Quest Resource Holding Corporation (NASDAQ: QRHC) (“Quest”), a

national leader in environmental waste and recycling services,

today announced financial results for the fourth quarter and fiscal

year ended December 31, 2023.

“I am proud of the considerable progress Quest has made over the

prior year and believe we are in an exceptionally strong position

to grow our business in 2024 and beyond,” said S. Ray Hatch,

President and Chief Executive Officer of Quest. “Over the course of

2023, we achieved notable client renewals, high new business

volume, and have substantial additional runway given our robust

pipeline and strong competitive position. Moreover, we completed

the integration of prior acquisitions, enhanced our IT systems

leading to greater operational efficiency system-wide, and

continued to meaningfully add proven and experienced talent

throughout the organization.”

Fourth Quarter 2023

Highlights:

- Revenue was $69.3 million, an 11.4% increase compared with the

fourth quarter of 2022.

- Gross profit was $11.5 million, a 6.9% increase compared with

the fourth quarter of 2022.

- Gross margin was 16.6% of revenue compared with 17.3% during

the fourth quarter of 2022.

- GAAP net loss per diluted share attributable to common

stockholders was $(0.11), compared with $(0.17) per diluted share

during the fourth quarter of 2022.

- Adjusted EBITDA was $3.5 million, compared with $2.3 million

during the fourth quarter of 2022. Excluding a cost of revenue

adjustment of approximately $1.2 million related to RWS, adjusted

EBITDA during the fourth quarter of 2023 would have been

approximately $4.6 million.

- Adjusted net income per diluted share was $0.03 compared with

adjusted net loss of $(0.02) per diluted share during the fourth

quarter of 2022.

Fiscal Year 2023 Highlights:

- Revenue was $288.4 million, a 1.5% increase compared with

2022.

- Gross profit was $50.1 million, a 1.3% increase compared with

2022.

- Gross margin was 17.4% of revenue compared to 17.2% during

2022.

- GAAP net loss per diluted share attributable to common

stockholders was $(0.36), compared with $(0.31) during 2022.

- Adjusted EBITDA was $16.2 million, compared to $16.4 million

during 2022. Excluding the cost of revenue adjustment for the

fourth quarter, adjusted EBITDA during 2023 would have been

approximately $17.4 million.

- Adjusted net income per diluted share was $0.15, compared with

$0.26 per diluted share during 2022.

During 2023, Quest achieved numerous milestones:

- Completed integrations of all previously announced

acquisitions, and all clients are now fully onboarded onto Quest’s

platform.

- Conducted a detailed evaluation of controls and processes with

the support of an outside accounting firm, successfully becoming an

SEC “accelerated filer.”

- Added more than 400 new vendors and seven new service lines,

all adding to our ability to serve clients broadly.

- Secured a large new client win in a new end market vertical,

positioning us to pursue other new clients in this vertical.

- Began next phase of technology and efficiency programs to

improve client experience, increase efficiencies, and grow margins.

Programs will enhance vendor onboarding and billing, client

invoicing and processing, and client service.

- Received a U.S. patent for Quest Proganics®, a food waste

recycling service that can help grocers deliver as much as 96%

diversion of organic waste from the landfill.

- Continued investment in business development leading to a very

strong start in 2024 with six new client wins, three of which are

expected to produce 7-figures in annual revenue and one of which is

expected to produce 8-figures with a Fortune 200 company in a new

end market vertical.

“We achieved solid progress in the fourth quarter, driven by

positive momentum across our business that has continued into the

early part of 2024,” added Mr. Hatch. “We expect significant

additional efficiencies to come from investments in our technology

platform, which are in addition to savings from the previously

announced $1.7 million in annualized cost efficiencies from the

integrations of acquisitions. Quest is poised for sustained organic

growth as we pursue numerous opportunities to accelerate our

momentum with new client wins and expand our relationships with

current ones, and we look forward to capitalizing on the wide range

of attractive opportunities in both our existing markets and

beyond.”

Focus on Balance Sheet and Debt Reduction

The Board of Directors, along with management, has formed a

committee that will evaluate alternative long-term debt structures

to lower our long-term cost of capital and to support long-term

growth. The committee is in the process of retaining an independent

financial advisor to assist in the process.

