March 11, 20240000918541falseCharlotteNorth Carolina00009185412024-03-112024-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 11, 2024

NN, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39268 | 62-1096725 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| 6210 Ardrey Kell Road, Suite 600 | | |

Charlotte, North Carolina | | 28277 |

| (Address of principal executive offices) | | (Zip Code) |

(980) 264-4300

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 | | NNBR | | The Nasdaq Stock Market LLC |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company. | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On March 11, 2024, NN, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter and year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (the "Current Report").

Pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), the information furnished pursuant to Item 2.02 of this Current Report (including Exhibit 99.1) is deemed to have been furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 7.01 REGULATION FD DISCLOSURE

On March 11, 2024, the Company posted an supplemental presentation to its website, https://investors.nninc.com/, which will be presented during its quarterly investor conference call on March 12, 2024, at 9:00a.m. ET. The supplemental presentation is included as Exhibit 99.2 to this Current Report.

Pursuant to the rules and regulations of the SEC, the information furnished pursuant to Item 7.01 of this Current Report (including Exhibit 99.2) is deemed to have been furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section. Such information shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description of Exhibit |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

| | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| |

| Date: | March 11, 2024 |

| | | | | | | | |

| NN, INC. |

| | |

| | |

| By: | /s/ Michael C. Felcher |

| Name: | Michael C. Felcher |

| Title: | Senior Vice President and Chief Financial Officer |

NN, Inc.

6210 Ardrey Kell Road, Suite 120

Charlotte, NC 28277

FOR IMMEDIATE RELEASE

NN, INC. REPORTS FOURTH QUARTER AND FULL YEAR 2023 RESULTS; 2024 GUIDANCE

Business transformation continues; delivering record-setting new business wins in 2023 and

significantly improved free cash flow performance

Company provides sales, adjusted EBITDA, and free cash flow outlook for 2024

CHARLOTTE, N.C., March 11, 2024 – NN, Inc. (NASDAQ: NNBR), a global diversified industrial company that engineers and manufactures high-precision components and assemblies, today reported its financial results for the fourth quarter ended December 31, 2023.

Financial and Strategic Highlights

•Displayed strong execution against the Company’s multi-year transformation plan, driving positive inflection in financial and operating results in the second half of the year;

•Delivered company record for new business awards of $62.6 million in 2023;

•Launched multiple long-term strategic initiatives to drive increased sales, increased profits, enhanced cash flows, and increased shareholder value;

•Generated positive free cash flow in 2023 with enhanced organization-wide focus driving step change in cash flow performance in the second half of the year;

•Fourth quarter net sales of $112.5 million, down 4.6% versus prior year;

•Fourth quarter operating loss of $7.9 million, improved by $3.1 million versus prior year;

•Fourth quarter adjusted EBITDA of $10.0 million up 28% versus prior year; and

•Fourth quarter free cash flow of $1.3 million, down $5.1 million versus prior year.

“Our fourth quarter results capped off a transformative year for NN Inc., a year in which we realigned our commercial and operational strategies to deliver improved returns and to better position the company for both short-term and long-term success,” said Harold Bevis, President and Chief Executive Officer. “In 2023, we launched a multi-year transformation and our revamped leadership team’s aggressive redirected approach is already making a clear impact on our financial and operational results, as evidenced by the strengthening of our margins, improved free cash flow performance, and accelerating sales growth. Additionally, we reset the bar on customer performance and already we are performing better with our customers. This is a tried and true path to future business expansion. We are really proud of our global team and our JV business as we are working as one team to reestablish leadership positions in multiple areas.”

Bevis continued, “For the full year, we delivered approximately $12 million in free cash flow, which is an increase of more than $21 million year-over-year. Notably, we were able to achieve improved operating income and fairly flat

adjusted EBITDA with a strong second half performance with the new game plan. Specific to the fourth quarter, we were also pleased with our big new business award performance. We are already in development and ramp up mode on many of these awards and are making technical advancements in many areas. This momentum has carried right into 2024, as our financial results showed step-change improvement in the second half of the year. We remain focused on both leveraging our core capabilities and adding to our leadership edge to win new business across our diverse portfolio and believe we can add between $55 million to $70 million of new business wins this year.”

Bevis concluded, “Our organization-wide commitment to our transformation into a profitable, growing company is working and gaining momentum, and we are expecting 2024 to continue to demonstrate progress reflected by improved results on new business wins, profitability, free cash flow, and customer service. Our capital efficient model and low-risk strategy to structurally improve our operations will prove critical in lowering risk for our company. These efforts will ultimately help optimize our balance sheet. While we are encouraged by the early success across our transformation efforts, our improvements are just beginning. We remain committed to advancing and expanding our progress as we move forward. Our decisive actions are taking hold and I would like to thank all our NN team globally, whose dedication and hard work are driving our transformation.”

Fourth Quarter GAAP Results

Net sales were $112.5 million, a decrease of 4.6% from the fourth quarter of 2022, which was primarily due to reduced volume, partially offset by higher customer pricing and favorable foreign exchange effects.

Loss from operations was $7.9 million compared to a loss from operations of $11.0 million in the fourth quarter of 2022. The decrease in loss from operations was primarily driven by facility closures and labor cost savings.

Income from operations for Power Solutions was $2.8 million compared to loss from operations of $0.8 million for the same period in 2022. Loss from operations for Mobile Solutions was $5.7 million compared to loss from operations of $5.4 million for the same period in 2022.

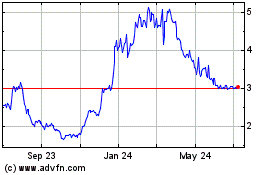

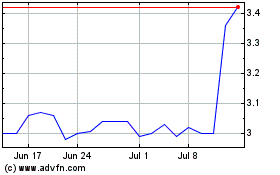

Net loss was $20.5 million compared to net loss of $12.0 million for the same period in 2022. The increase in net loss is primarily due to warrant valuation due to stock price increase as well as increased interest expense.

