Five Below, Inc. (NASDAQ: FIVE) today announced financial results

for the fourth quarter and full year of fiscal 2023 ended February

3, 2024, both of which contained one additional week ("53rd week")

versus the comparable periods, and outlook for fiscal 2024.

For the fourth quarter ended

February 3, 2024:

- Net sales increased by 19.1% to

$1.34 billion from $1.12 billion in the fourth quarter of fiscal

2022. Excluding the impact of the 53rd week in fiscal 2023, net

sales increased 14.9%; comparable sales increased by 3.1% on a

thirteen week basis.

- Net sales in the 53rd week were

$48.1 million and represented approximately $0.15 cents in diluted

earnings per share.

- The Company opened

63 net new stores and ended the quarter with 1,544 stores in 43

states. This represents an increase in stores of 15.2% from the end

of the fourth quarter of fiscal 2022.

- Operating income was

$268.4 million compared to $225.8 million in the fourth quarter of

fiscal 2022.

- The effective tax

rate was 25.8% compared to 24.8% in the fourth quarter of fiscal

2022.

- Net income was

$202.2 million compared to $171.3 million in the fourth quarter of

fiscal 2022.

- Diluted income per

common share was $3.65 compared to $3.07 in the fourth quarter of

fiscal 2022. The fourth quarter of fiscal 2022 included a $0.01

benefit from shared-based accounting.

Joel Anderson, President and CEO of Five Below, stated, "Holiday

2023 marked a strong end to the year for sales performance as our

amazing assortment of Wow product drove yet another quarter of comp

transaction growth, led by the Five Beyond format stores. In fiscal

2023, we opened a record 205 new stores and ended the year with

over half of our comparable stores in the Five Beyond format. The

benefit of strong sales performance to our profitability was offset

by higher than anticipated shrink headwinds, resulting in earnings

at the low end of our guidance range."

Mr. Anderson continued, “We have implemented additional shrink

mitigation initiatives based on our 2023 learnings. However, we

expect the resulting benefits to take some time to realize, and

therefore, we have not included any associated improvement in our

outlook this year. We will continue to focus on driving our growth

this year, supported by our five strategic pillars, delivering

between 225 and 235 planned new stores, approximately 200 store

conversions to the Five Beyond format and completing the expansion

of two distribution centers. We will leverage our growing scale and

sourcing capabilities to deliver even more Wow to our customers

while we utilize technology and data analytics throughout the

organization to refine our marketing strategies, generate inventory

efficiencies, and simplify processes for our Crew.”

For the fiscal year ended

February 3, 2024:

- Net sales increased by 15.7% to

$3.56 billion from $3.08 billion in fiscal 2022. Excluding the

impact of the 53rd week in fiscal 2023, net sales increased 14.1%;

comparable sales increased by 2.8% on a fifty-two week basis.

- Net sales in the 53rd week were

$48.1 million and represented approximately $0.15 cents in diluted

earnings per share.

- The Company opened

204 net new stores compared to 150 new stores in fiscal 2022.

- Operating income was

$385.6 million compared to $345.0 million in fiscal 2022.

- The effective tax

rate was 24.9% compared to 24.7% in fiscal 2022.

- Net income was

$301.1 million compared to $261.5 million in fiscal 2022.

- Diluted income per common share was

$5.41 compared to $4.69 in fiscal 2022. The benefit from

share-based accounting was approximately $0.07 in fiscal 2023

compared to approximately $0.04 in fiscal 2022.

- The Company repurchased approximately

500,000 shares in fiscal 2023 at a cost of approximately $80.0

million.

First Quarter and Fiscal 2024 Outlook:The

Company expects the following results for the first quarter and

full year of fiscal 2024. This guidance does not include the impact

of share repurchases, if any.

For the first quarter of Fiscal 2024:

- Net sales are expected to be in the range of $826 million to

$846 million based on opening approximately 55 to 60 new stores and

assuming an approximate flat to 2% increase in comparable

sales.

- Net income is expected to be in the range of $32 million to $38

million.

- Diluted income per common share is expected to be in the range

of $0.58 to $0.69 on approximately 55.6 million diluted weighted

average shares outstanding.

For the full year of Fiscal 2024:

- Net sales are expected to be in the range of $3.97 billion to

$4.07 billion based on opening between 225 and 235 new stores and

assuming an approximate flat to 3% increase in comparable

sales.

