false000118534800011853482024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of Earliest Event Reported): | February 15, 2024 |

PRA Group, Inc.

_________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | 000-50058 | | 75-3078675 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

| 120 Corporate Boulevard | | | | |

| Norfolk, | Virginia | | | | 23502 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | | | | | | | |

| Registrant’s telephone number, including area code: | | (888) | 772-7326 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | PRAA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 2.02 Results of Operations and Financial Condition.

On February 15, 2024, PRA Group, Inc. (the “Company”) issued a press release announcing its fourth quarter and full year 2023 results. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and is incorporated into this Item 2.02 by reference.

Item 7.01 Regulation FD Disclosure.

The slide presentation being used in connection with the Company’s previously announced February 15, 2024 webcast and conference call to discuss its fourth quarter and full year 2023 results is available in the Investor Relations section of the Company’s website at https://ir.pragroup.com/events-and-presentations.

None of the information furnished in Item 2.02, Item 7.01 or Exhibit 99.1 of this Form 8-K shall be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that Section. Unless expressly set forth by specific reference in such filings, none of the information furnished in this Form 8-K shall be incorporated by reference in any filing under the Securities Act of 1933, as amended, whether made before or after the date hereof and regardless of any general incorporation language in such filings.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

| | |

| (d) | Exhibits | |

| | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| PRA Group, Inc. |

| | |

| Date: February 15, 2024 | By: | /s/ Rakesh Sehgal |

| | Rakesh Sehgal |

| | Executive Vice President and Chief Financial Officer |

PRA Group Reports Fourth Quarter and Full Year 2023 Results

Total Portfolio Purchases of $1.2 billion, up 36% for 2023; U.S. Portfolio Purchases up 84% for 2023

Addressing U.S. Business Underperformance with Urgency; Well-positioned for Meaningful Profitability in 2024 with a Solid Platform for Future Growth

NORFOLK, Va., February 15, 2024 - PRA Group, Inc. (Nasdaq: PRAA) (the "Company"), a global leader in acquiring and collecting nonperforming loans, today reported its financial results for the fourth quarter ("Q4 2023") and full year of 2023.

Q4 2023 Highlights

•Total portfolio purchases of $284.9 million.

•Total cash collections of $410.3 million.

•Estimated remaining collections (ERC)1 of $6.4 billion.

•Cash efficiency ratio2 of 57.3%.

•Diluted earnings per share of $(0.22).

Full Year 2023 Highlights

•Total portfolio purchases of $1.2 billion.

•Total cash collections of $1.7 billion.

•Cash efficiency ratio of 58.0%.

•Diluted earnings per share of $(2.13).

•Debt to Adjusted EBITDA3 was 2.89x.

•Total availability under the Company's credit facilities as of December 31, 2023 was $1.3 billion, comprised of $344.4 million based on current ERC and $938.5 million of additional availability subject to debt covenants, including advance rates.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended Dec 31, | | Year Ended Dec 31, |

| ($ in thousands, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income/(loss) attributable to PRA Group, Inc. | | $ | (8,782) | | | $ | 15,959 | | | $ | (83,477) | | | $ | 117,147 | |

| Diluted earnings per share | | $ | (0.22) | | | $ | 0.41 | | | $ | (2.13) | | | $ | 2.94 | |

1.Refers to the sum of all future projected cash collections on the Company's nonperforming loan portfolios.

2.Calculated by dividing cash receipts less operating expenses by cash receipts. Cash receipts refers to cash collections on the Company's nonperforming loan portfolios, fees and revenue recognized from the Company's class action claims recovery services.

3.A reconciliation of net income, the most directly comparable financial measure calculated and reported in accordance with GAAP, to Adjusted EBITDA can be found at the end of this press release.

“2023 was an important and pivotal transition year for PRA. We delivered strong performance in our European business and worked with speed and intensity to address the shortcomings in our U.S. business,” said Vikram Atal, president and chief executive officer. "With growing portfolio supply in the U.S. and a stable investment environment in Europe, we purchased total portfolios of $285 million in the fourth quarter and $1.2 billion in 2023, with the latter representing an increase of 36% and the third highest level in company history. The impact of our cash generating and operational initiatives in our U.S. business—particularly around activity within call centers, post-judgment legal processes, and offshoring—have been highly encouraging, and demonstrate that we are on track to transform PRA into a more robust, efficient, and profitable enterprise. As we continue to grow ERC with discipline, maximize cash collections, and optimize our cost structure by reducing our marginal cost, we believe we are well-positioned to deliver meaningful profitability and shareholder value for full year 2024 with a solid platform for future growth.”

Cash Collections and Revenues

The following table presents cash collections by quarter and by source on an as reported and constant currency-adjusted basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Cash Collection Source | | 2023 | | 2022 |

| ($ in thousands) | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Americas and Australia Core | | $ | 220,127 | | | $ | 223,714 | | | $ | 220,886 | | | $ | 227,960 | | | $ | 205,619 | |

| Americas Insolvency | | 24,293 | | | 27,809 | | | 26,384 | | | 25,751 | | | 27,971 | |

| Europe Core | | 144,361 | | | 144,402 | | | 149,324 | | | 134,005 | | | 134,016 | |

| Europe Insolvency | | 21,502 | | | 23,639 | | | 22,725 | | | 23,568 | | | 24,051 | |

| Total Cash Collections | | $ | 410,283 | | | $ | 419,564 | | | $ | 419,319 | | | $ | 411,284 | | | $ | 391,657 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash Collection Source - | | | | | | | | | | |

