By Benjamin Mullin and Lillian Rizzo

Sports TV networks are facing a big problem: They have virtually

no games to put on the air.

In quick succession over the past 24 hours, the National

Basketball Association, National Hockey League and Major League

Baseball announced they were suspending operations due to concerns

about the coronavirus pandemic, and the NCAA canceled its men's and

women's basketball tournaments.

Now, their broadcast partners could face significant fallout.

The networks that carry NBA games will take a substantial hit to

advertising revenue and could potentially be on the hook for big

rights-fees payments, according to analysts and people familiar

with sports-rights deals.

Walt Disney Co.'s ESPN and AT&T Inc.'s Turner, the parent of

TNT, together spend about $2.7 billion annually to show NBA games

nationally. In addition, regional sports networks owned by media

giants such as Comcast Corp. and Sinclair Broadcast Group Inc.,

among others, air NBA games in local markets.

Comcast also is the NHL's major broadcast partner. Meanwhile,

ESPN, Turner and Fox Corp.'s Fox all have MLB rights.

The NBA is the most popular of the professional leagues that

suspended operations. Losing NBA games will leave a major hole in

the TV networks' prime-time schedules, translating into lower

ratings that will harm their ad sales -- especially if the season

doesn't resume for the playoffs that normally begin in April,

analysts said.

In the last NBA season, TV networks brought in nearly $600

million in ad revenue from NBA games and $972 million from the

playoffs, according to research firm Kantar.

Networks' other major stream of revenue -- from the

channel-carriage fees paid by cable-TV distributors -- also could

be impacted. Distributors require some TV programmers to air a

minimum number of games; if they don't, the carriage fees could be

cut, according to a report by Rich Greenfield, an analyst for

LightShed Partners. Since most of the NBA season is complete, he

said, many TV programmers may have met the quota for telecasts.

As networks assess the possible damage, a major variable is how

soon the NBA can resume play. If it can do so relatively quickly,

the worst business impact could be avoided, people close to the

networks say.

Mark Cuban, owner of the Dallas Mavericks and a streaming-video

entrepreneur, called the suspension of the NBA games due to the

coronavirus a "black swan event," adding that the league and its

partners are "in new territory."

"In terms of impact on media, it really depends on how the virus

plays out," Mr. Cuban said in an email. "The NBA and major media

companies will have to focus on the health and safety of their

employees and stakeholders. That will drive all

decision-making."

The suspension of the major sports leagues could have wider

implications for the pay television industry. Cable and satellite

TV providers have lost millions of subscribers to cord-cutting over

the past several years.

Live sports has been one of the major selling points of the

traditional TV bundle. The NBA's suspension could potentially

accelerate pay-TV cancellations, said Michael Nathanson, an analyst

for MoffettNathanson.

"We worry about seasonal churn," Mr. Nathanson said. "We think

sports is the glue for subscribers."

It's unclear whether the networks will be required to pay rights

fees for the full NBA season even though they aren't airing games.

Some media executives likened the season's suspension to the

1998-1999 NBA season, which was shortened due to a lockout. That

year, networks still paid rights fees.

Media contracts, including sports-rights deals, often include

exit clauses for both sides for catastrophic events, but it isn't

certain that those would apply in this case. The league could work

with TV networks to help them mitigate any losses from advertising

and distribution partners, including by letting them air more NBA

games in subsequent seasons, the people familiar with the NBA

rights deals said.

"This is an unprecedented situation," ESPN said in a statement.

"We have great relationships with our league partners and are

confident we can address all issues constructively going forward.

Our immediate focus is on everyone's safety and well-being."

After several college basketball tournaments were canceled, ESPN

put its "SportsCenter" program on throughout the day on its main

network and the ESPN2 channel simulcast programming from ESPN and

ESPNNews to fill the airtime.

A Turner Sports spokesman said the company is supportive of the

NBA's decision to "protect the health and well-being of everyone

involved."

Turner and ViacomCBS Inc.'s CBS Sports, which air the NCAA

tournament, known as "March Madness," said they were fully

supportive of its cancellation.

Like other networks, CBS will be filling its air with a mix of

substitute programming, which will include a mix of news,

prime-time entertainment and daytime shows, said a person familiar

with the network's plans.

In a statement, Fox Sports said: "We fully support our league

partners and are actively working with them to navigate this

evolving and unprecedented situation."

NBC Sports didn't have immediate comment.

Sinclair, which owns more than 20 regional sports networks,

including many that air NBA games, anticipates scenarios such as

this in its TV-rights agreements, said Jeff Krolik, president of

Sinclair's local sports unit. The company will continue to monitor

the situation and hold discussions with the league, teams and

pay-TV providers, he said.

David Levy, the former head of Turner Sports who struck the

unit's multibillion-dollar deal with the NBA, said that major

networks' first business priority should be preserving their

long-term relationships with leagues by supporting their decision

to protect their players.

"I wouldn't be thinking about profits and revenues at this

moment," Mr. Levy said. "I would be thinking about our employees

and our country."

Write to Benjamin Mullin at Benjamin.Mullin@wsj.com and Lillian

Rizzo at Lillian.Rizzo@wsj.com

(END) Dow Jones Newswires

March 12, 2020 19:06 ET (23:06 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

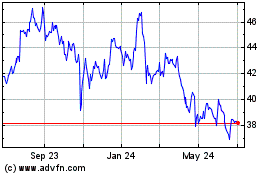

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

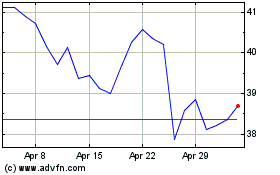

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024