0001879103falseCFSB Bancorp, Inc. /MA/X100018791032024-01-262024-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2024

CFSB Bancorp, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

United States of America |

001-41220 |

87-4396534 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

15 Beach Street, Quincy, Massachusetts |

|

02170 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 471-0750

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

CFSB |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition

On January 26, 2024, CFSB Bancorp, Inc., the holding company for Colonial Federal Savings Bank, issued a press release reporting its financial results for the three and six months ended December 31, 2023.

A copy of the press release announcing the results is included as Exhibit 99.1 to this Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits

Exhibit No. Description

99.1 Earnings Release dated January 26, 2024

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

CFSB BANCORP, INC. |

|

|

|

|

Date: January 26, 2024 |

|

By: |

/s/ Susan Shea |

|

|

|

Susan Shea |

|

|

|

Treasurer & Chief Operating Officer |

2

Exhibit 99.1

|

|

News Release - For Immediate Release January 26, 2024 |

For More Information, Contact: Michael E. McFarland, President and Chief Executive Officer (617-471-0750) |

CFSB BANCORP, INC. ANNOUNCES FISCAL SECOND QUARTER AND YEAR-TO-DATE 2024 FINANCIAL RESULTS

QUINCY, Massachusetts, January 26, 2024 – CFSB Bancorp, Inc. (the “Company”) (NASDAQ Capital Market: CFSB), the holding company for Colonial Federal Savings Bank (the “Bank”), today announced a net loss of $210,000, or ($0.03) per basic and diluted share, for the three months ended December 31, 2023 compared to net income of $123,000, or $0.02 per basic and diluted share, for the three months ended September 30, 2023 and net income of $341,000, or $0.05 per basic and diluted share, for the three months ended December 31, 2022.

For the six months ended December 31, 2023, net loss was $87,000, or ($0.01) per basic and diluted share, compared to net income of $986,000, or $0.16 per basic and diluted share, for the six months ended December 31, 2022.

Michael E. McFarland, President and Chief Executive Officer, stated “A recent pause from the Federal Reserve on interest rate increases provides some optimism going forward that the cost of funds will stabilize, and loan demand will start to show signs of recovery. We remain encouraged that the economy will land softly and we will benefit from a more stable interest rate environment.”

Second Quarter Operating Results

Net interest income, on a fully tax-equivalent basis, decreased by $168,000, or 9.2%, to $1.7 million for the three months ended December 31, 2023, from $1.8 million for the three months ended September 30, 2023. This decrease was primarily due to a 53 basis point increase in the average rate on certificates of deposit, partially offset by a 9 basis point increase in the average yield on loans and a 12 basis point decrease in the average rate on FHLB advances. The interest on loans increased $36,000, for the three months ended December 31, 2023 compared to the three months ended September 30, 2023. The interest on loans benefited from rising interest rates, partially offset by a $517,000 decrease in the average balance of loans to $176.2 million during the three months ended December 31, 2023. The net interest margin decreased by 20 basis points to 2.02% for the three months ended December 31, 2023, from 2.22% for the three months ended September 30, 2023.

Net interest income, on a fully tax-equivalent basis, decreased by $703,000, or 29.7%, to $1.7 million for the three months ended December 31, 2023, from $2.4 million for the three months ended December 31, 2022. The net interest margin decreased by 75 basis points to 2.02% for the three months ended December 31, 2023, from 2.77% for the three months ended December 31, 2022. The decline was primarily due to a 235 basis point increase in the average rate for certificates of deposit, partially offset by a $16.9 million decrease in the average balance of interest-bearing deposits and a 26 basis point increase in the average yield on interest-earning assets. The interest earned on loans increased $101,000, to $1.8 million for the three months ended December 31, 2023, from $1.7 million for the three months ended December 31, 2022. The interest earned on securities increased $96,000, to $997,000 for the three months ended December 31, 2023, from $901,000 for the three months ended December 31, 2022. The interest earned on loans and securities benefited from rising interest rate, offset by decreases in the average balance.

The Company recorded reversals of the provision for credit losses of $104,000 and $166,000 for the three months ended December 31, 2023 and September 30, 2023, respectively. The reversals of the provision for credit losses were recorded due to improved forecasted economic conditions. The Company did not record a provision for loan losses during the three months ended December 31, 2022. The allowance for credit losses as a percentage of total loans was 0.93%, 0.94% and 0.97% at December 31, 2023, September 30, 2023 and December 31, 2022, respectively.

Non-interest income increased $12,000, or 7.5%, to $172,000 for the three months ended December 31, 2023, from $160,000 for the three months ended September 30, 2023, due to an increase of $13,000 in other income.

Non-interest income increased $20,000, or 13.2%, to $172,000 for the three months ended December 31, 2023, from $152,000 for the three months ended December 31, 2022, primarily due to an increase of $14,000 in other income.

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

1

Non-interest expenses increased $193,000, or 10.1%, to $2.1 million for the three months ended December 31, 2023, from $1.9 million for the three months ended September 30, 2023. The increase was due to an increase in salaries and employee benefits of $123,000, or 10.8%, due to stock-based compensation expense and increases in other general and administrative expenses of $74,000, or 20.7%, primarily due to increases in printing, postage, legal and annual meeting expenses.

