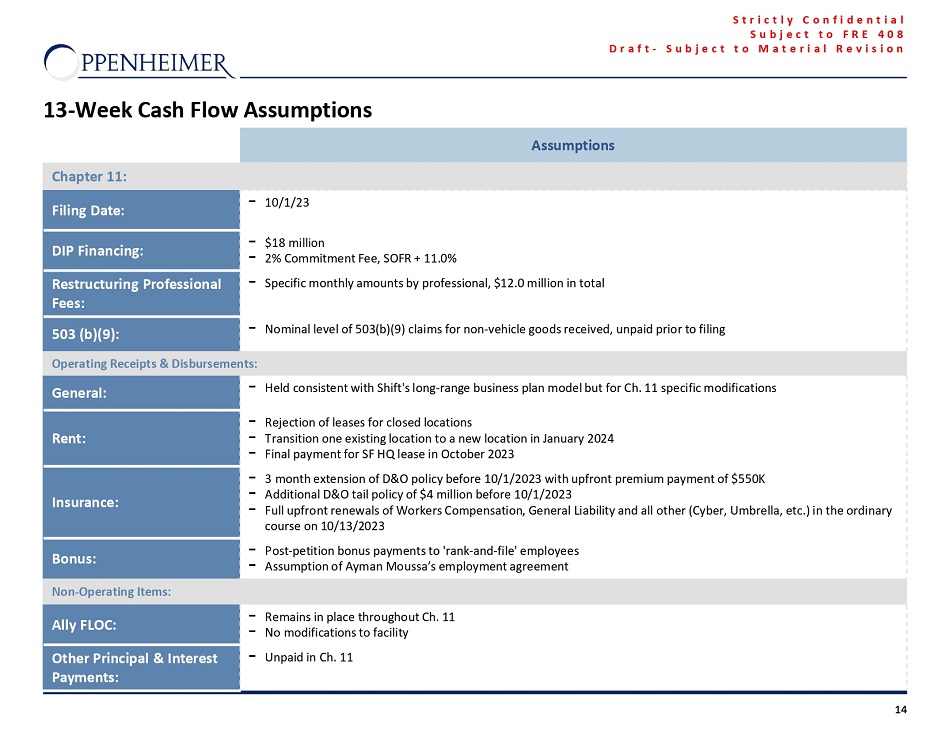

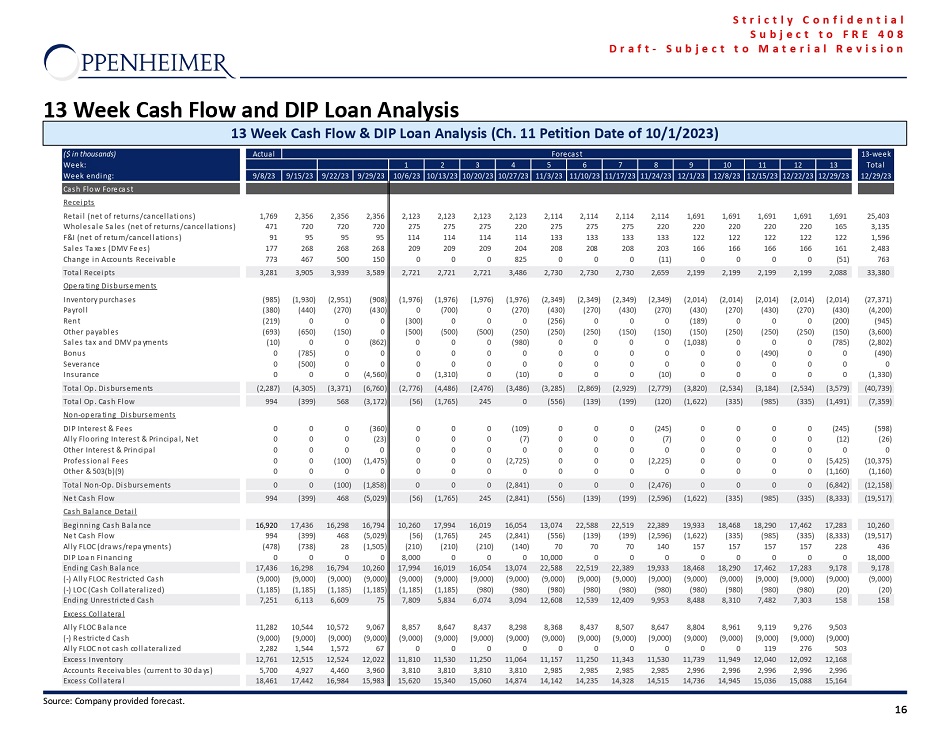

14 14 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision 13 - Week Cash Flow Assumptions Assumptions Chapter 11: – 10/1/23 Filing Date: – $18 million – 2% Commitment Fee, SOFR + 11.0% DIP Financing: – Specific monthly amounts by professional, $12.0 million in total Restructuring Professional Fees: – Nominal level of 503(b)(9) claims for non - vehicle goods received, unpaid prior to filing 503 (b)(9): Operating Receipts & Disbursements: – Held consistent with Shift's long - range business plan model but for Ch. 11 specific modifications General: – Rejection of leases for closed locations – Transition one existing location to a new location in January 2024 – Final payment for SF HQ lease in October 2023 Rent: – The Company will receive a 6 month extension of D&O policy and additional D&O tail policy with a premium of $3.9 million – Full upfront renewals of Workers Compensation, General Liability and all other (Cyber, Umbrella, etc.) in the ordinary course on 10/13/2023 