false

0000740664

0000740664

2024-02-29

2024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (date of earliest event reported): February 29, 2024

|

| |

R F INDUSTRIES, LTD.

|

|

| |

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

(State or Other Jurisdiction

of Incorporation)

|

0-13301

(Commission File Number)

|

88-0168936

(I.R.S. Employer

Identification No.)

|

|

16868 Via Del Campo Court, Suite 200 San Diego, CA 92127

(Address of Principal Executive Offices, including Zip Code)

(858) 549-6340

(Registrant’s Telephone Number, Including Area Code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

| |

|

|

|

Common Stock, $0.01 par value per share

|

RFIL

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On February 29, 2024, RF Industries, Ltd., a Nevada corporation (the “Company”) entered into Amendment No. 3 to Loan Agreement (“Loan Amendment No. 3”), effective as of February 29, 2024, with Bank of America, N.A. (the “Bank”), amending that certain Loan Agreement, dated as of February 25, 2022, between the Company and the Bank (as amended, the “Loan Agreement”), under which the Bank provided the Company with a $17 million term loan (the “Term Loan”) and a $3 million revolving credit facility (the “Revolving Credit Facility” and together with the Term Loan, the “Credit Facility”). Loan Amendment No. 3, among other matters, defers the requirement that the Company make an additional principal payment of $1.0 million on the Term Loan, from March 1, 2024, as was required under Amendment No. 2 to the Loan Agreement, entered into between the Company and the Bank on January 26, 2024 (“Loan Amendment No. 2”), to April 1, 2024. Further, Loan Amendment No. 3 reduces the additional fee the Company is required to pay the Bank on March 2, 2024 from 1% of the collective outstanding principal balances of the Revolving Credit Facility and Term Loan as of March 1, 2024 as required under Loan Amendment No. 2, to 0.50% of the collective outstanding principal balances of the Revolving Credit Facility and Term Loan as of March 1, 2024. Additionally, Loan Amendment No. 3 requires the Company to pay the Bank a fee equal to 0.50% of the collective outstanding principal balances of the Revolving Credit Facility and Term Loan as of March 1, 2024, if the Credit Facility is not repaid in full on or before April 2, 2024 (the “April 2024 Fee”). The April 2024 Fee, if applicable, will be due on April 2, 2024. Under Loan Amendment No. 3, the Company must continue to maintain liquidity of at least $2.0 million and pay the current remaining outstanding balance of $500,000 on the Revolving Credit Facility by March 1, 2024, as required under Loan Amendment No. 2.

The foregoing description of Loan Amendment No. 3 does not purport to be complete and is qualified in its entirety by reference to, and should be read in conjunction with, the full text of Loan Amendment No. 3, a copy of which is filed as Exhibit 10.1 and which is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Date File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

RF INDUSTRIES, LTD.

|

| |

|

|

March 1, 2024

|

By: /s/ Peter Yin

Peter Yin

Chief Financial Officer

|

Exhibit 10.1

AMENDMENT NO. 3TO LOAN AGREEMENT

This Amendment No. 3 to Loan Agreement (the “Amendment”) dated as of February 29, 2024 and effective as of February 29, 2024 is between Bank of America, N.A. (the “Bank”) and RF Industries, Ltd., a Nevada corporation (the “Borrower”).

RECITALS

A. The Bank and the Borrower entered into a certain Loan Agreement dated as February 25, 2022 (together with any previous amendments, “Agreement”). The current Facility No. 1 Commitment is $500,000.00, and the current principal amount outstanding under the Facility No. 2 Commitment is $12,354,000.00.

| |

B.

|

The Bank and the Borrower desire to amend the Agreement.

|

AGREEMENT

1. Definitions. Capitalized terms used but not defined in this Amendment shall have the meaning given to them in the Agreement.

| |

2.

|

Amendments. The Agreement is hereby amended as follows:

|

| |

2.1

|

Paragraph 3.4(d) is amended in its entirety to read as follows:

|

“(d) The Borrower shall make an additional principal payment in the amount of One Million and No/100 Dollars ($1,000,000.00) on April 1, 2024. This payment is in addition to, and not in lieu of, the monthly payments due under Paragraph 3.4(b) above.”

