Current Report Filing (8-k)

June 02 2020 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 27, 2020

Onconova Therapeutics, Inc.

(Exact name of Registrant as specified in

its charter)

|

Delaware

|

|

001-36020

|

|

22-3627252

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

375 Pheasant Run

Newtown, PA 18940

(267) 759-3680

(Address, Including Zip Code, and Telephone

Number, Including Area Code, of Registrant’s Principal Executive

Offices)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

|

ONTX

|

|

The Nasdaq Stock Market LLC

|

|

Common Stock Warrants

|

|

ONTXW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

Item 5.07. Submission of Matters to a Vote of Security Holders.

On May 27, 2020, Onconova Therapeutics, Inc. (the “Company”)

held its 2020 Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders

voted on the following proposals:

Proposal 1. To elect the eight nominees named in the Company’s

proxy statement to serve for one-year terms as directors of the Company, with such terms expiring as of the Company’s 2021

Annual Meeting of Stockholders and, in each case, until a successor is elected and qualified. Each nominee for director was elected

by a vote of the stockholders as follows:

|

Name

|

|

For

|

|

|

Withheld

|

|

|

Broker Non-Votes

|

|

|

Steven M. Fruchtman

|

|

|

34,372,553

|

|

|

|

7,655,834

|

|

|

|

63,046,927

|

|

|

Jerome E. Groopman

|

|

|

35,358,898

|

|

|

|

6,669,489

|

|

|

|

63,046,927

|

|

|

Michael B. Hoffman

|

|

|

36,390,556

|

|

|

|

5,637,831

|

|

|

|

63,046,927

|

|

|

James J. Marino

|

|

|

35,456,525

|

|

|

|

6,571,862

|

|

|

|

63,046,927

|

|

|

Viren Mehta

|

|

|

35,561,850

|

|

|

|

6,466,537

|

|

|

|

63,046,927

|

|

|

E. Premkumar Reddy

|

|

|

36,275,353

|

|

|

|

5,753,034

|

|

|

|

63,046,927

|

|

|

Terri Shoemaker

|

|

|

35,991,681

|

|

|

|

6,036,706

|

|

|

|

63,046,927

|

|

|

Jack E. Stover

|

|

|

34,946,218

|

|

|

|

7,082,169

|

|

|

|

63,046,927

|

|

Proposal 3. To consider and vote upon an amendment and restatement

of the 2018 Omnibus Incentive Compensation Plan, as amended and restated, to increase the number of shares available under the

plan and to make certain other changes. The proposal was not approved by a vote of the stockholders as follows:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

18,491,944

|

|

18,531,672

|

|

5,004,771

|

|

63,046,927

|

The final vote result for Proposal 3 differs from the preliminary

vote result for Proposal 3 announced at the Annual Meeting because certain votes were cast but not tabulated at the closing of

the polls for Proposal 3.

Proposal 4. To approve, on an advisory basis, the compensation

of our named executive officers. The proposal was approved by a vote of the stockholders as follows:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

19,494,712

|

|

18,719,553

|

|

3,814,122

|

|

63,046,927

|

Proposal 5. To ratify the selection of Ernst & Young

LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020. The

proposal was approved by a vote of the stockholders as follows:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

89,588,775

|

|

9,298,258

|

|

6,188,281

|

|

None

|

Proposal 6. To consider and vote upon a proposal to adjourn

the Annual Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of

the Annual Meeting to approve the reverse stock split. The proposal was approved by a vote of the stockholders as follows:

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

54,922,674

|

|

45,499,776

|

|

4,652,864

|

|

None

|

With regard to Proposal 4, the Company’s Compensation

Committee of the Board of Directors takes note of the results of the advisory “say-on-pay” proposal and expects to

consider these results and feedback from stockholder engagement among the factors considered in connection with continuing to discharge

its responsibilities in setting the compensation of the Company’s named executive officers.

Item 8.01 Other Events.

With respect to Proposal 2 to consider and vote upon an amendment

to the Company’s Tenth Amended and Restated Certificate of Incorporation, as amended, to combine outstanding shares of the

Company’s common stock into a lesser number of outstanding shares, or a “reverse stock split”, by a ratio of

not less than one-for-five and not more than one-for-twenty-five, with the exact ratio to be set within this range by the Company’s

Board of Directors in its sole discretion, in accordance with Proposal 6 which was approved by the stockholders, the Annual Meeting

was adjourned to June 26, 2020, at 10:30 a.m. Eastern Daylight Time.

The adjourned Annual Meeting will be held at the same virtual

meeting location, www.virtualshareholdermeeting.com/ONTX2020. This will enable the Company’s stockholders of record as of

the record date, which was March 30, 2020, additional time to consider and vote on Proposal 2, and enable the Company’s proxy

solicitor, MacKenzie Partners, Inc., more time to assist the Company with the solicitation of stockholder votes on Proposal 2.

At the adjourned Annual Meeting on June 26, 2020, stockholders

will be deemed to be present in person and vote at such adjourned meeting in the same manner as disclosed in the definitive proxy

statement the Company filed with the Securities and Exchange Commission on April 23, 2020 and mailed to the stockholders. Valid

proxies submitted prior to the reconvened Annual Meeting will continue to be valid for the upcoming reconvened Annual Meeting,

unless properly changed or revoked prior to votes being taken at such reconvened Annual Meeting.

The Company's Board of Directors expects to communicate with stockholders in the near future in connection with the adjourned

Annual Meeting.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: June 2, 2020

|

Onconova Therapeutics, Inc.

|

|

|

|

|

|

By:

|

/s/ MARK GUERIN

|

|

|

|

Name: Mark Guerin

|

|

|

|

Title: Chief Financial Officer

|

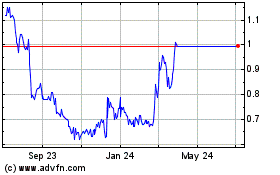

Onconova Therapeutics (NASDAQ:ONTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

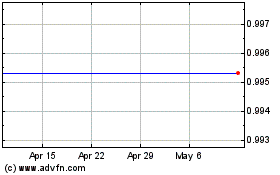

Onconova Therapeutics (NASDAQ:ONTX)

Historical Stock Chart

From Apr 2023 to Apr 2024