0000355019

false

0000355019

2022-07-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Act of 1934

Date

of Report (Date of earliest event reported): June

30, 2023

FONAR

CORPORATION

______________________________________________________

(Exact

name of registrant as specified in its charter)

| Delaware | |

0-10248 | |

11-2464137 |

| (State

or other jurisdiction of incorporation) | |

(Commission

File Number) | |

(I.R.S.

Employer Identification No.) |

| | |

| |

|

| | |

110

Marcus Drive,

Melville,

New

York 11747

(631)

694-2929 | |

|

| | |

(Address,

including zip code, and telephone number of registrant's principal executive office) | |

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[

] Written

communications pursuant to Rule 425 under the Securities Act 17 CFR 230.425)

[

] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[

] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[

] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities

registered pursuant to Section 12(b) of the Act.

| Title

of each class | |

Trading

symbol(s) | |

Name

of each exchange on which registered |

| Common

Stock, $.0001 par value | |

FONR | |

Nasdaq

Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [

]

Item

2.02(a) Results of Operations and Financial Condition.

We

reported the results of operations and financial condition of the Company for the Fiscal Year ended June 30, 2023 in a press release

dated September 28, 2023.

Exhibits:

99.1 Press Release dated September 28, 2023.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

FONAR

CORPORATION

(Registrant)

-------------------------------------------

By

/s/ Timothy R. Damadian

Timothy

R. Damadian

President

and CEO

Dated:

September 29, 2023

| NEWS |

|

| For

Immediate Release |

|

The

Inventor of MR Scanning™ |

| Contact:

Daniel Culver |

|

An

ISO 9001 Company |

| Director

of Communications |

|

Melville,

New York 11747 |

| E-mail:

investor@fonar.com |

|

Phone:

(631) 694-2929 |

| www.fonar.com |

|

Fax:

(631) 390-1772 |

FONAR

ANNOUNCES FINANCIAL RESULTS FOR FISCAL 2023

| · | On

August 3, 2022, FONAR founder and The Father of MRI, Raymond V. Damadian, died at 86. At

the time of his passing, Dr. Damadian was FONAR’s Chairman of the Board. Timothy R.

Damadian, FONAR’s president and CEO since 2016 has been elected as Chairman of the

Board. |

| · | On

September 13, 2022, the Company adopted a stock repurchase plan of up to $9 million. |

| · | Total

MRI scan volume at the HMCA-managed sites increased 1% to 188,348 scans for the fiscal year

ending June 30, 2023 as compared to the prior year. |

| · | Cash

and cash equivalents increased 5% to $51.3 million at June 30, 2023 versus the previous fiscal

year. |

| · | Total

Revenues-Net increased by 1% to $98.6 million for the fiscal year ended June 30, 2023 versus

the previous fiscal year. |

| · | Income

from Operations decreased 33% to $14.8 million for the fiscal year ended June 30, 2023 versus

the previous fiscal year. |

| · | Net

Income decreased 30% to $12.1 million for the fiscal year ended June 30, 2023 versus the

previous fiscal year. |

| · | Diluted

Net Income per Common Share decreased 25% to $1.32 for the fiscal year ended June 30, 2023

versus the previous fiscal year. |

| · | Working

Capital increased by 8% to $110.0 million during fiscal 2023. |

| · | Book

Value Per Share increased by 3% to $22.62 per share. |

| · | Two

HMCA-managed MRI scanners were added in fiscal 2023, bringing the total number to 41. |

MELVILLE,

NEW YORK, September 28, 2023 - FONAR Corporation (NASDAQ-FONR), The Inventor of MR Scanning™,

reported today its Fiscal 2023 results. FONAR’s primary source of income is attributable to its wholly-owned diagnostic imaging

management subsidiary, Health Management Company of America (HMCA). In 2009, HMCA managed 9 MRI scanners. Currently, HMCA manages 41

MRI scanners in New York and in Florida.

Financial

Results

Total

revenues - Net increased by 1% to $98.6 million for the fiscal year ended June 30, 2023, as compared to $97.6 million for the fiscal

year ended June 30, 2022.

