Monthly Portfolio Investments Report on Form N-port (public) (nport-p)

November 27 2019 - 5:01PM

Edgar (US Regulatory)

QQQX

Nuveen Nasdaq 100 Dynamic

Overwrite Fund

Portfolio of Investments September 30, 2019

(Unaudited)

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

LONG-TERM INVESTMENTS – 100.2%

|

|

|

|

|

|

|

|

|

|

COMMON STOCKS – 100.1%

|

|

|

|

|

|

|

|

|

|

Air Freight & Logistics – 0.1%

|

|

|

|

|

|

|

|

3,020

|

|

FedEx Corp

|

|

|

|

|

|

$439,621

|

|

|

|

Airlines – 0.5%

|

|

|

|

|

|

|

|

33,821

|

|

Delta Air Lines Inc.

|

|

|

|

|

|

1,948,090

|

|

7,356

|

|

Ryanair Holdings PLC

|

|

|

|

|

|

488,291

|

|

28,693

|

|

Southwest Airlines Co

|

|

|

|

|

|

1,549,709

|

|

|

|

Total Airlines

|

|

|

|

|

|

3,986,090

|

|

|

|

Auto Components – 0.2%

|

|

|

|

|

|

|

|

29,023

|

|

American Axle & Manufacturing Holdings Inc

|

|

|

|

|

|

238,569

|

|

23,986

|

|

Gentex Corp

|

|

|

|

|

|

660,455

|

|

4,609

|

|

Lear Corp

|

|

|

|

|

|

543,401

|

|

|

|

Total Auto Components

|

|

|

|

|

|

1,442,425

|

|

|

|

Automobiles – 0.1%

|

|

|

|

|

|

|

|

53,641

|

|

Ford Motor Co

|

|

|

|

|

|

491,352

|

|

|

|

Banks – 0.1%

|

|

|

|

|

|

|

|

5,455

|

|

JPMorgan Chase & Co

|

|

|

|

|

|

641,999

|

|

|

|

Beverages – 0.8%

|

|

|

|

|

|

|

|

24,872

|

|

Brown-Forman Corp, Class B

|

|

|

|

|

|

1,561,464

|

|

99,279

|

|

Monster Beverage Corp, (2)

|

|

|

|

|

|

5,764,139

|

|

|

|

Total Beverages

|

|

|

|

|

|

7,325,603

|

|

|

|

Biotechnology – 7.7%

|

|

|

|

|

|

|

|

9,056

|

|

Agios Pharmaceuticals Inc, (2)

|

|

|

|

|

|

293,414

|

|

15,331

|

|

Alkermes PLC, (2)

|

|

|

|

|

|

299,108

|

|

125,133

|

|

Amgen Inc, (3)

|

|

|

|

|

|

24,214,487

|

|

30,946

|

|

Biogen Inc, (2)

|

|

|

|

|

|

7,204,848

|

|

137,136

|

|

Celgene Corp, (2), (3)

|

|

|

|

|

|

13,617,605

|

|

219,937

|

|

Gilead Sciences Inc., (3)

|

|

|

|

|

|

13,939,607

|

|

67,590

|

|

ImmunoGen Inc, (2)

|

|

|

|

|

|

163,568

|

|

11,495

|

|

Ionis Pharmaceuticals Inc, (2)

|

|

|

|

|

|

688,665

|

|

14,078

|

|

Myriad Genetics Inc, (2)

|

|

|

|

|

|

403,053

|

|

19,200

|

|

Regeneron Pharmaceuticals Inc, (2)

|

|

|

|

|

|

5,326,080

|

|

13,285

|

|

Seattle Genetics Inc, (2)

|

|

|

|

|

|

1,134,539

|

|

3,945

|

|

United Therapeutics Corp, (2)

|

|

|

|

|

|

314,614

|

|

|

|

Total Biotechnology

|

|

|

|

|

|

67,599,588

|

|

QQQX

|

Nuveen Nasdaq 100 Dynamic Overwrite Fund (continued)