Fourth Quarter Adjusted Results

Adjusted loss from operations for the fourth quarter of 2023 was $1.4 million compared to adjusted loss from operations of $3.3 million for the same period in 2022. Adjusted EBITDA was $10.0 million, or 8.9% of sales, compared to $7.8 million, or 6.6% of sales, for the same period in 2022. Adjusted net loss was $4.9 million, or $0.10 per diluted share, compared to adjusted net loss of $5.8 million, or $0.12 per diluted share, for the same period in 2022.

Free cash flow was a generation of cash of $1.3 million compared to a generation of cash of $6.4 million for the same period in 2022.

Power Solutions

Net sales for the fourth quarter of 2023 were $43.3 million compared to $50.0 million in the fourth quarter of 2022, a decrease of 13.4% or $6.7 million. The decrease in sales was primarily due to lower volume with certain customers. Adjusted income from operations was $5.8 million compared to adjusted income from operations of $4.5 million in the fourth quarter of 2022. The increase in adjusted income from operations was primarily due to cost savings associated with facility closures and labor, partially offset by lower volume.

Mobile Solutions

Net sales for the fourth quarter of 2023 were $69.2 million compared to $68.0 million in the fourth quarter of 2022, an increase of 1.8% or $1.2 million. The increase in sales was due to pricing and favorable foreign exchange, partially offset by lower volume. Adjusted loss from operations was $2.3 million compared to adjusted loss from operations of $3.7 million in the fourth quarter of 2022. The decrease in adjusted loss from operations was due to cost savings and operational improvements, partially offset by lower volume and foreign exchange.

Full Year Results

Net sales decreased $9.5 million, or 1.9%, to $489.3 million compared to $498.7 million for 2022, primarily due to reduced volume, including the impact from the closure of the Taunton and Irvine facilities, lower customer settlements, and unfavorable foreign exchange, partially offset by pricing.

GAAP operating loss increased to $21.8 million compared to $21.1 million in 2022. Income from operations for 2023 in Power Solutions was $11.1 million and loss from operations for Mobile Solutions was $11.7 million.

On an adjusted basis, income from operations for 2023 was $3.1 million compared to adjusted income from operations of $1.9 million in 2022. Adjusted EBITDA for 2023 was $43.1 million, or 8.8% of sales, versus $43.9 million, or 8.8% of sales, for the same period in 2022. Free cash flow was a generation of $11.7 million compared to a use of cash of $9.8 million in 2022.

Power Solutions

Net sales for 2023 were $185.9 million compared to $205.2 million in 2022, a decrease of 9.4% or $19.3 million. The decrease in sales was primarily due to lower volumes, including the impact from the closure of the Taunton and Irvine facilities, partially offset by pricing. Adjusted income from operations for 2023 was $23.9 million compared to $20.1 million in 2022. The increase in adjusted operating income was primarily due to facility closure savings and a legal settlement reached during the first quarter of 2022, partially offset by lower volume.

Mobile Solutions

Net sales for 2023 were $303.3 million compared to $293.5 million in 2022, an increase of 3.3% or $9.8 million. The increase in sales was primarily due to higher customer pricing, partially offset by lower volume, and lower customer settlements. Adjusted loss from operations for 2023 was $1.3 million compared to $2.7 million of adjusted operating income in 2022. Adjusted operating income decreased due to lower sales volume, lower customer settlements and unfavorable foreign exchange effects, partially offset by cost savings and operating performance.

2024 Outlook

Assuming a steady end-market demand outlook with the exception of the North America commercial vehicle market, the Company has provided a ranged outlook for the full year 2024 as follows:

◦Revenue in the range of $485 million to $510 million;

◦Adjusted EBITDA in the range of $47 million to $55 million;

◦Free cash flow in the range of $10 million to $15 million;

◦New business wins in the range of $55 million to $70 million; and

◦Net leverage below 3.0x.

Michael Felcher, Senior Vice President and Chief Financial Officer, commented, “Our transformation strategy is working, and our 2024 Outlook reflects improved profitability and consistent free cash flow generation in a stable and consistent demand environment. We are also focused on improving our leverage and other actions to position us to be ready to refinance in a favorable market environment.”

Conference Call

NN will discuss its results during its quarterly investor conference call on March 12, 2024, at 9:00 a.m. ET. The call and supplemental presentation may be accessed via NN's website, www.nninc.com. The conference call can also be accessed by dialing 1-877-255-4315 or 1-412-317-6579. For those who are unavailable to listen to the live broadcast, a replay will be available shortly after the call until March 12, 2025.

NN discloses in this press release the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of restructuring and integration expense, acquisition and transition expenses, foreign exchange impacts on inter-company loans, amortization of intangibles and deferred financing costs, and other non-operating impacts on our business.

The financial tables found later in this press release include a reconciliation of adjusted income (loss) from operations, adjusted operating margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow to the U.S. GAAP financial measures of income (loss) from operations, net income (loss), net income (loss) per diluted common share, and cash provided (used) by operating activities.

About NN, Inc.

NN, Inc., a global diversified industrial company, combines advanced engineering and production capabilities with in-depth materials science expertise to design and manufacture high-precision components and assemblies for a variety of markets on a global basis. Headquartered in Charlotte, North Carolina, NN has facilities in North America, Europe, South America, and Asia. For more information about the company and its products, please visit www.nninc.com.

Except for specific historical information, many of the matters discussed in this press release may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc. (the “Company”) based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises, on our financial condition, business operations and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; new laws and governmental regulations; the impact of climate change on our operations; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this press release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements.