| Constant Currency Adjusted | | 2023 | | | | | | | | 2022 |

| ($ in thousands) | | Q4 | | | | | | | | Q4 |

| Americas and Australia Core | | $ | 220,127 | | | | | | | | | $ | 208,013 | |

| Americas Insolvency | | 24,293 | | | | | | | | | 27,970 | |

| Europe Core | | 144,361 | | | | | | | | | 140,393 | |

| Europe Insolvency | | 21,502 | | | | | | | | | 25,417 | |

| Total Cash Collections | | $ | 410,283 | | | | | | | | | $ | 401,793 | |

| | | | | | | | | | |

•Total cash collections in Q4 2023 increased 4.8%, or 2.1% on a constant currency-adjusted basis, to $410.3 million compared to $391.7 million in the fourth quarter of 2022 ("Q4 2022"). The increase was driven by higher cash collections in Brazil and Europe, which were partially offset by lower cash collections in the U.S. For the full year, total cash collections decreased $68.6 million compared to the full year of 2022, driven primarily by lower cash collections in the U.S.

•Total portfolio revenue in Q4 2023 was $217.4 million compared to $219.0 million in Q4 2022. For the full year, total portfolio revenue was $786.3 million compared to $941.2 million in 2022.

Expenses

•Operating expenses in Q4 2023 increased $12.4 million, or 7.6%, compared to Q4 2022. The increase was primarily driven by expenses related to growth in the Company's portfolio:

◦a $3.8 million increase in legal collection costs due to a higher volume of accounts placed in the legal channel;

◦a $3.8 million increase in agency fees due to higher cash collections in Brazil; and

◦a $2.8 million increase in communication expenses due to higher business volumes related to customer contact strategies.

•For the full year, operating expenses increased $21.4 million, or 3.1%, to $702.1 million compared to $680.7 million in the same period last year.

•Interest expense, net was $181.7 million in 2023, an increase of $51.0 million, or 39.1%, compared to $130.7 million in 2022, primarily reflecting a higher average debt balance and increased interest rates.

•The effective tax benefit rate for the full year was 19.5%.

Portfolio Acquisitions

•The Company purchased $284.9 million in portfolios of nonperforming loans in Q4 2023.

•At the end of Q4 2023, the Company had in place estimated forward flow commitments1 of $550.0 million over the next 12 months, comprised of $400.0 million in the Americas and Australia and $150.0 million in Europe.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Portfolio Purchase Source | | 2023 | | 2022 |

| ($ in thousands) | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 |

| Americas and Australia Core | | $ | 143,052 | | | $ | 187,554 | | | $ | 171,440 | | | $ | 116,867 | | | $ | 118,581 | |

| Americas Insolvency | | 18,608 | | | 44,279 | | | 12,189 | | | 15,701 | | | 8,967 | |

| Europe Core | | 110,780 | | | 60,628 | | | 136,834 | | | 90,454 | | | 140,011 | |

| Europe Insolvency | | 12,476 | | | 18,722 | | | 7,296 | | | 7,203 | | | 20,535 | |

| Total Portfolio Acquisitions | | $ | 284,916 | | | $ | 311,183 | | | $ | 327,759 | | | $ | 230,225 | | | $ | 288,094 | |

| | | | | | | | | | |

Conference Call Information

PRA Group, Inc. will hold a conference call today at 5:00 p.m. ET to discuss its financial and operational results. To listen to a webcast of the call and view the accompanying slides, visit https://ir.pragroup.com/events-and-presentations. To listen by phone, call 646-357-8785 in the U.S. or 1-800-836-8184 outside the U.S. and ask for the PRA Group conference call. To listen to a replay of the call, either visit the same website until February 15, 2025, or call 646-517-4150 in the U.S. or 1-888-660-6345 outside the U.S. and use access code 01663# until February 22, 2024.

About PRA Group

As a global leader in acquiring and collecting nonperforming loans, PRA Group, Inc. returns capital to banks and other creditors to help expand financial services for consumers in the Americas, Europe and Australia. With thousands of employees worldwide, PRA Group, Inc. companies collaborate with customers to help them resolve their debt. For more information, please visit www.pragroup.com.

About Forward-Looking Statements

Statements made herein that are not historical in nature, including PRA Group, Inc.’s or its management's intentions, hopes, beliefs, expectations, representations, projections, plans or predictions of the future, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

The forward-looking statements in this press release are based upon management's current beliefs, estimates, assumptions and expectations of PRA Group, Inc.’s future operations and financial and economic performance, taking into account currently available information. These statements are not statements of historical fact or guarantees of future performance, and there can be no assurance that anticipated events will transpire or that the Company's expectations will prove to be correct. Forward-looking statements involve risks and uncertainties, some of which are not currently known to PRA Group, Inc. Actual events or results may differ materially from those expressed or implied in any such forward-looking statements as a result of various factors, including risk factors and other risks that are described

1.Contractual agreements with sellers of nonperforming loans that allow for the purchase of nonperforming portfolios at pre-established prices. These amounts consider sellers' estimates of future flow sales and our expectations about how the agreements will perform over the next 12 months, and are dependent on actual delivery compared to these estimates. Accordingly, amounts purchased under these agreements may vary significantly.

from time to time in PRA Group, Inc.’s filings with the Securities and Exchange Commission, including PRA Group, Inc.’s annual reports on Form 10-K, its quarterly reports on Form 10-Q and its current reports on Form 8-K, which are available through PRA Group, Inc.'s website and contain a detailed discussion of PRA Group, Inc.'s business, including risks and uncertainties that may affect future results.