|

|

|

Portfolio of Investments September 30, 2019

|

|

|

(Unaudited)

|

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

Capital Markets – 0.6%

|

|

|

|

|

|

|

|

10,802

|

|

Moody's Corp

|

|

|

|

|

|

$2,212,574

|

|

26,703

|

|

Morgan Stanley

|

|

|

|

|

|

1,139,417

|

|

12,686

|

|

SEI Investments Co

|

|

|

|

|

|

751,709

|

|

7,968

|

|

T Rowe Price Group Inc

|

|

|

|

|

|

910,344

|

|

|

|

Total Capital Markets

|

|

|

|

|

|

5,014,044

|

|

|

|

Chemicals – 0.3%

|

|

|

|

|

|

|

|

6,428

|

|

Ecolab Inc

|

|

|

|

|

|

1,273,001

|

|

3,290

|

|

Sherwin-Williams Co

|

|

|

|

|

|

1,809,073

|

|

|

|

Total Chemicals

|

|

|

|

|

|

3,082,074

|

|

|

|

Commercial Services & Supplies – 0.5%

|

|

|

|

|

|

|

|

11,265

|

|

Copart Inc, (2)

|

|

|

|

|

|

904,917

|

|

8,298

|

|

IAA Inc, (2)

|

|

|

|

|

|

346,276

|

|

8,298

|

|

KAR Auction Services Inc

|

|

|

|

|

|

203,716

|

|

16,365

|

|

Tetra Tech Inc

|

|

|

|

|

|

1,419,827

|

|

7,836

|

|

Waste Connections Inc

|

|

|

|

|

|

720,912

|

|

10,274

|

|

Waste Management Inc

|

|

|

|

|

|

1,181,510

|

|

|

|

Total Commercial Services & Supplies

|

|

|

|

|

|

4,777,158

|

|

|

|

Communications Equipment – 4.3%

|

|

|

|

|

|

|

|

745,000

|

|

Cisco Systems Inc, (3)

|

|

|

|

|

|

36,810,450

|

|

5,452

|

|

F5 Networks Inc, (2)

|

|

|

|

|

|

765,570

|

|

|

|

Total Communications Equipment

|

|

|

|

|

|

37,576,020

|

|

|

|

Containers & Packaging – 0.1%

|

|

|

|

|

|

|

|

4,364

|

|

Ball Corp

|

|

|

|

|

|

317,743

|

|

10,909

|

|

International Paper Co

|

|

|

|

|

|

456,214

|

|

|

|

Total Containers & Packaging

|

|

|

|

|

|

773,957

|

|

|

|

Distributors – 0.2%

|

|

|

|

|

|

|

|

3,763

|

|

Genuine Parts Co

|

|

|

|

|

|

374,757

|

|

8,507

|

|

Pool Corp

|

|

|

|

|

|

1,715,862

|

|

|

|

Total Distributors

|

|

|

|

|

|

2,090,619

|

|

|

|

Diversified Consumer Services – 0.3%

|

|

|

|

|

|

|

|

47,131

|

|

Service Corp International/US

|

|

|

|

|

|

2,253,333

|

|

|

|

Electrical Equipment – 0.2%

|

|

|

|

|

|

|

|

10,254

|

|

Rockwell Automation Inc

|

|

|

|

|

|

1,689,859

|

|

|

|

Electronic Equipment, Instruments & Components – 0.5%

|

|

|

|

|

|

|

|

13,253

|

|

Amphenol Corp, Class A

|

|

|

|

|

|

1,278,914

|

|

4,010

|

|

Arrow Electronics Inc, (2)

|

|

|

|

|

|

299,066

|

|

6,503

|

|

Avnet Inc

|

|

|

|

|

|

289,286

|

|

33,069

|

|

Corning Inc

|

|

|

|

|

|

943,128

|

|

8,393

|

|

Keysight Technologies Inc, (2)

