Nautilus Biotechnology Reports Second Quarter 2021 Financial Results

August 10 2021 - 6:00AM

Nautilus Biotechnology, Inc. (NASDAQ: NAUT; or “Nautilus”), a life

sciences company creating a platform technology for quantifying and

unlocking the complexity of the proteome, today reported financial

results for the second quarter ended June 30, 2021.

Recent Highlights

- Completed business

combination transaction with ARYA Sciences Acquisition Corp III

(the “Business Combination”) and became a publicly traded company

on June 10, 2021, with gross proceeds from this transaction

totaling approximately $345.5 million.

- Continued to meet key internal

milestones across a range of platform design and science activities

in support of a planned late-2023 platform commercialization.

- Appointed Emma Lundberg, Ph.D. to

the Scientific Advisory Board. Dr. Lundberg, currently a professor

in cell biology proteomics at KTH Royal Institute of Technology in

Sweden.

- Appointed Karl Voss as Vice

President of Life Sciences. Karl joins Nautilus from Pacific

Biosciences and will lead the team focused on delivering Nautilus’

first-generation product.

“This has been an incredibly exciting year for

Nautilus as a company, and for the field of proteomics in general,”

said Sujal Patel, CEO of Nautilus Biotechnology. “Our vision at

Nautilus is to bring to market a complete, end-to-end,

massive-scale protein analysis platform that we believe has the

potential to deliver unique biological data and insight in an

easy-to-use, cost-effective way. Much as democratizing access to

the genome was a catalyst for the development of a broad, vibrant,

and healthy genomics ecosystem, we believe that Nautilus’

proteomics innovation has the potential to unlock high-value

applications in precision and personalized medicine, in drug

discovery, and in diagnostics.”

Second Quarter 2021 Financial

Results

Operating expenses were $10.7 million for the

second quarter of 2021, a 215% increase from $3.4 million for the

three months ended June 30, 2020. The increase in operating

expenses was driven primarily by an increase in headcount to

support ongoing development of our products as well as the costs

associated with being a public company.

Net loss was $10.7 million for the second

quarter of 2021, as compared to a net loss of $3.4 million for the

corresponding prior year period.

Cash, cash equivalents, and investments were

$388.4 million as of June 30, 2021.

Webcast and Conference Call

Information

Nautilus will host a conference call to discuss

the second quarter 2021 financial results, business developments

and outlook before market open on Tuesday, August 10, 2021 at 5:00

AM Pacific Time / 8:00 AM Eastern Time. Live audio of the webcast

will be available on the “Investors” section of the company website

at: www.nautilus.bio.

About Nautilus Biotechnology,

Inc.

Based in Seattle, Washington, Nautilus is a

development stage life sciences company creating a platform

technology for quantifying and unlocking the complexity of the

proteome. Nautilus’ mission is to transform the field of proteomics

by democratizing access to the proteome and enabling fundamental

advancements across human health and medicine. To learn more about

Nautilus, visit www.nautilus.bio

Special Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of federal securities laws.