Due to such uncertainties and risks, you are cautioned not to place undue reliance on such forward-looking statements, which speak only as of today. Information in this press release may be superseded by more recent information or statements, which may be disclosed in later press releases, subsequent filings with the Securities and Exchange Commission or otherwise. Except as required by law, PRA Group, Inc. assumes no obligation to publicly update or revise its forward-looking statements contained herein to reflect any change in PRA Group, Inc.’s expectations with regard thereto or to reflect any change in events, conditions or circumstances on which any such forward-looking statements are based, in whole or in part.

PRA Group, Inc.

Consolidated Income Statements

(Amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| (unaudited) | | (unaudited) | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Portfolio income | $ | 194,636 | | | $ | 184,921 | | | $ | 757,128 | | | $ | 772,315 | |

| Changes in expected recoveries | 22,754 | | | 34,087 | | | 29,134 | | | 168,904 | |

| Total portfolio revenue | 217,390 | | | 219,008 | | | 786,262 | | | 941,219 | |

| | | | | | | |

| Other revenue | 4,028 | | | 3,843 | | | 16,292 | | | 25,305 | |

| Total revenues | 221,418 | | | 222,851 | | | 802,554 | | | 966,524 | |

| Operating expenses: | | | | | | | |

| Compensation and employee services | 71,070 | | | 69,922 | | | 288,778 | | | 285,537 | |

| Legal collection fees | 9,844 | | | 9,060 | | | 38,072 | | | 38,450 | |

| Legal collection costs | 22,903 | | | 19,063 | | | 89,131 | | | 76,757 | |

| Agency fees | 20,208 | | | 16,434 | | | 74,699 | | | 63,808 | |

| Outside fees and services | 20,555 | | | 20,866 | | | 82,619 | | | 92,355 | |

| Communication | 9,905 | | | 7,143 | | | 40,430 | | | 39,205 | |

| Rent and occupancy | 4,126 | | | 4,299 | | | 17,319 | | | 18,589 | |

| Depreciation and amortization | 3,032 | | | 3,859 | | | 13,376 | | | 15,243 | |

| Impairment of real estate | 202 | | | — | | | 5,239 | | | — | |

| Other operating expenses | 14,044 | | | 12,893 | | | 52,399 | | | 50,778 | |

| | | | | | | |

| Total operating expenses | 175,889 | | | 163,539 | | | 702,062 | | | 680,722 | |

| | | | | | | |

| Income from operations | 45,529 | | | 59,312 | | | 100,492 | | | 285,802 | |

| Other income and (expense): | | | | | | | |

| | | | | | | |

| Interest expense, net | (50,946) | | | (34,912) | | | (181,724) | | | (130,677) | |

| Foreign exchange gain/(loss) | (695) | | | 194 | | | 289 | | | 985 | |

| Other | (564) | | | (572) | | | (1,944) | | | (1,325) | |

| Income/(loss) before income taxes | (6,676) | | | 24,022 | | | (82,887) | | | 154,785 | |

| Income tax expense/(benefit) | (816) | | | 6,960 | | | (16,133) | | | 36,787 | |

| Net Income/(loss) | (5,860) | | | 17,062 | | | (66,754) | | | 117,998 | |

| Adjustment for net income attributable to noncontrolling interests | 2,922 | | | 1,103 | | | 16,723 | | | 851 | |

| Net income/(loss) attributable to PRA Group, Inc. | $ | (8,782) | | | $ | 15,959 | | | $ | (83,477) | | | $ | 117,147 | |

| Net income/(loss) per common share attributable to PRA Group, Inc.: | | | | | | | |

| Basic | $ | (0.22) | | | $ | 0.41 | | | $ | (2.13) | | | $ | 2.96 | |

| Diluted | $ | (0.22) | | | $ | 0.41 | | | $ | (2.13) | | | $ | 2.94 | |

| Weighted average number of shares outstanding: | | | | | | | |

| Basic | 39,245 | | | 38,978 | | | 39,177 | | | 39,638 | |

| Diluted | 39,245 | | | 39,177 | | | 39,177 | | | 39,888 | |

PRA Group, Inc.

Consolidated Balance Sheets

(Amounts in thousands)

| | | | | | | | | | | |

| (unaudited) | | |

| December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 112,528 | | | $ | 83,376 | |

| | | |

| Investments | 72,404 | | | 79,948 | |

| Finance receivables, net | 3,656,598 | | | 3,295,008 | |

| Income taxes receivable | 27,713 | | | 31,774 | |

| Deferred tax assets, net | 74,694 | | | 56,908 | |

| Right-of-use assets | 45,877 | | | 54,506 | |

| Property and equipment, net | 36,450 | | | 51,645 | |

| Goodwill | 431,564 | | | 435,921 | |

| Other assets | 67,526 | | | 86,588 | |

| Total assets | $ | 4,525,354 | | | $ | 4,175,674 | |

| Liabilities and Equity | | | |

| Liabilities: | | | |

| Accounts payable | $ | 6,325 | | | $ | 7,329 | |

| Accrued expenses | 131,893 | | | 111,395 | |

| Income taxes payable | 17,912 | | | 25,693 | |

| Deferred tax liabilities, net | 17,051 | | | 42,918 | |

| Lease liabilities | 50,300 | | | 59,384 | |

| Interest-bearing deposits | 115,589 | | | 112,992 | |

| Borrowings | 2,914,270 | | | 2,494,858 | |

| Other liabilities | 32,638 | | | 34,355 | |

| Total liabilities | 3,285,978 | | | 2,888,924 | |

| | | |

| Equity: | | | |

| Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | — | | | — | |

| Common stock, $0.01 par value, 100,000 shares authorized, 39,247 shares issued and outstanding as of December 31, 2023; 100,000 shares authorized, 38,980 shares issued and outstanding as of December 31, 2022 | 392 | | | 390 | |