|

|

|

|

|

|

816,219

|

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

Electronic Equipment, Instruments & Components (continued)

|

|

|

|

|

|

|

|

15,009

|

|

National Instruments Corp

|

|

|

|

|

|

$630,228

|

|

|

|

Total Electronic Equipment, Instruments & Components

|

|

|

|

|

|

4,256,841

|

|

|

|

Energy Equipment & Services – 0.0%

|

|

|

|

|

|

|

|

35,571

|

|

Nabors Industries Ltd

|

|

|

|

|

|

66,518

|

|

40,695

|

|

Transocean Ltd

|

|

|

|

|

|

181,906

|

|

|

|

Total Energy Equipment & Services

|

|

|

|

|

|

248,424

|

|

|

|

Entertainment – 0.0%

|

|

|

|

|

|

|

|

10,583

|

|

Cinemark Holdings Inc

|

|

|

|

|

|

408,927

|

|

|

|

Equity Real Estate Investment Trust – 0.4%

|

|

|

|

|

|

|

|

20,097

|

|

Apartment Investment & Management Co, Class A

|

|

|

|

|

|

1,047,858

|

|

59,567

|

|

CubeSmart

|

|

|

|

|

|

2,078,888

|

|

3,380

|

|

Retail Value Inc

|

|

|

|

|

|

125,195

|

|

32,514

|

|

SITE Centers Corp

|

|

|

|

|

|

491,287

|

|

|

|

Total Equity Real Estate Investment Trust

|

|

|

|

|

|

3,743,228

|

|

|

|

Food & Staples Retailing – 0.3%

|

|

|

|

|

|

|

|

4,146

|

|

Casey's General Stores Inc

|

|

|

|

|

|

668,169

|

|

27,602

|

|

Kroger Co

|

|

|

|

|

|

711,580

|

|

9,491

|

|

Sysco Corp

|

|

|

|

|

|

753,585

|

|

22,148

|

|

US Foods Holding Corp, (2)

|

|

|

|

|

|

910,283

|

|

|

|

Total Food & Staples Retailing

|

|

|

|

|

|

3,043,617

|

|

|

|

Food Products – 0.2%

|

|

|

|

|

|

|

|

16,583

|

|

Conagra Brands Inc

|

|

|

|

|

|

508,766

|

|

5,782

|

|

Hain Celestial Group Inc, (2)

|

|

|

|

|

|

124,168

|

|

12,000

|

|

Pilgrim's Pride Corp, (2)

|

|

|

|

|

|

384,540

|

|

4,147

|

|

Post Holdings Inc, (2)

|

|

|

|

|

|

438,919

|

|

|

|

Total Food Products

|

|

|

|

|

|

1,456,393

|

|

|

|

Health Care Equipment & Supplies – 1.5%

|

|

|

|

|

|

|

|

74,842

|

|

Abbott Laboratories, (3)

|

|

|

|

|

|

6,262,030

|

|

3,982

|

|

Becton Dickinson and Co, (3)

|

|

|

|

|

|

1,007,287

|

|

17,456

|

|

Danaher Corp

|

|

|

|

|

|

2,521,170

|

|

9,202

|

|

Hill-Rom Holdings Inc

|

|

|

|

|

|

968,326

|

|

4,050

|

|

Stryker Corp, (3)

|

|

|

|

|

|

876,015

|

|

12,110

|

|

Zimmer Biomet Holdings Inc, (3)

|

|

|

|

|

|

1,662,340

|

|

|

|

Total Health Care Equipment & Supplies

|

|

|

|

|

|

13,297,168

|

|

|

|

Health Care Providers & Services – 0.2%

|

|

|

|

|

|

|

|

4,464

|

|

McKesson Corp, (3)

|

|

|

|

|

|

610,050

|

|

8,669

|

|

Universal Health Services Inc, Class B

|

|

|

|

|

|

1,289,514

|

|

|

|

Total Health Care Providers & Services

|

|

|

|

|

|

1,899,564

|

|

QQQX

|

Nuveen Nasdaq 100 Dynamic Overwrite Fund (continued)

