UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☑

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to sec. 240.14a-11(c) or sec. 240.14a-12

|

ATOSSA THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

Fee not required.

|

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies.

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies.

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction.

|

|

|

|

|

|

|

(5)

|

Total fee paid.

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid.

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration State No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

Atossa Therapeutics, Inc.

107 Spring Street

Seattle, Washington 98104

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on September 7, 2021 at 9:00 a.m. ET

Virtual Meeting Only

Technical Support Contact: VirtualMeeting@viewproxy.com or call 1-866-612-8937

Dear Stockholder:

You are cordially invited to attend the Special Meeting of Stockholders of Atossa Therapeutics, Inc., a Delaware corporation (the “Company”), which will be held virtually on September 7, 2021, at 9:00 a.m. Eastern time. Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders, this Special Meeting will be held in a virtual meeting format only. You can virtually attend the live webcast of the Special Meeting at http://www.viewproxy.com/AtossaTherapeutics/2021/SM. For more information, see “General Information—About the Special Meeting – What do I need to do to virtually attend the Special Meeting. meeting via live audio webcast?” Only stockholders of record who held common stock at the close of business on the record date, July 29, 2021 (the “Record Date”), may attend virtually and vote virtually at the Special Meeting, including any adjournment or postponement thereof.

At the Special Meeting, you will be asked to consider and vote upon approval of an amendment to the certificate of incorporation to increase the number of shares of authorized common stock by 100,000,000 shares.

No other items of business are expected to be considered at the meeting, pursuant to the Company’s Bylaws. The enclosed Proxy Statement more fully describes the details of the business to be conducted at the Special Meeting. After careful consideration, our Board of Directors has unanimously approved the proposal and recommends that you vote FOR the proposal. After reading the Proxy Statement, please mark, date, and sign and return the enclosed proxy card in the accompanying reply envelope to ensure receipt by our tabulator. YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN, DATE AND RETURN THE ENCLOSED PROXY OR ATTEND THE SPECIAL MEETING VIRTUALLY. Stockholders of record on the record date may also vote on-line or by phone by following the instructions contained in the accompanying Proxy Statement.

We look forward to your attendance at the Special Meeting.

Sincerely,

Steven C. Quay, M.D., Ph.D.

Chairman of the Board, President and

Chief Executive Officer

August 9, 2021

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE MARK, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT AT YOUR EARLIEST CONVENIENCE IN THE ENCLOSED POSTAGE-PREPAID RETURN ENVELOPE. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IF YOU ATTEND THE MEETING VIRTUALLY AND IF YOU ARE A STOCKHOLDER OF RECORD ON THE RECORD DATE YOU MAY VOTE ON-LINE OR VIA THE PHONE. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE VIRTUAL MEETING, YOU MUST OBTAIN A LEGAL PROXY ISSUED IN YOUR NAME FROM YOUR BROKER.

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD VIRTUALLY ON SEPTEMBER 7, 2021: THIS PROXY STATEMENT, THE NOTICE OF SPECIAL MEETING OF STOCKHOLDERS AND THE ANNUAL REPORT ARE AVAILABLE AT HTTP://WWW.VIEWPROXY.COM/ATOSSATHERAPEUTICS/2021SM.

|

107 Spring Street

Seattle, Washington 98104

PROXY STATEMENT FOR

2021 SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 7, 2021 AT 9:00 A.M. EASTERN TIME

VIRTUAL MEETING ONLY

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Atossa Therapeutics, Inc. (“Atossa” or the “Company”) for use at the Company’s 2021 Special Meeting of Stockholders. Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our stockholders, employees and directors, the Special Meeting will be held in a virtual meeting format only. For more information, see “General Information—How do I attend and vote shares at the virtual Special Meeting?” This Proxy Statement and the accompanying form of proxy will be mailed to our stockholders on or about August 9, 2021. Unless otherwise indicated herein, this Proxy Statement speaks as of the close of business on July 29, 2021, which is the record date for the special meeting (the “Record Date”).

For a proxy to be effective, it must be properly executed and received prior to the special meeting. Each proxy properly tendered will, unless otherwise directed by the stockholder, be voted for the proposals and nominees described in this Proxy Statement and at the discretion of the proxy holder(s) with regard to all other matters that may properly come before the meeting.

