Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275964

HENNESSY ADVISORS, INC.

PROSPECTUS

Dividend Reinvestment and Stock Purchase Plan

1,530,000 Shares of Common Stock (no par value)

We offer to participants in our Dividend Reinvestment and Stock Purchase Plan an opportunity to purchase our common stock, no par value. The plan provides holders of shares of our common stock and new investors with a convenient and economical means of purchasing shares of our common stock. The plan offers:

| |

●

|

automatic reinvestment of all or a portion of your cash dividends of our common stock in additional shares of our common stock;

|

| |

●

|

for new investors, initial purchase of shares of our common stock;

|

| |

●

|

for existing shareholders, purchase of additional shares of our common stock; and

|

| |

●

|

safekeeping in book‑entry form of your shares at no cost.

|

We may issue up to 1,530,000 authorized but unissued shares of our common stock under the plan. This prospectus describes and constitutes the plan. Participants in the plan should retain this prospectus for future reference.

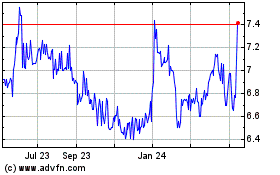

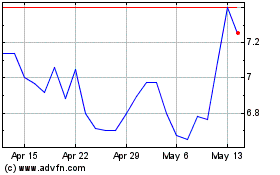

Our common stock is traded on The Nasdaq Global Market under the symbol “HNNA.” On January 5, 2024, the Nasdaq Official Closing Price of our common stock was $7.28 per share. The aggregate market value of our outstanding common stock held by non‑affiliates pursuant to General Instruction I.B.6 of Form S-3 was approximately $34,979,650, which was calculated based on 7,674,969 shares of common stock outstanding as of January 5, 2024, of which 2,870,072 shares were held by affiliates. We have sold approximately $81,240 of securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12-calendar month period that ends on and includes the date of this prospectus. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on this registration statement in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75,000,000.

You should not view the existence of the plan as a guarantee that we will continue to pay cash dividends on our common stock in the future. Our ability to pay future dividends, as well as the amount and timing of any such dividends, will depend on a number of factors, such as our ongoing capital requirements, regulatory limitations, our future operating results and financial condition, our anticipated future growth, and general economic conditions.

To the extent required by applicable law in certain states, shares of common stock offered under the plan are offered only through Computershare Trust Company, N.A. or a registered broker-dealer in those states.

Investing in our common stock involves risks. Please read the section titled “Risk Factors” beginning on page 2 of this prospectus.

The terms and conditions of the plan are set forth in the section titled “The Plan” in this prospectus. Any future amendments to the plan will be effective immediately upon mailing of notice to participants.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 5, 2024.

TABLE OF CONTENTS

Unless we otherwise indicate or the context otherwise requires, references in this prospectus to “Hennessy Advisors,” “we,” “us,” and “our” refer to Hennessy Advisors, Inc.

This prospectus is a part of the registration statement that we filed with the Securities and Exchange Commission (the “SEC”). You should read this prospectus together with the more detailed information regarding our company, our common stock, and our financial statements and notes to those statements that appear elsewhere in this prospectus or that we incorporate in this prospectus by reference.

You should not consider any information in this prospectus or any prospectus supplement to be investment, legal, or tax advice. You should consult your own counsel, accountant, and other advisors for legal, tax, business, financial, and related advice regarding any investment in our common stock. We are not making any representation to you regarding the legality under applicable investment or similar laws of any investment in our common stock.

You should rely only on the information contained in, or incorporated by reference in, this prospectus and any accompanying prospectus supplement. We have not authorized anyone to provide you with information different from that contained in, or incorporated by reference in, this prospectus. The common stock is not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of this prospectus or such prospectus supplement, as applicable.

SUMMARY

This prospectus describes our Dividend Reinvestment and Stock Purchase Plan (the “Plan”). The Plan provides a simple and convenient method of reinvesting cash dividends paid on shares of our common stock and making optional cash investments in additional shares of our common stock. The Plan also provides us with the ability to sell our authorized but unissued shares of our common stock to participants and new investors, which will improve our liquidity by providing additional funds for general corporate purposes. Please review this prospectus carefully and retain it for future reference.

The price of each share of our common stock purchased under the Plan will be the fair market value of shares of our common stock on the date of purchase, determined as provided in the Plan. You have no control over the price and, in the case of shares of our common stock purchased or sold in the open market, the time at which such shares are purchased or sold for your account. You bear the market risk associated with fluctuations in the price of our common stock that occur while completion of a purchase or sale of such shares for your account is pending.

We are not recommending that you buy or sell our common stock. You should invest in shares of our common stock through the Plan only after you have independently researched your investment decision.

If you have questions regarding the Plan, please write to the Plan administrator at the following address:

Computershare Trust Company, N.A.

P.O. Box 43006

Providence, RI 02940-3006

You may also call the Plan administrator at 1 (800) 393-5809. An automated voice response system is available 24 hours a day, seven days a week. Customer service representatives are available from 9:00 a.m. to 5:00 p.m. Eastern time, Monday through Friday (except holidays). In addition, you may visit the Investor Center on the Plan administrator’s website at www.computershare.com/investor. At this website, you can enroll in the Plan, obtain information, and perform certain transactions on your Plan account.

You have the following dividend reinvestment options:

| |

●

|

Full Dividend Reinvestment – If you elect this option, the Plan administrator will apply all cash dividends, less any withholding tax, on all shares of common stock then or subsequently registered in your name, and all cash dividends on all Plan shares, less any withholding tax, together with any optional cash payments, toward the purchase of additional Plan shares.

|

| |

●

|

Partial Dividend Reinvestment – If you elect this option, the Plan administrator will pay to you cash dividends, less any withholding tax, on only the number of shares of common stock specified on the Enrollment Form and will purchase additional Plan shares with all remaining cash dividends, less any withholding tax, together with any optional cash payments.

|

| |

●

|

All Dividends Paid in Cash (No Dividend Reinvestment) – If you elect this option, the Plan administrator will not apply any dividends toward the purchase of additional Plan shares, but will instead pay you cash dividends, less any withholding tax, on all shares of common stock then or subsequently registered in your name.

|

If you return a properly executed Enrollment Form to the Plan administrator without electing an investment option, you will be enrolled as if you had selected the full dividend reinvestment option. If you do not submit an Enrollment Form, none of your cash dividends will be reinvested.

Our principal corporate offices are located at 7250 Redwood Boulevard, Suite 200, Novato, California 94945, and our telephone number is (415) 899-1555.

RISK FACTORS

Before you decide to participate in the Plan and invest in shares of our common stock, you should carefully consider the specific risks set forth under the caption “Risk Factors” included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023, and under the caption “Risk Factors” in any of our subsequent annual reports on Form 10-K and quarterly reports on Form 10-Q incorporated by reference in this prospectus. For more information, see “Available Information” and “Incorporation of Certain Documents by Reference.” We cannot assure you of a profit or protect you against a loss on the shares of our common stock that you purchase or sell under the Plan.

Risks Associated with Participation in Plan

In addition, there are risks associated with participation in the Plan. You will not know the price of the shares you are purchasing under the Plan at the time you authorize the investment or elect to have your dividends reinvested. The price of our common stock may fluctuate between the time you decide to purchase shares under the Plan and the time of actual purchase. In addition, during this period, you may become aware of additional information that might affect your investment decision. If you instruct the Plan administrator to sell shares under the Plan, you will not be able to direct the time and price at which your shares are sold. The price of our shares may decline between the time you decide to sell shares and the time of actual sale. If you decide to withdraw from the Plan, the Plan administrator will continue to hold your shares unless you request to have your shares transferred to another account. If you request such a transfer, the market price of our shares may decline between the time you request such a transfer and the date such transfer is effective.