|

|

|

Portfolio of Investments September 30, 2019

|

|

|

(Unaudited)

|

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

Hotels, Restaurants & Leisure – 0.5%

|

|

|

|

|

|

|

|

22,598

|

|

Carnival Corp

|

|

|

|

|

|

$987,759

|

|

10,909

|

|

Darden Restaurants Inc

|

|

|

|

|

|

1,289,662

|

|

31,857

|

|

Restaurant Brands International Inc

|

|

|

|

|

|

2,266,307

|

|

|

|

Total Hotels, Restaurants & Leisure

|

|

|

|

|

|

4,543,728

|

|

|

|

Household Durables – 0.2%

|

|

|

|

|

|

|

|

45,314

|

|

KB Home

|

|

|

|

|

|

1,540,676

|

|

|

|

Industrial Conglomerates – 0.1%

|

|

|

|

|

|

|

|

6,260

|

|

Honeywell International Inc

|

|

|

|

|

|

1,059,192

|

|

|

|

Insurance – 0.3%

|

|

|

|

|

|

|

|

25,800

|

|

Fidelity National Financial Inc

|

|

|

|

|

|

1,145,778

|

|

13,092

|

|

Globe Life Inc

|

|

|

|

|

|

1,253,690

|

|

|

|

Total Insurance

|

|

|

|

|

|

2,399,468

|

|

|

|

Interactive Media & Services – 15.2%

|

|

|

|

|

|

|

|

32,600

|

|

Alphabet Inc, Class A, (2)

|

|

|

|

|

|

39,809,164

|

|

33,600

|

|

Alphabet Inc, Class C, (2), (3)

|

|

|

|

|

|

40,958,400

|

|

46,910

|

|

Baidu Inc, (2), (3)

|

|

|

|

|

|

4,820,471

|

|

240,000

|

|

Facebook Inc., Class A, (2)

|

|

|

|

|

|

42,739,200

|

|

19,201

|

|

IAC/InterActiveCorp

|

|

|

|

|

|

4,185,242

|

|

32,728

|

|

Twitter Inc, (2)

|

|

|

|

|

|

1,348,394

|

|

|

|

Total Interactive Media & Services

|

|

|

|

|

|

133,860,871

|

|

|

|

Internet & Direct Marketing Retail – 13.5%

|

|

|

|

|

|

|

|

53,000

|

|

Amazon.com Inc, (2)

|

|

|

|

|

|

92,003,230

|

|

9,274

|

|

Booking Holdings Inc, (2)

|

|

|

|

|

|

18,201,245

|

|

229,104

|

|

eBay Inc, (3)

|

|

|

|

|

|

8,930,474

|

|

|

|

Total Internet & Direct Marketing Retail

|

|

|

|

|

|

119,134,949

|

|

|

|

IT Services – 4.5%

|

|

|

|

|

|

|

|

7,911

|

|

Black Knight Inc, (2)

|

|

|

|

|

|

483,046

|

|

13,463

|

|

DXC Technology Co

|

|

|

|

|

|

397,159

|

|

25,966

|

|

Fidelity National Information Services Inc

|

|

|

|

|

|

3,447,246

|

|

20,955

|

|

Genpact Ltd

|

|

|

|

|

|

812,006

|

|

25,384

|

|

Global Payments Inc

|

|

|

|

|

|

4,036,056

|

|

64,256

|

|

Infosys Ltd

|

|

|

|

|

|

730,591

|

|

49,092

|

|

Jack Henry & Associates Inc

|

|

|

|

|

|

7,165,959

|

|

5,465

|

|

Leidos Holdings Inc

|

|

|

|

|

|

469,334

|

|

213,259

|

|

PayPal Holdings Inc, (2)