Insurance: – Post - petition bonus payments to 'rank - and - file' employees – Assumption of Ayman Moussa’s employment agreement Bonus: Non - Operating Items: – A flooring facility remains in place throughout Ch. 11 – No material change in terms relative to pre - bankruptcy Floorplan Financing: – Unpaid in Ch. 11 Other Principal & Interest Payments:

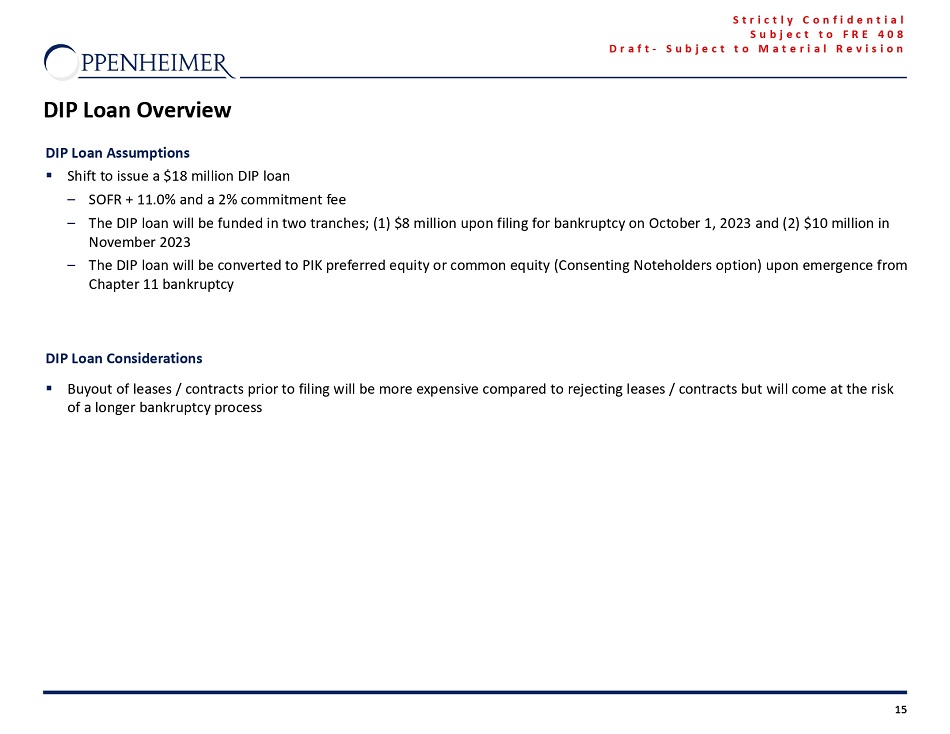

15 15 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision DIP Loan Overview DIP Loan Assumptions ▪ Shift to issue a $18 million DIP loan – SOFR + 11.0% and a 2% commitment fee – The DIP loan will be funded in two tranches; (1) $8 million upon filing for bankruptcy on October 1, 2023 and (2) $10 million in November 2023 – The DIP loan will be converted to PIK preferred equity or common equity (Consenting Noteholders option) upon emergence from Chapter 11 bankruptcy DIP Loan Considerations ▪ Buyout of leases / contracts prior to filing will be more expensive compared to rejecting leases / contracts but will come at th e risk of a longer bankruptcy process