Forward-looking statements in this press release include, but are

not limited to, statements regarding Nautilus’ expectations

regarding the company’s business operations, financial performance

and results of operations, as well as the potential functionality

and performance of Nautilus’ product platform, its potential impact

on pharmaceutical development and drug discovery, and market

opportunities available to Nautilus generally. These statements are

based on numerous assumptions concerning the development of

Nautilus’ products and target markets and involve substantial

risks, uncertainties and other factors that may cause actual

results to be materially different from the information expressed

or implied by these forward-looking statements. Risks and

uncertainties that could materially affect the accuracy of

Nautilus’ assumptions and its ability to achieve the

forward-looking statements set forth in this press release include

(without limitation) the following: Nautilus’ product platform is

not yet commercially available and remains subject to significant

scientific and technical development, which is inherently

challenging and difficult to predict, particularly with respect to

highly novel and complex products such as those being developed by

Nautilus. Even if our development efforts are successful, our

product platform will require substantial validation of its

functionality and utility in life science research. In the course

of Nautilus’ scientific and technical development and associated

product validation and commercialization, we may experience

material delays as a result of unanticipated events. We cannot

provide any guarantee or assurance with respect to the outcome of

our development and commercialization initiatives or with respect

to their associated timelines. For a more detailed description of

additional risks and uncertainties facing Nautilus and its

development efforts, investors should refer to the information

under the caption “Risk Factors” in the Registration Statement on

Form S-1 filed with the SEC as well as in our Quarterly Report on

Form 10-Q to be filed for the quarter ended June 30, 2021. The

forward-looking statements in this press release are as of the date

of this press release. Except as otherwise required by applicable

law, Nautilus disclaims any duty to update any forward-looking

statements. You should, therefore, not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

Disclosure Information

Nautilus uses filings with the Securities and Exchange

Commission, its website (www.nautilus.bio), press releases, public

conference calls, public webcasts, and its social media accounts as

means of disclosing material non-public information and for

complying with Regulation FD.

Media ContactThermal for Nautilus

BiotechnologyKaustuva Daspress@nautilus.bio

Investor

Contactinvestorrelations@nautilus.bio

Nautilus Biotechnology, Inc.Condensed

Consolidated Balance SheetsAs of June 30, 2021 and

December 31, 2020 (Unaudited)

| (in thousands) |

June 30,2021 |

|

December 31,2020 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

288,387 |

|

|

$ |

36,607 |

|

|

Short-term investments |

84,757 |

|

|

40,135 |

|

|

Prepaid expenses and other current assets |

1,484 |

|

|

917 |

|

|

Total current assets |

374,628 |

|

|

77,659 |

|

| Property and equipment,

net |

1,941 |

|

|

1,371 |

|

| Operating lease right-of-use

assets |

828 |

|

|

4,842 |

|

| Long-term investments |

15,266 |

|

|

— |

|

| Other long term assets |

612 |

|

|

1,139 |

|

|

Total assets |

$ |

393,275 |

|

|

$ |

85,011 |

|

|

Liabilities, Redeemable Convertible Preferred Stock, and

Stockholders’ Equity (Deficit) |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,229 |

|

|

$ |

470 |

|

|

Accrued expenses and other liabilities |

1,316 |

|

|

1,069 |

|

|

Current portion of operating lease liability |

686 |

|

|

1,479 |

|

|

Total current liabilities |

3,231 |

|

|

3,018 |

|

|

Operating lease liability, net of current portion |

— |

|

|

3,296 |

|

|

Total liabilities |

3,231 |

|

|

6,314 |

|

| Redeemable convertible

preferred stock: |

|

|

|

| Series Seed redeemable

convertible preferred stock |

— |

|

|

5,494 |

|

| Series A redeemable

convertible preferred stock |

— |

|

|

27,067 |

|

| Series B redeemable

convertible preferred stock |

— |

|

|

75,857 |

|

| |

|

|

|

| Stockholders’ equity

(deficit): |

|

|

|

|

Preferred stock |

— |

|

|

— |

|

|

Common stock |

12 |

|

|

1 |

|

|

Additional paid-in capital |

439,489 |

|

|

600 |

|

|

Accumulated other comprehensive income (loss) |

(10 |

) |

|

3 |

|

|

Accumulated deficit |

(49,447 |

) |

|

(30,325 |

) |

|

Total stockholders’ equity (deficit) |

390,044 |

|

|

(29,721 |

) |

|

Total liabilities, redeemable convertible preferred stock and

stockholders’ equity (deficit) |

$ |

393,275 |

|

|

$ |

85,011 |

|

Nautilus Biotechnology, Inc.Condensed

Consolidated Statements of OperationsThree and Six

Months Ended June 30, 2021 and 2020 (Unaudited)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (in thousands, except share

and per share amounts) |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Operating expenses |

