0001605301FALSE00016053012024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2024

| | | | | | | | |

| CB FINANCIAL SERVICES, INC. | |

| (Exact name of registrant as specified in its charter) | |

Commission file number: 001-36706

| | | | | | | | |

| Pennsylvania | | 51-0534721 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

100 N. Market Street, Carmichaels, PA | | 15320 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | |

| (724) 966-5041 | |

| (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| Not Applicable | |

| (Former name, former address and former fiscal year, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Common stock, par value $0.4167 per share | | CBFV | | The Nasdaq Stock Market, LLC |

| (Title of each class) | | (Trading symbol) | | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standard provided pursuant to Section 13(a) of the

Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 31, 2024, CB Financial Services, Inc. (the "Company") issued a press release announcing its financial results for the year ended December 31, 2023, a copy of which is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 8.01. Other Events.

On January 31, 2024, the Company announced that its Board of Directors declared a cash dividend on the Company's outstanding shares of common stock. The dividend of $0.25 per share will be paid on or about February 29, 2024 to stockholders of record as of the close of business on February 15, 2024.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

104. Cover Page Interactive Data File (embedded in Inline XBRL)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | CB FINANCIAL SERVICES, INC. |

| | | |

| | | |

Date: January 31, 2024 | By: | /s/ Jamie L. Prah |

| | | Jamie L. Prah |

| | | Executive Vice President and Chief Financial Officer |

CB Financial Services, Inc.

Announces Fourth Quarter and Full Year 2023 Financial Results and

Declares Quarterly Cash Dividend

WASHINGTON, PA., January 31, 2024 -- CB Financial Services, Inc. (“CB” or the “Company”) (NASDAQGM: CBFV), the holding company of Community Bank (the “Bank”), today announced its fourth quarter and 2023 financial results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | Year Ended |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | | | | 12/31/23 | 12/31/22 |

| (Dollars in thousands, except per share data) (Unaudited) | | | | | | | | | |

| | | | | | | | | | |

| Net Income (GAAP) | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 4,156 | | $ | 4,152 | | | | | $ | 22,550 | | $ | 11,247 | |

Net Income Adjustments | (9,905) | | 29 | | 78 | | (127) | | (66) | | | | | (9,926) | | (208) | |

Adjusted Net Income (Non-GAAP) (1) | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | $ | 4,029 | | $ | 4,086 | | | | | $ | 12,624 | | $ | 11,039 | |

| | | | | | | | | | |

| Earnings per Common Share - Diluted (GAAP) | $ | 2.52 | | $ | 0.52 | | $ | 0.54 | | $ | 0.81 | | $ | 0.81 | | | | | $ | 4.40 | | $ | 2.18 | |

Adjusted Earnings per Common Share - Diluted (Non-GAAP) (1) | $ | 0.60 | | $ | 0.53 | | $ | 0.55 | | $ | 0.79 | | $ | 0.80 | | | | | $ | 2.46 | | $ | 2.14 | |

(1) Refer to Explanation of Use of Non-GAAP Financial Measures and reconciliation of adjusted net income and adjusted earnings per common share - diluted as presented later in this Press Release.

2023 Fourth Quarter Financial Highlights

(Comparisons to three months ended December 31, 2022 unless otherwise noted)

•Net income was $13.0 million, compared to $4.2 million. Current period results were driven by a $24.6 million pre-tax gain on the sale of the Bank’s subsidiary insurance company, Exchange Underwriters (EU), partially offset by a $9.8 million pre-tax loss on the sale of securities resulting primarily from the execution of a balance sheet repositioning strategy. Results were also impacted by net interest margin (NIM) compression coupled with increases in noninterest expense and income tax expense, partially offset by a decrease in the provision for credit losses.

◦Adjusted net income (Non-GAAP) was $3.1 million compared to $4.1 million.

◦Income before income tax expense was $18.3 million compared to $5.2 million.

◦Adjusted pre-provision net revenue (PPNR) (Non-GAAP) was $2.1 million compared to $5.1 million.

•Earnings per diluted common share (EPS) increased to $2.52 from $0.81.

◦Adjusted earning per common share - diluted (Non-GAAP) was $0.60, compared to $0.80.

•Return on average assets (annualized) was 3.62%, compared to 1.16%.

◦Adjusted return on average assets (annualized) (Non-GAAP) was 0.85%, compared to 1.15%.

•Return on average equity (annualized) was 44.99%, compared to 15.26%.

◦Adjusted return on average equity (annualized) (Non-GAAP) was 10.62%, compared to 15.01%.

•NIM declined to 3.19% from 3.46%.

•Net interest and dividend income was $11.1 million, compared to $11.9 million.

•Noninterest income increased to $16.5 million, compared to $2.4 million including the aforementioned gain on the sale of the subsidiary and loss on the sale of securities.

•Noninterest expense increased to $10.8 million, compared to $9.0 million, primarily due to increases in compensation and benefits and equipment costs.

(Amounts at December 31, 2023; comparisons to December 31, 2022, unless otherwise noted)

•Total assets increased to $1.46 billion from $1.41 billion.

•Total loans increased $60.5 million, or 5.8%, to $1.11 billion compared to $1.05 billion, and included increases of $41.2 million, or 58.9%, in commercial and industrial loans, $30.3 million, or 6.9%, in commercial real estate loans, $17.1 million, or 5.2%, in residential mortgage loans, and $8.9 million, or 43.8%, in other loans, partially offset by a decrease of $35.3 million, or 24.0%, in consumer loans, which is primarily comprised of indirect automobile loans. Excluding the $34.9 million decrease in indirect automobile loans resulting from the discontinuation of that product as of June 30, 2023, total loans increased $95.4 million, or 9.1%.

•Nonperforming loans to total loans was 0.20%, a decrease of 35 basis points (“bps”), compared to 0.55%.

•Total deposits were $1.267 billion, a decrease of $1.3 million, compared to $1.269 billion.

•Book value per share was $27.31, compared to $22.43 as of September 30, 2023 and $21.60 as of December 31, 2022.

•Tangible book value per share (Non-GAAP) was $25.23, compared to $20.10 as of September 30, 2023 and $19.00 as of December 31, 2022. The year-to-date change was due to an increase in stockholders’ equity primarily related to current period net income of $22.6 million, a $9.5 million increase in accumulated other comprehensive income and a $2.1 million positive adjustment due to the Company’s January 1, 2023 adoption of CECL, partially offset by current period dividends paid to stockholders of $5.1 million.

Management Commentary

President and CEO John H. Montgomery commented, "Three years ago, we embarked on a comprehensive strategy aimed at optimizing operations, investing in talent, and fortifying our dedication to all stakeholders by striving for excellence in client experience. Despite facing a challenging and uncertain economic landscape, our efforts in 2023, coupled with the work of the preceding two years, underscore our commitment to these objectives.

While our fourth-quarter results reflected the ongoing trend of net interest margin pressure due to heightened funding costs driven by prevailing market interest rates, we sustained consistent loan growth. This growth was particularly notable in higher-yielding commercial loans. In a year marked by significant deposit movements, our core deposits remained relatively stable, albeit shifting from non-interest and low interest bearing accounts to higher cost time deposits. Notably, our asset quality remains strong, with nonperforming loans well below prior year levels.

Despite the challenges posed by the interest rate environment, our prior investments in talent and our ongoing efforts to streamline operations are yielding positive outcomes across our franchise.

During the quarter, we successfully completed the sale of our full-service independent insurance agency subsidiary, Exchange Underwriters, to World Insurance Associates. This transaction not only realized a substantial valuation premium but also proved immediately accretive to capital, tangible book value and liquidity. The additional capital infusion provides us with the flexibility to assess and pursue various strategic initiatives that reinforce our core banking business, with a specific focus on enhancing long-term shareholder value.

Furthermore, we made a proactive decision to reposition our securities portfolio. On an annualized basis, the acquired securities exhibit a positive spread differential of approximately 360 basis points over the securities that were divested. This strategic move is anticipated to add approximately 17 basis points to net interest margin and contribute approximately $1.8 million of after-tax earnings in 2024. Aligned with the sale of our insurance agency subsidiary, we view this as a judicious deployment of capital designed to augment long-term shareholder value and bolster earnings.”

