false000149632300014963232024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 07, 2024 |

IGM Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39045 |

77-0349194 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

325 E. Middlefield Road |

|

Mountain View, California |

|

94043 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 965-7873 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

IGMS |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2024, IGM Biosciences, Inc. (the “Company”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023. The full text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

All of the information furnished in this Item 2.02 and Item 9.01 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

IGM BIOSCIENCES, INC. |

|

|

|

|

Date: |

March 7, 2024 |

By: |

/s/ Misbah Tahir |

|

|

|

Misbah Tahir

Chief Financial Officer |

Exhibit 99.1

IGM Biosciences Announces Fourth Quarter and Full Year 2023 Financial Results and Provides Corporate Update

MOUNTAIN VIEW, Calif., Mar. 7, 2024 – IGM Biosciences, Inc. (Nasdaq: IGMS), a clinical-stage biotechnology company creating and developing engineered IgM antibodies, today announced its financial results for the fourth quarter and full year ended December 31, 2023 and provided an update on recent developments.

“We made significant progress during 2023 in the clinical development of our two lead product candidates in therapeutic areas that we believe have the greatest potential to produce significant near-term value,” said Fred Schwarzer, Chief Executive Officer of IGM Biosciences. “Enrollment in our randomized clinical trial of aplitabart plus FOLFIRI and bevacizumab in second-line metastatic colorectal cancer continues to be encouraging, and we expect to expeditiously complete our target enrollment of 110 patients. If the control arm of this randomized study demonstrates the expected median progression free survival of approximately six months, we will be able to begin evaluating the benefit of aplitabart in enhancing progression free survival by the end of this year."

Mr. Schwarzer continued, “We also initiated two Phase 1b clinical trials of imvotamab in severe systemic lupus erythematosus and in severe rheumatoid arthritis. We are encouraged by the initial level of investigator and patient interest that we have seen in these clinical trials, and we are optimistic that we will be able to generate meaningful initial clinical data by the end of 2024.”

Pipeline Updates

Aplitabart (DR5 agonist)

•Clinical development of aplitabart advances.

•Enrollment ongoing in randomized colorectal cancer clinical trial. The Company continues to enroll patients in a randomized clinical trial of aplitabart, a death receptor 5 agonist, plus FOLFIRI and bevacizumab in second-line metastatic colorectal cancer. In addition to clinical trial sites in the United States, this study includes multiple clinical trial sites in Asia and Europe. This randomized trial is designed to assess the additional benefit of 3 mg/kg of aplitabart when administered in combination with the current standard of care treatment arm of FOLFIRI and bevacizumab, with a primary endpoint of progression-free survival (PFS).

•Evaluating 10 mg/kg dose in single arm colorectal cancer clinical trial. The Company also continues to evaluate a dose of 10 mg/kg of aplitabart in combination with FOLFIRI and bevacizumab in the treatment of later line colorectal cancer patients in its single arm combination clinical trial. The Company expects to complete enrollment of patients in this 10 mg/kg single arm combination dose cohort in the first half of 2024.

Imvotamab (CD20 x CD3)

•Clinical development of imvotamab in autoimmune diseases advances. The Company currently has two Phase 1b clinical trials underway for imvotamab, an IgM-based CD20 x CD3 bispecific T cell engaging antibody: one in severe systemic lupus erythematosus (SLE) and one in severe rheumatoid arthritis (RA). These clinical trials are being expanded to include multiple U.S. and international clinical trial sites. The Company also received clearance in late 2023 from the

FDA of its IND application for the use of imvotamab in treating idiopathic inflammatory myopathies (myositis), and the Company is currently making preparations to initiate this clinical trial.

IGM-2644 (CD38 x CD3)

•Clinical development of IGM-2644 in autoimmune diseases to be initiated. The Company is currently making plans to begin clinical development of IGM-2644, a CD38 x CD3 T cell engager antibody, in the treatment of autoimmune diseases.

Fourth Quarter and Full Year 2023 Financial Results

•Cash and Investments: Cash and investments as of December 31, 2023 were $337.7 million, compared to $427.2 million as of December 31, 2022.

•Collaboration Revenue: For the fourth quarter and year ended 2023, collaboration revenues were $0.7 million and $2.1 million, respectively, compared to $0.4 million and $1.1 million for the fourth quarter and year ended 2022, respectively.