Total

Costs and Expenses for the fiscal year ended June 30, 2023 increased by 11% to $83.9 million, as compared to $75.6 million for the fiscal

year ended June 30, 2022.

Revenues

from the management of the diagnostic imaging center segment, consisting of patient fee revenue net of contractual allowances and discounts,

and management and other fees of related and non-related medical practices, increased to $90.4 million for the fiscal year ended June

30, 2023, as compared to $89.4 million for the fiscal year ended June 30, 2022.

Revenues

from product sales and upgrades and service and repair fees for related and non-related medical parties, for the fiscal year ended June

30, 2023 was $8.3 million, as compared to $8.2 million for the fiscal year ended June 30, 2022.

Research

and Development expenses increased 5% to $1.6 million for the fiscal year ended June 30, 2023, as compared to $1.5 million for the fiscal

year ended June 30, 2022

Selling,

general and administrative (SG&A) expenses increased 25% to $29.4 million for the fiscal year ended June 30, 2023, as compared to

$23.5 million for the fiscal year ended June 30, 2022.

Income

from Operations decreased 33% to $14.8 million for the fiscal year ended June 30, 2023, as compared to $22.0 million for the fiscal year

ended June 30, 2022.

Net

Income decreased 30% to $12.1 million for the fiscal year ended June 30, 2023, as compared to $17.2 million for the fiscal year ended

June 30, 2022.

Diluted

Net Income per Common Share available to common shareholders decreased 25% to $1.32, for the fiscal year ended June 30, 2023, as compared

to $1.75 for the fiscal year ended June 30, 2022.

The

weighted average diluted shares outstanding for the fiscal years ended June 30, 2023 and was 6.5 million versus 6.6 million for the fiscal

year ended June 30, 2022.

Balance

Sheet Items

Total

Cash and Cash Equivalents and Short Term Investments at June 30, 2023 increased 5% to $51.3 million as compared to the $48.7 million

at June 30, 2022.

Total

Assets at June 30, 2023 were $200.6 million as compared to $199.3 million at June 30, 2022.

Total

Liabilities at June 30, 2023 were $49.8 million as compared to $53.1 million at June 30, 2022.

Total

Current Assets at June 30, 2023 were $125.7 million as compared to $118.7 million at June 30, 2022.

Total

Current Liabilities at June 30, 2023 were $15.6 million as compared to $16.7 million at June 30, 2022.

FONAR

Stockholders’ Equity was $157.9 million at June 30, 2023, as compared to $150.3 million at June 30, 2022.

The

Current Ratio is 8.0 at June 30, 2023.

Working

Capital increased 8% to $110.0 million at June 30, 2023, as compared to $101.9 million at June 30, 2022.

The

ratio of Total Assets/Total Liabilities increased 7% to 4.0 at June 30, 2023 as compared to 3.8 at June 30, 2022.

Net

Book Value per Common Share (Total Stockholders Equity divided by Common Shares Outstanding) increased 3% to $22.62 at June 30, 2023

as compared to $21.89 at June 30, 2022.

Cash

Flow Item

Operating

Cash Flow was $14.5 million for the fiscal year ended June 30, 2023 as compared to $15.3 million for the fiscal year ended June 30, 2022.

Management

Discussion

Timothy

Damadian, President and CEO of FONAR, said: “It’s been over a year now since my father’s passing. I, among many others

who worked with him for decades, miss his wisdom, his leadership, his vision, his extraordinary perseverance, and his faith that created

not only an MRI company but an entire industry that has helped or even saved the lives of millions all over the world.”

“Regarding

Fiscal 2023,” continued Mr. Damadian, “scan volume at HMCA-managed sites for the year was 188,348, 1% higher than that of

Fiscal 2022 (186,448). As I discussed in the Company’s May 15, 2023 press release regarding the first nine months of Fiscal 2023,

we were, in the early months of the year, dealing with an acute shortage of MRI technologists, particularly among the facilities we manage

in New York. We, of course, weren’t the only ones contending with COVID-related manpower shortages. The ongoing effects of the

COVID-19 pandemic have negatively impacted the entire healthcare industry.”