| Additional paid-in capital | 7,071 | | | 2,172 | |

| Retained earnings | 1,489,548 | | | 1,573,025 | |

| Accumulated other comprehensive loss | (329,899) | | | (347,926) | |

| Total stockholders' equity - PRA Group, Inc. | 1,167,112 | | | 1,227,661 | |

| Noncontrolling interests | 72,264 | | | 59,089 | |

| Total equity | 1,239,376 | | | 1,286,750 | |

| Total liabilities and equity | $ | 4,525,354 | | | $ | 4,175,674 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Select Expenses (Income) Amounts in thousands, pre-tax |

| | | | | | | | |

| Three Months Ended |

| December 31,

2023 | September 30,

2023 | June 30,

2023 | March 31,

2023 | December 31,

2022 | September 30,

2022 | June 30,

2022 | March 31,

2022 |

| | | | | | | | |

| | | | | | | | |

| Noncash interest expense - amortization of debt issuance costs | 2,177 | | 2,220 | | 2,384 | | 2,441 | | 2,444 | | 2,555 | | 2,471 | | 2,627 | |

| Change in fair value of derivatives | (6,734) | | (6,545) | | (6,960) | | (5,470) | | (3,309) | | (1,042) | | 1,525 | | 2,726 | |

| Amortization of intangibles | 69 | | 69 | | 68 | | 66 | | 73 | | 73 | | 77 | | 83 | |

| Impairment of real estate | 202 | | 5,037 | | — | | — | | — | | — | | — | | — | |

| Stock-based compensation expense | 2,952 | | 1,629 | | 2,715 | | 3,799 | | 2,206 | | 3,101 | | 3,849 | | 3,891 | |

| | | | | | | | | | | | | | | | | |

Purchase Price Multiples as of December 31, 2023 Amounts in thousands |

| Purchase Period | Purchase Price (2)(3) | Total Estimated Collections (4) | Estimated Remaining Collections (5) | Current Purchase Price Multiple | Original Purchase Price Multiple (6) |