In conclusion, Mr. Montgomery affirmed, "As we usher in 2024, our commitment to prudently manage our capital and liquidity positions remains unwavering. We will persist in investing in our franchise, staying true to our long-term plan and prioritizing the delivery of an exceptional client experience that accrues benefits to all our stakeholders."

Dividend Information

The Company’s Board of Directors declared a $0.25 quarterly cash dividend per outstanding share of common stock, payable on or about February 29, 2024, to stockholders of record as of the close of business on February 15, 2024.

2023 Fourth Quarter Financial Review

Net Interest and Dividend Income

Net interest and dividend income decreased $730,000, or 6.2%, to $11.1 million for the three months ended December 31, 2023 compared to $11.9 million for the three months ended December 31, 2022.

•Net interest margin (GAAP) decreased to 3.19% for the three months ended December 31, 2023 compared to 3.46% for the three months ended December 31, 2022. Fully tax equivalent (FTE) net interest margin (Non-GAAP) decreased 26 bps to 3.21% for the three months ended December 31, 2023 compared to 3.47% for the three months ended December 31, 2022.

•Interest and dividend income increased $3.1 million, or 22.0%, to $16.9 million for the three months ended December 31, 2023 compared to $13.9 million for the three months ended December 31, 2022.

◦Interest income on loans increased $3.0 million, or 25.1%, to $14.8 million for the three months ended December 31, 2023 compared to $11.8 million for the three months ended December 31, 2022. The average yield on loans increased 82 bps to 5.36% compared to 4.54% resulting in a $2.2 million increase in interest income on loans. The average balance of loans increased $63.6 million to $1.10 billion from $1.03 billion, generating $750,000 of additional interest income on loans.

◦Interest income on taxable investment securities increased $190,000, or 19.5%, to $1.2 million for the three months ended December 31, 2023 compared to $974,000 for the three months ended December 31, 2022 driven by a 45 bp increase in average yield, partially offset by a $10.2 million decrease in average balances.

◦Interest income on interest-earning deposits at other banks decreased $131,000, to $808,000 for the three months ended December 31, 2023 compared to $939,000 for the three months ended December 31, 2022 driven by a $29.9 million decrease in average balances, partially offset by a 91 bp increase in the average yield. The increase in the average yield was the result of the Federal Reserve Board’s interest rate increases.

•Interest expense increased $3.8 million, or 190.0%, to $5.8 million for the three months ended December 31, 2023 compared to $2.0 million for the three months ended December 31, 2022.

◦Interest expense on deposits increased $3.5 million, or 194.6%, to $5.3 million for the three months ended December 31, 2023 compared to $1.8 million for the three months ended December 31, 2022. Rising market interest rates led to the repricing of interest-bearing demand and money market deposits and a shift in deposits from noninterest-bearing to interest-bearing demand and time deposits which resulted in a 139 bp, or 171.7%, increase in the average cost of interest-bearing deposits compared to the three months ended December 31, 2022. This accounted for a $3.4 million increase in interest expense. Additionally, interest-bearing deposit balances increased $73.3 million, or 8.3%, to $961.0 million as of December 31, 2023 compared to $887.7 million as of December 31, 2022, accounting for a $170,000 increase in interest expense.

◦Interest expense on borrowed funds increased $255,000, or 143.3%, to $433,000 for the three months ended December 31, 2023 compared to $178,000 for the three months ended December 31, 2022. The average balance of borrowed funds increased $20.6 million due to $20.0 million of FHLB long-term advances added during the second quarter of 2023. The increase in the average balance accounted for a $185,000 increase in interest expense.

Provision for Credit Losses

Effective January 1, 2023, the Company adopted ASU 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”, which replaced the incurred loss methodology with an expected loss methodology that is referred to as the current expected credit loss (CECL) methodology. The provision for credit losses recorded for the three months ended December 31, 2023 was a recovery of $1.4 million and was primarily due to improvements in qualitative factors coupled with a decrease in historical loss rates. This compared to no provision for credit losses recorded for the three months ended December 31, 2022.

Noninterest Income

Noninterest income increased $14.2 million, or 599.9%, to $16.5 million for the three months ended December 31, 2023, compared to $2.4 million for the three months ended December 31, 2022. This increase related to a $24.6 million pre-tax gain on the sale of EU, partially offset by a $9.8 million pre-tax loss on the sale of securities primarily resulting from the execution of a balance sheet repositioning strategy. Noninterest income excluding the gain on the sale of the subsidiary and gains and losses on securities for both periods decreased $507,000 to $1.8 million for the three months ended December 31, 2023 compared to $2.3 million for the three months ended December 31, 2022. This decrease resulted primarily from a $430,000 decrease in insurance commissions as only two months of income were recognized for the three months ended December 31, 2023 due to the sale of EU, compared to a full quarter of income recognized for the three months ended December 31, 2022.

Noninterest Expense

Noninterest expense increased $1.8 million, or 19.6%, to $10.8 million for the three months ended December 31, 2023 compared to $9.0 million for the three months ended December 31, 2022. The current quarter increase included one-time non-recurring expenses associated with sale of the insurance subsidiary of $691,000 related to salaries and benefits, $109,000 related to other noninterest expenses and $17,000 related to legal and professional fees. Salaries and benefits increased $1.6 million, or 34.6%, to $6.2 million primarily due to previously mentioned one-time non recurring expense, merit increases and revenue producing staff additions. Equipment expense increased $120,000 or 67.4%, to $298,000, due to costs associated with the implementation and operation of new interactive teller machines.

Statement of Financial Condition Review

Assets

Total assets increased $47.2 million, or 3.4%, to $1.46 billion at December 31, 2023, compared to $1.41 billion at December 31, 2022.

•Cash and due from banks decreased $33.7 million, or 32.5%, to $70.0 million at December 31, 2023, compared to $103.7 million at December 31, 2022, due to significant loan growth.

•Securities increased $17.0 million, or 8.9%, to $207.1 million at December 31, 2023, compared to $190.1 million at December 31, 2022. The securities balance was primarily impacted by the purchase of $29.9 million of collateralized loan obligation securities, partially offset by $15.8 million of repayments on mortgage-backed and collateralized mortgage obligation securities and a $110,000 decrease in the market value in the equity securities portfolio, which is primarily comprised of bank stocks. During the fourth quarter, the Bank implemented a balance sheet repositioning strategy of its portfolio of available-for-sale securities. The Bank sold $69.3 million in market value of its lower-yielding U.S government agency, mortgage-backed and municipal securities with an average yield of 1.89% and purchased $69.3 million of higher-yielding mortgage-backed and collateralized mortgage obligation securities with an average yield of 5.49%.

Loans and Credit Quality

•Total loans increased $60.5 million, or 5.8%, to $1.11 billion at December 31, 2023 compared to $1.05 billion at December 31, 2022. Loan growth was driven by increases in commercial and industrial loans, commercial real estate loans, residential mortgage loans and other loans of $41.2 million, $30.3 million, $17.1 million, and $8.9 million, respectively, partially offset by a decrease in consumer loans of $35.3 million. The decrease in consumer loans resulted from a reduction in indirect automobile loan production due to rising market interest rates and the discontinuation of this product offering as of June 30, 2023. This portfolio is expected to continue to decline as resources are allocated and production efforts are focused on more profitable commercial products. Excluding the $34.9 million decrease in indirect automobile loans, total loans increased $95.4 million, or 9.1%.

•The allowance for credit losses (ACL) was $9.7 million at December 31, 2023 and $12.8 million at December 31, 2022. As a result, the ACL to total loans was 0.87% at December 31, 2023 compared to 1.22% at December 31, 2022. The change in the ACL was primarily due to the Company's aforementioned adoption of CECL. At adoption, the Company decreased its ACL by $3.4 million. Contributing to the change in ACL was a prior year charge-off of $2.7 million and qualitative factors that significantly impacted the incurred loss model driven by historical activity compared to the adopted CECL methodology that is centered around CECL activity using a forecast approach. During the current year, the Company recorded a recovery of credit losses of $502,000 due to improvements in qualitative factors coupled with a decrease in historical loss rates

•Net recoveries for the three months ended December 31, 2023 were $6,000. Net charge-offs for the three months ended December 31, 2022 were $35,000, or 0.01% of average loans on an annualized basis. Net recoveries for the year ended December 31, 2023 were $557,000 primarily due to recoveries totaling $750,000 related to the prior year $2.7 million charged-off commercial and industrial loan. Net charge-offs for the year ended December 31, 2022 were $2.5 million.