Non-interest expenses increased $22,000, or 1.1%, to $2.1 million for the three months ended December 31, 2023, from $2.1 million for the quarter ended December 31, 2022. The increase was principally due to an increase in other general and administrative expenses of $27,000, or 6.7%, due to costs associated with our annual meeting.

Income tax expense was $16,000 for the three months ended December 31, 2023, compared to $93,000 for the three months ended September 30, 2023 and $65,000 for the three months ended December 31, 2022. The decrease in income tax expense for the three months ended December 31, 2023, compared to the three months ended September 30, 2023 and compared to the three months ended December 31, 2022, was due to decreases in income before income taxes.

Year-to-Date Operating Results

Net interest income decreased, on a fully tax-equivalent basis, by $1.3 million, or 26.6%, to $3.5 million for the six months ended December 31, 2023, from $4.8 million for the six months ended December 31, 2022. Total interest-earning assets income increased $244,000 from the prior year period due to higher average yields on loans, securities and cash and short-term investments. A 25 basis point increase in the average yield on loans, offset by a decrease in the average balance of loans of $734,000, or 0.4%, contributed to a $204,000 increase in loan income. A 28 basis point increase in the average yield on securities, offset by a decrease in the average balance of securities of $788,000, or 0.5%, contributed to a $196,000 increase in securities income. The interest earned on cash and short-term investments decreased $156,000 from the prior year, due to a $13.2 million decrease in the average balance of cash and short-term investments offset by a 164 basis point increase in the average yield. Partially offsetting the increase in interest and dividend income was a $1.5 million increase in interest expense due to an increase in the interest on certificates of deposit of $1.4 million and the increase in interest on FHLB advances of $164,000 from the prior year. The Company recognized a 131 basis point increase in the cost of interest-bearing liabilities. The net interest margin decreased 64 basis points for the six months ended December 31, 2023, to 2.12%, from 2.76% in the prior year period.

The Company recognized a reversal of the provision for credit losses of $270,000 for the six months ended December 31, 2023, compared to no provision for loan losses in the prior year period. For the six months ended December 31, 2023 improvements in the economy were the primary contributor for the reversal of the provision for credit losses.

Non-interest income decreased $20,000, or 5.7%, to $332,000 for the six months ended December 31, 2023 from $352,000 in the prior year period, due to a decrease of $31,000 in other income offset by an increase of $7,000 in income on bank-owned life insurance.

Non-interest expenses increased $190,000, or 5.0%, to $4.0 million for the six months ended December 31, 2023, from $3.8 million for the six months ended December 31, 2022. Salaries and benefits increased $143,000, or 6.3%, to $2.4 million, due to annual increases to salaries and health insurance of employees and stock-based compensation expense. Other general and administrative expense increased $52,000, or 7.0%, from the prior year period due to increases in insurance, data processing and annual meeting costs.

Income tax expense decreased $126,000 to $109,000 for the six months ended December 31, 2023 compared to income tax expense of $235,000 for the six months ended December 31, 2022 due to lower pre-tax income.

Balance Sheet

Assets: At December 31, 2023, total assets amounted to $359.0 million, compared to $349.0 million at June 30, 2023, an increase of $10.0 million, or 2.9%, due to an $8.9 million increase in cash and cash equivalents and a $1.2 million increase in securities held to maturity and a $569,000 increase in FHLB stock. The increase in cash and cash equivalents was due to increased borrowings from the FHLB, the increase in securities held to maturity was a result of reinvesting accumulated cash at higher interest rates, and the increase in FHLB stock was due to the increase in FHLB advances during the six months ended December 31, 2023.

Liabilities: Deposits decreased by $5.5 million, or 2.1%, during the six months as the Bank experienced decreases of customer deposits due to increases in inflation and competition. In addition, depositors moved deposits to higher-yielding term certificates due to the higher interest rate environment. Federal Home Loan Bank advances were $19.1 million at December 31, 2023 compared to $3.7 million at June 30, 2023, to add liquidity in light of decreases in customer deposits.

Stockholders' Equity. Total stockholders' equity decreased $94,000, to $75.8 million at December 31, 2023, from $75.9 million at June 30, 2023. The decrease was primarily due to the net loss of $87,000 and the effect of adoption of ASU 2016-13, net of taxes, of $223,000,

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

2

offset by the change in unearned ESOP compensation of $52,000, and stock-based compensation of $163,000, for the six months ended December 31, 2023.

