0001482981FALSE00014829812024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 6, 2024

_____________________________

The Vita Coco Company, Inc.

(Exact name of registrant as specified in its charter)

_____________________________

| | | | | | | | | | | | | | |

Delaware | | 001-40950 | | 11-3713156 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

250 Park Avenue South

Seventh Floor

New York, New York 10003

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, include area code) (212) 206-0763

N/A

(Former Name or Former Address, if Changed Since Last Report)

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class |

| Trading Symbols |

| Name of each exchange on which registered |

Common Stock, $0.01 par value per share |

| COCO |

| The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 4, 2024 (the “Effective Date”), The Vita Coco Company, Inc. (the “Company”) entered into a Second Amendment (the “Second Amendment”) to that certain Amended and Restated Employment Agreement, by and between the Company and Michael Kirban, dated October 20, 2021, as further amended effective as of May 2, 2022 (the “Employment Agreement”), which extends the term of the Employment Agreement and provides that Mr. Kirban will continue to be employed by the Company in the role of Executive Chairman and also continue to serve as Chairman of the Board of Directors of the Company (the “Board”).

Pursuant to the Second Amendment, (i) Mr. Kirban shall continue to serve as the Company’s Executive Chairman and Co-Founder and provide his services in such capacity through December 31, 2027, (ii) in his capacity as Executive Chairman, Mr. Kirban shall continue to report to the Board, (iii) Mr. Kirban’s rate of base salary will be increased to at least $525,000 per year; provided, that such compensation shall be annually reviewed by the Compensation Committee of the Board, (iv) Mr. Kirban’s annual cash bonus percentage will be increased from 80% to 100% of his then-current base salary, and his additional stretch cash bonus percentage will be increased from 80% to 100% of his then-current base salary, (v) Mr. Kirban may not be terminated without “cause” (as such term is defined in the Employment Agreement) prior to December 31, 2026, and (vi) the Board will no longer have the ability to move Mr. Kirban from full-time to part-time employee of the Company without triggering Mr. Kirban’s right to resign for “good reason” (as such term is defined in the Employment Agreement).

The foregoing description of the Second Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amendment, a copy which is filed herewith as Exhibit 10.1 and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 10.1 | | |

104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| THE VITA COCO COMPANY, INC. |

|

|

|

Date: March 6, 2024 | By: | /s/ Martin Roper |

|

| Name: Martin Roper |

|

| Title: Chief Executive Officer |

SECOND AMENDMENT TO EMPLOYMENT AGREEMENT

This Second Amendment to the Amended and Restated Employment Agreement (as amended) (this “Amendment”) is made and entered into as of March 4, 2024, by and between THE VITA COCO COMPANY, INC., a Delaware corporation (together with its predecessors and successors, the “Corporation”) and MICHAEL KIRBAN (the “Employee”).

WITNESSETH:

WHEREAS, the Corporation and the Employee previously entered into that certain Amended and Restated Employment Agreement, made and entered into as of October 20, 2021 and amended pursuant to that First Amendment to Employment Agreement, dated May 2, 2022 (the “Agreement”), pursuant to which Employee currently is employed by the Corporation; and

WHEREAS, the Corporation and the Employee wish to enter into this Amendment to modify certain terms of the Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth below, it is hereby covenanted and agreed by the Corporation and the Employee as follows:

1. Amendment to Section 1. Section 1 of the Agreement is hereby deleted in its entirety and hereby replaced with the following new Section 1:

“1. The Corporation hereby agrees to continue to employ the Employee as its Executive Chairman, and the Employee, in such capacity, agrees to continue to provide services to the Corporation for the period beginning on the Effective Date and ending on December 31, 2027 (the “Term” or the “Employment Period”). During the Term and at all times thereafter (and notwithstanding the termination of the Employee’s employment for any reason), the Employee shall retain, in perpetuity, the title of “Co Founder” of the Corporation.”

2. Amendment to Section 2(a). Section 2(a) of the Agreement is hereby deleted in its entirety and hereby replaced with the following new Section 2(a):

“(a) In his capacity as Executive Chairman, the Employee shall have such powers and responsibilities as customarily assigned to an executive chairman of a corporation. Employee shall continue to report to the Board.”

3. Amendment to Section 3(a). Section 3(a) of the Agreement is hereby deleted in its entirety and hereby replaced with the following new Section 3(a):

“(a) The Employee shall receive a rate of salary that is not less than $525,000 per year (the “Salary”), payable in substantially equal monthly or more frequent installments and subject to normal and customary tax withholding and other deductions, all on a basis consistent with the Corporation’s normal payroll procedures and policies. During the thirty (30) day period prior to the expiration of each successive twelve (12) month period during the Term, the Employee’s salary rate shall be reviewed by the Compensation Committee or, if no Compensation Committee is then in place, the Board, to determine whether an increase in his rate of compensation is appropriate, which determination shall be within the sole discretion of the Compensation Committee or the Board, whichever is applicable.”