•Nonperforming loans, which includes nonaccrual loans and accruing loans past due 90 days or more, were $2.2 million at December 31, 2023 compared to $5.8 million at December 31, 2022. The decrease of $3.6 million was due to ten loans totaling $1.7 million transferred from nonaccrual to accrual status during the current period and a $1.4 million partial repayment of a nonaccrual commercial real estate loan. Nonperforming loans to total loans ratio was 0.20% at December 31, 2023 compared to 0.55% at December 31, 2022.

Other

•Intangible assets decreased $2.6 million, or 74.0%, to $958,000 at December 31, 2023 compared to $3.5 million at December 31, 2022 due to $1.8 million of amortization expense recognized during the period and a write-off of the $789,000 remaining balance of EU’s customer list as a result of the sale of the subsidiary.

•Accrued interest and other assets increased $1.4 million or 6.6%, to $22.5 million at December 31, 2023, compared to $26.7 million at December 31, 2022 due primarily to a $1.8 million adjustment related to a fixed-to-floating interest rate swap derivative.

Total liabilities increased $17.5 million, or 1.3%, to $1.32 billion at December 31, 2023 compared to $1.30 billion at December 31, 2022.

Deposits

•Total deposits decreased $1.3 million to $1.267 billion as of December 31, 2023 compared to $1.269 billion at December 31, 2022. Non interest-bearing demand deposits decreased $112.7 million, savings deposits decreased $53.3 million, and money market deposits decreased $8.1 million, while interest-bearing demand deposits increased $51.2 million and time deposits increased $121.5 million. The increase in interest-bearing demand deposits was primarily the result of higher interest rates attracting more customers and additional deposits from existing customers while higher time deposits resulted from the offering of a higher-rate certificate of deposit product and the addition of $29.0 million of brokered certificates of deposit. The brokered certificates of deposits all mature within three months and were utilized to fund the purchase of floating rate collateralized loan obligation securities. FDIC insured deposits totaled approximately 59.4% of total deposits while an additional 16.0% of deposits were collateralized with investment securities.

Borrowed Funds

•Other borrowings increased $20.0 million, or 136.6%, to $34.7 million at December 31, 2023, compared to $14.6 million at December 31, 2022. During the second quarter, the Bank entered into $20.0 million of FHLB advances for a term of 24 months at 4.92%, the proceeds of which were utilized to match fund originations within the Bank’s commercial and industrial loan portfolio.

•Short-term borrowings decreased $8.1 million, or 100.0%, as there were no short-term borrowings at December 31, 2023, compared to $8.1 million at December 31, 2022. At December 31, 2022, short-term borrowings were comprised entirely of securities sold under agreements to repurchase. These accounts were transitioned into other deposit products and account for a portion of the interest-bearing demand deposit increase.

Accrued Interest Payable and Other Liabilities

•Accrued interest payable and other liabilities increased $6.8 million, or 89.7%, to $14.4 million at December 31, 2023, compared to $7.6 million at December 31, 2022 primarily due to a $3.4 million increase in accrued taxes payable, a $1.8 million increase related to a fixed-to-floating interest rate swap derivative and a $1.5 million increase in accrued interest payable on deposit accounts.

Stockholders’ Equity

Stockholders’ equity increased $29.7 million, or 27.0%, to $139.8 million at December 31, 2023, compared to $110.2 million at December 31, 2022. Key factors positively impacting stockholders’ equity included $22.6 million of net income for the current period, a $9.5 million increase in accumulated other comprehensive income and a $2.1 million positive adjustment, net of tax, due to the Company’s January 1, 2023 adoption of CECL as described above. These factors were partially offset by the payment of $5.1 million in dividends since December 31, 2022 and activity under share repurchase programs. On April 21, 2022, a $10.0 million repurchase program was authorized, with the Company repurchasing 74,656 shares at an average price of $22.38 per share since the inception of the program. In total, the Company repurchased $274,000 of common stock since December 31, 2022. The program expired on May 1, 2023.

Book value per share

Book value per common share was $27.31 at December 31, 2023 compared to $21.60 at December 31, 2022, an increase of $5.71.

Tangible book value per common share (Non-GAAP) was $25.23 at December 31, 2023, compared to $19.00 at December 31, 2022, an increase of $6.23.

Refer to “Explanation of Use of Non-GAAP Financial Measures” at the end of this Press Release.

About CB Financial Services, Inc.

CB Financial Services, Inc. is the bank holding company for Community Bank, a Pennsylvania-chartered commercial bank. Community Bank operates its branch network in southwestern Pennsylvania and West Virginia. Community Bank offers a broad array of retail and commercial lending and deposit services.

For more information about CB Financial Services, Inc. and Community Bank, visit our website at www.communitybank.tv.

Statement About Forward-Looking Statements

Statements contained in this press release that are not historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 and such forward-looking statements are subject to significant risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions contained in the Act. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, general and local economic conditions, changes in market interest rates, deposit flows, demand for loans, real estate values and competition, competitive products and pricing, the ability of our customers to make scheduled loan payments, loan delinquency rates and trends, our ability to manage the risks involved in our business, our ability to control costs and expenses, inflation, market and monetary fluctuations, changes in federal and state legislation and regulation applicable to our business, actions by our competitors, and other factors that may be disclosed in the Company’s periodic reports as filed with the Securities and Exchange Commission. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company assumes no obligation to update any forward-looking statements except as may be required by applicable law or regulation.

Company Contact:

John H. Montgomery

President and Chief Executive Officer

Phone: (724) 225-2400

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CB FINANCIAL SERVICES, INC. SELECTED CONSOLIDATED FINANCIAL INFORMATION |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | | | | |

| | | | | | | | | |

| Selected Financial Condition Data | 12/31/23 | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 |

| Assets | | | | | | | | | |

| Cash and Due From Banks | $ | 69,993 | | | $ | 52,597 | | | $ | 78,093 | | | $ | 103,545 | | | $ | 103,700 | |

| Securities | 207,095 | | | 172,904 | | | 181,427 | | | 189,025 | | | 190,058 | |

| | | | | | | | | |

| Loans | | | | | | | | | |

| Real Estate: | | | | | | | | | |

| Residential | 347,808 | | | 346,485 | | | 338,493 | | | 332,840 | | | 330,725 | |

| Commercial | 467,154 | | | 466,910 | | | 458,614 | | | 452,770 | | | 436,805 | |

| Construction | 43,116 | | | 41,874 | | | 44,523 | | | 39,522 | | | 44,923 | |

| Commercial and Industrial | 111,278 | | | 100,873 | | | 102,266 | | | 79,501 | | | 70,044 | |

| Consumer | 111,643 | | | 122,516 | | | 134,788 | | | 146,081 | | | 146,927 | |

| Other | 29,397 | | | 23,856 | | | 22,470 | | | 21,151 | | | 20,449 | |

| Total Loans | 1,110,396 | | | 1,102,514 | | | 1,101,154 | | | 1,071,865 | | | 1,049,873 | |

| Allowance for Credit Losses | (9,707) | | | (10,848) | | | (10,666) | | | (10,270) | | | (12,819) | |

| Loans, Net | 1,100,689 | | | 1,091,666 | | | 1,090,488 | | | 1,061,595 | | | 1,037,054 | |

| | | | | | | | | |

| Premises and Equipment, Net | 19,704 | | | 18,524 | | | 18,582 | | | 17,732 | | | 17,844 | |

| Bank-Owned Life Insurance | 25,378 | | | 25,227 | | | 25,082 | | | 24,943 | | | 25,893 | |

| Goodwill | 9,732 | | | 9,732 | | | 9,732 | | | 9,732 | | | 9,732 | |

| Intangible Assets, Net | 958 | | | 2,177 | | | 2,622 | | | 3,068 | | | 3,513 | |