On July 1, 2023, the Company adopted ASU 2016-13, which replaces the incurred loss methodology with an expected loss methodology that is referred to as the current expected credit loss methodology ("CECL"). The measurement of expected credit losses under the CECL methodology is applicable to financial assets measured at amortized cost, including loans receivable and securities held to maturity. In addition, ASU 326 made changes to the accounting of securities available for sale. It also applies to off-balance sheet credit exposures not accounted for as insurance, such as loan commitments, standby letters of credit, financial guarantees, and other similar instruments. The following table illustrates the impact of ASC 326:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-ASC Adoption |

|

|

As Reported Under ASC 326 |

|

|

|

|

(In thousands) |

|

June 30, 2023 |

|

|

July 1, 2023 |

|

|

Impact of ASC 326 Adoption |

|

Assets |

|

|

|

|

|

|

|

|

|

Allowance for credit losses on securities held to maturity |

|

$ |

- |

|

|

$ |

(276 |

) |

|

$ |

(276 |

) |

Allowance for credit losses on loans |

|

|

(1,747 |

) |

|

|

(1,759 |

) |

|

|

(12 |

) |

Deferred tax asset on allowance for credit losses |

|

|

466 |

|

|

|

378 |

|

|

|

(88 |

) |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

Allowance for credit losses on off-balance sheet exposures |

|

$ |

- |

|

|

$ |

23 |

|

|

$ |

23 |

|

|

|

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

|

|

|

|

Retained earnings |

|

$ |

50,416 |

|

|

$ |

50,193 |

|

|

$ |

(223 |

) |

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

3

About CFSB Bancorp, Inc.

CFSB Bancorp, Inc. is the federal mid-tier holding company of Colonial Federal Savings Bank and is the majority-owned subsidiary of 15 Beach, MHC. Colonial Federal Savings Bank is a federally chartered stock savings bank that has served the banking needs of its customers on the south shore of Massachusetts since 1889. It operates from three full-service offices and one limited-service office in Quincy, Holbrook and Weymouth, Massachusetts.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, which can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “assume,” “plan,” “seek,” “expect,” “will,” “may,” “should,” “indicate,” “would,” “contemplate,” “continue,” “target” and words of similar meaning. These forward-looking statements are based on our current beliefs and expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, demand for loan products, deposit flows, changes in the interest rate environment, the effects of inflation, potential recessionary conditions, general economic conditions or conditions within the securities markets, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Board of Governors of the FRB, changes in the quality, size and composition of our loan and securities portfolios, changes in liquidity, including the size and composition of our deposit portfolio, including the percentage of uninsured deposits in the portfolio; changes in demand for our products and services, legislative, accounting, tax and regulatory changes, the current or anticipated impact of military conflict, terrorism or other geopolitical events, a failure in or breach of our operational or security systems or infrastructure, including cyberattacks that could adversely affect the Company’s financial condition and results of operations and the business in which the Company and the Bank are engaged, the failure to maintain current technologies and the failure to retain or attract employees.

You should not place undue reliance on forward-looking statements. CFSB Bancorp, Inc. undertakes no obligation to revise these forward-looking statements or to reflect events or circumstances after the date of this press release.

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

4

CFSB Bancorp, Inc. and Subsidiary

Consolidated Balance Sheets (Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

June 30, |

|

|

|

2023 |

|

|

2023 |

|

Assets: |

|

|

|

|

|

|

Cash and due from banks |

|

$ |

1,299 |

|

|

$ |

1,486 |

|

Short-term investments |

|

|

14,425 |

|

|

|

5,375 |

|

Total cash and cash equivalents |

|

|

15,724 |

|

|

|

6,861 |

|

Securities available for sale, at fair value |

|

|

132 |

|

|

|

146 |

|

Securities held to maturity, at amortized cost, net of allowance for credit losses |

|

|

149,117 |

|

|

|

147,902 |

|

Loans: |

|

|

|

|

|

|

1-4 family |

|

|

138,445 |

|

|

|

140,109 |

|

Multifamily |

|

|

12,692 |

|

|

|

12,638 |

|

Second mortgages and home equity lines of credit |

|

|

3,542 |

|

|

|

2,699 |

|

Construction |

|

|

- |

|

|

|

- |

|

Commercial |

|

|

20,047 |

|

|

|

20,323 |

|

Total mortgage loans on real estate |

|

|

174,726 |

|

|

|

175,769 |

|

Consumer |

|

|

64 |

|

|

|

49 |

|

Home improvement |

|

|

2,220 |

|

|

|

2,191 |

|

Total loans |

|

|

177,010 |

|

|

|

178,009 |

|

Allowance for credit losses |

|

|

(1,641 |

) |

|

|

(1,747 |

) |

Net deferred loan costs and fees, and purchase premiums |

|

|

(395 |

) |

|

|

(351 |

) |

Loans, net |

|

|

174,974 |

|

|

|

175,911 |

|

Federal Home Loan Bank of Boston stock, at cost |

|

|

950 |

|

|

|

381 |

|

Premises and equipment, net |

|

|

3,317 |

|

|

|

3,413 |

|

Accrued interest receivable |

|

|

1,467 |

|

|

|

1,363 |

|

Bank-owned life insurance |

|

|

10,536 |

|

|

|

10,402 |

|

Deferred tax asset |

|

|

1,074 |

|

|

|

1,079 |

|

Operating lease right of use asset |

|

|

907 |

|

|

|

953 |

|

Other assets |

|

|

827 |

|

|

|

596 |

|

Total assets |

|

$ |

359,025 |

|

|

$ |

349,007 |

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity: |

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Non-interest bearing NOW and demand |