With respect to any non-GAAP financial measures included in the following document, the accompanying information required by SEC Regulation G can be found in the back of this document or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

Investor & Media Contacts:

Joe Caminiti or Stephen Poe, Investors

Tim Peters, Media

NNBR@alpha-ir.com

312-445-2870

Financial Tables Follow

NN, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| (in thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 112,533 | | | $ | 118,012 | | | $ | 489,270 | | | $ | 498,738 | |

| Cost of sales (exclusive of depreciation and amortization shown separately below) | 98,527 | | | 104,605 | | | 419,175 | | | 421,105 | |

| Selling, general, and administrative expense | 11,603 | | | 11,182 | | | 47,436 | | | 49,635 | |

| | | | | | | |

| Depreciation and amortization | 11,477 | | | 13,269 | | | 46,120 | | | 47,231 | |

| | | | | | | |

| Other operating expense (income), net | (1,131) | | | (3) | | | (1,657) | | | 1,859 | |

| Loss from operations | (7,943) | | | (11,041) | | | (21,804) | | | (21,092) | |

| Interest expense | 5,653 | | | 4,368 | | | 21,137 | | | 15,041 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other expense (income), net | 8,760 | | | (845) | | | 10,730 | | | (5,064) | |

| Loss before provision for income taxes and share of net income from joint venture | (22,356) | | | (14,564) | | | (53,671) | | | (31,069) | |

| Provision for income taxes | (904) | | | (107) | | | (2,285) | | | (1,621) | |

| Share of net income from joint venture | 2,719 | | | 2,657 | | | 5,806 | | | 6,592 | |

| | | | | | | |

| | | | | | | |

| Net loss | $ | (20,541) | | | $ | (12,014) | | | $ | (50,150) | | | $ | (26,098) | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency transaction gain (loss) | 5,016 | | | 5,387 | | | 1,410 | | | (8,156) | |

| Interest rate swap: | | | | | | | |

| Change in fair value, net of tax | — | | | 894 | | | (230) | | | 3,358 | |

| Reclassification adjustments included in net loss, net of tax | (449) | | | (369) | | | (1,815) | | | (420) | |

| Other comprehensive income (loss) | $ | 4,567 | | | $ | 5,912 | | | $ | (635) | | | $ | (5,218) | |

| Comprehensive loss | $ | (15,974) | | | $ | (6,102) | | | $ | (50,785) | | | $ | (31,316) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and diluted net loss per share | $ | (0.50) | | | $ | (0.33) | | | $ | (1.35) | | | $ | (0.83) | |

| Shares used to calculate basic and diluted net loss per share | 47,709 | | | 44,708 | | | 46,738 | | | 44,680 | |

| | | | | | | |

NN, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| (in thousands, except per share data) | December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 21,903 | | | $ | 12,808 | |

| Accounts receivable, net | 65,545 | | | 74,129 | |

| Inventories | 71,563 | | | 80,682 | |

| Income tax receivable | 11,885 | | | 12,164 | |

| Prepaid assets | 2,464 | | | 2,794 | |

| Other current assets | 9,194 | | | 9,123 | |

| Total current assets | 182,554 | | | 191,700 | |

| Property, plant and equipment, net | 185,812 | | | 197,637 | |

| Operating lease right-of-use assets | 43,357 | | | 46,713 | |

| Intangible assets, net | 58,724 | | | 72,891 | |

| Investment in joint venture | 32,701 | | | 31,802 | |

| Deferred tax assets | 734 | | | 102 | |

| Other non-current assets | 7,003 | | | 5,282 | |

| Total assets | $ | 510,885 | | | $ | 546,127 | |

| Liabilities, Preferred Stock, and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 45,480 | | | $ | 45,871 | |

| Accrued salaries, wages and benefits | 15,464 | | | 11,671 | |

| Income tax payable | 524 | | | 926 | |

| Short-term debt and current maturities of long-term debt | 3,910 | | | 3,321 | |

| Current portion of operating lease liabilities | 5,735 | | | 5,294 | |

| Other current liabilities | 10,506 | | | 11,723 | |

| Total current liabilities | 81,619 | | | 78,806 | |

| Deferred tax liabilities | 4,988 | | | 5,596 | |

| | | |

| Long-term debt, net of current maturities | 149,369 | | | 149,389 | |

| Operating lease liabilities, net of current portion | 47,281 | | | 51,411 | |

| Other non-current liabilities | 24,827 | | | 9,960 | |

| Total liabilities | 308,084 | | | 295,162 | |

| Commitments and contingencies | | | |

| Series D perpetual preferred stock | 77,799 | | | 64,701 | |

| Stockholders' equity: | | | |

| Common stock | 473 | | | 439 | |

| Additional paid-in capital | 457,632 | | | 468,143 | |

| Accumulated deficit | (295,348) | | | (245,198) | |

| Accumulated other comprehensive loss | (37,755) | | | (37,120) | |

| Total stockholders’ equity | 125,002 | | | 186,264 | |

| Total liabilities, preferred stock, and stockholders’ equity | $ | 510,885 | | | $ | 546,127 | |

NN, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Year Ended

December 31, |

| (in thousands) | 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net loss | $ | (50,150) | | | $ | (26,098) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 46,120 | | | 47,231 | |

| Amortization of debt issuance costs and discount | 1,941 | | | 1,361 | |

| Paid-in-kind interest | 2,239 | | | — | |

| | | |

| | | |

| Total derivative loss (gain), net of cash settlements | 11,933 | | | (5,265) | |

| Share of net income from joint venture, net of cash dividends received | (1,868) | | | (347) | |

| | | |

| Share-based compensation expense | 2,821 | | | 4,377 | |

| Deferred income taxes | (1,273) | | | (1,814) | |

| Other | (785) | | | (3,207) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 9,087 | | | (4,920) | |

