Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

November 06 2020 - 5:25PM

Edgar (US Regulatory)

Filed by: Broadway Financial Corporation

(Commission File No.: 001-39043)

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934, as amended

Subject Company: Broadway Financial Corporation

(Commission File No.: 001-39043)

Date: November 6, 2020

Integration Update No. 1

Friday, November 6th 2020 | Internal & Confidential

Brian E. Argrett & Wayne Bradshaw

Dear colleagues,

Since we announced plans to merge City First Bank in DC and Broadway Federal in Los Angeles, we’ve been working to advance toward our exciting vision, which we are calling our “North Star.” With the support of colleagues from both organizations, this work has now begun in earnest. We are pleased to report on progress.

Integration Framework

Combining our organizations in a way that delivers fully on the promise of our “merger of equals” requires careful planning, analysis, and detailed work. To that end, we recently launched an Integration Management Office (IMO), led by Cynthia Newell from City First and Ruth McCloud from Broadway, to lead this effort. The IMO, which will involve more than 20 colleagues with equal representation from both banks, will lead a range of workstreams and develop recommendations on the best way to integrate our operations. They will report to a Steering Committee (“SteerCo”), which we each will join, along with a number of members of the executive management of both banks.

McKinsey & Company, an international management consulting firm with deep experience in the banking industry and in merger integrations, will support our efforts. We expect to close the transaction (“Day 1”) in the first quarter of 2021. The full integration of our operations will take longer, and likely will not occur before the end of 2021. We look forward to keeping you apprised of our progress in the months ahead.

Regulatory Process

As announced, our merger requires the approval of shareholders of both banks, as well as a number of regulatory agencies. We filed for approval with the OCC (Office of the Comptroller of the Currency) and the Federal Reserve last week. We look forward to scheduling shareholders meetings in the near future.

Looking ahead

While we understand that any change can be challenging at times, we remain very excited about the prospects for our merged organization, as well as by the dedication, enterprise, and energy we are seeing from our colleagues. Together, with your continued leadership, we can build a much stronger and more successful institution—one that operates on a larger scale, resists margin pressure and boosts lending in the areas that need it most. This will strengthen our ability to deliver on our noble purpose—supporting low-to-moderate income and marginalized communities through our provision of capital, and access to resources and connections that allow our communities to become stronger and healthier.

For any questions please reach out to your respective IMO leaders (Cynthia Newell for City First and Ruth McCloud for Broadway).

|

Brian E. Argrett

|

|

Wayne Bradshaw

|

|

|

|

|

|

(signature)

|

|

(signature)

|

Additional Information and Where to Find it

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed business combination (the “proposed transaction”) between Broadway Financial Corporation, a Delaware corporation (“Broadway”) and CFBanc Corp., a District of Columbia benefit corporation (“City First”). In connection with the proposed transaction, Broadway intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”) that will include a joint proxy statement of Broadway and City First and a prospectus of Broadway (the “Joint Proxy/Prospectus”). Broadway also plans to file other relevant documents with the SEC regarding the proposed transaction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful. Any definitive Joint Proxy/Prospectus (if and when available) will be mailed or otherwise provided to stockholders of Broadway and City First. INVESTORS AND SECURITY HOLDERS OF BROADWAY AND CITY FIRST ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about Broadway and City First, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Broadway will also be available free of charge on Broadway’s website at https://www.broadwayfederalbank.com/financial-highlights. Copies of the Registration Statement and the Joint Proxy/Prospectus can also be obtained, when it becomes available, free of charge by directing a request to Broadway Financial Corporation, 5055 Wilshire Boulevard Suite 500 Los Angeles, California 90036, Attention: Investor Relations, Telephone: 323-556-3264, or by email to investor.relations@broadwayfederalbank.com, or to CFBanc Corporation, 1432 U Street, NW DC 20009, Attention: Audrey Phillips, Corporate Secretary, Telephone: 202-243-7141.

Certain Information Concerning Participants

Broadway, City First and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Broadway is set forth in Broadway’s proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on May 20, 2020. Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy/Prospectus and other relevant materials to be filed with the SEC when they become available. These documents, when available, can be obtained free of charge from the sources indicated above. Investors should read the Joint Proxy/Prospectus carefully when it becomes available before making any voting or investment decisions.

Cautionary Statement Regarding Forward-Looking Information

This communication includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “poised,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements; however the absence of these words does not mean the statements are not forward-looking. Forward-looking statements in this communication include matters that involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to differ materially from results expressed or implied by this communication. Such risk factors include, among others: the uncertainty as to the extent of the duration, scope and impacts of the COVID-19 pandemic; political and economic uncertainty, including any decline in global economic conditions or the stability of credit and financial markets; the expected timing and likelihood of completion of the proposed transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction that could reduce anticipated benefits or cause the parties to abandon the proposed transaction, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the possibility that stockholders of Broadway or of City First may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all or failure to close the proposed transaction for any other reason, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Broadway Common Stock, the risk relating to the potential dilutive effect of shares of Company Common Stock to be issued in the proposed transaction, the risk of any unexpected costs or expenses resulting from the proposed transaction, the risk of any litigation relating to the proposed transaction, the risk of possible adverse rulings, judgments, settlements and other outcomes of pending litigation, the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Broadway and City First to retain customers and retain and hire key personnel and maintain relationships with their customers and on their operating results and businesses generally, the risk the pending proposed transaction could distract management of both entities and that they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, or that the entities may not be able to successfully integrate the businesses, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Broadway’s control. Additional factors that could cause results to differ materially from those described above can be found in Broadway’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K or other filings, which have been filed with the SEC and are available on Broadway’s website at https://www.broadwayfederalbank.com/financial-highlights and on the SEC’s website at http://www.sec.gov.

Actual results may differ materially from those contained in the forward-looking statements in this communication. Forward-looking statements speak only as of the date they are made and Broadway undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after the date of this communication. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communication.

###

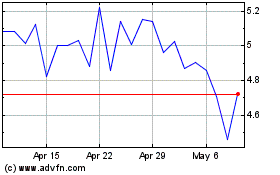

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

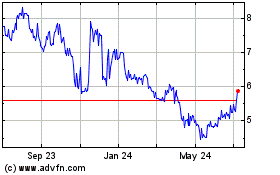

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Apr 2023 to Apr 2024