16 16 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision 13 Week Cash Flow and DIP Loan Analysis 13 Week Cash Flow & DIP Loan Analysis (Ch. 11 Petition Date of 10/1/2023) Source: Company provided forecast . ($ in thousands) Actual Forecast 13-week Week: 1 2 3 4 5 6 7 8 9 10 11 12 13 Total Week ending: 9/8/23 9/15/23 9/22/23 9/29/23 10/6/23 10/13/23 10/20/23 10/27/23 11/3/23 11/10/23 11/17/23 11/24/23 12/1/23 12/8/23 12/15/23 12/22/23 12/29/23 12/29/23 Cash Flow Forecast Receipts Retail (net of returns/cancellations) 1,769 2,356 2,356 2,356 2,123 2,123 2,123 2,123 2,114 2,114 2,114 2,114 1,691 1,691 1,691 1,691 1,691 25,403 Wholesale Sales (net of returns/cancellations) 471 720 720 720 275 275 275 220 275 275 275 220 220 220 220 220 165 3,135 F&I (net of return/cancellations) 91 95 95 95 114 114 114 114 133 133 133 133 122 122 122 122 122 1,596 Sales Taxes (DMV Fees) 177 268 268 268 209 209 209 204 208 208 208 203 166 166 166 166 161 2,483 Change in Accounts Receivable 773 467 500 150 0 0 0 825 0 0 0 (11) 0 0 0 0 (51) 763 Total Receipts 3,281 3,905 3,939 3,589 2,721 2,721 2,721 3,486 2,730 2,730 2,730 2,659 2,199 2,199 2,199 2,199 2,088 33,380 Operating Disbursements Inventory purchases (985) (1,930) (2,951) (908) (1,976) (1,976) (1,976) (1,976) (2,349) (2,349) (2,349) (2,349) (2,014) (2,014) (2,014) (2,014) (2,014) (27,371) Payroll (380) (440) (270) (430) 0 (700) 0 (270) (430) (270) (430) (270) (430) (270) (430) (270) (430) (4,200) Rent (219) 0 0 0 (300) 0 0 0 (256) 0 0 0 (189) 0 0 0 (200) (945) Other payables (693) (650) (150) 0 (500) (500) (500) (250) (250) (250) (150) (150) (150) (250) (250) (250) (150) (3,600) Sales tax and DMV payments (10) 0 0 (862) 0 0 0 (980) 0 0 0 0 (1,038) 0 0 0 (785) (2,802) Bonus 0 (785) 0 0 0 0 0 0 0 0 0 0 0 0 (490) 0 0 (490) Severance 0 (500) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Insurance 0 0 0 (4,560) 0 (1,310) 0 (10) 0 0 0 (10) 0 0 0 0 0 (1,330) Total Op. Disbursements (2,287) (4,305) (3,371) (6,760) (2,776) (4,486) (2,476) (3,486) (3,285) (2,869) (2,929) (2,779) (3,820) (2,534) (3,184) (2,534) (3,579) (40,739) Total Op. Cash Flow 994 (399) 568 (3,172) (56) (1,765) 245 0 (556) (139) (199) (120) (1,622) (335) (985) (335) (1,491) (7,359) Non-operating Disbursements DIP Interest & Fees 0 0 0 (360) 0 0 0 (109) 0 0 0 (245) 0 0 0 0 (245) (598) Flooring Interest & Principal, Net 0 0 0 (23) 0 0 0 (7) 0 0 0 (7) 0 0 0 0 (12) (26) Other Interest & Principal 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Professional Fees 0 0 (100) (1,475) 0 0 0 (2,725) 0 0 0 (2,225) 0 0 0 0 (5,425) (10,375) Other & 503(b)(9) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 (1,160) (1,160) Total Non-Op. Disbursements 0 0 (100) (1,858) 0 0 0 (2,841) 0 0 0 (2,476) 0 0 0 0 (6,842) (12,158) Net Cash Flow 994 (399) 468 (5,029) (56) (1,765) 245 (2,841) (556) (139) (199) (2,596) (1,622) (335) (985) (335) (8,333) (19,517) Cash Balance Detail Beginning Cash Balance 16,920 17,436 16,298 16,794 10,260 17,994 16,019 16,054 13,074 22,588 22,519 22,389 19,933 18,468 18,290 17,462 17,283 10,260 Net Cash Flow 994 (399) 468 (5,029) (56) (1,765) 245 (2,841) (556) (139) (199) (2,596) (1,622) (335) (985) (335) (8,333) (19,517) FLOC (draws/repayments) (478) (738) 28 (1,505) (210) (210) (210) (140) 70 70 70 140 157 157 157 157 228 436 DIP Loan Financing 0 0 0 0 8,000 0 0 0 10,000 0 0 0 0 0 0 0 0 18,000 Ending Cash Balance 17,436 16,298 16,794 10,260 17,994 16,019 16,054 13,074 22,588 22,519 22,389 19,933 18,468 18,290 17,462 17,283 9,178 9,178 (-) FLOC Restricted Cash (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (-) LOC (Cash Collateralized) (1,185) (1,185) (1,185) (1,185) (1,185) (1,185) (980) (980) (980) (980) (980) (980) (980) (980) (980) (980) (20) (20) Ending Unrestricted Cash 7,251 6,113 6,609 75 7,809 5,834 6,074 3,094 12,608 12,539 12,409 9,953 8,488 8,310 7,482 7,303 158 158 Excess Collateral FLOC Balance 11,282 10,544 10,572 9,067 8,857 8,647 8,437 8,298 8,368 8,437 8,507 8,647 8,804 8,961 9,119 9,276 9,503 (-) Restricted Cash (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) (9,000) FLOC not cash collateralized 2,282 1,544 1,572 67 0 0 0 0 0 0 0 0 0 0 119 276 503 Excess Inventory 12,761 12,515 12,524 12,022 11,810 11,530 11,250 11,064 11,157 11,250 11,343 11,530 11,739 11,949 12,040 12,092 12,168 Accounts Receivables (current to 30 days) 5,700 4,927 4,460 3,960 3,810 3,810 3,810 3,810 2,985 2,985 2,985 2,985 2,996 2,996 2,996 2,996 2,996 Excess Collateral 18,461 17,442 16,984 15,983 15,620 15,340 15,060 14,874 14,142 14,235 14,328 14,515 14,736 14,945 15,036 15,088 15,164

Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision 4. Proposed Restructuring Terms

18 18 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Summary In - Court Transaction Terms Convert Existing Debt into PIK Preferred Equity or Post Reorg Common Equity ▪ In - court pre - arranged transaction subject to obtaining under Chapter 11 of the U.S. Bankruptcy code Overview: ▪ Available on terms acceptable to the Company and the Consenting Noteholders Inventory Facility: ▪ In - Court Transaction: Existing $170 million of outstanding debt converted into: – 100.0% of post reorg common equity • Subject to dilution Convertible & SoftBank Notes: ▪ DIP loan of up to $18 million; Consenting Noteholders will have the right to fully backstop the DIP loan – Second lien on all assets – Cash interest rate: SOFR + 11.0% – 2.0% commitment fee – DIP loan to be funded in two tranches • $8 million upon filing for Chapter 11 bankruptcy in October 2023 • $10 million in November 2023 – DIP loan to be converted at par into PIK preferred equity or common equity (Consenting Noteholders option) upon emergence from Chapter 11 • PIK preferred equity terms TBD DIP Loan: ▪ TBD Other General Unsecured Creditors: ▪ Existing Equity to receive warrants for 5% of the fully diluted post reorg common equity after Existing Noteholders recover 50% or $85 million ($170 million debt outstanding multiplied by 50.0%) Existing Equity: ▪ To be determined by new BOD Governance: ▪ Up to 10% of the reorganized equity ▪ To be determined by new BOD MIP:

19 19 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision DIP Collateral Analysis As of September 30, 2023E ▪ Ally FLOC Balance: $9.1 million ▪ ( - ) Ally Restricted Cash ($9.0) million ▪ Ally FLOC Not Cash Collateralized: $0.1 million Ally FLOC Not Cash Collateralized: ▪ Inventory Value: $12.1 million ▪ ( - ) Ally FLOC Not Cash Collateralized: ($0.1) million ▪ Excess Inventory: $12.0 million Excess Inventory: ▪ Accounts Receivable: $4.0 million Accounts Receivable: ▪ Total Excess Collateral: $16.0 million Excess Collateral ▪ The table above excludes prepaid expenses and other current assets of $4.8 million, net property & equipment net of $1.7 mill ion , capitalized website and internal software of $0.9 million, goodwill of $2.1 million and other non - current assets of $1.3 million; all excluded asset fig ures as of August 31, 2023

Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Appendix: Supplemental Materials