| |

2.2

|

Item (f) of Schedule 4.1 is amended in its entirety to read as follows:

|

“(f) Additional Fees

On March 2, 2004, the Borrower shall pay the Bank an additional fee in an amount equal to one-half percent (0.50%) of the collective outstanding principal balances of the Facility No. 1 Commitment and the Facility No. 2 Commitment as of March 1, 2024. Additionally, if the Facility No. 1 Commitment and the Facility No. 2 Commitment are not repaid in full on or before April 2, 2024, then the Borrower shall pay the Bank an additional fee in an amount equal to one-half percent (0.50%) of the collective outstanding principal balances of the Facility No. 1 Commitment and the Facility No. 2 Commitment as of March 1, 2024 (the “April 2024 Fee”). The April 2024 Fee is due on April 2, 2024.”

3. Representations and Warranties. When the Borrower signs this Amendment, the Borrower represents and warrants to the Bank that: (a) there is no event which is, or with notice or lapse of time or both would be, a default under the Agreement except those events, if any, that have been disclosed in writing to the Bank or waived in writing by the Bank; (b) the representations and warranties in the Agreement are true as of the date of this Amendment as if made on the date of this Amendment; (c) this Amendment does not conflict with any law, agreement, or obligation by which the Borrower is bound; (d) if the Borrower is a business entity or a trust, this Amendment is within the Borrower’s powers, has been duly authorized, and does not conflict with any of the Borrower’s organizational papers; (e) as of the date of this Amendment and throughout the term of the Agreement, no Borrower or guarantor, if any, is (1) an employee benefit plan subject to Title I of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), (2) a plan or account subject to Section 4975 of the Internal Revenue Code of 1986 (the “Code”); (3) an entity deemed to hold “plan assets” of any such plans or accounts for purposes of ERISA or the Code; or (4) a “governmental plan” within the meaning of ERISA; and (f) as of the date of this Amendment, the information included in the Beneficial Ownership Certification, if applicable, is true and correct in all respects. “Beneficial Ownership Certification” means a certification regarding beneficial ownership required by the Beneficial Ownership Regulation.

4. Conditions. This Amendment will be effective when the Bank receives the following items, in form and content acceptable to the Bank:

4.1 Borrower shall have executed and delivered to the Bank this Agreement, and each guarantor shall have executed and delivered to the Bank the Consent and Reaffirmation attached hereto.

4.2 If the Borrower or any guarantor is anything other than a natural person, evidence that the execution, delivery and performance by the Borrower and/or such guarantor of this Amendment and any instrument or agreement required under this Amendment have been duly authorized.

4.3 Payment by the Borrower of all costs, expenses and attorneys’ fees (including allocated costs for in-house legal services) incurred by the Bank in connection with this Amendment.

4.4 Upon the request of the Bank, the Borrower shall have provided to the Bank, and the Bank shall be reasonably satisfied with, the documentation and other information so requested in connection with applicable “know your customer” and anti-money-laundering rules and regulations, including, without limitation, the Patriot Act.

4.5 If the Borrower that qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, the Borrower shall have delivered, to the Bank, a Beneficial Ownership Certification in relation to the Borrower.

5. Effect of Amendment. Except as provided in this Amendment, all of the terms and conditions of the Agreement, including, but not limited to, the Dispute Resolution Provision, shall remain in full force and effect.

6. Counterparts. This Amendment may be executed in counterparts, each of which when so executed shall be deemed an original, but all such counterparts together shall constitute but one and the same instrument.