Additionally, the Board is adding current director Glenn

Culpepper, former Chief Financial Officer of Republic Services,

Inc., to the Audit Committee as Chairman.

Daniel Friedberg, Quest’s Chairman of the Board, added, “These

actions reflect the Quest Board’s ongoing commitment to positioning

the Company for long-term success and driving value for all

shareholders. To that end, we are evaluating how we can best manage

our debt and continue to identify ways to drive operating

efficiencies, increase profitability, generate cashflow, and

maximize long-term shareholder value.”

Fourth Quarter and Fiscal Year 2023 Earnings Conference

Call and Webcast

Quest will conduct a conference call Tuesday, March 12, 2024, at

5:00 PM ET, to review the financial results for the fourth quarter

and year ended December 31, 2023. Investors interested in

participating on the live call can dial 1-855-327-6837 or

1-631-891-4304. The conference call, which may include

forward-looking statements, is also being webcast and is available

via the investor relations section of Quest’s website at

https://investors.qrhc.com. A replay of the webcast will be

archived on Quest’s investor relations website for 90 days.

Reconciliation of U.S. GAAP to Non-GAAP Financial

Measures

In this press release, non-GAAP financial measures, "Adjusted

EBITDA," and “Adjusted Net Income (Loss)” are presented. From

time-to-time, Quest considers and uses these supplemental measures

of operating performance in order to provide an improved

understanding of underlying performance trends. Quest believes it

is useful to review, as applicable, both (1) GAAP measures that

include (i) depreciation and amortization, (ii) interest expense,

(iii) stock-based compensation expense, (iv) income tax expense,

and (v) certain other adjustments, and (2) non-GAAP measures that

exclude such items. Quest presents these non-GAAP measures because

it considers them an important supplemental measure of Quest's

performance. Quest’s definition of these adjusted financial

measures may differ from similarly named measures used by others.

Quest believes these measures facilitate operating performance

comparisons from period to period by eliminating potential

differences caused by the existence and timing of certain expense

items that would not otherwise be apparent on a GAAP basis. These

non-GAAP measures have limitations as an analytical tool and should

not be considered in isolation or as a substitute for the Company's

GAAP measures. (See attached tables “Reconciliation of Net Loss to

Adjusted EBITDA” and “Adjusted Net Income (Loss) Per Share”).

About Quest Resource Holding Corporation

Quest is a national provider of waste and recycling services

that enable larger businesses to excel in achieving their

environmental and sustainability goals and responsibilities. Quest

delivers focused expertise across multiple industry sectors to

build single-source, client-specific solutions that generate

quantifiable business and sustainability results. Addressing a wide

variety of waste streams and recyclables, Quest provides

information and data that tracks and reports the environmental

results of Quest’s services, gives actionable data to improve

business operations, and enables Quest’s clients to excel in their

business and sustainability responsibilities. For more information,

visit www.qrhc.com.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, which provides a “safe harbor”

for such statements in certain circumstances. The forward-looking

statements include, but are not limited to, our belief that we are

in an exceptionally strong position to grow our business in 2024

and beyond; our expectation that significant additional

efficiencies and savings will come from investments in our

technology platform and the integrations of previously announced

acquisitions; and our belief that we are poised for sustained

organic growth. Actual events or results could differ materially

from those discussed in the forward-looking statements as a result

of various factors, including, but not limited to, competition in

the environmental services industry, the impact of the current

economic environment, interruptions to supply chains, commodity

price fluctuations, and extended shut down of businesses, and other

factors discussed in greater detail in our filings with the

Securities and Exchange Commission (“SEC”), including our Annual

Report on Form 10-K for the year ended December 31, 2023. You are

cautioned not to place undue reliance on such statements and to

consult our SEC filings for additional risks and uncertainties that

may apply to our business and the ownership of our securities. Our

forward-looking statements are presented as of the date made, and

we disclaim any duty to update such statements unless required by

law to do so.