- Net income is expected to be in the range of $318 million to

$346 million.

- Diluted income per common share is expected to be in the range

of $5.71 to $6.22 on approximately 55.6 million diluted weighted

average shares outstanding.

- Gross capital expenditures are expected to be approximately

$365 million in fiscal 2024.

Conference Call Information:A conference call

to discuss the financial results for the fourth quarter and full

year of fiscal 2023 is scheduled for today, March 20, 2024, at 4:30

p.m. Eastern Time. Investors and analysts interested in

participating in the call are invited to dial 412-902-6753

approximately 10 minutes prior to the start of the call. A live

audio webcast of the conference call will be available online at

investor.fivebelow.com, where a replay will be available shortly

after the conclusion of the call.

Forward-Looking Statements:This news release

includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 as contained in

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, which reflect management's current

views and estimates regarding the Company's industry, business

strategy, goals and expectations concerning its market position,

future operations, margins, profitability, capital expenditures,

liquidity and capital resources, store count potential and other

financial and operating information. Investors can identify these

statements by the fact that they use words such as "anticipate,"

"assume," "believe," "continue," "could," "estimate," "expect,"

"intend," "may," "plan," "potential," "predict," "project,"

"future" and similar terms and phrases. The Company cannot assure

investors that future developments affecting the Company will be

those that it has anticipated. Actual results may differ materially

from these expectations due to risks related to disruption to the

global supply chain, risks related to the Company's strategy and

expansion plans, risks related to disruptions in our information

technology systems and our ability to maintain and upgrade those

systems, risks related to the inability to successfully implement

our online retail operations, risks related to cyberattacks or

other cyber incidents, risks related to increased usage of machine

learning and other types of artificial intelligence in our

business, and challenges with properly managing its use; risks

related to our ability to select, obtain, distribute and market

merchandise profitably, risks related to our reliance on

merchandise manufactured outside of the United States, the

availability of suitable new store locations and the dependence on

the volume of traffic to our stores, risks related to changes in

consumer preferences and economic conditions, risks related to

increased operating costs, including wage rates, risks related to

inflation and increasing commodity prices, risks related to

potential systematic failure of the banking system in the United

States or globally, risks related to extreme weather, pandemic

outbreaks, global political events, war, terrorism or civil unrest

(including any resulting store closures, damage, or loss of

inventory), risks related to leasing, owning or building

distribution centers, risks related to our ability to successfully

manage inventory balance and inventory shrinkage, quality or safety

concerns about the Company's merchandise, increased competition

from other retailers including online retailers, risks related to

the seasonality of our business, risks related to our ability to

protect our brand name and other intellectual property, risks

related to customers' payment methods, risks related to domestic

and foreign trade restrictions including duties and tariffs

affecting our domestic and foreign suppliers and increasing our

costs, including, among others, the direct and indirect impact of

current and potential tariffs imposed and proposed by the United

States on foreign imports, risks associated with the restrictions

imposed by our indebtedness on our current and future operations,

the impact of changes in tax legislation and accounting standards

and risks associated with leasing substantial amounts of space. For

further details and a discussion of these risks and uncertainties,

see the Company's periodic reports, including the annual report on

Form 10-K, quarterly reports on Form 10-Q and current reports on

Form 8-K, filed with or furnished to the Securities and Exchange

Commission and available at www.sec.gov. If one or more of these

risks or uncertainties materialize, or if any of the Company's

assumptions prove incorrect, the Company's actual results may vary

in material respects from those projected in these forward-looking

statements. Any forward-looking statement made by the Company in

this news release speaks only as of the date on which the Company

makes it. Factors or events that could cause the Company's actual

results to differ may emerge from time to time, and it is not

possible for the Company to predict all of them. The Company

undertakes no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by any

applicable securities laws.

About Five Below:Five Below is a leading

high-growth value retailer offering trend-right, high-quality

products loved by tweens, teens and beyond. We believe life is

better when customers are free to "let go & have fun" in an

amazing experience filled with unlimited possibilities. With most

items priced between $1 and $5, and some extreme value items priced

beyond $5 in our incredible Five Beyond Shop, Five Below makes it

easy to say YES! to the newest, coolest stuff across eight awesome

Five Below worlds: Style, Room, Sports, Tech, Create, Party, Candy

and New & Now. Founded in 2002 and headquartered in

Philadelphia, Pennsylvania, Five Below today has nearly 1,600

stores in 43 states. For more information, please visit

www.fivebelow.com or find Five Below on Instagram, TikTok, and

Facebook @FiveBelow.