7. General Release. In consideration of this Amendment, the Borrower hereby releases and forever discharges the Bank and the Bank’s, respective predecessors, successors, assigns, officers, managers, directors, employees, agents, attorneys, representatives, and affiliates (collectively referred to as the “Bank Group”), from any and all presently existing claims, demands, damages, liabilities, actions and causes of action of any nature whatsoever, including, without limitation, all claims, demands, and causes of action for contribution and indemnity, whether arising at law or in equity, whether known or unknown, whether liability be direct or indirect, liquidated or unliquidated, whether absolute or contingent, foreseen or unforeseen, and whether or not heretofore asserted, which the Borrower may have or claim to have against any of the Bank Group arising out of facts or events in any way related to the Agreement and all documents executed in connection therewith (collectively with the Agreement, the “Loan Documents”) and/or the loan transactions evidenced thereby and which have occurred on or on or prior to the date hereof.

| A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY. |

8. Electronic Records and Signatures. This Amendment and any document, amendment, approval, consent, information, notice, certificate, request, statement, disclosure or authorization related to this Amendment (each a “Communication”), including Communications required to be in writing, may, if agreed by the Bank, be in the form of an Electronic Record and may be executed using Electronic Signatures, including, without limitation, facsimile and/or .pdf. The Borrower agrees that any Electronic Signature (including, without limitation, facsimile or .pdf) on or associated with any Communication shall be valid and binding on the Borrower to the same extent as a manual, original signature, and that any Communication entered into by Electronic Signature, will constitute the legal, valid and binding obligation of the Borrower enforceable against the Borrower in accordance with the terms thereof to the same extent as if a manually executed original signature was delivered to the Bank. Any Communication may be executed in as many counterparts as necessary or convenient, including both paper and electronic counterparts, but all such counterparts are one and the same Communication. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by the Bank of a manually signed paper Communication which has been converted into electronic form (such as scanned into PDF format), or an electronically signed Communication converted into another format, for transmission, delivery and/or retention. The Bank may, at its option, create one or more copies of any Communication in the form of an imaged Electronic Record (“Electronic Copy”), which shall be deemed created in the ordinary course of the Bank’s business, and destroy the original paper document. All Communications in the form of an Electronic Record, including an Electronic Copy, shall be considered an original for all purposes, and shall have the same legal effect, validity and enforceability as a paper record. Notwithstanding anything contained herein to the contrary, the Bank is under no obligation to accept an Electronic Signature in any form or in any format unless expressly agreed to by the Bank pursuant to procedures approved by it; provided, further, without limiting the foregoing, (a) to the extent the Bank has agreed to accept such Electronic Signature, the Bank shall be entitled to rely on any such Electronic Signature purportedly given by or on behalf of any Obligor without further verification and (b) upon the request of the Bank any Electronic Signature shall be promptly followed by a manually executed, original counterpart. For purposes hereof, “Electronic Record” and “Electronic Signature” shall have the meanings assigned to them, respectively, by 15 USC §7006, as it may be amended from time to time.

9. FINAL AGREEMENT. BY SIGNING THIS DOCUMENT EACH PARTY REPRESENTS AND AGREES THAT: (A) THIS DOCUMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES WITH RESPECT TO THE SUBJECT MATTER HEREOF; (B) THIS DOCUMENT SUPERSEDES ANY COMMITMENT LETTER, TERM SHEET OR OTHER WRITTEN OUTLINE OF TERMS AND CONDITIONS RELATING TO THE SUBJECT MATTER HEREOF, UNLESS SUCH COMMITMENT LETTER, TERM SHEET OR OTHER WRITTEN OUTLINE OF TERMS AND CONDITIONS EXPRESSLY PROVIDES TO THE CONTRARY; (C) THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES; AND (D) THIS DOCUMENT MAY NOT BE CONTRADICTED BY EVIDENCE OF ANY PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OR UNDERSTANDINGS OF THE PARTIES.

[Signatures on following page(s).]