Investor Relations Contact:

Three Part Advisors, LLCJoe Noyons

817.778.8424

|

Financial Tables Follow |

|

|

|

Quest Resource Holding Corporation and

Subsidiaries |

|

STATEMENTS OF OPERATIONS |

|

(In thousands, except per share amounts) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

(Unaudited) |

|

|

|

|

|

Revenue |

|

$ |

69,342 |

|

|

$ |

62,253 |

|

|

$ |

288,378 |

|

|

$ |

284,038 |

|

| Cost of revenue |

|

|

57,842 |

|

|

|

51,497 |

|

|

|

238,313 |

|

|

|

235,182 |

|

| Gross profit |

|

|

11,500 |

|

|

|

10,756 |

|

|

|

50,065 |

|

|

|

48,856 |

|

|

Selling, general, and administrative |

|

|

9,419 |

|

|

|

9,824 |

|

|

|

37,669 |

|

|

|

37,800 |

|

|

Depreciation and amortization |

|

|

2,352 |

|

|

|

2,342 |

|

|

|

9,571 |

|

|

|

9,650 |

|

| Total operating expenses |

|

|

11,771 |

|

|

|

12,166 |

|

|

|

47,240 |

|

|

|

47,450 |

|

| Operating income (loss) |

|

|

(271 |

) |

|

|

(1,410 |

) |

|

|

2,825 |

|

|

|

1,406 |

|

|

Interest expense |

|

|

(2,322 |

) |

|

|

(2,224 |

) |

|

|

(9,729 |

) |

|

|

(7,281 |

) |

| Loss before taxes |

|

|

(2,593 |

) |

|

|

(3,634 |

) |

|

|

(6,904 |

) |

|

|

(5,875 |

) |

| Income tax expense

(benefit) |

|

|

(263 |

) |

|

|

(306 |

) |

|

|

387 |

|

|

|

173 |

|

| Net loss |

|

$ |

(2,330 |

) |

|

$ |

(3,328 |

) |

|

$ |

(7,291 |

) |

|

$ |

(6,048 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss applicable to common

stockholders |

|

$ |

(2,330 |

) |

|

$ |

(3,328 |

) |

|

$ |

(7,291 |

) |

|

$ |

(6,048 |

) |

| Net loss per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.11 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.31 |

) |

|

Diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.31 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

20,264 |

|

|

|

19,922 |

|

|

|

20,123 |

|

|

|

19,474 |

|

|

Diluted |

|

|

20,264 |

|

|

|

19,922 |

|

|

|

20,123 |

|

|

|

19,474 |

|

|

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA |

|

(Unaudited) |

|

(In thousands) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Net loss |

|

$ |

(2,330 |

) |

|

$ |

(3,328 |

) |

|

$ |

(7,291 |

) |

|

$ |

(6,048 |

) |

| Depreciation and

amortization |

|

|

2,462 |

|

|

|

2,425 |

|

|

|

9,948 |

|

|

|

9,966 |

|

| Interest expense |

|

|

2,322 |

|

|

|

2,224 |

|

|

|

9,729 |

|

|

|

7,281 |

|

| Stock-based compensation

expense |

|

|

362 |

|

|

|

285 |

|

|

|

1,312 |

|

|

|

1,283 |

|

| Acquisition, integration, and

related costs |

|

|

598 |

|

|

|

773 |

|

|

|

1,624 |

|

|

|

3,074 |

|

| Other adjustments |

|

|

329 |

|

|

|

225 |

|

|

|

501 |

|

|

|

710 |

|

| Income tax expense

(benefit) |

|

|

(263 |

) |

|

|

(306 |

) |

|

|

387 |

|

|

|

173 |

|

| Adjusted EBITDA |

|

$ |

3,480 |

|

|

$ |

2,298 |

|

|

$ |

16,210 |

|

|

$ |

16,439 |

|

|

ADJUSTED NET INCOME (LOSS) PER SHARE |

|

(Unaudited) |

|

(In thousands) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Reported net loss (1) |