“By

employing innovative and concerted recruitment efforts, we’ve filled most of the technologist vacancies, allowing the affected

sites to return to their usual business hours and thereby accommodate more patients. This recruitment effort plus the addition of two

MRI scanners in Casselberry, Florida in the second half of Fiscal 2023, resulted in a significant increase in scan volume: For the 3-month

period ending on March 31, 2023, scan volume was 49,451, which was 7.1% higher than the scan volume of the corresponding period of the

previous fiscal year (46,190), and for the 3-month period ending on June 30, 2023, scan volume was 49,009, which was 7.0% higher than

the scan volume of the corresponding period of the previous fiscal year (45,798).”

“For

the most part, the effects of the pandemic are behind us. The scan volume of 188,348 at the HMCA-managed sites in Fiscal 2023 was 13.0%

higher than that achieved in Fiscal 2020 (166,698), when COVID-19 first hit our shores. I am grateful that we have maintained positive

trends in both revenue and profit over the course of some very challenging years.”

“I

would also like to report that pursuant to our September 13, 2022 announcement of a FONAR stock repurchase plan of up to $9 million,

the Company had, as of June 30, 2023, repurchased 103,148 shares at a cost of $1,759,457.”

“As

of June 30, 2023, HMCA was managing 41 MRI scanners, 24 in New York and 17 in Florida. In July 2023 (1st Quarter, Fiscal 2024), we expanded

the network of HMCA-managed sites in New York to include a new MRI facility in the southern part of the Bronx, New York, complementing

the existing and very busy HMCA-managed site located in the central part of that borough.”

“I

am grateful to our management team and all the HMCA employees who have been working diligently to get our COVID-impaired sites back on

track, planning, preparing and working towards growth, and keeping the Company profitable.”

Mr.

Damadian continued, “FONAR has the only MRI scanner with the ability to make cines

(movies) of the cerebrospinal fluid (CSF) as it flows up and down the neck and around the

brain with the patient in the upright, weight-loaded position. Because of the UPRIGHT®

MRI’s ability to scan patients in weight-bearing positions as well as in the recumbent,

non-weight-bearing position, we are finding significant posture-dependent differences in

CSF flow. These differences may provide clues that will enable physicians to find solutions

to their patients’ medical problems.”

“Our

research is currently focused on quantifying CSF flow and the velocity with which it navigates through the neck and head. We’ve

been able to use the data collected from asymptomatic patients to identify CSF flow abnormalities in patients with symptoms. We believe

that the study of CSF flow may lead to new a understanding of its role in neurodegenerative diseases, such as Multiple Sclerosis,

Alzheimer's, ALS, Parkinson's, Autism, Cerebral Palsy, Huntington's and Epilepsy.”

Significant

Events

On

September 13, 2022, the Company adopted a common stock repurchase plan. The plan has no expiration date and cannot determine the number

of shares which will be repurchased. On September 26, 2022, the Board of Directors approved up to $9 million to be repurchased under

the plan. The stock will be purchased on the publicly traded open market at prevailing prices.

For

the year ended June 30, 2023, the Company purchased 103,148 shares at a cost of $1,759,457 and those shares were returned to the corporate

treasury. Subsequently, 103,328 shares valued at $1,919,027 were canceled. (See note 8 of the 10-Q for details.)

Company

Legacy

FONAR’s

history is that of being the first company in the MRI industry and that its founder, Raymond V. Damadian, M.D., is the inventor of the

MRI. To accurately preserve these truths, achievements of FONAR and Dr. Damadian will occasionally be selected and presented.

One

of the many awards given to Dr. Damadian was the 2009 Honorary Fellow Award from the American Institute for Medical and Biological Engineering

(AIMBE) for his discovery of MRI. The AIMBE Award was presented at the annual meeting of AIMBE, held February 11-13, 2009 in Washington,

D.C.

|

Raymond Damadian, M.D.

RECIPIENT

OF THE 2009 AIMBE HONORARY FELLOW AWARD

The

2009 AIMBE Honorary Fellow Award was accompanied with the following citation:

Honorary Fellow Awards are given to individuals who have made outstanding contributions to medical and biological engineering through scientific, educational, governmental, financial or industrial organizations. This award is not presented to individuals who have already been named to the College of Fellows by regular AIMBE procedures.