Risk of Change of Control

If our common stock owned by Neil J. Hennessy, our Chairman of the Board and Chief Executive Officer, falls below 25% as a result of this offering, then under the Investment Advisors Act of 1940, as amended, and the Investment Company Act of 1940, as amended, we may be deemed to have experienced a change in control. A change in control will be deemed to constitute an assignment of the management agreements covering each of our investment funds, which will terminate such management agreements automatically. Therefore, new management agreements covering our investment funds would have to be approved by the holders of the lesser of (i) a majority of the outstanding shares of each investment fund and (ii) two-thirds of the shares voted, provided that at least a majority of the outstanding shares are voted.

If we are deemed to have experienced a change in control, we expect that the board of trustees that oversees our investment funds would recommend that the investment fund shareholders approve new management agreements with Hennessy Advisors covering each of our investment funds. However, we cannot assure you that the requisite fund shareholder vote would be obtained. Any meeting of fund shareholders may be adjourned for a total of up to 150 days in order to obtain the required vote. If the shareholders of any of our investment funds were to fail to approve the assignment after all adjournments, the board of trustees would be required to determine whether to engage a different investment manager to serve as investment manager for such fund. The board of trustees could also take other actions, such as closing a fund whose shareholders do not approve the new management agreement or merging the fund into one of our other investment funds. If any of our investment funds retains a new investment advisor or is closed following a change in control, we will lose the management agreement and any shareholder servicing agreement with that investment fund, and we may lose revenues if shareholders of a merged fund redeem their shares.

If we are deemed to have experienced a change in control, we will bear the cost of soliciting proxies for the meeting of investment fund shareholders called to approve the new management agreements covering our investment funds. We will pay these costs regardless of the outcome of the vote, even though these costs will not result in any increase in our revenues or earnings.

THE COMPANY

We are a publicly traded investment management firm whose primary business activity is providing investment advisory services to a family of 16 open-end mutual funds (collectively, the “Hennessy Mutual Funds”) and one exchange‑traded fund (“ETF”) branded as the Hennessy Funds. We are committed to providing superior service to investors and employing a consistent and disciplined approach to investing based on a buy‑and‑hold philosophy that rejects the idea of market timing. Our goal is to provide products that investors can have confidence in, knowing their money is invested as promised and with their best interests in mind. Our firm was founded on these principles over 30 years ago, and the same principles guide us today.

We earn revenues primarily by providing investment advisory services to the Hennessy Funds and secondarily by providing shareholder services to investors in the Hennessy Mutual Funds. Investment advisory services include managing the composition of each fund’s portfolio (including the purchase, retention, and disposition of portfolio securities in accordance with each fund’s investment objectives, policies, and restrictions), monitoring each fund’s compliance with its investment objectives and restrictions and federal securities laws, monitoring the liquidity of each fund, reviewing each fund’s investment performance, overseeing the selection and continued employment of sub-advisors and monitoring such sub-advisors’ adherence to the fund’s investment objectives, policies, and restrictions, overseeing other service providers, maintaining in‑house marketing and distribution departments, preparing and distributing regulatory reports, and overseeing distribution of the funds through third‑party financial institutions. Shareholder services include maintaining a toll‑free number that the current investors in the Hennessy Funds may call to ask questions about their accounts or the funds and actively participating as a liaison between investors in the Hennessy Funds and U.S. Bank Global Fund Services, the Hennessy Funds’ administrator. The fees we receive for investment advisory and shareholder services are calculated as a percentage of the average daily net asset values of the Hennessy Funds. Accordingly, our total revenue increases or decreases as our average assets under management rises or falls. The percentage amount of the investment advisory fees varies from fund to fund, but the percentage amount of the shareholder service fees is consistent across all Hennessy Mutual Funds.

We have delegated the day‑to‑day portfolio management responsibilities to sub‑advisors, subject to our oversight, for some of the Hennessy Funds. In exchange for these sub‑advisory services, we pay each sub‑advisor a fee out of our own assets, which is calculated as a percentage of the average daily net asset values of the sub‑advised funds. Accordingly, the sub‑advisory fees we pay increase or decrease as our average assets under management in our sub‑advised funds increases or decreases, respectively.

Our average assets under management for fiscal year 2023 was $3.0 billion, and our total assets under management as of the end of fiscal year 2023 was $3.0 billion. Our business strategy centers on (i) organic growth through our marketing, sales, and distribution efforts and (ii) growth through strategic purchases of management‑related assets.

Historical Calendar Year Timeline

|

1989

|

In February, we were founded as a California corporation under our previous name, Edward J. Hennessy, Inc., and registered as a broker-dealer with the Financial Industry Regulatory Authority.

|

| |

|

|

1996

|

In March, we launched our first mutual fund, the Hennessy Balanced Fund.

|

| |

|

|

1998

|

In October, we launched our second mutual fund, the Hennessy Total Return Fund.

|

| |

|

|

2000

|

In June, we successfully completed our first asset purchase by purchasing the assets related to the management of two mutual funds previously managed by Netfolio, Inc. (“Netfolio”) and changed the fund names to the Hennessy Cornerstone Growth Fund and the Hennessy Cornerstone Value Fund. The amount of the purchased assets as of the closing date totaled approximately $197 million.

|

| |

|

|

2002

|

In May, we successfully completed a self-underwritten initial public offering of our stock by raising $5.7 million at an offering price of $1.98 (HNNA.OB) and changed our firm name to Hennessy Advisors, Inc. Our total assets under management at the time of our initial public offering was approximately $358 million.

|

|

2003

|

In September, we purchased the assets related to the management of a mutual fund previously managed by SYM Financial Corporation and reorganized the assets of such fund into the newly created Hennessy Cornerstone Mid Cap 30 Fund. The amount of the purchased assets as of the closing date was approximately $35 million.

|

| |

|

|

2004

|

In March, we purchased the assets related to the management of five mutual funds previously managed by Lindner Asset Management, Inc. and reorganized the assets of such funds into four of our existing Hennessy Funds. The amount of the purchased assets as of the closing date totaled approximately $301 million.

|

| |

|

|

2005

|

In July, we purchased the assets related to the management of a mutual fund previously managed by Landis Associates LLC and changed the fund name to the Hennessy Cornerstone Growth, Series II Fund. The amount of the purchased assets as of the closing date was approximately $299 million.

|

| |

|

|

2007

|

In November, we launched the Hennessy Micro Cap Growth Fund, LLC, a non‑registered private pooled investment fund.

|

| |

|

|

2009

|

In March, we purchased the assets related to the management of two mutual funds previously managed by RBC Global Asset Management (U.S.) Inc. and reorganized the assets of such funds into the newly created Hennessy Cornerstone Large Growth Fund and the Hennessy Large Value Fund. In conjunction with the completion of the transaction, RBC Global Asset Management (U.S.) Inc. became the sub‑advisor to the Hennessy Large Value Fund. The amount of the purchased assets as of the closing date totaled approximately $158 million.

