Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 19 2019 - 5:23PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration Statement No. 333-233776

Issuer Free Writing Prospectus dated September 19, 2019

Relating to Preliminary Prospectus Supplement dated September 19, 2019

$5,000,000,000

Pricing Term Sheet

$1,000,000,000 2.200% Notes due 2022 (the “2022 Fixed Rate Notes”)

$1,250,000,000 2.400% Notes due 2024 (the “2024 Fixed Rate Notes”)

$1,250,000,000 2.650% Notes due 2026 (the “2026 Fixed Rate Notes”)

$1,500,000,000 2.850% Notes due 2029 (the “2029 Fixed Rate Notes”)

|

|

|

|

|

|

|

|

Issuer:

|

|

PayPal Holdings, Inc. (the “Company”)

|

|

|

|

|

Trade Date:

|

|

September 19, 2019

|

|

|

|

|

Settlement Date:

|

|

September 26, 2019 (T+5)*

|

|

|

|

|

Denominations:

|

|

$2,000 and integral multiples of $1,000 in excess thereof

|

|

|

|

|

Anticipated Ratings:

|

|

BBB+ (Fitch, Inc.)

BBB+ (Standard &

Poor’s Ratings Services)

|

|

|

|

|

Joint Book-Running Managers:

|

|

Goldman Sachs & Co. LLC

J.P. Morgan

Securities LLC

Morgan Stanley & Co. LLC

BNP Paribas

Securities Corp.

BofA Securities, Inc.

HSBC Securities (USA)

Inc.

MUFG Securities Americas Inc.

|

|

|

|

|

Co-Managers:

|

|

Citigroup Global Markets Inc.

Deutsche Bank

Securities Inc.

Wells Fargo Securities, LLC

Academy

Securities, Inc.

Scotia Capital (USA) Inc.

Barclays Capital

Inc.

The Williams Capital Group, L.P.

Mizuho Securities USA

LLC

nabSecurities, LLC

RBC Capital Markets, LLC

Standard Chartered Bank**

TD Securities (USA) LLC

Westpac Capital Markets LLC

|

1

|

|

|

|

|

|

|

|

Security:

|

|

Senior unsecured fixed rate notes

|

|

|

|

|

Principal Amount:

|

|

$1,000,000,000 of 2022 Fixed Rate Notes

$1,250,000,000 of 2024 Fixed Rate Notes

$1,250,000,000 of 2026

Fixed Rate Notes

$1,500,000,000 of 2029 Fixed Rate Notes

|

|

|

|

|

Maturity Date:

|

|

September 26, 2022 for the 2022 Fixed Rate Notes

October 1, 2024 for the 2024 Fixed Rate Notes

October 1, 2026 for the 2026 Fixed Rate Notes

October 1, 2029 for the 2029 Fixed Rate Notes

|

|

|

|

|

Coupon (Interest Rate):

|

|

2.200% per annum for the 2022 Fixed Rate Notes

2.400% per annum for the 2024 Fixed Rate Notes

2.650%

per annum for the 2026 Fixed Rate Notes

2.850% per annum for the 2029 Fixed Rate Notes

|

|

|

|

|

Interest Payment Dates:

|

|

Semi-annually each March 26 and September 26, commencing March 26, 2020 for the 2022 Fixed Rate Notes and semi-annually each April 1 and October 1, commencing April 1, 2020 for the 2024 Fixed Rate

Notes, the 2026 Fixed Rate Notes and the 2029 Fixed Rate Notes

|

|

|

|

|

Day Count Convention:

|

|

30/360

|

|

|

|

|

Price to Public:

|

|

99.873% for the 2022 Fixed Rate Notes

99.939%

for the 2024 Fixed Rate Notes

99.752% for the 2026 Fixed Rate Notes

99.663% for the 2029 Fixed Rate Notes

|

|

|

|

|

Benchmark Treasury:

|

|

1.500% due September 15, 2022 for the 2022 Fixed Rate Notes

1.250% due August 31, 2024 for the 2024 Fixed Rate Notes

1.375% due August 31, 2026 for the 2026 Fixed Rate Notes

1.625% due August 15, 2029 for the 2029 Fixed Rate Notes

|

|

|

|

|

Benchmark Treasury Price/Yield:

|

|

99-14 / 1.694% for the 2022 Fixed Rate Notes

98-01+ / 1.663% for the 2024 Fixed Rate Notes

97-20 / 1.739% for the 2026 Fixed Rate Notes

98-16+ / 1.789% for the 2029 Fixed Rate Notes

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

55 basis points for the 2022 Fixed Rate Notes

75 basis points for the 2024 Fixed Rate Notes

95 basis points for

the 2026 Fixed Rate Notes

110 basis points for the 2029 Fixed Rate Notes

|

|

|

|

|

Yield to Maturity:

|

|

2.244% for the 2022 Fixed Rate Notes

2.413% for

the 2024 Fixed Rate Notes

2.689% for the 2026 Fixed Rate Notes

2.889% for the 2029 Fixed Rate Notes

|

2

|

|

|

|

|

|

|

|

Make-Whole Call:

|

|

2022 Fixed Rate Notes: At any time prior to September 26, 2022, at a discount rate of Treasury plus 10 basis points

2024 Fixed Rate Notes: At any time prior to September 1, 2024, at a discount rate of Treasury plus 15 basis points

2026 Fixed Rate Notes: At any time prior to August 1, 2026, at a discount rate of Treasury plus 15 basis points

2029 Fixed Rate Notes: At any time prior to July 1, 2029, at a discount rate of Treasury plus 20 basis points

|

|

|

|

|

Par Call:

|

|

There is no par call for the 2022 Fixed Rate Notes.

At any time on and after September 1, 2024 (one month prior to the maturity date of the 2024 Fixed Rate Notes) for the 2024 Fixed Rate Notes.

At any time on and after August 1, 2026 (two months prior to the maturity date of the 2026 Fixed Rate Notes) for the 2026 Fixed Rate Notes.

At any time on and after July 1, 2029 (three months prior to the maturity date of the 2029 Fixed Rate Notes) for the 2029 Fixed Rate Notes.

|

|

|

|

|

CUSIP/ISIN:

|

|

70450Y AB9/US70450YAB92 for the 2022 Fixed Rate Notes

70450Y AC7/US70450YAC75 for the 2024 Fixed Rate Notes

70450Y

AD5/US70450YAD58 for the 2026 Fixed Rate Notes

70450Y AE3/US70450YAE32 for the 2029 Fixed Rate Notes

|

|

|

|

|

Net Proceeds Before Expenses:

|

|

$996,230,000 for the 2022 Fixed Rate Notes

$1,244,862,500 for the 2024 Fixed Rate Notes

$1,241,900,000 for

the 2026 Fixed Rate Notes

$1,488,195,000 for the 2029 Fixed Rate Notes

|

|

|

|

Note: A securities rating is not a recommendation to buy, sell or hold

securities and may be subject to revision or withdrawal at any time.

|

*Under Rule 15c6-1 under the Securities Exchange Act of 1934, as

amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Notes prior to the second business day preceding

the settlement date will be required, by virtue of the fact that the Notes initially will settle T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of Notes who wish to trade the

Notes prior to the second business day preceding the settlement date should consult their own advisors.

** Standard Chartered Bank

will not effect any offers or sales of any notes in the United States unless it is through one or more U.S. registered broker-dealers as permitted by the regulations of the Financial Industry Regulatory Authority, Inc.

3

The Company has filed a registration statement (including a prospectus) and a preliminary

prospectus supplement with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary

prospectus supplement and other documents that the Company has filed with the SEC, including the preliminary prospectus supplement, for more complete information about the Company and this offering. You may get these documents for free by visiting

the SEC website at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the preliminary prospectus supplement, the accompanying prospectus and, when available, the final

prospectus supplement if you request it by contacting: Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, telephone: (866) 471-2526, email: prospectus-ny@ny.email.gs.com; J.P. Morgan Securities LLC, Attention: Investment Grade Syndicate Desk, 383 Madison Avenue, New York, NY 10179, 3rd Floor, or by contacting collect at 1-212-834-4533; or Morgan Stanley & Co. LLC, 180 Varick Street, New York, NY 10014, Attention: Prospectus Department, telephone: (866) 718-1649, email: prospectus@morganstanley.com.

Any disclaimers or other notices that may

appear below are not applicable to this communication and should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or another email system.

4

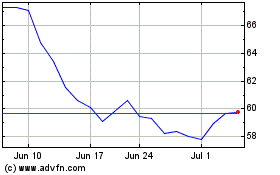

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Aug 2024 to Sep 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Sep 2023 to Sep 2024