Liberty Media Corporation (“Liberty Media”) (Nasdaq: LSXMA,

LSXMB, LSXMK, FWONA, FWONK, BATRA, BATRK) will hold a virtual

special meeting of stockholders on Monday, July 17, 2023 at 10:30

a.m. M.T. At the special meeting, stockholders will be asked to

consider and vote on proposals related to Liberty Media’s

previously announced transactions to split off the Atlanta Braves

and its associated real estate development project (the

“Split-Off”) into a separate public company Atlanta Braves

Holdings, Inc. (“Atlanta Braves Holdings”) and create a new Liberty

Live Group tracking stock (the “Reclassification”).

The Split-Off is expected to close as soon as practicable

following the stockholder vote, and the Reclassification is

expected to close as soon as practicable following the Split-Off,

estimated to be within three weeks of the completion of the

Split-Off. Holders of Liberty Media’s Liberty Braves common stock

at the time of the Split-Off will be eligible to receive shares of

Atlanta Braves Holdings in the Split-Off. Holders of Liberty

Media’s Liberty SiriusXM common stock and Liberty Formula One

common stock at the time of the Reclassification will be eligible

to receive shares of the new tracking stock groups.

Following the Reclassification, the Liberty Live Group tracking

stock (Series A, Series B and Series C Liberty Live common stock

(“LLYVA,” “LLYVB,” and “LLYVK,” respectively) will be comprised

of:

- Approximately $100 million of corporate cash, funded from

Formula One Group cash on hand, including cash from the partial

liquidation of ETF assets and other public equity holdings

- Liberty Media’s Live Nation Entertainment, Inc. (“Live Nation”)

(NYSE: LYV) stake consisting of 69.6 million shares of common

stock

- Other assets including remaining ETF assets, Associated

Partners, Drone Racing League, Griffin Gaming Fund, INRIX, Kroenke

Arena Company, Liberty Technology Venture Capital, Overtime Sports

and Tastemade

- $920 million principal amount (as of March 31, 2023) of 0.50%

Live Nation exchangeable debentures due 2050

- Undrawn margin loan secured by 9.0 million Live Nation shares

($400 million available capacity as of March 31, 2023)

Additional information regarding the composition of each

tracking stock group pro forma for the Split-Off and

Reclassification will be available on Liberty Media’s website at

https://www.libertymedia.com/about/asset-list and in the most

recent Registration Statements on Form S-4 filed by each of Liberty

Media and Atlanta Braves Holdings with the Securities and Exchange

Commission (the “SEC”) (the “Form S-4”).

If the Reclassification stockholder proposals are approved and

the Reclassification is implemented, at the date and time of the

effectiveness of the Liberty Media restated certificate of

incorporation, each outstanding share of Series A, Series B and

Series C Liberty SiriusXM common stock (“LSXMA,” “LSXMB,” and

“LSXMK,” respectively) and Series A, Series B and Series C Liberty

Formula One common stock (“FWONA,” “FWONB,” and “FWONK,”

respectively) would be reclassified as follows:

- 1 share of Liberty SiriusXM common stock shall be reclassified

into 1 share of the corresponding series of new Liberty SiriusXM

common stock and 0.2500 of a share of the corresponding series of

new Liberty Live common stock

- 1 share of Liberty Formula One common stock shall be

reclassified into 1 share of the corresponding series of new

Liberty Formula One common stock and 0.0428 of a share of the

corresponding series of new Liberty Live common stock.

In connection with the Split-Off, the intergroup interests in

the Braves Group attributed to the Liberty SiriusXM Group and the

Formula One Group will be settled and extinguished. Liberty Media

will attribute approximately 1.8 million shares of new BATRK to the

Liberty SiriusXM Group and approximately 6.8 million shares of new

BATRK to the Formula One Group, respectively, on a one-for-one

basis equal to the number of notional shares representing the

intergroup interest attributed to each immediately prior to the

Split-Off. Following the Split-Off: (i) Liberty Media intends to

exchange the shares of new BATRK attributed to the Liberty SiriusXM

Group with one or more third party lenders for satisfaction of

certain debt obligations of the Liberty SiriusXM Group and (ii)

Liberty Media will distribute the new BATRK shares attributed to

the Formula One Group on a pro rata basis to Formula One Group

common stockholders (the “Formula One Distribution”).

The approximate 1.1 million share intergroup interest in the

Formula One Group attributed to Liberty SiriusXM Group will be

settled and extinguished through the attribution of cash prior to

the record date for the Formula One Distribution.

Following the Split-Off and Reclassification and pro forma for

the settlement of the aforementioned intergroup interests, the

estimated number of undiluted outstanding shares of the new Liberty

Media tracking stocks and Atlanta Braves Holdings, based on shares

of Liberty Media outstanding as of April 30, 2023, are expected to

be:

- Liberty Media

- Liberty SiriusXM Group (LSXMA, LSXMB, LSXMK): 327 million

shares

- Formula One Group (FWONA, FWONB, FWONK): 234 million

shares

- Liberty Live Group (LLYVA, LLYVB, LLYVK): 92 million

shares

- Atlanta Braves Holdings (BATRA, BATRB, BATRK): 62 million

shares

Information regarding the new tracking stocks and stockholder

proposals is available in the Form S-4. The completion of the

Split-Off and the Reclassification is conditioned upon, among other

things, the requisite stockholder approvals, the receipt of

opinions from counsel regarding the tax-free nature of the

transactions and the receipt of all necessary approvals from Major

League Baseball.