| Americas and Australia Core | | | | | |

| 1996-2013 | $ | 1,932,722 | | $ | 5,725,248 | | $ | 52,146 | | 296% | 233% |

| 2014 | 404,117 | | 884,911 | | 27,461 | | 219% | 204% |

| 2015 | 443,114 | | 899,839 | | 35,758 | | 203% | 205% |

| 2016 | 455,767 | | 1,078,122 | | 65,679 | | 237% | 201% |

| 2017 | 532,851 | | 1,200,599 | | 105,245 | | 225% | 193% |

| 2018 | 653,975 | | 1,482,269 | | 152,931 | | 227% | 202% |

| 2019 | 581,476 | | 1,294,462 | | 182,487 | | 223% | 206% |

| 2020 | 435,668 | | 951,929 | | 216,016 | | 218% | 213% |

| 2021 | 435,846 | | 749,966 | | 362,191 | | 172% | 191% |

| 2022 | 406,082 | | 708,070 | | 460,475 | | 174% | 179% |

| 2023 | 622,583 | | 1,227,985 | | 1,118,683 | | 197% | 197% |

| Subtotal | 6,904,201 | | 16,203,400 | | 2,779,072 | | | |

| Americas Insolvency | | | | |

| 1996-2013 | 1,266,056 | | 2,502,614 | | 91 | | 198% | 159% |

| 2014 | 148,420 | | 218,811 | | 98 | | 147% | 124% |

| 2015 | 63,170 | | 88,009 | | 73 | | 139% | 125% |

| 2016 | 91,442 | | 117,987 | | 256 | | 129% | 123% |

| 2017 | 275,257 | | 356,839 | | 1,121 | | 130% | 125% |

| 2018 | 97,879 | | 135,530 | | 1,939 | | 138% | 127% |

| 2019 | 123,077 | | 168,658 | | 18,261 | | 137% | 128% |

| 2020 | 62,130 | | 90,690 | | 28,225 | | 146% | 136% |

| 2021 | 55,187 | | 73,803 | | 33,804 | | 134% | 136% |

| 2022 | 33,442 | | 46,811 | | 34,461 | | 140% | 139% |

| 2023 | 91,282 | | 122,780 | | 113,508 | | 135% | 135% |

| Subtotal | 2,307,342 | | 3,922,532 | | 231,837 | | | |

| Total Americas and Australia | 9,211,543 | | 20,125,932 | | 3,010,909 | | | |

| Europe Core | | | | | |

| 2012-2013 | 40,742 | | 71,982 | | 1 | | 177% | 153% |

2014 (1) | 773,811 | | 2,465,052 | | 394,133 | | 319% | 208% |

| 2015 | 411,340 | | 743,591 | | 141,158 | | 181% | 160% |

| 2016 | 333,090 | | 567,702 | | 162,940 | | 170% | 167% |

| 2017 | 252,174 | | 363,813 | | 107,971 | | 144% | 144% |

| 2018 | 341,775 | | 544,970 | | 194,808 | | 159% | 148% |

| 2019 | 518,610 | | 838,326 | | 353,219 | | 162% | 152% |

| 2020 | 324,119 | | 561,192 | | 262,884 | | 173% | 172% |

| 2021 | 412,411 | | 695,544 | | 428,779 | | 169% | 170% |

| 2022 | 359,447 | | 582,380 | | 489,333 | | 162% | 162% |

| 2023 | 410,593 | | 692,580 | | 640,924 | | 169% | 169% |

| Subtotal | 4,178,112 | | 8,127,132 | | 3,176,150 | | | |

| Europe Insolvency | | | | |

2014 (1) | 10,876 | | 18,882 | | — | | 174% | 129% |

| 2015 | 18,973 | | 29,301 | | 29 | | 154% | 139% |

| 2016 | 39,338 | | 57,673 | | 932 | | 147% | 130% |

| 2017 | 39,235 | | 51,995 | | 2,020 | | 133% | 128% |

| 2018 | 44,908 | | 52,658 | | 4,862 | | 117% | 123% |

| 2019 | 77,218 | | 112,260 | | 20,970 | | 145% | 130% |

| 2020 | 105,440 | | 156,670 | | 42,614 | | 149% | 129% |

| 2021 | 53,230 | | 72,736 | | 33,441 | | 137% | 134% |

| 2022 | 44,604 | | 60,935 | | 46,620 | | 137% | 137% |

| 2023 | 46,558 | | 64,411 | | 60,029 | | 138% | 138% |

| Subtotal | 480,380 | | 677,521 | | 211,517 | | | |

| Total Europe | 4,658,492 | | 8,804,653 | | 3,387,667 | | | |

| Total PRA Group | $ | 13,870,035 | | $ | 28,930,585 | | $ | 6,398,576 | | | |

(1)Includes finance receivables portfolios that were acquired through the acquisition of Aktiv Kapital AS in 2014.

(2)Includes the acquisition date finance receivables portfolios that were acquired through our business acquisitions.

(3)Non-U.S. amounts are presented at the exchange rate at the end of the year in which the portfolio was purchased. In addition, any purchase price adjustments that occur throughout the life of the portfolio are presented at the year-end exchange rate for the respective year of purchase.

(4)Non-U.S. amounts are presented at the year-end exchange rate for the respective year of purchase.

(5)Non-U.S. amounts are presented at the December 31, 2023 exchange rate.

(6)The Original Purchase Price Multiple represents the purchase price multiple at the end of the year of acquisition.

| | | | | | | | | | | | | | | | | |

Portfolio Financial Information For the Year Ended December 31, 2023 Amounts in thousands |

| Purchase Period | Cash Collections (2) | Portfolio Income (2) | Changes in Expected Recoveries (2) | Total Portfolio Revenue (2) | Net Finance Receivables as of December 31, 2023 (3) |

| Americas and Australia Core | | | | | |

| 1996-2013 | $ | 28,414 | | $ | 14,689 | | $ | 11,698 | | $ | 26,387 | | $ | 15,661 | |

| 2014 | 11,826 | | 5,085 | | 6,623 | | 11,708 | | 10,416 | |

| 2015 | 14,084 | | 8,296 | | (352) | | 7,944 | | 15,107 | |

| 2016 | 24,898 | | 16,456 | | (973) | | 15,483 | | 21,960 | |

| 2017 | 43,765 | | 24,863 | | (5,960) | | 18,904 | | 43,205 | |

| 2018 | 92,931 | | 38,221 | | 13,105 | | 51,326 | | 84,611 | |

| 2019 | 110,278 | | 49,393 | | 287 | | 49,681 | | 100,749 | |

| 2020 | 125,832 | | 55,634 | | (3,681) | | 51,953 | | 121,292 | |

| 2021 | 136,807 | | 78,122 | | (52,274) | | 25,848 | | 190,907 | |

| 2022 | 195,438 | | 95,009 | | (5,798) | | 89,211 | | 281,983 | |

| 2023 | 108,414 | | 75,234 | | 3,074 | | 78,307 | | 591,032 | |

| Subtotal | 892,687 | | 461,002 | | (34,251) | | 426,752 | | 1,476,923 | |

| Americas Insolvency | | | | | |

| 1996-2013 | 1,089 | | 336 | | 756 | | 1,092 | | — | |

| 2014 | 430 | | 249 | | 136 | | 385 | | — | |

| 2015 | 325 | | 105 | | 121 | | 226 | | 39 | |

| 2016 | 893 | | 120 | | 521 | | 641 | | 228 | |

| 2017 | 4,852 | | 438 | | 1,457 | | 1,895 | | 1,013 | |

| 2018 | 12,677 | | 1,085 | | (1,751) | | (667) | | 1,858 | |

| 2019 | 28,698 | | 3,149 | | 651 | | 3,800 | | 17,310 | |

| 2020 | 19,470 | | 4,202 | | 1,000 | | 5,202 | | 25,023 | |

| 2021 | 17,474 | | 4,590 | | 924 | | 5,515 | | 28,874 | |

| 2022 | 9,163 | | 3,831 | | 716 | | 4,547 | | 27,851 | |

| 2023 | 9,166 | | 4,998 | | 2,237 | | 7,234 | | 85,331 | |

| Subtotal | 104,237 | | 23,103 | | 6,768 | | 29,870 | | 187,527 | |

| Total Americas and Australia | 996,924 | | 484,105 | | (27,483) | | 456,622 | | 1,664,450 | |