•Research and Development (R&D) Expenses: For the fourth quarter and year ended 2023, R&D expenses were $54.2 million and $215.5 million, respectively, compared to $45.0 million and $179.3 million for the fourth quarter and year ended 2022, respectively.

•General and Administrative (G&A) Expenses: For the fourth quarter and year ended 2023, G&A expenses were $11.6 million and $50.1 million, respectively, compared to $11.6 million and $49.7 million for the fourth quarter and year ended 2022, respectively.

•Net Loss: For the fourth quarter of 2023, net loss was $60.7 million, or a loss of $1.01 per share, compared to a net loss of $52.6 million, or a loss of $1.19 per share, for the fourth quarter of 2022. For the year ended 2023, net loss was $246.4 million, or a loss of $4.71 per share, compared to a net loss of $221.1 million, or a loss of $5.32 per share, for the year ended 2022.

2024 Financial Guidance

The Company expects full year 2024 GAAP operating expenses of $210 million to $220 million, including estimated non-cash stock-based compensation expense of approximately $40 million, and full year collaboration revenue of approximately $3 million related to the Sanofi agreement. The Company expects to end 2024 with a balance of approximately $180 million in cash and investments, and for the balance to enable it to fund its operating expenses and capital expenditure requirements into the second quarter of 2026.

About IGM Biosciences, Inc.

IGM Biosciences is a clinical-stage biotechnology company committed to developing and delivering a new class of medicines to treat patients with cancer and autoimmune and inflammatory diseases. IGM’s pipeline of clinical and preclinical assets is based on the IgM antibody, which has 10 binding sites compared to conventional IgG antibodies with only 2 binding sites. IGM also has an exclusive worldwide collaboration agreement with Sanofi to create, develop, manufacture, and commercialize IgM antibody agonists against oncology and immunology and inflammation targets. For more information, please visit www.igmbio.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements. Such forward-looking statements are not based on historical fact and include, but are not limited to: the potential of, and expectations regarding, IGM’s technology platform and its IgM antibodies and product candidates, including aplitabart, imvotamab, and IGM-2644; IGM’s plans and expectations regarding its clinical development efforts and activities; statements regarding the clinical development of aplitabart, imvotamab, and IGM-2644, including the timing of clinical trial initiation and patient enrollment; IGM’s expectations regarding its financial position and guidance, including non-cash stock-based compensation expense, collaboration revenue, ending 2024 cash and investments and projected cash runway; and statements by IGM’s Chief Executive Officer. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially, including but not limited to: IGM’s early stages of clinical drug development; risks related to the use of engineered IgM antibodies, which is a novel and unproven therapeutic approach; IGM’s ability to demonstrate the safety and efficacy of its product candidates; IGM's ability to successfully and timely advance its product candidates through clinical trials;

IGM’s ability to enroll patients in its clinical trials; the potential for the results of clinical trials to differ from preclinical, preliminary, initial or expected results; the risk of significant adverse events, toxicities or other undesirable side effects; the risk of the occurrence of any event, change or other circumstance that could give rise to the termination of collaborations with third parties; IGM's ability to successfully manufacture and supply its product candidates for clinical trials; the potential impact of continuing or worsening supply chain constraints; the risk that all necessary regulatory approvals cannot be obtained; the potential market for IGM’s product candidates, and the progress and success of alternative therapeutics currently available or in development; IGM’s ability to obtain additional capital to finance its operations; uncertainties related to the projections of the size of patient populations suffering from the diseases IGM is targeting; IGM’s ability to obtain, maintain and protect its intellectual property rights; developments relating to IGM’s competitors and its industry, including competing product candidates and therapies; any potential delays or disruptions resulting from catastrophic events, including epidemics or other outbreaks of infectious disease; general economic and market conditions, including inflation; and other risks and uncertainties, including those more fully described in IGM’s filings with the Securities and Exchange Commission (SEC), including IGM’s Annual Report on Form 10-K filed with the SEC on March 7, 2024 and in IGM’s future reports to be filed with the SEC. Any forward-looking statements contained in this press release speak only as of the date hereof, and IGM specifically disclaims any obligation to update any forward-looking statement, except as required by law.