In 1970, Raymond Damadian, M.D., made the discovery that is the basis for magnetic resonance (MR) scanning that there is a marked difference in relaxation times between normal and abnormal tissues of the same type, as well as between different types of normal tissues. This seminal discovery, which remains the basis for the making of every MRI image ever produced, is the foundation of the MRI industry. Dr. Damadian published his discovery in his milestone 1971 paper in the journal Science (Science 171:1151, 1971) and filed the pioneer patent for the practical use of his discovery in 1972.

The

MRI scanner uses these relaxation differences in diseased tissues such as cancer and in normal tissues to supply and control the brightness

of the pixels that comprise the MRI image. These relaxation differences, which do not exist in any other imaging modality, provide the

exceptional contrast and beauty found only in MRI images (10 to 30 times that of X-ray). The significance and importance of Dr. Damadian’s

discovery in the origination of MRI was acknowledged by the U.S. Supreme Court in its 1997 decision, when the Court enforced Dr. Damadian’s

original patent (U.S. Patent #3,789,832) that patented the relaxation differences and their use in scanning.

|

AIMBE

citation continues:

With

the aid of his post-graduate assistants, Doctors Lawrence Minkoff and Michael Goldsmith, Dr. Damadian went on to build Indomitable, the

first MR scanner, which was conceived to take advantage of the relaxation differences among the body’s tissues. Indomitable produced

the first human image, that of Dr. Minkoff’s chest, on July 3, 1977 and the first scans of patients with cancer in 1978. Indomitable

has since assumed its rightful place in the Smithsonian Institute.

FONAR

was incorporated in 1978, making it the first, oldest and most experienced MR manufacturer in the industry. FONAR introduced the world’s

first commercial MRI (a whole-body MRI scanner) in 1980, and went public in 1981.

In

1982, FONAR introduced its patented iron-core technology, which is the basis for all Open MRI scanners. In 1984, the company invented

Oblique Imaging, providing medical technology the means to produce multiple images “at any angle,” which was never before

possible in medical imaging.

In

1985, the Multi-Angle Oblique (MAO) scanning protocol, an innovative, dramatic extension of FONAR’s Oblique Imaging was invented

and patented.

In

1985, the FONAR MRI scanner at the UCLA Medical Center became the world’s first MRI in which an interventional surgical procedure

was performed. That same year FONAR introduced the world’s first mobile MRI.

In

1988, Dr. Damadian was awarded the National Medal of Technology by President Ronald Reagan, which he shared jointly with Dr. Lauterbur,

for “their independent contributions in conceiving and developing the application of magnetic resonance technology to medical uses,

including whole-body scanning and diagnostic imaging.” Less than one year later, Dr. Damadian was inducted into the National Inventors

Hall of Fame of the United States Patent Office for his pioneer patent of MR scanning, joining a select group of renowned pioneers, including

Orville and Wilbur Wright, Henry Ford, Thomas Edison and Alexander Graham Bell, whose inventions have revolutionized our nation and society.

AIMBE

(www.aimbe.org) was founded in 1991 to establish a clear and comprehensive identity for the field of medical and biological engineering

– which is the bridge between the principles of engineering science and practice, and the problems and issues of biological and

medical science and practice. Representing over 75,000 bioengineers, AIMBE serves and coordinates a broad constituency of medical and

biological scientists and practitioners, scientific and engineering societies, academic departments and industries.

About

FONAR

FONAR,

The Inventor of MR Scanning™, located in Melville, NY, was incorporated in 1978, and is the first, oldest and most experienced

MRI company in the industry. FONAR went public in 1981 (Nasdaq:FONR). FONAR sold the world’s first commercial MRI to Ronald J Ross,

MD, Cleveland, Ohio. It was installed in 1980. Dr. Ross and his team began the world’s first clinical MRI trials in January 1981.

The results were reported in the June 1981 edition of Radiology/Nuclear Medicine Magazine. The technique used for obtaining T1 and T2

values was the FONAR technique (Field fOcusing Nuclear mAgnetic Resonance), not the back projection technique. www.fonar.com/innovations-timeline.html.

