Form 8-K - Current report

January 26 2024 - 4:32PM

Edgar (US Regulatory)

false12-31333-232018Provident Bancorp, Inc. /MD/00017787845 MARKET STREETAMESBURYNASDAQ00017787842024-01-252024-01-25

|

SECURITIES AND EXCHANGE COMMISSION

|

|

WASHINGTON, D.C. 20549

|

| |

|

|

|

|

|

|

FORM 8-K

|

| |

|

|

|

|

|

|

CURRENT REPORT

|

| |

|

|

|

|

|

|

PURSUANT TO SECTION 13 OR 15(D) OF

|

|

THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

|

|

|

|

|

Date of Report (Date of earliest event reported): January 25, 2024

|

| |

|

|

|

|

|

|

PROVIDENT BANCORP, INC.

|

|

(Exact Name of Registrant as Specified in Charter)

|

| |

|

|

|

|

|

|

Maryland

|

001-39090

|

84-4132422

|

|

(State or Other Jurisdiction

|

(Commission File No.)

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

|

Identification No.)

|

| |

|

|

|

|

|

| |

5 Market Street, Amesbury, Massachusetts

|

01913

|

|

| |

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

| |

|

|

|

|

|

|

Registrant’s telephone number, including area code: (978) 834-8555

|

| |

|

|

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

| |

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common stock

|

|

PVBC

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

|

|

|

|

|

| |

Emerging growth company

|

☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(d) On January 25, 2024, the

Board of Directors of Provident Bancorp, Inc. (the “Company”) appointed Dennis Pollack to the Company’s Board of Directors, effective immediately. Mr. Pollack has been appointed to the Company’s Compensation Committee. Mr. Pollack had

previously been appointed to the Board of Directors of BankProv, the Company’s wholly owned subsidiary.

Mr. Pollack’s appointments were made pursuant to a previously disclosed agreement (the “Agreement”), entered into by the Company with

Stilwell Activist Fund, L.P., Stilwell Activist Investments, L.P., Stilwell Partners, L.P., Stilwell Value LLC, Joseph Stilwell and Mr. Pollack.

Mr. Pollack is not a party to any transaction with the Company or BankProv that would require disclosure under Item 404(a) of Securities

and Exchange Commission Regulation S-K. Mr. Pollack will receive the standard compensatory arrangements that the Company currently provides its non-employee directors, as described in the Company’s proxy statement for its 2023 Annual Meeting of

Stockholders, as filed with the Securities and Exchange Commission on April 18, 2023, and will be granted equity awards as provided under the Agreement.

Item 5.03

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On January 25, 2024, the Board of Directors of the Company amended Article II, Section 12(a) of the Company’s Bylaws to remove a

residency requirement and to increase the age limitation on service as a director to 75.

The amendment to the Company’s bylaws is filed herewith as Exhibit 3 to this Current Report and incorporated herein by reference.

Item 8.01 Other Events

On January 26, 2024, the Company issued a press release announcing Mr. Pollack’s appointment. A copy of the press release is attached

as Exhibit 99.1 to this Current Report.

Item 9.01 Financial Statements and Exhibits

| |

(d)

|

Exhibits

|

| |

|

|

| |

|

Exhibit

|

Description

|

| |

|

|

|

| |

|

|

Text of amendments to Bylaws

|

| |

|

|

Press Release dated January 26, 2024

|

| |

|

104

|

Cover Page Interactive Data File (embedded within Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

| |

|

|

|

|

| |

|

PROVIDENT BANCORP, INC.

|

|

| |

|

|

|

|

|

DATE: January 26, 2024

|

|

By:

|

/s/ Joseph B. Reilly

|

|

| |

|

|

Joseph B. Reilly

|

|

| |

|

|

Co-President and Co-Chief Executive Officer

|

|

EXHIBIT 3

TEXT OF AMENDMENTS TO BYLAWS

Article II, Section 12(a) of the Bylaws is amended to read as follows:

Section 12. Director Qualifications

(a) No person shall be eligible for election or appointment to the Board of

Directors: (i) if a financial or securities regulatory agency has, within the past ten years, issued a cease and desist, consent or other formal order, other than a civil money penalty, against such person, which order is subject to public

disclosure by such agency; (ii) if such person has been convicted of a crime involving dishonesty or breach of trust which is punishable by imprisonment for a term exceeding one year under state or federal law; or (iii) if such person is currently

charged in any information, indictment, or other complaint with the commission of or participation in such a crime. No person may serve on the Board of Directors if such person is: (w) at the same time, a director, officer, employee or 10% or more

stockholder of a bank, savings institution, credit union, mortgage banking company, consumer loan company or similar organization, other than a subsidiary of the Corporation, that engages in financial services related business activities or

solicits customers, whether through a physical presence or electronically, in the same market area as the Corporation or any of its subsidiaries; (x) does not agree in writing to comply with all of the Corporation’s policies applicable to directors

including but not limited to its confidentiality policy and confirm in writing his or her qualifications hereunder; (y) is a party to any agreement, understanding or arrangement with a party other than the Corporation or a subsidiary that (1)

provides him or her with material benefits which are tied to or contingent on the Corporation entering into a merger, sale of control or similar transaction in which it is not the surviving institution, (2) materially limits his or her voting

discretion as a member of the Board of Directors of the Corporation, or (3) materially impairs his or her ability to discharge his or her fiduciary duties with respect to the fundamental strategic direction of the Corporation; or (z) has lost more

than one election for service as a director of the Corporation. No person shall be qualified to continue to serve as a Director after the annual meeting immediately following his or her seventy-fifth (75th) birthday.

EXHIBIT 99.1

Press Release – For Immediate Release:

Press Contact: Kathleen Barrett, VP, Director of Marketing

Phone: 603-334-1251

Email: kbarrett@bankprov.com

Provident Bancorp, Inc. Appoints Dennis Pollack to Board of Directors

Portsmouth, NH – January 26, 2024 – Provident

Bancorp, Inc. (NASDAQ: PVBC) is pleased to announce the appointment of Dennis Pollack to its Board of Directors as well as to the Board of Directors of its operating

subsidiary, BankProv, a future-ready commercial bank that offers technology-driven banking solutions to its clients. Mr. Pollack brings a wealth of experience to the role, having served in various executive positions, including most recently as President and CEO of Prudential Bank in Philadelphia, PA.

“We are thrilled to welcome Dennis Pollack to the boards of Provident and BankProv. With decades of banking experience and a deep

understanding of the market, Dennis is well-equipped to work with senior management to help guide our strategic vision in alignment with the interests of our shareholders” expressed Joe Reilly, Co-CEO of Provident Bancorp, Inc. and BankProv.

Dennis Pollack's extensive background includes executive roles at Sony Corporation of America, the Connecticut Bank of Commerce, the

Savings Bank of Rockland County, and Paulson & Company. He has previously served on the boards of several depository institutions and has been recognized for his contributions to the banking industry, with published articles in Bottomline

Magazine and The Bankers Magazine.

Mr. Pollack holds a B.S. in Economics from Seton Hall University, an M.B.A. from Columbia Business School, and a post-M.B.A. Diploma

in Bank Lending from New York University.

About BankProv

BankProv is a subsidiary of Provident Bancorp, Inc. (NASDAQ: PVBC). BankProv is a future-ready commercial bank that offers a

comprehensive suite of banking products for corporate clients. As a premier Banking-as-a-Service (BaaS) provider specializing in technology-driven banking solutions to niche markets, the Bank seeks to build financially strong and vibrant

communities by investing in the success of their clients through understanding and solving their unique business needs. BankProv is a trusted advisor and partner to a wide range of niche, technology-driven industries including renewable energy,

fintech and enterprise value lending. Headquartered in Amesbury, Massachusetts, BankProv is the 10th oldest bank in the nation. The Bank insures 100% of deposits through a combination of insurance provided by the Federal Deposit

Insurance Corporation (FDIC) and the Depositors Insurance Fund (DIF). To learn more about the organization, visit bankprov.com.

Forward-Looking Statements

This news release may contain certain forward-looking statements, such as statements of the Company’s or the Bank’s plans,

objectives, expectations, estimates and intentions. Forward-looking statements may be identified by the use of words such as, “expects,” “subject,” “believe,” “will,” “intends,” “may,” “will be” or “would.” These statements are subject to

change based on various important factors (some of which are beyond the Company’s or the Bank’s control) and actual results may differ materially. Accordingly, readers should not place undue reliance on any forward-looking statements (which

reflect management’s analysis of factors only as of the date on which they are given). Readers should carefully review the risk factors described in other documents that the Company files from time to time with the Securities and Exchange

Commission, including Annual and Quarterly Reports on Forms 10-K and 10-Q, and Current Reports on Form 8-K.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

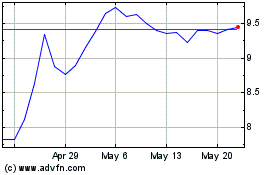

Provident Bancorp (NASDAQ:PVBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Provident Bancorp (NASDAQ:PVBC)

Historical Stock Chart

From Apr 2023 to Apr 2024