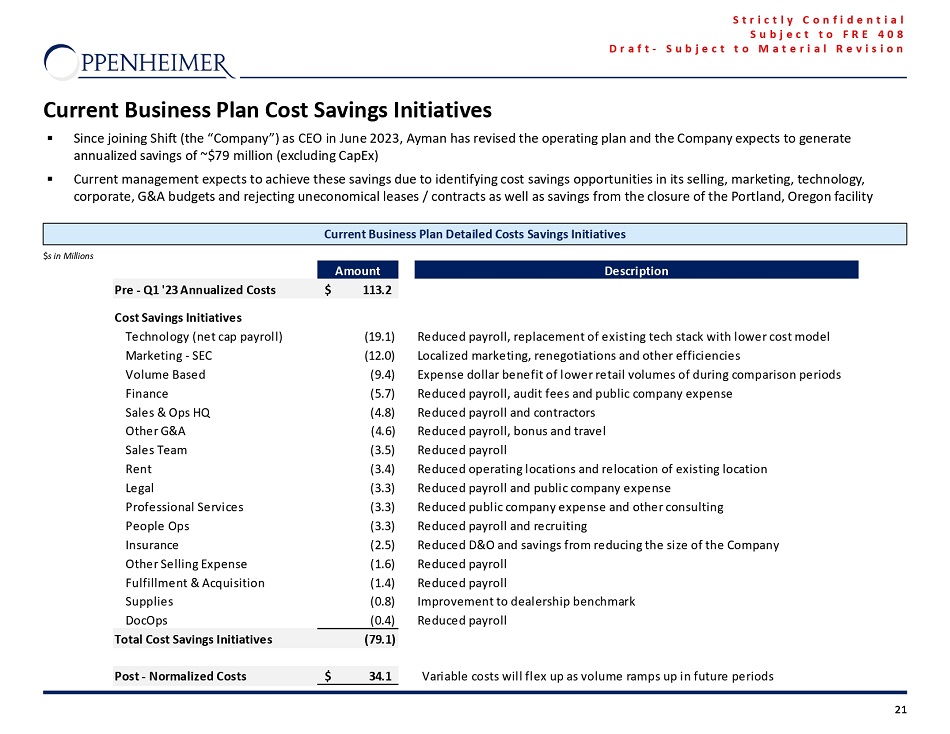

21 21 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Current Business Plan Cost Savings Initiatives $ s in Millions Current Business Plan Detailed Costs Savings Initiatives ▪ Since joining Shift (the “Company”) as CEO in June 2023, Ayman has revised the operating plan and the Company expects to gene rat e annualized savings of ~$79 million (excluding CapEx ) ▪ Current management expects to achieve these savings due to identifying cost savings opportunities in its selling, marketing, tec hnology, corporate, G&A budgets and rejecting uneconomical leases / contracts as well as savings from the closure of the Portland, Ore gon facility Amount Description Pre - Q1 '23 Annualized Costs 113.2$ Cost Savings Initiatives Technology (net cap payroll) (19.1) Reduced payroll, replacement of existing tech stack with lower cost model Marketing - SEC (12.0) Localized marketing, renegotiations and other efficiencies Volume Based (9.4) Expense dollar benefit of lower retail volumes of during comparison periods Finance (5.7) Reduced payroll, audit fees and public company expense Sales & Ops HQ (4.8) Reduced payroll and contractors Other G&A (4.6) Reduced payroll, bonus and travel Sales Team (3.5) Reduced payroll Rent (3.4) Reduced operating locations and relocation of existing location Legal (3.3) Reduced payroll and public company expense Professional Services (3.3) Reduced public company expense and other consulting People Ops (3.3) Reduced payroll and recruiting Insurance (2.5) Reduced D&O and savings from reducing the size of the Company Other Selling Expense (1.6) Reduced payroll Fulfillment & Acquisition (1.4) Reduced payroll Supplies (0.8) Improvement to dealership benchmark DocOps (0.4) Reduced payroll Total Cost Savings Initiatives (79.1) Post - Normalized Costs 34.1$ Variable costs will flex up as volume ramps up in future periods

22 22 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision Estimated General Unsecured Claim (“GUC”) & Rejected Contracts $ s in Millions ▪ Shift estimates that the total GUC claim will be ~$200 million including convertible and senior unsecured notes and ~$27 mill ion excluding convertible and senior unsecured notes ▪ The Company has identified ~$5 million of IT contract obligations that will be rejected / modified under Chapter 11 ▪ Shift also plans to reject lease obligations of ~$48 million GUC Estimate (10/31/23E) 1) Go - forward obligation of leases to be rejected presented inclusive of past - due rent, security deposits and tenant improvement re imbursements owed to Shift Est. Total Estimated Unsecured Claim Accounts Payable 4.9$ Accrued Expenses 8.8 Unpaid Rent & Lease Rejection Damages 8.3 Senior Unsecured Notes 20.5 Convertible Notes 152.7 Litigation Claims (Placeholder) 5.0 Total 200.1$ Estimated Cost Avoided IT Spend: Current monthly contracted spend 0.36$ Estimated monthly spend after rejections/renegotiations 0.04 IT spend monthly savings 0.33 Memo: Total go-forward obligation of contracts to be rejected/modified 4.5$ Lease Expense: Current go-forward obligation of leases to be rejected (1) 47.7$

