false

0001681206

0001681206

2023-11-07

2023-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 7,

2023

| NI Holdings, Inc. |

| (Exact name of registrant as specified in its charter) |

| |

|

|

|

|

| North Dakota |

|

001-37973 |

|

81-2683619 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

|

|

|

|

1101 First Avenue North

Fargo, North Dakota |

| (Address of principal executive offices) |

| |

| 58102 |

| (Zip code) |

| |

| (701) 298-4200 |

| (Registrant’s telephone number, including area code) |

| |

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Securities Exchange Act of 1934:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

NODK |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. [ ]

| Item 2.02. | Results of Operations and Financial Condition. |

On November 7, 2023, the Company issued a press release announcing

its financial results for the quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is

incorporated herein in its entirety by reference.

The information in this Item 2.02 and the Exhibit attached hereto

is furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly

set forth by specific reference in such document or filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NI Holdings, Inc. |

| |

|

| |

|

| Date: November 7, 2023 |

By: |

/s/ Michael J. Alexander |

| |

|

Michael J. Alexander |

| |

|

President and Chief Executive Officer |

NI Holdings, Inc. Reports Results for Third Quarter

Ended September 30, 2023

FARGO, North Dakota, November 7, 2023 –

NI Holdings, Inc. (NASDAQ: NODK) announced today results for the quarter ended September 30, 2023.

Summary of Third Quarter 2023 Results

(All comparisons vs. the third quarter of 2022,

unless noted otherwise)

| · | Direct written premiums of $81.2 million, flat

to prior year, driven by increases in Non-Standard Auto (17.9%), Private Passenger Auto (10.4%) and Home and Farm (7.1%), offset by a

decrease in Crop. |

| · | Net earned premiums of $90.8 million, up 1.4%.

|

| · | Combined Ratio of 102.0% versus 114.4%, driven

by lower weather-related losses in Home and Farm, lower loss frequency in Private Passenger Auto, and favorable crop growing conditions,

offset by further reserve strengthening in Non-Standard Auto and Commercial to address elevated liability loss severity and the continued

impact of higher inflationary-related loss costs. |

| · | Net investment income of $2.8 million versus

$2.0 million and net investment loss of $1.2 million versus $2.9 million, driven by higher fixed income reinvestment rates and more favorable

year-over-year equity market conditions. |

| · | Earnings per share of $0.01, compared to loss

per share of $0.47. |

| · | The Company repurchased 310,385 shares of common

stock at an average price of $12.86 per share for a total of $4.0 million. |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

Dollars in thousands, except per share data

(unaudited) |

2023 |

2022 |

Change |

|

2023 |

2022 |

Change |

|

| Direct written premiums |

$81,223 |

$81,147 |

0.1% |

|

$316,029 |

$301,642 |

4.8% |

|

| Net earned premiums |

$90,770 |

$89,532 |

1.4% |

|

$262,543 |

$243,615 |

7.8% |

|

| Loss and LAE ratio |

70.0% |

88.1% |

(18.1 pts) |

|

76.1% |

93.5% |

(17.4 pts) |

|

| Expense ratio |

32.0% |

26.3% |

5.7 pts |

|

33.2% |

30.0% |

3.2 pts |

|

| Combined ratio |

102.0% |

114.4% |

(12.4 pts) |

|

109.3% |

123.5% |

(14.2 pts) |

|

| Net income (loss) attributable to NI Holdings |

$231 |

($9,985) |

NM |

|

($12,101) |

($53,986) |

NM |

|

| Return on average equity |

0.4% |

(15.4%) |

15.8 pts |

|

(6.7%) |

(24.3%) |

17.6 pts |

|

| Basic earnings (loss) per share |

$0.01 |

($0.47) |

NM |

|

($0.57) |

($2.53) |

NM |

|

| |

|

|

|

|

|

NM = Not meaningful |

|

| |

Management Commentary

“During the third quarter, we began to benefit

from our significant rate and underwriting actions implemented earlier this year, with our profitability showing improvement over the