|

|

|

|

|

|

22,091,500

|

|

6,733

|

|

Perspecta Inc

|

|

|

|

|

|

175,866

|

|

|

|

Total IT Services

|

|

|

|

|

|

39,808,763

|

|

|

|

Life Sciences Tools & Services – 0.6%

|

|

|

|

|

|

|

|

63,277

|

|

Agilent Technologies Inc

|

|

|

|

|

|

4,848,916

|

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

Life Sciences Tools & Services (continued)

|

|

|

|

|

|

|

|

5,224

|

|

Charles River Laboratories International Inc, (2)

|

|

|

|

|

|

$691,501

|

|

|

|

Total Life Sciences Tools & Services

|

|

|

|

|

|

5,540,417

|

|

|

|

Machinery – 0.2%

|

|

|

|

|

|

|

|

10,391

|

|

Caterpillar Inc

|

|

|

|

|

|

1,312,487

|

|

8,734

|

|

Fortive Corp

|

|

|

|

|

|

598,803

|

|

|

|

Total Machinery

|

|

|

|

|

|

1,911,290

|

|

|

|

Media – 4.2%

|

|

|

|

|

|

|

|

5,347

|

|

AMC Networks Inc., Class A, (2)

|

|

|

|

|

|

262,859

|

|

20,947

|

|

CBS Corp., Class B

|

|

|

|

|

|

845,630

|

|

741,861

|

|

Comcast Corp, Class A, (3)

|

|

|

|

|

|

33,443,094

|

|

86,878

|

|

News Corp, Class A

|

|

|

|

|

|

1,209,342

|

|

72,100

|

|

News Corp, Class B

|

|

|

|

|

|

1,030,669

|

|

7,458

|

|

WPP PLC, Sponsored ADR

|

|

|

|

|

|

466,796

|

|

|

|

Total Media

|

|

|

|

|

|

37,258,390

|

|

|

|

Multiline Retail – 0.2%

|

|

|

|

|

|

|

|

69,505

|

|

JC Penney Co Inc

|

|

|

|

|

|

61,783

|

|

7,528

|

|

Kohl's Corp

|

|

|

|

|

|

373,841

|

|

11,020

|

|

Target Corp

|

|

|

|

|

|

1,178,148

|

|

|

|

Total Multiline Retail

|

|

|

|

|

|

1,613,772

|

|

|

|

Oil, Gas & Consumable Fuels – 0.1%

|

|

|

|

|

|

|

|

9,491

|

|

Continental Resources Inc/OK

|

|

|

|

|

|

292,228

|

|

10,146

|

|

Devon Energy Corp

|

|

|

|

|

|

244,113

|

|

26,076

|

|

Marathon Oil Corp

|

|

|

|

|

|

319,952

|

|

12,330

|

|

Noble Energy Inc

|

|

|

|

|

|

276,932

|

|

28,041

|

|

QEP Resources Inc

|

|

|

|

|

|

103,752

|

|

16,802

|

|

Range Resources Corp

|

|

|

|

|

|

64,183

|

|

|

|

Total Oil, Gas & Consumable Fuels

|

|

|

|

|

|

1,301,160

|

|

|

|

Pharmaceuticals – 0.1%

|

|

|

|

|

|

|

|

6,499

|

|

Jazz Pharmaceuticals PLC, (2)

|

|

|

|

|

|

832,782

|

|

|

|

Professional Services – 0.3%

|

|

|

|

|

|

|

|

11,246

|

|

IHS Markit Ltd, (2)

|

|

|

|

|

|

752,133

|

|

12,505

|

|

ManpowerGroup Inc

|

|

|

|

|

|

1,053,421

|

|

21,381

|

|

Robert Half International Inc

|

|

|

|

|

|

1,190,066

|

|

|

|

Total Professional Services

|

|

|

|

|

|

2,995,620

|

|

|

|

Semiconductors & Semiconductor Equipment – 11.9%

|

|

|

|

|

|

|

|

100,370

|

|

Analog Devices Inc

|

|

|

|

|

|

11,214,340

|

|

341,819

|

|

Applied Materials Inc, (3)