| Inventories | 9,997 | | | (6,672) | |

| Accounts payable | 1,142 | | | 8,619 | |

| Income taxes receivable and payable, net | (89) | | | (1,457) | |

| Other | (1,771) | | | (4,091) | |

| Net cash provided by operating activities | 29,344 | | | 7,717 | |

| Cash flows from investing activities | | | |

| Acquisition of property, plant and equipment | (20,496) | | | (17,952) | |

| | | |

| Proceeds from sale of property, plant, and equipment | 2,898 | | | 460 | |

| | | |

| | | |

| Net cash used in investing activities | (17,598) | | | (17,492) | |

| Cash flows from financing activities | | | |

| Proceeds from long-term debt | 61,000 | | | 46,000 | |

| Repayments of long-term debt | (65,395) | | | (47,958) | |

| | | |

| Cash paid for debt issuance costs | (169) | | | (136) | |

| | | |

| | | |

| Proceeds from short-term debt | 3,648 | | | — | |

| Other | (1,967) | | | (3,092) | |

| Net cash used in financing activities | (2,883) | | | (5,186) | |

| Effect of exchange rate changes on cash flows | 232 | | | (887) | |

| Net change in cash and cash equivalents | 9,095 | | | (15,848) | |

| Cash and cash equivalents at beginning of year | 12,808 | | | 28,656 | |

| Cash and cash equivalents at end of year | $ | 21,903 | | | $ | 12,808 | |

Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations

| | | | | | | | | | | |

| Three Months Ended December 31, |

| (in thousands) |

| NN, Inc. Consolidated | 2023 | | 2022 |

| GAAP loss from operations | $ | (7,943) | | | $ | (11,041) | |

| | | |

| | | |

| Professional fees | 225 | | | 382 | |

| Personnel costs (1) | 1,175 | | | 902 | |

| Facility costs (2) | 1,617 | | | 1,405 | |

| Amortization of intangibles | 3,478 | | | 5,067 | |

| | | |

| Non-GAAP adjusted loss from operations (a) | $ | (1,448) | | | $ | (3,285) | |

| | | |

| Non-GAAP adjusted operating margin (3) | (1.3) | % | | (2.8) | % |

| GAAP net sales | $ | 112,533 | | | $ | 118,012 | |

| | | | | | | | | | | |

| Three Months Ended December 31, |

| (in thousands) |

| Power Solutions | 2023 | | 2022 |

| GAAP income (loss) from operations | $ | 2,830 | | | $ | (840) | |

| | | |

| | | |

| Professional fees | 63 | | | — | |

| Personnel costs (1) | 82 | | | 590 | |

| Facility costs (2) | 141 | | | 506 | |

| Amortization of intangibles | 2,640 | | | 4,229 | |

| | | |

| Non-GAAP adjusted income from operations (a) | $ | 5,756 | | | $ | 4,485 | |

| | | |

| Non-GAAP adjusted operating margin (3) | 13.3 | % | | 9.0 | % |

| GAAP net sales | $ | 43,330 | | | $ | 50,020 | |

| | | | | | | | | | | |

| Three Months Ended December 31, |

| (in thousands) |

| Mobile Solutions | 2023 | | 2022 |

| GAAP loss from operations | $ | (5,686) | | | $ | (5,389) | |

| | | |

| | | |

| | | |

| Personnel costs (1) | 1,091 | | | — | |

| Facility costs (2) | 1,476 | | | 899 | |

| Amortization of intangibles | 838 | | | 838 | |

| | | |

| Non-GAAP adjusted loss from operations (a) | $ | (2,281) | | | $ | (3,652) | |

| | | |

| Share of net income from joint venture | 2,719 | | | 2,657 | |

| | | |

| Non-GAAP adjusted income (loss) from operations with JV (a) | $ | 438 | | | $ | (995) | |

| | | |

| Non-GAAP adjusted operating margin (3) | 0.6 | % | | (1.5) | % |

| GAAP net sales | $ | 69,203 | | | $ | 67,994 | |

| | | | | | | | | | | |

| Three Months Ended December 31, |

| (in thousands) |

| Elimination | 2023 | | 2022 |

| GAAP net sales | $ | — | | | $ | (2) | |

(1)Personnel costs include recruitment, retention, relocation, and severance costs

(2)Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations

(3)Non-GAAP adjusted operating margin = Non-GAAP adjusted income (loss) from operations / GAAP net sales

Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations

| | | | | | | | | | | |

| Year Ended December 31, |

| (in thousands) |

| NN, Inc. Consolidated | 2023 | | 2022 |

| GAAP loss from operations | (21,804) | | | (21,092) | |

| | | |

| Litigation / settlement costs | — | | | 1,850 | |

| Professional fees | 640 | | | 1,607 | |

| Personnel costs (1) | 2,857 | | | 945 | |

| Facility costs (2) | 7,271 | | | 2,571 | |

| Amortization of intangibles | 14,167 | | | 15,827 | |

| Impairments (Goodwill and fixed assets) | — | | | 219 | |

| Non-GAAP adjusted income from operations (a) | $ | 3,131 | | | $ | 1,927 | |

| | | |

| Non-GAAP adjusted operating margin (3) | 0.6 | % | | 0.4 | % |

| GAAP net sales | 489,270 | | | 498,738 | |

| | | | | | | | | | | |

| Year Ended December 31, |

| (in thousands) |

| Power Solutions | 2023 | | 2022 |

| GAAP income from operations | 11,096 | | | 3,536 | |

| | | |

| Litigation / settlement costs | — | | | 1,850 | |

| Professional fees | 63 | | | 339 | |

| Personnel costs (1) | 204 | | | 590 | |

| Facility costs (2) | 1,742 | | | 1,269 | |

| Amortization of intangibles | 10,814 | | | 12,474 | |

| | | |

| Non-GAAP adjusted income from operations (a) | $ | 23,919 | | | $ | 20,058 | |

| | | |

| Non-GAAP adjusted operating margin (3) | 12.9 | % | | 9.8 | % |

| GAAP net sales | 185,948 | | | 205,204 | |

| | | | | | | | | | | |

| Year Ended December 31, |

| (in thousands) |

| Mobile Solutions | 2023 | | 2022 |

| GAAP loss from operations | (11,749) | | | (2,165) | |

| | | |

| | | |

| | | |

| Personnel costs (1) | 1,593 | | | — | |

| Facility costs (2) | 5,529 | | | 1,302 | |

| Amortization of intangibles | 3,353 | | | 3,353 | |

| Impairments (Goodwill and fixed assets) | — | | | 219 | |

| Non-GAAP adjusted income (loss) from operations (a) | $ | (1,274) | | | $ | 2,709 | |

| | | |

| Share of net income from joint venture | 5,806 | | | 6,592 | |

| | | |

| Non-GAAP adjusted income from operations with JV (a) | $ | 4,532 | | | $ | 9,301 | |

| | | |

| Non-GAAP adjusted operating margin (3) | 1.5 | % | | 3.2 | % |

| GAAP net sales | 303,335 | | | 293,536 | |

| | | | | | | | | | | |

| Year Ended December 31, |

| (in thousands) |

| Elimination | 2023 | | 2022 |

| GAAP net sales | (13) | | | (2) | |

(1)Personnel costs include recruitment, retention, relocation, and severance costs