In September, we purchased the assets related to the management of two mutual funds previously managed by SPARX Investment & Research, USA, Inc. and sub‑advised by SPARX Asset Management Co., Ltd. and changed the fund names to the Hennessy Japan Fund and the Hennessy Japan Small Cap Fund. In conjunction with the completion of the transaction, SPARX Asset Management Co., Ltd. became the sub‑advisor to both funds. The amount of the purchased assets as of the closing date totaled approximately $74 million.

|

| |

|

|

2011

|

In October, we reorganized the assets of the Hennessy Cornerstone Growth, Series II Fund into the Hennessy Cornerstone Growth Fund.

|

| |

|

|

2012

|

In October, we purchased the assets related to the management of 10 mutual funds previously managed by FBR Fund Advisers (the “FBR Funds”). We reorganized the assets of three of the FBR Funds into existing Hennessy Funds and reorganized the assets of the seven other FBR Funds into newly created series of the Hennessy Funds. In conjunction with the completion of the transaction, Broad Run Investment Management, LLC became the sub‑advisor to the Hennessy Focus Fund, FCI Advisors became the sub‑advisor to the Hennessy Equity and Income Fund (fixed income allocation) and the Hennessy Core Bond Fund, and The London Company of Virginia, LLC became the sub‑advisor to the Hennessy Equity and Income Fund (equity allocation). The amount of the purchased assets as of the closing date was approximately $2.2 billion.

In December, we closed the Hennessy Micro Cap Growth Fund, LLC.

|

|

2014

|

In April, our common stock began trading on The Nasdaq Capital Market.

|

| |

|

|

2015

|

In September, we completed a self-tender offer, under which we repurchased 1,500,000 shares of our common stock at $16.67 per share.

In June, we launched Institutional Class shares for the Hennessy Japan Small Cap Fund and the Hennessy Large Cap Financial Fund.

|

| |

|

|

2016

|

In September, we purchased the assets related to the management of two mutual funds previously managed by Westport Advisers, LLC and reorganized the assets of such funds into the Hennessy Cornerstone Mid Cap 30 Fund. The amount of the purchased assets as of the closing date totaled approximately $435 million.

|

| |

|

|

2017

|

In February, we liquidated the Hennessy Core Bond Fund and reorganized the Hennessy Large Value Fund into the Hennessy Cornerstone Value Fund. Additionally, for the Hennessy Technology Fund, we implemented changes to the investment strategy and the portfolio management team.

In March, we launched Institutional Class shares for the Hennessy Gas Utility Fund.

In December, we purchased the assets related to the management of two mutual funds previously managed by Rainier Investment Management, LLC (“Rainier”) and reorganized the assets of such funds into the Hennessy Cornerstone Large Growth Fund and the Hennessy Cornerstone Mid Cap 30 Fund. The amount of the purchased assets as of the closing date totaled approximately $122 million.

|

| |

|

|

2018

|

In January, we purchased the assets related to the management of a third mutual fund previously managed by Rainier and reorganized the assets of such fund into the Hennessy Cornerstone Mid Cap 30 Fund. The amount of the purchased assets as of the closing date totaled approximately

$253 million.

In October, we purchased the assets related to the management of the two mutual funds previously managed by BP Capital Fund Services, LLC (“BP Capital”) and reorganized the assets of such funds into the newly created Hennessy Energy Transition Fund and the Hennessy Midstream Fund. In connection with the transaction, BP Capital became the sub‑advisor to both funds. The amount of the purchased assets as of the closing date totaled approximately $200 million.

|

| |

|

|

2019

|

During the year, we repurchased an aggregate of 560,734 shares of our common stock pursuant to our stock buyback program.

|

|

2020

|

In the first three months of the year, we repurchased an aggregate of 206,109 shares of our common stock pursuant to our stock buyback program.

|

| |

|

|

2021

|

In October, we transferred listing of our common stock from The Nasdaq Capital Market to The Nasdaq Global Market. Also in October, we completed a public offering of 4.875% notes due 2026 (the “2026 Notes”) in the aggregate principal amount of $40.25 million, which included the full exercise of the underwriters’ overallotment option.

|

| |

|

|

2022

|

In January, we mutually agreed with BP Capital to terminate the sub‑advisory agreement for the Hennessy Energy Transition Fund and the Hennessy Midstream Fund and began managing such funds internally. In December, we purchased the assets related to the management of an ETF previously managed by Red Gate Advisers, LLC and reorganized the assets of such fund into the newly created Hennessy Stance ESG ETF. In connection with the transaction, Stance Capital, LLC (“Stance Capital”) and Vident Investment Advisory, LLC (“VIA”) became sub‑advisors to the fund. The amount of the purchased assets as of the closing date totaled approximately $43 million.

|

| |

|

|

2023

|

In April, we signed a definitive agreement with Community Capital Management, LLC (“CCM”) to purchase the assets related to the management of the CCM Core Impact Equity Fund and the CCM Small/Mid-Cap Impact Value Fund.

In July, VIA completed an acquisition transaction that resulted in a change of control of VIA and automatic termination of our sub‑advisory agreement with VIA. On the same date, we entered into a new sub‑advisory agreement with Vident Advisory, LLC (“Vident Advisory”).

In November, we completed the acquisition of the CCM Small/Mid-Cap Impact Value Fund and reorganized the assets of such fund into the Hennessy Stance ESG ETF. The special meeting of the shareholders of the CCM Core Impact Equity Fund to approve the transaction was adjourned to November 21, 2023, and again to January 31, 2024. If approved by the shareholders, the assets of the CCM Core Impact Equity Fund will also be reorganized into the Hennessy Stance ESG ETF.

|

Product Information

Investment Strategies of the Hennessy Funds

We manage 16 mutual funds and one ETF, each of which is categorized as a Domestic Equity, Multi‑Asset, or Sector and Specialty product. Shares of the funds generally are available for purchase only by U.S. residents and, in certain circumstances, U.S. citizens living abroad.

| |

|

The Hennessy Funds Family |

|

|

| |

|

|

|

|

| Domestic Equity |

|

Multi-Asset |

|

Sector and Specialty |

| |

|

|

|

|

| |

|

|

|

|

|

Hennessy Cornerstone Growth Fund

|

|

Hennessy Total Return Fund

|

|

Hennessy Energy Transition Fund

|

| |

|

|

|

|

|

Hennessy Focus Fund

|

|

Hennessy Equity and Income Fund

|

|

Hennessy Midstream Fund

|

| |

|

|

|

|

|

Hennessy Cornerstone Mid Cap 30 Fund

|

|

Hennessy Balanced Fund

|

|

Hennessy Gas Utility Fund

|

| |

|

|

|

|

|

Hennessy Cornerstone Large Growth Fund

|

|

|

|

Hennessy Japan Fund

|

| |

|

|

|

|

|

Hennessy Cornerstone Value Fund

|

|

|

|

Hennessy Japan Small Cap Fund

|

| |

|

|

|

|

| |

|

|

|

Hennessy Large Cap Financial Fund

|

| |

|

|

|

|

| |

|

|

|

Hennessy Small Cap Financial Fund

|

| |

|

|

|

|

| |

|

|

|

Hennessy Technology Fund

|

| |

|

|

|

|

| |

|

|

|

Hennessy Stance ESG ETF

|

| |

|

|

|

|

Domestic Equity Funds

Five of the Hennessy Funds are categorized as Domestic Equity products. Of those five funds, four utilize a quantitative investment strategy and one is actively managed, and they all employ consistent and disciplined approaches to investing. Following is a brief description of the investment objectives and principal investment strategies of the Hennessy Funds in the Domestic Equity product category:

| |

●

|

Hennessy Cornerstone Growth Fund (Investor Class symbol HFCGX; Institutional Class symbol HICGX). The Hennessy Cornerstone Growth Fund seeks long-term growth of capital by investing in growth-oriented common stocks using a quantitative formula. From the investable common stocks of public companies in the S&P Capital IQ Database with market capitalizations exceeding $175 million, this fund invests in the 50 common stocks with the highest one-year price appreciation that also have price-to-sales ratios below 1.5, higher annual earnings than in the previous year, and positive stock price appreciation over the prior three-month and six-month periods.