Investor Contact:Five Below, Inc.Christiane

PelzVice President, Investor Relations &

Treasury215-207-2658investorrelations@fivebelow.com

|

FIVE BELOW, INC.Consolidated Balance

Sheets(Unaudited)(in thousands) |

| |

| |

February 3, 2024 |

|

January 28, 2023 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

179,749 |

|

|

$ |

332,324 |

|

|

Short-term investment securities |

|

280,339 |

|

|

|

66,845 |

|

|

Inventories |

|

584,627 |

|

|

|

527,720 |

|

|

Prepaid income taxes and tax receivable |

|

4,834 |

|

|

|

8,898 |

|

|

Prepaid expenses and other current assets |

|

153,993 |

|

|

|

130,592 |

|

|

Total current assets |

|

1,203,542 |

|

|

|

1,066,379 |

|

| Property and equipment, net |

|

1,134,312 |

|

|

|

925,530 |

|

| Operating lease assets |

|

1,509,416 |

|

|

|

1,319,132 |

|

| Long-term investment

securities |

|

7,791 |

|

|

|

— |

|

| Other assets |

|

16,976 |

|

|

|

13,870 |

|

| |

$ |

3,872,037 |

|

|

$ |

3,324,911 |

|

| |

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Line of credit |

$ |

— |

|

|

$ |

— |

|

|

Accounts payable |

|

256,275 |

|

|

|

221,120 |

|

|

Income taxes payable |

|

41,772 |

|

|

|

19,928 |

|

|

Accrued salaries and wages |

|

30,028 |

|

|

|

25,420 |

|

|

Other accrued expenses |

|

146,887 |

|

|

|

136,316 |

|

|

Operating lease liabilities |

|

240,964 |

|

|

|

199,776 |

|

|

Total current liabilities |

|

715,926 |

|

|

|

602,560 |

|

| Other long-term liabilities |

|

6,826 |

|

|

|

4,296 |

|

| Deferred income taxes |

|

66,743 |

|

|

|

59,151 |

|

| Long-term operating lease

liabilities |

|

1,497,586 |

|

|

|

1,296,975 |

|

|

Total liabilities |

|

2,287,081 |

|

|

|

1,962,982 |

|

| Shareholders’ equity: |

|

|

|

|

Common stock |

|

551 |

|

|

|

555 |

|

|

Additional paid-in capital |

|

182,709 |

|

|

|

260,784 |

|

|

Retained earnings |

|

1,401,696 |

|

|

|

1,100,590 |

|

|

Total shareholders’ equity |

|

1,584,956 |

|

|

|

1,361,929 |

|

| |

$ |

3,872,037 |

|

|

$ |

3,324,911 |

|

|

FIVE BELOW, INC.Consolidated Statements of

Operations(Unaudited)(in thousands, except share and per share

data) |

| |

| |

Fourteen weeks ended |

|

Thirteen weeks ended |

|

Fifty-three weeks ended |

|

Fifty-two weeks ended |

| |

February 3, 2024 |

|

January 28, 2023 |

|

February 3, 2024 |

|

January 28, 2023 |

|

Net sales |

$ |

1,337,736 |

|

|

$ |

1,122,751 |

|

|

$ |

3,559,369 |

|

|

$ |

3,076,308 |

|

| Cost of goods sold (exclusive

of items shown separately below) |

|

786,122 |

|

|

|

670,354 |

|

|

|

2,285,544 |

|

|

|

1,980,817 |

|

| Selling, general and

administrative expenses |

|

246,078 |

|

|

|

197,709 |

|

|

|

757,507 |

|

|

|

644,831 |

|

| Depreciation and

amortization |

|

37,094 |

|

|

|

28,919 |

|

|

|

130,747 |

|

|

|

105,617 |

|

|

Operating income |

|

268,442 |

|

|

|

225,769 |

|

|

|

385,571 |

|

|

|

345,043 |

|

| Interest income and other

income, net |

|

4,107 |

|

|

|

2,150 |

|

|

|

15,530 |

|

|

|

2,491 |

|

|

Income before income taxes |

|

272,549 |

|

|

|

227,919 |

|

|

|

401,101 |

|

|

|

347,534 |

|

| Income tax expense |

|

70,350 |

|

|

|

56,599 |

