false

0001735948

A6

0001735948

2024-03-21

2024-03-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 21, 2024

GREENBROOK TMS INC.

(Exact name of registrant as specified in its

charter)

| Ontario |

|

001-40199 |

|

98-1512724 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(IRS Employee

Identification No.) |

890 Yonge Street, 7th Floor

Toronto, Ontario Canada

M4W 3P4

(Address of Principal Executive Offices)

(866) 928-6076

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Common Shares, without par value |

|

GBNH(1) |

|

The Nasdaq Stock Market LLC |

(1) As described herein, Greenbrook TMS Inc. (the “Company”)

intends to file a Form 25 with the Securities and Exchange Commission (the “SEC”) to delist the Company’s

common shares (the “Common Shares”) from the Nasdaq Stock Market LLC (“Nasdaq”) on or about April 1,

2024, with the delisting becoming effective 10 days after such filing. The deregistration of the Common Shares under Section 12(b) of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be effective 90 days after filing of the

Form 25, or such shorter period as the SEC may determine.

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Exchange Act (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 3.01 | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing |

On

March 21, 2024, the Company notified Nasdaq of its intention to file a Form 25 to delist the Common Shares from trading

on Nasdaq following approval by the OTC Market Group Inc. (“OTC”) of the Company’s application to quote the Common

Shares on the OTCQB Market. Beginning on March 22, 2024, the Common Shares are quoted on OTCQB under the symbol “GBNHF”.

As previously disclosed, the

Common Shares were suspended from trading on Nasdaq as of February 26, 2024, pursuant to a final delisting notice sent to the Company

by the Listing Qualifications Department of Nasdaq due to the continued failure of the Company to satisfy either the $1.00 minimum bid

price listing requirement in Nasdaq Listing Rule 5550(a)(2) or the minimum stockholders’ equity requirements in Nasdaq

Listing Rule 5550(b). The Company has determined to file the Form 25 to formally delist the Common Shares from Nasdaq on a voluntary

basis, in advance of the anticipated filing by Nasdaq of a Form 25 with the SEC, in order to accelerate the timeline for deregistration

under Section 12(b) of the Exchange Act, which will reduce certain SEC reporting compliance burdens, and therefore lower the

Company’s administrative expenses and free up management time to operate the business and further develop its strategy.

The Company anticipates that

it will file its own Form 25 with the SEC on or about April 1, 2024, which would complete the process for delisting its Common

Shares from Nasdaq when the Form 25 becomes effective, no earlier than ten days thereafter. The Form 25 will also serve to deregister

the Common Shares under Section 12(b) of the Exchange Act, effective 90 days thereafter.

Certain statements contained

in this Current Report on Form 8-K, including statements relating to the anticipated benefits of SEC deregistration of the Common

Shares under Section 12(b) of the Exchange Act, may constitute “forward-looking information” within the meaning

of applicable securities laws in Canada and “forward-looking statements” within the meaning of the United States Private Securities

Litigation Reform Act of 1995 (collectively, “forward-looking information”). Forward-looking information may relate

to the Company’s future financial and liquidity outlook and anticipated events or results and may include information regarding

the Company’s business, financial position, results of operations, business strategy, growth plans and strategies, technological

development and implementation, budgets, operations, financial results, taxes, dividend policy, plans and objectives. In some cases, forward-looking

information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”

or “does not expect”, “is expected”, “an opportunity exists”, “budget”, “scheduled”,

“estimates”, “outlook”, “forecasts”, “projection”, “prospects”, “strategy”,

“intends”, “anticipates”, “does not anticipate”, “believes”, or variations of such words

and phrases or statements that certain actions, events or results “may”, “should”, “could”, “would”,

“might”, “will”, “will be taken”, “occur” or “be achieved”. In addition, any

statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking

information. Statements containing forward-looking information are not facts but instead represent management’s expectations, estimates

and projections regarding future events or circumstances.

Forward-looking information

is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date

of this Current Report on Form 8-K, are subject to known and unknown risks, uncertainties, assumptions and other factors that may

cause the actual results, level of activity, performance or achievements or future events or developments to differ materially from those

expressed or implied by the forward-looking statements, including, without limitation: macroeconomic factors such as inflation and recessionary

conditions, substantial doubt regarding the Company’s ability to continue as a going concern due to recurring losses from operations;

inability to increase cash flow and/or raise sufficient capital to support the Company’s operating activities and fund its cash

obligations, repay indebtedness and satisfy the Company’s working capital needs and debt obligations; prolonged decline in the price

of the Common Shares reducing the Company’s ability to raise capital; inability to satisfy debt covenants under the Company’s

credit facility with affiliates of Madryn Asset Management, LP (the “Credit Agreement”) and the potential acceleration

of indebtedness; risks related to the resolution of the Company’s ongoing litigation with Benjamin Klein and compliance with the

terms of their settlement agreement; risks related to the ability to continue to negotiate amendments to the Credit Agreement to prevent

a default; risks relating to the Company’s ability to deliver and execute on the previously-announced restructuring plan (the “Restructuring