|

| |

●

|

Hennessy Focus Fund (Investor Class symbol HFCSX; Institutional Class symbol HFCIX). The Hennessy Focus Fund seeks capital appreciation through a concentrated portfolio of approximately 20 companies that the portfolio managers believe are high‑quality businesses with large growth opportunities, excellent management, low tail risk, and discount valuations. This fund’s holdings are conviction-weighted, with the top ten positions comprising approximately 60‑80% of the fund’s assets.

|

| |

●

|

Hennessy Cornerstone Mid Cap 30 Fund (Investor Class symbol HFMDX; Institutional Class symbol HIMDX). The Hennessy Cornerstone Mid Cap 30 Fund seeks long-term growth of capital by investing in mid‑cap growth‑oriented common stocks using a quantitative formula. From the investable common stocks of public companies in the S&P Capital IQ Database with market capitalizations between $1 billion and $10 billion, this fund invests in the 30 common stocks with the highest one-year price appreciation that also have price-to-sales ratios below 1.5, higher annual earnings than in the previous year, and positive stock price appreciation over the prior three‑month and six‑month periods.

|

| |

●

|

Hennessy Cornerstone Large Growth Fund (Investor Class symbol HFLGX; Institutional Class symbol HILGX). The Hennessy Cornerstone Large Growth Fund seeks long-term growth of capital by investing in growth-oriented common stocks of larger companies using a quantitative formula. From the investable common stocks of public companies in the S&P Capital IQ Database, this fund invests in the 50 stocks that meet the following criteria, in the specified order: (1) above-average market capitalization; (2) a price‑to‑cash‑flow ratio less than the median of the remaining securities; (3) positive total capital; and (4) the highest one-year return on total capital.

|

| |

●

|

Hennessy Cornerstone Value Fund (Investor Class symbol HFCVX; Institutional Class symbol HICVX). The Hennessy Cornerstone Value Fund seeks total return, consisting of capital appreciation and current income, by investing in larger, dividend-paying common stocks using a quantitative formula. From the investable common stocks of public companies in the S&P Capital IQ Database, this fund invests in the 50 stocks with the highest dividend yield that also have above‑average market capitalizations, above‑average number of shares outstanding, 12‑month sales that are 50% greater than the average, and above‑average cash flows.

|

Multi-Asset Funds

Three of the Hennessy Funds are categorized as Multi-Asset products. Of those three funds, two utilize a quantitative investment strategy and one is actively managed. These funds follow a more conservative investment strategy focused on generating income and providing an alternative to funds containing only equity stocks. Following is a brief description of the investment objectives and principal investment strategies of the Hennessy Funds in the Multi‑Asset product category:

| |

●

|

Hennessy Total Return Fund (Investor Class symbol HDOGX). The Hennessy Total Return Fund seeks total return, consisting of capital appreciation and current income, by investing approximately 50% of its assets in the 10 highest dividend‑yielding common stocks of the Dow Jones Industrial Average (known as the “Dogs of the Dow”) in roughly equal dollar amounts and the remaining 50% of its assets in U.S. Treasury securities with a maturity of less than one year. This fund then utilizes a borrowing strategy that allows the fund’s performance to approximate what it would be if the fund had an asset allocation of roughly 75% Dogs of the Dow stocks and 25% U.S. Treasury securities.

|

| |

●

|

Hennessy Equity and Income Fund (Investor Class symbol HEIFX; Institutional Class symbol HEIIX). The Hennessy Equity and Income Fund seeks income and long-term capital appreciation with reduced volatility of returns by investing up to 70% of its assets in common stock, preferred stock, and equity‑like instruments and its remaining assets in asset backed and mortgage‑backed securities and debt instruments, including high‑yield bonds.

|

| |

●

|

Hennessy Balanced Fund (Investor Class symbol HBFBX). The Hennessy Balanced Fund seeks a combination of capital appreciation and current income by investing approximately 50% of its assets in roughly equal dollar amounts in the Dogs of the Dow stocks but limits exposure to market risk and volatility by investing approximately 50% of its assets in U.S. Treasury securities with a maturity of less than one year.

|

Sector and Specialty Funds

Nine of the Hennessy Funds are categorized as Sector and Specialty products. Of those nine funds, one is designed as an index fund and the other eight are actively managed, and each focuses on a niche sector of the stock market. Following is a brief description of the investment objectives and principal investment strategies of the Hennessy Funds in the Sector and Specialty product category:

| |

●

|

Hennessy Energy Transition Fund (Investor Class symbol HNRGX; Institutional Class symbol HNRIX). The Hennessy Energy Transition Fund seeks total return by investing in companies operating in the United States across the full spectrum of the energy supply/demand value chain, including traditional upstream, midstream, and downstream energy companies, as well as renewable energy companies and energy end users. The portfolio managers use a proprietary research and investment process that involves fundamental and quantitative analysis of various macroeconomic and commodity price and other factors to select this fund’s investments and determine the weighting of each investment.

|

| |

●

|

Hennessy Midstream Fund (Investor Class symbol HMSFX; Institutional Class symbol HMSIX). The Hennessy Midstream Fund seeks capital appreciation through distribution growth and current income by investing in midstream energy infrastructure companies, including master limited partnerships, that own and operate assets used in the transporting, storing, gathering, processing, distributing, or marketing of natural gas, natural gas liquids, crude oil, refined products, coal, or electricity or that provide energy-related equipment and services. The portfolio managers combine a top-down deductive reasoning approach with a detailed bottom-up analysis of individual companies.

|

| |

●

|

Hennessy Gas Utility Fund (Investor Class symbol GASFX; Institutional Class symbol HGASX). The Hennessy Gas Utility Fund seeks income and capital appreciation by investing in companies that are members of the American Gas Association (“AGA”) in approximately the same percentage as the percentage weighting of such company in the AGA Stock Index. The AGA Stock Index is a capitalization‑weighted index that consists of all member companies of the AGA whose securities are traded on a U.S. stock exchange. The index is adjusted monthly for the percentage of natural gas assets on each company’s balance sheet.

|

| |

●

|

Hennessy Japan Fund (Investor Class symbol HJPNX; Institutional Class symbol HJPIX). The Hennessy Japan Fund seeks long-term capital appreciation by investing in equity securities of Japanese companies. Using in-depth analysis and on‑site research, the portfolio managers focus on stocks with a potential “value gap” by screening for companies that they believe have strong businesses and management and are trading at attractive prices. The portfolio managers limit the portfolio to what they consider to be their best ideas and maintain a concentrated number of holdings.

|

| |

●

|

Hennessy Japan Small Cap Fund (Investor Class symbol HJPSX; Institutional Class symbol HJSIX). The Hennessy Japan Small Cap Fund seeks long-term capital appreciation by investing in equity securities of smaller Japanese companies, typically considered to be companies with market capitalizations in the bottom 20% of all publicly traded Japanese companies. Using in‑depth analysis and on-site research, the portfolio managers focus on stocks with a potential “value gap” by screening for small-cap companies that the portfolio managers believe have strong businesses and management and are trading at attractive prices. The portfolio managers limit the portfolio to what they consider to be their best ideas and is unconstrained by its benchmarks.

