Dollar Falls Amid US-China Trade Uncertainty

October 10 2019 - 2:22AM

RTTF2

The U.S. dollar fell against its most major counterparts in the

European session on Thursday, as market participants digested

conflicting headlines on trade talks between the U.S. and

China.

The United States and China made no progress in deputy-level

trade talks held on Monday and Tuesday in Washington, the South

China Morning Post (SCMP) said, citing sources.

The White House has denied reports suggesting that Chinese Vice

Premier Liu He is planning to leave Washington on Thursday after

just one day of minister-level meetings.

All eyes are focused on Washington, where high-level trade talks

between China and the United States begin today.

Meanwhile, U.S. Democratic presidential contender Joe Biden

called for the impeachment of Trump for the first time in a

deepening partisan fight over a congressional investigation of the

Republican president.

On the economic front, U.S. weekly jobless claims figures and

consumer price index for September will be released at 8:30 am

ET.

The currency has been trading in a negative territory against

its major counterparts in the Asian session, excepting the yen.

The greenback weakened to a 2-day low of 0.9915 against the

franc from Wednesday's closing value of 0.9959. The currency is

likely to face support around the 0.96 level.

The greenback slipped to 1.1020 against the euro, its lowest

since September 25. Next near term support for the greenback is

likely seen around the 1.12 level.

Data from Destatis showed that Germany's exports declined the

most in four months, while imports recovered at a faster than

expected pace.

Exports fell by more-than-expected 1.8 percent month-on-month in

August, reversing a 0.8 percent rise in July. Exports were forecast

to fall 1 percent.

The greenback edged down to 1.2249 against the pound, from a

high of 1.2200 hit at 5:00 pm ET. On the downside, 1.24 is likely

seen as the next support level for the greenback.

Data from the Office for National Statistics showed that the UK

economy expanded in three months to August for the second

consecutive time suggesting that it is on the course to avoid a

recession ahead of Brexit.

Rolling three-month gross domestic product growth increased to

0.3 percent from 0.1 percent in three months to July. This was also

faster than the expected 0.1 percent rise.

Reversing from a weekly high of 0.6277 seen at 6:45 pm ET, the

greenback dropped to a 2-day low of 0.6327 against the NZ currency.

The currency may challenge support around the 0.645 mark, if it

weakens further.

The greenback pulled back from an early weekly high of 1.3346

against the loonie, dropping to 1.3306. The greenback is seen

finding support around the 1.30 level.

Extending early slide, the greenback touched a 3-day low of

0.6762 against the aussie. This follows a 1-week high of 0.6710

seen at 7:00 pm ET. The next likely support for the greenback lies

around the 0.71 level.

On the other side, the greenback held steady against the yen,

after having risen to an 8-day of 107.77 at 9:30 pm ET. At

yesterday's close, the pair was worth 107.48.

Data from the Bank of Japan showed that Japan producer prices

were flat on month in September - matching forecasts following the

0.3 percent decline in August.

On a yearly basis, producer prices were down 1.1 percent - again

in line with expectations after sliding 0.9 percent in the previous

month.

Looking ahead, at 7:30 am ET, the European Central Bank

publishes the account of the monetary policy meeting of the

Governing Council held on September 11-12.

In the New York session, Canada new housing price index for

August, U.S. consumer price index for September and weekly jobless

claims for the week ended October 5 will be out.

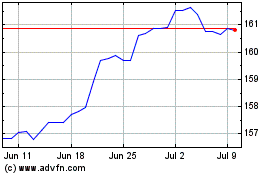

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024