Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 09 2021 - 5:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of April 2021

Commission File Number: 001-38851

POWERBRIDGE TECHNOLOGIES CO., LTD.

(Translation of Registrant's name into English)

1st Floor, Building D2, Southern Software Park

Tangjia Bay, Zhuhai, Guangdong 519080, China

Tel: +86-756-339-5666

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note : Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant’s “home country”), or under the rules of the home country exchange on which

the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and

has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject

of a Form 6-K submission or other Commission filing on EDGAR.

CONTENTS

Entry into a Material Definitive Agreement

On April 9, 2021, Powerbridge Technologies Co., Ltd. (“Powerbridge”

or the “Company”) (Nasdaq: PBTS) entered into a securities purchase agreement with YA II PN, LTD. (the “Investor”),

pursuant to which the Investor purchases convertible notes (the “Notes”) in the principal amount of US$7,000,000 (the

“Principal”), which shall be convertible into the Company’s ordinary shares (the “Ordinary Shares”)

par value $0.00166667 per share, and a warrant (the “Warrant”) to purchase 571,429 Ordinary Shares (the

“Offering”), for gross proceeds of approximately US$6,790,000. The Notes have a conversion price (the “Conversion

Price”) of the lower of (i) US$3.675 per Ordinary Shares (the “Fixed Conversion Price”), or (ii) 90%

of the lowest daily VWAP (as defined in the Note) during the 10 consecutive trading days immediately preceding the conversion date or

other date of determination, but not lower than the floor price of US$1.50 per ordinary share. The Principal will become due and payable

12 months from the date of closing (the “Maturity Date”) and bears an annual interest rate of 6% unless earlier converted

or redeemed by the Company. At any time before the Maturity Date, the Investor may convert the Notes at its option into Ordinary Shares

at the Conversion Price. The Company has the right, but not the obligation, to redeem (“Optional Redemption”) a portion

or all amounts outstanding under the Notes prior to the Maturity Date at a cash redemption price equal to the outstanding Principal balance

to be redeemed, plus the applicable redemption premium, plus accrued and unpaid interest; provided that the trading price of the ordinary

shares is less than the Fixed Conversion Price and the Company provides Investor with at least 15 business days’ prior written notice

of its desire to exercise an Optional Redemption. The Investor may convert all or any part of the Notes after receiving a redemption notice,

in which case the redemption amount shall be reduced by the amount so converted. No public market currently exists for the Notes, and

the Company does not intend to apply to list the Notes on any securities exchange or for quotation on any inter-dealer quotation system.

The Notes contain customary events of default, indemnification obligations of the Company and other obligations and rights of the parties.

The Warrant is subject to anti-dilution provisions to reflect stock dividends and splits, and future securities offerings at lower prices

with certain exception.

The Offering will be

conducted in two closings. The first closing consists of offer and sale of a Note in the principal amount of $4,000,000. The first

closing occurred on April 9, 2021.

The second closing consists of

offer and sale of a Note in the principal amount of $3,000,000 and the Warrant. The second closing is expected to occur within five (5)

trading days of the Company files its Form 20-F with the Securities and Exchange Commission (“SEC”) for the fiscal

year ended December 31, 2020 in compliance with applicable rules and regulations promulgated by the SEC and is subject to various conditions.

The Warrant will be exercisable immediately following the date of issuance for a period of five years at an initial exercise price of

$3.675. The Warrant is subject to anti-dilution provisions to reflect stock dividends and splits, and future securities offerings at lower

prices with certain exception. No public market currently exists for the Warrant, and the Company does not intend to apply to list the

Warrant on any securities exchange or for quotation on any inter-dealer quotation system.

The Notes and Warrant are

and will be offered pursuant to the Company’s effective registration statement on Form F-3 (Registration Statement No. 333-253395)

previously filed with the SEC and prospectus supplements thereunder.

The foregoing description

of the securities purchase agreement, the Notes, and the Warrant is qualified in its entirety by reference to the full text of the securities

purchase agreement, the Notes and the Warrants, a copy of which is filed herewith as Exhibit 10.1, Exhibit 10.2, and Exhibit

10.3 to this Current Report on Form 6-K. This Form 6-K (including the documents attached as exhibits hereto) is hereby incorporated

by reference into the Company’s registration statement on Form F-3 initially filed on February 23, 2021 (Registration Statement

No. 333-253395).

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 9, 2021

|

|

POWERBRIDGE TECHNOLOGIES CO., LTD.

|

|

|

|

|

|

|

By:

|

/s/ Stewart Lor

|

|

|

|

Stewart Lor

Chief Financial Officer

|

|

|

|

2

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

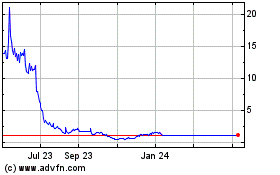

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Apr 2023 to Apr 2024