|

| |

●

|

Hennessy Large Cap Financial Fund (Investor Class symbol HLFNX; Institutional Class symbol HILFX). The Hennessy Large Cap Financial Fund seeks capital appreciation by investing in securities of large-cap companies principally engaged in the business of providing financial services, including information technology companies that are primarily engaged in providing products or services to financial services companies.

|

| |

●

|

Hennessy Small Cap Financial Fund (Investor Class symbol HSFNX; Institutional Class symbol HISFX). The Hennessy Small Cap Financial Fund seeks capital appreciation by investing in securities of small‑cap companies principally engaged in the business of providing financial services.

|

| |

●

|

Hennessy Technology Fund (Investor Class symbol HTECX; Institutional Class symbol HTCIX). The Hennessy Technology Fund seeks long-term capital appreciation by investing in securities of companies principally engaged in the research, design, development, manufacturing, or distributing of products or services in the technology industry. From the investable common stocks of public companies in the S&P Capital IQ Database with market capitalizations exceeding $175 million, this fund invests in approximately 60 stocks (weighted equally by dollar amount) that the portfolio managers believe demonstrate sector‑leading cash flows and profits, a history of delivering returns in excess of cost of capital, attractive relative valuations, ability to generate cash, attractive balance sheet risk profiles, and prospects for sustainable profitability.

|

| |

●

|

Hennessy Stance ESG ETF (NYSE: STNC). The Hennessy Stance ESG ETF seeks long term growth of capital by combining environmental, social, and governance (“ESG”) and machine learning/artificial intelligence (“ML/AI”) in an ETF structure. The portfolio managers seek exposure to companies that score well on ESG metrics and that the portfolio managers believe will outperform based on ML/AI models. The fund leverages optimization in an attempt to reduce portfolio level tail risk and mitigate downside losses.

|

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into it contain “forward‑looking statements” within the meaning of the securities laws, for which we claim the protection of the safe harbor for forward looking statements contained in the Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by terminology such as “expect,” “anticipate,” “intend,” “may,” “plan,” “will,” “should,” “could,” “would,” “assume,” “believe,” “estimate,” “predict,” “potential,” “project,” “continue,” “seek,” and similar expressions, as well as statements in the future tense. We have based these forward‑looking statements on our current expectations and projections about future events, based on information currently available to us. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at which, or means by which, such performance or results will be achieved.

Forward-looking statements are subject to risks, uncertainties, and assumptions, including those described in the section titled “Risk Factors” and elsewhere in this prospectus. Unforeseen developments could cause actual performance or results to differ substantially from those expressed in or suggested by the forward looking statements. Management does not assume responsibility for the accuracy or completeness of these forward looking statements. There is no regulation requiring an update of any of the forward-looking statements after the date of this report to conform these statements to actual results or to changes in our expectations.

Our business activities are affected by many factors, including, without limitation, redemptions by investors in the Hennessy Funds, taxes, general economic and business conditions, interest rate movements, inflation, the personal savings rate, competitive conditions, industry regulation, and fluctuations in the stock market, many of which are beyond the control of our management. Further, the business and regulatory environments in which we operate remain complex, uncertain, and subject to change. We expect that regulatory requirements and developments will cause us to incur additional administrative and compliance costs. Notwithstanding the variability in our economic and regulatory environments, we remain focused on the investment performance of the Hennessy Funds and on providing high quality customer service to investors.

Our business strategy centers on (i) the identification, completion, and integration of future acquisitions and (ii) organic growth, through both the retention of the fund assets we currently manage and the generation of inflows into the funds we manage. The success of our business strategy may be influenced by the factors discussed in the section titled “Risk Factors” in this prospectus. All statements regarding our business strategy, as well as statements regarding market trends and risks and assumptions about changes in the marketplace, are forward looking by their nature.

THE PLAN

The following are the terms and conditions of the Plan set forth as a series of questions and answers:

PURPOSES AND DESCRIPTION

|

1.

|

What are the purposes of the Plan?

|

The purpose of the Plan is to offer a convenient and simple method for our shareholders and new investors to purchase shares of our common stock and to reinvest cash dividends paid on our common stock without payment of any brokerage commission. Participants in the Plan may have all or any portion of their cash dividends automatically reinvested in shares of our common stock. Participants may also elect to make optional cash purchases through the Plan administrator.

There are no processing fees or service fees on newly issued shares purchased from us for your account. In connection with any investment in which the Plan administrator purchases shares in the open market, the participant must pay the processing fees per share purchased. Processing fees include the applicable brokerage commissions that the Plan administrator is required to pay. We will pay all costs of administering the Plan.

The Plan is primarily intended to benefit long-term investors who want to increase their investment in our common stock, in contrast to individuals or institutions that engage in short‑term trading activities that could cause aberrations in the overall trading volume of our common stock. We reserve the right to modify, suspend, or terminate participation in this Plan by otherwise‑eligible common shareholders in order to eliminate practices that are inconsistent with the purposes of the Plan. We may also use the Plan to raise additional capital through the direct sale of shares of our common stock to shareholders or new investors, who, in connection with any resales of such shares, may be deemed to be underwriters. Our ability to waive limitations applicable to the amounts that participants may invest pursuant to the optional cash purchase feature of the Plan would allow for these sales to raise additional capital.

Participation in the Plan is voluntary, and we give no advice regarding your decision to join or withdraw from the Plan. Participation in the Plan may begin or terminate at any time. If you decide to participate, Enrollment Forms may be found and completed online. You can access these forms through the Plan administrator’s website, www.computershare.com/investor.

Under the Plan, the acquired shares will be purchased through open market purchases, privately negotiated transactions, or directly from us out of authorized but unissued shares. These sales of shares by the Company will provide additional funds to the Company. We intend to use the proceeds of such sales for general corporate purposes, including funding additional asset growth.

|

2.

|

What investment options are available under the Plan?

|

Once enrolled in the Plan, you may purchase our common stock through dividend reinvestment options or a stock purchase plan.

Dividend Reinvestment Options. The Enrollment Form allows you to choose one of the three dividend options listed below regarding your dividends. If you return an Enrollment Form and do not otherwise specify your choice on the Enrollment Form, your account will automatically be set up for full dividend reinvestment. You can change your reinvestment decision at any time by notifying the Plan administrator. You have the following dividend reinvestment options:

| |

●

|

Full Dividend Reinvestment – If you elect this option, the Plan administrator will apply all cash dividends, less any withholding tax, on all shares of common stock then or subsequently registered in your name, and all cash dividends on all Plan shares, less any withholding tax, together with any optional cash payments, toward the purchase of additional Plan shares.

|

| |

●

|

Partial Dividend Reinvestment – If you elect this option, the Plan administrator will pay to you cash dividends, less any withholding tax, on only the number of shares of common stock specified on the Enrollment Form and will purchase additional Plan shares with all remaining cash dividends, less any withholding tax, together with any optional cash payments, will be used to purchase additional Plan shares, but will instead pay you cash dividends, less any withholding tax, on all shares of common stock then or subsequently registered in your name.

|

| |

●

|

All Dividends Paid in Cash (No Dividend Reinvestment) – If you elect this option, the Plan administrator will not apply any dividends toward the purchase of additional Plan shares, but will instead pay you cash dividends, less any withholding tax, on all shares of common stock then or subsequently registered in your name.

|

If you return a properly executed Enrollment Form to the Plan administrator without electing an investment option, you will be enrolled as if you had selected the full dividend reinvestment option. If you do not submit an Enrollment Form, none of your cash dividends will be reinvested, and instead you will receive a check or electronic deposit for the full amount of cash dividends, minus any withholding tax, paid on the shares held in your Plan account.

