UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES

EXCHANGE ACT OF 1934

(Amendment No. 4)

Miromatrix Medical Inc.

(Name of Subject Company)

Miromatrix Medical Inc.

(Name of Persons Filing Statement)

Common Stock, par value $0.00001 per share

(Title of Class of Securities)

60471P108

(CUSIP Number of Class of Securities)

John S. Hess, Jr., Esq.

Executive Vice President and Deputy General

Counsel

6455 Flying Cloud Drive, Suite 107

Eden Prairie, MN 55344

(952) 942-6000

(Name, address, and telephone numbers of person

authorized to receive notices and communications

on behalf of the persons filing statement)

With copies to:

Stephen Glover, Esq.

Alexander Orr, Esq.

Gibson, Dunn & Crutcher LLP

1050 Connecticut Avenue, N.W.

Washington, D.C. 20036

(202) 955-8500

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Amendment No. 4 (this “Amendment”)

amends and supplements the Solicitation/Recommendation Statement on Schedule 14D-9 of Miromatrix Medical Inc., a Delaware corporation

(the “Company”), filed with the Securities and Exchange Commission (the “SEC”) on November 13,

2023 (as amended or supplemented from time to time, the “Recommendation Statement”), relating to the tender offer by

Morpheus Subsidiary Inc. (“Purchaser”), a Delaware corporation and a wholly owned subsidiary of United Therapeutics

Corporation (“Parent”), a Delaware public benefit corporation, to purchase all of the outstanding shares of common

stock of the Company, par value $0.00001 per share (the “Shares”), for (a) $3.25 per Share in cash, plus (b) one

contractual contingent value right per Share, representing the right to receive a contingent payment of $1.75 in cash upon the achievement

of a specified milestone on or prior to December 31, 2025, upon the terms and subject to the conditions set forth in the offer to

purchase, dated as of November 13, 2023 (the “Offer to Purchase”), and in the related letter of transmittal (the

“Letter of Transmittal,” which, together with the Offer to Purchase and other related materials, as each may be amended,

supplemented or otherwise modified from time to time, collectively constitute the “Offer”).

Capitalized terms used in this Amendment but not

defined herein shall have the respective meanings given to such terms in the Recommendation Statement. The information set forth

in the Recommendation Statement remains unchanged and is incorporated herein by reference, except that such information is hereby

amended or supplemented to the extent specifically provided herein. Underlined text shows text being added to a referenced disclosure

in the Recommendation Statement and stricken-through text shows text being deleted from a referenced disclosure in the Recommendation

Statement.

Item 8. Additional Information.

Item 8(h) of the Recommendation Statement

is hereby amended and supplemented as follows:

“(h) Final Results of the Offer and Expected

Completion of the Merger.

The Offer expired at one minute after 11:59 p.m.,

New York City time, on December 11, 2023 (such date and time, the “Expiration Date”). Continental Stock Transfer &

Trust Company, in its capacity as Paying Agent for the Offer, advised that, as of the Expiration Date, a total of 22,876,102 Shares were

validly tendered and “received” (as defined in Section 251(h) of the DGCL) by the Paying Agent and not validly withdrawn pursuant to the Offer, which Shares, together with all other Shares beneficially owned by Purchaser

and its affiliates, represent approximately 83.43% of the Shares outstanding as of the Expiration Date. As of the Expiration Date,

the number of Shares validly tendered and not validly withdrawn pursuant to the Offer, together with all other Shares beneficially owned

by Purchaser and its affiliates, satisfied the Minimum Condition. After the expiration of the Offer, Purchaser irrevocably accepted for

payment all Shares validly tendered and not validly withdrawn pursuant to the Offer. Purchaser will promptly pay for all such Shares.

As the final step of the acquisition process,

Parent expects to completed its acquisition of the Company by consummating the Merger on December

13, 2023, in accordance with Section 251(h) of the DGCL, without a vote of the Company’s stockholders. At the Effective Time, Purchaser

will be merged with and into the Company, the separate existence of Purchaser will ceased,

and the Company will continued as the Surviving Corporation and a wholly owned subsidiary of Parent.

Each issued and outstanding Share immediately before the Effective Time (other than (i) any Excluded Shares and (ii) any Dissenting

Shares) will be converted into the right to receive the Offer Consideration from Purchaser.

As a result of the Merger, the Shares will be

delisted and will cease to trade on the Nasdaq Capital Market. Parent and Purchaser intend to take steps to cause the termination of the

registration of the Shares under the Exchange Act and to suspend all of the Company’s reporting obligations under the Exchange

Act as promptly as practicable.

On December 12, 2023, Parent and the Company

issued a joint press release announcing the expiration and results of the Offer. The full text of the press release is included as Exhibit (a)(5)(D) hereto

and is incorporated herein by reference.

On December 13, 2023, Parent and the

Company issued a joint press release announcing the completion of the Merger. The full text of the press release is included as Exhibit (a)(5)(E) hereto

and is incorporated herein by reference.”

Item 9. Exhibits.