23 23 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision DISCLAIMER THIS DOCUMENT IS FOR DISCUSSION PURPOSES ONLY AND DOES NOT CONSTITUTE ADVICE OF ANY KIND, INCLUDING TAX, ACCOUNTING, LEGAL OR REGULATORY ADVICE, AND OPPENHEIMER & CO . INC . IS NOT AND DOES NOT HOLD ITSELF OUT TO BE AN ADVISOR AS TO TAX, ACCOUNTING, LEGAL OR REGULATORY MATTERS . THIS DOCUMENT WAS PREPARED ON A CONFIDENTIAL BASIS SOLELY FOR DISCUSSION BY THE COMPANY AND OPPENHEIMER & CO . INC . AND NOT WITH A VIEW TOWARD PUBLIC DISCLOSURE . THIS DOCUMENT SHALL BE TREATED AS CONFIDENTIAL BY ITS RECIPIENTS . THE INFORMATION CONTAINED HEREIN WAS OBTAINED FROM THE COMPANY AND PUBLIC SOURCES AND WAS RELIED UPON BY OPPENHEIMER & CO . INC . WITHOUT ASSUMING RESPONSIBILITY FOR INDEPENDENT VERIFICATION AS TO THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION . ANY ESTIMATES AND PROJECTIONS FOR THE COMPANY CONTAINED HEREIN HAVE BEEN SUPPLIED BY THE MANAGEMENT OF THE COMPANY OR ARE PUBLICLY AVAILABLE, AND INVOLVE NUMEROUS AND SIGNIFICANT SUBJECTIVE DETERMINATIONS, WHICH MAY NOT BE CORRECT . NO REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, IS MADE AS TO THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION AND NOTHING CONTAINED HEREIN IS, OR SHALL BE RELIED UPON AS, A REPRESENTATION OR WARRANTY, WHETHER AS TO THE PAST OR THE FUTURE . THE INFORMATION CONTAINED HEREIN WAS DESIGNED FOR USE BY SPECIFIC PERSONS FAMILIAR WITH THE BUSINESS AND AFFAIRS OF THE COMPANY AND OPPENHEIMER & CO . INC . ASSUMES NO OBLIGATION TO UPDATE OR OTHERWISE REVISE THESE MATERIALS . OPPENHEIMER & CO . INC . ’S RESEARCH DEPARTMENT IS REQUIRED TO BE INDEPENDENT FROM ITS INVESTMENT BANKING DEPARTMENT, AND ITS RESEARCH ANALYSTS MAY HOLD AND MAKE STATEMENTS OR INVESTMENT RECOMMENDATIONS WITH RESPECT TO THE COMPANY AND/OR ANY OFFERING CONDUCTED BY THE COMPANY THAT DIFFER FROM THE VIEWS OF ITS INVESTMENT BANKERS . FURTHER, PURSUANT TO APPLICABLE LAW OPPENHEIMER & CO . INC . IS (AMONG OTHER THINGS) PRECLUDED FROM OFFERING FAVORABLE RESEARCH, A SPECIFIC RATING OR A SPECIFIC PRICE TARGET, OR THREATEN TO CHANGE RESEARCH, A RATING OR A PRICE TARGET, TO THE COMPANY AS CONSIDERATION OR INDUCEMENT FOR THE RECEIPT OF BUSINESS OR COMPENSATION .

24 24 Strictly Confidential Subject to FRE 408 Draft - Subject to Material Revision FORWARD LOOKING STATEMENTS THIS DOCUMENT INCLUDES “FORWARD LOOKING STATEMENTS” WITHIN THE M EANING OF THE “SAFE HARBOR” PROVISIONS OF THE UNITED STATES PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD - LOOKING STATEMENTS MAY BE IDENTIFIED BY THE USE OF WORDS SUCH AS “FORECAST,” “INTEND,” “SEEK,” “TARGET,” “ANTICIPATE,” “B ELIEVE,” “EXPECT,” “ESTIMATE,” “PLAN,” “OUTLOOK,” AND “PROJECT” AND OTHER SIMILAR EXPRESSIONS THAT PREDICT OR INDICATE FUTURE EVENTS OR TRENDS OR THAT ARE NOT STATEMENTS OF HISTORICAL MATTERS. SUCH FORWARD LOOKING STATEMENTS INCLUDE ESTIMATED FINANCIAL INFO RMATION. SUCH FORWARD LOOKING STATEMENTS WITH RESPECT TO REVENUES, EARNINGS, PERFORMANCE, STRATEGIES, PROSPECTS AND OT HER ASPECTS OF SHIFT’S BUSINESS ARE BASED ON CURRENT EXPECTATIONS THAT ARE SUBJECT TO RISKS AND UNCERTAINTIES. A NUMB ER OF FACTORS COULD CAUSE ACTUAL RESULTS OR OUTCOMES TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD LOOKING S TATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO: (1) SHIFT’S ABILITY TO GROW AND MANAGE GROWTH PROFITABLY, MAINTAIN R ELATIONSHIPS WITH CUSTOMERS AND SUPPLIERS AND RETAIN ITS MANAGEMENT AND KEY EMPLOYEES; (2) CHANGES IN APPLICABLE LAWS OR REGULATIONS; (3) THE POSSIBILITY THAT SHIFT MAY BE ADVERSELY AFFECTED BY OTHER ECONOMIC, BUSINESS, AND/OR COMPETITIVE FACTORS ; (4) THE OPERATIONAL AND FINANCIAL OUTLOOK OF SHIFT; (5) THE ABILITY FOR SHIFT TO EXECUTE ITS STRATEGY; (6) SHIFT’S ABILITY T O PURCHASE SUFFICIENT QUANTITIES OF VEHICLES AT ATTRACTIVE PRICE S; (7) LEGISLATIVE, REGULATORY AND ECONOMIC DEVELOPMENTS AND (8) OTHER RISKS AND UNCERTAINTIES INDICATED FROM TIME TO TIME IN OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC BY SHIFT. YOU ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE UPON ANY FORWARD - LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE MADE. SHIFT UNDERTAKES NO COMMITMENT TO UPDATE OR REVISE THE FORWARD - LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATI ON, FUTURE EVENTS OR OTHERWISE, EXCEPT AS MAY BE REQUIRED BY LAW.