Cash dividends are paid on common stock as, when, and if declared by our Board of Directors, generally on a quarterly basis. Subject to the availability of shares of our common stock registered for issuance under the Plan, there is no limitation on the amount of dividends you may reinvest under the dividend reinvestment program.

Stock Purchase Option. You can purchase shares of our common stock by using the Plan’s optional cash purchase feature. To purchase shares using this feature, you must invest at least $50 at any one time (or at least $250 for an initial investment if you are not already a shareholder), but you cannot invest more than $10,000 monthly. However, we may waive the maximum limit at our discretion. See Question 16 for more information on requests for a waiver of these limitations. Any optional cash purchase of less than $50 (or less than $250 for an initial investment if you are not already a shareholder) and the portion of any optional cash purchase or investments totaling more than $10,000 monthly, except for optional cash purchases made pursuant to a granted waiver request, will be returned to you without interest. You have no obligation to make any optional cash purchases under the Plan.

Purchases of shares of our common stock made with initial cash purchases and with optional cash purchases will begin on an investment date (the “Investment Date”), which will be the first trading day of each month. Shares issued and sold by us will be credited on the Investment Date.

You may elect to make optional cash purchases by check or through automatic deductions from your bank account, and you may do so even if dividends on your shares are not being reinvested and even if a dividend has not been declared. You may, but are not required to, enroll any shares of common stock purchased through the Plan into the dividend reinvestment program. (To designate these shares for participation in the dividend reinvestment program, make the appropriate election on the Enrollment Form described in Question 8.)

|

3.

|

What are the advantages of the Plan?

|

The advantages of the Plan include the following:

(a) You do not pay brokerage commissions, fees, or service charges for participating in the Plan or in connection with purchases of shares of our common stock under the Plan made with reinvested dividends. There are nominal fees associated with optional cash investments. However, in connection with any investment in which the Plan administrator purchases shares in the open market, the participant must pay the processing fees per share purchased. Processing fees include the applicable brokerage commissions that the Plan administrator is required to pay. We will pay all costs of administering the Plan.

(b) Computershare Trust Company, N.A. (“Computershare”), which is acting as custodian for shares acquired under the Plan, or any successor custodian or a nominee for the custodian or the participants under the Plan, holds the shares purchased under the Plan in its name and credits the shares purchased under the Plan to a separate account for each participant. This relieves you, as a participant in the Plan, of the responsibility for the safekeeping of multiple certificates for shares purchased and it protects you against loss, theft, or destruction of stock certificates.

(c) Computershare will furnish to you a statement for your Plan account after each transaction (that is, the purchase, sale, withdrawal, or transfer of shares) to simplify your recordkeeping.

(d) The purchase price for shares of common stock purchased directly from us through reinvestment of dividends, optional cash purchases, and initial investments may be issued at a discount from the market price. We may, at our sole discretion and at any time, establish or remove a discount rate ranging from 1% to 5%. As of the date of this prospectus, we do not anticipate offering a discount rate.

(e) Full investment of funds is possible under the Plan because the Plan permits fractional shares to be credited to your account. You are credited with dividends on both the full and fractional shares held under the Plan.

|

4.

|

Are there disadvantages to investing under the Plan?

|

Disadvantages of the Plan include the following:

(a) You have no control over the price and, in the case of shares of our common stock purchased or sold in the open market, the time at which such shares are purchased or sold for your account, depending on the method of sale you choose. You bear the market risk associated with fluctuations in the price of shares of our common stock that occur while completion of a purchase or sale of such shares for your account is pending, including that the purchase price may exceed the price of acquiring shares of our common stock (including transaction costs) on the open market at any particular time on the related Investment Date.

(b) No interest will be paid on funds held for you pending investment under the Plan.

(c) All shares purchased under the Plan, whether through the dividend reinvestment options or stock purchase option, are purchased at the fair market value of shares of our common stock on the date of purchase. The fair market value of shares purchased under the Plan will be the closing price of our common stock as reported on The Nasdaq Global Market for each date on which shares are purchased under the Plan (except for those shares acquired pursuant to a waiver request or shares purchased on the open market). As a result, you will not know the actual purchase price per share or the number of shares you will purchase until the actual date of purchase.

(d) As of the date of this prospectus, we do not anticipate offering a discount rate. However, if we do offer a discount in the future, we may adjust the discount from the market price of shares of our common stock at our sole discretion and at any time. The granting of a discount for one month or quarter will not ensure the availability of a discount or the same discount in future months or quarters.

(e) If you request the Plan administrator to sell shares from your Plan account, the Plan administrator will deduct a service fee and processing fees from the proceeds of the sale. Such sales of shares for participants are generally irrevocable and will be made at market prices at the time of sale. You may not be able to control the timing of such sales or the prices at which you are willing to sell your shares, depending on the method of sale you choose.

(f) To sell your shares through a broker of your choice, you must first arrange for your broker to request the shares be electronically delivered to them. The Plan administrator will promptly process your instructions, but you should leave ample time for the transfer of shares to your broker. You may incur brokerage charges for sales made through your broker.

(g) Your participation in the dividend reinvestment program will result in your being treated as having received a distribution equal to the cash dividend reinvested for federal income tax purposes. These distributions will be taxable as dividends to the extent of our earnings and profits and may give rise to a liability for the payment of income tax without providing you with the immediate cash to pay the tax when it becomes due.

(h) If you elect to make an optional cash purchase and a discount from the open market is applied (as described in Question 20 below), for federal income tax purposes you will be treated as having received a distribution equal to the excess, if any, of the fair market value of the shares of our common stock on the purchase date over the amount of your optional cash purchase. These distributions will be taxable as dividends to the extent of our earnings and profits, and may give rise to a liability for the payment of income tax without providing you with the immediate cash to pay the tax when it becomes due.

(i) You cannot pledge our common stock deposited in your Plan account until the shares are withdrawn from the Plan.

(j) Although there are no enrollment or purchase-related brokerage or transaction fees, there will be a $2.50 per occurrence charge plus a processing fee of $0.05 per share for recurring ACH payments and a $5.00 per occurrence charge plus a processing fee of $0.05 per share for each non-recurring ACH or check payment.

|

5.

|

Who is eligible to participate in the Plan?

|

The Plan is open to all investors. See Questions 33 and 36 for potential limitations on participation in the Plan. You may enroll in the Plan through the Plan administrator’s website (www.computershare.com/investor) or by completing an Enrollment Form and returning it to the Plan administrator.

Your participation in the Plan is entirely voluntary, and you may terminate your participation at any time.

If you are a beneficial owner of our common stock, you must either become a registered holder by having such shares registered in your own name or instruct your broker, bank, or other nominee in whose name your shares are held to participate in the Plan on your behalf.

Your right to participate in the Plan is not transferable to another person apart from a transfer of your underlying shares of our common stock.

We reserve the right to exclude from participation in the Plan any participant who utilizes the Plan to engage in short-term trading activities that could cause aberrations in the trading volume of our common stock. We reserve the right to modify, suspend, or discontinue participation in the Plan by otherwise-eligible holders or beneficial owners of our common stock in order to eliminate practices that are inconsistent with the purposes of the Plan.