Plan”) and the possible failure to complete the Restructuring Plan on terms acceptable to the Company or its suppliers (including

Neuronetics, Inc.), or at all; risks relating to maintaining an active, liquid and orderly trading market for Common Shares as a

result of the Company’s forthcoming delisting from Nasdaq; risks relating to the Company’s ability to realize expected cost-savings

and other anticipated benefits from the Restructuring Plan; risks related to the Company’s negative cash flows, liquidity and its

ability to secure additional financing; increases in indebtedness levels causing a reduction in financial flexibility; inability to achieve

or sustain profitability in the future; inability to secure additional financing to fund losses from operations and satisfy the Company’s

debt obligations; risks relating to strategic alternatives, including restructuring or refinancing of the Company’s debt, seeking

additional debt or equity capital, reducing or delaying the Company’s business activities and strategic initiatives, or selling

assets, other strategic transactions and/or other measures, including obtaining bankruptcy protection, and the terms, value and timing

of any transaction resulting from that process; claims made by or against the Company, which may be resolved unfavorably to us; risks

relating to the Company’s dependence on Neuronetics, Inc. as its exclusive supplier of TMS devices. Additional risks and uncertainties

are discussed in the Company’s materials filed with the Canadian securities regulatory authorities and the SEC from time to time,

available at www.sedarplus.ca and www.sec.gov, respectively. These factors are not intended to represent a complete list of the factors

that could affect the Company; however, these factors should be considered carefully. There can be no assurance that such estimates and

assumptions will prove to be correct. The forward-looking statements contained in this Current Report on Form 8-K are made as of

the date of this report, and the Company expressly disclaims any obligation to update or alter statements containing any forward-looking

information, or the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except

as required by law.

| Item 7.01 | Regulation FD Disclosure. |

On

March 21, 2024, the Company issued a press release announcing the quotation of its Common Shares on OTCQB and its intention to file

a Form 25. The press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by

reference.

The

information contained in this Current Report on Form 8-K under Item 7.01, including the attached Exhibit 99.1, is being furnished

pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of the Exchange Act, or otherwise

subject to the liabilities of that section. The information contained in this Current Report on Form 8-K under Item 7.01, shall not

be incorporated by reference into any filing under the Securities Act of 1933, as amended, or any filing under the Exchange Act, whether

made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 26, 2024

| |

Greenbrook TMS Inc. |

| |

|

|

| |

By: |

/s/ Bill Leonard |

| |

Name: |

Bill Leonard |

| |

Title: |

President & Chief Executive Officer |

Exhibit 99.1

GREENBROOK ANNOUNCES QUOTATION ON OTCQB

March 21,

2024 – Toronto, ON – Greenbrook TMS Inc. (OTC: GBNHF) (“Greenbrook” or the “Company”)

announced that the OTC Market Group Inc. (“OTC”) has approved the Company’s application to quote the Company’s

common shares (the “Common Shares”) on the OTCQB Market. The Company’s Common Shares will be quoted on OTCQB

starting on March 22, 2024, under the symbol GBNHF.

The Company is also announcing that following

the suspension of the Common Shares from trading on Nasdaq Capital Market (“Nasdaq”) on February 26, 2024, the

Company plans to provide formal notice to Nasdaq of its intention to formally delist the Common Shares from Nasdaq on a voluntary basis,

in advance of the anticipated filing by Nasdaq of a Form 25 (Notification of Removal of Listing) with the Securities and Exchange

Commission (the “SEC”). As previously disclosed, the Common Shares were suspended pursuant to a final delisting notice

sent to the Company by the Listing Qualifications Department of Nasdaq due to the continued failure of the Company to satisfy either the

$1.00 minimum bid price listing requirement in Nasdaq Listing Rule 5550(a)(2) or the minimum stockholders’ equity requirements

in Nasdaq Listing Rule 5550(b).

The Company currently anticipates that it will

file its own Form 25 with the SEC on or about April 1, 2024, which would complete the process for delisting its Common Shares

from Nasdaq when the Form 25 becomes effective no earlier than ten days thereafter. The Form 25 will also serve to deregister

the Common Shares under Section 12(b) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”),

effective 90 days thereafter. The Company has determined to file its own Form 25 in advance of the anticipated Nasdaq filing of a

Form 25 in order to accelerate the timeline for deregistration under Section 12(b) of the Exchange Act, which will reduce

certain SEC reporting compliance burdens, and therefore lower the Company’s administrative expenses and free up management time

to operate the business and further develop its strategy.

