CSX Moderates Outlook for 2016 Coal Volume Declines

September 07 2016 - 11:59AM

Dow Jones News

By Tess Stynes

CSX Corp. (CSX) moderated its 2016 guidance for declines in coal

shipments, a major source of revenue for railroad operators, citing

an improved outlook for coal exports.

The Jacksonville, Fla., company's shares, up 10% this year, rose

1.8% to $28.63 in recent trading.

CSX and other railroad companies have been hit as weak demand

for coal in recent years has contributed to lower freight

volume.

At an industry conference on Wednesday, CSX Finance Chief Frank

Lonegro said the company now expects coal exports to reach roughly

25 million tons this year, compared with the company's previous

estimate of about 20 million tons, citing modest improvements in

global markets.

As a result, CSX now expects its 2016 coal market shipments will

decline between 20% and 25%, compared with its earlier view for a

drop of roughly 25%.

Mr. Lonegro said the company expects its per-share earnings for

the third quarter will come in slightly below the 47 cents a share

CSX reported for the second quarter. Analysts polled by Thomson

Reuters projected per-share earnings of 45 cents.

CSX expects overall freight volume declines at the high end of

its previous estimate for a drop in the mid to high single digits

on a percentage basis. Mr. Lonegro said CSX expects the lower

volume will be partly offset by improving efficiency and higher

pricing.

CSX has met or exceeded earnings expectations in recent

quarters, having responded to sector turmoil with efficiency moves

that included layoffs and the mothballing of trains.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

September 07, 2016 11:44 ET (15:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

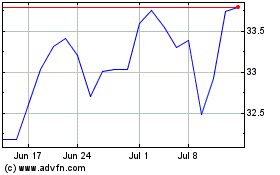

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

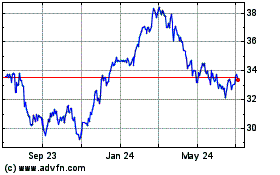

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024