|

$ |

(2,330 |

) |

|

$ |

(3,328 |

) |

|

$ |

(7,291 |

) |

|

$ |

(6,048 |

) |

| Amortization of intangibles

(2) |

|

|

2,196 |

|

|

|

2,222 |

|

|

|

8,864 |

|

|

|

8,839 |

|

| Acquisition, integration, and

related costs (3) |

|

|

598 |

|

|

|

773 |

|

|

|

1,624 |

|

|

|

3,074 |

|

| Other adjustments (4) |

|

|

280 |

|

|

|

(114 |

) |

|

|

205 |

|

|

|

(114 |

) |

| Adjusted net income

(loss) |

|

$ |

744 |

|

|

$ |

(447 |

) |

|

$ |

3,402 |

|

|

$ |

5,751 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

(loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reported net income

(loss) |

|

$ |

(0.11 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.31 |

) |

| Adjusted net income

(loss) |

|

$ |

0.03 |

|

|

$ |

(0.02 |

) |

|

$ |

0.15 |

|

|

$ |

0.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding: Diluted (5) |

|

|

22,502 |

|

|

|

19,922 |

|

|

|

22,362 |

|

|

|

21,818 |

|

| |

|

(1) Applicable to common stockholders(2) Reflects the elimination

of non-cash amortization of acquisition-related intangible

assets(3) Reflects the add back of acquisition/integration related

transaction costs(4) Reflects adjustments to earn-out fair value(5)

Reflects adjustment for dilution when adjusted net income is

positive |

|

BALANCE SHEETS |

|

(In thousands, except per share amounts) |

| |

| |

|

December 31, |

|

December 31, |

|

|

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

324 |

|

|

$ |

9,564 |

|

| Accounts receivable, less

allowance for doubtful accounts of $1,582 and $2,176 as of December

31, 2023 and 2022, respectively |

|

|

58,147 |

|

|

|

45,891 |

|

| Prepaid expenses and other

current assets |

|

|

2,142 |

|

|

|

2,310 |

|

|

Total current assets |

|

|

60,613 |

|

|

|

57,765 |

|

| |

|

|

|

|

|

|

| Goodwill |

|

|

85,828 |

|

|

|

84,258 |

|

| Intangible assets, net |

|

|

26,052 |

|

|

|

33,557 |

|

| Property and equipment, net,

and other assets |

|

|

4,626 |

|

|

|

5,911 |

|

|

Total assets |

|

$ |

177,119 |

|

|

$ |

181,491 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

|

$ |

41,296 |

|

|

$ |

32,207 |

|

| Other current liabilities |

|

|

2,470 |

|

|

|

4,689 |

|

| Current portion of notes

payable |

|

|

1,159 |

|

|

|

1,159 |

|

|

Total current liabilities |

|

|

44,925 |

|

|

|

38,055 |

|

| |

|

|

|

|

|

|

| Notes payable, net |

|

|

64,638 |

|

|

|

70,573 |

|

| Other long-term

liabilities |

|

|

1,275 |

|

|

|

1,724 |

|

|

Total liabilities |

|

|

110,838 |

|

|

|

110,352 |

|

| |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

| Preferred stock, $0.001 par

value, 10,000 shares authorized, no shares issued or outstanding as

of December 31, 2023 and 2022 |

|

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value, 200,000 shares authorized, 20,161 and 19,696 shares issued

and outstanding as of December 31, 2023 and 2022, respectively |

|

|

20 |

|

|

|

20 |

|

| Additional paid-in

capital |

|

|

176,309 |

|

|

|

173,876 |

|

| Accumulated deficit |

|

|

(110,048 |

) |

|

|

(102,757 |

) |

|

Total stockholders’ equity |

|

|

66,281 |

|

|

|

71,139 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

177,119 |

|

|

$ |

181,491 |

|

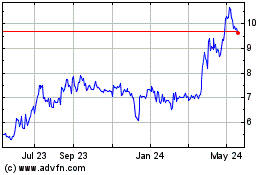

Quest Resource (NASDAQ:QRHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

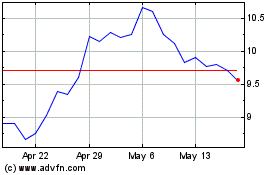

Quest Resource (NASDAQ:QRHC)

Historical Stock Chart

From Apr 2023 to Apr 2024