|

|

|

99,995 |

|

|

|

86,006 |

|

| Net income |

$ |

202,199 |

|

|

$ |

171,320 |

|

|

$ |

301,106 |

|

|

$ |

261,528 |

|

| Basic income per common

share |

$ |

3.66 |

|

|

$ |

3.09 |

|

|

$ |

5.43 |

|

|

$ |

4.71 |

|

| Diluted income per common

share |

$ |

3.65 |

|

|

$ |

3.07 |

|

|

$ |

5.41 |

|

|

$ |

4.69 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic shares |

|

55,194,999 |

|

|

|

55,524,883 |

|

|

|

55,487,252 |

|

|

|

55,547,267 |

|

|

Diluted shares |

|

55,356,074 |

|

|

|

55,808,193 |

|

|

|

55,621,619 |

|

|

|

55,745,279 |

|

|

FIVE BELOW, INC.Consolidated Statements of Cash

Flows(Unaudited)(in thousands) |

|

|

| |

Fifty-three weeks ended |

|

Fifty-two weeks ended |

| |

February 3, 2024 |

|

January 28, 2023 |

| Operating activities: |

|

|

|

|

Net income |

$ |

301,106 |

|

|

$ |

261,528 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

130,747 |

|

|

|

105,617 |

|

|

Share-based compensation expense |

|

17,859 |

|

|

|

23,583 |

|

|

Deferred income tax expense |

|

7,592 |

|

|

|

22,995 |

|

|

Other non-cash expenses |

|

351 |

|

|

|

409 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Inventories |

|

(56,907 |

) |

|

|

(72,616 |

) |

|

Prepaid income taxes and tax receivable |

|

4,064 |

|

|

|

2,427 |

|

|

Prepaid expenses and other assets |

|

(26,651 |

) |

|

|

(39,379 |

) |

|

Accounts payable |

|

35,133 |

|

|

|

24,891 |

|

|

Income taxes payable |

|

21,844 |

|

|

|

(8,168 |

) |

|

Accrued salaries and wages |

|

4,608 |

|

|

|

(28,119 |

) |

|

Operating leases |

|

51,515 |

|

|

|

30,022 |

|

|

Other accrued expenses |

|

8,358 |

|

|

|

(8,264 |

) |

|

Net cash provided by operating activities |

|

499,619 |

|

|

|

314,926 |

|

| Investing activities: |

|

|

|

|

Purchases of investment securities and other investments |

|

(416,649 |

) |

|

|

(56,459 |

) |

|

Sales, maturities, and redemptions of investment securities |

|

195,364 |

|

|

|

304,473 |

|

|

Capital expenditures |

|

(335,050 |

) |

|

|

(251,954 |

) |

|

Net cash used in investing activities |

|

(556,335 |

) |

|

|

(3,940 |

) |

| Financing activities: |

|

|

|

|

Cash paid for Revolving Credit Facility financing costs |

|

— |

|

|

|

(248 |

) |

|

Net proceeds from issuance of common stock |

|

980 |

|

|

|

824 |

|

|

Repurchase and retirement of common stock |

|

(80,541 |

) |

|

|

(40,007 |

) |

|

Proceeds from exercise of options to purchase common stock and

vesting of restricted and performance-based restricted stock

units |

|

288 |

|

|

|

777 |

|

|

Common shares withheld for taxes |

|

(16,586 |

) |

|

|

(4,981 |

) |

|

Net cash used in financing activities |

|

(95,859 |

) |

|

|

(43,635 |

) |

|

Net (decrease) increase in cash and cash equivalents |

|

(152,575 |

) |

|

|

267,351 |

|

| Cash and cash equivalents at

beginning of year |

|

332,324 |

|

|

|

64,973 |

|

| Cash and cash equivalents at

end of year |

$ |

179,749 |

|

|

$ |

332,324 |

|

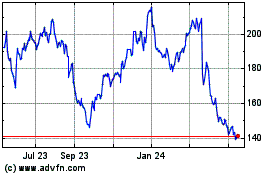

Five Below (NASDAQ:FIVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Five Below (NASDAQ:FIVE)

Historical Stock Chart

From Apr 2023 to Apr 2024