| Accrued Interest Receivable and Other Assets | 22,542 | | | 26,665 | | | 26,707 | | | 21,068 | | | 21,144 | |

| Total Assets | $ | 1,456,091 | | | $ | 1,399,492 | | | $ | 1,432,733 | | | $ | 1,430,708 | | | $ | 1,408,938 | |

| | | | | | | | | |

| | | | | | | | | |

| Liabilities | | | | | | | | | |

| | | | | | | | | |

| Deposits | | | | | | | | | |

| Noninterest-Bearing Demand Accounts | $ | 277,747 | | | $ | 305,145 | | | $ | 316,098 | | | $ | 350,911 | | | $ | 390,405 | |

| Interest-Bearing Demand Accounts | 362,994 | | | 357,381 | | | 374,654 | | | 359,051 | | | 311,825 | |

| Money Market Accounts | 201,074 | | | 189,187 | | | 185,814 | | | 206,174 | | | 209,125 | |

| Savings Accounts | 194,703 | | | 207,148 | | | 217,267 | | | 234,935 | | | 248,022 | |

| Time Deposits | 230,641 | | | 177,428 | | | 169,482 | | | 130,449 | | | 109,126 | |

| Total Deposits | 1,267,159 | | | 1,236,289 | | | 1,263,315 | | | 1,281,520 | | | 1,268,503 | |

| | | | | | | | | |

| Short-Term Borrowings | — | | | — | | | — | | | 121 | | | 8,060 | |

| Other Borrowings | 34,678 | | | 34,668 | | | 34,658 | | | 14,648 | | | 14,638 | |

| Accrued Interest Payable and Other Liabilities | 14,420 | | | 13,689 | | | 18,171 | | | 17,224 | | | 7,582 | |

| Total Liabilities | 1,316,257 | | | 1,284,646 | | | 1,316,144 | | | 1,313,513 | | | 1,298,783 | |

| | | | | | | | | |

| Stockholders’ Equity | 139,834 | | | 114,846 | | | 116,589 | | | 117,195 | | | 110,155 | |

| Total Liabilities and Stockholders’ Equity | $ | 1,456,091 | | | $ | 1,399,492 | | | $ | 1,432,733 | | | $ | 1,430,708 | | | $ | 1,408,938 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | | |

| | | | | | | |

| | Three Months Ended | Year Ended |

| Selected Operating Data | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | 12/31/23 | 12/31/22 |

| Interest and Dividend Income: | | | | | | | |

| Loans, Including Fees | $ | 14,804 | | $ | 14,049 | | $ | 13,426 | | $ | 12,371 | | $ | 11,835 | | $ | 54,650 | | $ | 41,933 | |

| Securities: | | | | | | | |

| Taxable | 1,164 | | 940 | | 950 | | 964 | | 974 | | 4,017 | | 3,852 | |

| Tax-Exempt | 33 | | 41 | | 42 | | 41 | | 40 | | 157 | | 213 | |

| Dividends | 32 | | 25 | | 25 | | 24 | | 28 | | 106 | | 91 | |

| Other Interest and Dividend Income | 872 | | 819 | | 760 | | 844 | | 978 | | 3,295 | | 1,627 | |

| Total Interest and Dividend Income | 16,905 | | 15,874 | | 15,203 | | 14,244 | | 13,855 | | 62,225 | | 47,716 | |

| Interest Expense: | | | | | | | |

| Deposits | 5,336 | | 4,750 | | 3,842 | | 2,504 | | 1,811 | | 16,433 | | 4,025 | |

| Short-Term Borrowings | 26 | | — | | 3 | | 2 | | 7 | | 32 | | 63 | |

| Other Borrowings | 407 | | 407 | | 238 | | 155 | | 171 | | 1,207 | | 693 | |

| Total Interest Expense | 5,769 | | 5,157 | | 4,083 | | 2,661 | | 1,989 | | 17,672 | | 4,781 | |

| Net Interest and Dividend Income | 11,136 | | 10,717 | | 11,120 | | 11,583 | | 11,866 | | 44,553 | | 42,935 | |

(Recovery) Provision for Credit Losses - Loans | (1,147) | | 291 | | 492 | | 80 | | — | | (284) | | 3,784 | |

(Recovery) Provision for Credit Losses - Unfunded Commitments | (273) | | 115 | | (60) | | — | | — | | (218) | | — | |

Net Interest and Dividend Income After (Recovery) Provision for Credit Losses | 12,556 | | 10,311 | | 10,688 | | 11,503 | | 11,866 | | 45,055 | | 39,151 | |

| Noninterest Income: | | | | | | | |

| Service Fees | 460 | | 466 | | 448 | | 445 | | 530 | | 1,819 | | 2,160 | |

| Insurance Commissions | 969 | | 1,436 | | 1,511 | | 1,922 | | 1,399 | | 5,839 | | 5,934 | |

| Other Commissions | 60 | | 94 | | 224 | | 144 | | 157 | | 521 | | 669 | |

Net Gain (Loss) on Sales of Loans | 2 | | — | | (5) | | 2 | | — | | — | | — | |

| Net (Loss) Gain on Securities | (9,830) | | (37) | | (100) | | (232) | | 83 | | (10,199) | | (168) | |

| Net Gain on Purchased Tax Credits | 7 | | 7 | | 7 | | 7 | | 14 | | 29 | | 57 | |

| Gain on Sale of Subsidiary | 24,578 | | — | | — | | — | | — | | 24,578 | | — | |

| Net Gain on Disposal of Fixed Assets | — | | — | | — | | 11 | | — | | 11 | | 431 | |

| Income from Bank-Owned Life Insurance | 151 | | 145 | | 139 | | 140 | | 143 | | 576 | | 561 | |

| Net Gain on Bank-Owned Life Insurance Claims | — | | — | | 1 | | 302 | | — | | 303 | | — | |

| Other Income | 121 | | 301 | | 44 | | 69 | | 34 | | 535 | | 176 | |

| Total Noninterest Income | 16,518 | | 2,412 | | 2,269 | | 2,810 | | 2,360 | | 24,012 | | 9,820 | |

| Noninterest Expense: | | | | | | | |

| Salaries and Employee Benefits | 6,224 | | 5,369 | | 5,231 | | 5,079 | | 4,625 | | 21,903 | | 18,469 | |

| Occupancy | 810 | | 698 | | 789 | | 701 | | 817 | | 2,998 | | 3,047 | |

| Equipment | 298 | | 265 | | 283 | | 218 | | 178 | | 1,064 | | 739 | |

| Data Processing | 726 | | 714 | | 718 | | 857 | | 681 | | 3,014 | | 2,152 | |

| FDIC Assessment | 189 | | 189 | | 224 | | 152 | | 154 | | 754 | | 638 | |

| PA Shares Tax | 217 | | 217 | | 195 | | 260 | | 258 | | 889 | | 979 | |

| Contracted Services | 299 | | 286 | | 434 | | 147 | | 405 | | 1,166 | | 1,628 | |

| Legal and Professional Fees | 434 | | 320 | | 246 | | 182 | | 362 | | 1,182 | | 1,237 | |

| Advertising | 158 | | 114 | | 75 | | 79 | | 165 | | 426 | | 527 | |

| Other Real Estate Owned (Income) | (36) | | (8) | | (35) | | (37) | | (38) | | (115) | | (151) | |

| Amortization of Intangible Assets | 430 | | 445 | | 446 | | 445 | | 446 | | 1,766 | | 1,782 | |

| | | | | | | |

| | | | | | | |

| Other | 1,016 | | 878 | | 895 | | 945 | | 945 | | 3,735 | | 3,844 | |

| Total Noninterest Expense | 10,765 | | 9,487 | | 9,501 | | 9,028 | | 8,998 | | 38,782 | | 34,891 | |

| Income Before Income Tax Expense | 18,309 | | 3,236 | | 3,456 | | 5,285 | | 5,228 | | 30,285 | | 14,080 | |

| Income Tax Expense | 5,343 | | 564 | | 699 | | 1,129 | | 1,076 | | 7,735 | | 2,833 | |

| Net Income | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 4,156 | | $ | 4,152 | | $ | 22,550 | | $ | 11,247 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| Per Common Share Data | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | | | 12/31/23 | 12/31/22 |