FONAR’s

signature product is the FONAR UPRIGHT® Multi-Position™ MRI (also known as the STAND-UP® MRI), the only whole-body MRI

that performs Position™ Imaging (pMRI™) and scans patients in numerous weight-bearing positions, i.e. standing, sitting,

in flexion and extension, as well as the conventional lie-down position. The FONAR UPRIGHT® MRI often detects patient problems that

other MRI scanners cannot because they are lie-down, “weightless-only” scanners. The patient-friendly UPRIGHT® MRI has

a near-zero patient claustrophobic rejection rate. As a FONAR customer states, “If the patient is claustrophobic in this scanner,

they’ll be claustrophobic in my parking lot.” Approximately 85% of patients are scanned sitting while watching TV.

FONAR

has new works-in-progress technology for visualizing and quantifying the cerebral hydraulics of the central nervous system, the flow

of cerebrospinal fluid (CSF), which circulates throughout the brain and vertebral column at the rate of 32 quarts per day. This imaging

and quantifying of the dynamics of this vital life-sustaining physiology of the body’s neurologic system has been made possible

first by FONAR’s introduction of the MRI and now by this latest works-in-progress method for quantifying CSF in all the normal

positions of the body, particularly in its upright flow against gravity. Patients with whiplash or other neck injuries are among those

who will benefit from this new understanding.

FONAR’s

primary source of income and growth is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company

of America (HMCA) www.hmca.com.

FONAR’s

substantial list of patents includes recent patents for its technology enabling full weight-bearing MRI imaging of all the gravity sensitive

regions of the human anatomy, especially the brain, extremities and spine. It includes its newest technology for measuring the Upright

cerebral hydraulics of the cerebrospinal fluid (CSF) of the central nervous system. FONAR’s UPRIGHT® Multi-Position™

MRI is the only scanner licensed under these patents.

UPRIGHT®

and STAND-UP® are

registered trademarks. The Inventor of MR Scanning™, CSP™,

Multi-Position™, UPRIGHT RADIOLOGY™, The

Proof is in the Picture™, pMRI™, CSF Videography™,

and Dynamic™ are trademarks of FONAR Corporation.

This

release may include forward-looking statements from the company that may or may not materialize. Additional information on factors that

could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission.

CONSOLIDATED

BALANCE SHEETS

ASSETS

| | |

June

30, |

| | |

2023 | |

2022 |

| Current

Assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 51,279,707 | | |

$ | 48,722,977 | |

| Short-term

investments | |

| 32,799 | | |

| 32,326 | |

| Accounts

receivable – net of allowances for doubtful accounts of $198,593 and $204,597 at June 30, 2023 and 2022, respectively | |

| 3,861,512 | | |

| 4,335,956 | |

| Medical

receivables – net | |

| 21,259,262 | | |

| 20,108,989 | |

| Management

and other fees receivable – net of allowances for doubtful accounts of $12,608,567 and $16,627,917 at June 30, 2023 and 2022,

respectively | |

| 35,888,253 | | |

| 33,419,219 | |

| Management

and other fees receivable – related party medical practices – net of allowances for doubtful accounts of $3,989,692 and