Item 9 of the Recommendation Statement is hereby

amended by adding the following exhibit.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: December 13, 2023 |

MIROMATRIX MEDICAL INC. |

| |

|

|

| |

By: |

/s/ John S. Hess, Jr. |

| |

Name: |

John S. Hess, Jr. |

| |

Title: |

Executive Vice President, Deputy General Counsel, and Assistant Corporate Secretary |

Exhibit (a)(5)(E)

For

Immediate Release

United

Therapeutics and Miromatrix Medical

Announce

Completion of Tender Offer and Merger

SILVER

SPRING, Md., RESEARCH TRIANGLE PARK, N.C., and EDEN PRAIRIE, Minn., December 13, 2023 -- United Therapeutics Corporation (Nasdaq:

UTHR) and Miromatrix Medical Inc. (Nasdaq: MIRO) announced today that United Therapeutics, through its wholly owned subsidiary

Morpheus Subsidiary Inc. (“Merger Sub”), has successfully completed the previously announced tender offer to acquire

all outstanding shares of Miromatrix for a purchase price of $3.25 per share in cash at closing and an additional $1.75 per share in

cash upon the achievement of a clinical development milestone related to Miromatrix’s development-stage, fully-implantable manufactured

kidney product known as mirokidney™ by December 31, 2025.

The

tender offer expired at one minute after 11:59 p.m., New York City time, on December 11, 2023. Continental Stock Transfer &

Trust Company, the depositary and paying agent for the tender offer, has indicated that, as of the expiration, 22,876,102 shares of Miromatrix

common stock (not including 39,582 shares tendered but not received pursuant to guaranteed delivery procedures as of the expiration)

were validly tendered, and not validly withdrawn, representing approximately 83% of the issued and outstanding shares of Miromatrix common

stock. All conditions of the tender offer were satisfied or waived and all shares validly tendered and not validly withdrawn were accepted

for payment.

Following

the closing of the tender offer, Merger Sub merged with and into Miromatrix, Miromatrix became a wholly owned subsidiary of United Therapeutics,

and all shares of Miromatrix common stock that had not been validly tendered were converted into the right to receive the consideration

paid in the tender offer. Shares of Miromatrix common stock ceased trading on Nasdaq, and United Therapeutics intends promptly to cause

such shares to be delisted.

Gibson,

Dunn & Crutcher LLP acted as legal counsel for United Therapeutics. For Miromatrix, Piper Sandler & Co. acted as lead

financial advisor and Faegre Drinker Biddle & Reath LLP as legal counsel. Craig-Hallum Capital Group LLC also acted as financial

advisor to Miromatrix.

United

Therapeutics: Enabling Inspiration

At

United Therapeutics, our vision and mission are one. We use our enthusiasm, creativity, and persistence to innovate for the unmet medical

needs of our patients and to benefit our other stakeholders. We are bold and unconventional. We have fun; we do good. We are the first

publicly traded biotech or pharmaceutical company to take the form of a public benefit corporation. Our public benefit purpose is to

provide a brighter future for patients through the development of novel pharmaceutical therapies; and technologies that expand the availability

of transplantable organs.

You

can learn more about what it means to be a PBC here: unither.com/pbc.

About

Miromatrix Medical

Miromatrix

is a life sciences company pioneering a novel technology for bioengineering fully transplantable human organs to help save and improve

patients’ lives. Miromatrix has developed a proprietary perfusion technology platform for bioengineering organs that it believes

will efficiently scale to address the shortage of available human organs. Miromatrix’s initial development focus is on bioengineered

human livers and kidneys.

Forward-looking

Statements

United

Therapeutics and Miromatrix are providing this information as of December 13, 2023 and undertake no obligation to update or revise

the information contained in this press release whether as a result of new information, future events or any other reason. Statements

included in this press release that are not historical in nature are forward-looking statements, including, but not limited to, statements

related to: United Therapeutics’ plan to innovate for the unmet medical needs of its patients and to benefit its other stakeholders,

and its plan to provide a brighter future for patients through the development of novel pharmaceutical therapies and technologies that

expand the availability of transplantable organs; and the ability of Miromatrix’s technology platform to address the availability

of organs for patients in need. Forward-looking statements are based on United Therapeutics or Miromatrix management’s beliefs,

as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations as to

future events and results and are not statements of fact, actual events and results may differ materially from those projected. The risks

and uncertainties which forward-looking statements are subject to include, but are not limited to: the ability of United Therapeutics

to successfully integrate Miromatrix’s operations and technology; future research and development results, including preclinical

and clinical trial results; the timing or outcome of FDA approvals or actions, if any; and other risks and uncertainties, such as those

described in periodic and other reports filed by United Therapeutics and Miromatrix with the Securities and Exchange Commission, including

their respective most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

MIROKIDNEY

is a registered trademark of Miromatrix Medical Inc.

For

Further Information Contact:

Dewey

Steadman

Phone:

(202) 919-4097

https://ir.unither.com/contact-ir/

MiroMatrix Medical (NASDAQ:MIRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

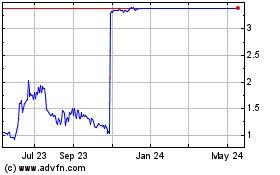

MiroMatrix Medical (NASDAQ:MIRO)

Historical Stock Chart

From Apr 2023 to Apr 2024