(2)Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations

(3)Non-GAAP adjusted operating margin = Non-GAAP adjusted income (loss) from operations / GAAP net sales

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA

| | | | | | | | | | | |

| Three Months Ended December 31, |

| (in thousands) | 2023 | | 2022 |

| GAAP net loss | $ | (20,541) | | | $ | (12,014) | |

| | | |

| Provision for income taxes | 904 | | | 107 | |

| Interest expense | 5,653 | | | 4,368 | |

| | | |

| | | |

| Change in fair value of preferred stock derivatives and warrants | 9,172 | | | (407) | |

| Depreciation and amortization | 11,477 | | | 13,269 | |

| | | |

| Professional fees | 225 | | | 382 | |

| Personnel costs (1) | 1,175 | | | 902 | |

| Facility costs (2) | 1,617 | | | 1,405 | |

| Non-cash stock compensation | 763 | | | 515 | |

| Non-cash foreign exchange loss on inter-company loans | (422) | | | (715) | |

| | | |

| | | |

| | | |

| | | |

| Non-GAAP adjusted EBITDA (b) | $ | 10,023 | | | $ | 7,812 | |

| | | |

| Non-GAAP adjusted EBITDA margin (3) | 8.9 | % | | 6.6 | % |

| GAAP net sales | $ | 112,533 | | | $ | 118,012 | |

| | | |

| (1) Personnel costs include recruitment, retention, relocation, and severance costs |

(2) Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations |

(3) Non-GAAP adjusted EBITDA margin = Non-GAAP adjusted EBITDA / GAAP net sales |

| | | | | | | | | | | |

| Year Ended December 31, |

| (in thousands) | 2023 | | 2022 |

| GAAP net loss | $ | (50,150) | | | $ | (26,098) | |

| | | |

| Provision for income taxes | 2,285 | | | 1,621 | |

| Interest expense | 21,137 | | | 15,041 | |

| | | |

| | | |

| Change in fair value of preferred stock derivatives and warrants | 10,814 | | | (5,267) | |

| Depreciation and amortization | 46,120 | | | 47,231 | |

| Litigation / settlement costs | — | | | 1,850 | |

| Professional fees | 640 | | | 1,607 | |

| Personnel costs (1) | 2,857 | | | 945 | |

| Facility costs (2) | 7,271 | | | 2,571 | |

| Non-cash stock compensation | 2,823 | | | 4,378 | |

| Non-cash foreign exchange (gain) loss on inter-company loans | (676) | | | (212) | |

| | | |

| | | |

| | | |

| Fixed asset and goodwill impairments | — | | | 219 | |

| Non-GAAP adjusted EBITDA (b) | $ | 43,121 | | | $ | 43,886 | |

| | | |

| Non-GAAP adjusted EBITDA margin (3) | 8.8 | % | | 8.8 | % |

| GAAP net sales | 489,270 | | | 498,738 | |

| | | |

| (1) Personnel costs include recruitment, retention, relocation, and severance costs |

| (2) Facility costs include costs of opening / closing facilities and relocation / exit of manufacturing operations |

(3) Non-GAAP adjusted EBITDA margin = Non-GAAP adjusted EBITDA / GAAP net sales |

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share

| | | | | | | | | | | |

| Three Months Ended December 31, |

| (in thousands) | 2023 | | 2022 |

| GAAP net loss | $ | (20,541) | | | $ | (12,014) | |

| | | |

| | | |

| Pre-tax professional fees | 225 | | | 382 | |

| Pre-tax personnel costs | 1,175 | | | 902 | |

| Pre-tax facility costs | 1,617 | | | 1,405 | |

| Non-cash foreign exchange loss on inter-company loans | (422) | | | (715) | |

| | | |

| | | |

| Pre-tax change in fair value of preferred stock derivatives and warrants | 9,172 | | | (407) | |

| Pre-tax amortization of intangibles and deferred financing costs | 4,009 | | | 5,407 | |

| | | |

| | | |

| | | |

| Tax effect of adjustments reflected above (c) | (107) | | | (1,465) | |

| Non-GAAP discrete tax adjustments | — | | | 730 | |

| | | |

| | | |

| | | |

| | | |

| Non-GAAP adjusted net income (loss) (d) | $ | (4,872) | | | $ | (5,775) | |

| | | |

| Three Months Ended December 31, |

| (per diluted common share) | 2023 | | 2022 |

| GAAP net loss per diluted common share | $ | (0.50) | | | $ | (0.33) | |

| | | |

| | | |

| Pre-tax professional fees | — | | | 0.01 | |

| Pre-tax personnel costs | 0.03 | | | 0.02 | |

| Pre-tax facility costs | 0.03 | | | 0.03 | |

| Pre-tax foreign exchange (gain) loss on inter-company loans | (0.01) | | | (0.02) | |

| | | |

| | | |

| Pre-tax change in fair value of preferred stock derivatives and warrants | 0.19 | | | (0.01) | |

| Pre-tax amortization of intangibles and deferred financing costs | 0.08 | | | 0.12 | |

| | | |

| | | |

| | | |

| Tax effect of adjustments reflected above (c) | — | | | (0.03) | |

| Non-GAAP discrete tax adjustments | — | | | 0.02 | |

| | | |

| | | |

| | | |

| Preferred stock cumulative dividends and deemed dividends | 0.07 | | | 0.07 | |

| Non-GAAP adjusted net income (loss) per diluted common share (d) | $(0.10) | | $(0.12) |

| Shares used to calculate net earnings (loss) per share | 47,709 | | | 44,708 | |