Shareholders who reside in jurisdictions in which it is unlawful for us to permit their participation are not eligible to participate in the Plan.

ADMINISTRATION

|

6.

|

Who administers the Plan?

|

We will rely on an unaffiliated third party to administer the Plan, keep records, send statements of account activity to participants, and perform other duties related to the Plan. Computershare Trust Company, N.A. presently serves as the Plan administrator and Computershare Inc. acts as its service agent under the Plan. We may substitute another agent in place of the current Plan administrator at any time. You will be notified promptly of any such substitution.

If you have questions regarding the Plan, please write to the Plan administrator at the following address:

Computershare Trust Company, N.A.

P.O. Box 43006

Providence, RI 02940-3006

You may also call the Plan administrator at 1 (800) 393-5809. An automated voice response system is available 24 hours a day, 7 days a week. Customer service representatives are available from 9:00 a.m. to 5:00 p.m. Eastern time, Monday through Friday (except holidays).

In addition, you may visit the Investor Center on the Plan administrator’s website at www.computershare.com/investor. At this website, you can enroll in the Plan, obtain information, and perform certain transactions on your Plan account.

Include your name, address, daytime phone number, account number, and a reference to Hennessy Advisors, Inc. on all correspondence.

PARTICIPATION AND ENROLLMENT

|

7.

|

Are there limitations on participation in the Plan other than those described above?

|

Foreign Law Restrictions. You may not participate in the Plan if it would be unlawful for you to do so in the jurisdiction where you are a citizen or reside. If you are a citizen or resident of a country other than the United States, you should confirm that by participating in the Plan you will not violate local laws governing, among other things, taxes, currency and exchange controls, stock registration, and foreign investments.

Exclusion from Plan for Short-Term Trading or Other Practices. You should not use the Plan to engage in short-term trading activities that could change the normal trading volume of our common stock. If you do engage in short-term trading activities, we may prevent you from participating in the Plan. We reserve the right to modify, suspend, or terminate participation in the Plan by otherwise-eligible holders of shares of our common stock in order to eliminate practices that we determine, at our sole discretion, are inconsistent with the purposes or operation of the Plan or that may adversely affect the price of our common stock.

Restrictions at Our Discretion. In addition to the restrictions described above, we reserve the right to prevent you from participating in the Plan for any other reason. We have the sole discretion to exclude you from, or terminate your participation in, the Plan.

|

8.

|

What does the Enrollment Form provide?

|

The Enrollment Form appoints the Plan administrator as your agent and directs us to pay to the Plan administrator, on the applicable record date, the cash dividends on your shares of common stock that are enrolled in the dividend reinvestment program, including all whole and fractional shares of common stock that are subsequently credited to your Plan account, as they are added with each reinvestment or optional cash purchase designated for reinvestment. These cash dividends will be automatically reinvested by the Plan administrator in common stock. Any remaining cash dividends with respect to shares not enrolled in the dividend reinvestment program will be paid directly to you.

Additionally, the Enrollment Form directs the Plan administrator to purchase common stock with your payments for optional cash purchases, if any, and whether to enroll all or none of such purchased shares in the dividend reinvestment program.

The Enrollment Form provides for the following dividend reinvestment options:

| |

●

|

Full Dividend Reinvestment – If you elect this option, the Plan administrator will apply all cash dividends, less any withholding tax, on all shares of common stock then or subsequently registered in your name, and all cash dividends on all Plan shares, together with any payments for optional cash purchases, toward the purchase of additional Plan shares.

|

| |

●

|

Partial Dividend Reinvestment – If you elect this option, the Plan administrator will pay to you cash dividends, less any withholding tax, on only the number of shares of common stock specified on the Enrollment Form and will purchase additional Plan shares with all remaining cash dividends, less any withholding tax, together with any payments for optional cash purchases.

|

| |

●

|

All Dividends Paid in Cash (No Dividend Reinvestment) – If you elect this option, the Plan administrator will not apply any dividends toward the purchase of additional Plan shares, but will instead pay you cash dividends, less any withholding tax, on all shares of common stock then or subsequently registered in your name..

|

If you return a properly executed Enrollment Form to the Plan administrator without electing an investment option, you will be enrolled as if you had selected the full dividend reinvestment option. If you do not submit an Enrollment Form, none of your cash dividends will be reinvested.

You may select one option, and the designated option will remain in effect until (i) you specify otherwise by indicating a different option on a new Enrollment Form or by withdrawing some or all Plan shares in favor of receiving cash dividends or in order to sell your common stock or (ii) until the Plan is terminated. You may change your reinvestment election at any time by submitting a revised Enrollment Form to the Plan administrator or by accessing your account online at www.computershare.com/investor. To be effective with respect to a particular dividend, any such change must be received by the Plan administrator before the record date for that dividend.

To arrange to have your dividends directly deposited into your designated bank account, you must complete and return an Authorization for Electronic Deposit form. You may request an authorization form by calling the Plan administrator at 1 (800) 393-5809, or you may authorize the direct deposit of dividends when you enroll in the Plan online or by accessing your account online at www.computershare.com/investor.

OPTIONAL CASH PURCHASES

|

9.

|

How does the optional cash purchase feature work under the Plan?

|

While you are enrolled in the Plan, the minimum additional cash purchase is $50 (or $250 if the cash payment is for the initial purchase of shares of our common stock). The aggregate amount of any optional cash payments that you may deliver to the Plan administrator during any calendar month may not exceed $10,000. Any additional amount that you may invest through your participation in the dividend reinvestment feature under the Plan does not count toward either the minimum or the maximum permissible investment amount under the optional cash purchase feature.

From time to time, we may accept requests for waiver of the maximum optional cash purchases and initial investments in excess of $10,000. As further explained in Question 16, you may call the Plan administrator at 1 (800) 393-5809 to inquire whether we are accepting waiver requests. If we are accepting waiver requests and we approve your request, your optional cash purchase or initial investment, as applicable, may exceed $10,000. See the section titled “Optional Cash Purchases and Initial Investments in Excess of $10,000 – Waiver Request” for more information.

If the Plan administrator receives payment for an optional cash purchase of less than $50 if you are an existing shareholder or $250 if you are an initial investor, then the Plan administrator will return the cash payment to you without interest. If the Plan administrator receives payment for an optional cash purchase that is more than $10,000 or receives multiple payments for optional cash purchases totaling more than $10,000 in any calendar month and we are not accepting waiver requests or have not granted your waiver request, then the Plan administrator will return the amount that is in excess of $10,000 to you without interest.

If you enroll initially in the Plan with both the dividend reinvestment and optional cash purchase features (which is automatically the case if you are currently enrolled in the Plan), then you may choose at any time in the future to terminate the dividend reinvestment feature on all or a portion of your shares. If you maintain your participation in the Plan without the dividend reinvestment feature, then the only way you may purchase additional shares through the Plan is through the optional cash purchase feature.

Payment for an optional cash purchase may be made by authorizing an individual automatic deduction from your bank account online through the Investor Center or by sending a check to the Plan administrator for each optional cash purchase. If you choose to submit a check, use the contribution form that appears on your Plan statement and mail it to the Plan administrator at the applicable address provided on the contribution form. The Plan administrator will not accept cash, traveler’s checks, money orders, or third-party checks. Each check submitted for an optional cash purchase is considered a separate transaction subject to a service fee.