|

$ |

29,612 |

|

|

$ |

32,760 |

|

Interest bearing NOW and demand |

|

|

28,915 |

|

|

|

28,778 |

|

Regular and other |

|

|

58,665 |

|

|

|

64,184 |

|

Money market accounts |

|

|

24,061 |

|

|

|

26,995 |

|

Term certificates |

|

|

116,687 |

|

|

|

110,659 |

|

Total deposits |

|

|

257,940 |

|

|

|

263,376 |

|

Federal Home Loan Bank of Boston advances |

|

|

19,100 |

|

|

|

3,675 |

|

Mortgagors' escrow accounts |

|

|

1,644 |

|

|

|

1,596 |

|

Operating lease liability |

|

|

920 |

|

|

|

962 |

|

Accrued expenses and other liabilities |

|

|

3,626 |

|

|

|

3,509 |

|

Total liabilities |

|

|

283,230 |

|

|

|

273,118 |

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

Common stock |

|

|

65 |

|

|

|

65 |

|

Additional paid-in capital |

|

|

27,976 |

|

|

|

27,814 |

|

Retained earnings |

|

|

50,106 |

|

|

|

50,416 |

|

Accumulated other comprehensive loss, net of tax |

|

|

(1 |

) |

|

|

(3 |

) |

Unearned compensation - ESOP |

|

|

(2,351 |

) |

|

|

(2,403 |

) |

Total stockholders' equity |

|

|

75,795 |

|

|

|

75,889 |

|

Total liabilities and stockholders' equity |

|

$ |

359,025 |

|

|

$ |

349,007 |

|

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

5

CFSB Bancorp, Inc. and Subsidiary

Consolidated Statements of Net Income (Loss) (Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

1,758 |

|

|

$ |

1,722 |

|

|

$ |

1,657 |

|

|

$ |

3,480 |

|

|

$ |

3,276 |

|

Interest and dividends on debt securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