| Europe Core | | | | | |

| 2012-2013 | 1,029 | | 1 | | 1,028 | | 1,029 | | — | |

2014 (1) | 107,571 | | 67,749 | | 24,528 | | 92,277 | | 101,742 | |

| 2015 | 33,779 | | 16,091 | | 2,643 | | 18,734 | | 72,591 | |

| 2016 | 29,663 | | 15,334 | | (3,008) | | 12,326 | | 96,274 | |

| 2017 | 20,166 | | 7,471 | | 1,012 | | 8,484 | | 73,646 | |

| 2018 | 41,613 | | 15,083 | | 1,326 | | 16,409 | | 128,861 | |

| 2019 | 75,074 | | 23,993 | | 23,157 | | 47,150 | | 238,759 | |

| 2020 | 56,078 | | 21,772 | | 3,436 | | 25,207 | | 163,027 | |

| 2021 | 73,017 | | 32,638 | | (5,931) | | 26,707 | | 258,670 | |

| 2022 | 83,782 | | 34,199 | | 986 | | 35,185 | | 307,528 | |

| 2023 | 50,320 | | 20,129 | | (1,029) | | 19,099 | | 377,193 | |

| Subtotal | 572,092 | | 254,460 | | 48,148 | | 302,607 | | 1,818,291 | |

| Europe Insolvency | | | | | |

2014 (1) | 235 | | — | | 235 | | 235 | | — | |

| 2015 | 395 | | 26 | | 289 | | 315 | | 27 | |

| 2016 | 1,315 | | 248 | | 330 | | 578 | | 429 | |

| 2017 | 3,800 | | 259 | | 821 | | 1,080 | | 1,753 | |

| 2018 | 7,154 | | 650 | | 39 | | 690 | | 4,417 | |

| 2019 | 17,460 | | 2,479 | | 1,266 | | 3,745 | | 18,413 | |

| 2020 | 29,687 | | 4,643 | | 3,180 | | 7,823 | | 38,342 | |

| 2021 | 14,734 | | 3,556 | | 1,405 | | 4,961 | | 28,669 | |

| 2022 | 12,352 | | 4,588 | | 195 | | 4,783 | | 36,875 | |

| 2023 | 4,302 | | 2,114 | | 709 | | 2,823 | | 44,932 | |

| Subtotal | 91,434 | | 18,563 | | 8,469 | | 27,033 | | 173,857 | |

| Total Europe | 663,526 | | 273,023 | | 56,617 | | 329,640 | | 1,992,148 | |

| Total PRA Group | $ | 1,660,450 | | $ | 757,128 | | $ | 29,134 | | $ | 786,262 | | $ | 3,656,598 | |

(1)Includes finance receivables portfolios that were acquired through the acquisition of Aktiv Kapital AS in 2014.

(2)Non-U.S. amounts are presented using the average exchange rates during the current reporting period.

(3)Non-U.S. amounts are presented at the December 31, 2023 exchange rate.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash Collections by Year, By Year of Purchase (1) as of December 31, 2023 Amounts in millions |

| | | | | | | | | | | | | |

| | Cash Collections | |

| Purchase Period | Purchase Price (3)(4) | 1996-2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Total |

| Americas and Australia Core | | | | | | | | | | | |

| 1996-2013 | $ | 1,932.7 | | $ | 3,618.9 | | $ | 660.3 | | $ | 474.4 | | $ | 299.7 | | $ | 197.0 | | $ | 140.3 | | $ | 99.7 | | $ | 64.7 | | $ | 46.5 | | $ | 36.0 | | $ | 28.4 | | $ | 5,665.9 | |

| 2014 | 404.1 | | — | | 92.7 | | 253.4 | | 170.3 | | 114.2 | | 82.2 | | 55.3 | | 31.9 | | 22.3 | | 15.0 | | 11.8 | | 849.1 | |

| 2015 | 443.1 | | — | | — | | 117.0 | | 228.4 | | 185.9 | | 126.6 | | 83.6 | | 57.2 | | 34.9 | | 19.5 | | 14.1 | | 867.2 | |

| 2016 | 455.8 | | — | | — | | — | | 138.7 | | 256.5 | | 194.6 | | 140.6 | | 105.9 | | 74.2 | | 38.4 | | 24.9 | | 973.8 | |

| 2017 | 532.9 | | — | | — | | — | | — | | 107.3 | | 278.7 | | 256.5 | | 192.5 | | 130.0 | | 76.3 | | 43.8 | | 1085.1 | |

| 2018 | 654.0 | | — | | — | | — | | — | | — | | 122.7 | | 361.9 | | 337.7 | | 239.9 | | 146.1 | | 92.9 | | 1301.2 | |

| 2019 | 581.5 | | — | | — | | — | | — | | — | | — | | 143.8 | | 349.0 | | 289.8 | | 177.7 | | 110.3 | | 1070.6 | |

| 2020 | 435.7 | | — | | — | | — | | — | | — | | — | | — | | 132.9 | | 284.3 | | 192.0 | | 125.8 | | 735.0 | |

| 2021 | 435.8 | — | | — | | — | | — | | — | | — | | — | | — | | 85.0 | | 177.3 | | 136.8 | | 399.1 | |

| 2022 | 406.1 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 67.7 | | 195.4 | | 263.1 | |

| 2023 | 622.6 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 108.5 | | 108.5 | |

| Subtotal | 6,904.3 | | 3,618.9 | | 753.0 | | 844.8 | | 837.1 | | 860.9 | | 945.1 | | 1,141.4 | | 1,271.8 | | 1,206.9 | | 946.0 | | 892.7 | | 13,318.6 | |

| Americas Insolvency | | | | | | | | | | | |

| 1996-2013 | 1,266.1 | | 1,491.4 | | 421.4 | | 289.9 | | 168.7 | | 85.5 | | 30.3 | | 6.8 | | 3.6 | | 2.2 | | 1.6 | | 1.1 | | 2,502.5 | |

| 2014 | 148.4 | | — | | 37.0 | | 50.9 | | 44.3 | | 37.4 | | 28.8 | | 15.8 | | 2.2 | | 1.1 | | 0.7 | | 0.4 | | 218.6 | |

| 2015 | 63.2 | | — | | — | | 3.4 | | 17.9 | | 20.1 | | 19.8 | | 16.7 | | 7.9 | | 1.3 | | 0.6 | | 0.3 | | 88.0 | |