Exhibit 99.3

| STRICTLY

CONFIDENTIAL |

| DRAFT

- SUBJECT TO MATERIAL REVISION |

| Ch.

11 Liquidation Analysis |

| Shift

Technologies, Inc. |

| October

3, 2023 |

| Shift Technologies, Inc. | STRICTLY

CONFIDENTIAL |

| Ch. 11 Liquidation - Wholesale Liquidation | DRAFT - SUBJECT TO MATERIAL REVISION |

| Line

Item |

Assumptions |

| General Assumptions |

|

| |

|

| - Form |

- Liquidating Ch. 11 (3 months) |

| -

Filing Date |

-

10/6/2023 - 10/8/2023 |

| -

DIP Financing |

-

No DIP Financing required, Company may require access to restricted cash. |

| Recovery

Values |

|

| |

|

| -

Unrestricted & Restricted Cash at filing |

-

Assumed usage of Ally FLOC restricted cash during the liquidation, all other restricted cash amounts (cash backed LCs supporting

leases) assumed unrecovered.

-

Limited unrestricted cash prior to filing.

-

Restricted to be repaid as collections from liquidation of inventory comes in.

-

Cash at end of liquidation distributed to prepetition unsecured creditors after satisfaction of administrative and priority claims. |

| -

Accounts Receivable as

of filing date |

-

87% - 97% Recovery |

|

-

A/R has should be collected recovered in first three weeks following filing |

| -

Inventory as of filing date |

-

71% - 89% Recovery equating to $0 front end GPU on the high end. |

| |

-

394 vehicles sold in the liquidation. |

| |

-

Cars are liquidated at wholesale/auction in the ordinary course following filing.

-

40 cars sold at 10% price reductions in “as is / red light” sales

-

Sales taxes on inventory sales excluded from recovery (assumed collected and passed on, net amount included in winddown budget) |

| |

|

| -

All Other Assets as of filing date |

-

0-5% Recovery |

| Administrative

Costs |

|

| |

|

| -

Winddown Budget |

-

$5.0 - $4.1M Cost |

| |

-

22% of forecasted payroll and benefits for one month (then nominal spend thereafter), 100% of rent and sales tax, 10% of forecasted

other payables (plus 20% cushion in the low case).

-

Inclusive of prepetition admin and priority claims.

-

1 months of rent payments for the Oakland building, Pamona and the SF HQ, deferred till end of Ch. 11 case due to 10/6/2023 filing

date.

-

$150K retention for remaining employees.

-

$990K for workers comp, general liability and other insurance renewal WE 10/13. |

| -

Professional Fees |

-

$2.1M Total. 20% higher in low case. |

| |

|

| -

Plan Administrator |

-

$300K for estate winddown and plan administration |

| Shift Technologies, Inc. | STRICTLY

CONFIDENTIAL |

| Ch. 11 Liquidation - Wholesale Liquidation | DRAFT

- SUBJECT TO MATERIAL REVISION |

General

Note: Assumptions for individual line-items detailed on the prior page.