Additional Special Meeting

Details

Stockholders of record as of the record date for the special

meeting will be able to listen, vote and submit questions

pertaining to the special meeting of stockholders by logging in at

www.virtualshareholdermeeting.com/LMC2023SM. The record date for

the special meeting is 5:00 p.m., New York City time, on June 6,

2023. Stockholders will need the 16-digit control number that is

printed in the box marked by the arrow on the stockholder’s proxy

card for the special meeting to enter the virtual special meeting

website. A technical support number will become available at the

virtual meeting link 10 minutes prior to the scheduled meeting

time.

In addition, access to the special meeting will be available on

the Liberty Media website. All interested persons should visit

https://www.libertymedia.com/investors/news-events/ir-calendar to

access the webcast. An archive of the webcast will also be

available on this website after appropriate filings have been made

with the SEC.

Forward-Looking Statements

This communication includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including certain statements relating to the proposed

Split-Off and Reclassification, the proposed timing of the

Split-Off and Reclassification and other matters that are not

historical facts. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws. These forward-looking statements

generally can be identified by phrases such as “possible,”

“potential,” “intends” or “expects” or other words or phrases of

similar import or future or conditional verbs such as “will,”

“may,” “might,” “should,” “would,” “could,” or similar variations.

These forward-looking statements involve many risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements, including,

without limitation, the satisfaction of conditions to the proposed

Split-Off and Reclassification. These forward-looking statements

speak only as of the date of this communication, and Liberty Media

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained

herein to reflect any change in Liberty Media’s expectations with

regard thereto or any change in events, conditions or circumstances

on which any such statement is based. Please refer to the publicly

filed documents of Liberty Media, including its most recent Forms

10-K and 10-Q, as such risk factors may be amended, supplemented or

superseded from time to time by other reports Liberty Media

subsequently files with the SEC, for additional information about

Liberty Media and about the risks and uncertainties related to

Liberty Media’s business which may affect the statements made in

this communication.

Additional Information

Nothing in this communication shall constitute a solicitation to

buy or an offer to sell shares of common stock of Liberty Media or

Atlanta Braves Holdings. The proposed offer and issuance of shares

of Atlanta Braves Holdings common stock in the Split-Off and the

Formula One Distribution and Liberty Media common stock in the

Reclassification will be made only pursuant to each company’s

respective effective registration statement. Liberty Media

stockholders and other investors are urged to read the registration

statements, including the joint proxy statement/prospectus forming

a part thereof regarding the Split-Off, Reclassification and

Formula One Distribution, and any other relevant documents filed as

exhibits therewith, as well as any amendments or supplements to

those documents, because they will contain important information

about the Split-Off, the Reclassification and the Formula One

Distribution. Copies of these SEC filings are available free of

charge at the SEC’s website (http://www.sec.gov). Copies of the

filings together with the materials incorporated by reference

therein will also be available, without charge, by directing a

request to Liberty Media Corporation, 12300 Liberty Boulevard,

Englewood, Colorado 80112, Attention: Investor Relations,

Telephone: (877) 772-1518.

Participants in a Solicitation

Liberty Media and Atlanta Braves Holdings and their respective

directors and executive officers and other persons may be deemed to

be participants in the solicitation of proxies in respect of

proposals relating to the Split-Off and Reclassification.

Information regarding the directors and executive officers of

Liberty Media and Atlanta Braves Holdings and other participants in

the proxy solicitation and a description of their respective direct

and indirect interests, by security holdings or otherwise, are

available in the definitive proxy materials with respect to the

Split-Off and Reclassification filed with the SEC. Investors should

read the joint proxy statement/prospectus carefully before making

any voting or investment decisions. Free copies of these proxy

materials from Liberty Media may be obtained as indicated

above.

About Liberty Media Corporation

Liberty Media Corporation operates and owns interests in a broad

range of media, communications and entertainment businesses. Those

businesses are attributed to three tracking stock groups: the

Liberty SiriusXM Group, the Braves Group and the Formula One Group.

The businesses and assets attributed to the Liberty SiriusXM Group

(NASDAQ: LSXMA, LSXMB, LSXMK) include Liberty Media Corporation’s

interests in SiriusXM and Live Nation Entertainment. The businesses

and assets attributed to the Braves Group (NASDAQ: BATRA, BATRK)

include Liberty Media Corporation’s subsidiary Braves Holdings,

LLC. The businesses and assets attributed to the Formula One Group

(NASDAQ: FWONA, FWONK) consist of all of Liberty Media

Corporation’s businesses and assets other than those attributed to

the Liberty SiriusXM Group and the Braves Group, including its

subsidiary Formula 1 and other minority investments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230611921430/en/

Shane Kleinstein, 720-875-5432

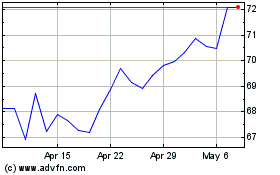

Liberty Media (NASDAQ:FWONK)

Historical Stock Chart

From Sep 2024 to Oct 2024

Liberty Media (NASDAQ:FWONK)

Historical Stock Chart

From Oct 2023 to Oct 2024