904 |

|

|

|

868 |

|

|

|

795 |

|

|

|

1,772 |

|

|

|

1,546 |

|

Tax-exempt |

|

|

93 |

|

|

|

97 |

|

|

|

106 |

|

|

|

190 |

|

|

|

214 |

|

Interest on short-term investments and certificates of deposit |

|

|

49 |

|

|

|

45 |

|

|

|

123 |

|

|

|

94 |

|

|

|

250 |

|

Total interest and dividend income |

|

|

2,804 |

|

|

|

2,732 |

|

|

|

2,681 |

|

|

|

5,536 |

|

|

|

5,286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

1,051 |

|

|

|

876 |

|

|

|

340 |

|

|

|

1,927 |

|

|

|

582 |

|

Borrowings |

|

|

114 |

|

|

|

50 |

|

|

|

- |

|

|

|

164 |

|

|

|

- |

|

Total interest expense |

|

|

1,165 |

|

|

|

926 |

|

|

|

340 |

|

|

|

2,091 |

|

|

|

582 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

1,639 |

|

|

|

1,806 |

|

|

|

2,341 |

|

|

|

3,445 |

|

|

|

4,704 |

|

Provision for (reversal of) credit losses |

|

|

(104 |

) |

|

|

(166 |

) |

|

|

- |

|

|

|

(270 |

) |

|

|

- |

|

Net interest income after provision for (reversal of) credit losses |

|

|

1,743 |

|

|

|

1,972 |

|

|

|

2,341 |

|

|

|

3,715 |

|

|

|

4,704 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer service fees |

|

|

37 |

|

|

|

40 |

|

|

|

36 |

|

|

|

77 |

|

|

|

73 |

|

Income on bank-owned life insurance |

|

|

68 |

|

|

|

66 |

|

|

|

63 |

|

|

|

134 |

|

|

|

127 |

|

Other income |

|

|

67 |

|

|

|

54 |

|

|

|

53 |

|

|

|

121 |

|

|

|

152 |

|

Total non-interest income |

|

|

172 |

|

|

|

160 |

|

|

|

152 |

|

|

|

332 |

|

|

|

352 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

1,267 |

|

|

|

1,144 |

|

|

|

1,250 |

|

|

|

2,411 |

|

|

|

2,268 |

|

Occupancy and equipment |

|

|

240 |

|

|

|

254 |

|

|

|

255 |

|

|

|

494 |

|

|

|

498 |

|

Advertising |

|

|

36 |

|

|

|

38 |

|

|

|

71 |

|

|

|

74 |

|

|

|

110 |

|

Data processing |

|

|

101 |

|

|

|

89 |

|

|

|

84 |

|

|

|

190 |

|

|

|

178 |

|

Deposit insurance |

|

|

33 |

|

|

|

33 |

|

|

|

22 |

|

|

|

66 |

|

|

|

43 |

|

Other general and administrative |

|

|

432 |

|

|

|

358 |

|

|

|

405 |

|

|

|

790 |

|

|

|

738 |

|

Total non-interest expenses |

|

|

2,109 |

|

|

|

1,916 |

|

|

|

2,087 |

|

|

|

4,025 |

|

|

|

3,835 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

|

(194 |

) |

|

|

216 |

|

|

|

406 |

|

|

|

22 |

|

|

|

1,221 |

|

Provision for income taxes |

|

|

16 |

|

|

|

93 |

|

|

|

65 |

|

|

|

109 |

|

|

|

235 |

|

Net income (loss) |

|

$ |

(210 |

) |

|

$ |

123 |

|

|

$ |

341 |

|

|

$ |

(87 |

) |

|

$ |

986 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.03 |

) |

|

$ |

0.02 |

|

|

$ |

0.05 |

|

|

$ |

(0.01 |

) |

|

$ |

0.16 |

|

Diluted |

|

$ |

(0.03 |

) |

|

$ |

0.02 |

|

|

$ |

0.05 |

|

|

$ |

(0.01 |

) |

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

6,284,768 |

|

|

|

6,282,203 |

|

|

|

6,274,542 |

|

|

|

6,283,485 |

|

|

|

6,273,260 |

|

Diluted |

|

|

6,284,768 |

|

|

|

6,282,203 |

|

|

|

6,274,542 |

|

|

|

6,394,485 |

|

|

|

6,273,260 |

|

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

6

CFSB Bancorp, Inc. and Subsidiary

Average Balances and Yields, Fully Tax-Equivalent Basis (Unaudited)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Balance and Yields |

