SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number 001-38490

HIGHWAY HOLDINGS LIMITED

(Translation of Registrant's Name Into English)

Suite 1801, Level 18

Landmark North

39 Lung Sum Avenue

Sheung Shui

New Territories, Hong Kong

(Address of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Attached to this Report on

Form 6-K is the press release issued by the registrant on February 1, 2024.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

HIGHWAY HOLDINGS LIMITED |

| |

|

|

| Date: February 2, 2024 |

By |

/s/ ROLAND W. KOHL |

| |

|

Roland W. Kohl |

| |

|

Chief Executive Officer |

1

Exhibit 99.1

NEWS RELEASE

HIGHWAY HOLDINGS REPORTS

FISCAL 2024 THIRD QUARTER AND NINE MONTH RESULTS; THIRD QUARTER SALES INCREASE 60% YEAR OVER YEAR

HONG KONG – February 1, 2024 – Highway

Holdings Limited (Nasdaq: HIHO) (the “Company” or “Highway Holdings”) today reported financial results

for its fiscal third quarter and nine months ended December 31, 2023, with a 60% increase in revenue and a $0.06 increase in diluted earnings

per share for the fiscal third quarter of 2024, both compared to the year ago period.

Net sales for the third quarter of fiscal year

2024 increased 60% to $4.1 million compared with $2.6 million in the year ago period. Net income for the third quarter of fiscal year

2024 increased to $302,000, or $0.07 per diluted share, compared with $52,000 or $0.01 per diluted share in the year ago period.

Net sales for the first nine months of fiscal year

2024 were $6.8 million, compared with $8.5 million in the year ago period. Net

income for the first nine months of 2023 was $177,000, or $0.04 per diluted share, compared with a net income of $831,000, or $0.20 per

diluted share for the same period last year. Revenue in the first nine months of fiscal year 2024 was significantly impacted by the COVID

boom and post-COVID bust cycle on Highway Holdings’ customers.

Roland Kohl, chairman, president and chief executive

officer of Highway Holdings, said, “We ended the calendar year on a positive

note, as compared to the year ago period, with revenue increasing about 60% in the third quarter of fiscal year 2024 and diluted EPS increasing

600% over the same period. We are happy to announce such strong results, and encouraged to be off to a good start for the new calendar

year 2024. We are cautiously optimistic about the coming year based on several company catalysts that we believe will help us to drive

growth, as we focus on the continued recovery of our business and turnaround of our Company.”

“There are three main reasons for our cautious

optimism. First, we are seeing a slow but steady return to more normal order patterns of our customers. This represents an important inflection

point after almost 12 months since the start of the downturn. Our strong revenue growth in the third quarter of fiscal 2024 was led in

part by this return to more normal order patterns and we read this as a sign that the huge inventory levels of our customers now have

been depleted, which indicates that the time with zero or little order quantities are behind us.”

“Second, as we noted last quarter, we are

benefitting from a restarting of the business from our customer Playmaji, Inc., which owns the Polymega game console business. This business

has now returned to full production after the motherboard supplier stabilized its supply chain and finally achieved a reasonable component

lead time last year. We expect to see continued regular orders for the existing Polymega products in 2024, while also adding on manufacturing

support for some very promising new products that could be further additive to our sales in the near future.”

“Finally, we are excited about our intended

acquisition of a majority of Synova, for which we announced a letter of intent last month. Our customers’ response to the transaction

has been very positive and we are working to complete the acquisition over the coming month. Synova serves as an all-encompassing OEM

manufacturer, with a comparable technological proficiency and a parallel business approach with Highway Holdings. Sharing the extensive

synergies will make both companies highly attractive to our combined customer base, while allowing increased cost savings for a more profitable

operation.”

“As a result of the above catalysts, we are

looking cautiously optimistic into the future. We have remained focused on the turnaround of our business after fighting against the many

challenges that negatively impacted our customers and our business, and resulted at the beginning of the fiscal year in an almost complete

evaporation of previously stable revenue streams. This was a tremendously challenging period, which we believe we have emerged from stronger

due to our resilience supported by our very strong and solid financial situation. We are cautiously confident entering the new calendar

year 2024 and focused on achieving a significant turnaround in our Company’s performance as we continue to navigate continued volatility

worldwide.”

Gross margin for the third quarter of fiscal year

2024 was 21.3 percent, compared to 28.4 percent in the year ago period, mainly due to a different product mix with various margin levels

particularly for Polymega game console deliveries in the current quarter. Gross margin for the first nine months of fiscal year 2024 was

24.1 percent, compared to 33.7 percent in the year ago period which is not considered comparable as it included some rental subsidy from

PRC government in fiscal year 2023, which affected the product margin.

The Company reported a $58,000 currency exchange

gain for the fiscal 2024 nine months, compared with a $26,000 currency exchange gain a year earlier. The currency exchange gain in the

current year was mainly due to the weakening of the Kyat used in our Myanmar operations and the Chinese RMB. The Company does not engage

in currency exchange rate hedging, and the fluctuation in the exchange rate of the RMB and Kyat are expected to affect the Company’s

future results.

The Company’s balance of cash at December

31, 2023 was approximately $6.2 million, or approximately $1.43 per diluted share.

The Company’s current ratio was 2.13:1 at

December 31, 2023.

About Highway Holdings

Highway Holdings is an international manufacturer

of a wide variety of quality parts and products for blue chip equipment manufacturers based primarily in Germany. Highway Holdings’

administrative offices are located in Hong Kong and its manufacturing facilities are located in Yangon, Myanmar and Shenzhen, China. For

more information visit website www.highwayholdings.com.