Contact

Argot Partners

David Pitts

212-600-1902

igmbio@argotpartners.com

IGM Biosciences, Inc.

Selected Statement of Operations Data

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Collaboration revenue |

|

$ |

651 |

|

|

$ |

372 |

|

|

$ |

2,130 |

|

|

$ |

1,069 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development (1) |

|

|

54,190 |

|

|

|

45,018 |

|

|

|

215,519 |

|

|

|

179,289 |

|

General and administrative (1) |

|

|

11,580 |

|

|

|

11,618 |

|

|

|

50,072 |

|

|

|

49,736 |

|

Total operating expenses |

|

|

65,770 |

|

|

|

56,636 |

|

|

|

265,591 |

|

|

|

229,025 |

|

Loss from operations |

|

|

(65,119 |

) |

|

|

(56,264 |

) |

|

|

(263,461 |

) |

|

|

(227,956 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

4,666 |

|

|

|

3,746 |

|

|

|

17,743 |

|

|

|

7,035 |

|

Other expense |

|

|

— |

|

|

|

(58 |

) |

|

|

(20 |

) |

|

|

(181 |

) |

Total other income (expense) |

|

|

4,666 |

|

|

|

3,688 |

|

|

|

17,723 |

|

|

|

6,854 |

|

Loss before income tax expense |

|

|

(60,453 |

) |

|

|

(52,576 |

) |

|

|

(245,738 |

) |

|

|

(221,102 |

) |

Income tax expense |

|

|

(242 |

) |

|

|

— |

|

|

|

(678 |

) |

|

|

— |

|

Net loss |

|

$ |

(60,695 |

) |

|

$ |

(52,576 |

) |

|

$ |

(246,416 |

) |

|

$ |

(221,102 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(1.01 |

) |

|

$ |

(1.19 |

) |

|

$ |

(4.71 |

) |

|

$ |

(5.32 |

) |

Weighted-average common shares outstanding, basic and diluted |

|

|

59,829,077 |

|

|

|

44,241,491 |

|

|

|

52,311,958 |

|

|

|

41,543,954 |

|

(1) Amounts include stock-based compensation expense as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

5,421 |

|

|

$ |

6,582 |

|

|

$ |

27,499 |

|

|

$ |

25,620 |

|

General and administrative |

|

|

3,816 |

|

|

|

4,527 |

|

|

|

19,048 |

|

|

|

19,090 |

|

Total stock-based compensation expense |

|

$ |

9,237 |

|

|

$ |

11,109 |

|

|

$ |

46,547 |

|

|

$ |

44,710 |

|

IGM Biosciences, Inc.

Selected Balance Sheet Data

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash and investments |

|

$ |

337,677 |

|

|

$ |

427,162 |

|

Total assets |

|

|

423,411 |

|

|

|

513,499 |

|

Accounts payable |

|

|

1,326 |

|

|

|

2,512 |

|

Accrued liabilities |

|

|

31,544 |

|

|

|

33,621 |

|

Deferred revenue |

|

|

146,801 |

|

|

|

148,931 |

|

Total liabilities |

|

|

220,177 |

|

|

|

226,236 |

|

Accumulated deficit |

|

|

(821,242 |

) |

|

|

(574,826 |

) |

Total stockholders' equity |

|

|

203,234 |

|

|

|

287,263 |

|

v3.24.0.1

Document And Entity Information

|

Mar. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity Registrant Name |

IGM Biosciences, Inc.

|

| Entity Central Index Key |

0001496323

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39045

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

77-0349194

|

| Entity Address, Address Line One |

325 E. Middlefield Road

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94043

|

| City Area Code |

(650)

|

| Local Phone Number |

965-7873

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

IGMS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

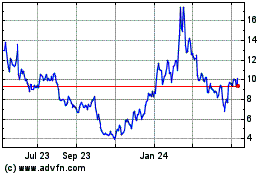

IGM Biosciences (NASDAQ:IGMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

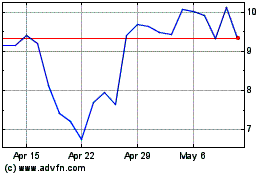

IGM Biosciences (NASDAQ:IGMS)

Historical Stock Chart

From Apr 2023 to Apr 2024