|

|

Three Months Ended |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

|

Average |

|

|

Interest |

|

|

Average |

|

|

Average |

|

|

Interest |

|

|

Average |

|

|

Average |

|

|

Interest |

|

|

Average |

|

|

Outstanding |

|

|

Earned/ |

|

|

Yield/ |

|

|

Outstanding |

|

|

Earned/ |

|

|

Yield/ |

|

|

Outstanding |

|

|

Earned/ |

|

|

Yield/ |

|

(Dollars in thousands) |

Balance |

|

|

Paid |

|

|

Rate |

|

|

Balance |

|

|

Paid |

|

|

Rate |

|

|

Balance |

|

|

Paid |

|

|

Rate |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

176,149 |

|

|

$ |

1,758 |

|

|

|

3.99 |

% |

|

$ |

176,668 |

|

|

$ |

1,722 |

|

|

|

3.90 |

% |

|

$ |

177,648 |

|

|

$ |

1,657 |

|

|

|

3.73 |

% |

Securities (1) |

|

149,187 |

|

|

|

1,022 |

|

|

|

2.74 |

% |

|

|

149,259 |

|

|

|

991 |

|

|

|

2.66 |

% |

|

|

151,249 |

|

|

|

927 |

|

|

|

2.45 |

% |

Cash and short-term investments |

|

4,491 |

|

|

|

49 |

|

|

|

4.36 |

% |

|

|

3,852 |

|

|

|

45 |

|

|

|

4.67 |

% |

|

|

13,153 |

|

|

|

123 |

|

|

|

3.74 |

% |

Total interest-earning assets |

|

329,827 |

|

|

|

2,829 |

|

|

|

3.43 |

% |

|

|

329,779 |

|

|

|

2,758 |

|

|

|

3.35 |

% |

|

|

342,050 |

|

|

|

2,707 |

|

|

|

3.17 |

% |

Noninterest-earning assets |

|

16,875 |

|

|

|

|

|

|

|

|

|

16,655 |

|

|

|

|

|

|

|

|

|

16,747 |

|

|

|

|

|

|

|

Total assets |

$ |

346,702 |

|

|

|

|

|

|

|

|

$ |

346,434 |

|

|

|

|

|

|

|

|

$ |

358,797 |

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand deposits |

$ |

29,746 |

|

|

$ |

4 |

|

|

|

0.05 |

% |

|

$ |

29,912 |

|

|

$ |

4 |

|

|

|

0.05 |

% |

|

$ |

33,557 |

|

|

$ |

4 |

|

|

|

0.05 |

% |

Savings deposits |

|

58,992 |

|

|

|

15 |

|

|

|

0.10 |

% |

|

|

62,446 |

|

|

|

16 |

|

|

|

0.10 |

% |

|

|

72,708 |

|

|

|

18 |

|

|

|

0.10 |

% |

Money market deposits |

|

24,153 |

|

|

|

15 |

|

|

|

0.25 |

% |

|

|

26,271 |

|

|

|

17 |

|

|

|

0.26 |

% |

|

|

39,876 |

|

|

|

27 |

|

|

|

0.27 |

% |

Certificates of deposit |

|

115,397 |

|

|

|

1,017 |

|

|

|

3.53 |

% |

|

|

111,812 |

|

|

|

839 |

|

|

|

3.00 |

% |

|

|

99,041 |

|

|

|

291 |

|

|

|

1.18 |

% |

Total interest-bearing deposits |

|

228,288 |

|

|

|

1,051 |

|

|

|

1.84 |

% |

|

|

230,441 |

|

|

|

876 |

|

|

|

1.52 |

% |

|

|

245,182 |

|

|

|

340 |

|

|

|

0.55 |

% |

FHLB advances |

|

8,323 |

|

|

|

114 |

|

|

|

5.48 |

% |

|

|

3,571 |

|

|

|

50 |

|

|

|

5.60 |

% |

|

|

- |

|

|

|

- |

|

|

|

0.00 |

% |

Total interest-bearing liabilities |

|

236,611 |

|

|

|

1,165 |

|

|

|

1.97 |

% |

|

|

234,012 |

|

|

|

926 |

|

|

|

1.58 |

% |

|

|

245,182 |

|

|

|

340 |

|

|

|

0.55 |

% |

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing demand deposits |

|

28,223 |

|

|

|

|

|

|

|

|

|

30,971 |

|

|

|

|

|

|

|

|

|

32,887 |

|

|

|

|

|

|

|

Other noninterest-bearing liabilities |

|

5,968 |

|

|

|

|

|

|

|

|

|

5,740 |

|

|

|

|

|

|

|

|

|

5,554 |

|

|

|

|

|

|

|

Total liabilities |

|

270,802 |

|

|

|

|

|

|

|

|

|

270,723 |

|

|

|

|

|

|

|

|

|

283,623 |

|

|

|

|

|

|

|

Total stockholders' equity |

|

75,900 |

|

|

|

|

|

|

|

|

|

75,711 |

|

|

|

|

|

|

|

|

|

75,174 |

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

346,702 |

|

|

|

|

|

|

|

|

$ |

346,434 |

|

|

|

|

|

|

|

|

$ |

358,797 |

|

|

|

|

|

|

|

Net interest income |

|

|

|

$ |

1,664 |

|

|

|

|

|

|

|

|

$ |

1,832 |

|

|

|

|

|

|

|

|

$ |

2,367 |

|

|

|

|

Net interest rate spread(2) |

|

|

|

|

|

|

|

1.46 |

% |

|

|

|

|

|

|

|

|

1.77 |

% |

|

|

|

|

|

|

|

|

2.62 |

% |

Net interest-earning assets(3) |

$ |

93,216 |

|

|

|

|

|

|

|

|

$ |

95,767 |

|

|

|

|

|

|

|

|

$ |

96,868 |

|

|

|

|

|

|

|

Net interest margin(4) |

|

|

|

|

|

|

|

2.02 |

% |

|

|

|

|

|

|

|

|

2.22 |

% |

|

|

|

|

|

|

|

|

2.77 |

% |

Cost of deposits(5) |

|

|

|

|

|

|

|

1.64 |

% |

|

|

|

|

|

|

|

|

1.34 |

% |

|

|

|

|

|

|

|

|

0.49 |

% |

Cost of funds(6) |

|

|

|

|

|

|

|

1.76 |

% |

|

|

|

|

|

|

|

|

1.40 |

% |

|

|

|

|

|

|

|

|

0.49 |

% |

Ratio of interest-earning assets to interest-bearing liabilities |

|

139.40 |

% |

|

|

|

|

|

|

|

|

140.92 |

% |

|

|

|

|

|

|

|

|

139.51 |

% |

|

|

|

|

|

|

(1)Includes tax equivalent adjustments for municipal securities, based on a statutory tax rate of 21%, of $25,000, $26,000, and $26,000 for the three months ended December 31, 2023, September 30, 2023 and December 31, 2022, respectively.

(2)Net interest rate spread represents the difference between the weighted average yield earned on interest-earning assets and the weighted average rate paid on interest-bearing liabilities.

(3)Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(4)Net interest margin represents net interest income divided by average total interest-earning assets.

(5)Cost of deposits represents the total interest paid on deposits, divided by total interest-bearing deposits plus total noninterest-bearing deposits.

(6)Cost of funds represents the total interest paid on liabilities, divided by total interest-bearing liabilities plus total noninterest-bearing deposits.

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

7

CFSB Bancorp, Inc. and Subsidiary

Average Balances and Yields, Fully Tax-Equivalent Basis (Unaudited)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Balance and Yields |