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share

| | | | | | | | | | | |

| Year Ended December 31, |

| (in thousands) | 2023 | | 2022 |

| GAAP net income (loss) | $ | (50,150) | | | $ | (26,098) | |

| | | |

| Pre-tax foreign exchange (gain) loss on inter-company loans | (676) | | | (212) | |

| Pre-tax litigation / settlement costs | — | | | 1,850 | |

| Pre-tax professional fees | 640 | | | 1,607 | |

| Pre-tax personnel costs | 2,857 | | | 945 | |

| Pre-tax facility costs | 7,271 | | | 2,571 | |

| | | |

| Pre-tax change in fair value of preferred stock derivatives and warrants | 10,814 | | | (5,267) | |

| Pre-tax amortization of intangibles and deferred financing costs | 16,108 | | | 17,188 | |

| | | |

| Pre-tax impairments of fixed asset costs | — | | | 219 | |

| | | |

| Tax effect of adjustments reflected above (c) | (592) | | | (3,978) | |

| Non-GAAP discrete tax adjustments | — | | | 3,128 | |

| | | |

| | | |

| | | |

| | | |

| Non-GAAP adjusted net income (loss) (d) | $ | (13,728) | | | $ | (8,047) | |

| | | |

| Year Ended December 31, |

| (per diluted common share) | 2023 | | 2022 |

| GAAP net income (loss) per diluted common share | $ | (1.35) | | | $ | (0.83) | |

| | | |

| Pre-tax foreign exchange (gain) loss on inter-company loans | (0.01) | | | — | |

| Pre-tax litigation / settlement costs | — | | | 0.04 | |

| Pre-tax professional fees | 0.01 | | | 0.04 | |

| Pre-tax personnel costs | 0.06 | | | 0.02 | |

| Pre-tax facility costs | 0.16 | | | 0.06 | |

| | | |

| Pre-tax change in fair value of preferred stock derivatives and warrants | 0.23 | | | (0.12) | |

| Pre-tax amortization of intangibles and deferred financing costs | 0.34 | | | 0.38 | |

| | | |

| | | |

| | | |

| Tax effect of adjustments reflected above (c) | (0.01) | | | (0.09) | |

| Non-GAAP discrete tax adjustments | — | | | 0.07 | |

| | | |

| | | |

| | | |

| Preferred stock cumulative dividends and deemed dividends | 0.28 | | | 0.24 | |

| Non-GAAP adjusted net income (loss) per diluted common share (d) | $(0.29) | | $(0.19) |

| Weighted average common shares outstanding | 46,738 | | | 44,680 | |

Reconciliation of Operating Cash Flow to Free Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 5,454 | | | $ | 10,388 | | | $ | 29,344 | | | $ | 7,717 | |

| Acquisition of property, plant, and equipment | (4,204) | | | (3,941) | | | (20,496) | | | (17,952) | |

| Proceeds from sale of property, plant, and equipment | 22 | | | — | | | 2,898 | | | 460 | |

| Free cash flow | $ | 1,272 | | | $ | 6,447 | | | $ | 11,746 | | | $ | (9,775) | |

The Company discloses in this presentation the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. Over the past five years, we have completed several acquisitions, one of which was transformative for the Company, and sold two of our businesses. The costs we incurred in completing such acquisitions, including the amortization of intangibles and deferred financing costs, and these divestitures have been excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and which we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted common share, and free cash flow provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods.

The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results.

(a) Non-GAAP adjusted income (loss) from operations represents GAAP income (loss) from operations, adjusted to exclude the effects of restructuring and integration expense; non-operational charges related to acquisition and transition expense, intangible amortization costs for fair value step-up in values related to acquisitions, non-cash impairment charges, and when applicable, our share of income from joint venture operations. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income (loss) from operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from operations.

(b) Non-GAAP adjusted EBITDA represents GAAP net income (loss), adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value that was recognized in earnings, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations.

(c) This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the respective table. NN, Inc. estimates the tax effect of the adjustment items identified in the reconciliation schedule above by applying the applicable statutory rates by tax jurisdiction unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment.

(d) Non-GAAP adjusted net income (loss) represents GAAP net income (loss) adjusted to exclude the tax-affected effects of charges related to acquisition and transition costs, foreign exchange gain (loss) on inter-company loans, restructuring and integration charges, amortization of intangibles costs for fair value step-up in values related to acquisitions and amortization of deferred financing costs, non-cash impairment charges, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, costs related to divested businesses and litigation settlements, income (loss) from discontinued operations, and preferred stock cumulative dividends and deemed dividends. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry.

Q4 & FY’23 Earnings Presentation NN Inc. | March 12, 2024

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 2 Forward Looking Statement & Disclosures Except for specific historical information, many of the matters discussed in this press release may express or imply projections of revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These statements may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to NN, Inc. (the “Company”) based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such forward-looking statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the impacts of pandemics, epidemics, disease outbreaks and other public health crises, on our financial condition, business operations and liquidity; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; new laws and governmental regulations; the impact of climate change on our operations; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s filings made with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this press release, and the Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements. With respect to any non-GAAP financial measures included in the following presentation, the accompanying information required by SEC Regulation G can be found at the back of this presentation or in the “Investors” section of the Company’s web site, www.nninc.com, under the heading “News & Events” and subheading “Presentations.”