| Dividends Per Common Share | $ | 0.25 | | $ | 0.25 | | $ | 0.25 | | $ | 0.25 | | $ | 0.24 | | | | $ | 1.00 | | $ | 0.96 | |

| Earnings Per Common Share - Basic | 2.53 | | 0.52 | | 0.54 | | 0.81 | | 0.81 | | | | 4.41 | | 2.19 | |

| Earnings Per Common Share - Diluted | 2.52 | | 0.52 | | 0.54 | | 0.81 | | 0.81 | | | | 4.40 | | 2.18 | |

| | | | | | | | | |

| Weighted Average Common Shares Outstanding - Basic | 5,119,184 | | 5,115,026 | | 5,111,987 | | 5,109,597 | | 5,095,237 | | | | 5,113,978 | | 5,136,670 | |

| Weighted Average Common Shares Outstanding - Diluted | 5,135,997 | | 5,126,546 | | 5,116,134 | | 5,115,705 | | 5,104,254 | | | | 5,122,916 | | 5,149,312 | |

| | | | | | | | | | | | | | | | | |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 |

| Common Shares Outstanding | 5,119,543 | | 5,120,678 | | 5,111,678 | | 5,116,830 | | 5,100,189 | |

| Book Value Per Common Share | $ | 27.31 | | $ | 22.43 | | $ | 22.81 | | $ | 22.90 | | $ | 21.60 | |

Tangible Book Value per Common Share (1) | 25.23 | | 20.10 | | 20.39 | | 20.40 | | 19.00 | |

| Stockholders’ Equity to Assets | 9.6 | % | 8.2 | % | 8.1 | % | 8.2 | % | 7.8 | % |

Tangible Common Equity to Tangible Assets (1) | 8.9 | | 7.4 | | 7.3 | | 7.4 | | 6.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

Selected Financial Ratios (2) | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | | | 12/31/23 | 12/31/22 |

| Return on Average Assets | 3.62 | % | 0.75 | % | 0.79 | % | 1.21 | % | 1.16 | % | | | 1.60 | % | 0.80 | % |

| Return on Average Equity | 44.99 | | 9.03 | | 9.38 | | 14.69 | | 15.26 | | | | 19.42 | | 9.56 | |

| Average Interest-Earning Assets to Average Interest-Bearing Liabilities | 138.74 | | 139.65 | | 142.28 | | 147.38 | | 148.93 | | | | 141.87 | | 148.06 | |

| Average Equity to Average Assets | 8.04 | | 8.32 | | 8.38 | | 8.27 | | 7.63 | | | | 8.25 | | 8.36 | |

| Net Interest Rate Spread | 2.56 | | 2.54 | | 2.78 | | 3.13 | | 3.18 | | | | 2.73 | | 3.07 | |

Net Interest Rate Spread (FTE) (1) | 2.57 | | 2.55 | | 2.79 | | 3.14 | | 3.19 | | | | 2.74 | | 3.08 | |

| Net Interest Margin | 3.19 | | 3.13 | | 3.29 | | 3.51 | | 3.46 | | | | 3.28 | | 3.24 | |

Net Interest Margin (FTE) (1) | 3.21 | | 3.14 | | 3.30 | | 3.52 | | 3.47 | | | | 3.29 | | 3.25 | |

| Net Charge-Offs (Recoveries) to Average Loans | — | | 0.04 | | 0.04 | | (0.29) | | 0.01 | | | | (0.05) | | 0.25 | |

| Efficiency Ratio | 38.93 | | 72.26 | | 70.96 | | 62.72 | | 63.25 | | | | 56.56 | | 66.14 | |

| | | | | | | | | | | | | | | | | | |

| Asset Quality Ratios | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | |

| Allowance for Credit Losses to Total Loans | 0.87 | % | 0.98 | % | 0.97 | % | 0.96 | % | 1.22 | % | |

| | | | | | |

Allowance for Credit Losses to Nonperforming Loans (3) | 433.35 | | 330.13 | | 260.46 | | 189.73 | | 221.06 | | |

Allowance for Credit Losses to Noncurrent Loans (4) | 433.35 | | 330.13 | | 260.46 | | 189.73 | | 320.64 | | |

Delinquent and Nonaccrual Loans to Total Loans (4) (5) | 0.62 | | 0.73 | | 0.68 | | 1.02 | | 0.81 | | |

Nonperforming Loans to Total Loans (3) | 0.20 | | 0.30 | | 0.37 | | 0.51 | | 0.55 | | |

Noncurrent Loans to Total Loans (4) | 0.20 | | 0.30 | | 0.37 | | 0.51 | | 0.38 | | |

Nonperforming Assets to Total Assets (6) | 0.16 | | 0.23 | | 0.30 | | 0.40 | | 0.41 | | |

| | | | | | | | | | | | | | | | | | |

Capital Ratios (7) | 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | |

| Common Equity Tier 1 Capital (to Risk Weighted Assets) | 13.64 | % | 12.77 | % | 12.54 | % | 12.60 | % | 12.33 | % | |

| Tier 1 Capital (to Risk Weighted Assets) | 13.64 | | 12.77 | | 12.54 | | 12.60 | | 12.33 | | |

| Total Capital (to Risk Weighted Assets) | 14.61 | | 13.90 | | 13.64 | | 13.69 | | 13.58 | | |

| Tier 1 Leverage (to Adjusted Total Assets) | 10.19 | | 9.37 | | 9.26 | | 9.24 | | 8.66 | | |

(1) Refer to Explanation of Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(2) Interim period ratios are calculated on an annualized basis.

(3) Nonperforming loans consist of all nonaccrual loans and accruing loans that are 90 days or more past due.

(4) Noncurrent loans consist of nonaccrual loans and accruing loans that are 90 days or more past due.

(5) Delinquent loans consist of accruing loans that are 30 days or more past due.

(6) Nonperforming assets consist of nonperforming loans and other real estate owned.

(7) Capital ratios are for Community Bank only.

Certain items previously reported may have been reclassified to conform with the current reporting period’s format.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE BALANCES AND YIELDS |

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) | | Average Balance | Interest and Dividends | Yield / Cost (1) |

| (Dollars in thousands) (Unaudited) | | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | | |

| Interest-Earning Assets: | | | | | | | | | | | | | | | | | | | |

Loans, Net (2) | $ | 1,098,284 | | $ | 14,840 | | 5.36 | % | | $ | 1,088,691 | | $ | 14,081 | | 5.13 | % | | $ | 1,079,399 | | $ | 13,450 | | 5.00 | % | | $ | 1,040,570 | | $ | 12,391 | | 4.83 | % | | $ | 1,034,714 | | $ | 11,853 | | 4.54 | % |

| Debt Securities | | | | | | | | | | | | | | | | | | | |

| Taxable | 206,702 | | 1,164 | | 2.25 | | | 204,848 | | 940 | | 1.84 | | | 209,292 | | 950 | | 1.82 | | | 213,158 | | 964 | | 1.81 | | | 216,915 | | 974 | | 1.80 | |

| Exempt From Federal Tax | 4,833 | | 42 | | 3.48 | | | 6,013 | | 52 | | 3.46 | | | 6,180 | | 53 | | 3.43 | | | 6,270 | | 52 | | 3.32 | | | 6,277 | | 51 | | 3.25 | |

| Equity Securities | 2,693 | | 32 | | 4.75 | | | 2,693 | | 25 | | 3.71 | | | 2,693 | | 25 | | 3.71 | | | 2,693 | | 24 | | 3.56 | | | 2,693 | | 28 | | 4.16 | |

| Interest-Earning Deposits at Banks | 68,164 | | 808 | | 4.74 | | | 52,466 | | 750 | | 5.72 | | | 53,582 | | 721 | | 5.38 | | | 73,221 | | 805 | | 4.40 | | | 98,110 | | 939 | | 3.83 | |

| Other Interest-Earning Assets | 3,387 | | 64 | | 7.50 | | | 3,292 | | 69 | | 8.32 | | | 2,783 | | 39 | | 5.62 | | | 2,633 | | 39 | | 6.01 | | | 2,875 | | 39 | | 5.38 | |