Neither the filing of the Form 25 nor the

official delisting of the Common Shares will impact the quotation of the Common Shares on the OTCQB.

About Greenbrook TMS Inc.

Operating through 130 Company-operated treatment

centers, Greenbrook is a leading provider of Transcranial Magnetic Stimulation (“TMS”) therapy and Spravato® (esketamine

nasal spray), FDA-cleared, non-invasive therapies for the treatment of Major Depressive Disorder (“MDD”) and other

mental health disorders, in the United States. TMS therapy provides local electromagnetic stimulation to specific brain regions known

to be directly associated with mood regulation. Spravato® is offered to treat adults with treatment-resistant depression and depressive

symptoms in adults with MDD with suicidal thoughts or actions. Greenbrook has provided more than 1.3 million treatments to over 40,000

patients struggling with depression.

For further information please contact:

Glen Akselrod

Investor Relations

Greenbrook TMS Inc.

Contact Information:

investorrelations@greenbrooktms.com

1-855-797-4867

Cautionary Note Regarding Forward-Looking Information

Certain information in this press release may

constitute forward-looking information within the meaning of applicable securities laws in Canada and the United States, including the

United States Private Securities Litigation Reform Act of 1995. In some cases, but not necessarily in all cases, forward-looking information

can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”

or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”,

“intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”,

or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”,

“might”, “will” or “will be taken”, “occur” or “be achieved”. In addition,

any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking

information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations,

estimates and projections regarding future events.

Forward-looking information is necessarily based

on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date of this press release,

are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity,

performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking

statements, including, without limitation: macroeconomic factors such as inflation and recessionary conditions, substantial doubt regarding

the Company’s ability to continue as a going concern due to recurring losses from operations; inability to increase cash flow and/or

raise sufficient capital to support the Company’s operating activities and fund its cash obligations, repay indebtedness and satisfy

the Company’s working capital needs and debt obligations; prolonged decline in the price of the Common Shares reducing the Company’s

ability to raise capital; inability to satisfy debt covenants under the Company’s credit facility and the potential acceleration

of indebtedness; including as a result of an unfavorable decision in respect of the litigation with Benjamin Klein; risks related to

the ability to continue to negotiate amendments to the Company’s credit facility to prevent a default; risks relating to the Company’s

ability to deliver and execute on the previously-announced restructuring plan (the “Restructuring Plan”) and the possible

failure to complete the Restructuring Plan on terms acceptable to the Company or its suppliers (including Neuronetics, Inc.), or

at all; risks relating to maintaining an active, liquid and orderly trading market for the Common Shares as a result of the Company’s

suspension of trading on Nasdaq; risks relating to the Company’s ability to realize expected cost-savings and other anticipated

benefits from the Restructuring Plan; risks related to the Company’s negative cash flows, liquidity and its ability to secure additional

financing; increases in indebtedness levels causing a reduction in financial flexibility; inability to achieve or sustain profitability

in the future; inability to secure additional financing to fund losses from operations and satisfy the Company’s debt obligations;

risks relating to strategic alternatives, including restructuring or refinancing of the Company’s debt, seeking additional debt

or equity capital, reducing or delaying the Company’s business activities and strategic initiatives, or selling assets, other strategic

transactions and/or other measures, including obtaining bankruptcy protection, and the terms, value and timing of any transaction resulting

from that process; claims made by or against the Company, which may be resolved unfavorably to us; risks relating to the Company’s

dependence on Neuronetics, Inc. as its exclusive supplier of TMS devices. Additional risks and uncertainties are discussed in the

Company’s materials filed with the Canadian securities regulatory authorities and the SEC from time to time, available at www.sedarplus.ca and www.sec.gov, respectively. These factors are not intended to represent a complete list of the factors that could affect

the Company; however, these factors should be considered carefully. There can be no assurance that such estimates and assumptions will

prove to be correct. The forward-looking statements contained in this press release are made as of the date of this press release, and

the Company expressly disclaims any obligation to update or alter statements containing any forward-looking information, or the factors

or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required by law.

v3.24.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

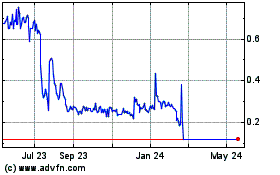

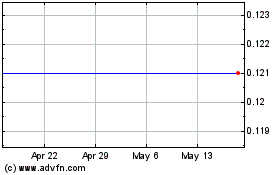

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From Apr 2023 to Apr 2024