|

|

|

|

|

|

17,056,768

|

|

709,241

|

|

Intel Corp, (3)

|

|

|

|

|

|

36,547,189

|

|

90,004

|

|

NVIDIA Corp

|

|

|

|

|

|

15,666,996

|

|

QQQX

|

Nuveen Nasdaq 100 Dynamic Overwrite Fund (continued)

|

|

|

Portfolio of Investments September 30, 2019

|

|

|

(Unaudited)

|

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

Semiconductors & Semiconductor Equipment (continued)

|

|

|

|

|

|

|

|

30,423

|

|

ON Semiconductor Corp, (2)

|

|

|

|

|

|

$584,426

|

|

6,473

|

|

Power Integrations Inc

|

|

|

|

|

|

585,353

|

|

257,470

|

|

QUALCOMM Inc, (3)

|

|

|

|

|

|

19,639,812

|

|

11,070

|

|

Silicon Laboratories Inc, (2)

|

|

|

|

|

|

1,232,645

|

|

22,000

|

|

Skyworks Solutions Inc

|

|

|

|

|

|

1,743,500

|

|

21,819

|

|

Taiwan Semiconductor Manufacturing Co Ltd

|

|

|

|

|

|

1,014,147

|

|

|

|

Total Semiconductors & Semiconductor Equipment

|

|

|

|

|

|

105,285,176

|

|

|

|

Software – 15.1%

|

|

|

|

|

|

|

|

19,637

|

|

ANSYS Inc, (2)

|

|

|

|

|

|

4,346,846

|

|

58,910

|

|

Autodesk Inc, (2)

|

|

|

|

|

|

8,701,007

|

|

13,077

|

|

CDK Global Inc

|

|

|

|

|

|

628,873

|

|

5,245

|

|

j2 Global Inc, (3)

|

|

|

|

|

|

476,351

|

|

825,000

|

|

Microsoft Corp, (3)

|

|

|

|

|

|

114,699,750

|

|

1,728

|

|

MicroStrategy Inc., Class A, (2), (3)

|

|

|

|

|

|

256,383

|

|

24,247

|

|

Open Text Corp

|

|

|

|

|

|

989,520

|

|

43,639

|

|

Oracle Corp

|

|

|

|

|

|

2,401,454

|

|

13,531

|

|

PTC Inc, (2)

|

|

|

|

|

|

922,544

|

|

|

|

Total Software

|

|

|

|

|

|

133,422,728

|

|

|

|

Specialty Retail – 0.8%

|

|

|

|

|

|

|

|

16,258

|

|

Aaron's Inc

|

|

|

|

|

|

1,044,739

|

|

4,877

|

|

Advance Auto Parts Inc

|

|

|

|

|

|

806,656

|

|

873

|

|

AutoZone Inc, (2)

|

|

|

|

|

|

946,873

|

|

18,001

|

|

Bed Bath & Beyond Inc

|

|

|

|

|

|

191,531

|

|

21,819

|

|

CarMax Inc, (2)

|

|

|

|

|

|

1,920,072

|

|

19,136

|

|

Dick's Sporting Goods Inc

|

|

|

|

|

|

780,940

|

|

10,146

|

|

Foot Locker Inc

|

|

|

|

|

|

437,901

|

|

15,820

|

|

Michaels Cos Inc, (2)

|

|

|

|

|

|

154,878

|

|

15,274

|

|

Sally Beauty Holdings Inc, (2)

|

|

|

|

|

|

227,430

|

|

19,420

|

|

Urban Outfitters Inc, (2)

|

|

|

|

|

|

545,508

|

|

|

|

Total Specialty Retail

|

|

|

|

|

|

7,056,528

|

|

|

|

Technology Hardware, Storage & Peripherals – 12.9%

|

|

|

|

|

|

|

|

500,000

|

|

Apple Inc, (3)

