Airbnb Files Confidentially for IPO With SEC -- Update

August 19 2020 - 7:07PM

Dow Jones News

By Preetika Rana

Airbnb Inc. said Wednesday it confidentially filed paperwork

with the Securities and Exchange Commission for an initial public

offering, marking a surprising turnaround for a company whose

business was initially ravaged by the coronavirus pandemic.

The Wall Street Journal reported last week that the company was

close to such a filing.

The San Francisco-based home-sharing giant said the number of

shares and the price range for the proposed offering haven't been

determined. Airbnb is leaning toward listing its shares on Nasdaq,

according to people familiar with the matter. There is no guarantee

it will do so, and the company could still opt for the New York

Stock Exchange instead.

Airbnb said late last year that it planned to go public, but its

plans were thrown into disarray as the health crisis shut down

global travel. It initially had planned to make its widely

anticipated debut on the public markets this year via a direct

listing, which wouldn't involve raising any additional money, but

now plans to raise cash through a traditional IPO.

The long-awaited move will bring one of the stalwarts of the

sharing economy into the public domain, alongside ride-sharing

platforms Uber Technologies Inc. and Lyft Inc., and sets up the

next few months to be an especially busy time for big IPOs.

Airbnb joins a rush of companies tapping public investors after

the IPO market emerged from a virtual standstill triggered by the

coronavirus pandemic. Still, its offering will test the public

markets, particularly amid increased wariness for money-losing

startups.

Founded in 2008 after the company's co-founders began renting

guests an air mattress in their downtown San Francisco apartment,

Airbnb grew into one of the most highly valued startups over the

last decade. It was privately valued at more than $30 billion in

2017 and earned $4.8 billion in revenue last year, according to

financial statements reviewed by the Journal.

But its administrative costs also soared in recent years as it

spent big on a trendy corporate headquarters and struggled to

police crime and safety in its rental homes. That led the company

to post a net loss for the first nine months of 2019, down from a

profit in the same period a year earlier.

Then, the pandemic struck this year. Bookings vanished overnight

and the company found itself in the crosshairs of angry hosts who

also saw their earnings evaporate as the company refunded

guests.

Airbnb rushed to secure $2 billion in debt at a steep interest

rate -- and with warrants to its investors that when exercised

would value the company at $18 billion, nearly half of what it was

valued in 2017. In May, Airbnb said it would lay off a quarter of

its staff.

Since spring, however, Airbnb's recovery has been surprisingly

swift. Even as people stayed closer to home, they still sought

rental-home bookings. On July 8, guests booked more than one

million nights of future stays at Airbnb listings around the world,

the company said. It was the first time to hit that level since

March 3.

While bookings are still down year-over-year globally, bookings

in the U.S. in June and July grew 22% and 6.7% year-over year,

respectively, according to AirDNA, an analytics firm that tracks

the short-term rental market.

--Corrie Driebusch and Maureen Farrell contributed to this

article.

Write to Preetika Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

August 19, 2020 18:52 ET (22:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

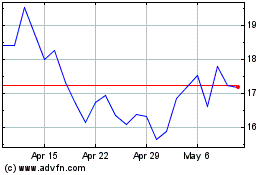

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Apr 2023 to Apr 2024