| 2016 | 91.4 | | — | | — | | — | | 18.9 | | 30.4 | | 25.0 | | 19.9 | | 14.4 | | 7.4 | | 1.8 | | 0.9 | | 118.7 | |

| 2017 | 275.3 | | — | | — | | — | | — | | 49.1 | | 97.3 | | 80.9 | | 58.8 | | 44.0 | | 20.8 | | 4.9 | | 355.8 | |

| 2018 | 97.9 | | — | | — | | — | | — | | — | | 6.7 | | 27.4 | | 30.5 | | 31.6 | | 24.6 | | 12.7 | | 133.5 | |

| 2019 | 123.1 | | — | | — | | — | | — | | — | | — | | 13.4 | | 31.4 | | 39.1 | | 37.8 | | 28.7 | | 150.4 | |

| 2020 | 62.1 | | — | | — | | — | | — | | — | | — | | — | | 6.5 | | 16.1 | | 20.4 | | 19.5 | | 62.5 | |

| 2021 | 55.2 | | — | | — | | — | | — | | — | | — | | — | | — | | 4.6 | | 17.9 | | 17.5 | | 40.0 | |

| 2022 | 33.4 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 3.2 | | 9.2 | | 12.4 | |

| 2023 | 91.3 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 9.0 | | 9.0 | |

| Subtotal | 2,307.4 | | 1,491.4 | | 458.4 | | 344.2 | | 249.8 | | 222.5 | | 207.9 | | 180.9 | | 155.3 | | 147.4 | | 129.4 | | 104.2 | | 3,691.4 | |

| Total Americas and Australia | 9,211.7 | | 5,110.3 | | 1,211.4 | | 1,189.0 | | 1,086.9 | | 1,083.4 | | 1,153.0 | | 1,322.3 | | 1,427.1 | | 1,354.3 | | 1,075.4 | | 996.9 | | 17,010.0 | |

| Europe Core | | | | | | | | | | | |

| 2012-2013 | 40.7 | | 27.7 | | 14.2 | | 5.5 | | 3.5 | | 3.3 | | 3.3 | | 2.4 | | 1.9 | | 1.8 | | 1.4 | | 1.0 | | 66.0 | |

2014 (2) | 773.8 | | — | | 153.2 | | 292.0 | | 246.4 | | 220.8 | | 206.3 | | 172.9 | | 149.8 | | 149.2 | | 122.2 | | 107.6 | | 1,820.4 | |

| 2015 | 411.3 | | — | | — | | 45.8 | | 100.3 | | 86.2 | | 80.9 | | 66.1 | | 54.3 | | 51.4 | | 40.7 | | 33.8 | | 559.5 | |

| 2016 | 333.1 | | — | | — | | — | | 40.4 | | 78.9 | | 72.6 | | 58.0 | | 48.3 | | 46.7 | | 36.9 | | 29.7 | | 411.5 | |

| 2017 | 252.2 | | — | | — | | — | | — | | 17.9 | | 56.0 | | 44.1 | | 36.1 | | 34.8 | | 25.2 | | 20.2 | | 234.3 | |

| 2018 | 341.8 | | — | | — | | — | | — | | — | | 24.3 | | 88.7 | | 71.3 | | 69.1 | | 50.7 | | 41.6 | | 345.7 | |

| 2019 | 518.6 | | — | | — | | — | | — | | — | | — | | 48.0 | | 125.7 | | 121.4 | | 89.8 | | 75.1 | | 460.0 | |

| 2020 | 324.1 | | — | | — | | — | | — | | — | | — | | — | | 32.3 | | 91.7 | | 69.0 | | 56.1 | | 249.1 | |

| 2021 | 412.4 | | — | | — | | — | | — | | — | | — | | — | | — | | 48.5 | | 89.9 | | 73.0 | | 211.4 | |

| 2022 | 359.4 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 33.9 | | 83.8 | | 117.7 | |

| 2023 | 410.6 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 50.2 | | 50.2 | |

| Subtotal | 4,178.0 | | 27.7 | | 167.4 | | 343.3 | | 390.6 | | 407.1 | | 443.4 | | 480.2 | | 519.7 | | 614.6 | | 559.7 | | 572.1 | | 4,525.8 | |

| Europe Insolvency | | | | | | | | | | | |

2014 (2) | 10.9 | | — | | — | | 4.3 | | 3.9 | | 3.2 | | 2.6 | | 1.5 | | 0.8 | | 0.3 | | 0.2 | | 0.2 | | 17.0 | |

| 2015 | 19.0 | | — | | — | | 3.0 | | 4.4 | | 5.0 | | 4.8 | | 3.9 | | 2.9 | | 1.6 | | 0.6 | | 0.4 | | 26.6 | |

| 2016 | 39.3 | | — | | — | | — | | 6.2 | | 12.7 | | 12.9 | | 10.7 | | 7.9 | | 6.0 | | 2.7 | | 1.3 | | 60.4 | |

| 2017 | 39.2 | | — | | — | | — | | — | | 1.2 | | 7.9 | | 9.2 | | 9.8 | | 9.4 | | 6.5 | | 3.8 | | 47.8 | |

| 2018 | 44.9 | | — | | — | | — | | — | | — | | 0.6 | | 8.4 | | 10.3 | | 11.7 | | 9.8 | | 7.2 | | 48.0 | |

| 2019 | 77.2 | | — | | — | | — | | — | | — | | — | | 5.0 | | 21.1 | | 23.9 | | 21.0 | | 17.5 | | 88.5 | |

| 2020 | 105.4 | | — | | — | | — | | — | | — | | — | | — | | 6.0 | | 34.6 | | 34.1 | | 29.7 | | 104.4 | |

