After taking it easy in the second half of 2011, iShares appears

to be fighting back a number of surging issuers by launching a

variety of new products to start the new year. In fact, the company

has debuted over 25 funds in the time period, pushing its total

offering well above the 250 fund mark. However, all of these funds

look to be in the equity world, rounding out the company’s offering

list in segments including commodity producers, European equities,

and emerging market stocks. However, in the latest release, this

looks to be changing as the company has revealed seven new,

targeted bond ETFs for investors (see Top Three High Yield Junk

Bond ETFs).

The new products segment the bond asset class in relatively

unique ways, allowing investors to further target any corner of the

bond world that they so choose. Additionally, it also helps the

company to better compete in the fixed income world as a number of

companies—specifically PIMCO, PowerShares, and Van Eck-- have seen

decent inflows in months past in their fixed income lineups.

Hopefully from iShares’ perspective, the new launches will allow

the San Francisco-based firm to continue to dominate the bond ETF

world as it currently does in the equity space.

With that being said, the new funds should also be welcomed news

to investors as well, offering better segmentation in the fixed

income corner of the exchange-traded world. For investors who are

looking to further segment their bond holdings, or are curious as

to how the new products could fit into a portfolio, we have

highlighted some of the key details from the iShares launch

below:

Utilities Sector Bond Fund (AMPS)

This fund tracks the Barclays Capital U.S. Utility Bond index,

giving investors exposure to bonds from about 54 companies that are

in the utilities space while charging 30 basis points a year in

fees. With this focus, the level of risk may be lower than in

comparable funds in other sectors, suggesting that it could be a

good option for those seeking minimal volatility (read Utility

ETFs: Slumping Sector In Rebounding Market).

In terms of industry focus, electric utilities make up close to

70% while natural gas utilities make up the remainder of the

product. Meanwhile, the effective duration comes in at around 8.6

years for the underlying index as more than 57% of the holdings

mature in less than 10 years. This gives the index an average yield

to maturity of about 3.4%, a decent level but one that isn’t

exactly an ultra-high payout either.

Industrials Sector Bond Fund (ENGN)

For investors searching for bonds of companies outside the

financial and utilities sectors, a closer look at ENGN could be

warranted. The product tracks an index of about 71 bonds, charging

investors a low 30 basis points a year in fees. Sector exposure is

tilted towards consumer staples (25%), communication (19.8%), and

energy (12.5%) while the effective duration is just 7.3 years.

Given this focus on lower duration securities, as well as more

highly rated bonds, the product has a lower yield of 3.1%. Still,

this is far higher than many Treasury bond funds in the space and

the focus on industrial bonds could be ideal for some investors

seeking more targeted exposure.

Financials Sector Bond Fund (MONY)

If investors are looking to gain access to the financial sector

but are worried about the significant volatility in the equity

space, MONY could be a less volatile way to go instead. The

new fund targets about 65 bonds in total, charging investors 30

basis points a year in fees. Banking firms dominate the underlying

index, comprising about 63% of the total, although insurance firms

also make up a decent chunk at 19.8% (see Capital Markets ETF For

2012?).

Investors should also note that the fund is tilted towards

securities in the A+ to A- range on the S&P scale, meaning that

the fund is relatively safe but isn’t heavily exposed to top notch

financials. Despite this and the index’s relatively low duration of

5.4 years, the yield to maturity is a respectable 3.8% for the

benchmark of MONY.

Barclays U.S. Treasury Bond Fund (GOVT)

For a low cost way to play the U.S. Treasury bond market, GOVT

could be a new way to go. The fund holds bonds from across the

curve, charging investors just 15 basis points a year in fees for

its services. While the product is definitely tilted towards

short-term bonds—those maturing in one to five years make up 56% of

the index while five to ten years makes up another 27%-- 25+ year

bonds also make up about 10.7% as well.

Unfortunately, the fund may not be a great destination for

yield, although it will probably be a good spot for safety. The

underlying index has an average yield to maturity below 1% while

the weighted average coupon is just 2.6% (read Three Bond ETFs For

A Fixed Income Bear Market).

Barclays GNMA Bond Fund (GNMA)

To target mortgage-backed pass-through securities issued by the

Government National Mortgage Association, investors could consider

GNMA. The product holds just 13 securities in total and charges

investors 32 basis points a year in fees, potentially giving

investors quality access to the MBS segment. Interestingly,

investors should note that many of the bonds do not mature for

quite some time but the effective duration on the index is still

quite low, coming in at just under 3.2 years. Still, the yield to

maturity of the benchmark is 2.6%, a decent level considering the

relatively short-term and low risk focus of the fund.

Barclays CMBS Bond Fund (CMBS)

If investors prefer the commercial side of the real estate

market to residential, a closer look at CMBS could be warranted.

The product tracks the Barclays Capital U.S. CMBS Index, following

a benchmark of Erisa-eligible commercial mortgage-backed securities

market. In total, the fund holds 25 securities while charging 25

basis points a year in fees. Investors should note that the

holdings breakdown is decidedly short term as the vast majority of

the underlying index matures in less than five years while all of

the components mature in less than 10. However, given the slightly

higher risk of this corner in the market, despite the AAA rating of

many underlying securities, the benchmark still has a decent yield

at 3.2%.

Aaa-A Rated Corporate Bond Fund (QLTA)

For investors who only want the cream of the crop in the

corporate bond market, QLTA makes for an interesting choice. The

product only focuses on highly rated securities, ensuring that

return of capital will be achieved by virtually all the bonds in

question. Additionally, the underlying index is tilted towards

short-term securities, reducing interest rate risk as well,

suggesting that the fund could be a good pick for those looking for

slightly higher risks than Treasury bonds but not too much higher

than those ultra-safe securities (see The Best Bond ETF You Have

Never Heard Of).

However, investors must pay for this added safety with lower

yields, as the underlying index in the fund pays out just over 2.9%

in yield to maturity terms. While this level may be higher

than government bond funds on this list, it is also far lower than

many of the industry focused products which are more liberal in the

credit quality profile of their holdings.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

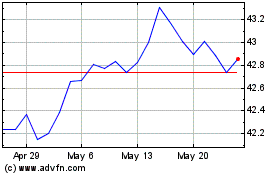

iShares GNMA (NASDAQ:GNMA)

Historical Stock Chart

From Apr 2024 to May 2024

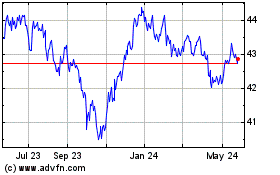

iShares GNMA (NASDAQ:GNMA)

Historical Stock Chart

From May 2023 to May 2024