$4,686,893 at June 30, 2023 and 2022, respectively | |

| 9,161,870 | | |

| 8,602,561 | |

| Inventories | |

| 2,569,666 | | |

| 2,359,821 | |

| Prepaid

expenses and other current assets | |

| 1,607,768 | | |

| 1,104,325 | |

| Total

Current Assets | |

| 125,660,837 | | |

| 118,686,174 | |

| Accounts

receivable – long term | |

| 710,085 | | |

| 1,871,890 | |

| Deferred

income tax asset | |

| 10,041,960 | | |

| 12,842,478 | |

| Property

and equipment – net | |

| 22,146,373 | | |

| 22,281,791 | |

| Right-of-use-asset

– operating leases | |

| 33,068,755 | | |

| 34,232,109 | |

| Right-of-use-asset

– financing lease | |

| 729,229 | | |

| 928,109 | |

| Goodwill | |

| 4,269,277 | | |

| 4,269,277 | |

| Other

intangible assets – net | |

| 3,431,865 | | |

| 3,703,885 | |

| Other

assets | |

| 523,506 | | |

| 526,269 | |

| Total

Assets | |

$ | 200,581,887 | | |

$ | 199,341,982 | |

CONSOLIDATED

BALANCE SHEETS

LIABILITIES

| | |

June

30, |

| | |

2023 | |

2022 |

| Current

Liabilities: | |

| | | |

| | |

| Current

portion of long-term debt | |

$ | 43,767 | | |

$ | 40,078 | |

| Accounts

payable | |

| 1,579,240 | | |

| 1,551,269 | |

| Other

current liabilities | |

| 5,443,724 | | |

| 6,417,227 | |

| Operating

lease liability – current portion | |

| 3,905,484 | | |

| 3,880,129 | |

| Financing

lease liability – current portion | |

| 217,597 | | |

| 210,140 | |

| Unearned

revenue on service contracts | |

| 3,832,184 | | |

| 4,288,766 | |

| Customer

deposits | |

| 602,377 | | |

| 361,245 | |

| | |

| | | |

| | |

| Total

Current Liabilities | |

| 15,624,373 | | |

| 16,748,854 | |

| Long-Term

Liabilities: | |

| | | |

| | |

| Unearned

revenue on service contracts | |

| 760,242 | | |

| 1,857,257 | |

| Deferred

income tax liability | |

| 394,758 | | |

| 215,726 | |

| Due

to related party medical practices | |

| 92,663 | | |

| 92,663 | |

| Operating

lease liability – net of current portion | |

| 32,105,405 | | |

| 33,090,990 | |

| Financing

lease liability – net of current portion | |

| 620,481 | | |

| 838,291 | |

| Long-term

debt and capital leases, less current portion | |

| 115,075 | | |

| 155,379 | |

| Other

liabilities | |

| 41,750 | | |

| 106,541 | |

| Total

Long-Term Liabilities | |

| 34,130,374 | | |

| 36,356,847 | |

| Total

Liabilities | |

| 49,754,747 | | |

| 53,105,701 | |

CONSOLIDATED

BALANCE SHEETS

STOCKHOLDERS’

EQUITY

| | |

June

30, |

| | |

2023 | |

2022 |

| Stockholders’

Equity: | |

| | | |

| | |

| Class

A non-voting preferred stock $.0001 par value; 453,000 shares authorized at June 30, 2023 and 2022, 313,438 issued and outstanding

at June 30, 2023 and 2022 | |

$ | 31 | | |

$ | 31 | |

| Preferred

stock $.001 par value; 567,000 shares authorized at June 30, 2023 and 2022, issued and outstanding – none | |

| — | | |

| — | |

| Common

stock $.0001 par value; 8,500,000 shares authorized at June 30, 2023 and 2022, 6,462,524 and 6,565,853 issued at June

30, 2023 and 2022, respectively 6,450,882 and 6,554,210 outstanding at June 30, 2023 and 2022, respectively | |

| 647 | | |

| 657 | |

| Class

B convertible common stock (10 votes per share) $.0001 par value; 227,000 shares authorized at June 30, 2023 and 2022, 146 issued

and outstanding at June 30, 2023 and 2022 | |

| — | | |

| — | |

| Class

C common stock (25 votes per share) $.0001 par value; 567,000 shares authorized at June 30, 2023 and 2022, 382,513 issued and outstanding

at June 30, 2023 and 2022 | |

| 38 | | |

| 38 | |

| Paid-in

capital in excess of par value | |

| 182,612,518 | | |

| 184,531,535 | |

| Accumulated

deficit | |

| (24,190,981 | ) | |

| (33,566,757 | ) |

| Treasury

stock, at cost – 11,463 and 11,643 shares of common stock at June 30, 2023 and 2022, respectively | |