|

|

|

|

|

|

111,985,000

|

|

20,777

|

|

Hewlett Packard Enterprise Co

|

|

|

|

|

|

315,187

|

|

29,000

|

|

NetApp Inc

|

|

|

|

|

|

1,522,790

|

|

|

|

Total Technology Hardware, Storage & Peripherals

|

|

|

|

|

|

113,822,977

|

|

|

|

Textiles, Apparel & Luxury Goods – 0.2%

|

|

|

|

|

|

|

|

8,067

|

|

PVH Corp

|

|

|

|

|

|

711,751

|

|

4,144

|

|

Ralph Lauren Corp

|

|

|

|

|

|

395,628

|

|

19,420

|

|

Skechers USA Inc., Class A, (2)

|

|

|

|

|

|

725,337

|

|

|

|

Total Textiles, Apparel & Luxury Goods

|

|

|

|

|

|

1,832,716

|

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

Wireless Telecommunication Services – 0.1%

|

|

|

|

|

|

|

|

31,206

|

|

Sprint Corp, (2)

|

|

|

|

|

|

$192,541

|

|

20,995

|

|

Telephone & Data Systems Inc

|

|

|

|

|

|

541,671

|

|

14,195

|

|

United States Cellular Corp, (2)

|

|

|

|

|

|

533,448

|

|

|

|

Total Wireless Telecommunication Services

|

|

|

|

|

|

1,267,660

|

|

|

|

Total Common Stocks (cost $297,343,801)

|

|

|

|

|

|

884,026,767

|

|

Shares

|

|

Description (1), (4)

|

|

|

|

|

|

Value

|

|

|

|

EXCHANGE-TRADED FUNDS – 0.1%

|

|

|

|

|

|

|

|

10,000

|

|

Vanguard Total Stock Market ETF

|

|

|

|

|

|

$1,510,000

|

|

|

|

Total Exchange-Traded Funds (cost $1,515,077)

|

|

|

|

|

|

1,510,000

|

|

|

|

Total Long-Term Investments (cost $298,858,878)

|

|

|

|

|

|

885,536,767

|

|

Principal Amount (000)

|

|

Description (1)

|

|

|

Coupon

|

Maturity

|

|

Value

|

|

|

|

SHORT-TERM INVESTMENTS – 0.3%

|

|

|

|

|

|

|

|

|

|

REPURCHASE AGREEMENTS – 0.3%

|

|

|

|

|

|

|

|

$2,368

|

|

Repurchase Agreement with Fixed Income Clearing Corporation, dated 9/30/19, repurchase price $2,368,137,

collateralized $2,260,000 U.S. Treasury Notes, 2.375%, due 5/15/29, value $2,420,392

|

|

|

0.850%

|

10/01/19

|

|

$2,368,081

|

|

|

|

Total Short-Term Investments (cost $2,368,081)

|

|

|

|

|

|

2,368,081

|

|

|

|

Total Investments (cost $301,226,959) – 100.5%

|

|

|

|

|

|

887,904,848

|

|

|

|

Other Assets Less Liabilities – (0.5)% (5)

|

|

|

|

|

|

(4,603,071)

|

|

|

|

Net Assets Applicable to Common Shares – 100%

|

|

|

|

|

|

$883,301,777

|

Investments in Derivatives

|

Options Written

|

|

|

Description (6)

|

Type

|

Number of

Contracts

|

Notional

Amount (7)

|

Exercise

Price

|

Expiration

Date

|

Value

|

|

NASDAQ® 100 INDEX

|

Call

|

(500)

|

$(395,000,000)

|

$7,900

|

10/18/19

|

$(2,715,000)

|

|

NASDAQ® 100 INDEX

|

Call

|

(60)

|

(48,450,000)

|

8,075

|

10/18/19

|

(61,500)

|

|

S&P 500® Index

|

Put

|

(62)

|

(17,670,000)

|

2,850

|

10/18/19

|

(63,860)

|

|

Total Options Written (premiums received $6,242,209)

|

|

(622)