The Company will pay all of the costs of soliciting proxies. We will provide copies of this Proxy Statement, notice of special meeting and accompanying materials to brokerage firms, fiduciaries and custodians for forwarding to beneficial owners and will reimburse these persons for their costs of forwarding these materials. Our directors, officers and employees may also solicit proxies by telephone, facsimile, or personal solicitation; however, we will not pay them additional compensation for any of these services.

Only holders of record of our common stock (“common stock”) at the close of business on the Record Date are entitled to notice of and to vote at the special meeting. On the Record Date, there were a total of 126,435,756 shares of common stock issued and outstanding. Each share of common stock is entitled to one vote on all matters to be voted upon at the special meeting. The presence, virtually or by proxy, of the holders of a majority of the outstanding shares of common stock on the Record Date will constitute a quorum for the transaction of business at the special meeting and any adjournment thereof.

Persons who hold shares of Atossa common stock directly on the Record Date and not through a broker, bank or other financial institution (“record holders”) may vote by the following methods:

|

|

●

|

Vote by proxy - You may complete, sign and return a proxy card;

|

|

|

●

|

Vote by attendance - You may virtually attend the special meeting and virtually vote at the meeting.

|

|

|

●

|

Proxy Vote by Internet - As explained in greater detail in the Notice of Internet Availability of Proxy Materials, mailed on or about August 9, 2021 to stockholders of record who held common stock at the close of business on the Record Date, you may use the Internet to transmit your voting instructions up until 12:59 PM Eastern Daylight Time on September 6, 2021 by going to the website http://www.FCRvote.com/ATOSSM. Please have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

|

|

|

●

|

Proxy Vote by Phone - You may use any touch-tone telephone to transmit your voting instructions up until 12:59 PM Eastern Daylight Time on September 6, 2021 by calling the toll-free number 1-866-402-3905. Have your proxy card in hand when you call and then follow the instructions.

|

Persons who hold shares of Atossa common stock indirectly on the Record Date through a brokerage firm, bank or other financial institution (“beneficial holders”) must return a voting instruction form to have their shares voted on their behalf. Brokerage firms, banks or other financial institutions that do not receive voting instructions from beneficial holders may either vote these shares on behalf of the beneficial holders or return a proxy leaving these shares un-voted (a “broker non-vote”).

Abstentions and broker non-votes will be counted for the purpose of determining the presence or absence of a quorum, but will not be counted for the purpose of determining the number of votes cast on a given proposal. The required vote for each of the proposals expected to be acted upon at the special meeting is described below:

Proposal No. 1 — Approval of an amendment to Atossa’s certificate of incorporation to increase the number of authorized shares of common stock by 100,000,000 shares. This proposal must be approved by the affirmative vote of the holders of a majority of the common stock outstanding and entitled to vote on the Record Date. As a result, abstentions and broker non-votes will have the same effect as voting against this proposal.

We encourage you to vote by returning your proxy or voting instruction form or if you are a record holder by voting on-line or via phone. By voting in advance of the meeting, this ensures that your shares will be voted and reduces the likelihood that the Company will be forced to incur additional expenses soliciting proxies for another special meeting. Any record holder of our common stock may attend the special meeting virtually and may revoke the enclosed form of proxy at any time by:

|

|

●

|

executing and delivering to the corporate Secretary a later-dated proxy (not by internet or phone);

|

|

|

●

|

delivering a written revocation to the corporate Secretary before the meeting; or

|

|

|

●

|

voting in online http://www.FCRvote.com/ATOSSM during the virtual special meeting.

|

Beneficial holders of our common stock who wish to change or revoke their voting instructions should contact their brokerage firm, bank or other financial institution for information on how to do so. Beneficial holders who wish to attend the special meeting virtually and vote during the virtual meeting should contact their brokerage firm, bank or other financial institution holding shares of Atossa on their behalf in order to obtain a “legal proxy,” which will allow them vote during the meeting virtually. Without a legal proxy, beneficial holders cannot vote at the virtual special meeting because their brokerage firm, bank or other financial institution may have already voted or returned a broker non-vote on their behalf.

FOR TECHNICAL SUPPORT PRIOR TO OR DURING THE SPECIAL MEETING, PLEASE CONTACT:

VirtualMeeting@viewproxy.com or call 1-866-612-8937

PROPOSAL NO. 1

AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO

INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK BY

100,000,000 SHARES.