|

|

Six Months Ended |

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

|

Average |

|

|

Interest |

|

|

Average |

|

|

Average |

|

|

Interest |

|

|

Average |

|

|

Outstanding |

|

|

Earned/ |

|

|

Yield/ |

|

|

Outstanding |

|

|

Earned/ |

|

|

Yield/ |

|

(Dollars in thousands) |

Balance |

|

|

Paid |

|

|

Rate |

|

|

Balance |

|

|

Paid |

|

|

Rate |

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

$ |

176,408 |

|

|

$ |

3,480 |

|

|

|

3.95 |

% |

|

$ |

177,143 |

|

|

$ |

3,276 |

|

|

|

3.70 |

% |

Securities (1) |

|

149,223 |

|

|

|

2,013 |

|

|

|

2.70 |

% |

|

|

150,011 |

|

|

|

1,817 |

|

|

|

2.42 |

% |

Cash and short-term investments |

|

4,172 |

|

|

|

94 |

|

|

|

4.51 |

% |

|

|

17,435 |

|

|

|

250 |

|

|

|

2.87 |

% |

Total interest-earning assets |

|

329,803 |

|

|

|

5,587 |

|

|

|

3.39 |

% |

|

|

344,589 |

|

|

|

5,343 |

|

|

|

3.10 |

% |

Noninterest-earning assets |

|

16,608 |

|

|

|

|

|

|

|

|

|

16,342 |

|

|

|

|

|

|

|

Total assets |

$ |

346,411 |

|

|

|

|

|

|

|

|

$ |

360,931 |

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand deposits |

$ |

29,829 |

|

|

$ |

7 |

|

|

|

0.05 |

% |

|

$ |

33,346 |

|

|

$ |

8 |

|

|

|

0.05 |

% |

Savings deposits |

|

60,719 |

|

|

|

30 |

|

|

|

0.10 |

% |

|

|

74,076 |

|

|

|

37 |

|

|

|

0.10 |

% |

Money market deposits |

|

25,212 |

|

|

|

32 |

|

|

|

0.25 |

% |

|

|

42,685 |

|

|

|

58 |

|

|

|

0.27 |

% |

Certificates of deposit |

|

113,604 |

|

|

|

1,858 |

|

|

|

3.27 |

% |

|

|

98,097 |

|

|

|

479 |

|

|

|

0.98 |

% |

Total interest-bearing deposits |

|

229,364 |

|

|

|

1,927 |

|

|

|

1.68 |

% |

|

|

248,204 |

|

|

|

582 |

|

|

|

0.47 |

% |

FHLB advances |

|

5,947 |

|

|

|

164 |

|

|

|

5.52 |

% |

|

|

- |

|

|

|

- |

|

|

|

0.00 |

% |

Total interest-bearing liabilities |

|

235,311 |

|

|

|

2,091 |

|

|

|

1.78 |

% |

|

|

248,204 |

|

|

|

582 |

|

|

|

0.47 |

% |

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing demand deposits |

|

29,597 |

|

|

|

|

|

|

|

|

|

32,702 |

|

|

|

|

|

|

|

Other noninterest-bearing liabilities |

|

5,697 |

|

|

|

|

|

|

|

|

|

5,127 |

|

|

|

|

|

|

|

Total liabilities |

|

270,605 |

|

|

|

|

|

|

|

|

|

286,033 |

|

|

|

|

|

|

|

Total stockholders' equity |

|

75,806 |

|

|

|

|

|

|

|

|

|

74,898 |

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

346,411 |

|

|

|

|

|

|

|

|

$ |

360,931 |

|

|

|

|

|

|

|

Net interest income |

|

|

|

$ |

3,496 |

|

|

|

|

|

|

|

|

$ |

4,761 |

|

|

|

|

Net interest rate spread(2) |

|

|

|

|

|

|

|

1.61 |

% |

|

|

|

|

|

|

|

|

2.63 |

% |

Net interest-earning assets(3) |

$ |

94,492 |

|

|

|

|

|

|

|

|

$ |

96,385 |

|

|

|

|

|

|

|

Net interest margin(4) |

|

|

|

|

|

|

|

2.12 |

% |

|

|

|

|

|

|

|

|

2.76 |

% |

Cost of deposits(5) |

|

|

|

|

|

|

|

1.49 |

% |

|

|

|

|

|

|

|

|

0.41 |

% |

Cost of funds(6) |

|

|

|

|

|

|

|

1.58 |

% |

|

|

|

|

|

|

|

|

0.41 |

% |

Ratio of interest-earning assets to interest-bearing liabilities |

|

140.16 |

% |

|

|

|

|

|

|

|

|

138.83 |

% |

|

|

|

|

|

|

(1)Includes tax equivalent adjustments for municipal securities, based on a statutory tax rate of 21%, of $51,000 and $57,000 for the six months ended December 31, 2023 and December 31, 2022, respectively.

(2)Net interest rate spread represents the difference between the weighted average yield earned on interest-earning assets and the weighted average rate paid on interest-bearing liabilities.

(3)Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(4)Net interest margin represents net interest income divided by average total interest-earning assets.

(5)Cost of deposits represents the total interest paid on deposits, divided by total interest-bearing deposits plus total noninterest-bearing deposits.

(6)Cost of funds represents the total interest paid on liabilities, divided by total interest-bearing liabilities plus total noninterest-bearing deposits.

CFSB Bancorp, Inc. and Subsidiary

Reconciliation of Fully Tax-Equivalent Income (Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Securities interest income (no tax adjustment) |

|

$ |

997 |

|

|

$ |

965 |

|

|

$ |

901 |

|

|

$ |

1,962 |

|

|

$ |

1,760 |

|

Tax-equivalent adjustment |

|

|

25 |

|

|

|

26 |

|

|

|

26 |

|

|

|

51 |

|

|

|

57 |

|

Securities (tax-equivalent basis) |

|

$ |

1,022 |

|

|

$ |

991 |

|

|

$ |

927 |

|

|

$ |

2,013 |

|

|

$ |

1,817 |

|

Net interest income (no tax adjustment) |

|

$ |

1,639 |

|

|

$ |

1,806 |

|

|

$ |

2,341 |

|

|

$ |

3,445 |

|

|

|

4,704 |

|

Tax-equivalent adjustment |

|

|

25 |

|

|

|

26 |

|

|

|

26 |

|

|

|

51 |

|

|

|

57 |

|

Net interest income (tax-equivalent adjustment) |

|

$ |

1,664 |

|

|

$ |

1,832 |

|

|

$ |

2,367 |

|

|

$ |

3,496 |

|

|

$ |

4,761 |

|

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CFSB Bancorp, Inc. and Subsidiary |