| Total Interest-Earning Assets | 1,384,063 | | 16,950 | | 4.86 | | | 1,358,003 | | 15,917 | | 4.65 | | | 1,353,929 | | 15,238 | | 4.51 | | | 1,338,545 | | 14,275 | | 4.33 | | | 1,361,584 | | 13,884 | | 4.05 | |

| Noninterest-Earning Assets | 37,750 | | | | | 52,885 | | | | | 52,812 | | | | | 49,703 | | | | | 52,716 | | | |

| Total Assets | $ | 1,421,813 | | | | | $ | 1,410,888 | | | | | $ | 1,406,741 | | | | | $ | 1,388,248 | | | | | $ | 1,414,300 | | | |

| Liabilities and Stockholders' Equity: | | | | | | | | | | | | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | | | |

| Interest-Bearing Demand Accounts | $ | 362,018 | | $ | 1,965 | | 2.15 | % | | $ | 363,997 | | $ | 2,003 | | 2.18 | % | | $ | 354,497 | | $ | 1,582 | | 1.79 | % | | $ | 335,327 | | $ | 1,191 | | 1.44 | % | | $ | 315,352 | | $ | 810 | | 1.02 | % |

| Savings Accounts | 200,737 | | 57 | | 0.11 | | | 212,909 | | 54 | | 0.10 | | | 225,175 | | 53 | | 0.09 | | | 242,298 | | 37 | | 0.06 | | | 249,948 | | 29 | | 0.05 | |

| Money Market Accounts | 205,060 | | 1,441 | | 2.79 | | | 187,012 | | 1,141 | | 2.42 | | | 194,565 | | 1,033 | | 2.13 | | | 213,443 | | 939 | | 1.78 | | | 206,192 | | 604 | | 1.16 | |

| Time Deposits | 193,188 | | 1,873 | | 3.85 | | | 173,832 | | 1,552 | | 3.54 | | | 155,867 | | 1,174 | | 3.02 | | | 101,147 | | 337 | | 1.35 | | | 116,172 | | 368 | | 1.26 | |

| Total Interest-Bearing Deposits | 961,003 | | 5,336 | | 2.20 | | | 937,750 | | 4,750 | | 2.01 | | | 930,104 | | 3,842 | | 1.66 | | | 892,215 | | 2,504 | | 1.14 | | | 887,664 | | 1,811 | | 0.81 | |

| Short-Term Borrowings | 1,902 | | 26 | | 5.42 | | | — | | — | | — | | | 480 | | 3 | | 2.51 | | | 1,344 | | 2 | | 0.60 | | | 8,985 | | 7 | | 0.31 | |

| Other Borrowings | 34,673 | | 407 | | 4.66 | | | 34,662 | | 407 | | 4.66 | | | 21,026 | | 238 | | 4.54 | | | 14,641 | | 155 | | 4.29 | | | 17,598 | | 171 | | 3.86 | |

| Total Interest-Bearing Liabilities | 997,578 | | 5,769 | | 2.29 | | | 972,412 | | 5,157 | | 2.10 | | | 951,610 | | 4,083 | | 1.72 | | | 908,200 | | 2,661 | | 1.19 | | | 914,247 | | 1,989 | | 0.86 | |

| Noninterest-Bearing Demand Deposits | 305,789 | | | | | 312,016 | | | | | 326,262 | | | | | 362,343 | | | | | 391,300 | | | |

Total Funding and Cost of Funds | 1,303,367 | | | 1.76 | | | 1,284,428 | | | 1.59 | | | 1,277,872 | | | 1.28 | | | 1,270,543 | | | 0.85 | | | 1,305,547 | | | 0.60 | |

| Other Liabilities | 4,119 | | | | | 9,025 | | | | | 10,920 | | | | | 2,953 | | | | | 788 | | | |

| Total Liabilities | 1,307,486 | | | | | 1,293,453 | | | | | 1,288,792 | | | | | 1,273,496 | | | | | 1,306,335 | | | |

| Stockholders' Equity | 114,327 | | | | | 117,435 | | | | | 117,949 | | | | | 114,752 | | | | | 107,965 | | | |

| Total Liabilities and Stockholders' Equity | $ | 1,421,813 | | | | | $ | 1,410,888 | | | | | $ | 1,406,741 | | | | | $ | 1,388,248 | | | | | $ | 1,414,300 | | | |

Net Interest Income (FTE) (Non-GAAP) (3) | | $ | 11,181 | | | | | $ | 10,760 | | | | | $ | 11,155 | | | | | $ | 11,614 | | | | | $ | 11,895 | | |

Net Interest-Earning Assets (4) | 386,485 | | | | | 385,591 | | | | | 402,319 | | | | | 430,345 | | | | | 447,337 | | | |

Net Interest Rate Spread (FTE) (Non-GAAP) (3) (5) | | | 2.57 | % | | | | 2.55 | % | | | | 2.79 | % | | | | 3.14 | % | | | | 3.19 | % |

Net Interest Margin (FTE) (Non-GAAP) (3)(6) | | | 3.21 | | | | | 3.14 | | | | | 3.30 | | | | | 3.52 | | | | | 3.47 | |

| | | | | | | | | | | | | | | | | | | |

(1) Annualized based on three months ended results.

(2) Net of the allowance for credit losses and includes nonaccrual loans with a zero yield.

(3) Refer to Explanation and Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(4) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(5) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(6) Net interest margin represents annualized net interest income divided by average total interest-earning assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AVERAGE BALANCES AND YIELDS |

| | | | | | | | | | | |

| Year Ended |

| December 31, 2023 | | December 31, 2022 |

| Average Balance | | Interest and Dividends | | Yield /Cost | | Average Balance | | Interest and Dividends | | Yield / Cost |

| (Dollars in thousands) (Unaudited) | | | | | | | | | | | |

| Assets: | | | | | | | | | | | |

| Interest-Earning Assets: | | | | | | | | | | | |

Loans, Net (1) | $ | 1,076,928 | | | $ | 54,763 | | | 5.09 | % | | $ | 1,019,124 | | | $ | 42,010 | | | 4.12 | % |

| Debt Securities | | | | | | | | | | | |

| Taxable | 208,472 | | | 4,017 | | | 1.93 | | | 220,818 | | | 3,852 | | | 1.74 | |

| Exempt From Federal Tax | 5,821 | | | 199 | | | 3.42 | | | 8,383 | | | 270 | | | 3.22 | |

| Marketable Equity Securities | 2,693 | | | 106 | | | 3.94 | | | 2,693 | | | 91 | | | 3.38 | |

| Interest-Earning Deposits at Banks | 61,818 | | | 3,084 | | | 4.99 | | | 71,283 | | | 1,473 | | | 2.07 | |

| Other Interest-Earning Assets | 3,027 | | | 211 | | | 6.97 | | | 3,092 | | | 154 | | | 4.98 | |

| Total Interest-Earning Assets | 1,358,759 | | | 62,380 | | | 4.59 | | | 1,325,393 | | | 47,850 | | | 3.61 | |

| Noninterest-Earning Assets | 48,268 | | | | | | | 81,035 | | | | | |

| Total Assets | $ | 1,407,027 | | | | | | | $ | 1,406,428 | | | | | |

| | | | | | | | | | | |

| Liabilities and Stockholders' Equity: | | | | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | | | |

| Interest-Bearing Demand Accounts | $ | 354,060 | | | $ | 6,741 | | | 1.90 | % | | $ | 282,850 | | | $ | 1,362 | | | 0.48 | % |

| Savings Accounts | 220,146 | | | 202 | | | 0.09 | | | 248,334 | | | 88 | | | 0.04 | |

| Money Market Accounts | 199,962 | | | 4,554 | | | 2.28 | | | 194,223 | | | 976 | | | 0.50 | |

| Time Deposits | 156,310 | | | 4,936 | | | 3.16 | | | 124,817 | | | 1,599 | | | 1.28 | |

| Total Interest-Bearing Deposits | 930,478 | | | 16,433 | | | 1.77 | | | 850,224 | | | 4,025 | | | 0.47 | |

| Short-Term Borrowings | 931 | | | 32 | | | 3.44 | | | 27,360 | | | 63 | | | 0.23 | |

| Other Borrowings | 26,328 | | | 1,207 | | | 4.58 | | | 17,609 | | | 693 | | | 3.94 | |

| Total Interest-Bearing Liabilities | 957,737 | | | 17,672 | | | 1.85 | | | 895,193 | | | 4,781 | | | 0.53 | |

| Noninterest-Bearing Demand Deposits | 326,408 | | | | | | | 389,553 | | | | | |