At the Special Meeting, you are being asked to approve an amendment to the certificate of incorporation to increase the number of authorized shares of common stock by 100,000,000 shares.

The total number of shares of common stock authorized for issuance is 175,000,000, par value $0.18 per share, and the total number of shares of preferred stock authorized for issuance is 10,000,000 shares, par value $0.001 per share, of which 597 Series B convertible preferred stock are outstanding as of the Record Date.

As of July 22, 2021, 171,402,146 shares of common stock were issued and outstanding or reserved for future issuance, consisting of the following: (i) 126,435,756 shares of common stock issued and outstanding, (ii) 10,234,776 shares of common stock reserved for future issuance upon exercise of options that have previously been granted, (iii) 166,191 shares of common stock reserved for future conversion of Series B convertible stock to common stock, (iv) 12,101,079 shares of common stock reserved for issuance upon exercise of options subject to grant under the 2020 Plan, and (v) 22,464,344 shares of common stock issuable upon the exercise of outstanding warrants. This leaves only 3,597,854 shares of common stock available for future issuance.

The proposed amendment would amend and restate the first Paragraph of the Article IV of our Certificate of Incorporation as follows:

|

|

A.

|

The total number of shares of all classes of stock which the Corporation shall have authority to issue is Two Hundred Eighty Five Million (285,000,000), consisting of Two Hundred Seventy Five Million (275,000,000) shares of common stock, par value $0.18 per share (the “Common Stock”), and Ten Million (10,000,000) shares of Preferred Stock, par value $0.001 per share (the “Preferred Stock”).

|

Reasons for Amendment

Because we have only 3,597,854 shares of common stock available for issuance as of July 22, 2021, our ability to raise funds to support our operations by selling common stock, and our ability to issue common stock in connection with acquisitions and licensing arrangements, is limited. We have not yet generated revenue and will continue to finance our commercial operations and research and development activities through use of our existing cash balances and financing activities, including the potential sale of our common stock, preferred stock, and warrants to purchase our stock.

Our Board desires to have the shares available to provide additional flexibility to use our common stock for business and financial purposes in the future. The additional shares of common stock may be used for various purposes without further stockholder approval, subject to the rules of the Nasdaq stock market. These purposes may include raising capital to support future operations; providing equity incentives to employees, officers or directors; establishing strategic relationships with other companies; expanding our business or products through acquisitions and/or licensing arrangements; and other purposes. Having such additional authorized common stock available for issuance in the future would allow our Board to issue shares of our common stock without delay and enable us to engage in financing transactions and/or strategic alliances and take advantage of changing market and financial conditions on a timelier basis as determined by our Board.

General Effect of the Amendment

Upon stockholder approval of this Proposal 1, an amendment to the Certificate of Incorporation, which we refer to as the Amendment, will be filed with the Secretary of State of the State of Delaware and the number of authorized shares of our common stock will be increased from 175,000,000 shares to 275,000,000 shares.

The additional shares of our common stock to be authorized by adoption of the Amendment would have rights identical to our currently outstanding shares of common stock. Adoption of the proposed Amendment and subsequent issuance of the shares of common stock would not affect the rights of the holders of our currently outstanding shares of common stock, except for effects incidental to increasing the number of shares of our common stock. Incidental effects of a subsequent issuance of shares of our common stock (but not of the adoption of the Amendment in and of itself) include potentially diluting the voting power and percentage ownership of existing stockholders. Current holders of shares of our common stock do not have preemptive or similar rights, which means that current stockholders do not have a prior right to purchase any new issue of our capital stock, including shares of our common stock, in order to maintain their proportionate ownership of our company.

If the proposed Amendment is approved, our Board may cause the issuance of additional shares of our common stock without further vote of our stockholders, except as provided under Delaware or other applicable law, our charter or bylaws or under the rules of the Nasdaq stock market. If the Amendment is adopted, it will become effective upon filing of the Amendment with the Secretary of State of the State of Delaware.

The increase in number of authorized shares of our common stock is not being proposed as a means of preventing or dissuading a change in control or takeover of our company; however, use of these shares for such a purpose is possible. Shares of authorized but unissued or unreserved common stock, for example, could be issued in an effort to dilute the stock ownership and voting power of persons seeking to obtain control of us or could be issued to purchasers who would support our Board in opposing a takeover proposal. In addition, the increase in number of authorized shares of our common stock, if approved, may have the effect of discouraging a challenge for control of us or make it less likely that such a challenge, if attempted, would be successful. Our Board and executive officers have no knowledge of any current effort to obtain control of our company or to accumulate large amounts of our common stock.