This Amendment is executed as of the date stated at the beginning of this Amendment.

| Bank of America, N.A. |

|

RF Industries, Ltd.,

a Nevada corporation

|

| By: |

/s/ Shirley Yoo |

|

By: |

/s/ Peter Yin |

|

Name: Shirley Yoo

Title: Vice President, SAG Sr Portfolio Officer

|

|

Name: Peter Yin

Title: Chief Financial Officer

|

CONSENT AND REAFFIRMATION OF GUARANTORS AND PLEDGORS

Each of the undersigned (collectively referred to as the “Credit Support Providers”) is a guarantor of, and/or is a pledgor of collateral for, the Borrower’s obligations to the Bank under the Agreement. Each Credit Support Provider hereby (i) acknowledges and consents to the foregoing Amendment, (ii) reaffirms its obligations under its respective guaranty in favor of the Bank and/or under any agreement under which it has granted to the Bank a lien or security interest in any of its real or personal property, and (iii) confirms that such guaranty and other agreements, including but not limited to the Dispute Resolution Provision, remain in full force and effect, without defense, offset, or counterclaim. (Capitalized terms used herein shall have the meanings specified in the foregoing Amendment.)

Although each of the undersigned has been informed of the terms of the Amendment, each understands and agrees that the Bank has no duty to so notify it or any other guarantor/pledgor or to seek this or any future acknowledgment, consent or reaffirmation, and nothing contained herein shall create or imply any such duty as to any transactions, past or future.

In consideration of the foregoing amendment, each Credit Support Provider hereby releases and forever discharges the Bank and the Bank’s, respective predecessors, successors, assigns, officers, managers, directors, employees, agents, attorneys, representatives, and affiliates (collectively referred to as the “Bank Group”), from any and all presently existing claims, demands, damages, liabilities, actions and causes of action of any nature whatsoever, including, without limitation, all claims, demands, and causes of action for contribution and indemnity, whether arising at law or in equity, whether known or unknown, whether liability be direct or indirect, liquidated or unliquidated, whether absolute or contingent, foreseen or unforeseen, and whether or not heretofore asserted, which such Credit Support Provider may have or claim to have against any of the Bank Group arising out of facts or events in any way related to the Loan Documents and/or the loan transactions evidenced thereby and which have occurred on or on or prior to the date hereof. Each Credit Support Provider hereby specifically waives the benefit of California Civil Code Section 1542 which states:

| A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY. |

Dated as of February 29, 2024.

| |

Rel-Tech Electronics, Inc.,

a Connecticut corporation

|

| |

By: /s/ Peter Yin

Name: Peter Yin

Title: Chief Financial Officer

|

| |

|

| |

Cables Unlimited, Inc.,

a New York corporation

|

| |

|

| |

By: /s/ Peter Yin

Name: Peter Yin

Title: Chief Financial Officer

|

|

|

|

| |

C Enterprises, Inc.,

a California corporation

By: /s/ Peter Yin

Name: Peter Yin

Title: Chief Financial Officer

|

| |

|

| |

Schroff Technologies International, Inc.,

a Rhode Island corporation

By: /s/ Peter Yin

Name: Peter Yin

Title: Chief Financial Officer

|

| |

|

| |

Microlab/FXR LLC,

a New Jersey limited liability company

By: RF Industries, Ltd.,

a Nevada corporation,

its Sole Member

By: /s/ Peter Yin

Name: Peter Yin

Title: Chief Financial Officer

|

G-2

v3.24.0.1

Document And Entity Information

|

Feb. 29, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

R F INDUSTRIES, LTD.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 29, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

0-13301

|

| Entity, Tax Identification Number |

88-0168936

|

| Entity, Address, Address Line One |

16868 Via Del Campo Court, Suite 200

|

| Entity, Address, City or Town |

San Diego

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

92127

|

| City Area Code |

858

|

| Local Phone Number |

549-6340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

RFIL

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000740664

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

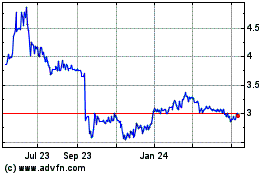

RF Industries (NASDAQ:RFIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

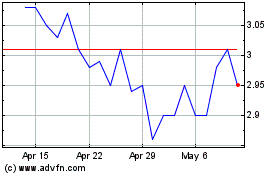

RF Industries (NASDAQ:RFIL)

Historical Stock Chart

From Apr 2023 to Apr 2024