| (515,820 | ) | |

| (675,390 | ) |

| Total

Fonar Corporation’s Stockholders’ Equity | |

| 157,906,433 | | |

| 150,290,114 | |

| Noncontrolling

interests | |

| (7,079,293 | ) | |

| (4,053,833 | ) |

| Total

Stockholders’ Equity | |

| 150,827,140 | | |

| 146,236,281 | |

| Total

Liabilities and Stockholders’ Equity | |

$ | 200,581,887 | | |

$ | 199,341,982 | |

CONSOLIDATED

STATEMENTS OF INCOME

| | |

For

the Years Ended June 30, |

| | |

2023 | |

2022 |

| Revenues | |

| |

|

| Patient

fee revenue, net of contractual allowances and discounts | |

$ | 29,793,993 | | |

$ | 29,582,238 | |

| Product

sales – net | |

| 731,607 | | |

| 517,939 | |

| Service

and repair fees – net | |

| 7,419,104 | | |

| 7,590,865 | |

| Service

and repair fees – related parties – net | |

| 110,000 | | |

| 110,000 | |

| Management

and other fees – net | |

| 48,640,497 | | |

| 48,226,787 | |

| Management

and other fees – related party medical practices – net | |

| 11,949,900 | | |

| 11,564,316 | |

| Total

Revenues – Net | |

| 98,645,101 | | |

| 97,592,145 | |

| Costs

and Expenses | |

| | | |

| | |

| Costs

related to product sales | |

| 852,025 | | |

| 416,814 | |

| Costs

related to service and repair fees | |

| 3,033,967 | | |

| 2,991,069 | |

| Costs

related to service and repair fees – related parties | |

| 44,983 | | |

| 43,344 | |

| Costs

related to patient fee revenue | |

| 16,183,166 | | |

| 13,307,819 | |

| Costs

related to management and other fees | |

| 26,975,563 | | |

| 27,251,268 | |

| Costs

related to management and other fees – related party medical practices | |

| 5,807,454 | | |

| 6,567,887 | |

| Research

and development | |

| 1,567,749 | | |

| 1,494,181 | |

| Selling,

general and administrative expenses | |

| 29,390,932 | | |

| 23,512,581 | |

| Total

Costs and Expenses | |

| 83,855,839 | | |

| 75,584,963 | |

| Income

from Operations | |

| 14,789,262 | | |

| 22,007,182 | |

| Other

Income and (Expenses): | |

| | | |

| | |

| Interest

expense | |

| (50,131 | ) | |

| (346,552 | ) |

| Investment

income | |

| 1,222,176 | | |

| 247,158 | |

| Other

(expense) income | |

| (202,720 | ) | |

| 861,087 | |

| Income

before provision for income taxes and noncontrolling interests | |

| 15,758,587 | | |

| 22,768,875 | |

| Provision

for Income Taxes | |

| (3,632,071 | ) | |

| (5,534,487 | ) |

| Net

Income | |

$ | 12,126,516 | | |

$ | 17,234,388 | |

| Net

Income – Noncontrolling Interests | |

| (2,750,740 | ) | |

| (4,793,482 | ) |

| Net

Income – Attributable to FONAR | |

$ | 9,375,776 | | |

$ | 12,440,906 | |

CONSOLIDATED

STATEMENTS OF INCOME (Continued)

