0001662579false00016625792024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________________

FORM 8-K

_________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2024 (March 1, 2024)

_________________________________________________________________

C4 THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

_________________________________________________________________

| | | | | | | | |

| Delaware | 001-39567 | 47-5617627 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

490 Arsenal Way, Suite 120 Watertown, MA | | 02472 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 231-0700

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | CCCC | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

On March 1, 2024, C4 Therapeutics, Inc. (“C4T”) entered into a Research Collaboration and License Agreement (“License Agreement”) with Merck KGaA, Darmstadt, Germany (“MKDG”), which operates its healthcare business as EMD Serono in the U.S. and Canada, to exclusively discover two targeted protein degraders against critical oncogenic proteins that C4T has progressed within its internal discovery pipeline.

Pursuant to the terms of the License Agreement, C4T grants MKDG a worldwide, exclusive license under certain of C4T’s intellectual property rights to discover two targeted protein degraders against critical oncogenic proteins. MKDG is responsible for all development, regulatory approval, manufacturing and commercialization costs. Under the terms of the License Agreement, MKDG has agreed to make an upfront cash payment of $16.0 million and will fund C4T’s discovery research efforts. C4T is eligible to receive approximately $740 million in aggregate in discovery, regulatory, and commercial milestone payments across the collaboration, plus tiered royalties on net sales. Royalties payable from MKDG to C4T range from mid-single digit to low-double digit percent, subject to reductions under certain circumstances as described in the License Agreement.

Under the License Agreement, the royalty term for all contemplated royalties shall terminate on a product-by-product and country-by-country basis on the latest of (i) the ten (10) year anniversary of the first commercial sale of such product in such country, and (ii) the expiration of the last-to-expire licensed patent that covers such product in such country.

The License Agreement includes customary representations and warranties, covenants and indemnification obligations for a transaction of this nature. The License Agreement became effective upon signing and will continue until all of MKDG’s applicable payment obligations under the License Agreement have been performed or have expired, or the agreement is earlier terminated. Under the terms of the License Agreement, each of C4T and MKDG has the right to terminate the License Agreement for material breach by, or insolvency of, the other party. MKDG may also terminate the License Agreement in its entirety, or on a product-by-product or country-by-country basis, for convenience upon sixty (60) days’ notice.

The foregoing description of the License Agreement is only a summary and is qualified in its entirety by reference to the License Agreement, a copy of which C4T intends to file as an exhibit to C4T’s Quarterly Report on Form 10-Q for the period ending March 31, 2024.

Item 7.01 Regulation FD Disclosure.

On March 4, 2024, C4T issued a press release relating to the License Agreement. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed subject to the requirements of amended Item 10 of Regulation S-K, nor shall it be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The furnishing of this information hereby shall not be deemed an admission as to the materiality of any such information.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The exhibits shall be deemed to be filed or furnished, depending on the relevant item requiring such exhibit, in accordance with the provisions of Item 601 of Regulation S-K (17 CFR 229.601) and Instruction B.2 to this form.

| | | | | | | | |

Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| C4 Therapeutics, Inc. |

| | |

Date: March 4, 2024 | By: | /s/ Jolie M. Siegel |

| | Jolie M. Siegel |

| | Chief Legal Officer |

Exhibit 99.1

C4 Therapeutics Announces Strategic Discovery Research Collaboration with Merck KGaA, Darmstadt, Germany, Against Critical Oncogenic Proteins

Collaboration Focused on Two Targeted Protein Degraders from C4T’s Internal Discovery Pipeline

C4T to Receive a $16 Million Upfront Payment; Merck KGaA, Darmstadt, Germany, to Cover Discovery Research Costs Under the Collaboration

C4T Eligible for up to Approximately $740 Million in Discovery, Development and Commercial Milestone Payments, in Addition to Future Royalties, Across Entire Collaboration

WATERTOWN, Mass., March 4, 2024 (GLOBE NEWSWIRE) -- C4 Therapeutics, Inc. (C4T) (Nasdaq: CCCC), a clinical-stage biopharmaceutical company dedicated to advancing targeted protein degradation science, today announced it has entered into a license and collaboration agreement with Merck KGaA, Darmstadt, Germany, which operates its healthcare business as EMD Serono in the U.S. and Canada, to exclusively discover two targeted protein degraders against critical oncogenic proteins that C4T has progressed within its internal discovery pipeline.

