UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 6)1

Farmer Bros. Co.

(Name

of Issuer)

Common Stock, par value $1.00 per share

(Title of Class of Securities)

307675108

(CUSIP Number)

Aron R. English

22NW, LP

590 1st Ave. S

Unit C1

Seattle, Washington 98104

(206) 227-3078

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

March 6, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☒.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW Fund, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.3%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

* Percentage based on 21,074,434 Shares outstanding as of February 5, 2024,

as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on February 8, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.3%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

* Percentage based on 21,074,434 Shares outstanding as of February 5, 2024,

as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on February 8, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW Fund GP, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.3%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

* Percentage based on 21,074,434 Shares outstanding as of February 5, 2024,

as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on February 8, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW GP, Inc. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,955,526 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,955,526 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,955,526 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.3%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

* Percentage based on 21,074,434 Shares outstanding as of February 5, 2024,

as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on February 8, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Aron R. English |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO, PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,964,536 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,964,536 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,964,536 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.3%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Percentage based on 21,074,434 Shares outstanding as of February 5, 2024,

as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on February 8, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Bryson O. Hirai-Hadley |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

1,261 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

1,261 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

1,261 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1%* |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

* Percentage based on 21,074,434 Shares outstanding as of February 5, 2024,

as disclosed in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on February 8, 2024.

The following constitutes Amendment

No. 6 to the Schedule 13D filed by the undersigned (“Amendment No. 6”). This Amendment No. 6 amends the Schedule 13D as specifically

set forth herein.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On March 6, 2024, the Reporting

Persons and JCP (as defined in Amendment No. 4 to the Schedule 13D) entered into an Amendment to Letter Agreement (the “Amendment

to Letter Agreement”) with the Issuer. Pursuant to the Amendment to Letter Agreement, the parties to the Letter Agreement (as defined

in Amendment No. 5 to the Schedule 13D) modified the Letter Agreement by deleting Section 2(ii) thereof in its entirety. Other than as

modified thereby, the Letter Agreement will continue in effect and terminate in accordance with its terms.

The foregoing description

of the Amendment to Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the Amendment to

Letter Agreement, which is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

On March 6, 2024, the Reporting

Persons, JCP and the Issuer entered into the Amendment to Letter Agreement as defined and described in Item 4 above and attached as Exhibit

99.1 hereto.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibit:

| 99.1 | Amendment to Letter Agreement, dated March 6, 2024. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: March 7, 2024

| |

22NW FUND, LP |

| |

|

| |

By: |

22NW Fund GP, LLC

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW, LP |

| |

|

| |

By: |

22NW GP, Inc.

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

22NW FUND GP, LLC |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW GP, INC. |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

/s/ Aron R. English |

| |

ARON R. ENGLISH |

| |

/s/ Bryson O. Hirai-Hadley |

| |

BRYSON O. HIRAI-HADLEY |

Exhibit 99.1

March 6, 2024

JCP Investment Partnership, LP

1177 West Loop South, Suite 1320

Houston, TX 77027

22NW, LP

590 1st Ave. S, Unit C1

Seattle, WA 98104

| Email: | english@englishcap.com |

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, NY 10019

| Attn: | Ryan Nebel

Rebecca Van Derlaske |

| Email: | rnebel@olshanlaw.com

rvanderlaske@olshanlaw.com |

Re: Amendment to Letter Agreement

Dear Messrs. Pappas and English:

Reference is hereby made

to the letter agreement (the “letter agreement”), dated November 7, 2023, by and among Farmer Bros. Co. (the “Company”),

JCP Investment Partnership, LP (collectively with JCP Investment Partners, LP, JCP Investment Holdings, LLC, JCP Investment Management,

LLC and James C. Pappas, “JCP”), 22NW, LP (collectively with 22NW Fund, LP, 22NW Fund GP, LLC, 22NW GP, Inc., Aron R. English,

"22NW") and Bryson O. Hirai-Hadley. In accordance with Section 9 of the letter agreement, the parties to the letter agreement

hereby modify the letter agreement by deleting Section 2(ii) thereof in its entirety. Other than as modified hereby, the letter agreement

will continue in effect and terminate in accordance with its terms.

[Remainder of page intentionally left blank; signature

pages follow.]

IN WITNESS WHEREOF,

the undersigned has duly executed this amendment to the letter agreement as of the date first written above.

| |

COMPANY: |

| |

|

| |

FARMER BROS. CO. |

| |

|

| |

By: |

/s/ John E. Moore, III |

| |

|

Name: |

John E. Moore, III |

| |

|

Title: |

Chief Executive Officer |

| |

Address for Notices to the Company: |

| |

|

| |

Farmer Bros. Co. |

| |

1912 Farmer Brothers Drive |

| |

Northlake, TX 76262 |

| |

Attn: General Counsel |

| |

Email: LegalDepartment@farmerbros.com |

Signature Page to Amendment to Letter Agreement

IN WITNESS WHEREOF, the undersigned

has duly executed this amendment to the letter agreement as of the date first written above.

| |

JCP: |

| |

|

| |

/s/ James C. Pappas |

| |

James C. Pappas, individually and on behalf of JCP Investment Partnership, LP, JCP Investment Partners, LP, JCP Investment Holdings, LLC and JCP Investment Management, LLC, in his appropriate capacity for each entity |

| |

Address for Notices to JCP: |

| |

|

| |

1177 West Loop South, Suite 1320 |

| |

Houston, TX 77027 |

| |

Attn: James C. Pappas |

| |

Email: jcp@jcpinv.com |

Signature Page to Amendment to Letter Agreement

IN WITNESS WHEREOF, the undersigned

has duly executed this amendment to the letter agreement as of the date first written above.

| |

22NW: |

| |

|

| |

/s/ Aron R. English |

| |

Aron R. English, individually and on behalf of 22NW, LP, 22NW Fund, LP, 22NW Fund GP, LLC and 22NW GP, Inc., in his appropriate capacity for each entity |

| |

Address for Notices to 22NW: |

| |

|

| |

590 1st Ave. S, Unit C1 |

| |

Seattle, WA 98104 |

| |

Attn: Aron R. English |

| |

Email: english@englishcap.com |

Signature Page to Amendment to Letter Agreement

IN WITNESS WHEREOF,

the undersigned has duly executed this amendment to the letter agreement as of the date first written above.

| |

/s/ Bryson O. Hirai-Hadley |

| |

Bryson O. Hirai-Hadley |

Signature Page to Amendment to Letter Agreement

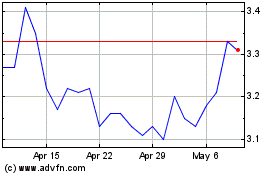

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

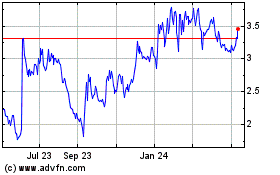

Farmer Brothers (NASDAQ:FARM)

Historical Stock Chart

From Apr 2023 to Apr 2024