|

|

|

|

|

|

|

|

Research and development |

$ |

6,380 |

|

|

$ |

2,751 |

|

|

$ |

11,215 |

|

|

$ |

5,221 |

|

| General and

administrative |

4,317 |

|

|

649 |

|

|

7,899 |

|

|

1,176 |

|

|

Total operating expenses |

10,697 |

|

|

3,400 |

|

|

19,114 |

|

|

6,397 |

|

| Other income (expense),

net |

(16 |

) |

|

45 |

|

|

(8 |

) |

|

108 |

|

| Net loss |

$ |

(10,713 |

) |

|

$ |

(3,355 |

) |

|

$ |

(19,122 |

) |

|

$ |

(6,289 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

$ |

(0.19 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.43 |

) |

|

$ |

(0.23 |

) |

| Weighted-average shares used

in computing net loss per share attributable to common

stockholders, basic and diluted (1) |

55,070,480 |

|

|

28,184,532 |

|

|

44,096,149 |

|

|

27,321,614 |

|

(1) the weighted-average number of shares of

Common Stock outstanding prior to the Business Combination have

been retroactively restated to reflect the exchange ratio of

approximately 3.6281 established in the Business Combination.

Nautilus Biotechnology,

Inc.Condensed Consolidated Statements of Cash

FlowsSix Months Ended June 30, 2021 and 2020

(Unaudited)

| |

Six Months Ended June 30, |

| (in thousands) |

2021 |

|

2020 |

| Cash flows from

operating activities |

|

|

|

|

Net loss |

$ |

(19,122 |

) |

|

$ |

(6,289 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities |

|

|

|

|

Depreciation |

479 |

|

|

327 |

|

|

Stock-based compensation |

3,156 |

|

|

60 |

|

|

Net amortization of premiums on securities |

213 |

|

|

80 |

|

|

Amortization of operating lease right-of-use assets |

760 |

|

|

836 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Prepaid expenses and other assets |

(331 |

) |

|

(313 |

) |

|

Accounts payable |

725 |

|

|

(107 |

) |

|

Accrued expenses and other liabilities |

410 |

|

|

315 |

|

|

Operating lease liability |

(835 |

) |

|

(807 |

) |

|

Net cash used in operating activities |

(14,545 |

) |

|

(5,898 |

) |

| Cash flows from

investing activities |

|

|

|

| Proceeds from sale and

maturities of securities |

40,000 |

|

|

11,001 |

|

| Purchases of securities |

(100,035 |

) |

|

(48,333 |

) |

| Purchases of property and

equipment |

(1,013 |

) |

|

(355 |

) |

|

Net cash used in investing activities |

(61,048 |

) |

|

(37,687 |

) |

| Cash flows from

financing activities |

|

|

|

| Net proceeds from reverse

recapitalization and PIPE financing |

335,409 |

|

|

— |

|

| Payments of deferred offering

costs |

(8,082 |

) |

|

— |

|

| Proceeds from exercise of

stock options |

46 |

|

|

4 |

|

| Proceeds from issuance of

convertible preferred stock, net of issuance costs |

— |

|

|

75,857 |

|

|

Net cash provided by financing activities |

327,373 |

|

|

75,861 |

|

|

Net increase in cash, cash equivalents and restricted cash |

251,780 |

|

|

32,276 |

|

| |

|

|

|

| Cash, cash equivalents and

restricted cash at beginning of period |

37,219 |

|

|

595 |

|

| Cash, cash equivalents and

restricted cash at end of period |

$ |

288,999 |

|

|

$ |

32,871 |

|

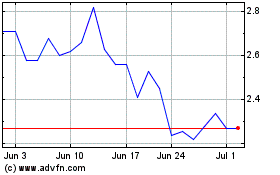

Nautilus Biotechnology (NASDAQ:NAUT)

Historical Stock Chart

From Mar 2024 to Apr 2024

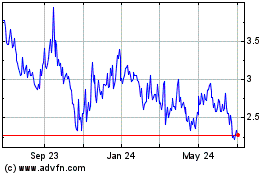

Nautilus Biotechnology (NASDAQ:NAUT)

Historical Stock Chart

From Apr 2023 to Apr 2024