Except for the historical information contained

herein, the matters discussed in this press release are forward-looking statements, which involve risks and uncertainties, including but

not limited to economic, competitive, governmental, political and technological factors affecting the company's revenues, operations,

markets, products and prices, the impact of the worldwide COVID-19 pandemic, and other factors discussed in the company’s various

filings with the Securities and Exchange Commission, including without limitation, the company’s annual reports on Form 20-F.

(Financial Tables Follow)

For further information, please contact:

Global IR Partners

David Pasquale

HIHO@globalirpartners.com

New York Office: +1-914-337-8801

HIGHWAY HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statement of Income

(Dollars in thousands, except per share data)

(Unaudited)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net sales | |

$ | 4,107 | | |

$ | 2,562 | | |

$ | 6,776 | | |

$ | 8,547 | |

| Cost of sales | |

| 3,231 | | |

| 1,835 | | |

| 5,140 | | |

| 5,669 | |

| Gross profit | |

| 876 | | |

| 727 | | |

| 1,636 | | |

| 2,878 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 679 | | |

| 722 | | |

| 1,728 | | |

| 2,130 | |

| Operating income | |

| 197 | | |

| 5 | | |

| (92 | ) | |

| 748 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating items | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Exchange gain /(loss), net | |

| 27 | | |

| 3 | | |

| 58 | | |

| 26 | |

| Interest income | |

| 63 | | |

| 16 | | |

| 156 | | |

| 35 | |

| Gain/(Loss) on disposal of Asset | |

| 3 | | |

| 2 | | |

| 16 | | |

| 7 | |

| Other income/(expenses) | |

| 8 | | |

| 0 | | |

| 14 | | |

| 5 | |

| Total non-operating income/ (expenses) | |

| 101 | | |

| 21 | | |

| 244 | | |

| 73 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income before income tax and non-controlling interests | |

| 298 | | |

| 26 | | |

| 152 | | |

| 821 | |

| Income taxes | |

| 1 | | |

| 15 | | |

| 7 | | |

| 10 | |

| Net income before non-controlling interests | |

| 299 | | |

| 41 | | |

| 159 | | |

| 831 | |

| Net loss /(income) attributable to non-controlling interests | |

| 3 | | |

| 11 | | |

| 18 | | |

| 0 | |

| Net income attributable to Highway Holdings Limited’s shareholders | |

| 302 | | |

| 52 | | |

| 177 | | |

| 831 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Gain/ (loss) per share – Basic | |

$ | 0.07 | | |

$ | 0.01 | | |

$ | 0.04 | | |

$ | 0.20 | |

| Net Gain/ (loss) per share - Diluted | |

$ | 0.07 | | |

$ | 0.01 | | |

$ | 0.04 | | |

$ | 0.20 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 4,386 | | |

| 4,072 | | |

| 4,314 | | |

| 4,058 | |

| Diluted | |

| 4,396 | | |

| 4,130 | | |

| 4,323 | | |

| 4,115 | |

IGHWAY HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Balance Sheet

(Dollars in thousands, except per share data)

| | |

Dec 31, | | |

Mar 31, | |

| | |

2023 | | |

2023 | |

| | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 6,186 | | |

$ | 6,952 | |

| Accounts receivable, net of doubtful accounts | |

| 3,533 | | |

| 1,886 | |

| Inventories | |

| 1,812 | | |

| 1,413 | |

| Prepaid expenses and other current assets | |

| 200 | | |

| 406 | |

| Income tax recoverable | |

| - | | |

| 3 | |

| Total current assets | |

| 11,731 | | |

| 10,660 | |

| | |

| | | |

| | |

| Property, plant and equipment, (net) | |

| 379 | | |

| 401 | |

| Operating lease right-of-use assets | |

| 2,004 | | |

| 2,514 | |

| Long-term deposits | |

| 205 | | |

| 213 | |

| Long-term loan receivable | |

| 95 | | |

| 95 | |

| Investments in equity method investees | |

| - | | |

| - | |

| Total assets | |

$ | 14,414 | | |

$ | 13,883 | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,477 | | |

$ | 928 | |

| Operating lease liabilities, current | |

| 586 | | |

| 573 | |

| Other liabilities and accrued expenses | |

| 1,845 | | |

| 1,991 | |

| Income tax payable | |

| 551 | | |

| 568 | |

| Dividend payable | |

| 46 | | |

| 1 | |

| Total current liabilities | |

| 5,505 | | |

| 4,061 | |

| | |

| | | |

| | |

| Long term liabilities: | |

| | | |

| | |

| Operating lease liabilities, non-current | |

| 1,013 | | |

| 1,482 | |

| Deferred income taxes | |

| 98 | | |

| 107 | |

| Long terms accrued expenses | |

| 17 | | |

| 17 | |

| Total liabilities | |

| 6,633 | | |

| 5,667 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Preferred shares, $0.01 par value | |

| - | | |

| - | |

| Common shares, $0.01 par value | |

| 44 | | |

| 41 | |

| Additional paid-in capital | |

| 12,140 | | |

| 12,003 | |

| Accumulated deficit | |

| (3,879 | ) | |

| (3,396 | ) |

| Accumulated other comprehensive income/(loss) | |

| (517 | ) | |

| (444 | ) |

| Non-controlling interest | |

| (7 | ) | |

| 12 | |

| Total shareholders’ equity | |

| 7,781 | | |

| 8,216 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 14,414 | | |

$ | 13,883 | |

5

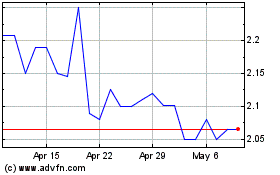

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

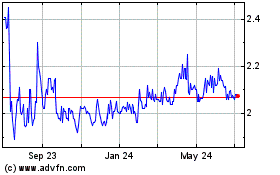

Highway (NASDAQ:HIHO)

Historical Stock Chart

From Apr 2023 to Apr 2024