| 2021 | 53.2 | | — | | — | | — | | — | | — | | — | | — | | — | | 5.5 | | 14.4 | | 14.7 | | 34.6 | |

| 2022 | 44.6 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 4.5 | | 12.4 | | 16.9 | |

| 2023 | 46.6 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 4.2 | | 4.2 | |

| Subtotal | 480.3 | | — | | — | | 7.3 | | 14.5 | | 22.1 | | 28.8 | | 38.7 | | 58.8 | | 93.0 | | 93.8 | | 91.4 | | 448.4 | |

| Total Europe | 4,658.3 | | 27.7 | | 167.4 | | 350.6 | | 405.1 | | 429.2 | | 472.2 | | 518.9 | | 578.5 | | 707.6 | | 653.5 | | 663.5 | | 4,974.2 | |

| Total PRA Group | $ | 13,870.0 | | $ | 5,138.0 | | $ | 1,378.8 | | $ | 1,539.6 | | $ | 1,492.0 | | $ | 1,512.6 | | $ | 1,625.2 | | $ | 1,841.2 | | $ | 2,005.6 | | $ | 2,061.9 | | $ | 1,728.9 | | $ | 1,660.4 | | $ | 21,984.2 | |

(1)Non-U.S. amounts are presented using the average exchange rates during the cash collection period.

(2)Includes finance receivables portfolios that were acquired through the acquisition of Aktiv Kapital AS in 2014.

(3)Includes the nonperforming loan portfolios that were acquired through our business acquisitions.

(4)Non-U.S. amounts are presented at the exchange rate at the end of the year in which the portfolio was purchased. In addition, any purchase price adjustments that occur throughout the life of the pool are presented at the year-end exchange rate for the respective year of purchase.

Use of Non-GAAP Financial Measures

PRA Group, Inc. reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). However, management uses certain non-GAAP financial measures, including Adjusted EBITDA, internally to evaluate the Company’s performance and to set performance goals. Adjusted EBITDA is calculated as net income attributable to PRA Group, Inc. plus income tax expense; less foreign exchange gain (or plus foreign exchange loss); plus interest expense, net; plus other expense (or less other income); plus depreciation and amortization; plus adjustment for net income attributable to noncontrolling interests; and plus recoveries applied to negative allowance less changes in expected recoveries. Adjusted EBITDA is a supplemental measure of performance that is not required by, or presented in accordance with, GAAP. PRA Group, Inc. presents Adjusted EBITDA because the Company considers it an important supplemental measure of operations and financial performance. Management believes Adjusted EBITDA helps provide enhanced period-to-period comparability of operations and financial performance and is useful to investors as other companies in the industry report similar financial measures. Adjusted EBITDA should not be considered as an alternative to net income determined in accordance with GAAP. Set forth below is a reconciliation of net income, the most directly comparable financial measure calculated and reported in accordance with GAAP, to Adjusted EBITDA for the years ended December 31, 2023 and 2022. The calculation of Adjusted EBITDA below may not be comparable to the calculation of similarly titled measures reported by other companies.

| | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Non-GAAP Financial Measures |

| Adjusted EBITDA for PRA Group ($ in millions) | December 31, 2023 | December 31, 2022 |

| Net income/(loss) attributable to PRA Group, Inc. | $ | (83) | | $ | 117 | |

| Adjustments: | | | | | | |

| Income tax expense | (16) | | 37 | |

| Foreign exchange (gains)/losses | — | | (1) | |

| Interest expense, net | 181 | | 131 | |

| Other expense | 2 | | 1 | |

| Depreciation and amortization | 13 | | 15 | |

| Impairment of real estate | 5 | | — | |

| Adjustment for net income attributable to noncontrolling interests | 17 | | 1 | |

| | |

| Recoveries applied to negative allowance less Changes in expected recoveries | | | | | 888 | | 806 | |

| Adjusted EBITDA | $ | 1,007 | | $ | 1,107 | |

Additionally, the Company evaluates its business using certain ratios that use Adjusted EBITDA. Debt to Adjusted EBITDA is calculated by dividing borrowings by Adjusted EBITDA. The following table reflects the Company's Debt to Adjusted EBITDA for the years ended December 31, 2023 and 2022 (amounts in millions):

| | | | | | | | |

| Debt to Adjusted EBITDA |

| | |

| December 31, 2023 | December 31, 2022 |

| Borrowings | $ | 2,914 | | $ | 2,495 | |

| Adjusted EBITDA | 1,007 | | 1,107 | |

| Debt to Adjusted EBITDA | 2.89 | 2.25 |

Investor Contact:

Najim Mostamand, CFA

Vice President, Investor Relations

(757) 431-7913

IR@PRAGroup.com

News Media Contact:

Elizabeth Kersey

Senior Vice President, Communications and Public Policy

(757) 641-0558

Elizabeth.Kersey@PRAGroup.com

v3.24.0.1

Cover Page

|

Feb. 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 15, 2024

|

| Entity Registrant Name |

PRA Group, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

000-50058

|

| Entity Tax Identification Number |

75-3078675

|

| Entity Address, Address Line One |

120 Corporate Boulevard

|

| Entity Address, City or Town |

Norfolk,

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23502

|

| City Area Code |

(888)

|

| Local Phone Number |

772-7326

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

PRAA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001185348

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

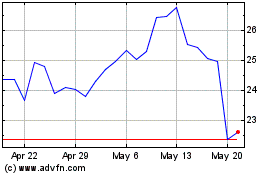

PRA (NASDAQ:PRAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

PRA (NASDAQ:PRAA)

Historical Stock Chart

From Apr 2023 to Apr 2024