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 3 Results As Expected, Carrying Momentum Into 2024 Launched business transformation in May 2023; early results have been accomplished largely with existing team. • Initiated culture change: (1) increased accountability to outcomes, (2) more aggressive new business agenda, and (3) bluntly addressed underperforming areas • More strategic about spending money and investing capital Made immediate improvement in EBITDA and free cash flow (FCF) generation during full-year 2023; top line sales improvements will take more time. Significantly increased dollar amount of new awards. • Attacked the ~$100 million of unprofitable business in the portfolio • Committed to free cash flow generation and debt paydown Initiated several mid-term/longer actions to more substantially grow sales, EBITDA, and free cash flow. • Expanded growth program; kicked off 2 internal startups (connect & protect and medical), and added new people and new advanced capabilities • Implemented global cost productivity program 2024 demand environment is steady to year-end 2023, improvement actions are underway. • 2024 results will gradually reflect transformation work along the way Net Sales Q4: $113M FY: $489M • Power Solutions* (9.4%) • Mobile Solutions* +3.3% Adjusted EBITDA Q4: $10M FY: $43M • FY’23 Loss from Ops ($21.8M) • FY'23 Adjusted Operating Income $3.1M Free Cash Flow Q4: $1M FY: $12M • $12.5M in 2H’23 • Delivered on key objectives prioritizing cash flows New Awards Q4: $26M FY: $63M • Step-change underway in commercial initiatives; leading to faster, larger new awards * Comparisons are FY’23 vs. FY’22

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 4 Status Goal Progress and 2024 Actions 1. Strengthen Leadership & Accountability • Adding talent in sales, engineering, procurement, and manufacturing • Reducing headcount in underperforming areas • Bolstering operational processes and systems infrastructure • Strengthening teamwork and collaboration • Renewing focus on customer engagement, satisfaction, and growth 2. Fix Unprofitable Business Areas • Addressing unprofitable business strips • Utilizing open capacity to add new business at a faster pace • Cost-out and asset management improvements at plant level with established monthly and quarterly targets 3. Expand Margins • Global total cost productivity and procurement optimization programs are both just beginning • Margin expansion goals will be supported by achieving preferred supplier status with OEMs / improve operational performance 4. Deliver Consistent Annual Free Cash Flow • Significant FCF improvement in 2023, forecasting continued momentum in 2024 • Targeting similar levels of FCF in 2024, driven primarily by base business results, reinvestment rates, and high-cost capital structure • FCF continues to support further debt reduction and refinancing goals 5. Increase New Business Wins • Delivered record new business wins in 2023 and expect similar pace of wins in 2024 • Multiple initiatives in development and just beginning • Launching first-ever search engine optimization efforts for enhanced lead generation • Entering new and diverse markets; further upgrading our revenue mix ~30% Transformation On Track

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 $0.6 $0.6 $1.3 $2.1 $2.7 $4.7 $5.4 $9.6 $11.2 $18.0 Equipment Ride Control Armature Shafts Battery Management Sensors/Cameras Fuel Systems Electric Motors Diesel Injection Electrical Steering 5 $63 Million of New Business Awards $41 $63 FY'22 FY'23 NBW Annual Peak Value (millions) Primary NBW Market Segments: 2023 Wins (millions) FY’23 New Business Awards: Driving Momentum • Acceleration of new business win (NBW) program brought strong results in 2H’23, delivering record performance in FY’23 • Over 60 program awards in steering systems, electric motors, commercial vehicles, passenger vehicles, air bag systems, battery management, defense, and vehicle sensors • Balanced approach across portfolio in desirable, diverse markets o New customer additions, strengthening retention with existing customers o 92% of FY’23 NBW in diversified business; only 8% ICE-specific o Automotive exposure is agnostic to powertrain (ICE, Hybrid, BEV) • Majority of new wins are in low-cost geographies that are close to NN’s end markets Growth Recap • Leveraging existing capabilities and open capacity for more wins o Stronger use of multi-functional teams o Growing sales team to expand commercial reach and breadth o Expanding medical market participation – NN Medical Over $580 million of new business in the current pipeline +54% Y/Y

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 $0 $100 $200 $300 $400 $500 $600 $700 2023 2024 2025 2026 2027 2028 2029 2030 (m il li o n s) TOTAL ADDRESSABLE MARKET – GLOBAL SHIELDS FHEV PHEV BEV 6 New Market – Electrical Connectors and Shields Overt market entry into desirable new market • Prime market for NN’s expertise in high-precision engineered metal products, plating, and knowledge of electrical components • Deepening relationships with market’s largest connector and wire harness manufacturers for commercial & passenger vehicles • Adding to company's material science, in-house prototyping, and machine accuracy Ability to become a market leader • Technical advancement, vertical integration, existing equipment and know-how, industry expertise, product quality, and low-cost sourcing • Knowledgeable leaders, cost structure, product offering, and global footprint allow NN to be immediately competitive 2023 program wins will immediately help 2024 • Using same approach to re-enter medical products market: add knowledgeable leaders, use existing capacity, add new targeted capacity, and enter the market directly with major customers when ready

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 7 Q4’23 Financial Results Were As Expected Sales Drivers • Volume: ~($7M) • Pricing: ~$5M • Taunton & Irvine Closures: ~($3M) (Dollars in millions, except per share data) Q4’22 Q4’23 Δ Net Sales $118.0 $112.5 (4.6%) Operating Income (Loss) ($11.0) ($7.9) ($3.1) Adjusted Operating Income (Loss) ($3.3) ($1.4) $1.9 Adjusted EBITDA $7.8 $10.0 $2.2 Adjusted EBITDA Margin 6.6% 8.9% +2.3% Income (Loss) per Diluted Common Share ($0.33) ($0.50) ($0.17) Adjusted Income (Loss) per Diluted Common Share ($0.12) ($0.10) $0.02 Adj. EBITDA Drivers • Volume: ~($3M) • Cost Savings: ~$3M • Taunton & Irvine Closures: ~$2M • Overhead Absorption: ~$1M • FX: ~($1M)