Vote Required

This proposal must be approved by the affirmative vote of the holders of a majority of the common stock outstanding and entitled to vote on the Record Date. As a result, abstentions and broker non-votes will have the same effect as voting against this proposal.

Voting Agreements

Holders of common stock have contractually agreed to vote at least 12,000,000 shares of common stock in favor of the proposal to increase authorized shares of common stock.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NO. 1.

GENERAL

"About the Meeting - What do I need to do to virtually attend the special meeting via live audio webcast?"

In order to participate in the 2021 Special Meeting live via the Internet, you must register at http://www.viewproxy.com/AtossaTherapeutics/2021SM/htype.asp by 11:59 p.m. Eastern Time on September 4, 2021. If you are a registered holder, you must register using the Virtual Control Number, mailed on or about August 9, 2021 to stockholders of record who held common stock at the close of business on the record date, July 29, 2021, included on your proxy card (if you received a printed copy of the proxy materials). If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a Virtual Control Number in order to vote your shares during the 2021 Special Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to virtually attend the 2021 Special Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://www.viewproxy.com/AtossaTherapeutics/2021SM/htype.asp.

“About the Meeting – Who do I contact if I am having technical problems voting or attending the meeting?”

If you have any questions about attending the virtual meeting, or otherwise require technical assistance prior to or during the meeting, please contact: VirtualMeeting@viewproxy.com or call 1-866-612-8937

OTHER BUSINESS

We know of no other matters to be submitted to a vote of stockholders at the special meeting. If any other matter is properly brought before the special meeting or any adjournment thereof, it is the intention of the persons named in the enclosed proxy to vote the shares they represent in accordance with their judgment. In order for any stockholder to nominate a candidate or to submit a proposal for other business to be acted upon at a given special meeting, he or she must provide timely written notice to our corporate Secretary in the form prescribed by our Bylaws, as described below.

STOCKHOLDER PROPOSALS

No stockholder proposals have been presented for consideration at the special meeting.

DELIVERY OF PROXY MATERIALS

Copies of our Annual Report on Form 10-K for fiscal 2020 are available from the Company without charge upon written request of a stockholder. Copies of these materials are also available online through the SEC at www.sec.gov. The Company may deliver only one proxy statement to multiple stockholders who share an address, unless contrary instructions are received prior to the mailing date. Similarly, if you share an address with another stockholder and have received multiple copies of our proxy materials, you may write or call us at the address and phone number below to request delivery of a single copy of these materials in the future. We undertake to deliver promptly upon written or oral request a separate copy of the proxy statement and/or annual report, as requested, to a stockholder at a shared address to which a single copy of these documents was delivered. If you hold stock as a record stockholder and prefer to receive separate copies of a proxy statement or annual report either now or in the future, please contact the Company’s Secretary at 107 Spring Street, Seattle, Washington 98104 or by telephone at (866) 893-4927. If your stock is held through a brokerage firm or bank and you prefer to receive separate copies of a proxy statement or annual report either now or in the future, please contact your brokerage firm or bank.

AVAILABLE INFORMATION

The Company is subject to the informational requirements of the Exchange Act, and, in accordance therewith, files reports and other information with the SEC. Any interested party may inspect information filed by the Company, without charge, at the public reference facilities of the SEC at its principal office at 100 F. Street, N.E., Washington, D.C. 20549. Any interested party may obtain copies of all or any portion of the information filed by the Company at prescribed rates from the Public Reference Section of the SEC at its principal office at 100 F. Street, N.E., Washington, D.C. 20549. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding the Company and other registrants that file electronically with the SEC at http://www.sec.gov.

The Company’s common stock is listed on The Nasdaq Capital Market and trades under the symbol “ATOS”.

EACH STOCKHOLDER IS URGED TO COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE

ENCLOSED PROXY.

ATOSSA THERAPEUTICS, INC.

107 Spring Street

Seattle, Washington 98104

APPENDIX A

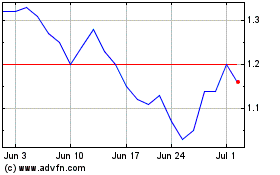

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Sep 2023 to Sep 2024