4. Amendment to Section 3(b). Section 3(b) of the Agreement is hereby deleted in its entirety and hereby replaced with the following new Section 3(b):

“(b) The Employee shall be eligible to receive, for each calendar year during the Employment Period, a bonus (the “Bonus”) of up to a maximum of 100% of the Employee’s then applicable Salary and a stretch bonus (the “Stretch Bonus”) of up to an additional 100% of the Employee’s then applicable Salary, both of which will be based upon the Corporation achieving certain performance goals for each calendar year, which shall be determined by the Board (in consultation with Employee), within the first sixty (60) days following the commencement of such calendar year. The Bonus and Stretch Bonus, if any, shall accrue (and be computed) upon the completion of the applicable calendar year and shall be paid on or about February 15th of the calendar year following the end of the calendar year to which the Bonus and Stretch Bonus relates. Except as provided in Section

5, the Employee must remain continuously employed with the Corporation through December 31 of the applicable performance year in order to be eligible to receive his bonus payment entitlement (“earned bonus”).”

5. Deletion of Section 3(g). Section 3(g) of the Agreement is hereby deleted in its entirety.

6. Amendment to Section 4(d). Section 4(d) of the Agreement is hereby deleted in its entirety and hereby replaced with the following new Section 4(d):

“(d) Termination by the Corporation without Cause. The Corporation may terminate the Employee’s employment hereunder without Cause at any time after December 31, 2026 by providing sixty (60) days written notice to the Employee; provided that such notice may be provided prior to December 31, 2026. The Corporation may not terminate the Employee’s employment without Cause prior to December 31, 2026. For purposes hereof, the determination to remove the Employee without Cause shall be made by the Board as follows: (i) from December 31, 2026 through December 30, 2027, any termination without Cause shall be determined by a supermajority vote of the Board (i.e., the vote of all directors other than the vote of the directors appointed by the Employee) and (ii) from December 31, 2027 through the remainder of the Employment Period, as may be extended by mutual agreement through December 31, 2028, any termination without Cause shall be determined by a simple majority vote of the Board. For the avoidance of doubt, nothing herein shall limit the Corporation’s right to terminate the Employee’s employment for Cause, at any time, in accordance with this Agreement.”

7. Amendment to Section 5(a)(iii). Section 5(a)(iii) of the Agreement is hereby deleted in its entirety and replaced with the following new Section 5(a)(iii):

“(iii) For purposes of clarity, nothing contained herein shall permit the Corporation to terminate Employee’s employment without Cause prior to December 31, 2026, nor shall anything limit the Employee’s recourse if the Employee is terminated in contravention of this Agreement at any time during the Employment Period.”

8. Amendment to Section 5A. Section 5A of the Agreement is hereby deleted in its entirety and replaced with the following new Section 5A:

“5A. Transition to Part‑Time Position. The Employee may, at any time in his discretion, elect to move from a full‑time employee to a part‑time employee of the Corporation, without being deemed in breach of this Agreement.”

9. Status of Agreement. Except to the limited extent expressly amended hereby, the Agreement and its terms and conditions remain in full force and effect and unchanged by this Amendment. Capitalized terms used herein but not defined herein shall have the meanings ascribed such terms in the Agreement.

10. Counterparts and Facsimile Signatures. This Amendment may be executed in one or more counterparts hereof, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Facsimile signatures are permitted and shall be binding for purposes of this Amendment.

IN WITNESS WHEREOF, the Employee and the Corporation have executed this Amendment as of the day and year first above written.

Employee

/s/ Michael Kirban______________

MICHAEL KIRBAN

Corporation

THE VITA COCO COMPANY, INC.

/s/ Martin Roper______________

By: Martin Roper

Title: Chief Executive Officer

v3.24.0.1

Cover

|

Mar. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

The Vita Coco Company, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40950

|

| Entity Tax Identification Number |

11-3713156

|

| Entity Address, Address Line One |

250 Park Avenue South

|

| Entity Address, Address Line Two |

Seventh Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10003

|

| City Area Code |

212

|

| Local Phone Number |

206-0763

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

COCO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001482981

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 06, 2024

|

| Entity Information [Line Items] |

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

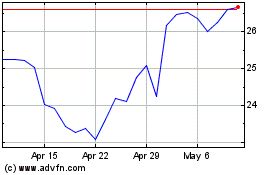

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

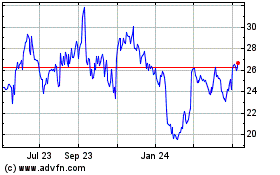

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Apr 2023 to Apr 2024