| |

Estimated | | |

Recovery (%) | | |

Recovery ($) | |

| ($ in thousands) | |

NBV(1) | | |

Low | | |

High | | |

Low | | |

High | |

| Asset Values | |

| | |

| | |

| | |

| | |

| |

| Unrestricted & Restricted Cash | |

$ | 8,819 | | |

| 100.0 | % | |

| 100.0 | % | |

$ | 8,819 | | |

$ | 8,819 | |

| Accounts receivable, net | |

| 3,859 | | |

| 87.1 | % | |

| 96.8 | % | |

| 3,361 | | |

| 3,734 | |

| Inventory | |

| 9,301 | | |

| 70.8 | % | |

| 88.6 | % | |

| 6,589 | | |

| 8,236 | |

| Prepaid and other current assets | |

| 4,812 | | |

| 0.0 | % | |

| 5.0 | % | |

| 0 | | |

| 241 | |

| Property & Equipment, net | |

| 1,732 | | |

| 0.0 | % | |

| 5.0 | % | |

| 0 | | |

| 87 | |

| Capitalized website/software | |

| 903 | | |

| 0.0 | % | |

| 5.0 | % | |

| 0 | | |

| 45 | |

| Other non-current tangible assets | |

| 1,313 | | |

| 0.0 | % | |

| 5.0 | % | |

| 0 | | |

| 66 | |

| Total | |

$ | 30,738 | | |

| 61.1 | % | |

| 69.1 | % | |

$ | 18,768 | | |

$ | 21,227 | |

| Ch. 11 Administrative & Priority Claims | |

| | | |

| | | |

| | | |

| | | |

| | |

| Wind-Down Budget (incl. prepetition admin & priority claims) | |

| | | |

| | | |

| | | |

$ | (4,964 | ) | |

$ | (4,136 | ) |

| Professional Fees | |

| | | |

| | | |

| | | |

$ | (2,520 | ) | |

| (2,100 | ) |

| Plan Administrator | |

| | | |

| | | |

| | | |

$ | (300 | ) | |

| (300 | ) |

| US Trustee Fees | |

| | | |

| | | |

| | | |

$ | (450 | ) | |

| (450 | ) |

| Total | |

$ | (8,234 | ) | |

$ | (6,986 | ) |

| Net Proceeds Available for Distribution | |

$ | 10,535 | | |

$ | 14,240 | |

| Secured Debt | |

| |

| Ally FLOC | |

$ | 6,976 | | |

| 100.0 | % | |

| 100.0 | % | |

$ | 6,976 | | |

$ | 6,976 | |

| Total | |

$ | 6,976 | | |

| 100.0 | % | |

| 100.0 | % | |

$ | 6,976 | | |

$ | 6,976 | |

| Available to Unsecureds | |

$ | 3,559 | | |

| | | |

| | | |

| | | |

$ | 7,265 | |

| Unsecured Debt | |

| |

| Accounts Payable | |

$ | 4,852 | | |

| 1.8 | % | |

| 3.6 | % | |

$ | 86 | | |

$ | 176 | |

| Accrued Expenses | |

| 8,797 | | |

| 1.8 | % | |

| 3.6 | % | |

| 156 | | |

| 318 | |

| Unpaid Rent & Lease Rejection Damages | |

| 8,830 | | |

| 1.8 | % | |

| 3.6 | % | |

| 157 | | |

| 320 | |

| Senior Unsecured Notes | |

| 20,500 | | |

| 1.8 | % | |

| 3.6 | % | |

| 364 | | |

| 742 | |

| Convertible Notes | |

| 152,700 | | |

| 1.8 | % | |

| 3.6 | % | |

| 2,708 | | |

| 5,528 | |

| Litigation Claim | |

| 5,000 | | |

| 1.8 | % | |

| 3.6 | % | |

| 89 | | |

| 181 | |

| Total | |

$ | 200,679 | | |

| 1.8 | % | |

| 3.6 | % | |

$ | 3,559 | | |

$ | 7,265 | |

Footnote:

| 1 | Estimated

Net Book Value as of 10/6/2023 utilizes the 13-week cash flow forecast for cash, working capital assets and secured debt balances, and

the 8/31/2023 balance sheet for all other line items. |

Page 3 of 3

v3.23.3

Cover

|

Oct. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 06, 2023

|

| Entity File Number |

001-38839

|

| Entity Registrant Name |

SHIFT TECHNOLOGIES, INC.

|

| Entity Central Index Key |

0001762322

|

| Entity Tax Identification Number |

82-5325852

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

290 Division Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94103

|

| City Area Code |

855

|

| Local Phone Number |

575-6739

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

SFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

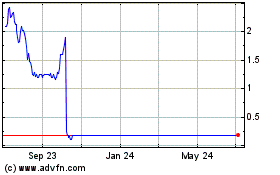

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shift Technologies (NASDAQ:SFT)

Historical Stock Chart

From Apr 2023 to Apr 2024