Current Report Filing (8-k)

December 16 2021 - 6:07AM

Edgar (US Regulatory)

0001808665

false

0001808665

2021-12-15

2021-12-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 16, 2021 (December 15, 2021)

ASSERTIO HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

001-39294

|

|

85-0598378

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

100

South Sanders Rd., Suite

300,

Lake Forest, IL 60045

(Address of principal executive

offices, including zip code)

(224) 419-7106

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name or former address, if changed

since last report)

Securities registered pursuant

to Section 12(b) of the Act:

|

Title

of each class:

|

|

Trading

Symbol(s):

|

|

Name

of each exchange on which registered:

|

|

Common Stock, $0.0001 par value

|

|

ASRT

|

|

The Nasdaq Stock Market LLC

|

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2 below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth Company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On December 15, 2021, Assertio Holdings, Inc.

(the “Company”), through its newly-formed subsidiary, Otter Pharmaceuticals, LLC, entered into an Asset Purchase Agreement

(the “Purchase Agreement”) with Antares Pharma, Inc. (“Antares”), and concurrently consummated the

transactions contemplated by the Purchase Agreement (the “Closing”).

Pursuant to the terms of the Purchase Agreement,

the Company acquired Antares’ rights, title and interest in and to Otrexup® (methotrexate), a drug device combination single-dose

once weekly auto-injector for subcutaneous use (“Otrexup”), including certain related assets, intellectual property

and product inventory (the “Transaction”) for (i) $18.0 million in cash payable at the Closing, (ii) $16.0 million

in cash payable on May 31, 2022 and (iii) and $10.0 million in cash payable on December 15, 2022. Pursuant to the terms of the Purchase

Agreement, the Company also assumed certain contracts, liabilities and obligations of Antares relating to Otrexup.

The Purchase Agreement contains customary representations,

warranties and covenants, as well as indemnification provisions subject to specified limitations. In connection with the Transaction,

the Company (i) received an exclusive, fully paid-up, royalty-free, irrevocable, transferable license, with the right to sublicense, to

certain intellectual property of Antares pursuant to the terms of a license agreement and (ii) entered into a supply agreement with Antares

for the certain components of Otrexup and the manufacture of products.

The foregoing

summary of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement,

a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ending December 31, 2021.

Item 2.01 Completion of Acquisition or Disposition

of Assets.

The disclosure set forth above in Item 1.01 of

this Current Report on Form 8-K with respect to the Transaction is incorporated by reference herein.

Item 7.01 Other Events

On December 15, 2021, the Company issued a press

release announcing certain of the matters described in this Current Report on Form 8-K. A copy of this press release is attached hereto

as Exhibit 99.1 to this Current Report on Form 8-K. The information set forth in this Item 7.01 and in Exhibit 99.1 shall not be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Special Note Regarding Forward Looking

Statements

Statements included herein that are not historical

facts are forward-looking statements that reflect the Company’s management’s current expectations, assumptions and estimates

of future performance and economic conditions. These forward-looking statements are made in reliance on the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to, among other things, future events or the future performance or operations of the Company. All statements other

than historical facts may be forward-looking statements and can be identified by words such as “anticipate,” “believe,”

“could,” “design,” “estimate,” “expect,” “forecast,” “goal,”

“guidance,” “imply,” “intend,” “may”, “objective,” “opportunity,”

“outlook,” “plan,” “position,” “potential,” “predict,” “project,”

“prospective,” “pursue,” “seek,” “should,” “strategy,” “target,”

“would,” “will,” “aim” or other similar expressions that convey the uncertainty of future events

or outcomes are used to identify forward-looking statements. Such forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and other factors, some of which are beyond the control of the Company. Factors that could cause

the Company actual results to differ materially from those implied in the forward-looking statements include: (1) risks

related to the Company’s commercialization of Otrexup using its non-personal and digital promotion strategies; (2) the Company’s

ability to realize the anticipated benefits of the Transaction, including the possibility that the expected benefits from the Transaction

will not be realized or will not be realized within the expected time period; (3) potential liabilities and/or litigation related to

the Transaction, including risks associated with the supply agreement between the Company and Antares and/or third-party contracts assumed

by the Company in the Transaction; (4) risks related to disruption of management time from ongoing business operations due to

the Transaction, the restructuring of the Company’s workforce announced on December 15, 2020 (the “Restructuring”)