Total Funding and Cost of Funds | 1,284,145 | | | | | 1.38 | | | 1,284,746 | | | | | 0.37 | |

| Other Liabilities | 6,764 | | | | | | | 4,072 | | | | | |

| Total Liabilities | 1,290,909 | | | | | | | 1,288,818 | | | | | |

| Stockholders' Equity | 116,118 | | | | | | | 117,610 | | | | | |

| Total Liabilities and Stockholders' Equity | $ | 1,407,027 | | | | | | | $ | 1,406,428 | | | | | |

Net Interest Income (FTE) (Non-GAAP) (2) | | | 44,708 | | | | | | | 43,069 | | | |

Net Interest-Earning Assets (3) | 401,022 | | | | | | | 430,200 | | | | | |

Net Interest Rate Spread (FTE) (Non-GAAP) (2)(4) | | | | | 2.74 | % | | | | | | 3.08 | % |

Net Interest Margin (FTE) (Non-GAAP) (2)(5) | | | | | 3.29 | | | | | | | 3.25 | |

| | | | | | | | | | | |

(1) Net of the allowance for credit losses and includes nonaccrual loans with a zero yield.

(2) Refer to Explanation and Use of Non-GAAP Financial Measures in this Press Release for the calculation of the measure and reconciliation to the most comparable GAAP measure.

(3) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

(4) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average cost of interest-bearing liabilities.

(5) Net interest margin represents annualized net interest income divided by average total interest-earning assets.

Explanation of Use of Non-GAAP Financial Measures

In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), we use, and this Press Release contains or references, certain Non-GAAP financial measures. We believe these Non-GAAP financial measures provide useful information in understanding our underlying results of operations or financial position and our business and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Non-GAAP adjusted items impacting the Company's financial performance are identified to assist investors in providing a complete understanding of factors and trends affecting the Company’s business and in analyzing the Company’s operating results on the same basis as that applied by management. Although we believe that these Non-GAAP financial measures enhance the understanding of our business and performance, they should not be considered an alternative to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with similar Non-GAAP measures which may be presented by other companies. Where Non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found herein.

| | | | | | | | | | | | | | | | | |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | |

| | | | | |

Total Assets (GAAP) | $ | 1,456,091 | | $ | 1,399,492 | | $ | 1,432,733 | | $ | 1,430,708 | | $ | 1,408,938 | |

| Goodwill and Intangible Assets, Net | (10,690) | | (11,909) | | (12,354) | | (12,800) | | (13,245) | |

| Tangible Assets (Non-GAAP) (Numerator) | $ | 1,445,401 | | $ | 1,387,583 | | $ | 1,420,379 | | $ | 1,417,908 | | $ | 1,395,693 | |

| | | | | |

| Stockholders' Equity (GAAP) | $ | 139,834 | | $ | 114,846 | | $ | 116,589 | | $ | 117,195 | | $ | 110,155 | |

| Goodwill and Intangible Assets, Net | (10,690) | | (11,909) | | (12,354) | | (12,800) | | (13,245) | |

| Tangible Common Equity or Tangible Book Value (Non-GAAP) (Denominator) | $ | 129,144 | | $ | 102,937 | | $ | 104,235 | | $ | 104,395 | | $ | 96,910 | |

| | | | | |

| Stockholders’ Equity to Assets (GAAP) | 9.6 | % | 8.2 | % | 8.1 | % | 8.2 | % | 7.8 | % |

| Tangible Common Equity to Tangible Assets (Non-GAAP) | 8.9 | % | 7.4 | % | 7.3 | % | 7.4 | % | 6.9 | % |

| | | | | |

| Common Shares Outstanding (Denominator) | 5,119,543 | | 5,120,678 | | 5,111,678 | | 5,116,830 | | 5,100,189 | |

| | | | | |

| Book Value per Common Share (GAAP) | $ | 27.31 | | $ | 22.43 | | $ | 22.81 | | $ | 22.90 | | $ | 21.60 | |

| Tangible Book Value per Common Share (Non-GAAP) | $ | 25.23 | | $ | 20.10 | | $ | 20.39 | | $ | 20.40 | | $ | 19.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Year Ended | |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | 12/31/23 | 12/31/22 | |

| (Dollars in thousands) (Unaudited) | | | | | | | | |

| | | | | | | | |

| Net Income (GAAP) | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 4,156 | | $ | 4,152 | | $ | 22,550 | | $ | 11,247 | | |

| Amortization of Intangible Assets, Net | 430 | | 445 | | 446 | | 445 | | 446 | | 1,766 | | 1,782 | | |

| | | | | | | | |

| Adjusted Net Income (Non-GAAP) (Numerator) | $ | 13,396 | | $ | 3,117 | | $ | 3,203 | | $ | 4,601 | | $ | 4,598 | | $ | 24,316 | | $ | 13,029 | | |

| | | | | | | | |

| Annualization Factor | 3.97 | | 3.97 | | 4.01 | | 4.06 | | 3.97 | | 1.00 | | 1.00 | | |

| | | | | | | | |

| Average Stockholders' Equity (GAAP) | $ | 114,327 | | $ | 117,435 | | $ | 117,949 | | $ | 114,752 | | $ | 107,965 | | $ | 116,118 | | $ | 117,610 | | |

| Average Goodwill and Intangible Assets, Net | (11,829) | | (12,185) | | (12,626) | | (13,080) | | (13,534) | | (12,426) | | (14,193) | | |

| Average Tangible Common Equity (Non-GAAP) (Denominator) | $ | 102,498 | | $ | 105,250 | | $ | 105,323 | | $ | 101,672 | | $ | 94,431 | | $ | 103,692 | | $ | 103,417 | | |

| | | | | | | | |

| Return on Average Equity (GAAP) | 44.99 | % | 9.03 | % | 9.38 | % | 14.69 | % | 15.26 | % | 19.42 | % | 9.56 | % | |

| Return on Average Tangible Common Equity (Non-GAAP) | 51.85 | % | 11.75 | % | 12.20 | % | 18.35 | % | 19.32 | % | 23.45 | % | 12.60 | % | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | Year Ended |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | | | | 12/31/23 | 12/31/22 |

| (Dollars in thousands) (Unaudited) | | | | | | | | | | |

| | | | | | | | | | |

| Interest Income (GAAP) | $ | 16,905 | | $ | 15,874 | | $ | 15,203 | | $ | 14,244 | | $ | 13,855 | | | | | $ | 62,225 | | $ | 47,716 | |

| Adjustment to FTE Basis | 45 | | 43 | | 35 | | 31 | | 29 | | | | | 155 | | 134 | |

| Interest Income (FTE) (Non-GAAP) | 16,950 | | 15,917 | | 15,238 | | 14,275 | | 13,884 | | | | | 62,380 | | 47,850 | |

| Interest Expense (GAAP) | 5,769 | | 5,157 | | 4,083 | | 2,661 | | 1,989 | | | | | 17,672 | | 4,781 | |

| Net Interest Income (FTE) (Non-GAAP) | $ | 11,181 | | $ | 10,760 | | $ | 11,155 | | $ | 11,614 | | $ | 11,895 | | | | | $ | 44,708 | | $ | 43,069 | |

| | | | | | | | | | |

| Net Interest Rate Spread (GAAP) | 2.56 | % | 2.54 | % | 2.78 | % | 3.13 | % | 3.18 | % | | | | 2.73 | % | 3.07 | % |

| Adjustment to FTE Basis | 0.01 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | | | | | 0.01 | | 0.01 | |

| Net Interest Rate Spread (FTE) (Non-GAAP) | 2.57 | % | 2.55 | % | 2.79 | % | 3.14 | % | 3.19 | % | | | | 2.74 | % | 3.08 | % |