| | |

For

the Years Ended June 30, |

| | |

2023 | |

2022 |

| Net

Income Available to Common Stockholders | |

$ | 8,801,974 | | |

$ | 11,690,796 | |

| Net

Income Available to Class A Non-Voting Preferred Stockholders | |

$ | 427,666 | | |

$ | 559,072 | |

| Net

Income Available to Class C Common Stockholders | |

$ | 146,136 | | |

$ | 191,038 | |

| Basic

Net Income Per Common Share Available to Common Stockholders | |

$ | 1.35 | | |

$ | 1.78 | |

| Diluted

Net Income Per Common Share Available to Common Stockholders | |

$ | 1.32 | | |

$ | 1.75 | |

| Basic

and Diluted Income Per Share – Class C Common | |

$ | 0.38 | | |

$ | 0.50 | |

| Weighted

Average Basic Shares Outstanding – Common Stockholders | |

| 6,539,376 | | |

| 6,554,209 | |

| Weighted

Average Diluted Shares Outstanding – Common Stockholders | |

| 6,666,880 | | |

| 6,681,713 | |

| Weighted

Average Basic and Diluted Shares Outstanding – Class C Common | |

| 382,513 | | |

| 382,513 | |

CONSOLIDATED

STATEMENTS OF CASH FLOWS

| | |

For

the Years Ended June 30, |

| CASH

FLOWS FROM OPERATING ACTIVITIES | |

2023 | |

2022 |

| Net

Income | |

$ | 12,126,516 | | |

$ | 17,234,388 | |

| Adjustments

to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation

and amortization | |

| 4,540,135 | | |

| 4,535,236 | |

| Provision

for bad debts | |

| 5,513,476 | | |

| 1,343,533 | |

| Deferred

income tax - net | |

| 2,979,550 | | |

| 3,093,893 | |

| Amortization

on right-of-use assets | |

| 4,264,818 | | |

| 4,000,131 | |

| Loss

on disposition of fixed assets | |

| 213,244 | | |

| — | |

| Gain

on forgiveness of PPP loan | |

| — | | |

| (700,764 | ) |

| (Increase)

decrease in operating assets, net: | |

| | | |

| | |

| Accounts,

medical and management fee receivables | |

| (8,055,843 | ) | |

| (5,602,188 | ) |

| Notes

receivable | |

| (64,532 | ) | |

| 43,334 | |

| Inventories | |

| (209,845 | ) | |

| (696,402 | ) |

| Prepaid

expenses and other current assets | |

| (438,911 | ) | |

| 90,638 | |

| Other

assets | |

| 2,763 | | |

| 129,411 | |

| Increase

(decrease) in operating liabilities, net: | |

| | | |

| | |

| Accounts

payable | |

| 19,685 | | |

| (314,766 | ) |

| Other

current liabilities | |

| (2,527,100 | ) | |

| (3,765,215 | ) |

| Customer

advances | |

| 241,132 | | |

| (369,856 | ) |

| Operating

lease liabilities | |

| (3,862,814 | ) | |

| (3,437,743 | ) |

| Financing

lease liabilities | |

| (210,353 | ) | |

| (202,741 | ) |

| Contract

liabilities | |

| — | | |

| (14,739 | ) |

| Other

liabilities | |

| (64,791 | ) | |

| (64,790 | ) |

| NET

CASH PROVIDED BY OPERATING ACTIVITIES | |

| 14,467,130 | | |

| 15,301,360 | |

| CASH

FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchases

of property and equipment | |

| (4,218,084 | ) | |

| (4,545,292 | ) |

| Proceeds

of Short-term investment | |

| (473 | ) | |

| (149 | ) |

| Purchase

of noncontrolling interests | |

| — | | |

| (546,000 | ) |

| Cost

of patents | |

| (119,571 | ) | |

| (87,882 | ) |

| NET

CASH USED IN INVESTING ACTIVITIES | |

| (4,338,128 | ) | |

| (5,179,323 | ) |

| CASH

FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Repayment

of borrowings and capital lease obligations | |

| (36,615 | ) | |

| (37,239 | ) |

| Purchase

of treasury stock | |

| (1,759,457 | ) | |

| — | |

| Distributions

to noncontrolling interests | |

| (5,776,200 | ) | |

| (5,822,232 | ) |

| NET

CASH USED IN FINANCING ACTIVITIES | |

| (7,572,272 | ) | |

| (5,859,471 | ) |

| NET

INCREASE IN CASH AND CASH EQUIVALENTS | |

| 2,556,730 | | |

| 4,262,566 | |

| CASH

AND CASH EQUIVALENTS - BEGINNING OF YEAR | |

| 48,722,977 | | |

| 44,460,411 | |

| CASH

AND CASH EQUIVALENTS - END OF YEAR | |

$ | 51,279,707 | | |

$ | 48,722,977 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

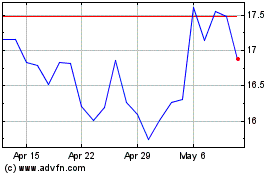

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Apr 2023 to Apr 2024