and/or the integration of the merger with Zyla Life Sciences (the “Merger”); (5) unexpected costs, charges or expenses

resulting from the Transaction, the Restructuring and/or the Merger; (6) the ability of the Company to retain key personnel; (7) potential

adverse changes to business relationships resulting from the Transaction and/or the Merger; (8) the Company’s ability to achieve

the growth prospects and synergies expected from the Transaction and the Merger, as well as delays, challenges and expenses associated

with integrating the Company’s businesses; (9) negative effects of the Transaction and/or Merger on the market price of the Company’s

common stock, credit ratings and operating results; (10) legislative, regulatory and economic developments, including changing business

conditions in the industries in which the Company operates; (11) the Company’s ability to successfully pursue and complete business

development, strategic partnerships, and investment opportunities to build and grow for the future; (12) the commercial success and market

acceptance of the Company’s products; (13) coverage of the Company’s products by payors and pharmacy benefit managers; (14)

the Company’s ability to execute on its sales, marketing and non-personal and digital promotion strategies, including developing

relationships with customers, physicians, payors and other constituencies; (15) the entry of any generic products for any of the Company’s

products; (16) the outcome of the Company’s opioid-related investigations, the Company’s opioid-related litigation and related

claims for insurance coverage, and the Company’s securities class action and other disputes and litigation, and the costs and expenses

associated therewith; (17) the outcome of the Company’s antitrust litigation relating to the drug Glumetza®; (18) the Company’s

estimates regarding expenses, future revenues, capital requirements and needs for additional financing; (19) the Company’s ability

to generate sufficient cash flow from its business to make payments on its indebtedness; (20) the Company’s ability to restructure

or refinance its indebtedness and the Company’s compliance with the terms and conditions of the agreements governing its indebtedness;

(21) compliance or non-compliance with legal and regulatory requirements related to the development or promotion of pharmaceutical products

in the U.S.; (22) the Company’s plans to acquire, in-license or co-promote other products, and/or acquire companies; (23) the Company’s

ability to raise additional capital, if necessary; (24) variations in revenues obtained from collaborative agreements; (25) the Company’s

counterparties’ compliance or non-compliance with obligations under agreements; (26) the ability of the Company’s common

stock to maintain compliance with Nasdaq’s minimum closing bid requirement of at least $1.00 per share; (27) obtaining and maintaining

intellectual property protection for the Company’s products; (28) the Company’s ability to operate its business without infringing

the intellectual property rights of others; (29) the impact of disasters, acts of terrorism or global pandemics, including COVID-19;

(30) general market conditions; and (31) other risks listed in the Company’s filings with the United States Securities and Exchange

Commission (“SEC”). These risks are more fully described in the Company’s Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q filed with the SEC and in other filings the Company makes with the SEC from time to time. Investors and potential

investors are urged not to place undue reliance on forward-looking statements in this communication, which speak only as of this date.

While the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation

to update or revise any forward-looking-statements contained herein whether as a result of new information or future events, except as

may be required by applicable law. Nothing contained herein constitutes or will be deemed to constitute a forecast, projection or estimate

of the future financial performance or expected results of the Company.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of

business acquired.

The financial statements required

by this Item 9.01(a) are not included in this Current Report on Form 8-K. The Company intends to file such financial statements by amendment

to this Current Report on Form 8-K not later than 71 calendar days after the date this Current Report on Form 8-K is required to be filed.

(b) Pro forma financial information.

The pro forma financial information

required by this Item 9.01(b) is not included in this Current Report on Form 8-K. The Company intends to file such pro forma financial

information by amendment to this Current Report on Form 8-K not later than 71 calendar days after the date this Current Report on Form

8-K is required to be filed.

(d) Exhibits

99.1 Assertio Holdings, Inc. Press Release issued on December 15, 2021

104 Cover

Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: December 16, 2021

|

|

ASSERTIO HOLDINGS, INC.

|

|

|

|

|

|

/s/ Dan Peisert

|

|

|

Dan Peisert

|

|

|

President and Chief Executive Officer

|

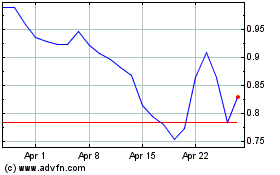

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

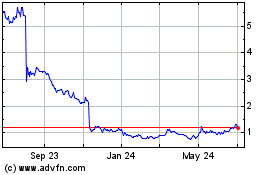

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024