| | | | | | | | | | |

| Net Interest Margin (GAAP) | 3.19 | % | 3.13 | % | 3.29 | % | 3.51 | % | 3.46 | % | | | | 3.28 | % | 3.24 | % |

| Adjustment to FTE Basis | 0.02 | | 0.01 | | 0.01 | | 0.01 | | 0.01 | | | | | 0.01 | | 0.01 | |

| Net Interest Margin (FTE) (Non-GAAP) | 3.21 | % | 3.14 | % | 3.30 | % | 3.52 | % | 3.47 | % | | | | 3.29 | % | 3.25 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Year Ended |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | 12/31/23 | 12/31/22 |

| (Dollars in thousands) (Unaudited) | | | | | | | |

| | | | | | | |

| Net Income Before Income Tax Expense (GAAP) | $ | 18,309 | | $ | 3,236 | | $ | 3,456 | | $ | 5,285 | | $ | 5,228 | | $ | 30,285 | | $ | 14,080 | |

| (Recovery) Provision for Credit Losses | (1,420) | | 406 | | 432 | | 80 | | — | | (502) | | 3,784 | |

| Adjustments | | | | | | | |

| Loss (Gain) on Securities | 9,830 | | 37 | | 100 | | 232 | | (83) | | 10,199 | | 168 | |

| Gain on Sale of Subsidiary | (24,578) | | — | | — | | — | | — | | (24,578) | | — | |

| Adjusted PPNR (Non-GAAP) (Numerator) | $ | 2,141 | | $ | 3,679 | | $ | 3,988 | | $ | 5,597 | | $ | 5,145 | | $ | 15,404 | | $ | 18,032 | |

| | | | | | | |

| Annualization Factor | 3.97 | | 3.97 | | 4.01 | | 4.06 | | 3.97 | | 1.00 | | 1.00 | |

| | | | | | | |

| Average Assets (Denominator) | $ | 1,421,813 | | $ | 1,410,888 | | $ | 1,406,741 | | $ | 1,388,248 | | $ | 1,414,300 | | $ | 1,407,027 | | $ | 1,406,428 | |

| | | | | | | |

| Adjusted PPNR Return on Average Assets (Non-GAAP) | 0.60 | % | 1.04 | % | 1.14 | % | 1.64 | % | 1.44 | % | 1.09 | % | 1.28 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Year Ended |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | 12/31/23 | 12/31/22 |

| (Dollars in thousands, except share and per share data) (Unaudited) | | | | | | | |

| | | | | | | |

| Net Income (GAAP) | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 4,156 | | $ | 4,152 | | $ | 22,550 | | $ | 11,247 | |

| | | | | | | |

| Adjustments | | | | | | | |

| Loss (Gain) on Securities | 9,830 | | 37 | | 100 | | 232 | | (83) | | 10,199 | | 168 | |

| Gain on Sale of Subsidiary | (24,578) | | — | | — | | — | | — | | (24,578) | | — | |

Gain on Disposal of Fixed Assets | — | | — | | — | | (11) | | — | | (11) | | (431) | |

| Gain on Bank-Owned Life Insurance Claims | — | | — | | (1) | | (302) | | — | | (303) | | — | |

| Tax effect | 4,843 | | (8) | | (21) | | (46) | | 17 | | 4,767 | | 55 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted Net Income (Non-GAAP) | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | $ | 4,029 | | $ | 4,086 | | $ | 12,624 | | $ | 11,039 | |

| | | | | | | |

| Weighted-Average Diluted Common Shares and Common Stock Equivalents Outstanding | 5,135,997 | | 5,126,546 | | 5,116,134 | | 5,115,705 | | 5,104,254 | | 5,122,916 | | 5,149,312 | |

| | | | | | | |

| Earnings per Common Share - Diluted (GAAP) | $ | 2.52 | | $ | 0.52 | | $ | 0.54 | | $ | 0.81 | | $ | 0.81 | | $ | 4.40 | | $ | 2.18 | |

| | | | | | | |

| Adjusted Earnings per Common Share - Diluted (Non-GAAP) | $ | 0.60 | | $ | 0.53 | | $ | 0.55 | | $ | 0.79 | | $ | 0.80 | | $ | 2.47 | | $ | 2.15 | |

| | | | | | | |

| Net Income (GAAP) (Numerator) | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 4,156 | | $ | 4,152 | | $ | 22,550 | | $ | 11,247 | |

| | | | | | | |

| Annualization Factor | 3.97 | | 3.97 | | 4.01 | | 4.06 | | 3.97 | | 1.00 | | 1.00 | |

| | | | | | | |

| Average Assets (Denominator) | 1,421,813 | | 1,410,888 | | 1,406,741 | | 1,388,248 | | 1,414,300 | | 1,407,027 | | 1,406,428 | |

| | | | | | | |

| Return on Average Assets (GAAP) | 3.62 | % | 0.75 | % | 0.79 | % | 1.21 | % | 1.16 | % | 1.60 | % | 0.80 | % |

| | | | | | | |

| Adjusted Net Income (Non-GAAP) (Numerator) | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | $ | 4,029 | | $ | 4,086 | | $ | 12,624 | | $ | 11,039 | |

| | | | | | | |

| Annualization Factor | 3.97 | | 3.97 | | 4.01 | | 4.06 | | 3.97 | | 1.00 | | 1.00 | |

| | | | | | | |

| Average Assets (Denominator) | 1,421,813 | | 1,410,888 | | 1,406,741 | | 1,388,248 | | 1,414,300 | | 1,407,027 | | 1,406,428 | |

| | | | | | | |

| Adjusted Return on Average Assets (Non-GAAP) | 0.85 | % | 0.76 | % | 0.81 | % | 1.18 | % | 1.15 | % | 0.90 | % | 0.78 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| 12/31/23 | 9/30/23 | 6/30/23 | 3/31/23 | 12/31/22 | | | 12/31/23 | 12/31/22 |

| (Dollars in thousands) (Unaudited) | | | | | | | | | |

| | | | | | | | | |

| Net Income (GAAP) (Numerator) | $ | 12,966 | | $ | 2,672 | | $ | 2,757 | | $ | 4,156 | | $ | 4,152 | | | | $ | 22,550 | | $ | 11,247 | |

| | | | | | | | | |

| Annualization Factor | 3.97 | | 3.97 | | 4.01 | | 4.06 | | 3.97 | | | | 1.00 | | 1.00 | |

| | | | | | | | | |

| Average Equity (GAAP) (Denominator) | 114,327 | | 117,435 | | 117,949 | | 114,752 | | 107,965 | | | | 116,118 | | 117,610 | |

| | | | | | | | | |

| Return on Average Equity (GAAP) | 44.99 | % | 9.03 | % | 9.38 | % | 14.69 | % | 15.26 | % | | | 19.42 | % | 9.56 | % |

| | | | | | | | | |

| Adjusted Net Income (Non-GAAP) (Numerator) | $ | 3,061 | | $ | 2,701 | | $ | 2,835 | | $ | 4,029 | | $ | 4,086 | | | | $ | 12,624 | | $ | 11,039 | |

| | | | | | | | | |

| Annualization Factor | 3.97 | | 3.97 | | 4.01 | | 4.06 | | 3.97 | | | | 1.00 | | 1.00 | |

| | | | | | | | | |

| Average Equity (GAAP) (Denominator) | 114,327 | | 117,435 | | 117,949 | | 114,752 | | 107,965 | | | | 116,118 | | 117,610 | |

| | | | | | | | | |

| Adjusted Return on Average Equity (Non-GAAP) | 10.62 | % | 9.12 | % | 9.64 | % | 14.24 | % | 15.01 | % | | | 10.87 | % | 9.39 | % |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

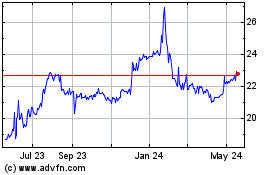

CB Financial Services (NASDAQ:CBFV)

Historical Stock Chart

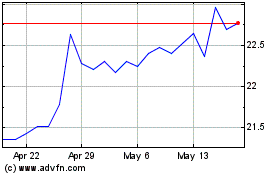

From Mar 2024 to Apr 2024

CB Financial Services (NASDAQ:CBFV)

Historical Stock Chart

From Apr 2023 to Apr 2024