prior year,” said Michael J. Alexander, President, and Chief Executive Officer. “We certainly benefited from avoiding catastrophe

losses during 2023, which allowed our Home and Farm segment to return to expected profitability, along with strong results from our multi-peril

crop business. Although we are pleased with our progress and return to profitability, we continue to be challenged by the ongoing effects

of elevated loss cost inflation impacting our industry. Our Non-Standard Auto and Commercial segments both experienced unfavorable prior

year reserve development, driven by elevated loss severity as a result of inflation and other challenging market conditions. To that end,

we remain focused on pursuing continued aggressive rate and underwriting actions, along with other strategic measures to improve our overall

risk profile across all lines of business. Our results continue to be positively impacted by our investment portfolio, which is producing

steadily rising returns, due to higher reinvestment rates and more favorable market conditions.

Overall, we remain positive regarding the outlook

for our business, and our ability to execute the actions necessary to provide our shareholders with appropriate returns over time.”

Securities and Exchange Commission (SEC) Filings

The Company’s Quarterly Report on Form 10-Q

and latest financial supplement can be found on the Company’s website at www.niholdingsinc.com. The Company’s filings with

the SEC can also be found at www.sec.gov.

About the Company

NI Holdings, Inc. is an insurance holding company.

The company is a North Dakota business corporation that is the stock holding company of Nodak Insurance Company and became such in connection

with the conversion of Nodak Mutual Insurance Company from a mutual to stock form of organization and the creation of a mutual holding

company. The conversion was consummated on March 13, 2017. Immediately following the conversion, all of the outstanding shares of common

stock of Nodak Insurance Company were issued to Nodak Mutual Group, Inc., which then contributed the shares to NI Holdings in exchange

for 55% of the outstanding shares of common stock of NI Holdings. Nodak Insurance Company then became a wholly-owned stock subsidiary

of NI Holdings. NI Holdings’ financial statements are the consolidated financial results of NI Holdings; Nodak Insurance, including

Nodak’s wholly-owned subsidiaries American West Insurance Company and Primero Insurance Company, and its affiliate Battle Creek

Mutual Insurance Company; Direct Auto Insurance Company; and Westminster Insurance Company.

Safe Harbor Statement

Some of the statements included in this news release,

particularly those anticipating future financial performance, including investment performance and yields, business prospects, growth

and operating strategies, the impact of pricing and underwriting changes on operating results, our ability to achieve returns for our

shareholders, and similar matters, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform

Act of 1995. Actual results could vary materially. Factors that could cause actual results to vary materially include: our ability to

maintain profitable operations, the adequacy of the loss and loss adjustment expense reserves, business and economic conditions, interest

rates, competition from various insurance and other financial businesses, terrorism, the availability and cost of reinsurance, adverse

and catastrophic weather events, including the impacts of climate change, legal and judicial developments, changes in regulatory requirements,

our ability to integrate and manage successfully the insurance companies we may acquire from time to time, the impact of inflation on

our operating results, and other risks we describe in the periodic reports we file with the Securities and Exchange Commission. You should

not place undue reliance on any such forward-looking statements. We disclaim any obligation to update such statements or to announce publicly

the results of any revisions that we may make to any forward-looking statements to reflect the occurrence of anticipated or unanticipated

events or circumstances after the date of such statements.

For a detailed discussion of the risk factors that

could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to our Annual

Report on Form 10-K, as filed with the SEC.

Investor Relations Contact:

Seth Daggett

Executive Vice President, Treasurer and Chief Financial Officer

701-298-4348

IR@nodakins.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

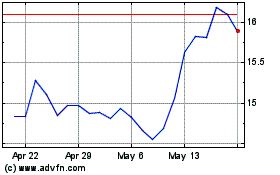

NI (NASDAQ:NODK)

Historical Stock Chart

From Mar 2024 to Apr 2024

NI (NASDAQ:NODK)

Historical Stock Chart

From Apr 2023 to Apr 2024