RBA To Remain Patient Before Rate Hike, Says Lowe

February 01 2022 - 10:22PM

RTTF2

Reserve Bank of Australia Governor Philip Lowe said the bank is

prepared to remain patient before it raises its key interest rate

as policymakers monitor the evolution of various factors affecting

inflation.

The board will not increase the cash rate until inflation is

sustainably within the 2 to 3 percent range and it is too early to

conclude that inflation is sustainably in the target range, Lowe

said at the National Press Club of Australia on Wednesday.

"We will also be looking for further evidence that labour costs

are growing at a rate consistent with inflation being sustained

within the target range," he said. "We expect this evidence to

emerge over time, but it is unlikely to do so quickly."

The unemployment rate is forecast to fall to around 3.75 percent

by the end of this year and be sustained at around this rate during

2023.

In terms of underlying inflation, the midpoint of the target

range has been reached for the first time in over seven years, Lowe

said. This comes on the back of very significant disruptions in

supply chains and distribution networks, which would be expected to

be resolved over the months ahead.

But standing here in early February, the governor said the

economy is closer to full employment and achieving the inflation

than had anticipated earlier.

On Tuesday, the RBA had decided to discontinue its bond purchase

programme and kept its cash rate unchanged at a record low of 0.10

percent. But the governor said ceasing purchases under the bond

purchase program does not imply a near-term increase in interest

rates.

The RBA is set to release a full set of updated economic

forecasts on Friday in the quarterly Statement on Monetary

Policy.

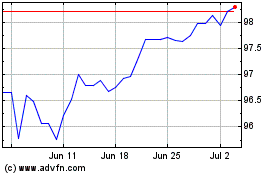

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

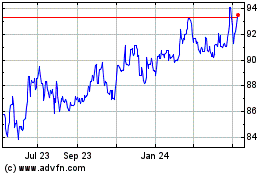

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024