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 8 FY’23 Financial Results Were As Expected (Dollars in millions, except per share data) 2022 2023 Δ Net Sales $498.7 $489.3 (1.9%) Operating Income (Loss) ($21.1) ($21.8) ($0.7) Adjusted Operating Income (Loss) $1.9 $3.1 $1.2 Adjusted EBITDA $43.9 $43.1 ($0.8) Adjusted EBITDA Margin 8.8% 8.8% - Income (Loss) per Diluted Common Share ($0.83) ($1.35) ($0.52) Adjusted Income (Loss) per Diluted Common Share ($0.19) ($0.29) ($0.10) Sales Drivers • Volume: ~($32M) • Pricing: ~$31M • Taunton & Irvine Closures: ~($6M) • Customer Settlements: ~($2M) • FX: ~($1M) Adj. EBITDA Drivers • Volume: ~($11M) • Taunton & Irvine Closures: ~$8M • Cost / Performance: ~$5M • FX: ~($3M) • Customer Settlements: ~($2M) • Overhead Absorption: ~$2M

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Mobile Solutions: Machined Products - Q4’23 Highlights 9 Q4 Sales up 1.8%, or $1.2 million, from prior year (+) Pricing (+) Foreign exchange effects (-) Volume Q4 Profitability (+) Improved product mix and operating performance within several facilities (+) Benefits of right-sizing indirect labor support Comments • 2023 new business wins in-line with the business plan • China wins were above plan and other regions gaining traction • Growth target and plans set for 2024 • Reinforcing the sales team, globally • Aggressive use of digital tools, including SEO for sales leads • Strong cost-down program in place • Operating performance improving in-line with business plan • Protecting cash flow through capital expenditure and working capital management

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Power Solutions: Stamped Products - Q4’23 Highlights 10 Q4 Sales down 13.4%, or $6.7 million, from prior year (-) Aerospace and defense sales decline due to Irvine, CA and Taunton, MA facility closures (-) General industrial market and commercial truck component sales decline due to broader market softness (-) Lower auto component sales driven by customer inventory management, and market share loss with one customer Q4 Profitability (+) Rationalized unprofitable businesses within Taunton, MA and Irvine, CA facilities and eliminated redundant fixed costs (+) Benefits of right-sizing indirect labor support (-) Volume Comments • Average daily sales increased sequentially in Q4, continuing to grow • Adding dedicated sales personnel to gain new awards • Advancing capabilities with push into connectors and shields • Managing free cash flow carefully

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 11 Balance Sheet Optimization Plan Strong Organizational Commitment • Implemented much tougher stance on balancing cash inflows with outflows, reducing leverage, and increasing liquidity o Showing strong early results o 3.20x leverage, down vs. 3.37x in Q3’23 • Plan to reduce leverage below 3.0x in 2024 while implementing stronger, focused growth program Free Cash Flow Focus to Support Balance Sheet Optimization and Positioning for Refinancing • 2023 free cash flow of $11.7M; committed to similar performance in 2024 • Footprint actions to lower debt, reduce cost of capital, and eliminate costs o Sale leaseback transaction and corporate footprint reduction • Capex of $4.2M in Q4’23 as expected • Free cash flow expected to be driven primarily by improved profitability, including improvements at underperforming facilities and continued cost out initiatives (Dollars in millions) 9/30/23 12/31/23 Short-term Debt $8.8 $6.0 Long-term Debt $150.7 $153.9 Funded Debt $159.5 $159.9 Cash $21.8 $21.9 Net Debt $137.7 $138.0 TTM Adjusted EBITDA $40.9 $43.1 Net Debt to Adjusted EBITDA 3.37x 3.20x $(4.1) $1.3 $11.7 $(5) $- $5 $10 $15 $20 Q1'23 Q2'23 Q3'23 Q4'23 Trailing 12 Month Free Cash Flow (millions) Step-change in FCF generation under transformation $16.9

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 2024 Outlook: Transformation Impacts Will Continue to Build • Net sales flat to low single digit % increase; inclusive of impact from shedding unprofitable business; not enough predecessor wins in 2022 and early 2023 • Adjusted EBITDA growth due to cost-out and fixing underperforming areas • Deliver positive free cash flow performance in FY’24 on improved EBITDA and margins o Will reinvest capex at $20 million rate • Upsized and continued aggressive growth program o Grow share with all open capacity – existing and new customers o Targeted growth in several new areas • Outlook assumes steady end-market demand with exception of NA commercial vehicle market declining vs 2023 • Business is currently on track with full year 2024 projections (millions) 2024 Outlook Net Sales $485 - $510 Adjusted EBITDA $47 - $55 Free Cash Flow $10 - $15 New Business Wins $55 - $70 Net Leverage <3.0x 12

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Appendix 13

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 14 Non-GAAP Financial Measures Footnotes The Company discloses in this presentation the non-GAAP financial measures of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow and net debt. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. Over the past five years, we have completed several acquisitions, one of which was transformative for the Company, and sold two of our businesses. The costs we incurred in completing such acquisitions, including the amortization of intangibles and deferred financing costs, and these divestitures have been excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, which we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded, as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share, free cash flow and net debt provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods. The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results. (a) Non-GAAP adjusted EBITDA represents GAAP income (loss) from operations, adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations.

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations and Non-GAAP Adjusted EBITDA 15

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations and Non-GAAP Adjusted EBITDA 16

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income (Loss) and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share 17

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted Net Income (Loss) and GAAP Net Income (Loss) per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share 18

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Reconciliation of Operating Cash Flow to Free Cash Flow 19

NN Inc., Q4’23 and Full-Year Earnings Presentation | March 2024 Thank You 20 Joe Caminiti or Stephen Poe, Investors Tim Peters, Media NNBR@alpha-ir.com 312-445-2870 Investor & Media Contacts

v3.24.0.1

Cover Page

|

Mar. 11, 2024 |

| Cover [Abstract] |

|

| Entity Registrant Name |

NN, Inc.

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 11, 2024

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000918541

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39268

|

| Entity Tax Identification Number |

62-1096725

|

| Entity Address, Address Line One |

6210 Ardrey Kell Road, Suite 600

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28277

|

| City Area Code |

980

|

| Local Phone Number |

264-4300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

NNBR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef