false

0001368148

0001368148

2024-01-05

2024-01-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 5, 2024

ATHERSYS, INC.

ATHERSYS, INC / NEW

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-33876

|

20-4864095

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

3201 Carnegie Avenue, Cleveland, Ohio

|

|

44115-2634

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (216) 431-9900

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

The information set forth under Item 1.03 of this Current Report on Form 8-K (this “Current Report”) regarding the Asset Purchase Agreement (as defined below) and the information set forth under Item 2.03 of this Current Report regarding the DIP Financing Agreement (as defined below) is incorporated by reference into this Item 1.01.

Item 1.03 Bankruptcy or Receivership

Bankruptcy Filing

On January 5, 2024 (the “Petition Date”), Athersys, Inc. (the “Company”) and its direct and indirect subsidiaries, ABT Holding Company, Advanced Biotherapeutics, Inc., ReGenesys, LLC, and ReGenesys BVBA (collectively with the Company, the “Debtors”), filed voluntary petitions (the “Bankruptcy Petitions”) for relief under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Northern District of Ohio (such court, the “Court”; and such cases, the “Cases”). The Debtors have filed a motion with the Court seeking joint administration of the Cases, with the Company as the lead debtor under the caption “In re Athersys, Inc., et. al.,” in Case No. 24-10043. The Debtors will continue to manage their assets as “debtors-in-possession” under the jurisdiction of the Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Court.

To ensure a smooth transition into chapter 11, as well as the efficient administration of the Cases, the Debtors have filed various “first day” motions with the Bankruptcy Court requesting customary relief, including authority to obtain postpetition financing to fund the Cases. The Debtors also have filed a motion with the Court seeking approval of certain sale, bid, and auction procedures by which they will seek to sell substantially all of their assets to the Stalking Horse Bidder (defined below), subject to any higher and better bids at auction.

There has been no order confirming a plan of reorganization, arrangement, or liquidation of the Debtors’ assets in the Cases. The Company cannot be certain that holders of the Company’s common stock will receive any payment or other distribution on account of their shares in the Cases.

Purchase Agreement

On January 5, 2024, prior to the filing of the Bankruptcy Petitions, the Debtors, entered into a “stalking horse” Asset Purchase Agreement (the “Asset Purchase Agreement”) with HEALIOS K.K. (the “Stalking Horse Bidder” or the “DIP Lender”), pursuant to which, among other things, the Debtors will sell to the Stalking Horse Bidder substantially all of their assets, including but not limited to their contracts, personal property, inventory, intellectual property, intangible property, accounts receivable, permits and approvals, studies, documents, and claims (collectively, other than excluded assets, the “Purchased Assets”). The Asset Purchase Agreement provides that the aggregate consideration to be paid by the Stalking Horse Bidder for the sale of all of the Purchased Assets and the obligations of Sellers as set forth in the Asset Purchase Agreement shall be an amount equal to the sum of $2,000,000 (the “Purchase Price”), in the form of a credit bid as provided for pursuant to the DIP Financing Agreement (defined below), plus the payment of any applicable cure costs for contracts approved for assumption and assignment by the Court at the closing of the transaction (the “Closing”).

Sale, Bidding, and Auction Procedures

Contemporaneously with the filing of the Bankruptcy Petitions, the Debtors filed a motion with the Court to seek approval of proposed bidding procedures (the “Bidding Procedures”) for the sale of the Purchased Assets. Pursuant to the Bidding Procedures, the Debtors will, among other things, (i) provide notice of the sale to all known potential purchasers, (ii) solicit qualified bids, and, if necessary, (iii) conduct an auction to determine the highest and best offer for the Purchased Assets. The Company will manage the bidding process and evaluate the bids in consultation with its advisors and as overseen by the Court.

The Asset Purchase Agreement contains customary representations and warranties of the parties and is subject to a number of conditions to Closing, including, among others, (i) the truth and correctness of representations and warranties of the parties, subject to various standards of accuracy, (ii) material compliance with the obligations of the parties set forth in the Asset Purchase Agreement, (iii) there being in effect no laws or orders restraining in any material respect, preventing or prohibiting the Closing, and (iv) a sale order in the Cases having become a final order of the Court.

The Asset Purchase Agreement is subject to certain customary termination events, including but not limited to, if a court or governmental authority takes action to prohibit entry into the DIP Facility or the sale of the Purchased Assets; if the Debtors fail to meet any of the bankruptcy-related deadlines set forth in the Asset Purchase Agreement; if the Debtors agree to consummate a sale of the Purchased Assets to a bidder other than the Stalking Horse Bidder; if the Debtors’ Bankruptcy Cases are converted to cases under chapter 7 of the Bankruptcy Code; or if the Debtors materially breach the Asset Purchase Agreement or DIP Financing Agreement and fail to cure such breach within three (3) business days from receipt of notice of such breach.

As consideration for and as a material inducement to the Stalking Horse Bidder conducting its due diligence and entering into the Asset Purchase Agreement, in the event that (i) the Debtors close on a transaction with a party other than the Stalking Horse Bidder involving, among other things, the sale of the Purchased Assets (an “Alternative Transaction”), (ii) the Stalking Horse Bidder terminates the Asset Purchase Agreement following an uncured material breach by the Debtors or (iii) if the Stalking Horse Bidder is restricted from credit bidding its secured debt under the DIP Financing Agreement as part of the Purchase Price, then the Stalking Horse Bidder shall be entitled to receive (A) a break-up fee in the amount of Two Hundred Thousand Dollars ($200,000) and (B) reimbursement of attorneys’, accountants’, investment bankers’ and representatives’ reasonable, documented fees and expenses actually incurred with respect to the Asset Purchase Agreement, its approval by the Court, or the closing thereon, up to a total of Three Hundred Thousand Dollars ($300,000), each of which shall be payable at the time of closing any Alternative Transaction.

The foregoing description of the Asset Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Asset Purchase Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report and is incorporated herein by reference. The Asset Purchase Agreement has been filed with this Current Report to provide investors and security holders with information regarding the Asset Purchase Agreement’s terms. The foregoing description of the Asset Purchase Agreement is not intended to provide any other factual information about the Stalking Horse Bidder. The representations, warranties and covenants contained in the Asset Purchase Agreement were made only for purposes of the Asset Purchase Agreement and as of the specific dates referenced therein, and may be subject to important limitations agreed upon by the contracting parties. The representations and warranties may have been made for the purposes of allocating contractual risk between the parties to the Asset Purchase Agreement instead of establishing these matters as facts and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Asset Purchase Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or its subsidiaries. Moreover, information concerning the subject matter of such representations, warranties and covenants may change after the date of the Asset Purchase Agreement containing them, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

Debtor-in-Possession Financing

On January 5, 2024, in connection with filing the Bankruptcy Petitions and subject to the approval of the Court, the Debtors entered into a certain Secured Superpriority Debtor-in-Possession Financing Agreement (the “DIP Financing Agreement”) with the DIP Lender. If approved by the Court as proposed, the DIP Financing Agreement would provide term loans in an aggregate amount not to exceed $2,250,000 consisting of (i) a term loan not to exceed $850,000 to be available upon the entry by the Court of an order approving the DIP Financing Agreement on an interim basis, (ii) a term loan not to exceed $650,000 to be available upon the entry by the Court of an order approving the DIP Financing Agreement on a final basis, and (iii) 750,000 to be available on or promptly after February 16, 2024.

Pursuant to sections 364(c)(2) and 364(d)(1) of the Bankruptcy Code, the DIP Lender will be granted and shall have a valid, binding, continuing, enforceable, fully-perfected first priority senior security interest in and lien upon substantially all of the Debtors’ assets to the extent not subject to a specified carveout or to valid, perfected, non-avoidable and enforceable liens in existence as of the Petition Date or valid liens in existence as of the Petition Date that are perfected subsequent to such date to the extent permitted by section 546(b) of the Bankruptcy Code. Subject to the carveout, the DIP Lender will be granted an allowed superpriority administrative claim (the “DIP Superpriority Claims”) in accordance with section 364(c)(1) of the Bankruptcy Code, having a priority in right of payment over any and all other obligations, liabilities and indebtedness of the Debtors, now in existence or hereafter incurred by the Debtors and over any and all administrative expenses or priority claims of any kind, whether arising in the chapter 11 cases or in any superseding chapter 7 cases concerning the Debtors. The DIP Financing Agreements include customary covenants, representations and warranties of the type required of debtors in possession, including but not limited to an obligation to use the proceeds of the loans in accordance with a Court-approved budget.

The DIP Financing Agreement is subject to approval by the Court, which has not been obtained at this time. The foregoing descriptions of the DIP Financing Agreement do not purport to be complete and are subject to, and qualified in their entirety by, the full text of the DIP Financing Agreement. The Company intends to file copies of the DIP Financing Agreement as an exhibit to a Current Report on Form 8-K following its approval by the Bankruptcy Court and execution by all relevant parties.

Item 7.01 Regulation FD Disclosure

Additional Information on the Cases

Court filings and information about the Cases can be found (i) through the Public Access to Court Electronic Records (PACER) website at https://ecf.ohnb.uscourts.gov/, (ii) by email to counsel to the Company, Nicholas M. Miller, Esq., at nmiller@mcdonaldhopkins.com, or (iii) by phone to counsel to the Company, Nicholas M. Miller, Esq., at 312-259-0473. The documents and other information available via website or elsewhere are not incorporated by reference into, and do not constitute part of, this Current Report.

The information in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language contained in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

2.1

|

|

Asset Purchase Agreement. |

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

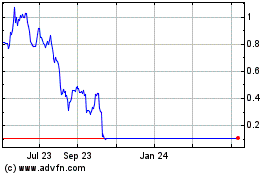

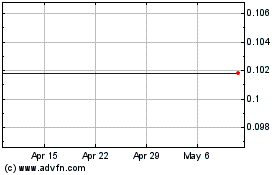

Cautionary Note Regarding the Company’s Common Stock

The Company cautions that trading in the Company’s securities (including, without limitation, the Company’s common stock) during the pendency of the Cases is highly speculative and poses substantial risks. Trading prices (or quotations for prices) for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Cases. The Company expects that holders of shares of the Company’s common stock could experience a significant or complete loss on their investment, depending on the outcome of the Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

Cautionary Note Regarding Forward-Looking Statements

This Current Report contains statements that are, or may be deemed, “forward-looking statements.” Forward-looking statements generally use forward-looking words, such as “may,” “will,” “could,” “should,” “would,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast” and other words that convey the uncertainty of future events or outcomes. Forward-looking statements include, but are not limited to, information concerning the following: expectations regarding risks attendant to the Chapter 11 bankruptcy process, including the Company’s ability to obtain court approval from the Court with respect to motions or other requests made to the Court throughout the course of the Chapter 11 process, including with respect to the asset sale and the DIP Financing Agreement; the Company’s plans to sell certain assets pursuant to Chapter 11 of the Bankruptcy Code, the outcome and timing of such sale, and the Company’s ability to satisfy closing and other conditions to such sale; the effects of Chapter 11, including increased legal and other professional costs necessary to execute the Company’s wind down, on the Company’s liquidity and results of operations (including the availability of operating capital during the pendency of Chapter 11); the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of Chapter 11; the Company’s ability to continue funding operations through the Chapter 11 bankruptcy process, and the possibility that it may be unable to obtain any additional funding as needed; the Company’s ability to meet its financial obligations during the Chapter 11 process and to maintain contracts that are critical to its operations; the Company’s ability to comply with the restrictions imposed by the terms and conditions of the DIP Financing Agreement and other financing arrangements; objections to the Company’s wind down process, the DIP Financing Agreement, or other pleadings filed that could protract the Chapter 11 process; the effects of Chapter 11 on the interests of various constituents and financial stakeholders; the effect of the Chapter 11 filings and any potential asset sale on the Company’s relationships with vendors, regulatory authorities, employees, and other third parties; risks relating to the removal of the Company’s common stock from trading and quotation on the OTC Markets; possible proceedings that may be brought by third parties in connection with the Chapter 11 process or the potential asset sale and risks associated with third-party motions in Chapter 11; the timing or amount of any distributions, if any, to the Company’s stakeholders; the impact and timing of any cost-savings measures and related local law requirements in various jurisdictions; the impact of litigation and regulatory proceedings; expectations regarding financial performance, strategic and operational plans, and other related matters; and other factors discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” section of the Annual Report on Form 10-K for its 2022 fiscal year. These forward-looking statements are not guarantees of the Company’s future performance and involve risks, uncertainties, estimates, and assumptions that are difficult to predict and may be outside of the Company’s control. Therefore, the actual outcomes and results may differ materially from those expressed in or contemplated by the forward-looking statements. Any forward-looking statement speaks only as of the date of this Current Report. Except as may be required by applicable law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and investors are cautioned not to rely upon them unduly.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 8, 2024

| |

ATHERSYS, INC.

|

| |

|

|

| |

By:

|

/s/ Kasey Rosado

|

| |

|

Kasey Rosado

Interim Chief Financial Officer

|

Exhibit 2.1

ASSET PURCHASE AGREEMENT

This ASSET PURCHASE AGREEMENT (“Agreement” or the “Asset Purchase Agreement”) is made and entered into as of this 5 day of January 2024 (the “Execution Date”), by and between HEALIOS K.K. (“Buyer”), on the one hand, and Athersys, Inc., ABT Holding Company, Advanced Biotherapeutics, Inc., and ReGenesys, LLC, each of which is organized in the state of Delaware, and ReGenesys BVBA, a company organized in Belgium (collectively, “Sellers” and, together with Buyer, the “Parties”), each Seller will become a debtor and debtor in possession in voluntary chapter 11 cases (the “Bankruptcy Cases”) to be filed (the date of such filing, the “Petition Date”) in the United States Bankruptcy Court for the Northern District of Ohio (the “Bankruptcy Court”).

RECITALS

| |

A.

|

Sellers were in the business of developing and manufacturing stem cell technologies for the treatment of disease (the “Business”).

|

| |

B.

|

Sellers wish to sell to Buyer, pursuant to section 363 of Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”), substantially all of Sellers’ assets heretofore used in connection with or arising out of the operation of the Business, all at the price and on the other terms and conditions specified in detail below and Buyer wishes to so purchase and acquire such assets from Sellers.

|

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

| |

1.1

|

Purchase and Sale of Assets. On the Closing Date, as hereinafter defined, in consideration of the covenants, representations and obligations of Buyer hereunder, and subject to the conditions hereinafter set forth, Sellers shall sell, assign, transfer, convey and deliver to Buyer, and Buyer shall purchase from Sellers free and clear of all liens, claims, interests and encumbrances whatsoever to the maximum extent permitted by law, Sellers’ right, title and interest in and to those assets and properties, interests and rights of any kind or nature, whether real, personal, tangible or intangible, used in connection with the operation of the Business and existing as of the Execution Date and as of the Closing Date, including, without limitation, the following (collectively, excluding the Excluded Assets (as defined in Section 1.2 below), the “Purchased Assets”):

|

| |

1.1.1

|

Contracts. Each Seller’s right, title and interest in and to the contracts, leases, orders, purchase orders, licenses, contracts, agreements and similar arrangements described on Schedule 1.1.1 attached to this Agreement and incorporated herein by this reference, and that may be subsequently added or removed from such schedule in accordance with the terms of the Sellers’ motion to approve the Sale (collectively, the “Contracts”). All Contracts that constitute executory contracts as that term is used in section 365 of the Bankruptcy Code are “Executory Contracts.”

|

| |

1.1.2.

|

Personal Property. All of those items of equipment and tangible personal property owned by any of Sellers and heretofore used in connection with the Business, including, without limitation, all such furniture, vehicles, machinery, equipment, tools, spare parts, computers, fixtures and furnishings and other items of tangible personal property listed or described in Schedule 1.1.2 attached to this Agreement and incorporated herein by this reference (collectively, the “Personal Property”). As used herein, the Personal Property does not include the Inventory (as defined below). The Personal Property shall also expressly exclude any equipment or other tangible property held by any Sellers pursuant to a Contract where Buyer does not assume the underlying Contracts relating to such personal property at the Closing (as defined herein), and the foregoing is deemed to be an Excluded Asset (as defined below).

|

| |

1.1.3.

|

Inventory. All supplies, goods, materials, work in process, inventory and stock in trade owned and held by any Sellers for use in connection with the operation of the Business (collectively, the “Inventory”) including, without limitation, the supplies of master cell bank, working cell bank, and Multistem doses listed on Schedule 1.1.3(a) and the process equipment, manufacturing supplies, media and research tools listed on Schedule 1.1.3(b).

|

| |

1.1.4.

|

Intellectual Property. All Intellectual Property owned or held by any Seller to the extent heretofore used in connection with the Business, together with all books and records associated with such Intellectual Property and all royalties, fees, income, payments and other proceeds to any Seller with respect to such Intellectual Property, such intellectual property to include, but not be limited to, the patents, patent applications listed on Schedule 1.1.4(a), and any other patents or applications that are parents, counterparts, divisionals, or otherwise related thereto; all Trademarks, including, without limitation, the trademark registrations listed on Schedule 1.1.4(b) as well as any common law trademark rights and goodwill associated with the Business; the copyright registrations listed on Schedule 1.1.4(c) and all other unregistered copyrights owned or held by any Seller; the trade secret rights listed on Schedule 1.1.4(d) and any other trade secret rights or knowhow owned or held by any Seller associated with the Business. For purposes of this Agreement, “Intellectual Property” means all intellectual or proprietary rights of Sellers, which may exist or be created under the law of any jurisdiction in the world, including all: (a) rights associated with works of authorship, including exclusive exploitation rights, mask work rights, copyrights, and moral and similar attribution rights; (b) Trademarks (as defined below), trade dress, and design rights; (c) proprietary rights in internet domain names, IP addresses, and social media and third-party website handles, pages, and accounts including the access information for the same; (d) trade secret rights including formulas, recipes, and ingredients lists; (e) patents, industrial design and other industrial property rights; (f) rights in or relating to any and all pending applications, registrations, goodwill, issuances, provisionals, reissuances, continuations, continuations-in-part, revisions, substitutions, reexaminations, renewals, extensions, combinations, divisions, and reissues of, and applications for, any of the foregoing rights and all common law rights; and (g) rights to prosecute, sue, enforce, or recover or retain damages, costs, or attorneys’ fees with respect to the past, present and future infringement, misappropriation, dilution, unauthorized use or disclosure, or other violation of any of the foregoing. For purposes of this Agreement, “Trademarks” means any and all trade names, corporate names, logos, slogans, taglines, trade dress, trademarks, service marks, and other source or business identifiers and general intangibles of a like nature, and common law rights, as well as trademark and service mark registrations and applications therefor, and all goodwill associated with the foregoing, whether protected, created, or arising under the laws of the United States (including common law) or any other jurisdiction or under any international convention.

|

| |

1.1.5.

|

Intangible Property. All intangible personal property owned or held by any Seller to the extent heretofore used in connection with the Business, but in all cases only to the extent of such Seller’s interest and only to the extent transferable, together with all books, records and like items pertaining to the Business, including, without limitation, the goodwill of the Business, catalogues, supplier and customer lists and other customer databases, correspondence with present or prospective customers and suppliers, advertising materials, software, including (i) any and all computer programs (consisting of sets of statements or instructions to be used directly or indirectly in a computer in order to bring about a certain result), including, without limitation, all source code and object code, and related documentation, (ii) all associated data and compilations of data, and (iii) all design documents, flow charts, user manuals and training materials used to design, plan, organize and develop any of the foregoing, and telephone exchange numbers identified with the Business and any right, title and interest of Sellers in and to those items described on Schedule 1.1.5 attached hereto and incorporated herein by this reference (collectively, the “Intangible Property”). As used in this Agreement, Intangible Property shall in all events exclude (i) any materials containing privileged communications or information about employees, disclosure of which would violate an employee’s reasonable expectation of privacy and any other materials which are subject to attorney-client or any other privilege (except materials relating to the prosecution of and obtaining intellectual property rights), and (ii) any software or other item of intangible property held by Sellers pursuant to a license or other Contract where Buyer does not assume the underlying Contract relating to such intangible personal property at the Closing, and the foregoing is deemed to be an Excluded Asset (as defined below).

|

| |

1.1.6.

|

Accounts Receivable. All accounts and notes receivable (whether current or non-current, including billed and unbilled), in each case to the extent arising out of the operation of the Business and listed on Schedule 1.1.6 attached hereto (collectively, the “Accounts Receivable”).

|

| |

1.1.7.

|

Regulatory Proceedings, Permits and Approvals. All regulatory applications, approvals, and / or permits (“Regulatory Proceedings”) issued to or held by any Seller in any country of the world to the extent transferrable, including, without limitation, the regulatory applications listed on Schedule 1.1.7 and all cross-reference rights associated with any such applications.

|

| |

1.1.8.

|

Studies. All in vitro, in vivo, non-clinical and/or clinical studies (“Studies”) currently or formerly performed by or for any Seller, including, without limitation, the studies listed on Schedule 1.1.8 and all data and biological material associated any such study unless such clinical study, data, or biological material is subject to an Executory Contract not assumed by Buyer.

|

| |

1.1.9.

|

Documents. To the extent permitted by applicable law, all documents as of the Closing that are primarily used in, held for use in or intended to be used in, or that primarily relate to, the Purchased Assets, the Assumed Liabilities (as defined herein), or the Business, including all documents related to products of any Seller, research and development, Intellectual Property, supplier lists, records, literature and correspondence. Notwithstanding anything to the contrary in this Agreement, the Purchased Assets shall not include any information, documents or materials of any kind that are subject to third party privacy rights that preclude the transfer. Notwithstanding anything to the contrary, except as to documents related to the prosecution or obtaining of Intellectual Property, none of the Purchased Assets shall include any information, documents or materials of any kind that are (i) subject to attorney-client or attorney- client work product or similar privileges (including, for the avoidance of doubt, any of the foregoing that relate to the negotiation of this Agreement or the preparation for the filing of the Bankruptcy Cases), or (ii) subject to third party privacy rights that preclude the transfer.

|

| |

1.1.10.

|

Claims, Etc. All claims, prepayments, warranties, guarantees, refunds, reimbursements, causes of action, rights of recovery, rights of set-off and rights of recoupment of every kind and nature relating to or arising in connection with the operation or management of the Business, the Contracts or the Purchased Assets, including all preference or avoidance claims and actions of any of Sellers, including, without limitation, any such claims and actions arising under sections 544, 547, 548, 549, and 550 of the Bankruptcy Code (collectively, the “Claims”); provided that Buyer agrees to waive and not to pursue any such preference or avoidance claims and actions.

|

| |

1.2.

|

Excluded Assets. Notwithstanding anything to the contrary in this Agreement, the Purchased Assets shall exclude all of the following (collectively, the “Excluded Assets”):

|

| |

1.2.1.

|

Sellers’ rights under this Agreement and all cash and non-cash consideration payable or deliverable to Sellers pursuant to the terms and provisions hereof;

|

| |

1.2.2.

|

All cash deposits and prepaid items relating to or arising in connection with the operation of the Business;

|

| |

1.2.3.

|

All cash and cash equivalents (including checking account balances, certificates of deposit and other time deposits and petty cash) and marketable and other securities on hand as of the Closing Date;

|

| |

1.2.4.

|

All tax refunds, rebates, credits and similar items relating to or arising out of the operation of the Business and to any period, or portion of any period, on or prior to the Closing Date;

|

| |

1.2.5.

|

All insurance policies, insurance proceeds, and other claims and causes of action with respect to or arising in connection with (A) any Contract which is not assigned to Buyer at the Closing, or (B) any item of tangible or intangible property not acquired by Buyer at the Closing;

|

| |

1.2.6.

|

Any Contract to which any Seller is a party which is not listed or described on Schedule 1.1.1 or and that may be subsequently added or removed from such schedule in accordance with the terms of the Sellers’ motion to approve the Sale, including, without limitation, those supplier and other contracts specifically listed for greater certainty as being Excluded Contracts on Schedule 1.2.6, and any agreement or contract which is not assumable and assignable as a matter of applicable law (including, without limitation, any with respect to which any consent requirement in favor of the counter-party thereto may not be overridden pursuant to section 365 of the Bankruptcy Code) (collectively, the “Excluded Contracts”);

|

| |

1.2.7.

|

All securities or equity interests, whether capital stock or debt, of any Seller or any other entity;

|

| |

1.2.8.

|

All tax records, minute books, stock transfer books and corporate seal of each Seller;

|

| |

1.2.9.

|

All funds advanced to Sellers under the Debtor-in-Possession Credit Agreement, dated January , 2024, by and among Sellers and Buyer (such agreement, the “DIP Credit Agreement” and the facility thereunder, the “DIP Facility”) as amended, supplemented, or otherwise modified from time to time and as approved by an interim or final order of the Bankruptcy Court (“DIP Order”);

|

| |

1.2.10.

|

Any rights of Sellers under this Agreement or any ancillary agreements thereto to which Sellers are a Party, including rights related to the Purchase Price (as defined below);

|

| |

1.2.11.

|

All rights of recovery, rights of set-off, rights of indemnity, contribution or recoupment, warranties, guarantees, rights, remedies, counter-claims, cross-claims and defenses related to any Excluded Liability (as defined herein);

|

| |

1.2.12.

|

Any letters of credit or similar financial accommodations issued to any third party(ies) for the account of any Seller and any collateral therefor and other collateral deposits and prepaid items associated with the Purchased Assets;

|

| |

1.2.13.

|

All rights, claims and causes of action of Sellers entirely unrelated to the Business or the Purchased Assets; and

|

| |

1.2.14.

|

Those additional assets, if any, listed on Schedule 1.2.14 attached hereto and incorporated herein by this reference.

|

| |

1.3.

|

Instruments of Transfer. The sale, assignment, transfer, conveyance and delivery of the Purchased Assets to Buyer shall be made by deeds, assignments, bill of sale, and other instruments of assignment, transfer and conveyance provided for in Article 3 below and such other instruments as may reasonably be requested by Buyer to transfer, convey, assign and deliver the Purchased Assets to Buyer.

|

| |

2.1.1..

|

The consideration to be paid by Buyer to Sellers for the Purchased Assets (the “Purchase Price”) shall be an amount equal to Two Million Dollars ($2,000,000.00) in the form of a credit bid as provided for in the DIP Facility plus the payment of any applicable cure costs for Assumed Contracts to the extent the assumption and assignment of such Assumed Contracts has been approved by the Bankruptcy Court (the “Cure Costs”). |

| |

2.1.2..

|

The Purchase Price shall be paid as (i) (a) a credit bid of all Obligations (as defined in the DIP Credit Agreement) as of the Closing plus (b) cash in the amount equal to the unfunded portion of the DIP Facility as of the Closing (if applicable) and (ii) any agreed Cure Costs to be paid in cash. Overbid amounts, if any, that are to be paid according to the terms of an initial overbid must be, at minimum, equal to Two Million Dollars ($2,000,000) plus the Bid Protections (as defined below) plus Two Hundred and Fifty Thousand Dollars ($250,000) (such overbid, an “Acceptable Overbid”). The Parties agree that Buyer has the right to assign its right to credit bid or any portion of the Obligations to a newly formed acquisition vehicle affiliate of Buyer. |

| |

2.2.

|

Assumed Liabilities. Effective as of the Closing Date, Buyer shall assume only the following liabilities and obligations of Sellers: (i) all obligations of Sellers arising or accruing in connection with the Purchased Assets or the Assumed Contracts from and after the Closing Date, but excluding liabilities and obligations required to have been performed prior to Closing by Sellers or any obligations incurred by reason of facts attributable to an act or omission of Sellers that occurred prior to Closing; (ii) Cure Costs to be paid pursuant to the Sale Order (as defined below) as a condition to Sellers’ assumption and assignment of the Executory Contracts; and (iii) those additional liabilities and obligations set forth on Schedule 2.2 hereto (collectively, the “Assumed Liabilities”).

|

| |

2.3.

|

Excluded Liabilities. Notwithstanding anything herein to the contrary, Buyer shall not assume, be obligated to pay, perform or otherwise discharge or in any other manner be liable or responsible for any liabilities of, or action against, Sellers or relating to the Business or the Purchased Assets, of any kind or nature whatsoever, whether absolute, accrued, contingent or otherwise, liquidated or unliquidated, due or to become due, known or unknown, currently existing or hereafter arising, matured or unmatured, direct or indirect, and however arising, whether existing on the Closing Date or arising thereafter as a result of any act, omission, or circumstances taking place prior to the Closing, other than the Assumed Liabilities (the “Excluded Liabilities”). For the avoidance of doubt, Buyer is not assuming, shall not assume and shall not be responsible for, and Sellers expressly retain, all liabilities of, or actions against, Sellers related to the Excluded Assets, whether such liabilities arise before or after the Closing Date.

|

| |

2.4.

|

Purchase Price Allocation. Prior to the Closing Date, Buyer shall prepare and deliver to Sellers a schedule (the “Allocation Schedule”) allocating the Purchase Price among the various assets comprising the Purchased Assets in accordance with Treasury Regulation 1.1060-1 (or any comparable provisions of state or local tax law) or any successor provision. Any proposed changes by Sellers to the Allocation Schedule will be considered by Buyer provided they do not adversely impact Buyer’s tax position. Buyer and Sellers shall file or cause to be filed any and all forms (including U.S. Internal Revenue Service Form 8594), statements and schedules with respect to such allocation, including any required amendments to such forms, and both parties will not make any statement or take any position inconsistent with such allocation.

|

| |

2.5.

|

Assumption and Assignment of Executory Contracts. Sellers shall provide timely and proper written notice of the hearing before the Bankruptcy Court to approve the sale of the Purchased Assets (the “Sale Hearing”) to all parties to any Assumed Contracts as set forth on Schedule 1.1.1 and take all other actions reasonably necessary to cause Executory Contracts to be assumed by Sellers and assigned to Buyer pursuant to section 365 of the Bankruptcy Code. At the Closing, Sellers shall assume and assign to Buyer the Executory Contracts that may be assigned by Sellers to Buyer pursuant to sections 363 and 365 of the Bankruptcy Code. Schedule 1.1.1 sets forth Sellers’ good faith estimate (on a vendor- by-vendor basis) as of the Execution Date of the amounts necessary to cure defaults, if any, with respect to each counterparty to any Executory Contracts, in each case as determined by Sellers based on Sellers’ books and records and good faith judgment. Notwithstanding anything herein to the contrary, Buyer shall have the right to notify Seller in writing of any Assigned Contract (as defined below) that it does not wish to assume as an Assigned Contract up to one (1) business day prior to Closing, and any such previously considered Assigned Contract that Buyer no longer wishes to assume shall be automatically deemed removed from Schedule 1.1.1 without any adjustment to the Purchase Price. In the case of any amendment by Buyer of the list of Executory Contracts, Sellers shall give notice to the other parties to any such Executory Contract to which such amendment relates.

|

| |

3.1.

|

Closing Conference. The Closing of the transactions provided for herein (the “Closing”) shall take place at such place or places as the Parties may mutually agree upon.

|

| |

3.2.

|

Closing Date. The Closing shall be held upon the earlier to occur of (such date, the “Closing Date”) (i) the second (2nd) business day following the satisfaction of the last of the conditions set forth in Sections 4.1 and 4.2 below, and (ii) April 1, 2024 (the “Outside Date”); provided, however, in the event the conditions to Closing have not been satisfied or waived by the Outside Date, then any Party who is not in default hereunder may terminate this Agreement. Alternatively, the Parties may mutually agree in writing (which may be via email) to an extended Closing Date (“Extended Closing Date”). Until this Agreement is terminated, the Parties shall diligently continue to work in good faith to satisfy all conditions to Closing and the transaction contemplated herein shall close as soon as such conditions are satisfied or waived but in no event later than the Outside Date or the Extended Closing Date (if agreed).

|

| |

3.3.

|

Sellers’ Deliveries to Buyer at Closing. On the Closing Date, Sellers shall make the following deliveries to Buyer:

|

| |

3.3.1.

|

An Assignment and Assumption of Contracts substantially in the form and content attached as Exhibit A hereto, duly executed by Sellers pursuant to which each Seller shall assign to Buyer such Seller’s respective right, title and interest, if any, in and to the Executory Contracts (the “Assignment of Contracts”).

|

| |

3.3.2.

|

A Bill of Sale and Assignment, duly executed by Sellers in the form and on the terms of the bill of sale attached hereto as Exhibit B, pursuant to which each Seller shall transfer and assign to Buyer such Seller’s right, title and interest in and to the Purchased Assets (the “Bill of Sale”).

|

| |

3.3.3.

|

An Assignment of Intellectual Property, duly executed by Sellers, in the form and content of the assignment of intellectual property attached as Exhibit C hereto, pursuant to which each Seller assigns to Buyer such Seller’s right, title and interest, if any, in and to the Intellectual Property (the “Assignment of Intellectual Property”).

|

| |

3.3.4.

|

An Assignment of Intangible Property, duly executed by Sellers, in the form and content of the assignment of intangible property attached as Exhibit D hereto, pursuant to which each Seller assigns to Buyer such Seller’s right, title and interest, if any, in and to the Intangible Property (the “Assignment of Intangible Property”).

|

| |

3.3.5.

|

A release in the form attached as Exhibit E hereto (the “Release”).

|

| |

3.3.6.

|

A certificate, duly executed by an authorized representative of Sellers, with respect to the matters specified in Section 5.2.3.

|

| |

3.3.7.

|

Any such other documents or other things reasonably contemplated by this Agreement to be delivered by Sellers to Buyer at the Closing.

|

| |

3.4.

|

Buyer’s Deliveries to Sellers at Closing. On the Closing Date, Buyer shall make or cause the following deliveries to Sellers:

|

| |

3.4.1.

|

Satisfaction of the DIP Facility according to its terms in a customary form acceptable to Buyer.

|

| |

3.4.2.

|

A counterpart of the Assignment of Contracts, duly executed by Buyer.

|

| |

3.4.3.

|

A list of the Assumed Liabilities, if any, in the form and content attached as Exhibit F hereto and incorporated herein by this reference, duly executed by Buyer (the “Assumption of Liabilities” and collectively with this Agreement, the Assignment of Contracts, the Bill of Sale, the Assignment of Intellectual Property, and the Assignment of Intangible Property, the “Transaction Documents”).

|

| |

3.4.4.

|

A certificate, duly executed by an authorized representative of Buyer, with respect to the matters specific in Sections 5.1.4.

|

| |

3.4.5.

|

Any such other documents or other things reasonably contemplated by this Agreement to be delivered by Buyer to Sellers at the Closing.

|

| |

3.5.

|

Taxes Related to Purchase of Assets. All recording and filing fees and all federal, state and local sales, transfer, excise, value-added or other similar taxes, including all state and local taxes in connection with the transfer of the Purchased Assets, but excluding all income taxes based upon gain realized by Seller as a result of the sale of the Purchased Assets (collectively, “Transaction Taxes”), that may be imposed by reason of the sale, transfer, assignment and delivery of the Purchased Assets, and which are not exempt under section 1146(a) of the Bankruptcy Code, shall be paid by Seller. Buyer and Seller agree to cooperate to determine the amount of Transaction Taxes payable in connection with the transactions contemplated under this Agreement, and Buyer agrees to assist Seller reasonably in the preparation and filing of any and all required returns for or with respect to such Transaction Taxes with any and all appropriate taxing authorities. Each of Buyer and Seller shall provide the other with any exemption certificate or its equivalent to lawfully mitigate or eliminate Transaction Taxes that are not otherwise exempt under section 1146(a) of the Bankruptcy Code.

|

| |

3.6.

|

Possession. Right to possession of the Purchased Assets shall transfer to Buyer on the Closing Date. Sellers shall transfer and deliver to Buyer on the Closing Date such keys, locks, passwords, two-factor authentication tokens, safe combinations and other similar items as Buyer may reasonably require to obtain possession and control of the Purchased Assets, and shall also make available to Buyer at their then-existing locations the originals of all hard-copy documents in Sellers’ actual possession (or the possession of its agents) that are required to be transferred to Buyer by this Agreement.

|

| |

4.1.

|

Stalking Horse Bidder and Sale Process. Sellers have selected Buyer to serve, and Buyer has consented to its selection and service, collectively, as a “Stalking Horse Bidder,” whereby this Agreement shall serve as a base by which other offers for a potential Alternative Transaction (as defined below) may be measured and is subject to competing offers for an Alternative Transaction (as defined below) by way of the process for Acceptable Overbids contemplated by and more fully set forth in an order of the Bankruptcy Court approving a bid procedure (“Auction”) entered in accordance with this Agreement, including approving the Break- Up Fee and Expense Reimbursement provisions set forth (and defined) herein and otherwise in form and substance acceptable to Buyer in its sole discretion to be reasonably applied (“Bid Procedures Order”). Until the time bids are due in accordance with the Bid Procedures Order or, if a competing bid is submitted, until the conclusion of the Auction, Sellers are permitted to and to cause their representatives and affiliates to initiate contact with, solicit or encourage submission of any inquiries, proposals or offers by any person (in addition to Buyer and its affiliates and representatives) in connection with any Alternative Transaction (as defined below); provided, however, that until the date the Bankruptcy Court enters the Bid Procedures Order, Sellers agree that (a) they will not, and they will direct their agents, representatives, professionals, advisors, attorneys, employees, directors, officers, and affiliates not to, directly or indirectly, solicit or entertain offers from, negotiate with, or in any manner encourage, discuss, accept, or consider any proposal, agreements, or arrangements with any person or entity other than Buyer with respect to a possible sale, divestiture, or otherwise of any of the Purchased Assets of Sellers that could or would serve as a “stalking horse,” compete with the transactions contemplated by this Agreement as the “stalking horse,” potentially or actually replace Buyer as the “stalking horse” for some or all of the Purchased Assets, or otherwise interfere with the transactions contemplated by this Agreement prior to the date the Bankruptcy Court enters the Bid Procedures Order and (b) a breach of this provision shall be deemed a material breach of a covenant giving Buyer the right to terminate this Agreement (without any right to cure), and a cross-default of the DIP Credit Agreement; provided, further, that nothing shall prevent Seller from (a) entering into any confidentiality agreement or (b) providing access to information to any party that has entered into a confidentiality agreement. In addition, Sellers shall have the authority to respond to any inquiries or offers with respect to an Alternative Transaction and perform any and all other acts related thereto to the extent any such act is not in violation of the Bid Procedures Order, the Bankruptcy Code or this Agreement. “Alternative Transaction” means any transaction or series of transactions, whether a going concern sale, liquidation or otherwise, whether with one or more than one non-Debtor counterparty, that involves one or more direct or indirect sales, leases or other transfers of all or any portion of the Business or the Purchased Assets outside the ordinary course of business by any Seller or by Sellers to a transferee or transferees other than Buyer or any other transaction, including a plan of liquidation or plan of reorganization, that transfers or vests ownership of, economic rights to, or benefits in all or any portion of the Purchased Assets to any person other than Buyer.

|

| |

4.2.

|

Break-Up Fee and Expense Reimbursement.

|

| |

4.2.1.

|

As consideration for and as a material inducement to Buyer conducting its due diligence and entering into this Agreement, in the event that (i) Sellers close an Alternative Transaction, subject to Court approval; or (ii) this Agreement is terminated pursuant to Section 10.1(h) hereof, Buyer shall be entitled to receive (A) a break-up fee in the amount of Two Hundred Thousand Dollars ($200,000) to compensate Buyer for serving as the “stalking horse” and subjecting this Agreement to higher and better offers (“Break-Up Fee”) and (B) Buyer’s and its affiliates and each of their attorneys’, accountants’, investment bankers’ and representatives’ reasonable, documented fees and expenses actually incurred in engaging in due diligence, negotiating and preparing this Agreement and any ancillary agreements thereto, preserving and protecting Buyer’s rights and interests as Buyer in the Bankruptcy Cases, seeking approval of the Bid Procedures Order and the Sale Order, and seeking to consummate the Closing, capped at Three Hundred Thousand Dollars ($300,000) (“Expense Reimbursement”), each of which shall be payable at the time of any Alternative Transaction. The Break-Up Fee and the Expense Reimbursement collectively are referred to herein as the “Bid Protections.”

|

| |

4.2.2.

|

Buyer and Sellers acknowledge and agree that (a) they have expressly negotiated the provisions of this 4.2.2 and the payment of the Break-Up Fee and the Expense Reimbursement are integral parts of this Agreement, (b) in the absence of Seller’s obligations to make these payments, Buyer would not have entered into this Agreement, and (c) the Bid Protections (i) are actual and necessary costs of preserving Sellers’ bankruptcy estates, within the meaning of section 503(b) of the Bankruptcy Code, and (ii) shall, subject to the provisions of the Bid Procedures Order, constitute allowed superpriority administrative expense claims against Sellers’ bankruptcy estates pursuant to sections 105(a), 503(b) and 507(a)(2) of the Bankruptcy Code and shall have priority over and shall not be subordinate to any other superpriority administrative expense claims or administrative expense claims against Sellers other than the DIP Superpriority Claims, DIP Liens, and Carve-Out (each as defined in the DIP Order).

|

| |

4.2.3.

|

Sellers acknowledge and agree that the entities comprising Sellers shall be jointly and severally liable for the entire Break-Up Fee and Expense Reimbursement payable by Sellers pursuant to this Agreement.

|

| |

4.4.4.

|

The obligations of Seller to pay the Break-Up Fee or the Expense Reimbursement, if any, shall survive termination of this Agreement. The right, if any, to pursue payment of the Break-Up Fee and Expense Reimbursement shall be deemed earned upon entry of the Bid Procedures Order and shall be payable by Sellers upon the closing of an Alternative Transaction from the proceeds from such Alternative Transaction and concurrently with any other payments or distributions being made from the proceeds of such Alternative Transaction, including professionals retained in the Bankruptcy Cases or other administrative claimants in the Bankruptcy Cases; provided that the obligation, if any, to pay the Break-Up Fee and/or Expense Reimbursement shall be subordinate to payments of any amounts due under (a) the Carve Out for (i) professional fees and (ii) other expenses provided for under the DIP Facility and (b) the DIP Facility for principal amounts of up to Two Million Dollars ($2,000,000) plus all interest, fees, expenses and other amounts in the DIP Facility approved by the DIP Order.

|

| |

4.2.5.

|

Bankruptcy Court Milestones. Sellers shall comply with the following timeline (collectively, the “Bankruptcy Court Milestones”):

|

| |

(i)

|

No later than one (1) business day following the Petition Date, Sellers shall have filed with the Bankruptcy Court a combined motion seeking entry of (A) the Bid Procedures Order and (B) an order seeking approval of the sale, the assumption and assignment of certain executory contracts and/or unexpired nonresidential real property leases, the auction process, the designation of Buyer as “stalking horse” bidder, and the Break-Up Fee and the Expense Reimbursement as allowed superpriority administrative expense claims in the Bankruptcy Cases pursuant to sections 503(b)(1) and 507(a)(2) of the Bankruptcy Code, which Bid Protections shall be payable to Buyer within one (1) business day following the closing of a sale of the Purchased Assets to a party other than Buyer or its affiliate pursuant to the terms of this Agreement (“Sale Order”). On the same day, Sellers shall file a motion for approval of the DIP Facility (“DIP Motion”) that shall request interim approval by the Bankruptcy Court of the DIP Facility be granted within five (5) days of the submission of the DIP Motion and that final approval of the DIP Facility be granted within thirty (30) days of the submission of the DIP Motion.

|

| |

(ii)

|

No later than thirty (30) calendar days following the Petition Date, Seller shall obtain entry by the Bankruptcy Court of the Bid Procedures Order, including obtaining Bankruptcy Court approval of the Expense Reimbursement and the Break-Up Fee.

|

| |

(iii)

|

No later than sixty (60) calendar days following the Petition Date, the Auction shall have been completed in accordance with the Bid Procedures Order.

|

| |

(iv)

|

No later than seventy (70) calendar days following the Petition Date, Seller shall obtain entry by the Bankruptcy Court of the Sale Order and such order shall be in full force and effect and not reversed, modified or stayed.

|

| |

(v)

|

The Closing shall be completed no more than eighty-five (85) days following the Petition Date.

|

| |

4.2.6.

|

Entry of Bid Procedures Order and Sale Order:

|

| |

(a)

|

Sellers shall seek entry of the Bid Procedures Order, the Sale Order, and any other necessary orders by the Bankruptcy Court to consummate the Closing following the execution of this Agreement consistent with the Bankruptcy Court Milestones, subject to the terms of the Bid Procedures Order and entry of the Sale Order. Buyer and Sellers understand and agree that the transaction is subject to approval by the Bankruptcy Court. Buyer agrees that it will promptly take such actions as are reasonably requested by Sellers to assist in obtaining entry of the Bid Procedures Order and the Sale Order, including a finding of adequate assurance of future performance by Buyer, including by furnishing affidavits or other documents or information for filing with the Bankruptcy Court for the purposes, among others, of providing necessary assurances of future performance by Buyer under this Agreement and demonstrating that Buyer is a “good faith” purchaser under section 363(m) of the Bankruptcy Code. In the event that the Bid Procedures Order or the Sale Order shall be appealed by any person (or a petition for certiorari or motion for reconsideration, amendment, clarification, modification, vacation, stay, rehearing or reargument shall be filed with respect to any such order), Sellers and Buyer will reasonably cooperate (taking into account the Outside Date provided for herein) in determining and pursuing the response to any such appeal, petition or motion, and Sellers (to the extent Sellers have adequate funding available therefor) and Buyer shall use their commercially reasonable efforts to obtain an expedited resolution of any such appeal, petition or motion.

|

| |

(b)

|

Sellers shall file such motions or pleadings as may be appropriate or necessary to: (A) assume and assign the Assumed Contracts; and (B) subject to the consent of Buyer, determine the amount of the Cure Costs (as defined in the Bid Procedures Order).

|

| |

(c)

|

Sellers and Buyer shall cooperate concerning the Bid Procedures Order, the Sale Order, any other orders of the Bankruptcy Court relating to the transactions contemplated by this Agreement and the bankruptcy proceedings in connection therewith, and Sellers shall provide Buyer with draft copies of all applications, pleadings, notices, proposed orders and other documents relating to such proceedings within a reasonable amount of time, which in all cases shall be at least one (1) day in advance of the proposed filing date, so as to permit Buyer sufficient time to review and comment on such drafts, and, with respect to all provisions that impact Buyer or relate to the transactions contemplated by this Agreement, such pleadings and proposed orders shall be in form and substance reasonably acceptable to Buyer. Sellers shall use commercially reasonable efforts to give Buyer reasonable advance notice of any hearings regarding the motions required to obtain the issuance of the Bid Procedures Order and the Sale Order.

|

| |

5.

|

Conditions Precedent to Closing.

|

| |

5.1.

|

Conditions to Sellers’ Obligations. Sellers’ obligation to make the deliveries required of Sellers at the Closing and otherwise consummate the transactions contemplated herein shall be subject to the satisfaction or waiver by Sellers of each of the following conditions:

|

| |

5.1.1.

|

All of the representations and warranties of Buyer contained herein shall continue to be true and correct at the Closing in all material respects.

|

| |

5.1.2.

|

Buyer shall have executed and delivered to Sellers the Assignment of Contracts, the Assumption of Liabilities and such other documents required to be delivered pursuant to Section 3.4.

|

| |

5.1.3.

|

Buyer shall have delivered, or shall be prepared to deliver to Sellers at the Closing, the Purchase Price.

|

| |

5.1.4.

|

Buyer shall have delivered to Sellers appropriate evidence of all necessary entity action by Buyer in connection with the transactions contemplated hereby, including, without limitation: (i) certified copies of resolutions duly adopted by Buyer’s Board of Directors approving the transactions contemplated by this Agreement and authorizing the execution, delivery, and performance by Buyer of this Agreement; and (ii) a certificate as to the incumbency of those officers of Buyer executing this Agreement and any instrument or other document delivered in connection with the transactions contemplated by this Agreement.

|

| |

5.1.5.

|

No action, suit or other proceedings shall be pending before any court, tribunal or governmental authority seeking or threatening to restrain or prohibit the consummation of the transactions contemplated by this Agreement, or seeking to obtain substantial damages in respect thereof, or involving a claim that consummation thereof would result in the violation of any law, decree or regulation of any governmental authority having appropriate jurisdiction and no law shall be in effect which prohibits the transactions contemplated herein.

|

| |

5.1.6.

|

Buyer shall have substantially performed or tendered performance of each and every material covenant on Buyer’s part to be performed which, by its terms, is required to be performed at or before the Closing.

|

| |

5.1.7.

|

The Bankruptcy Court shall have entered the Bid Procedures Order and Sale Order and the Sale Order shall be unstayed, final, non-appealable and in full force and effect as of the Closing Date.

|

| |

5.2.

|

Conditions to Buyer’s Obligations. Buyer’s obligation to make the deliveries required of Buyer at the Closing and otherwise consummate the transactions contemplated herein shall be subject to the satisfaction or waiver by Buyer of each of the following conditions:

|

| |

5.2.1.

|

All of the representations and warranties of Sellers contained herein shall continue to be true and correct in all material respects at the Closing, disregarding any materiality, material adverse effect or similar qualifiers.

|

| |

5.2.2.

|

Sellers shall have performed in all material respects each and every covenant on Sellers’ part to be performed which, by its terms, is required to be performed or capable of performance at or before the Closing.

|

| |

5.2.3.

|

Sellers shall have executed on behalf of themselves and the bankruptcy estates and delivered to Buyer the Release of all pre-Closing Date claims (including, for the avoidance of doubt, prepetition and post-petition claims) and the Release shall have been approved by the Bankruptcy Court.

|

| |

5.2.4.

|

Sellers shall have executed and be prepared to deliver to Buyer the Assignment of Contracts, the Assumption of Liabilities, the Bill of Sale, the Assignment of Intellectual Property and the Assignment of Intangible Property and such other documents required to be delivered pursuant to Article 3 of this Agreement.

|

| |

5.2.5.

|

Sellers shall have delivered or shall be prepared to deliver to Buyer at the Closing, all other documents reasonably required of Sellers to be delivered at the Closing.

|

| |

5.2.6.

|

No action, suit or other proceedings shall be pending before any court, tribunal or governmental authority seeking or threatening to restrain or prohibit the consummation of the transactions (including, without limitation, any action for a temporary restraining order or preliminary or permanent injunction) contemplated by this Agreement, or seeking to obtain substantial damages in respect thereof, or involving a claim that consummation thereof would result in the violation of any law, decree or regulation of any governmental authority having appropriate jurisdiction and no law shall be in effect which prohibits the transactions contemplated herein.

|

| |

5.2.7.

|

The Bankruptcy Court shall have entered the Bid Procedures Order and Sale Order in form and substance reasonably acceptable to Buyer, and the Sale Order shall be unstayed, final, non-appealable and in full force and effect as of the Closing Date.

|

| |

5.2.8.

|

Without consideration of the filing of the Bankruptcy Cases or any defaults that may arise as a result thereof, there shall not have been any event causing a material adverse effect on (i) the condition (financial or otherwise), business, properties, assets, or results of operations of the Business as it is conducted as of the Petition Date or (ii) the ability of Sellers to perform their obligations under this Agreement or the Transaction Documents in material compliance with the terms hereof or the other Transaction Documents or to consummate the transactions contemplated by this Agreement (a “Seller Material Adverse Effect”); provided that, there shall be no Seller Material Adverse Effect if Sellers are in compliance under the DIP Facility and no default has been declared thereunder.

|

| |

5.2.9.

|

The Bankruptcy Court shall have approved the DIP Facility and there shall have been no default or event of default under the terms of the DIP Facility or any DIP Order.

|

| |

5.2.10.

|

Any Hart-Scott-Rodino filing or waiting periods which may be applicable to the sale have expired or have been terminated or waived and all other governmental and regulatory approvals, if any, shall have been obtained.

|

| |

5.2.11.

|

Sellers shall have delivered to Buyer appropriate evidence of all necessary entity action by each of Sellers in connection with the transactions contemplated hereby, including, without limitation: (i) certified copies of resolutions duly adopted by Sellers’ respective Board of Directors approving the transactions contemplated by this Agreement and authorizing the execution, delivery, and performance by Sellers of this Agreement; and (ii) a certificate as to the incumbency of those officers of Sellers executing this Agreement and any instrument or other document delivered in connection with the transactions contemplated by this Agreement.

|

| |

5.2.12.

|

Sellers shall have met all the Bankruptcy Court Milestones set forth in Section 4.2.5 of this Agreement except as may otherwise be agreed between Sellers and Buyer in writing (which may be via electronic mail).

|

| |

5.3.

|

Waiver of Conditions. Any waiver of a condition shall be effective only if such waiver is stated in writing and signed by the waiving Party; provided, however, that the consent of a Party to the Closing shall constitute a waiver by such Party of any conditions to Closing not satisfied as of the Closing Date.

|

| |

6.

|

Sellers’ Representations and Warranties. Sellers hereby represent and warrant to Buyer as of the Execution Date and as of the Closing Date, that:

|

| |

6.1.

|

Organization, Standing and Power. Sellers are duly organized, validly existing and in good standing under the laws of the states of their respective organization set forth in the preamble to this Agreement. Sellers have all requisite entity power and authority to own, lease and, subject to the provisions of the Bankruptcy Code applicable to debtors in possession, operate its properties, to carry on Sellers’ business as now being conducted. Subject to entry of the Sale Order, Sellers have the power and authority to execute, deliver and perform this Agreement and each of the other Transaction Documents to which it is or will be a party.

|

| |

6.2.

|

Validity and Execution. This Agreement has been duly executed and delivered by Sellers and, upon entry of the Sale Order, will constitute the valid and binding obligation of Sellers enforceable against each of Sellers in accordance with its terms, except as may be limited by any bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer or other laws (whether statutory, regulatory or decisional), now or hereafter in effect, relating to or affecting the rights of creditors generally or by equitable principles (regardless of whether considered in a proceeding at law or in equity).

|

| |

6.3.

|

No Conflict. Subject to the entry of the Sale Order and to Sellers’ knowledge, the consummation of the transactions herein contemplated, and the performance of, fulfillment of and compliance with the terms and conditions hereof by Sellers do not and will not as to each of Sellers: (i) conflict with or result in a breach of the articles of incorporation, by-laws or operating agreement, as applicable, of Sellers; (ii) violate any statute, law, rule or regulation, or any order, writ, injunction or decree of any court or governmental authority; or (iii) violate or conflict with or constitute a default under any agreement, instrument or writing of any nature to which any Seller is a Party or by which Buyer or its assets or properties may be bound.

|

| |

6.4.

|

Title to the Purchased Assets. As of the Closing Date, subject to the filing of the Bankruptcy Cases and the entry of the Sale Order by the Bankruptcy Court, Sellers shall deliver to Buyer good and marketable title to all of the Purchased Assets free and clear of all liens, claims, interests and encumbrances whatsoever to the maximum extent provided by law, other than the Assumed Liabilities and, other than the Assumed Liabilities, all such liens, claims, interests and encumbrances shall be extinguished upon the Closing as to the Purchased Assets.

|

| |

6.5.

|

Intellectual Property.

|

| |

6.5.1.

|

To the best knowledge of any Seller, Schedules 1.1.4(a), 1.1.4(b) and 1.1.4(c) set forth a complete and accurate list, as of the Execution Date, of (i) each item of registered Intellectual Property in which any Seller has an ownership interest of any nature (whether exclusively, jointly with another person or otherwise), (ii) the jurisdiction in which each such item of registered Intellectual Property has been registered or filed and the applicable registration or serial number, and (iii) any other person that has an ownership interest in each such item of registered Intellectual Property and the nature of such ownership interest.

|

| |

6.5.2.

|

To the best knowledge of any Seller, Schedule 6.5.1 sets forth (i) a complete and accurate list, as of the Execution Date of all material Contracts pursuant to which Seller obtains the right to use any Intellectual Property owned by third parties (“Acquired Intellectual Property”), and (ii) all material Contracts pursuant to which Seller grants to any other person the right to use any Intellectual Property. To the best knowledge of any Seller, Sellers do not have knowledge of and have not received any written notice from any person alleging infringement, misappropriation or any other violation of any Acquired Intellectual Property rights or challenging the validity, enforceability, use or ownership of any Acquired Intellectual Property or Sellers’ interest in any Acquired Intellectual Property. To the best knowledge of any Seller, all Acquired Intellectual Property is fully transferable, alienable and licensable by Sellers, in each case without restriction and without payment of any kind to any third party, other than payments that are not material in nature.

|

| |

6.5.3.

|

To the best knowledge of any Seller, Sellers own, or have valid licenses or rights to use, all Intellectual Property that is necessary to operate the Business as currently conducted, except where the failure to so own, or to have any such license or right, would not reasonably be expected to result in a Seller Material Adverse Effect. To the best knowledge of any Seller, Sellers have not received from any third party a claim in writing that any of Sellers is infringing, in any material respect, the intellectual property rights of such third party, except as otherwise disclosed in Schedule 6.5.3.

|

| |

6.6.

|

Contracts. As of the Execution Date, other than as set forth on Schedule 6.6, neither Sellers nor, to the best knowledge of any Seller, any other party to any of the Assumed Contracts has commenced any action against any of the parties to the Assumed Contracts or given or received any written notice of any material default or violation under any Assumed Contract that was not withdrawn or dismissed, except only for those defaults that will be cured in accordance with the Sale Order (or that need not be cured under the Bankruptcy Code to permit the assumption and assignment of the Assumed Contracts). Seller has not assigned, delegated or otherwise transferred to any third party any of its rights or obligations with respect to any such Assumed Contract. Assuming due authorization, execution, delivery and performance by the other Parties thereto, each of the Assumed Contracts is, or will be at the Closing, after payment of any Cure Cost, valid, binding and in full force and effect against Seller, except as otherwise set forth on Schedule 6.6.

|

| |

6.7.

|

Related Party Transactions. Except as set forth on Schedule 6.7, (a) no officer, director or executive committee member of any Seller or any member of their immediate family or any affiliate of any Seller is a party to any Assumed Contract, or has any material business arrangement with, or has any material financial obligations to or is owed any financial obligations from, any Seller, (b) to the best knowledge of any Seller, none of the foregoing parties have any cause of action or other claim whatsoever against or related to the Purchased Assets and (c) to the best knowledge of any Seller, Sellers do not have any direct or indirect business arrangement with or financial obligation to the foregoing parties.

|

| |

6.8.

|

Regulatory Proceedings and Studies. To the best knowledge of any Seller, Schedule 1.1.7 sets forth a complete and correct list of all Regulatory Proceedings and Schedule 1.1.8 sets forth a complete list of all Studies currently conducted by Sellers in connection with the Business. To the best knowledge of any Seller, Sellers hold all permits necessary for the operation of the Regulatory Proceedings and the Studies, including all such permits required by or relating any Governmental Authority relating to the Regulatory Proceedings and Studies (“Permits”), and all such Permits are in full force and effect, and have at all times during the last three (3) years been in substantial compliance with the terms of such permits. To the best knowledge of any Seller, Sellers are not presently in material default under any of such Permits or other similar authority. Sellers have the following documents on file and other records, which are available for Buyer’s review: (1) true and complete copies of all such Permits and approvals; and (2) true and complete copies of any and all notices, demands and correspondence that specifically affect and relate to the Regulatory Proceedings. To the best knowledge of any Seller, Sellers are operating in compliance with all Permits; any applications for renewal necessary to maintain any Permit in effect have been filed; and no legal proceeding is pending or, to the best knowledge of any Seller, threatened in writing to revoke, suspend, limit or adversely modify any Permit.

|

| |

6.9.

|