MarketAxess Announces First Casada Trade Via RFQ

March 12 2024 - 8:15AM

Business Wire

Fixed-Income E-Trading Platform Now Supports Full Range of

Brazilian Debt Instruments

MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a

leading electronic trading platform for fixed-income securities,

today announced the first client Casada trade executed via

Request-for-Quote (RFQ) protocol on their Emerging Markets (EM)

platform, with Safra as the buyside client. MarketAxess now

provides trading in the complete spectrum of Brazilian sovereign

debt instruments – including LFTs, LTNs, NTN-Fs and NTN-Bs.

This new comprehensive trading coverage comes as the Brazilian

secondary debt market trading volume soared to $20 billion in

trading ADV and more than $4 trillion in the aggregate in 2023,

according to the Brazilian National Treasury. As the dominant

protocol for fixed income electronic trading globally, the

introduction of trading Casada via RFQ by MarketAxess supports

greater liquidity discovery for local and international investors

trading Brazilian debt strategies. A private RFQ auction allows

investors to find transparency and liquidity on demand.

“We are extremely proud that we were able to support the

first-ever Casada trade via RFQ,” said Maria Calderon, Head of

Latin America Sales at MarketAxess. “This marks a pivotal moment

for our Emerging Markets platform and the entire firm as Brazil

represents one of the largest markets by value of bonds outstanding

within Latin America. We will continue to innovate our robust EM

platform with advances that we believe will benefit both onshore

LATAM investors and global investors.”

The MarketAxess EM platform has more than 1,600 market

participants in over 120 countries, with a worldwide liquidity pool

and 28 local currency bond markets. In Q4 2023, MarketAxess

launched Open Trading for local currency bonds to connect local

onshore dealers with a network of international buyside clients,

which significantly deepens the available liquidity pool.

MarketAxess continues to invest heavily in emerging markets like

Brazil, as this new diverse product range demonstrates the

commitment to local clients and dealers who have previously

expressed the need for RFQ protocols.

For more information, please visit:

https://www.marketaxess.com/trade/latin-america/brazil

About MarketAxess

MarketAxess (Nasdaq: MKTX) operates a leading electronic trading

platform that delivers greater trading efficiency, a diversified

pool of liquidity and significant cost savings to institutional

investors and broker-dealers across the global fixed-income

markets. Over 2,000 firms leverage MarketAxess’ patented technology

to efficiently trade fixed-income securities. Our automated and

algorithmic trading solutions, combined with our integrated and

actionable data offerings, help our clients make faster,

better-informed decisions on when and how to trade on our platform.

MarketAxess’ award-winning Open Trading® marketplace is widely

regarded as the preferred all-to-all trading solution in the global

credit markets. Founded in 2000, MarketAxess connects a robust

network of market participants through an advanced full trading

lifecycle solution that includes automated trading solutions,

intelligent data and index products and a range of post-trade

services. Learn more at www.marketaxess.com and on X

@MarketAxess.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240304722483/en/

INVESTOR RELATIONS Stephen Davidson MarketAxess

Holdings Inc. sdavidson2@marketaxess.com

MEDIA RELATIONS Marisha Mistry MarketAxess

Holdings Inc. mmistry@marketaxess.com

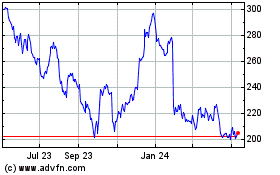

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

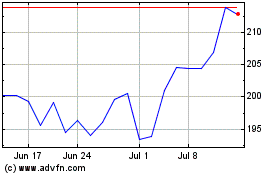

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024