|

$(461,120,000)

|

|

|

$(2,840,360)

|

|

QQQX

|

Nuveen Nasdaq 100 Dynamic Overwrite Fund (continued)

|

|

|

Portfolio of Investments September 30, 2019

|

|

|

(Unaudited)

|

Part F of Form N-PORT was prepared

in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) and in conformity with the applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”)

related to interim filings. Part F of Form N-PORT does not include all information and footnotes required by U.S. GAAP for complete financial statements. Certain footnote disclosures normally included in financial

statements prepared in accordance with U.S. GAAP have been condensed or omitted from this report pursuant to the rules of the SEC. For a full set of the Fund’s notes to financial statements, please refer to the

Fund’s most recently filed annual or semi-annual report.

Fair Value Measurements

The Fund's investments in securities

are recorded at their estimated fair value. Fair value is defined as the price that would be received upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the

principal or most advantageous market for the investment. A three-tier hierarchy is used to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of

fair value measurements for disclosure purposes. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from

sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable

inputs are based on the best information available in the circumstances. The following is a summary of the three-tiered hierarchy of valuation input levels.

Level 1

– Inputs are unadjusted and prices are determined using quoted prices in active markets for identical securities.

Level 2 – Prices are determined using other significant observable inputs (including quoted prices for similar securities, interest rates, credit spreads, etc.).

Level 3 – Prices are determined using significant unobservable inputs (including management’s assumptions in determining the fair value of investments).

The inputs or methodologies used for

valuing securities are not an indication of the risks associated with investing in those securities. The following is a summary of the Fund’s fair value measurements as of the end of the reporting period:

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Long-Tem Investments:

|

|

|

|

|

|

Common Stocks

|

$884,026,767

|

$ —

|

$ —

|

$884,026,767

|

|

Exchange-Traded Funds

|

1,510,000

|

—

|

—

|

1,510,000

|

|

Short-Term Investments:

|

|

|

|

|

|

Repurchase Agreements

|

—

|

2,368,081

|

—

|

2,368,081

|

|

Investments in Derivatives:

|

|

|

|

|

|

Options Written

|

(2,840,360)

|

—

|

—

|

(2,840,360)

|

|

Total

|

$882,696,407

|

$2,368,081

|

$ —

|

$885,064,488

|

|

|

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized

market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

|

|

|

(1)

|

All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted.

|

|

|

(2)

|

Non-income producing; issuer has not declared a dividend within the past twelve months.

|

|

|

(3)

|

Investment, or portion of investment, has been pledged to collateralized the net payment obligations for investments in derivatives.

|

|

|

(4)

|

A copy of the most recent financial statements for the exchange-traded funds in which the Fund invests can be obtained directly from the Securities and Exchange Commission on its

website at http://www.sec.gov.

|

|

|

(5)

|

Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as well as the OTC cleared and

exchange-traded derivatives, when applicable.

|

|

|

(6)

|

Exchange-traded, unless otherwise noted.

|

|

|

(7)

|

For disclosure purposes, Notional Amount is calculated by multiplying the Number of Contracts by the Exercise Price by 100.

|

|

|

ADR

|

American Depositary Receipt

|

|

|

ETF

|

Exchange-Traded Fund

|

|

|

S&P

|

Standard & Poor's

|

|

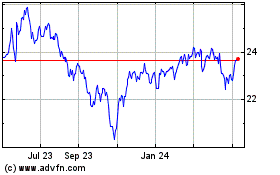

Nuveen Nasdaq 100 Dynami... (NASDAQ:QQQX)

Historical Stock Chart

From Mar 2024 to Apr 2024

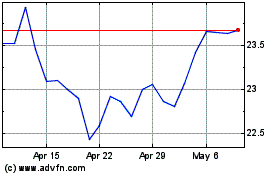

Nuveen Nasdaq 100 Dynami... (NASDAQ:QQQX)

Historical Stock Chart

From Apr 2023 to Apr 2024