|

At or for the Three Months Ended |

|

|

At or for the Six Months Ended |

|

Selected Financial Highlights (Unaudited) |

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

(In thousands, except share and per share amounts) |

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Performance Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return (loss) on average assets (GAAP) (1, 4) |

|

|

(0.24 |

%) |

|

|

0.14 |

% |

|

|

0.38 |

% |

|

|

(0.05 |

%) |

|

|

0.55 |

% |

Return (loss) on average equity ("ROAE") (GAAP) (1, 5) |

|

|

(1.11 |

%) |

|

|

0.65 |

% |

|

|

1.81 |

% |

|

|

(0.23 |

%) |

|

|

2.63 |

% |

Noninterest expense to average assets (GAAP) (1) |

|

|

2.43 |

% |

|

|

2.21 |

% |

|

|

2.33 |

% |

|

|

2.21 |

% |

|

|

2.13 |

% |

Total loans to total deposits |

|

|

68.62 |

% |

|

|

67.56 |

% |

|

|

65.60 |

% |

|

|

68.62 |

% |

|

|

65.60 |

% |

Total loans to total assets |

|

|

49.30 |

% |

|

|

50.87 |

% |

|

|

50.64 |

% |

|

|

49.30 |

% |

|

|

50.64 |

% |

Efficiency ratio (GAAP) (6) |

|

|

116.45 |

% |

|

|

97.46 |

% |

|

|

83.71 |

% |

|

|

106.57 |

% |

|

|

75.85 |

% |

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capital to risk-weighted assets |

|

|

33.32 |

% |

|

|

33.28 |

% |

|

|

32.60 |

% |

|

|

32.42 |

% |

|

|

32.60 |

% |

Common equity tier 1 capital to risk-weighted assets |

|

|

32.41 |

% |

|

|

32.32 |

% |

|

|

31.70 |

% |

|

|

32.42 |

% |

|

|

31.70 |

% |

Tier 1 capital to risk-weighted assets |

|

|

32.41 |

% |

|

|

32.32 |

% |

|

|

31.70 |

% |

|

|

33.34 |

% |

|

|

31.70 |

% |

Tier 1 capital to average assets (2) |

|

|

18.32 |

% |

|

|

18.35 |

% |

|

|

17.40 |

% |

|

|

18.32 |

% |

|

|

17.40 |

% |

Asset Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses on loans as a percentage of total loans (3) |

|

|

0.93 |

% |

|

|

0.94 |

% |

|

|

0.97 |

% |

|

|

0.93 |

% |

|

|

0.97 |

% |

Allowance for credit losses on loans as a percentage of non-performing loans |

|

|

1740.46 |

% |

|

NM |

|

|

NM |

|

|

|

1740.46 |

% |

|

NM |

|

Net (charge-offs) recoveries to average outstanding loans |

|

|

- |

% |

|

|

- |

% |

|

|

- |

% |

|

|

- |

% |

|

|

- |

% |

Non-performing loans as a percentage of total loans |

|

|

0.05 |

% |

|

|

- |

% |

|

|

- |

% |

|

|

0.05 |

% |

|

|

- |

% |

Non-performing loans as a percentage of total assets |

|

|

0.03 |

% |

|

|

- |

% |

|

|

- |

% |

|

|

0.03 |

% |

|

|

- |

% |

Informational Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value of held to maturity securities |

|

$ |

136,427 |

|

|

$ |

128,959 |

|

|

$ |

132,625 |

|

|

$ |

136,427 |

|

|

$ |

132,625 |

|

Book value per share (7) |

|

$ |

11.43 |

|

|

$ |

11.44 |

|

|

$ |

11.54 |

|

|

$ |

11.43 |

|

|

$ |

11.54 |

|

Outstanding common shares |

|

|

6,632,642 |

|

|

|

6,632,642 |

|

|

|

6,521,642 |

|

|

|

6,632,642 |

|

|

|

6,521,642 |

|

(1) Annualized.

(2)Average assets calculated on a quarterly basis.

(3)Total loans exclude net deferred loan costs and fees.

(4)Represents net income divided by average assets.

(5)Represents net income divided by average stockholders' equity

(6)Represents total non-interest expenses divided by net interest income and non-interest income.

(7)Represents total stockholders' equity divided by outstanding shares at period end.

____________________________________________________________________________________________________________

15 Beach Street, Quincy, MA 02170 | 617.471.0750 | colonialfed.com

9

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

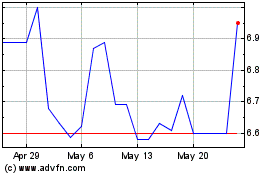

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From Apr 2024 to May 2024

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From May 2023 to May 2024