“We look forward to partnering with Merck KGaA, Darmstadt, Germany, and leveraging our collective strengths to advance an exciting program from C4T’s internal oncology pipeline that has the potential to transform how cancer is treated,” said Andrew Hirsch, president and chief executive officer of C4 Therapeutics. “This new partnership highlights C4T’s differentiated approach to targeted protein degradation science and our strong track record of designing novel targeted protein degrader medicines with desirable drug-like properties that have the potential to treat patients with unmet medical needs.”

“The collaboration adds to Merck KGaA, Darmstadt, Germany's growing portfolio of targeted protein degradation projects and accelerates our efforts to expand our presence in this highly dynamic field,” said Paul Lyne, Head of Research Unit Oncology at the Healthcare business sector of Merck KGaA, Darmstadt, Germany. “We look forward to capitalizing on C4 Therapeutics’ experience in advancing degrader candidates targeting disease-causing proteins from discovery to the clinical stage, with the shared goal of improving patient outcomes.”

Under the terms of the agreement, C4T and Merck KGaA, Darmstadt, Germany, will collaborate to discover two targeted protein degraders against critical oncogenic proteins. C4T will receive an upfront payment of $16 million. Merck KGaA Darmstadt, Germany, will fund C4T’s discovery research efforts. C4T has the potential to receive up to approximately $740 million in discovery, regulatory, and commercial milestone payments across the collaboration. In addition, C4T is eligible for mid-single to low-double digit tiered royalties on future sales for each program.

As part of the collaboration, C4T will utilize its proprietary TORPEDO® platform to discover degraders targeting the partnership’s oncogenic proteins of interest. Merck KGaA, Darmstadt, Germany, will be responsible for clinical development and commercialization for drug candidates coming out of these programs.

About C4 Therapeutics C4 Therapeutics (C4T) (Nasdaq: CCCC) is a clinical-stage biopharmaceutical company dedicated to delivering on the promise of targeted protein degradation science to create a new generation of medicines that transforms patients’ lives. C4T is progressing targeted oncology programs through clinical studies and leveraging its TORPEDO® platform to efficiently design and optimize small-

molecule medicines to address difficult-to-treat diseases. C4T’s degrader medicines are designed to harness the body’s natural protein recycling system to rapidly degrade disease-causing proteins, offering the potential to overcome drug resistance, drug undruggable targets and improve patient outcomes. For more information, please visit www.c4therapeutics.com.

Forward-Looking Statements This press release contains “forward-looking statements” of C4 Therapeutics, Inc. within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include, but may not be limited to, express or implied statements regarding our ability to develop potential therapies for patients; the design and potential efficacy of our therapeutic approaches; the predictive capability of our TORPEDO® platform in the development of novel, selective, orally bioavailable BiDAC™ and MonoDAC™ degraders; our ability to achieve potential future milestone or royalty payments; and our ability to fund our future operations. Any forward-looking statements in this press release are based on management’s current expectations and beliefs of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. For a discussion of the risks and uncertainties, and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section entitled “Risk Factors” in C4 Therapeutics’ most recent Annual Report on Form 10-K and/or Quarterly Report on Form 10-Q, as filed with the Securities and Exchange Commission. All information in this press release is as of the date of the release and C4 Therapeutics undertakes no duty to update this information unless required by law.

Contacts:

Investors:

Courtney Solberg

Senior Manager, Investor Relations

CSolberg@c4therapeutics.com

Media:

Loraine Spreen

Senior Director, Corporate Communications & Patient Advocacy

LSpreen@c4therapeutics.co

v3.24.0.1

Cover Page Document

|

Mar. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 04, 2024

|

| Entity Registrant Name |

C4 THERAPEUTICS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39567

|

| Entity Tax Identification Number |

47-5617627

|

| Entity Address, Address Line One |

490 Arsenal Way,

|

| Entity Address, Address Line Two |

Suite 120

|

| Entity Address, City or Town |

Watertown,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

617

|

| Local Phone Number |

231-0700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

CCCC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001662579

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

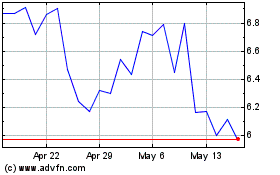

C4 Therapeutics (NASDAQ:CCCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

C4 Therapeutics (NASDAQ:CCCC)

Historical Stock Chart

From Apr 2023 to Apr 2024