The Plan administrator must receive payment for optional cash purchases no later than three business days before the Investment Date for those who wish to invest in shares of our common stock beginning on the Investment Date. Otherwise, the Plan administrator may hold those funds and invest them beginning on the next Investment Date. No interest will be paid on funds held by the Plan administrator pending investment. Accordingly, you may wish to transmit payment for any optional cash purchases so that they reach the Plan administrator shortly before—but not less than three business days before—the Investment Date. This will minimize the period during which your funds are held by the Plan administrator but not invested. Participants have an unconditional right to obtain the return of any cash payment by sending a written request to the Plan administrator no later than two business days prior to the applicable monthly Investment Date.

Alternatively, if you wish to make regular monthly optional cash purchases, you may authorize automatic deductions from your bank account. This feature enables you to make ongoing investments in an amount that is comfortable for you without having to write a check each month.

To initiate automatic monthly investments, you must complete and sign a Direct Debit Authorization form and return it to the Plan administrator together with a voided blank check or a deposit form for the account from which funds are to be drawn. Direct Debit Authorization forms may be obtained from the Plan administrator. You may also initiate automatic monthly investments by accessing your account online at www.computershare.com/investor. Forms will be processed and become effective as promptly as practicable; however, you should allow four to six weeks for the first investment to be initiated using the automatic investment feature.

Once your automatic monthly investment is initiated, funds will be drawn from the designated bank account on the 26th day of each month (or the next banking business day if such 26th day is not a banking business day). You may change your automatic monthly investment by completing and submitting to the Plan administrator a new Direct Debit Authorization form or by accessing your account online at www.computershare.com/investor. To be effective with respect to a particular Investment Date, new instructions must be received by the Plan administrator at least six business days prior to such Investment Date. Automatic deductions will continue indefinitely until you notify the Plan administrator in writing or online that you wish to stop the automatic deductions. Employees and affiliates (as defined in Question 36) must comply with the restrictions set forth in Question 36.

There is a $2.50 charge plus a processing fee of $0.05 per share for each recurring ACH payment and a $5.00 charge plus a processing fee of $0.05 per share for each non-recurring ACH or check payment. Processing fees include the applicable brokerage commissions that the Plan administrator is required to pay. Any fractional share will be rounded up to a whole share for purposes of calculating the per‑share fee.

Subject to the limitations described in the preceding paragraphs, the Plan administrator will use any payments for optional cash purchases that you may deliver to the Plan administrator during any calendar month to purchase shares, including fractional shares, on the applicable monthly Investment Date for credit to your Plan account. The Plan administrator will wait up to three business days after receipt of payment to ensure it received good funds. Therefore, any payments for optional cash purchases must be received by the Plan administrator no later than three business days before an applicable monthly Investment Date to be effective on such date.

In the event that any check, draft, or electronic funds transfer you tender or order as payment to the Plan administrator for an optional cash purchase of our common stock is dishonored, refused, or returned, you agree that the purchased shares, when credited to your account, may be sold at the direction of the Plan administrator without your consent or approval in order to satisfy the amount owing on the purchase. The amount owing will include the purchase price paid, any purchase and sale transaction fees, any applicable fees, and the Plan administrator’s returned check or failed electronic payment fee of $35. If the sale proceeds of purchased shares are insufficient to satisfy the amount owing, you authorize the Plan administrator to sell additional shares then credited to your account as necessary to cover the amount owing without any further consent or authorization from you. The Plan administrator may sell shares to cover an amount owing in any manner consistent with applicable securities laws, and you acknowledge that any sale for that purpose in a national securities market would be commercially reasonable. You grant the Plan administrator a security interest in all shares credited to your account, including securities subsequently acquired and held or tendered for deposit, for purposes of securing any amount owing as described in this paragraph.

Your payments for optional cash purchases may be commingled by the Plan administrator with dividends and with other participants’ payments for optional cash purchases for the purpose of buying shares of common stock. You cannot specify the prices or timing of purchases, nor can you place any other limitations on the purchase of shares other than those specified herein. You may stop any optional cash purchase (and receive a refund of the associated payment amount) if the Plan administrator receives your request for a refund no later than two business days prior to the applicable monthly Investment Date. You may submit your request to the Plan administrator through the internet, by telephone, or in writing.

|

10.

|

Will interest be paid on funds tendered for optional cash purchases that are received prior to an Investment Date?

|

No. Under no circumstances will interest be paid on funds for optional cash purchases tendered at any time prior to the Investment Date. You are encouraged to time the transmittal of funds for optional cash purchases so that they are received by the Plan administrator as close as possible to, but no later than three business days before, an Investment Date. If you have any questions regarding the Investment Date, you should contact the Plan administrator at the address or phone number set forth in Question 6.

|

11.

|

Am I obligated to make cash purchases if I enroll in the Plan?

|

No. Cash purchases are entirely voluntary. You may supplement the reinvestment of your dividends with optional cash purchases as often as you like within the Plan parameters or not at all.

|

12.

|

What limitations apply to optional cash purchases?

|

Optional cash purchases are subject to minimum and maximum purchase amounts. An existing shareholder must invest at least $50 in an optional cash purchase. New investors must invest at least $250 in an initial cash purchase. Alternatively, new investors may authorize a minimum of five $50 recurring monthly ACH debits to reach the minimum $250 investment. Optional cash purchases of less than $50 by existing shareholders or $250 by initial investors will be returned, without interest. In addition, optional cash purchases are subject to a maximum investment amount of $10,000 per month. The portion of an optional cash purchase that exceeds the $10,000 monthly purchase limit, unless such limit has been waived as described in Question 16, will be returned to you, without interest. We reserve the right to waive the maximum limit on optional cash purchases at our sole discretion, which may include the consideration of relevant factors including, but not limited to, whether we are selling newly issued shares of our common stock or acquiring shares for the Plan through open market purchases or privately negotiated transactions. If you are an employee or affiliate (as defined in Question 36 of this prospectus) of the Company, see Questions 33 and 36 for additional limitations.

PURCHASES AND PRICING OF SHARES

|

13.

|

When will shares be purchased under the Plan?

|

The purchase of shares through the dividend reinvestment feature under the Plan will occur as of each date on which a cash dividend that has been declared by our Board of Directors is paid to shareholders (the “Dividend Payment Date”).

Optional cash purchases of $10,000 or less will be made on the Investment Date, or, in the case of shares of our common stock purchased on the open market, as soon thereafter as determined by the Plan administrator. For optional cash purchases of more than $10,000 made pursuant to a waiver request, the applicable Investment Date is described in Question 19.

Shares purchased through the Plan, whether by dividend reinvestment or optional cash purchase, will be transferred to your account under the Plan, and all dividend and voting rights with respect to such shares will commence, upon the settlement date for each purchase, which is ordinarily no later than two business days after the date of purchase.

|

14.

|

How will the price of shares purchased under the Plan be determined?

|

The price of the shares purchased for your Plan account will be equal to the fair market value of our common stock on the Dividend Payment Date for purchases made with dividends on our common stock, including dividends on the shares credited to your Plan account, and on the Investment Date for optional cash purchases timely delivered to the Plan administrator.

For purposes of the Plan, the fair market value of our common stock at any particular time will be determined as follows:

| |

●

|

If our common stock is listed or admitted to trading on any stock exchange, which includes its current listing on The Nasdaq Global Market, then the fair market value will equal the closing price of our common stock on the Dividend Payment Date or the Investment Date, as applicable, on such stock exchange.

|

| |

●

|